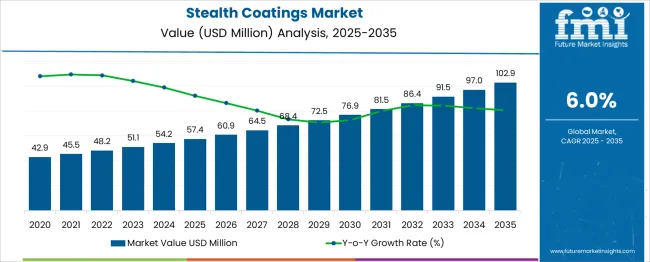

The Stealth Coatings Market is estimated to be valued at USD 57.4 million in 2025 and is projected to reach USD 102.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The 10-year growth trajectory shows a steady upward trend, with values reaching 60.9 million in 2026, 64.5 million in 2027, 68.4 million in 2028, 72.5 million in 2029, and 76.9 million in 2030, contributing USD 19.5 million in the first half, which accounts for about 43% of total growth.

The second half (2030–2035) delivers USD 26.0 million, or 57% of the overall increase, as the market advances through 81.5 million in 2031, 86.4 million in 2032, 91.5 million in 2033, 97.0 million in 2034, and 102.9 million in 2035, confirming a moderately back-weighted growth pattern.

The decade multiplier stands at 1.79x, with both halves registering a multiplier of around 1.34x, indicating consistent momentum across the forecast period. This trajectory is driven by expanding applications of radar-absorbing coatings for stealth aircraft, naval systems, and unmanned platforms, along with technological progress in nanostructured materials and thermal-resistant formulations. Companies focusing on innovation, lightweight composites, and scalable manufacturing will capture competitive advantage in this high-value defense segment.

| Metric | Value |

|---|---|

| Stealth Coatings Market Estimated Value in (2025 E) | USD 57.4 million |

| Stealth Coatings Market Forecast Value in (2035 F) | USD 102.9 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The stealth coatings market plays a specialized but critical role across advanced defense and aerospace segments. Within the military and defense coatings market, stealth coatings account for 18–20%, as low-observability finishes are prioritized for next-generation aircraft and naval vessels. In the advanced materials and functional coatings market, the share is 6–8%, since this segment also includes thermal control, anti-corrosion, and biofouling-resistant coatings.

For the radar absorbing materials (RAM) and stealth technology market, stealth coatings dominate with 35–38%, as surface-applied absorptive layers are essential for reducing radar cross-sections. In the aerospace coatings and specialty finishes market, stealth coatings hold 8–10%, reflecting their integration into critical systems alongside high-temperature and corrosion-resistant coatings. In the security and strategic systems integration market, the share is about 5–6%, as budgets also cover sensors, avionics, and propulsion upgrades.

Demand is fueled by increasing investments in low-observable platforms, modernization of air fleets, and naval stealth retrofits for strategic advantage. Key innovations include nanostructured absorptive layers, infrared suppression coatings, and adaptive surface technologies capable of altering emissivity in real-time. With rising global defense budgets and multi-role stealth aircraft programs, stealth coatings are set to remain a core enabler of survivability and performance in modern warfare platforms.

Current market dynamics are shaped by rising demand for coatings that minimize detection across radar, infrared, and visual spectrums, particularly in military and aerospace domains. These coatings are increasingly viewed as critical to enhancing the operational effectiveness and survivability of next-generation platforms. Future growth is anticipated to be supported by ongoing innovations in nanocomposite materials, improvements in durability and thermal resistance, and the rising need to retrofit existing fleets with advanced coatings.

Collaborations between defense contractors and specialty chemical manufacturers are creating pathways for accelerated development and deployment of stealth technologies, paving the way for broader application beyond traditional defense segments.

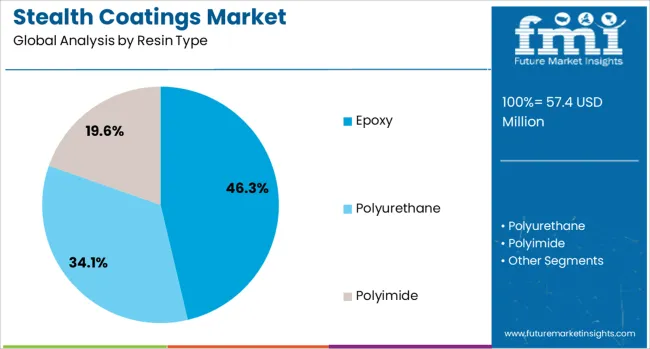

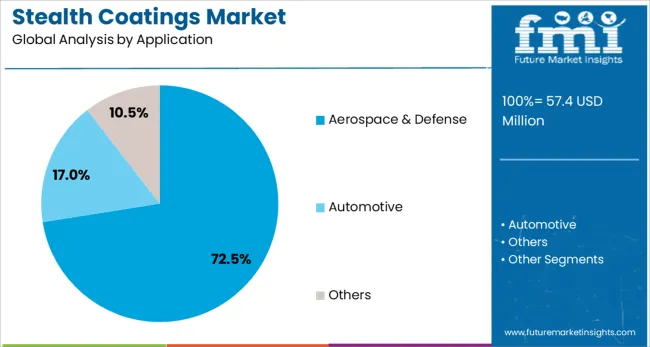

The stealth coatings market is segmented by resin type, application, and geographic regions. The stealth coatings market is divided by resin type into Epoxy, Polyurethane, and Polyimide. The stealth coatings market is classified into Aerospace & Defense, Automotive, and Others. Regionally, the stealth coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by resin type, epoxy is expected to hold 46.30% of the total market revenue in 2025, establishing itself as the leading resin segment. This dominance has been reinforced by the superior mechanical strength, adhesion properties, and chemical resistance of epoxy-based coatings, which have made them well-suited to meet the demanding operational environments of stealth platforms.

The ability of epoxy formulations to be engineered for specific dielectric and electromagnetic properties has allowed them to effectively contribute to radar absorption and reduced signal reflection. Furthermore, the proven durability and ease of application of epoxy resins have enhanced their appeal for both initial production and maintenance cycles of aerospace and defense assets.

These attributes have positioned epoxy as the preferred choice among manufacturers and maintenance teams seeking high-performance stealth coatings that reliably sustain operational requirements over extended service periods.

Segmented by application, aerospace and defense is projected to command 72.5% of the market revenue in 2025, maintaining its leadership in the stealth coatings market. This dominance has been driven by the sector’s critical requirement for technologies that enhance platform survivability and mission effectiveness under contested conditions.

Stealth coatings have been increasingly integrated into fighter aircraft, drones, naval vessels, and ground vehicles to minimize detection and improve operational outcomes. The aerospace and defense segment has leveraged its ability to fund and adopt advanced materials that meet rigorous specifications for electromagnetic interference reduction, thermal regulation, and environmental resilience.

Additionally, continuous upgrades of existing fleets and the development of new-generation platforms have sustained demand for cutting-edge coatings. The strategic imperative to maintain technological superiority and the long procurement cycles typical of defense contracts have reinforced the prominence of this segment in shaping the evolution and expansion of the stealth coatings market.

Stealth coatings are specialized formulations applied to military and aerospace platforms to reduce radar, infrared and acoustic signatures. These coatings include radar-absorbing materials, infrared suppressants, and noise-dampening treatments. Usage spans defense aircraft, naval vessels, military vehicles and strategic infrastructure. Market growth is reliant on defense modernization programs, the upgrade of legacy assets, and rising defense procurement worldwide. Manufacturers offering coatings with superior absorption, thermal stability and environmental durability are positioned to meet demand from defense organizations seeking enhanced survivability. Solutions that can be applied with minimal maintenance and remain effective under operational stress are commanding preference in procurement decisions.

Global defense spending increases and fleet upgrade initiatives across air, sea and land platforms have propelled adoption of stealth coatings. Asset survivability under threat has remained a top priority among military organizations, leading to renewed focus on signature reduction technologies. Deployment of advanced platforms and retrofitting of legacy systems have prompted demand for coatings capable of functioning across wide frequency ranges. Rising threats and strategic competition have heightened the need for effective radar and infrared suppression. Coatings exhibiting low detectability and minimal weight penalty have received strong preference. Consistent defense budgeting for upgrade programs continues to support sustained procurement of next‑generation stealth solutions.

Challenges have emerged from high material and formulation costs associated with specialized absorber and suppressant compounds, which increase unit pricing. Complex application procedures and stringent surface preparation requirements raise operational overhead for users. Performance variation due to inconsistencies in coating thickness or curing conditions has reduced effectiveness in some field deployments. Maintenance difficulties and repair of damaged coatings in operational environments have elevated the total cost of ownership. Regulatory export controls on advanced materials have limited customer access in certain regions. The absence of interoperability standards across military platforms has created barriers for universal application. Competing technologies, such as active signature suppression methods, have intensified the complexity of choices for defense integrators.

Opportunities are being identified in retrofit programs that upgrade legacy airframes, naval hulls, and armored vehicles with next-level stealth coatings. Development of coatings tailored for extreme environments such as high temperature exhaust surfaces, saltwater exposure zones and desert theaters is expanding product scope. Integration of multifunction coatings that offer radar absorption, thermal suppression and corrosion resistance within single systems is gaining traction. Collaborations with defense integrators and platform manufacturers have enabled bespoke solutions for specific mission needs. Demand from emerging defense markets and allied modernization efforts has opened new procurement channels. Suppliers offering application training and lifecycle support services have strengthened value propositions within competitive bid processes.

Multifunction stealth coatings combining radar-absorbing, infrared-suppressing and anti-corrosion characteristics have become a key trend. Low-observable paint systems capable of enduring extreme operational stresses without performance degradation are gaining preference. Growing adoption of modular coating kits for field repair and maintenance supports extended asset availability. Surface treatments that retain signature suppression properties despite abrasion, weather exposure or chemical contamination have been prioritized. Customized formulations for acoustic and visual concealment, in addition to radar reduction, are emerging. Continuous improvements in coating adhesion, thermal resistance and longevity are guiding R&D direction, reinforcing demand for high‑performance, rugged stealth surface treatments.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

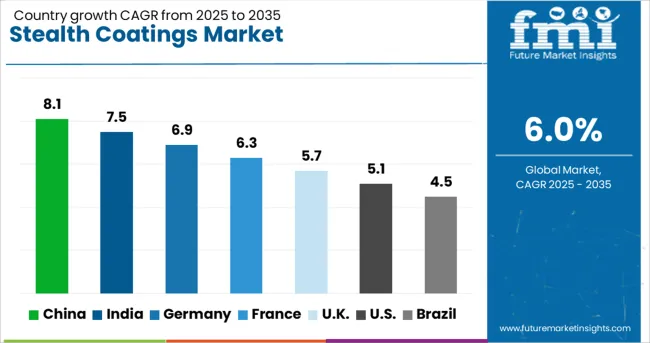

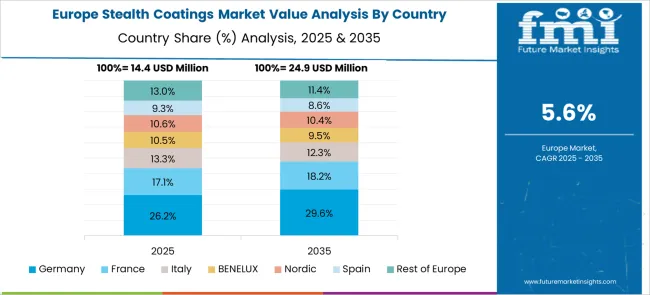

The stealth coatings market is projected to grow at a CAGR of 6.0% between 2025 and 2035, driven by demand for radar-absorbing materials, thermal signature suppression, and advanced coatings for next-generation defense systems. China, part of BRICS, leads with an 8.1% CAGR, supported by heavy investments in stealth-enabled aircraft and naval programs. India, also within BRICS, follows at 7.5% CAGR, fueled by defense modernization and indigenous manufacturing initiatives. Germany, a core OECD economy, posts 6.9%, driven by advanced aerospace programs and eco-compliant coating innovations. France records 6.3%, emphasizing stealth applications for fighter jets and naval fleets, while the United Kingdom grows at 5.7%, influenced by the Tempest combat air system and stealth-enabled maritime assets. The report includes analysis of over 40 countries, with five leading markets detailed below.

China is forecast to achieve a CAGR of 8.1%, the highest among major markets, supported by advanced stealth aircraft programs and radar-absorbing coatings for naval applications. Expanding domestic R&D and localized manufacturing strengthen China’s ability to meet both internal defense requirements and international export commitments. Partnerships with global material science companies focus on multi-layer coating systems with high durability under extreme operational conditions. Demand is expected to rise with new-generation fighter jets and advanced warship programs under national defense strategies.

India is projected to post a CAGR of 7.5%, driven by indigenous defense manufacturing initiatives and large-scale modernization projects. Programs like the Advanced Medium Combat Aircraft and naval stealth ship development create sustained demand for stealth coatings with radar and infrared signature suppression. Suppliers are introducing coatings that balance thermal protection and radar absorption while ensuring operational reliability in diverse climatic conditions. Collaboration with international defense firms is enhancing access to advanced stealth coating technologies, accelerating India’s position as a regional defense hub.

Germany is expected to grow at 6.9%, supported by aerospace defense programs, including Eurofighter upgrades and future combat air systems. Demand for stealth coatings with enhanced durability and eco-compliance aligns with stringent EU regulations. Manufacturers are focusing on multilayer coatings that provide radar absorption while minimizing weight impact on airframes. Advanced R&D projects in collaboration with European defense alliances aim to deliver next-generation stealth technologies. Export opportunities to NATO member countries further expand Germany’s market footprint in high-performance coating solutions.

France is forecasted to record a 6.3% CAGR, driven by the modernization of Rafale fighters and stealth integration in naval assets. Programs under the Future Combat Air System initiative are fueling innovation in radar-absorbing coatings. Naval defense platforms, including submarines and frigates, require high-performance stealth coatings capable of reducing multiple signature profiles. Domestic suppliers are investing in coating systems with durability in multi-environment deployments. Strong collaboration with European defense partners positions France as a leading innovator in stealth technologies.

The United Kingdom is projected to grow at 5.7%, supported by investments in the Tempest sixth-generation fighter program and stealth coatings for maritime defense systems. Advanced coating technologies that combine radar absorption and environmental resilience are being prioritized. Development of predictive maintenance capabilities for stealth coatings is gaining attention, ensuring reduced lifecycle costs. UK-based manufacturers are leveraging joint defense projects with European and allied nations to expand their technological base and export reach.

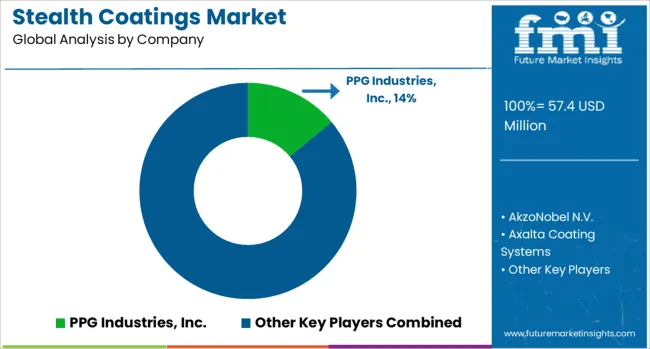

The stealth coatings market is highly specialized, featuring a mix of global coating manufacturers and defense contractors such as PPG Industries, Inc., AkzoNobel N.V., Axalta Coating Systems, BASF SE, The Sherwin-Williams Company, and defense-focused companies including BAE Systems, Lockheed Martin Corporation, Intermat Defense, Hentzen Coatings, Inc., and niche innovators like Stealth Veils Inc.

Leading players like PPG Industries and AkzoNobel dominate through advanced material technologies and extensive R&D aimed at radar-absorbing and infrared-suppressing coatings for military aircraft, naval vessels, and armored vehicles. Axalta, BASF, and Sherwin-Williams focus on integrating stealth properties with corrosion resistance, durability, and reduced maintenance costs. Defense primes such as Lockheed Martin and BAE Systems maintain competitive advantage by developing proprietary coatings for next-generation stealth platforms, often through exclusive defense contracts and in-house formulations.

Intermat Defense and Stealth Veils Inc. specialize in adaptive and camouflage coating solutions, addressing emerging requirements for low-visibility and multispectral signature management in tactical environments. Market rivalry is intense due to strict performance standards, high entry barriers related to defense certifications, and the need for specialized production facilities. Competitive differentiation is driven by radar absorption efficiency, thermal and UV stability, adhesion properties, and life-cycle cost advantages.

Strategic priorities include integrating nanomaterials, developing coatings compatible with composite substrates, and enhancing durability under extreme operational conditions. Future growth will be supported by rising investments in next-generation fighter programs, unmanned systems, and naval stealth upgrades, with opportunities centered on advanced radar-absorbing materials and multifunctional coatings that combine stealth with environmental resilience.

| Item | Value |

|---|---|

| Quantitative Units | USD 57.4 Million |

| Resin Type | Epoxy, Polyurethane, and Polyimide |

| Application | Aerospace & Defense, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries, Inc., AkzoNobel N.V., Axalta Coating Systems, BAE Systems, BASF SE, Hentzen Coatings, Inc., Intermat Defense, Lockheed Martin Corporation, Stealth Veils Inc., and The Sherwin-Williams Company |

| Additional Attributes | Dollar sales segmented by platform type (aircraft, naval vessels, and ground vehicles) and coating technology (radar-absorbing coatings, infrared-suppressing coatings, and adaptive camouflage systems), with demand driven by the need for reduced radar cross-section, enhanced survivability, and compliance with defense standards. Regional trends indicate strong adoption in North America and Europe for military modernization programs, while Asia-Pacific accelerates investments in stealth technologies for new-generation platforms. Innovation focuses on nanostructured materials, self-healing stealth surfaces, and multifunctional coatings that combine electromagnetic absorption with corrosion protection for extended service life. |

The global stealth coatings market is estimated to be valued at USD 57.4 million in 2025.

The market size for the stealth coatings market is projected to reach USD 102.9 million by 2035.

The stealth coatings market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in stealth coatings market are epoxy, polyurethane and polyimide.

In terms of application, aerospace & defense segment to command 72.5% share in the stealth coatings market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA