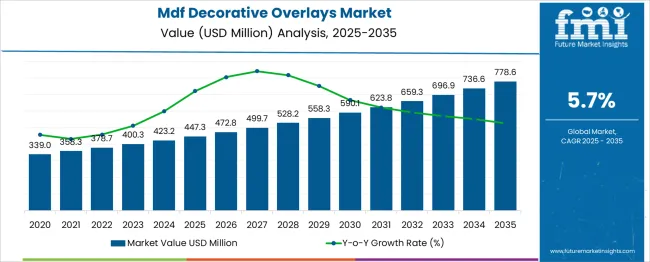

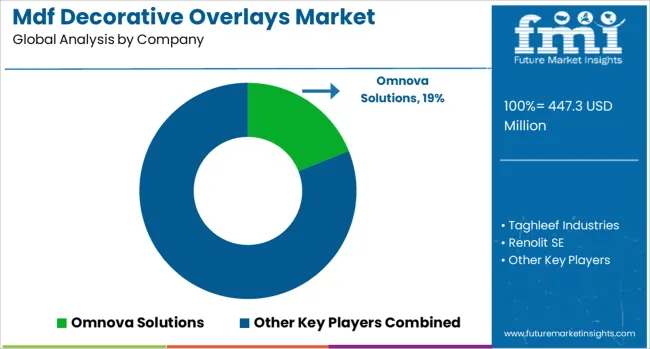

The MDF Decorative Overlays Market is estimated to be valued at USD 447.3 million in 2025 and is projected to reach USD 778.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The growth rate volatility index suggests that the market experiences stable and consistent growth over the forecast period. Annual increases in market value range steadily between USD 25 million and USD 40 million each year, indicating minimal fluctuations in growth rates. For example, the value rises from USD 447.3 million in 2025 to USD 472.8 million in 2026, then progresses to USD 499.7 million in 2027, showing consistent expansion without sudden spikes or drops.

This reflects a balanced market environment with predictable demand and supply dynamics. The steady increments in market value highlight low volatility, which is favorable for long-term investments and strategic planning. Such stability suggests that consistent end-user requirements and gradual adoption of decorative overlays in furniture and interior design sectors drive the market. The growth rate volatility index confirms a reliable upward trajectory. This stability allows manufacturers and investors to plan production and marketing strategies confidently, anticipating steady returns. The moderate but consistent growth ensures that the Mdf Decorative Overlays Market remains an attractive segment within the broader wood product industry.

| Metric | Value |

|---|---|

| MDF Decorative Overlays Market Estimated Value in (2025 E) | USD 447.3 million |

| MDF Decorative Overlays Market Forecast Value in (2035 F) | USD 778.6 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The MDF decorative overlays market is witnessing sustained growth, supported by the expanding global furniture and interior design industries. A shift toward aesthetically pleasing, cost-effective alternatives to solid wood has driven the adoption of overlay solutions on MDF boards.

Increasing urbanization, rising demand for ready-to-assemble (RTA) furniture, and growth in modular construction have contributed to heightened demand for laminated surfaces that enhance durability and appearance. Environmental regulations promoting low-emission wood products have accelerated the adoption of engineered substrates like MDF, further boosting the market for decorative overlays.

Manufacturers are also investing in high-definition printing and advanced lamination technologies to meet the demand for premium visual finishes and moisture-resistant surfaces. Looking forward, the integration of eco-friendly overlay materials and recyclable laminates is expected to influence procurement decisions, with end-users prioritizing both design and sustainability in furniture applications.

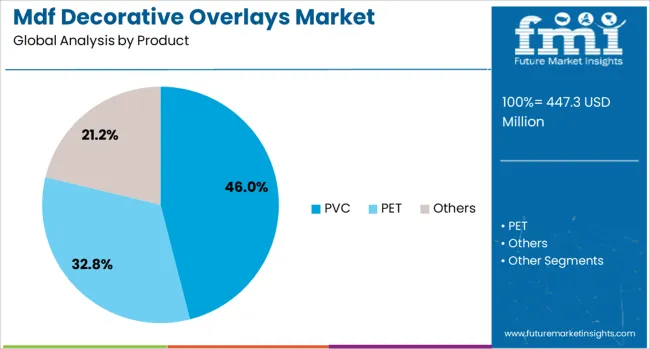

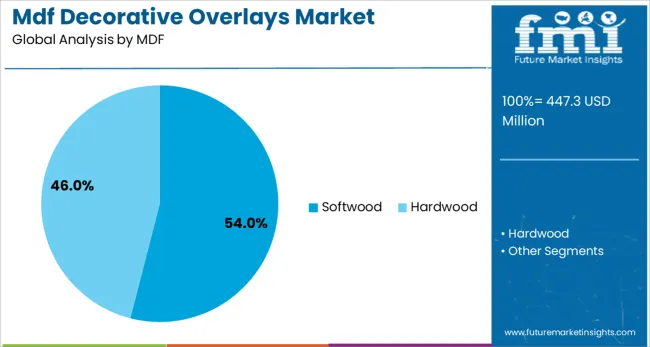

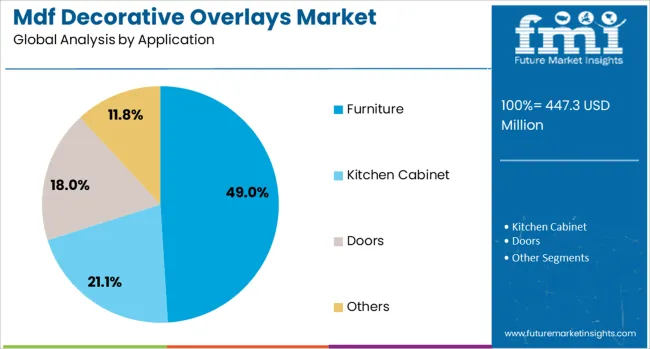

The MDF decorative overlays market is segmented by product, application, and geographic regions. The product of the MDF decorative overlays market is divided into PVC, PET, and others. In terms of MDF, the MDF decorative overlays market is classified into Softwood and Hardwood. Based on the application of the MDF decorative overlays market, it is segmented into Furniture, Kitchen Cabinet, Doors, and Others. Regionally, the MDF decorative overlays industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

PVC overlays are expected to account for 46.00% of the total market share by 2025, making them the leading product segment in MDF decorative overlays. Their popularity is being supported by PVC’s superior moisture resistance, flexibility, and low cost, which make it ideal for residential and commercial furniture surfaces.

The material's ability to mimic wood grain and metallic finishes while maintaining durability and scratch resistance has enhanced its adoption in both low-end and premium applications. PVC overlays are also preferred due to ease of maintenance and compatibility with various MDF grades.

As furniture brands seek customizable, easy-to-apply finishes for mass production, PVC remains the dominant choice, particularly in developing economies where price sensitivity is high. Additionally, innovations in PVC film printing and surface texture enhancement are driving its continued market preference.

Softwood MDF is projected to hold 54.00% of the market share by 2025, making it the dominant MDF substrate used for overlays. This segment's strength lies in the material’s lighter weight, better machinability, and relatively lower cost compared to hardwood MDF.

It is widely utilized in applications where moderate strength is sufficient, such as decorative paneling and general-purpose furniture. The availability of softwood-based MDF in large sheet formats and its compatibility with various laminating and coating technologies have supported widespread adoption.

Moreover, producers are increasingly optimizing softwood MDF production to align with green building certifications, boosting its appeal in both residential and commercial interior markets. As cost-efficiency and environmental compliance remain top priorities for furniture manufacturers, softwood MDF continues to lead as a substrate for decorative overlays.

Furniture applications are expected to contribute 49.00% of the revenue share in 2025, making it the largest end-use segment in the MDF decorative overlays market. The segment’s dominance is being driven by high demand for customizable, lightweight, and aesthetically consistent furniture in residential and commercial interiors.

MDF overlays enable smooth finishes and enhanced surface properties, making them ideal for visible components such as cabinet doors, tabletops, and shelving. With the global rise in small-space urban housing and the shift toward modular and DIY furniture formats, MDF-based panels with decorative finishes offer an efficient and affordable solution.

The segment is also benefiting from the expansion of online and DTC furniture brands that prioritize visually appealing yet cost-effective materials. As consumer demand grows for eco-conscious and stylish furniture, overlays on MDF continue to deliver both form and function in diverse design applications.

The market has witnessed growth driven by the demand for enhanced aesthetics and functional finishes in furniture, interior design, and construction sectors. These overlays are thin decorative sheets applied to medium-density fiberboard (MDF) surfaces to provide appealing textures, colors, and protective properties. The rising popularity of cost-effective interior solutions that mimic natural wood grains, stone patterns, and other designs has supported market expansion. Manufacturers have focused on producing overlays with improved scratch resistance, UV stability, and fire retardancy to meet diverse application requirements.

The furniture manufacturing sector has been a significant consumer of MDF decorative overlays, leveraging their ability to enhance visual appeal and durability of products such as cabinets, wardrobes, and tables. Overlay applications have allowed manufacturers to replicate expensive natural materials at lower costs, aligning with consumer preferences for stylish yet affordable furniture. The demand for lightweight, easy-to-install components has increased the use of decorative overlays in modular and flat-pack furniture. Enhanced surface finishes have improved resistance to moisture, scratches, and wear, extending product lifespan. Additionally, overlays with anti-fingerprint and easy-clean properties have gained popularity in high-use furniture pieces. The furniture sector’s emphasis on customization and rapid product cycles has driven innovations in overlay materials and printing processes.

Advancements in overlay manufacturing have introduced features such as textured embossing, antimicrobial coatings, and enhanced fire resistance to meet evolving industry standards and consumer expectations. Digital printing technologies have enabled high-resolution, photorealistic designs, broadening aesthetic options. Environmentally friendly adhesives and coating materials have been developed to reduce volatile organic compound (VOC) emissions, supporting regulatory compliance and indoor air quality improvements. Integration of UV-cured finishes has improved surface hardness and chemical resistance without prolonging production times. These technological improvements have allowed MDF decorative overlays to be used in a wider range of applications, including commercial interiors, hospitality, and retail displays. Product innovations focusing on sustainability and durability have strengthened market competitiveness.

In the construction industry, MDF decorative overlays have been utilized for wall panels, ceiling elements, doors, and partition systems to deliver visually appealing and functional interiors. The overlays offer architects and designers versatile options to achieve design aesthetics aligned with modern architectural trends. Their ease of installation and compatibility with standard MDF substrates have facilitated rapid deployment in residential and commercial projects. Renovation and refurbishment activities have also favored the use of decorative overlays as a cost-effective alternative to solid wood or natural stone finishes. Furthermore, overlays with enhanced fire retardant properties have been preferred for compliance with building safety codes. Increasing urbanization and commercial infrastructure development have supported sustained demand growth within this sector.

Despite growing adoption, challenges remain related to the environmental impact of synthetic overlay materials and production processes. The use of formaldehyde-based resins in MDF cores and certain coatings has raised health and safety concerns, prompting demand for low-emission alternatives. Price sensitivity among end users has limited widespread adoption in price-competitive markets, especially in emerging economies. Variability in raw material availability and fluctuating costs have influenced production expenses and final product pricing. Additionally, competition from alternative decorative materials such as laminates, veneers, and PVC films has created pressure on market share. Overcoming these challenges will require continued innovation in eco-friendly materials, cost optimization, and enhanced product differentiation strategies.

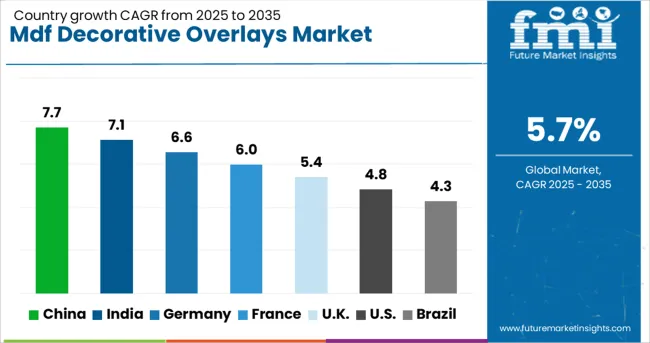

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

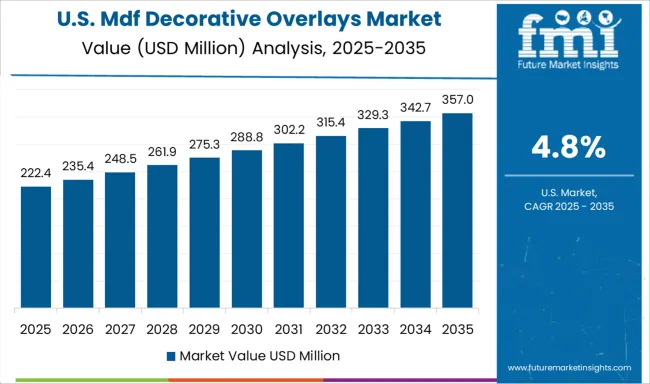

| USA | 4.8% |

| Brazil | 4.3% |

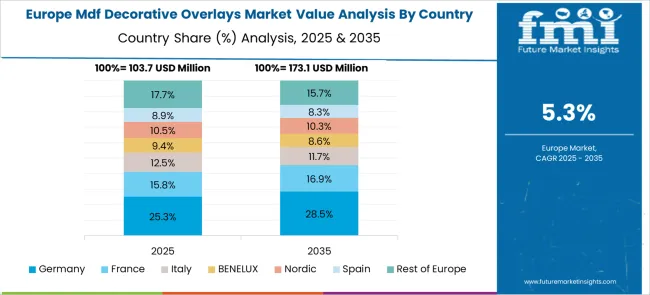

The MDF decorative overlays market is projected to grow at a CAGR of 5.7% from 2025 to 2035, driven by increasing demand in furniture manufacturing, interior design, and building renovations. China leads with a 7.7% CAGR, supported by large-scale production capabilities and growing construction activity. India follows at 7.1%, fueled by expanding residential and commercial real estate sectors. Germany, growing at 6.6%, benefits from high-quality manufacturing standards and design innovations. The UK, with a 5.4% CAGR, experiences steady demand from refurbishment and custom cabinetry projects. The USA, at 4.8%, reflects growth in home improvement and premium furniture markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.7% between 2025 and 2035 in the MDF decorative overlays market, propelled by extensive residential and commercial construction activities. Demand for decorative surfaces combining aesthetics and durability is rising, particularly in urban housing projects. Domestic manufacturers are enhancing product designs with improved textures and environmental compliance. Collaborations with furniture producers and interior design firms are expanding market penetration. Companies such as Dongguan Yuming and Shenzhen Henglun are focusing on innovation to meet evolving consumer preferences.

India is forecasted to grow at a CAGR of 7.1% in the MDF decorative overlays market, supported by rising affordable housing projects and demand for cost-effective interior finishes. Local manufacturers are developing overlays that combine durability with attractive finishes suited for tropical climates. Increasing adoption in modular furniture and interior refurbishment projects is driving growth. Government housing schemes and urban development plans are indirectly boosting the market.

Germany is expected to grow at a CAGR of 6.6% in the MDF decorative overlays market, focusing on high-quality products with sustainable sourcing and low emissions. Manufacturers are complying with strict European standards for formaldehyde emissions and are innovating with recyclable and bio-based overlay materials. Demand from premium furniture and architectural applications is significant. Partnerships between overlay producers and green building projects are advancing.

The United Kingdom is projected to grow at a CAGR of 5.4% in the MDF decorative overlays market, driven by consumer preference for customizable and designer finishes. Growth in home renovation and bespoke furniture segments is encouraging innovation in overlay patterns and textures. Manufacturers are collaborating with interior designers to create trend-responsive products. Expansion of online retail channels for decorative materials is supporting market reach.

The United States is anticipated to grow at a CAGR of 4.8% in the MDF decorative overlays market, focusing on overlays with enhanced durability and resistance to wear. Demand from commercial furniture and cabinetry sectors is increasing. Innovation in surface treatments and UV-resistant coatings is gaining traction. Manufacturers such as Formica and Wilsonart are investing in R&D to expand product portfolios and address evolving consumer demands for long-lasting decorative materials.

The market consists of companies supplying thin films and laminates applied to medium-density fiberboard surfaces to enhance aesthetics and durability in furniture, cabinetry, and interior design. These overlays contribute to improved scratch resistance, color stability, and texture variation, meeting growing demand for customizable and cost-effective surface finishes. Key competitive factors include product innovation, pattern variety, ease of application, and environmental compliance. Omnova Solutions offers a broad portfolio of decorative films featuring advanced coating technologies that improve wear resistance and color retention. Taghleef Industries specializes in sustainable, high-performance films with diverse patterns suited for modern interior applications.

Renolit SE provides premium textured overlays that mimic natural materials such as wood and stone, supporting high-end furniture production. Hueck Folien GmbH and Dackor focus on producing films with enhanced printability and adhesive compatibility to facilitate efficient manufacturing processes. Hyundai L&C Europe delivers decorative overlays combining aesthetic appeal with environmental certifications aligned with green building standards. Eurovinyl Plus and ISA International cater to regional markets with tailored product lines emphasizing cost-efficiency and application versatility. The market is evolving with increasing interest in eco-friendly materials, UV-resistant coatings, and digital printing capabilities that allow for rapid design customization. Providers investing in research and development to address these trends while maintaining quality and affordability are positioned to expand their footprint in the competitive MDF overlay segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 447.3 Million |

| Product | PVC, PET, and Others |

| MDF | Softwood and Hardwood |

| Application | Furniture, Kitchen Cabinet, Doors, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Omnova Solutions, Taghleef Industries, Renolit SE, Hueck Folien GmbH, Dackor, Hyundai L&C Europe, Eurovinyl Plus, and ISA International |

| Additional Attributes | Dollar sales by overlay type and application segment, demand dynamics across furniture manufacturing, interior decoration, and construction industries, regional trends in usage across North America, Europe, and Asia-Pacific, innovation in high-pressure laminates, digital printing technologies, and eco-friendly resin formulations, environmental impact of formaldehyde emissions, waste management, and sustainable sourcing, and emerging use cases in customizable interior finishes, lightweight decorative panels, and modular furniture design. |

The global MDF decorative overlays market is estimated to be valued at USD 447.3 million in 2025.

The market size for the MDF decorative overlays market is projected to reach USD 778.6 million by 2035.

The MDF decorative overlays market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in MDF decorative overlays market are pvc, pet and others.

In terms of mdf, softwood segment to command 54.0% share in the MDF decorative overlays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decorative Rugs Market Size and Share Forecast Outlook 2025 to 2035

Decorative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Decorative Inks Market Analysis by Application and Region Through 2035

Decorative Paints Market Growth – Trends & Forecast 2025 to 2035

Decorative Surface Films Market

Decorative Laminates Market Growth 2022 to 2032

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Automotive Decorative Exterior Trim Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA