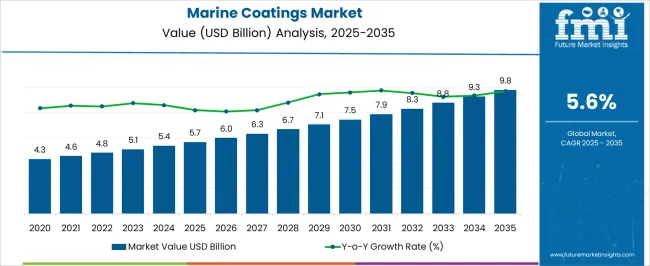

The marine coatings market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Analysis of the acceleration and deceleration pattern shows that market growth is not uniform but experiences phases of faster and slower expansion influenced by shipbuilding activity, maintenance cycles, and regulatory changes. In the initial phase from 2025 to 2028, growth accelerates moderately as global shipping demand rises, particularly in commercial shipping, cruise lines, and naval vessels. Replacement of old coatings with environmentally compliant, anti-fouling, and corrosion-resistant formulations contributes to early momentum. Between 2028 and 2032, growth decelerates slightly due to cyclical fluctuations in new ship orders, commodity price variability, and delays in retrofitting older fleets.

During this period, market expansion depends more on maintenance and specialty coatings rather than new-build applications. From 2032 to 2035, the market experiences renewed acceleration as stricter emission and environmental regulations drive higher adoption of advanced, low-VOC, and eco-friendly coatings. Technological innovations such as self-polishing, fouling-release, and hybrid coating systems further enhance demand. This acceleration-deceleration pattern highlights that long-term growth in marine coatings is influenced by a combination of new ship construction cycles, retrofitting activity, and evolving regulatory frameworks, requiring manufacturers to align production, R&D, and supply chain strategies with these cyclical trends.

| Metric | Value |

|---|---|

| Marine Coatings Market Estimated Value in (2025 E) | USD 5.7 billion |

| Marine Coatings Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The market is shifting toward eco-friendly and high-durability solutions. Waterborne and silicone-based anti-fouling coatings now constitute over 30% of new applications, aligning with environmental regulations. High-solids epoxy and polyurethane coatings are improving corrosion protection, extending maintenance intervals by 15–20%. Demand for coatings in offshore wind platforms has grown by 12% year-on-year, driven by structural exposure to harsh marine conditions. Digital application technologies, including robotic spraying and automated surface monitoring, are increasing efficiency by 8–10%. Additionally, lightweight, abrasion-resistant coatings are being adopted in naval vessels to reduce fuel consumption and improve operational performance.

The market is supported by multiple upstream sectors. Shipbuilding and repair yards account for approximately 38%, as they apply protective and anti-fouling coatings during construction and retrofits. Defense and naval vessel programs represent about 26%, requiring specialized coatings for corrosion resistance and stealth.

Offshore oil and gas platforms contribute nearly 17%, using coatings for structural durability and chemical resistance. Recreational and yacht manufacturers hold close to 11%, applying high-performance finishes for aesthetic and protective purposes. Coating raw material and chemical suppliers make up the remaining 8%, providing pigments, binders, and additives for marine formulations.

The marine coatings market is experiencing steady expansion, supported by rising global shipbuilding activity, increased focus on vessel performance efficiency, and stringent environmental regulations governing marine operations. Industry announcements and maritime sector reports have emphasized the role of advanced coating technologies in enhancing vessel durability, reducing fuel consumption, and mitigating environmental impact.

Anti-corrosion and anti-fouling solutions have become critical in maintaining hull integrity and operational efficiency over extended service periods. Shipbuilders and fleet operators are investing in high-performance coatings to comply with International Maritime Organization (IMO) regulations on emissions and biofouling management.

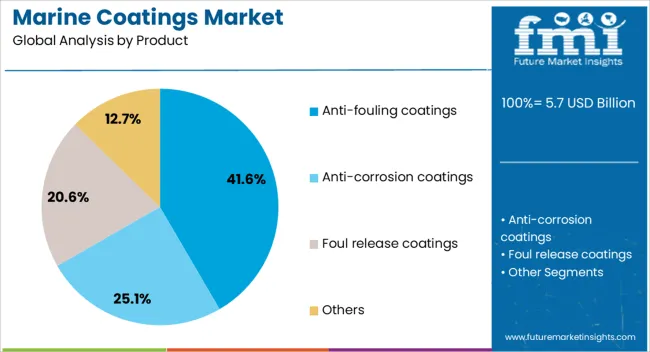

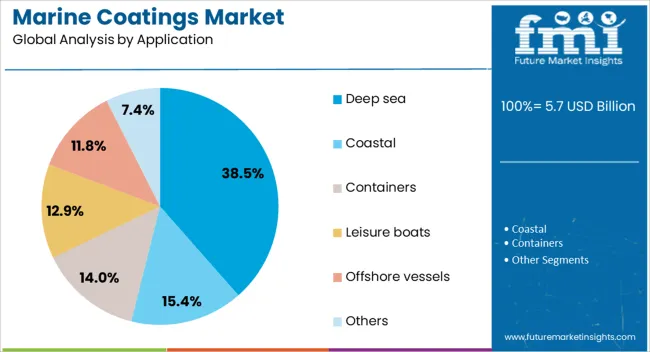

Additionally, demand growth is being reinforced by the expansion of commercial shipping fleets, offshore infrastructure projects, and naval modernization programs. Innovations in eco-friendly, low-VOC, and biocide-free coating formulations are expected to further shape the market landscape. Segmental leadership is projected to remain with anti-fouling products, new ship construction as the primary end-user category, and deep-sea applications due to their high-performance requirements and operational challenges.

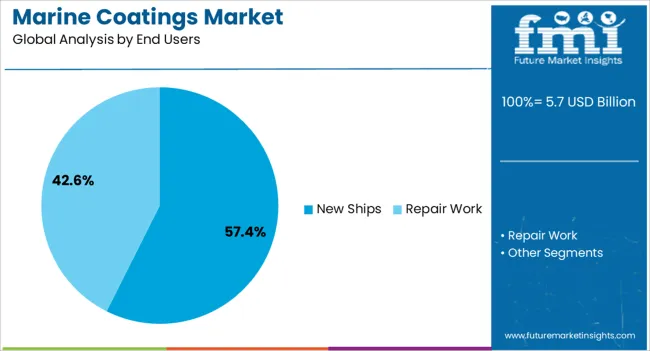

The marine coatings market is segmented by product, end users, application, and geographic regions. By product, marine coatings market is divided into anti-fouling coatings, anti-corrosion coatings, foul release coatings, and others. In terms of end users, marine coatings market is classified into new ships and repair work. Based on application, marine coatings market is segmented into deep sea, coastal, containers, leisure boats, offshore vessels, and others. Regionally, the marine coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti-fouling coatings segment is projected to account for 41.6% of the marine coatings market revenue in 2025, maintaining its leadership position. Growth in this segment is driven by its effectiveness in preventing the accumulation of marine organisms on vessel hulls, which can otherwise lead to increased drag, higher fuel consumption, and reduced operational efficiency. Maritime engineering studies have shown that biofouling significantly impacts vessel performance, making anti-fouling coatings a cost-effective solution for long-term maintenance. The segment has benefited from regulatory frameworks promoting sustainable and biocide-free formulations that meet environmental compliance standards while maintaining performance. Shipbuilders and operators have increasingly adopted advanced anti-fouling technologies, including self-polishing and foul-release coatings, to extend dry-docking intervals and reduce maintenance costs. These performance and compliance advantages are expected to sustain the segment’s strong market presence.

The new ships segment is projected to hold 57.4% of the marine coatings market revenue in 2025, positioning it as the leading end-user category. This growth has been supported by the continuous expansion of the global shipbuilding industry, particularly in Asia-Pacific regions such as China, South Korea, and Japan. New vessel construction demands comprehensive coating solutions to ensure long-term protection from corrosion, fouling, and harsh marine environments. Shipyards have increasingly integrated high-performance coating applications into the construction process to meet customer specifications and regulatory requirements. Additionally, advances in hull coating technologies have enabled shipbuilders to offer improved warranties and performance guarantees, further encouraging the use of premium marine coatings. The strong pipeline of commercial cargo ships, passenger vessels, and naval ships is expected to reinforce the segment’s dominance in the coming years.

The deep sea segment is projected to contribute 38.5% of the marine coatings market revenue in 2025, sustaining its role as the leading application area. This segment’s growth is driven by the extreme operational demands of vessels navigating long distances in open waters, where exposure to varying temperatures, salinity levels, and high-pressure conditions is constant. Deep-sea vessels require robust coatings that offer maximum protection against corrosion, biofouling, and mechanical wear over extended voyages. Maritime safety regulations and performance standards have reinforced the adoption of high-durability coating systems tailored for these conditions. Furthermore, the expansion of global trade routes and offshore oil and gas exploration activities has increased demand for vessels operating in deep-sea environments. The need for coatings that minimize maintenance while ensuring consistent operational efficiency continues to position this segment as a critical focus in the marine coatings market.

The marine coatings market is expanding due to rising global shipping traffic, offshore energy projects, and naval vessel modernization programs. Demand is driven by the need for corrosion protection, biofouling prevention, and long-term durability in harsh marine environments. Asia Pacific leads consumption, supported by large shipbuilding hubs in China, Japan, and South Korea, while Europe and North America adopt high-performance coatings for commercial and defense vessels. Technological advancements include waterborne and low-VOC coatings that reduce environmental impact and improve application efficiency. I believe ongoing fleet expansions, stricter environmental regulations, and adoption of advanced materials will collectively drive sustainable growth across the marine coatings industry.

Rising global maritime trade volumes and naval modernization programs are key drivers for marine coatings demand. Cargo vessels, container ships, and tankers require protective coatings to enhance hull durability, reduce maintenance, and improve fuel efficiency. Defense sectors in Asia and North America are retrofitting and commissioning new vessels with anti-corrosion and anti-fouling coatings. In my opinion, increasing offshore infrastructure projects and fleet replacements for aging vessels will continue to sustain robust demand for marine coating solutions worldwide.

The push for low-VOC, waterborne, and environmentally compliant coatings is creating new growth opportunities. Marine operators are increasingly selecting eco-friendly coatings to meet regulatory standards while minimizing environmental impact. High-performance formulations now include anti-fouling, anti-corrosion, and abrasion-resistant properties that extend maintenance intervals. I believe manufacturers offering environmentally safe, durable, and technologically advanced coatings will capture long-term contracts across commercial shipping, cruise lines, and offshore energy projects.

Smart coating technologies are emerging to enhance durability, corrosion resistance, and hull monitoring capabilities. Automated coating application systems improve consistency, reduce labor requirements, and accelerate project timelines. Advanced coatings with self-healing or biofouling indication properties are being piloted in naval and commercial fleets. In my view, digital monitoring integration and adoption of smart marine coatings will become a competitive differentiator for fleet operators seeking operational efficiency and compliance with environmental regulations.

Fluctuations in resin, pigment, and solvent prices increase production costs, affecting profit margins for manufacturers. Compliance with environmental regulations and VOC limits adds operational expenses, particularly for small and mid-sized players. Transitioning to sustainable and high-performance formulations requires additional R&D and infrastructure investment. I believe that manufacturers optimizing supply chains, investing in eco-friendly technologies, and enhancing operational efficiency will maintain competitiveness despite these challenges.

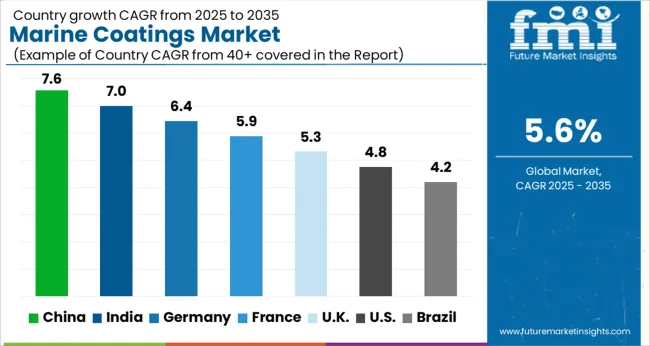

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The marine coatings market is advancing at a global CAGR of 5.6% from 2025 to 2035, driven by rising global shipping activity, fleet maintenance needs, and regulatory requirements for anti-corrosion solutions. China leads with a CAGR of 7.6%, +36% above the global average, supported by BRICS-led growth in shipbuilding, port expansion, and domestic maritime trade. India follows at 7.0%, +25% above the global benchmark, reflecting expanding commercial fleets and investment in coastal shipping infrastructure. Germany records 6.4%, +14% over global growth, shaped by OECD-supported innovation in eco-friendly and high-performance coating technologies for naval and commercial vessels. The United Kingdom posts 5.3%, slightly below the global rate, with growth influenced by selective upgrades in port and shipping operations. The United States stands at 4.8%, −14% under the global CAGR, constrained by slower fleet expansion but supported by demand for specialized coatings in naval and offshore applications.

China is growing at a CAGR of 7.6% in the marine coatings market, supported by the country’s large shipbuilding and repair industry. Rising orders for container ships, bulk carriers, and naval vessels are increasing demand for antifouling and protective coatings. Domestic manufacturers are scaling production of epoxy and polyurethane-based marine coatings to cater to both export-focused shipyards and local fleets. Investments in port infrastructure and offshore projects are further driving consumption. Technological upgrades in coating formulations, including improved corrosion and abrasion resistance, are enhancing product adoption. Export-oriented shipbuilders are also raising their quality standards, increasing reliance on high-performance marine coatings.

India is witnessing a 7.0% CAGR in the marine coatings market, driven by growth in shipbuilding, port expansion, and offshore oil and gas activities. The rise of naval and commercial vessel construction is creating steady demand for antifouling and protective coatings. Local suppliers are investing in epoxy and acrylic coatings to meet domestic requirements and export standards. Repair and maintenance of existing fleets, especially along the western and eastern coasts, are also contributing to consistent consumption. Government initiatives to modernize shipyards and improve maritime infrastructure are supporting adoption of advanced marine coatings, while international partnerships are helping transfer technology and enhance product performance.

Germany is recording a CAGR of 6.4% in the marine coatings market, driven by its shipbuilding clusters in Northern Germany and specialized yacht manufacturing. Strong export demand for vessels in Europe and Asia is creating a requirement for high-performance coatings with long service life. Manufacturers are focusing on environmentally friendly formulations with low volatile organic content to comply with EU regulations. Industrial and naval vessel maintenance is also contributing to steady market growth. Research initiatives on corrosion-resistant and antifouling technologies are helping German producers maintain competitiveness in the global marine coatings segment.

The United Kingdom is expanding at a CAGR of 5.3% in the marine coatings market, supported by naval shipbuilding, ferry operations, and offshore energy projects. Coating demand is increasing for new ship constructions and maintenance of existing fleets. Local producers rely heavily on imports of high-performance epoxy and polyurethane coatings from Europe and Asia. Offshore wind farms and port infrastructure development are boosting consumption, especially for protective coatings that prevent corrosion. Collaborations between coating manufacturers and shipbuilders are enabling the delivery of advanced formulations tailored to specific operational requirements.

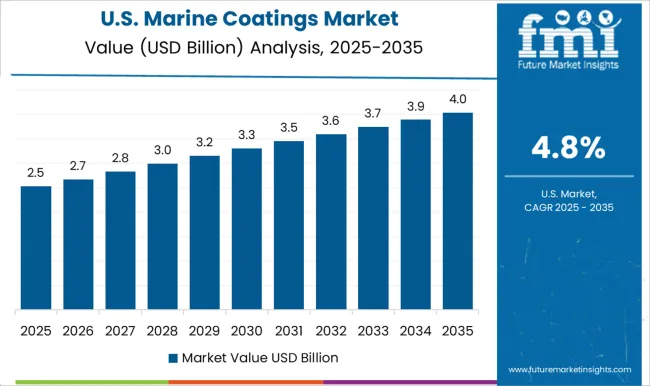

The United States is progressing at a CAGR of 4.8% in the marine coatings market, supported by commercial shipbuilding, naval fleet expansion, and repair of industrial vessels. Demand for antifouling and corrosion-resistant coatings is increasing as aging fleets undergo maintenance. Domestic producers are supplying epoxy and polyurethane-based products with enhanced performance for both civilian and defense applications. Investments in port infrastructure, offshore operations, and naval modernization are contributing to growth. Strategic partnerships between OEMs and coating suppliers are helping ensure consistent supply and regulatory compliance, while R&D initiatives are developing coatings with longer service life and lower environmental impact.

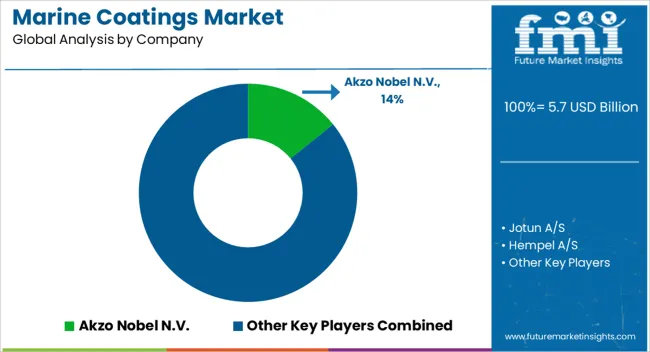

The marine coatings market is driven by chemical and paint companies supplying protective and decorative coatings for ships, offshore structures, and port facilities. Akzo Nobel N.V. is assumed to be the leading player, supported by a diverse portfolio of anti-corrosive, antifouling, and topcoat solutions designed for long-term durability under harsh marine conditions. Jotun A/S and Hempel A/S maintain competitive positions by offering specialized coatings that enhance resistance to abrasion, UV exposure, and biofouling, while Chugoku Marine Paints, Ltd. and Kansai Paint Co., Ltd. focus on high-performance formulations for naval and commercial vessels. Nippon Paint Co. and Sherwin-Williams Company strengthen their presence through regional expansion, emphasizing eco-compliant products that meet international maritime regulations. PPG Industries, RPM International, and KCC Corporation enhance market depth with customized coatings, technical support services, and long-term service agreements tailored to shipping operators.

Product brochures highlight anti-fouling paints, epoxy primers, polyurethane topcoats, and specialized protective layers designed to extend hull life and reduce maintenance costs. Features such as chemical resistance, fast-drying properties, smooth application, and color retention are emphasized. Coatings are promoted for use on steel, aluminum, and composite surfaces, ensuring compatibility across a wide range of vessels and offshore installations. Marketing materials stress operational reliability, reduced downtime, and compliance with environmental regulations, while technical assistance and regional service networks are presented as key differentiators. Collectively, these offerings are positioned to maintain structural integrity, improve vessel performance, and reduce long-term operational expenditures in global maritime operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 billion |

| Product | Anti-fouling coatings, Anti-corrosion coatings, Foul release coatings, and Others |

| End Users | New Ships and Repair Work |

| Application | Deep sea, Coastal, Containers, Leisure boats, Offshore vessels, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Akzo Nobel N.V., Jotun A/S, Hempel A/S, Chugoku Marine Paints, Ltd, Kansai Paint Co.,Ltd., NipponPaint Co., Sherwin-Williams Company, PPG Industries, RPM International, and KCC Corporation |

| Additional Attributes | Dollar sales by coating type and vessel application, demand dynamics across commercial ships, naval vessels, and recreational boats, regional trends across North America, Europe, and Asia-Pacific, innovation in antifouling, anticorrosion, and eco-friendly formulations, environmental impact of VOC emissions and biocides, and emerging use in autonomous vessels and offshore renewable platforms. |

The global marine coatings market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the marine coatings market is projected to reach USD 9.8 billion by 2035.

The marine coatings market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in marine coatings market are anti-fouling coatings, anti-corrosion coatings, foul release coatings and others.

In terms of end users, new ships segment to command 57.4% share in the marine coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Propulsion Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Marine Collagen-Based Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Communication Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA