Anti-Soiling Coating Market is anticipated growth from 2025 to 2035, which is majorly driven by self-cleaning and low-maintenance surface coatings across various industries automotive, solar energy, aerospace and aerospace. Anti-soiling coatings, on the other hand, give new life to surface integrity, allow for economic maintenance, and even enhance energy efficiency as they reduce dirt, dust, and other residues from adhering to the surfaces.

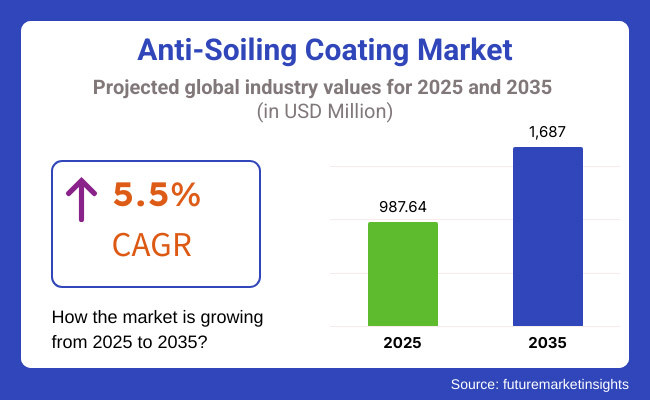

The market is projected to increase from USD 987.64 million in 2025 to USD 1687.0 Million by 2035, at a compound annual growth rate (CAGR) of 5.5%. Nanotech coating technology is redefining products, hydrophobic and oleo phobic materials and self-cleaning surfaces. The market growth is also further driven by the regulation on these kinds by worldwide authorities for facilitating energy efficiency and sustainable energy consumption.

North America is the leading region in the anti-soiling coating market due to high penetration in the solar industry, rising trends in smart construction and advanced research activities. Increasing adoption of self-cleaning coatings in photovoltaic panels, automotive glass and architectural surfaces is witnessed in the region including United States and Canada.

The demand for anti-soiling coatings is primarily driven by the growth of the solar energy sector, as these coatings enhance photovoltaic efficiency by preventing dust accumulation. Automotive manufacturers are increasingly adopting hydrophobic coatings, which boost visibility, durability, and a lower maintenance burden for vehicles. Government incentives for clean energy and smart buildings are driving demand for durable, self-cleaning coatings.

the coatings for anti-soiling market analysis, Europe continues to hold an essential part in terms of volume and value during the projected timeframe owing to the growing green building directives, strict environmental regulations & advanced manufacturing technologies. Germany, France, the UK, and Italy lead in innovation of smart coatings.

In the European solar sector, investments are pouring into anti-soiling coatings to maximize energy production and to minimize longer-term maintenance costs. Self-cleaning coatings are used on glass façade structures and energy-efficient buildings to enhance aesthetics and reduce maintenance requirements. The anti-soiling is used in aerospace and transportation industries as it improves durability and reduces cleaning & maintenance cost.

The Asia-Pacific region is estimated to be the fastest-growing region in the anti-soiling coating market supported by quick urbanization, industrial growth, and growing renewable energy projects.

The forefront of the global clean energy transition are increasingly building up their solar energy infrastructure, where anti-soiling coatings are rapidly being used on solar panels. Self-cleaning coatings are seeing an increase in demand as the boom in construction activities in Asia-Pacific drive the use of these coatings in road infrastructure, windows, and glass facades. Soaring R&D in nanotechnology-based Coatings driving innovation in water-repellent and dust-resistant materials

Challenge

High Production Costs Limiting Market Penetration

High cost from the economy is posing a serious challenge for the global advanced anti-soiling coatings market. The complex champagne production process to manufacture such products is based on nanotechnology and specialized chemical formulations, which increases overall costs and makes such coatings less accessible in price-sensitive markets.

Consequently, industries with tight budgets, particularly in developing regions, may be slow to adopt these solutions despite the offline benefits they offer. Manufacturers are seeking to lower the cost through high-throughput production methods, scalability for nanomaterial synthesis, and government incentives for large-scale adoption to target this issue.

Opportunities

Rising Solar Energy Adoption Driving Demand

Globally, the rapid growth of solar energy infrastructure is creating significant growth opportunities for the anti-soiling coatings market. Solar panels are extensively getting dirty with dust, dirt, and environmental contaminants, which reduces the efficiency of solar panels so self-cleaning coating is a free-of-cost solution for solar panels.

Governments and private investors alike are calling for integration of renewable energy, causing demand for these kinds of coatings to grow strongly particularly in arid and high-dust regions. Companies that invest in durable, long-lasting formulations that minimize upkeep and optimize solar panel performance have the opportunity to capitalize on this growing market segment.

2020 to 2024: Increasing Adoption in Solar Panels and Automotive Applications

From 2020 to 2024, the anti-soiling coating markets flourished as demand for self-cleaning surfaces increased in the solar energy, automotive, and construction industries.

Growing installation of solar PV systems called for higher development of anti-soiling coatings to prevent the accumulation of dust, dirt, and other pollutants on solar panels that could hamper its efficiency by 30%. Hydrophobic and hydrophilic formulations were developed by various manufacturers of coatings that helped repel water and dust more and reduced cleaning and increased energy yield.

In another heavy industry, the growing demand for aesthetic durability and low-maintenance surfaces paved the way for the introduction of anti-soiling coatings in vehicle exteriors, windshields and side mirrors. These coatings reduced water spots, dirt adhesion and smudging, contributing to sight efficiency and vehicle endurance.

It also gained traction in architectural and industrial applications where anti-soiling coatings were integrated into glass facades, smart windows and high-rise buildings in order to minimize the cleaning costs and maintenance efforts. With the growing emphasis on green building projects and self-cleaning materials, the demand escalated even more.

Nonetheless, issues like expensive formulation, low long-term stability, and variance in extreme conditions limited large-scale use. However, these challenges were countered with nanotechnology innovations and hybrid coating formulations that offered improved product efficiency.

2025 to 2035: Smart Coatings, AI-Driven Monitoring, and Sustainable Innovations

The 2025 to 2035 decade, on the other hand, will witness disruptions - smarts, predictive surface monitoring, and sustainability will drive the anti-soiling coating market.

Self-repairing and adaptive coatings will disrupt the market. These will include nanostructured coatings with responsive surface properties, responding to varying environmental conditions that ensure longevity of dirt and moisture repellences.

AI- and IoT-based surface monitoring systems will improve maintenance efficiency, particularly for solar energy and infrastructure applications. Intelligent embedded sensors will monitor soiling and activate cleaning or coating reactivation, minimizing manual effort and operational expenses.

Manufacturers are already being held to stringent standards and sustainability will be a major driver in the global anti-soiling market, with bio-based, water-based and fluorine-free coatings being the key components. There will be an increased focus on eco-friendly solutions, with recyclable and biodegradable formulations taking the lead in lowering the environmental impact of coating processes.

In the solar energy industry, enhanced anti-soiling coatings will be tailored for arid and high-pollution regions as the accumulation of dirt and dust continues to be a problem. The hydrophobic-hydrophilic hybrid coatings will activate the self-cleaning functionalities using rain water and improve the energy efficiency overall.

Super hydrophobic, anti-static and self-healing coatings will be adopted by the automotive and aerospace industries in order to keep surfaces as clean as possible while reducing maintenance costs. Anti-soiling properties will be integrated into future transparent conductive coatings with energy-harvesting functions, which are more widely used in smart windows and solar-integrated vehicles.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Technological Advancements | Use of nanocoatings, hydrophobic, and hydrophilic materials. |

| Solar Energy Applications | Adoption in solar PV panels to reduce dust accumulation. |

| Automotive & Aerospace | Use of hydrophobic coatings for windshields and exteriors. |

| Construction & Architecture | Application in smart windows, facades, and self-cleaning surfaces. |

| Sustainability & Regulations | Shift toward fluorine-free and water-based coatings. |

| Cost & Durability Challenges | High costs and performance limitations in harsh environments. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Technological Advancements | Rise of self-repairing, AI-powered, and adaptive coatings. |

| Solar Energy Applications | Integration of AI-based monitoring and smart surface activation. |

| Automotive & Aerospace | Expansion of anti-static, self-cleaning, and energy-harvesting coatings. |

| Construction & Architecture | Growth of transparent conductive coatings and green building materials. |

| Sustainability & Regulations | Adoption of bio-based, biodegradable, and recyclable anti-soiling coatings. |

| Cost & Durability Challenges | Development of low-cost, long-lasting, and extreme-condition-resistant coatings. |

The anti-soiling coating market has a relatively large share in the United States due to the increasing usage of solar energy, as well as the need for better maintenance of solar panels. As investments in renewing energy infrastructure are made, solar farm operators are using anti-soiling coatings to improve energy efficiency by minimizing dusty build-up.

Moreover, the expanding construction sector is adopting these coatings in order to reduce dirt accumulation on glass surfaces, improving visibility and reducing cleaning costs. Technological advancements that result in self-cleaning and hydrophobic coatings, improving durability and performance, continue to drive growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

With increasing focus on clean energy and sustainable infrastructure, the demand for anti-soiling coatings is also rising in the United Kingdom. The demand for high reflective coatings is driving their increased use in solar panel projects in both urban and rural areas. In addition, the strict environmental regulations encouraging green cleaning solutions are propelling the growth.

In the commercial sector, with regards to high-rise buildings, self-cleaning coatings help in saving maintenance cost and improve operational efficiency, this in turn is creating a positive growth in the market. The market is additionally aided by research and development activities targeting nanotechnology-based coatings with superior dirt-repelling capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

Market growth is primarily driven by the firm commitment of the region towards renewable energy, especially solar energy. As the trend of installing utility-scale solar farms continues to rise, the need for advanced coatings to ensure maximum energy efficiency becomes increasingly relevant.

Automotive sector is also adopting anti-soiling coatings in the automotive glass and bodywork for low-maintenance. High-performance coatings featuring UV resistance and enhanced durability remain key factors shaping the market growth path.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

The Japan anti-soiling coating market is growing and characterized by technological progress and Japan's commitment to renewable energy projects. These coatings for glass skyscrapers and public transportation systems are gaining a foothold in the densely populated urban areas of the nation, reducing cleaning frequency and cost.

These regions, such as Kyushu and Hokkaido, are home to a high concentration of solar farms, which creates demand for effective dirt-repellent coatings to optimize energy output. There is also an increase in research investment towards next-generation coatings with photocatalytic properties for the purpose of self-cleaning applications that is witnessed in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

Rapid advancements in hold technology and urban infrastructure development have emerged South Korea as one of the key markets for anti-soiling coatings. Used advanced coatings as the number of solar panels installed in homes, businesses, and industries increases, advanced coatings are needed to increase efficiency in the automotive sector.

The integral inclusion of hydrophobic and anti-smudge coatings added to vehicles for enhanced aesthetics and durability emphasizes their need in a wide-ranging industry, as well. Furthermore, the development of smart cities in Seoul and Busan fuelling the demand for building materials that are designed to be low maintenance and self-cleaning is anticipated to further propel the market growth over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Anti-Soiling Coatings Market Analysis: The anti-soiling coating market is expected to witness significant growth due to the increasing demand for advanced surface protection solution across several industries to prevent the accumulation of dust, environmental dust, and contamination. This results in increased efficiency, durability, and service life through the reduction of the negative effects of dirt, water, and microbial attack of most surfaces.

Growing adoption of anti-soiling coatings across industries (such as solar energy, oil & gas, marine, etc.) due to its ability to increase operational performance and reduce maintenance & operational costs, thereby extending the operational life of equipment is helping grow the global anti-soiling coating market. Nano coatings and hybrid formulations are among the technological advancements that are improving the efficacy of anti-soiling treatments in a variety of applications.

Self-Polishing Copolymer Coatings Offer Superior Performance in Dynamic Environments

These advantages make self-polishing copolymer (SPC) coatings as most used coatings as they provide long-lasting protection, self-renewing properties, and longer intervals with lower maintenance. They provide a controlled hydrolysis reaction to release active ingredients gradually reducing the anti-fouling effect because of very low surface pollution.

SPC coatings are commonly utilized in marine applications, offshore structures, and industrial equipment to inhibit biofouling, algae formation, and particulate accumulation. Increasing application of self-cleaning coatings in wind turbines, solar panels, and building facades are also factors boosting demand.

Novel SPC technology ensures non-toxic formulations, significantly decreasing toxic biocide release into water bodies, aligning with sustainability efforts in industrial marine applications. Hybrid SPC Coatings Combining hydrophobic and photocatalytic properties to create hybrid SPC coatings are being developed by manufacturers for a stronger self-cleaning effect.

Copper-Based Coatings Remain Essential for Marine and Industrial Applications

Detailed Description of Anti-Fouling Paint Coatings by Applications Copper-based coating is an active component of the anti-soiling protection, especially in marine vessels, offshore equipment, as well as industrial pipelines. These coatings utilize copper’s innate antimicrobial and anti-fouling characteristics to prevent biofilm formation, corrosion, and particle adhesion.

They provide long-lasting protection, even in extreme conditions and ship owners and offshore operators strongly favour copper forms of this compound. Such coatings reduce hull drag considerably, improving overall fuel consumption and maintenance downtime for the maritime sector. Copper-infused protective coatings are used in everything from cardiovascular implants to industrial machinery and oil rigs to mitigate efficiency-robbing contamination.

Although there are regulatory concerns surrounding copper leaching into marine ecosystems, manufacturers are developing eco-friendly alternatives that still meet high-performance standards compliant with environmental regulations. Thus, this bodes well for sustained market presence of copper-polymer hybrid coatings as well.

Marine Industry Leads in Anti-Soiling Coating Adoption

This market was followed and is used extensively in the marine industry as the largest user of anti-soiling coatings, which is because of self-polishing or other copper-based and composite coatings. Grafted and palletized substances are used to coat vessel hulls, underwater structures, and marine equipment, preventing fouling, saltwater corrosion, and sediment formation.

Modern anti-soiling solutions, from the flow of water on individual ships to increased speed and reduced fuel consumption, make them indispensable on commercial ships, naval fleets and recreational boats. Anti-soiling coatings are also essential in offshore oil platforms and underwater structures to avoid structural damage and optimize maintenance.

As conventional anti-fouling agents face increasing restrictions due to strict environmental regulations, innovation towards biodegradable and non-toxic coatings is driving research forward. To do this, manufacturers are developing next generation marine coatings that have enhanced properties of hydrophobicity, self-cleaning and anti-corrosive properties without waiving sustainability and/ or performance.

Oil & Gas Sector Adopts Anti-Soiling Coatings for Equipment Protection

Oil and gas is another key end-user industry for anti-soiling coatings, which can be applied to pipelines, storage tanks, and offshore drilling rigs to protect them against fouling, corrosion, and biofouling. They also extend the equipment's service life, improve performance, and minimize operational risks at extreme weather conditions.

The self-cleaning coatings repel dust, oil residues, and moisture, which is very well, as in the oil refineries and/or petrochemical plants, helping to guarantee the optimal performance of machinery. The growing adoption of nanotechnology-based coatings in the industry also is contributing to enhanced durability, thermal resistance and chemical stability.

This, along with an increased focus on cost-cutting and sustainable development is likely to drive demand for sustainable anti-soiling coatings, particularly low emission, non-toxic, and biodegradable formulations. Therefore, the increase in offshore exploration activities is one of the factors that is taking the high-performance coating market to grow in demand such as in extreme environments.

As manufacturers and industrial players have been developing advanced nano coatings, self-cleaning surfaces, and hydrophobic formulations to enhance the durability, energy efficiency, and maintenance reduction potential of various products, the anti-soiling coating market is booming. Leading players improve coating durability, UV stability, and dust-repellent features in reaction to solar panels, automotive surfaces, marine vessels, and building shutters.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Boero | 12-16% |

| PPG Industries Inc. | 10-14% |

| Nippon Paint Marine Coatings Co. Ltd. | 9-13% |

| Chigoku Marine Paints, Ltd. | 7-11% |

| Jotun | 6-10% |

| Kop Coat Inc. | 5-9% |

| Akzo Nobel N.V. | 4-8% |

| Other Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops nanostructured anti-soiling coatings with self-cleaning and hydrophobic properties for solar panels and architectural applications. |

| Boero | Produces anti-soiling coatings for marine and industrial applications, reducing biofouling and surface contamination. |

| PPG Industries Inc. | Specializes in durable, UV-resistant coatings for automotive and aerospace sectors, enhancing surface cleanliness and visibility. |

| Nippon Paint Marine Coatings Co. Ltd. | Offers marine-grade anti-soiling coatings, improving hull performance and reducing fuel consumption. |

| Chigoku Marine Paints, Ltd. | Innovates in marine coatings with anti-soiling and anti-fouling technologies, ensuring long-lasting surface protection. |

| Jotun | Focuses on protective coatings for industrial and offshore applications, utilizing low-maintenance and anti-dust formulations. |

| Kop Coat Inc. | Supplies anti-soiling solutions for wood, metal, and composite surfaces, enhancing protection against environmental contaminants. |

| Akzo Nobel N.V. | Develops eco-friendly anti-soiling coatings with hydrophobic and self-cleaning properties for automotive and architectural sectors. |

Key Company Insights

BASF SE (18-22%)

BASF dominates the anti-soiling coatings segment, delivering high-performance nanocoatings for solar panels, glass, and automotive surfaces.

Boero (12-16%)

Boero enhances marine coatings, ensuring long-term resistance against dirt, biofouling, and water-based contaminants.

PPG Industries Inc. (10-14%)

PPG Industries produces durable, anti-soiling coatings for aerospace and automotive applications, improving surface cleanliness and maintenance cycles.

Nippon Paint Marine Coatings Co. Ltd. (9-13%)

Nippon Paint leads in marine anti-soiling coatings, reducing hull contamination and improving hydrodynamic efficiency.

Chigoku Marine Paints, Ltd. (7-11%)

Chigoku Marine Paints specializes in biofouling-resistant coatings, extending marine vessel lifespan and reducing operational costs.

Jotun (6-10%)

Jotun advances industrial anti-soiling coatings, ensuring low-maintenance solutions for offshore, building, and energy infrastructure.

Kop Coat Inc. (5-9%)

Kop Coat focuses on wood and metal surface protection, developing coatings that prevent dust accumulation and organic build-up.

Akzo Nobel N.V. (4-8%)

Akzo Nobel develops self-cleaning coatings, reducing dirt adhesion in automotive, marine, and architectural applications.

Other Key Players (30-40% Combined)

Emerging companies and research institutions contribute to eco-friendly formulations, advanced hydrophobic coatings, and multi-surface anti-soiling technologies. Key innovators include:

The overall market size for the Anti-Soiling Coating Market was USD 987.64 Million in 2025.

The Anti-Soiling Coating Market is expected to reach USD 1687.0 Million in 2035.

The demand is driven by increasing adoption in solar panels, automotive surfaces, and architectural glass, alongside growing awareness of maintenance cost reduction and efficiency improvement.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

Marine Industry is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA