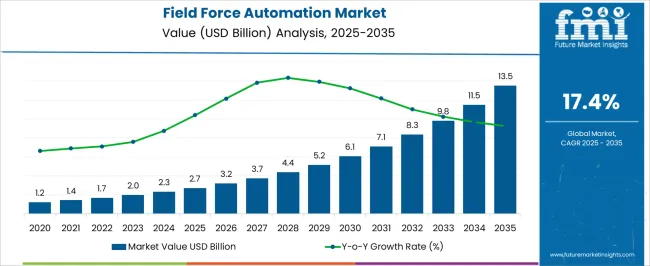

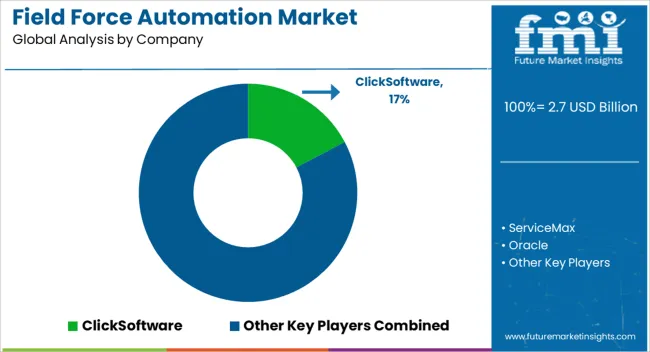

The Field Force Automation Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

| Metric | Value |

|---|---|

| Field Force Automation Market Estimated Value in (2025 E) | USD 2.7 billion |

| Field Force Automation Market Forecast Value in (2035 F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

The field force automation market is expanding rapidly as organizations prioritize operational efficiency, real time communication, and enhanced customer service delivery. Increasing adoption of mobile devices, cloud integration, and AI driven analytics has elevated the role of automation in streamlining workforce management.

Companies are deploying advanced platforms to optimize scheduling, route planning, and task tracking, thereby reducing downtime and improving productivity. Rising competition across industries such as utilities, telecommunications, and retail is further fueling demand for integrated solutions that provide transparency and accountability.

Security considerations, compliance requirements, and data driven insights are also shaping adoption patterns. The outlook remains favorable as enterprises increasingly invest in digital transformation initiatives to empower field teams, ensure customer satisfaction, and achieve cost efficiency.

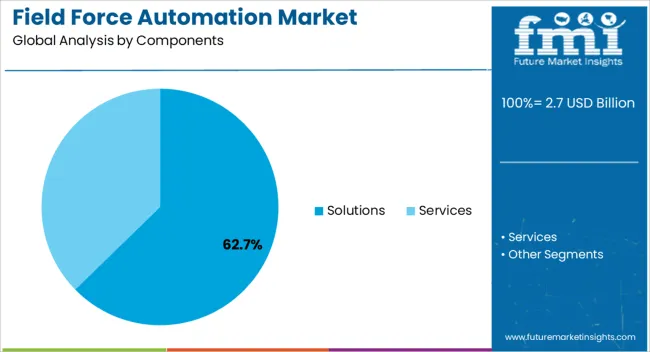

The solutions segment is expected to contribute 62.70% of overall market revenue by 2025, making it the leading component. This growth is driven by the ability of solutions to integrate multiple field operations into a unified platform, offering real time data sharing, performance monitoring, and workflow automation.

Solutions enhance decision making by enabling predictive maintenance, resource allocation, and improved customer engagement. Their scalability and customization capabilities make them suitable for diverse industries, supporting end to end field management.

As organizations continue to prioritize digitalization, the demand for comprehensive solutions has strengthened, securing their leadership in the component category.

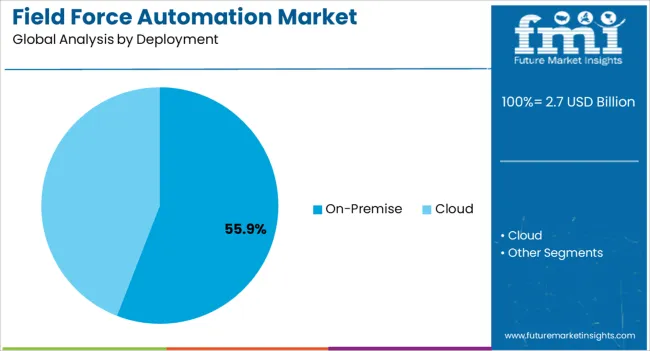

The on premise deployment segment is projected to account for 55.90% of total market revenue by 2025, establishing it as the dominant deployment model. This preference is associated with greater control over data security, compliance with strict regulatory frameworks, and the ability to customize systems to align with complex enterprise requirements.

Organizations operating in sectors with sensitive customer data and mission critical operations have leaned toward on premise deployment to mitigate cybersecurity risks.

The reliability, data sovereignty, and long term cost advantages have reinforced the segment’s adoption, maintaining its leading position in the deployment category.

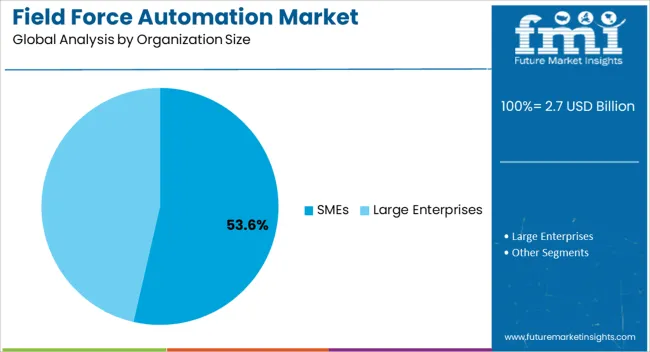

The SMEs segment is anticipated to represent 53.60% of total market revenue by 2025, making it the most prominent segment within organization size. Growth in this segment is being driven by the increasing need for operational agility, cost efficiency, and competitive differentiation.

SMEs are adopting field force automation to improve customer responsiveness, optimize resource utilization, and reduce operational inefficiencies. The availability of affordable, scalable, and user friendly automation tools has further encouraged adoption among smaller businesses.

As SMEs focus on digital transformation to expand their market presence, the segment continues to strengthen its leadership within the overall market.

In the historical period, the market gained a value of USD 1,724.2 million in 2025. The market throughout the historical period enjoyed a CAGR of 14.3%.

From 2020 to 2025, the market has been positively influenced by the surging adoption of cloud-based solutions. Additionally, the sale of field force automation solutions is climbing owing to rising demand to maximize the field forces’ efficiency.

Over the forecast period, the field force automation industry is pegged to achieve USD 10,725.9 million by 2035. At present, the market is estimated to stand at USD 1,970.7 million in 2025. From 2025 to 2035, the market is expected to register a CAGR of 17.4%.

In the assessment period, the market is projected to be catalyzed by the soaring solution providers that are delivering cost-effective solutions. Even enterprises with limited budgets i.e., small or medium-sized enterprises, are capable of deploying these solutions to manage field forces. This factor is anticipated to propel market development.

The emerging trend of BYOD followed and perpetuated by enterprises is expected to offer revenue-maximizing opportunities. In addition to this, the integration of ML and AI technology is projected to provide significant growth prospects in the future.

| Segment | Solution |

|---|---|

| Market Share (2025) | 77.3% |

| Market Size (2025) | USD 1,523.35 million |

| Market Size (2035) | USD 8,291.12 million |

According to the analysis, based on components, the solution segment is anticipated to lead the market during the forecast period. The segment is expected to witness a growth rate of 16.6% from 2025 to 2035. Growth can be attributed to the integration of solutions with existing systems like FSM, ERP, and CRM.

The emergence of advanced features such as daily reporting, automated scheduling, worker dispatching, mobile workforce monitoring, and real-time communication propels the demand for field force automation solutions. This is projected to augment the industry in the forecast period.

As per the analysis, the cloud segment is anticipated to expand at a CAGR of 16.8% during the forecast period. The expansion of the segment can be attributed to the growing preference for cloud-based field force applications. Developing nations such as India, China, and Japan are expected to make significant contributions to strengthen the market.

| Region | The United States |

|---|---|

| Market Share % 2025 | 23.9% |

| Market Size (USD million) by 2025 | USD 470.99 million |

| Market Size (USD million) by End of Forecast Period (2035) | USD 2,563.49 million |

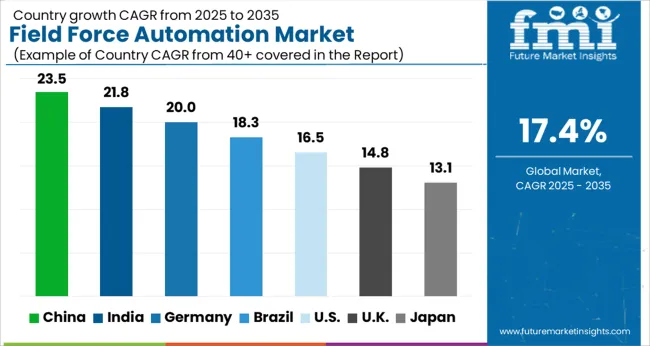

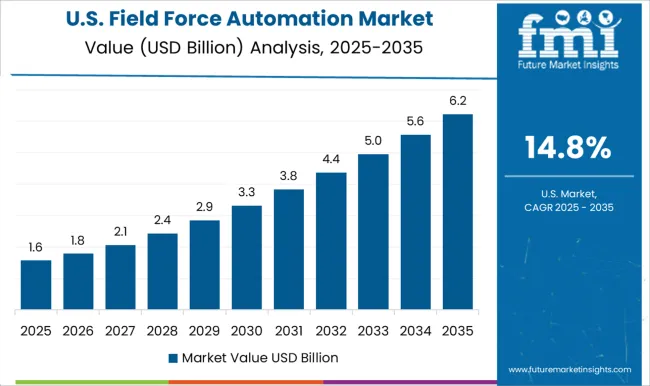

According to the analysis, the global field force automation market is expected to be dominated by the United States during the forecast period. The country is projected to register a value of USD 2,563.49 million by 2035 while recording a CAGR of 17.3% during the forecast period.

The expansion of the United States market can be attributed to the presence of substantial field force automation vendors and growing technology among enterprises. Also, players take various initiatives to expand their reach.

For instance, in 2020, SalesForce, Inc., a United States-based cloud software organization acquired ClickSoftware Technologies. The acquisition helped SalesForce to augment its service cloud software and offer better Field Service Lighting (FSL).

| Country | The United Kingdom |

|---|---|

| CAGR % (2025 to 2035) | 13.3% |

According to the FMI’s analysis, the United Kingdom is another remunerative market. The market is expected to garner USD 433.4 million while expanding at a CAGR of 13.3% during the forecast period. The growth of the United Kingdom market can be attributed to the rapid adoption of advanced technologies like cloud computing, IoT, and AI. Moreover, players in the region are making aggressive investments to augment their reach in the global market.

| Country | CAGR % (2025 to 2035) |

|---|---|

| India | 21.2% |

| China | 14.1% |

The Asia Pacific has been identified as the most lucrative market during the forecast period. As per the analysis, China is projected to garner USD 725 million while recording a CAGR of 14.1% during the forecast period. India is projected to register a significant CAGR of 21.2% in the estimated time. Japan is estimated at USD 584 million by 2035, expanding at a CAGR of 15.7% until 2035. South Korea has been anticipated at USD 364 million by 2035, exhibiting a 15% CAGR.

The Asia Pacific is anticipated to gain considerable market share. Owing to the rapid industrialization and the growing awareness regarding computerized operations of field sales teams. Besides, the deployment of cloud technology, the presence of several startups in India, China, and Japan, among others are projected to augment the regional expansion.

The field force automation industry is projected to witness substantial competition in the upcoming years. To attract more customers, service providers are releasing new solutions and services consistently. Various ties up are also being given due concentration by competitors, to expand the pool of customers. Key strategies followed by industry leaders are acquisition and mergers.

'

'

Recent key developments among players are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; the Asia Pacific; and the Middle East and Africa (MEA) |

| Key Countries Covered | The United States, Canada, Mexico, Germany, the United Kingdom, France, Italy, China, Japan, South Korea, Australia, Brazil, the Middle East, and Africa |

| Key Segments Covered | Components, Deployment, Organization Size, Vertical, and Region |

| Key Companies Profiled | ClickSoftware; ServiceMax; Oracle; Microsoft; and Salesforce; among others. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global field force automation market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the field force automation market is projected to reach USD 13.5 billion by 2035.

The field force automation market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in field force automation market are solutions and services.

In terms of deployment, on-premise segment to command 55.9% share in the field force automation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Field Service Management Market Size and Share Forecast Outlook 2025 to 2035

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field Erected Cooling Tower Market Growth – Trends & Forecast 2024-2034

Field-effect Rectifier Diodes Market

Field Erected Boiler Market

Field-programmable Gate Array (FPGA) Market

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Airfield Fencing Market Insights by Material, Height, Product Type, and Region through 2035

Oilfield Roller Chain Market

Far-field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Far Field Speech and Voice Recognition Market Size and Share Forecast Outlook 2025 to 2035

Fin Field Effect Transistor (FinFET) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Field Drill Bits Market Growth - Trends & Forecast 2025 to 2035

Widefield Imaging Systems Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA