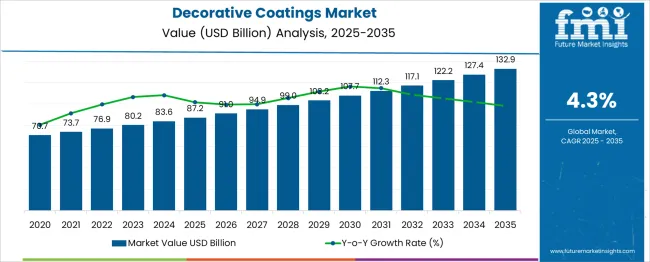

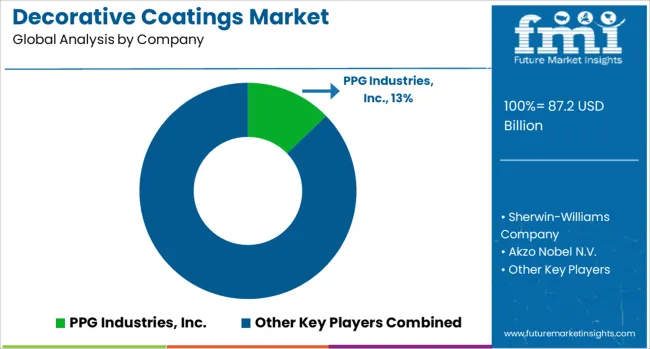

The Decorative Coatings Market is estimated to be valued at USD 87.2 billion in 2025 and is projected to reach USD 132.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Decorative Coatings Market Estimated Value in (2025 E) | USD 87.2 billion |

| Decorative Coatings Market Forecast Value in (2035 F) | USD 132.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The decorative coatings market is expanding steadily due to the rising demand for aesthetic enhancements, surface protection, and long-lasting finishes in residential and commercial construction. Rapid urbanization, increasing disposable incomes, and the growing trend of home renovation are key factors supporting market growth globally.

Environmental regulations and consumer preferences are shifting toward low-VOC and sustainable formulations, which has led to increased investment in eco-friendly technologies by major players. The market is also witnessing significant traction from smart coating technologies and value-added features such as stain resistance and antimicrobial properties.

Over the forecast period, innovation in water-based systems and the development of high-performance acrylic and polyurethane coatings are expected to propel growth further. Strong real estate activity and ongoing architectural trends will continue to reinforce the demand for decorative coatings, particularly in emerging markets where infrastructure development remains a priority.

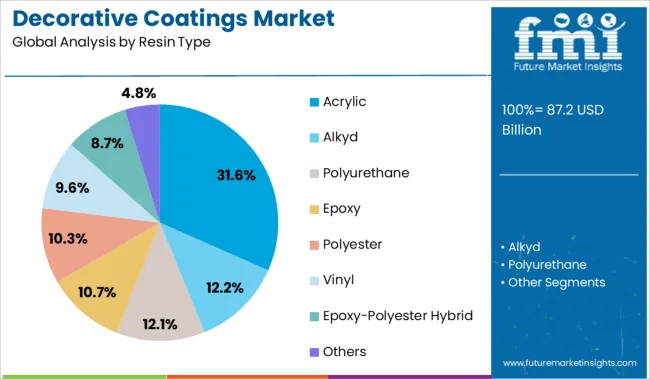

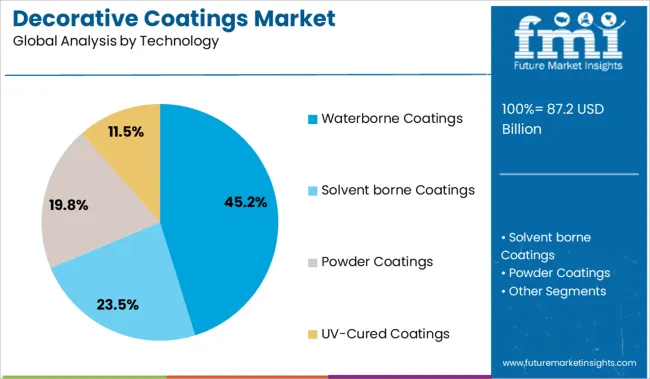

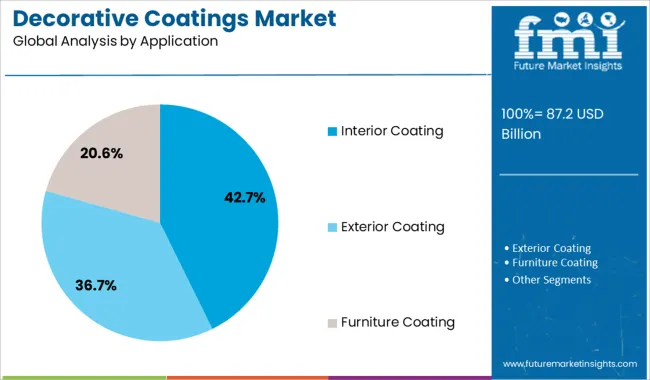

The decorative coatings market is segmented by resin type, technology, application, and end-use and geographic regions. The decorative coatings market is divided by resin type into Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Vinyl, Epoxy-Polyester Hybrid, and Others. In terms of technology, the decorative coatings market is classified into Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, and UV-cured coatings. Based on the application, the decorative coatings market is segmented into Interior Coating, Exterior Coating, and Furniture Coating. The decorative coatings market is segmented by end-use into Residential, Commercial, Industrial, and Others. Regionally, the decorative coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic segment dominates the resin type category with a 31.6% market share, driven by its excellent color retention, weather resistance, and versatility in both indoor and outdoor applications. Acrylic-based coatings are favored for their durability, ease of application, and compatibility with a variety of substrates, making them a go-to solution for decorative uses.

Advancements in binder technology have improved their performance in high-humidity and UV-exposed environments, enhancing their appeal among residential and commercial users alike. Additionally, the shift toward environmentally responsible formulations has increased the adoption of water-based acrylics, which offer low odor and reduced emissions.

Manufacturers are focused on optimizing drying times, film-forming capabilities, and surface finish options to meet evolving aesthetic preferences. Continued demand for cost-effective and high-performance coatings ensures that acrylic resins will retain their lead within the decorative coatings segment.

Waterborne coatings hold a leading 45.2% share in the technology category, driven by their environmental benefits, regulatory compliance, and rising consumer awareness regarding indoor air quality. These coatings are increasingly chosen over solvent-based alternatives due to their low VOC emissions, minimal odor, and ease of cleanup, making them suitable for interior environments and sensitive applications.

Technological advancements have narrowed the performance gap with solvent-based products, enabling improved adhesion, abrasion resistance, and drying efficiency. The segment has gained widespread acceptance in both new construction and renovation projects, where sustainability and health considerations are prioritized.

Government regulations and green building certifications are further accelerating adoption, prompting manufacturers to expand their portfolio of waterborne decorative coatings. As product performance and environmental standards continue to converge, waterborne technologies are expected to drive sustained growth and innovation across the industry.

The interior coating segment leads the application category with a 42.7% market share, reflecting strong consumer preference for indoor wall and ceiling finishes that offer aesthetic appeal, durability, and surface protection. Demand is driven by both new construction and refurbishment projects, particularly in urban residential and commercial developments.

Interior decorative coatings are designed to resist stains, mildew, and abrasion while maintaining color vibrancy, which makes them a staple in modern building practices. The segment also benefits from seasonal repainting trends and increasing interest in DIY home improvement, boosting sales of user-friendly and quick-drying products.

Manufacturers are continuously innovating with odor-free, anti-bacterial, and washable formulations that align with consumer wellness trends. As lifestyle-driven demand continues to shape interior design choices, the interior coating segment is expected to maintain its leadership position through functional upgrades and expanding distribution networks.

Demand for decorative coatings is growing as consumers and commercial facilities upgrade interiors and exteriors with premium, long-lasting finishes. Sales of low-VOC, antimicrobial, and textured decorative paints are increasing sharply across residential renovation and hospitality segments. Growth is strongest in urban markets with high aesthetic and health-related requirements.

Demand for low-VOC (volatile organic compound) and antimicrobial decorative coatings surged approximately 28% in 2024, driven by homeowners and facility managers seeking healthier indoor environments. Coatings incorporating silver-ion or copper-based biocides gained preference in hospitals, hotels, and schools, reducing surface contamination risk by over 35%. Low-VOC finishes containing plant-derived binders provided equivalent coverage while reducing indoor odor complaints by 22%. This trend is particularly strong in North America and Europe as stricter indoor air quality guidelines accompany aesthetic renovation waves.

Sales of textured decorative coatings, including metallics, mineral finishes, and pearl-effect topcoats, rose by 32% year over year in 2024, especially in upscale residential and boutique commercial interior projects. Specialty finishes designed for wall feature panels and accent surfaces improved perceived quality and visual appeal, leading to 18% longer retention on wall vibrancy over five years. Custom-matching services with digital tinting capabilities accounted for over 40% of new decorative SKU introductions. Boutique coating suppliers offering small-batch, curated color palettes reported repeat customer orders increasing by 26% in design-focused urban markets.

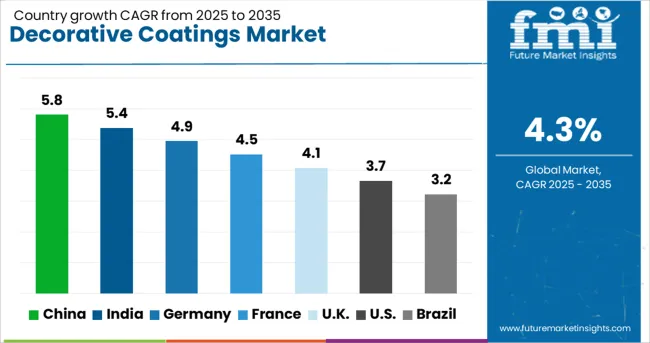

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

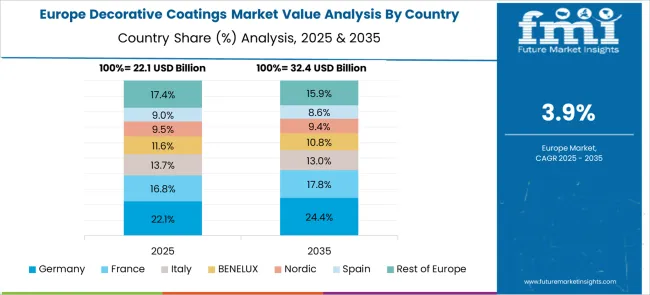

The global market is poised to grow at a CAGR of 4.3% from 2025 to 2035, fueled by rising urbanization, infrastructure development, and consumer interest in aesthetic home improvement solutions. China leads with a CAGR of 5.8%, supported by extensive residential construction, demand for waterborne coatings, and government incentives for sustainable building practices. India follows at 5.4%, driven by middle-class housing expansion and robust DIY paint demand in Tier 2 and Tier 3 cities.

Germany is growing at 4.9% due to refurbishment activities and strict regulations favoring low-VOC decorative products. The United Kingdom, at 4.1%, is seeing growth from energy-efficient retrofit projects and increased demand for digitally textured coatings. The United States, with a CAGR of 3.7%, continues to be influenced by remodeling activity and innovation in odorless, fast-dry formulations. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 5.8% CAGR, supported by strong residential construction and infrastructure development. Rising consumer preference for waterborne decorative coatings is shaping product strategies among leading manufacturers. The demand for odor-free and quick-drying interior paints is increasing in metropolitan housing projects. Premium finishes, including high-gloss and digitally textured coatings, are gaining traction in luxury homes and commercial spaces. Government programs promoting eco-compliant coatings and low-emission paints provide additional momentum for product innovation. Domestic producers are focusing on expanding distribution channels through e-commerce platforms to meet growing demand for decorative coatings in both new and renovation projects.

India is expected to grow at a 5.4% CAGR, supported by expansion in housing projects and increased consumer inclination toward aesthetically advanced coatings. DIY decorative paints are gaining traction in smaller towns and regional markets, driven by rising affordability and brand outreach. Interior wall finishes with antimicrobial and stain-resistant properties are witnessing strong acceptance among middle-income households. Demand for waterborne decorative coatings is growing in response to the need for low-odor and quick-application solutions. Domestic manufacturers are enhancing their dealer networks and investing in digital campaigns to expand reach in semi-urban and rural housing clusters, while premium segments focus on washable and texture-rich coatings.

Germany is forecast to grow at a 4.9% CAGR, driven by extensive building refurbishment activities and increasing demand for environment-friendly decorative solutions. Low-VOC and solvent-free coatings dominate regulatory compliance-driven product offerings. Rising popularity of matte and textured finishes in premium residential interiors enhances demand for advanced formulations. Smart tinting systems and digital color-matching platforms are gaining traction in retail outlets, improving customer experience and customization. Domestic brands focus on expanding product portfolios for insulation-friendly coatings used in retrofitting projects, while export-oriented manufacturers strengthen their premium range for the European market.

The United Kingdom is projected to grow at a 4.1% CAGR, supported by demand for advanced decorative solutions in energy-efficient retrofitting projects. High adoption of digitally textured finishes and smart coatings is shaping design trends across new and renovated housing units. Waterborne coatings dominate due to compliance with stringent environmental standards. Increasing consumer preference for low-odor, quick-dry products is strengthening the indoor decorative segment. Manufacturers are leveraging retail partnerships and e-commerce channels to introduce high-end finishes with self-cleaning and antimicrobial properties. R&D efforts focus on expanding digitally printed designs for commercial and hospitality sectors.

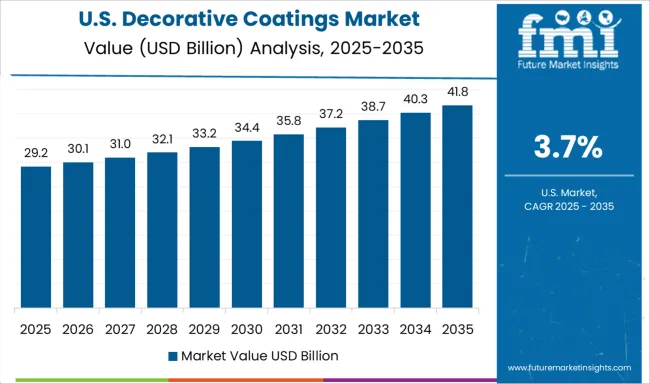

The United States is projected to grow at a 3.7% CAGR, supported by remodeling and home renovation activities. Decorative coatings with odorless and quick-dry formulations are increasingly favored for interior applications. Innovation in stain-resistant and washable coatings is expanding in the premium segment, particularly for kitchen and high-traffic zones. Exterior coatings with weather-protection features are witnessing demand in residential and commercial spaces. Major manufacturers are focusing on digital paint selection tools and app-based tinting to enhance customer engagement. Distribution expansion through retail chains and home improvement platforms continues to strengthen product penetration across suburban and regional markets..

PPG Industries, Inc. holds the top position with a significant market share, driven by innovation in eco-friendly and long-lasting decorative paints. Sherwin-Williams Company and Akzo Nobel N.V. follow closely, offering strong global distribution networks and broad product lines across architectural finishes. Nippon Paint Holdings and Axalta Coating Systems Ltd. are strengthening their presence in Asia and the Middle East through localized solutions and acquisitions. BASF SE focuses on advanced formulation technologies that reduce VOCs and improve surface durability. Kansai Paint Co., Ltd. and RPM International Inc. cater to both premium and economy segments. Regional players like Asian Paints, Jotun, Berger Paints, and Hempel continue to grow through design-focused offerings and strong retail penetration.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.2 Billion |

| Resin Type | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Vinyl, Epoxy-Polyester Hybrid, and Others |

| Technology | Waterborne Coatings, Solvent borne Coatings, Powder Coatings, and UV-Cured Coatings |

| Application | Interior Coating, Exterior Coating, and Furniture Coating |

| End-use | Residential, Commercial, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries, Inc., Sherwin-Williams Company, Akzo Nobel N.V., Nippon Paint Holdings Co., Axalta Coating Systems Ltd., BASF SE, Kansai Paint Co., Ltd., RPM International Inc., Asian Paints Limited, Hempel A/S, Jotun Group, Benjamin Moore & Co., DAW SE (Caparol), Berger Paints India Limited, and Dunn-Edwards Corporation |

| Additional Attributes | Dollar sales by resin type (e.g. acrylic, polyurethane) and application (interior vs exterior), demand dynamics across residential, commercial and industrial segments, regional leadership in Asia‑Pacific and North America, innovation in low‑VOC, powder and smart coatings, and environmental impact through sustainability and indoor air quality regulations. |

The global decorative coatings market is estimated to be valued at USD 87.2 billion in 2025.

The market size for the decorative coatings market is projected to reach USD 132.9 billion by 2035.

The decorative coatings market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in decorative coatings market are acrylic, alkyd, polyurethane, epoxy, polyester, vinyl, epoxy-polyester hybrid and others.

In terms of technology, waterborne coatings segment to command 45.2% share in the decorative coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decorative Rugs Market Size and Share Forecast Outlook 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Decorative Inks Market Analysis by Application and Region Through 2035

Decorative Paints Market Growth – Trends & Forecast 2025 to 2035

Decorative Surface Films Market

Decorative Laminates Market Growth 2022 to 2032

MDF Decorative Overlays Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Automotive Decorative Exterior Trim Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA