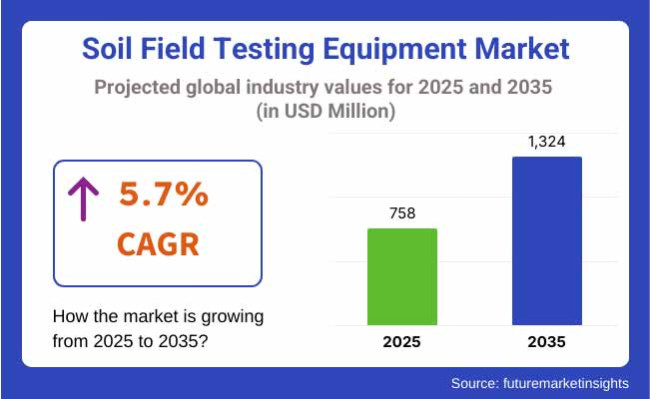

The soil field testing equipment market is projected to value USD 758 million in 2025 and is expected to reach USD 1,324 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the decade. This growth is being driven by increasing demand from precision agriculture, environmental monitoring, and infrastructure surveying sectors.

In early 2025, at Iowa State University's Institute for Transportation (InTrans), development of a prototype Cyclic Borehole Shear Test (CBST) device was reported. This field-deployable instrument is intended to measure soil cyclic behavior in situ, reducing time and costs compared to traditional lab tests. The technology is aimed at improving reliability and safety in geotechnical assessment for infrastructure projects.

The agricultural field testing segment has seen notable advancements as well. In May 2025, Martin Lishman launched a new range of soil testing kits offering rapid pH, conductivity, and nitrogen-phosphorus-potassium (NPK) analysis in the field.

These kits are designed to produce results comparable to laboratory-grade equipment, as noted by Managing Director Joel Capper: “Reintroducing a comprehensive line of soil test equipment is great news for customers seeking insights into their soil condition”. Bluetooth-enabled pH meters and reagent-based NPK testing tools have also been included to support agronomic decision-making.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 758 million |

| Industry Value (2035F) | USD 1,324 million |

| CAGR (2025 to 2035) | 5.7% |

In response to precision agriculture policies, government initiatives have supported digitization in soil sampling. In India, a handheld digital soil testing system was piloted in early 2025 by the Union Agriculture Department. The device provides real-time soil parameter readings such as texture, pH, organic matter, and nutrient levels allowing for immediate, site-specific recommendations.

Regional market interest has varied. Europe and North America have shown increased investment in field-ready testing tools. Martin Lishman's booths at UK agritech events have highlighted field analysis solutions, reinforcing the shift toward on-site testing.

Research and innovation continue. Works on sensor fusion techniques combining satellite data with handheld device readings are in progress to improve efficiency for environmental monitoring. Agricultural test kit suppliers are also offering calibration services and software integration for labs and farming cooperatives.

With increasing scrutiny on nutrient runoff, soil health monitoring, and funding for rural infrastructure, demand for fast, accurate, and field-deployable soil testing tools is being prioritized.

Laboratory site applications are estimated to account for approximately 61% of the global soil testing equipment market share in 2025 and are projected to grow at a CAGR of 5.8% through 2035. These facilities provide controlled environments for conducting highly accurate mechanical, chemical, and classification tests on soil samples for construction, mining, and agricultural planning.

Governments and private sector developers continue to mandate detailed lab-based soil analysis for infrastructure and foundation safety. Equipment such as triaxial shear testers, consolidation apparatus, and permeability testing systems remain in demand for laboratory installations.

As civil engineering projects grow in complexity and regulatory scrutiny increases, laboratories remain central to producing reliable soil strength, compaction, and fertility data across developed and emerging economies.

Automatic soil testing equipment is projected to account for approximately 44% of the global market share in 2025 and is expected to grow at a CAGR of 5.9% through 2035. These systems offer programmable testing cycles, digital data capture, and reduced human error, making them ideal for high-throughput laboratories and large-scale site investigations.

In civil construction and research settings, automatic models are increasingly deployed for tests such as CBR (California Bearing Ratio), compaction, and shear strength. Manufacturers are integrating touch-screen controls, wireless data transfer, and real-time analytics to enhance operational efficiency.

As infrastructure development, smart agriculture, and environmental monitoring become more data-driven, automatic soil testing solutions are positioned as critical tools for consistent and scalable project execution.

High Initial Expense and Technological Limitations

Computerized determination of soil moisture and digital equipment for shear strength testing are costly, and utilization is limited within developing economies. There is very little technical competency to utilize higher test equipment as a constraint.

Construction and agribusiness ventures would prefer to retain traditional methods of doing business due to expense restrictions, thereby limiting their market reach with high-tech solutions.

Redesign of handheld and computer-based test solutions

Soil testing equipment is a leading opportunity for growth during its development, as portable and digital. Suppliers invest in wireless-ready, light, portable equipment for on-site measurement.

These innovations extend soil testing into farmers' hands and construction engineers, reducing testing in laboratories. Government policies boosting soil consciousness also tend to improve demand for simpler test kits to emerging markets.

The USA market for soil field testing equipment is growing, driven by a greater emphasis on sustainable agriculture, increased infrastructure spending, and testing for contamination. Soil health is a priority, with policies supporting both precision agriculture and the sustainable use of land.

The United States Department of Agriculture (USDA) has increased its expenditure on soil conservation programs, which is propelling demand for portable soil testers. In the construction industry, strict control over soil stability and compaction necessitates the demand for automated testing kits.

Additionally, environmental concerns such as soil contamination with industrial waste remain a key factor in the preference for enhanced utilization of innovative soil contamination testing kits. The growing demand for AI-based testing technology and real-time monitoring systems propels market growth, ranking the United States as a leading nation in soil diagnostic innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The UK soil field testing equipment market is being transformed by government environmental policies, government regulations, and precision agriculture practices. The application of soil monitoring systems in real-time is becoming increasingly popular, particularly with government initiatives promoting regenerative agriculture.

Construction, including geotechnical soil testing, is also seeing a trend towards the application of automated soil testing equipment for optimized project efficiency. The UK's transformation towards more environmentally friendly infrastructure also provides additional impetus for market growth, with earth analysis technology leading the way in terms of carbon sequestration capacity through reforestation.

Growing expenditure on artificial intelligence-based earth analysis and green agriculture practice places the UK at the world leader for a new technology market in higher-technology equipment for soil testing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

EU soil testing equipment market is characterized by stringent soil protection regulation that compels demand for premium diagnostic equipment in agriculture and land reclamation. The usage of AI-directed soil monitoring machines to aid sustainable land use is dominated by Germany, France, and the Netherlands.

As the European Green Deal promotes soil health and biodiversity recovery, digital soil testing is gaining mainstream adoption. The construction building sector utilizes intelligent geotechnical analysis software more effectively to achieve maximum foundation stability. Furthermore, innovations in real-time contamination monitoring are propelling industry change at rapid speeds, particularly in industrial waste treatment and environmental rehabilitation work.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 5.9% |

Technological innovation in smart construction and precision agriculture drives the soil field test equipment market in Japan. Its emphasis on food security and soil conservation is the rationale for the demand for high-precision soil analysers.

Japan's robotics leadership in worldwide automation is also apparent in testing the soil, as artificial intelligence-driven soil sensors gain greater popularity for use in commercial agriculture. Its construction is easier too, with enhanced seismic soil tests for earthquake resilience. Government efforts to develop pollution monitoring and soil remediation technology further propel market advancement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korean soil field testing equipment market is expanding due to urbanization, technological advancements, and enforcement of regulations in the industrial and agricultural sectors. Smart agriculture activities in the country enhance the requirement for instant soil quality testing.

In the field of construction, geotechnical testing requirements drive investment in test systems based on artificial intelligence to enhance infrastructure accuracy.

Increased green awareness is also driving industries to adopt high-tech test equipment to detect contaminated soil. Incentives offered by the government towards digital soil mapping and sustainability are also accelerating the adoption process.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

The soil field testing equipment market is highly competitive, with a mix of international and regional players driving industry growth. Leading players focus on technological innovation, high-precision test systems, and compliance with environmental and regulatory standards.

These players develop advanced soil testing equipment to be applied in agriculture, construction, and environmental monitoring. The market comprises established firms and new market entrants, each influencing industry dynamics by offering portable, digital, and automated testing systems.

The overall market size for soil field testing equipment market was USD 758 million in 2025.

The soil field testing equipment market is expected to reach USD 1,324 million in 2035.

The increasing infrastructure development, rising demand for precision agriculture, and growing concerns over soil quality and environmental sustainability fuels the soil field testing equipment market during the forecast period.

The top 5 countries which drive the development of soil field testing equipment market are USA, UK, Germany, China, and India.

On the basis of application, the construction industry is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Site, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Site, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Site, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 34: Europe Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 36: Europe Market Volume (Units) Forecast by Site, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 38: Europe Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 40: Europe Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 41: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 44: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 45: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 46: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Site, 2017 to 2033

Table 47: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 48: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 49: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 50: Asia Pacific Excluding Japan Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 51: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: Japan Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 54: Japan Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 55: Japan Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 56: Japan Market Volume (Units) Forecast by Site, 2017 to 2033

Table 57: Japan Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 58: Japan Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 59: Japan Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 60: Japan Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Test Type, 2017 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Test Type, 2017 to 2033

Table 65: Middle East and Africa Market Value (US$ Million) Forecast by Site, 2017 to 2033

Table 66: Middle East and Africa Market Volume (Units) Forecast by Site, 2017 to 2033

Table 67: Middle East and Africa Market Value (US$ Million) Forecast by Degree of Automation, 2017 to 2033

Table 68: Middle East and Africa Market Volume (Units) Forecast by Degree of Automation, 2017 to 2033

Table 69: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industry, 2017 to 2033

Table 70: Middle East and Africa Market Volume (Units) Forecast by End Use Industry, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Site, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 26: Global Market Attractiveness by Test Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Site, 2023 to 2033

Figure 28: Global Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Site, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 56: North America Market Attractiveness by Test Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Site, 2023 to 2033

Figure 58: North America Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Site, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Test Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Site, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Site, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 116: Europe Market Attractiveness by Test Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Site, 2023 to 2033

Figure 118: Europe Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 119: Europe Market Attractiveness by End Use Industry, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Excluding Japan Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 122: Asia Pacific Excluding Japan Market Value (US$ Million) by Site, 2023 to 2033

Figure 123: Asia Pacific Excluding Japan Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 124: Asia Pacific Excluding Japan Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 125: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 131: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 132: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 133: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 134: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 135: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 136: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 137: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 138: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 139: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 140: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 141: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 142: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 143: Asia Pacific Excluding Japan Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 144: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 145: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 146: Asia Pacific Excluding Japan Market Attractiveness by Test Type, 2023 to 2033

Figure 147: Asia Pacific Excluding Japan Market Attractiveness by Site, 2023 to 2033

Figure 148: Asia Pacific Excluding Japan Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 149: Asia Pacific Excluding Japan Market Attractiveness by End Use Industry, 2023 to 2033

Figure 150: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 151: Japan Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 152: Japan Market Value (US$ Million) by Site, 2023 to 2033

Figure 153: Japan Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 154: Japan Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 155: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Japan Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 161: Japan Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 162: Japan Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 163: Japan Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 164: Japan Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 165: Japan Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 166: Japan Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 167: Japan Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 168: Japan Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 169: Japan Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 170: Japan Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 171: Japan Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 172: Japan Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 173: Japan Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 174: Japan Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 175: Japan Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 176: Japan Market Attractiveness by Test Type, 2023 to 2033

Figure 177: Japan Market Attractiveness by Site, 2023 to 2033

Figure 178: Japan Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 179: Japan Market Attractiveness by End Use Industry, 2023 to 2033

Figure 180: Japan Market Attractiveness by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) by Test Type, 2023 to 2033

Figure 182: Middle East and Africa Market Value (US$ Million) by Site, 2023 to 2033

Figure 183: Middle East and Africa Market Value (US$ Million) by Degree of Automation, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) by End Use Industry, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Test Type, 2017 to 2033

Figure 191: Middle East and Africa Market Volume (Units) Analysis by Test Type, 2017 to 2033

Figure 192: Middle East and Africa Market Value Share (%) and BPS Analysis by Test Type, 2023 to 2033

Figure 193: Middle East and Africa Market Y-o-Y Growth (%) Projections by Test Type, 2023 to 2033

Figure 194: Middle East and Africa Market Value (US$ Million) Analysis by Site, 2017 to 2033

Figure 195: Middle East and Africa Market Volume (Units) Analysis by Site, 2017 to 2033

Figure 196: Middle East and Africa Market Value Share (%) and BPS Analysis by Site, 2023 to 2033

Figure 197: Middle East and Africa Market Y-o-Y Growth (%) Projections by Site, 2023 to 2033

Figure 198: Middle East and Africa Market Value (US$ Million) Analysis by Degree of Automation, 2017 to 2033

Figure 199: Middle East and Africa Market Volume (Units) Analysis by Degree of Automation, 2017 to 2033

Figure 200: Middle East and Africa Market Value Share (%) and BPS Analysis by Degree of Automation, 2023 to 2033

Figure 201: Middle East and Africa Market Y-o-Y Growth (%) Projections by Degree of Automation, 2023 to 2033

Figure 202: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industry, 2017 to 2033

Figure 203: Middle East and Africa Market Volume (Units) Analysis by End Use Industry, 2017 to 2033

Figure 204: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industry, 2023 to 2033

Figure 205: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industry, 2023 to 2033

Figure 206: Middle East and Africa Market Attractiveness by Test Type, 2023 to 2033

Figure 207: Middle East and Africa Market Attractiveness by Site, 2023 to 2033

Figure 208: Middle East and Africa Market Attractiveness by Degree of Automation, 2023 to 2033

Figure 209: Middle East and Africa Market Attractiveness by End Use Industry, 2023 to 2033

Figure 210: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soil Health Nano-Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soil Moisture Sensor Market Size and Share Forecast Outlook 2025 to 2035

Soil Aerators Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Soil Stabilization Material Market Outlook 2025 to 2035

Soil Treatment Chemicals Market

Soil Inoculants Market

Soil Sampling Services Market

Soil Stabilizers Market

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Soil Testing Kit Market Growth - Trends & Forecast 2025 to 2035

Soil Testing, Inspection, and Certification Market Growth – Forecast 2017-2027

Soil Erosion Testing Market Size and Share Forecast Outlook 2025 to 2035

Anti-Soiling Coating Market Growth - Trends & Forecast 2025 to 2035

Impact Soil Tester Market Size and Share Forecast Outlook 2025 to 2035

Silicon Soil Conditioner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Professional Potting Soil Market Size and Share Forecast Outlook 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Field Force Automation Market Size and Share Forecast Outlook 2025 to 2035

Field Service Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA