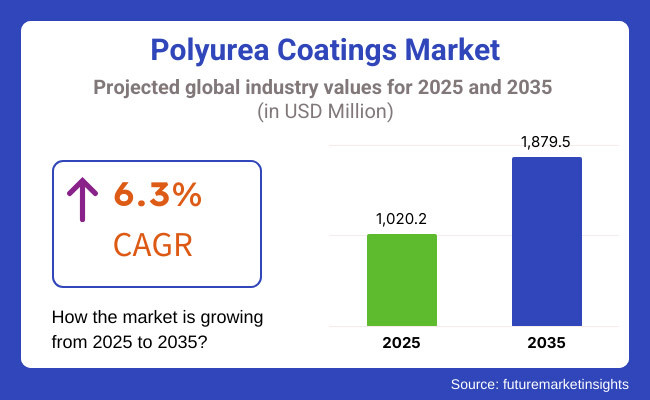

The global polyurea coatings market is estimated to be valued at USD 1,020.2 million in 2025 and is projected to reach USD 1,879.5 million by 2035, reflecting a CAGR of 6.3% during the forecast period. Growth is being supported by increased adoption in construction, automotive, and industrial sectors, where protective coatings are required for corrosion resistance, waterproofing, and long-term durability.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,020.2 million |

| Industry Value (2035F) | USD 1,879.5 million |

| CAGR (2025 to 2035) | 6.3% |

Polyurea coatings are being utilized for their high-performance characteristics, including rapid curing, chemical resistance, and mechanical strength. These coatings are being applied to surfaces in infrastructure, oil and gas pipelines, automotive components, and wastewater treatment facilities, where exposure to moisture, abrasion, or chemicals is common. According to Protective Coatings Europe, polyurea is being adopted in place of traditional epoxies and polyurethanes due to its faster application time and superior flexibility in extreme temperatures.

In the construction sector, polyurea is being used for parking deck membranes, foundation waterproofing, and bridge coatings. Its seamless and elastomeric nature allows for efficient coverage of large surfaces and complex geometries. The demand for long-lasting protective systems is increasing with the scale of infrastructure investment across Asia Pacific, the Middle East, and North America.

The automotive industry is applying polyurea coatings for underbody protection, truck bed liners, and rust prevention treatments. Vehicle manufacturers are using polyurea-based formulations to extend service life and minimize maintenance. The adoption of these coatings aligns with performance standards established by automotive OEMs and regulatory requirements for chemical resistance.

Formulation advances are enabling the development of low-VOC and greener polyurea systems. Regulatory support for sustainable coating solutions, particularly from environmental agencies in the European Union and North America, is contributing to innovation in raw materials and spray equipment.

In the aerospace industry, polyurea coatings are being explored for their lightweight and protective capabilities in non-structural components and cargo hold applications. As durability, curing time, and environmental resistance remain top procurement priorities, demand for polyurea coatings is expected to rise steadily.Market expansion is anticipated to be driven by performance optimization, regulatory compliance, and the broader shift toward high-efficiency surface protection systems.

Pure polyurea is estimated to account for approximately 58% of the global polyurea coating market share in 2025 and is projected to grow at a CAGR of 6.5% through 2035. These coatings are derived from the reaction of an isocyanate component with a polyamine, without the presence of any modifying agents such as esters or urethane links.

Pure polyurea is widely favored in high-performance applications that demand fast-set times, exceptional abrasion resistance, and long-term waterproofing. End users in infrastructure, tank linings, containment systems, and waterproof membranes continue to prefer pure polyurea for its ability to withstand aggressive environmental conditions. Manufacturers are also advancing formulations for low-VOC, high-elongation coatings suitable for corrosion protection in marine, energy, and defense sectors.

The building & construction segment is projected to account for approximately 42% of the global polyurea coating market share in 2025 and is expected to grow at a CAGR of 6.4% through 2035. Polyurea coatings are increasingly applied in commercial roofs, parking decks, bridges, tunnels, and below-grade structures for their crack-bridging capabilities, fast return-to-service, and long-term durability.

The demand is particularly strong in urban infrastructure projects and water containment applications, where exposure to chemicals, temperature extremes, and dynamic loads requires high-performance barrier systems. With increased investment in smart cities, infrastructure rehabilitation, and green building certifications, construction professionals across North America, Europe, and Asia-Pacific continue to adopt polyurea coatings as a premium protective solution.

High Application Costs and Equipment Requirements

The main challenge in the polyurea coatings market is the very high costs incurred at the start of application. In contrast to conventional coatings, polyurea coatings necessitate specific equipment and licensed personnel for suitable application, escalating the fees of end-users, respectively. Precise mixing and application technicalities imply that the complexity level of the construction makes it difficult for small enterprises.

The price of raw materials like isocyanates and polyamines, which are variable depending on economic conditions, also has material implications for the overall prices. For these reasons, some areas of the world may find it difficult to participate in a polyurea coating project, especially in the realms of cost-sensitive industries that generally look for budget-friendly options.

Regulatory and Environmental Concerns

Though polyurea coatings provide benefits such as lower VOC emissions and increased durability, a few mixtures contain substances that could attract more scrutiny under strict regulations. Governments from all over the world are applying tight environmental rules that restrict the use of feeding. Manufacturers must constantly evolve to produce green alternatives that comply with the regulations without losing performance.

Meeting the regulatory changes requires a massive investment in research and development that simply cannot afford smaller companies oftentimes. Besides, regional inequalities in compliance issues are the barriers to worldwide vendors who are trying to sell their general products in various regions.

Advancements in Eco-Friendly and Sustainable Polyurea Coatings

As sustainability is becoming a significant area of concern, the polyurea coatings sector is reaping huge advantages from it. The manufacturers are turning green by employing bio-based and waterborne polyurea formulations, thus reducing the harmful effect while still offering a super performance. The innovation of non-toxic, solvent-free coatings that coincide with the global sustainability objectives serves as an added attraction to the industries that are environmentally friendly.

The companies that are the first to evolve and launch these revolutionary coatings will obtain a clear advantage, especially in areas where environmental laws are rigid. The evolving existence of coatings that are both incredibly durable and environmentally friendly is likely to drive massive growth in the market.

Expanding Applications in Renewable Energy and Marine Industries

The establishment of more and more renewable energy projects, including wind and solar power plants, is paving the way for new business opportunities for polyurethane coatings. The manufacturers of wind and solar energy storage need protective coatings that will survive adverse weather like storms and ultraviolet radiation.

The marine sector is also coming to the age of polyurea coatings for ship hulls, decks, and offshore structures, increasing the service life and decreasing the cost of maintenance. With the burst of global investment in renewable energy and maritime infrastructure, demand for advanced coatings is replacing the market.

The polyurea coatings sector in the USA is experiencing a strong surge due to the increasing requirement in building, automotive, and industrial applications. The main drivers for this are the infrastructure restoration programs, the implementation of strict environmental regulations that mandate the use of eco-friendly coatings, and the mode of Spray Coating.

The market benefits largely from the rising investment in sustainable and anti-corrosion coatings for systems like bridges, pipelines, and military assets. The growing popularity of polyurea in flooring and waterproofing areas could be another cause for growth in the sector. The USA market is forecasted to develop at a CAGR of 6.8% between 2025 and 2035, with industrial demand and infrastructure investments being the main income sources.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK polyurea coatings market is expanding, supported by rising adoption in marine, construction, and oil & gas industries. The major factor of sustainability and the need to adhere to VOC regulations are the main reasons for the demand for high-performance, solvent-free coatings. The other driver for market growth is government support for green building projects and transportation infrastructure.

The automotive sector, especially the electric vehicle (EV) industry, is also the reason for the requirement of protective coatings. The market in the UK is expected to have a CAGR of 5.9% between 2025 and 2035, hence it will be characterized by stable growth with environmental compliance as the main focus.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

The polyurea coatings market of the EU is chiefly a result of the rigid environmental policies, the rising industrial applications, and the idea of sustainable construction materials. Aerospace, energy, and marine are the main industries that are applying polyurea coatings for gaining high corrosion resistance and durability. The need for protective coatings in wind energy projects and automotive components is also growing.

EU directives on VOC emissions are again inducing waterborne and solvent-free coatings. This is further expected to enlarge the market, which will gain a 6.1% CAGR in the forecast period, thus supported by regulatory compliance and technological advancement.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.1% |

The national polyurea coatings market in Japan is experiencing continual development, which is mainly due to the introduction of nanotechnology-based coatings and their growing use in the electronics, automotive, and construction sectors. Earthquake-resistant infrastructure projects in the country are being introduced with durable coatings for protection.

Besides, innovative bio-based and high-performance coatings for aerospace and marine applications are being developed through Japan's strong research and development environment. The country is likely to witness a market growth rate of 5.7% during the period of 2025 to 2035, thanks to technological advancements and infrastructure resilience initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The polyurea coating industry in South Korea is marking a remarkable growth performance bolstered by the ongoing expansions in its construction, shipbuilding, and automotive sectors. The major factors with a vigorous influence constitute the rising of smart coatings, nanotechnology integration, and high-performance industrial coatings.

The government has given a strong push for green manufacturing and sustainable urban development, which in turn is propelling the acceptance of eco-friendly coatings. Polyurea is being used notably by Korea's semiconductor and electronics giants in various protective applications, a trend that is increasingly being observed. The South Korean market is scribed to have a 6.5% CAGR from 2025 to 2035, innovation developments at the forefront, as well as the implementation of sustainability initiatives are the main drivers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The polyurea coating market is competitive, with several players actively innovating to meet diverse industry needs, from construction and automotive to infrastructure and industrial applications. Companies are increasingly focusing on developing polyurea coatings that offer superior durability, rapid curing times, and resistance to harsh chemicals and extreme temperatures.

As the demand for environmentally friendly solutions grows, many are also investing in low-VOC and eco-conscious formulations to comply with stricter regulations. While entry barriers remain moderate, expertise in both chemical formulation and application technologies plays a key role in establishing market presence. Players are differentiating through specialized, high-performance coatings and expanding their product lines to cater to niche applications.

In terms of Product Type, the industry is divided into Pure Polyurea, Hybrid Polyurea

In terms of Application, the industry is divided into Building & Construction, Industrial, Automotive & Transportation

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Polyurea Coatings market is projected to reach USD 1,020.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.3% over the forecast period.

By 2035, the Polyurea Coatings market is expected to reach USD 1,879.5 million.

The Pure Polyurea segment is expected to dominate the market, due to its superior durability, fast curing, high chemical resistance, excellent waterproofing, and widespread use in industrial, automotive, and construction applications.

Key players in the Polyurea Coatings market include PPG Industries, Sherwin-Williams, BASF SE, VersaFlex, Nukote Coating Systems.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyurea Greases Market

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ablative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA