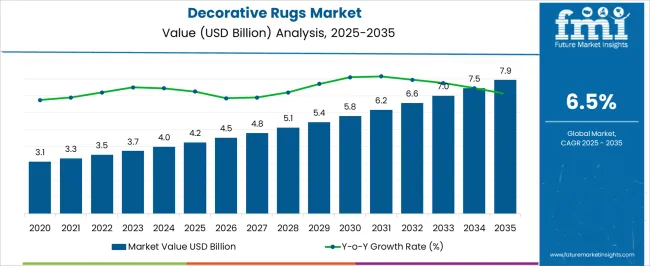

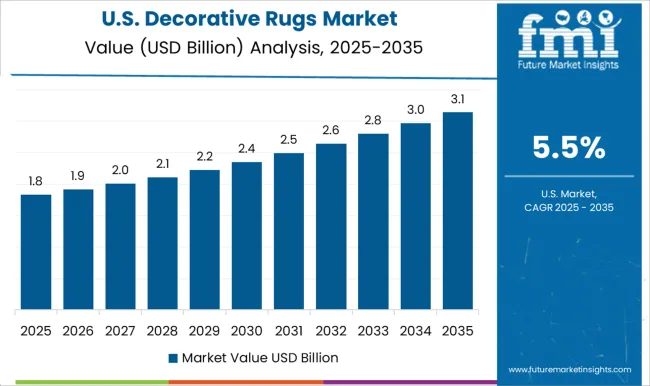

The decorative rugs market is projected to grow from USD 4.2 billion in 2025 to USD 7.9 billion by 2035, reflecting a CAGR of 6.5%. This implies an absolute dollar opportunity of USD 3.7 billion over the period. The trajectory shows a steady climb from USD 3.1 billion in the base years to USD 5.8 billion by 2030, supported by consistent category demand and retail channel expansion.

Players that secure shelf space, broaden assortments, and refine pricing can capture a meaningful share of the incremental pool. Early moves in sourcing, private label development, and geographic coverage position brands to harvest compounding gains later in the decade. From 2025 onward, incremental opportunity builds predictably USD 4.5 billion (2026), USD 4.8 billion (2027), USD 5.1 billion (2028), and USD 5.4 billion (2029), before passing USD 5.8 billion in 2030 and accelerating toward USD 7.5 billion in 2034 and USD 7.9 billion in 2035.

This stair-step pattern favors disciplined capacity planning and tight inventory turns. Vendors can segment growth between higher-margin premium designs and volume-driven essentials, aligning promotions with seasonal refresh cycles. Contract and e-commerce channels amplify reach, while merchandising agility and channel partnerships help translate the USD 3.7 billion expansion into profitable share capture.

| Metric | Value |

|---|---|

| Decorative Rugs Market Estimated Value in (2025 E) | USD 4.2 billion |

| Decorative Rugs Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

A breakpoint analysis of the decorative rugs market highlights two distinct phases of growth. The first breakpoint occurs between 2025 and 2029, where the market expands from USD 4.2 billion to USD 5.4 billion. During this period, annual increments average USD 0.3–0.4 billion, reflecting stable but moderate growth. This stage allows companies to refine sourcing models, test new distribution approaches, and build brand visibility. It also represents a period of lower risk entry, where competitive positioning can be established. Firms that consolidate supply and expand product availability during this early phase will be well-prepared for stronger gains in the later years.

The second breakpoint emerges from 2030 to 2035, as the market accelerates from USD 5.8 billion to USD 7.9 billion, with annual increments increasing to USD 0.5–0.7 billion. This sharper rise in opportunity signals stronger consumer uptake and more rapid category expansion. Companies that scale during this phase can capture significant revenue as the market moves toward higher volumes and greater value per unit. Strategic focus on differentiated assortments and cross-channel visibility becomes essential.

The decorative rugs market is expanding steadily, driven by rising consumer spending on home décor, growing interest in artisanal craftsmanship, and the increasing influence of interior design trends on purchasing decisions. Industry reports and trade publications have noted a heightened preference for rugs that combine aesthetic appeal with durability, leading to strong demand for premium and handcrafted options.

The expansion of residential construction, renovation activities, and hospitality sector projects has created a consistent need for decorative floor coverings. Furthermore, social media platforms and online design communities have amplified consumer awareness of global rug-making traditions, boosting interest in heritage and luxury designs.

Sustainability has also emerged as a key factor, with buyers favoring natural fibers and eco-friendly production practices. The market is expected to be shaped by product innovation, customization options, and expanding distribution networks, with leading growth contributions anticipated from hand-knotted rugs, wool-based materials, and specialty store sales channels.

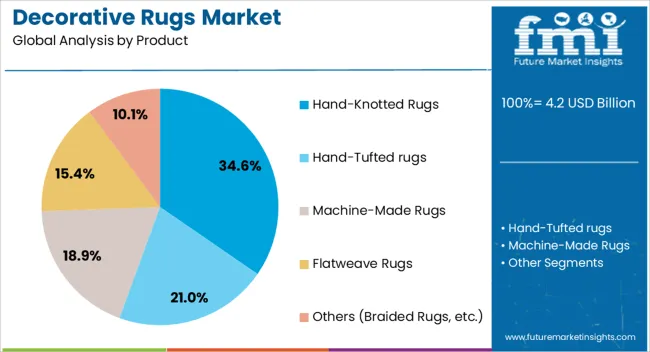

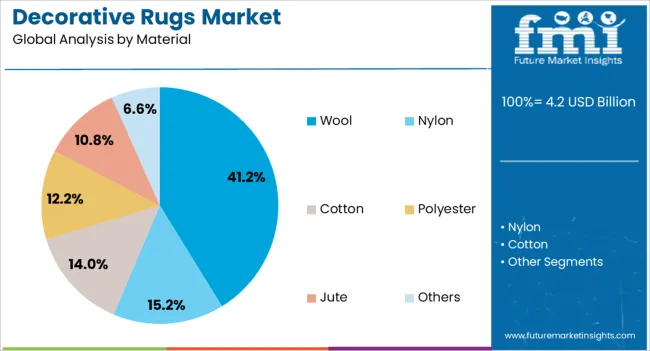

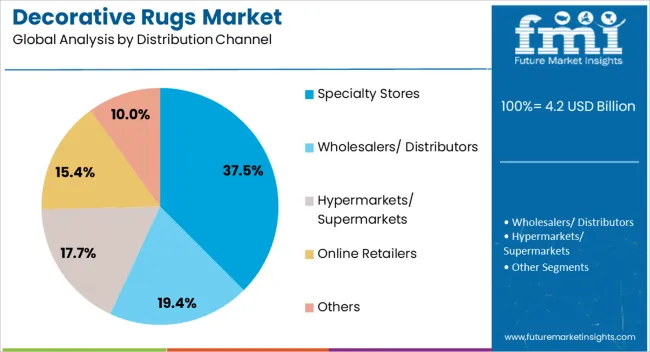

The decorative rugs market is segmented by product, material, distribution channel, end use, and geographic regions. By product, decorative rugs market is divided into Hand-Knotted Rugs, Hand-Tufted rugs, Machine-Made Rugs, Flatweave Rugs, and Others (Braided Rugs, etc.). In terms of material, decorative rugs market is classified into Wool, Nylon, Cotton, Polyester, Jute, and Others. Based on distribution channel, decorative rugs market is segmented into Specialty Stores, Wholesalers/ Distributors, Hypermarkets/ Supermarkets, Online Retailers, and Others. By end use, decorative rugs market is segmented into Residential and Commercial. Regionally, the decorative rugs industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hand-knotted rugs segment is projected to account for 34.6% of the decorative rugs market revenue in 2025, maintaining its position as the leading product category. This growth has been supported by the craftsmanship, durability, and unique aesthetic value associated with hand-knotted designs.

Each piece’s intricate weaving process and high-quality construction appeal to consumers seeking long-lasting, timeless décor investments. Trade fairs and industry showcases have highlighted hand-knotted rugs as premium offerings that command higher price points, contributing to their strong market presence.

Their association with cultural authenticity and artisanal heritage further enhances their desirability among collectors and design-conscious buyers. With increasing global exposure through both specialty retail and digital marketplaces, the hand-knotted rugs segment is expected to sustain its market leadership in the premium décor space.

The wool segment is projected to contribute 41.2% of the decorative rugs market revenue in 2025, retaining its dominance as the preferred material. Wool’s natural resilience, softness, and insulating properties make it a highly valued choice for decorative and functional rugs.

Industry publications have emphasized wool’s longevity and its ability to retain color vibrancy over time, which appeals to both residential and commercial buyers. The material’s inherent stain resistance and eco-friendly profile also align with growing consumer interest in sustainable home furnishings.

Wool rugs are often positioned in the premium segment due to their tactile comfort and ability to enhance indoor ambiance. As supply chains adapt to offer responsibly sourced wool, and as consumer awareness of material quality increases, the wool segment is expected to remain a central driver of market growth.

The specialty stores segment is projected to hold 37.5% of the decorative rugs market revenue in 2025, leading the distribution landscape due to its focus on curated, high-quality product selections.

Specialty retailers have built their reputation on offering expert guidance, personalized service, and exclusive designs not typically found in mass-market outlets. This channel caters to consumers seeking unique, premium rugs and the assurance of material authenticity and craftsmanship.

Store displays and in-person consultations allow buyers to experience product texture, quality, and design details before purchase, which is a key decision factor for high-value décor items. Industry observations indicate that specialty stores have also adapted to omnichannel retail models, combining in-store experiences with online accessibility. As consumer demand for distinctive, well-crafted decorative rugs continues to rise, specialty stores are expected to maintain their leading role in connecting premium rug makers with discerning buyers.

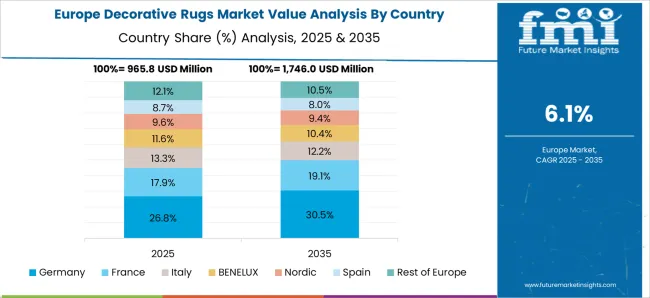

The decorative rugs market is expanding due to rising interest in interior design, home renovation projects, and the influence of lifestyle trends. North America and Europe lead in demand for premium, design-focused rugs with sustainable materials and artisanal craftsmanship, while Asia-Pacific shows rapid growth driven by affordable mass production and growing urban housing. Key players differentiate through design variety, quality of materials, and distribution reach across online and offline channels. Market growth is fueled by increasing disposable incomes, evolving consumer preferences, and the integration of rugs into modern home décor and hospitality spaces.

Decorative rugs vary in material composition, durability, and finish. Europe and North America favor natural fibers such as wool, cotton, and jute for their durability and premium aesthetic. In contrast, Asia-Pacific markets often adopt synthetic fiber rugs like polypropylene and polyester due to affordability and ease of mass production. Material quality directly affects longevity, texture, and consumer perception. Global suppliers emphasize eco-friendly and artisanal options, while regional producers focus on large-scale, cost-efficient output. These differences influence consumer choice, pricing strategies, and market competitiveness between high-value and mass-market segments.

Consumer preferences for rug designs and patterns vary significantly by region. North American and European consumers prioritize minimalist, contemporary, or custom designs to match modern interiors. In contrast, Asia-Pacific and Middle Eastern buyers often prefer traditional motifs and vibrant colors reflecting cultural aesthetics. Differences in design demand affect product development, marketing campaigns, and regional adoption rates. Leading manufacturers invest in trend analysis and customization to attract diverse markets, while regional producers capitalize on cultural identity and affordability. These design-driven contrasts shape the competitive landscape and determine brand positioning in global and local markets.

The sale of decorative rugs depends heavily on distribution strategies. Europe and North America emphasize online platforms, specialty stores, and premium home décor outlets. Asia-Pacific markets prioritize high-volume sales through supermarkets, local retailers, and emerging e-commerce channels. Differences in retail structure affect consumer access, pricing, and brand visibility. Established global players rely on e-commerce partnerships and showrooms, while smaller regional producers distribute primarily through local channels. Variations in retail and distribution strategies determine adoption speed, consumer loyalty, and long-term competitiveness across premium and mass-market segments.

Decorative rug manufacturing relies on raw material sourcing, weaving techniques, and production scale. Europe and North America highlight artisanal craftsmanship and certified sustainable sourcing, ensuring consistency but with limited volumes. Asia-Pacific leads in high-volume, machine-made rug production with variable quality standards. Supply reliability, labor availability, and transportation logistics influence delivery timelines and pricing. Large multinational suppliers maintain diversified sourcing and global distribution networks, while regional producers face constraints tied to raw material or seasonal demand. These contrasts shape supplier credibility, market reach, and the ability to capture long-term contracts in global decorative rug markets.

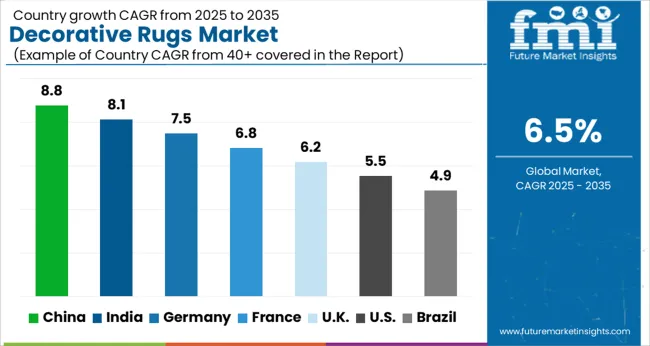

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global decorative rugs market was projected to grow at a 6.5% CAGR through 2035, driven by rising demand in home décor, furnishing, and interior design applications. Among BRICS nations, China recorded 8.8% growth as large-scale production facilities were expanded and compliance with quality and export standards was enforced, while India at 8.1% growth saw expansion of traditional and modern manufacturing clusters to serve domestic and international demand. In the OECD region, Germany at 7.5% maintained strong output under strict product safety and trade regulations, while the United Kingdom at 6.2% focused on moderate-scale operations catering to residential and premium furnishing markets. The USA, expanding at 5.5%, remained a mature market with steady demand across residential and commercial interiors, supported by adherence to federal and state-level safety and trade requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Decorative rugs market in China is growing at a CAGR of 8.8%. Between 2020 and 2024, growth was driven by rising urbanization, expansion of the real estate sector, and consumer preference for home décor upgrades. Manufacturers focused on machine-woven and hand-knotted rugs, blending traditional designs with modern aesthetics. In the forecast period 2025 to 2035, growth is expected to accelerate with increasing adoption of eco-friendly materials, customization options, and premium product offerings. Rising disposable income, e-commerce penetration, and lifestyle-driven demand will further support market expansion. China remains a leading market due to large-scale production, competitive pricing, and growing domestic consumption of luxury home décor products.

Decorative rugs market in India is growing at a CAGR of 8.1%. Historical period 2020 to 2024 saw growth supported by rising demand for handmade rugs, increased exports, and adoption of traditional designs in modern households. Manufacturers focused on artisanal craftsmanship, sustainable materials, and cost-effective production. In the forecast period 2025 to 2035, market growth is expected to continue with expansion in luxury rugs, eco-friendly products, and e-commerce-driven distribution. Rising middle-class incomes, home renovation trends, and global demand for Indian handmade rugs will further drive growth. India is projected to maintain strong growth due to heritage in rug-making and expanding domestic market.

Decorative rugs market in Germany is growing at a CAGR of 7.5%. Between 2020 and 2024, growth was supported by rising demand for premium home décor, sustainable textiles, and increasing consumer spending on interiors. Manufacturers focused on eco-friendly raw materials, modern designs, and durable quality. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of luxury rugs, smart textile innovations, and e-commerce distribution. Sustainability, preference for minimalistic designs, and advanced customization will further support adoption. Germany remains a key European market due to strong consumer focus on design quality and environmentally responsible products.

Decorative rugs market in the United Kingdom is growing at a CAGR of 6.2%. During 2020 to 2024, adoption was driven by home renovations, rising online sales, and consumer demand for modern yet practical rug designs. Manufacturers focused on durable, easy-to-clean, and affordable rugs. In the forecast period 2025 to 2035, market growth is expected to continue moderately with demand for eco-friendly products, premium rugs, and smart textile solutions. Government initiatives on sustainable home products, combined with rising consumer focus on design and comfort, will further support market expansion. The United Kingdom reflects stable growth with emphasis on affordability, sustainability, and style.

Decorative rugs market in the United States is growing at a CAGR of 5.5%. Historical period 2020 to 2024 saw growth driven by residential remodeling, e-commerce expansion, and consumer preference for modern interior design. Manufacturers focused on premium quality rugs, innovative textures, and stain-resistant materials. In the forecast period 2025 to 2035, growth is expected to continue with adoption of sustainable rugs, customizable designs, and luxury product lines. Rising disposable incomes, home décor trends, and green building initiatives will further support expansion. The United States market demonstrates steady growth with emphasis on style, quality, and sustainable innovation.

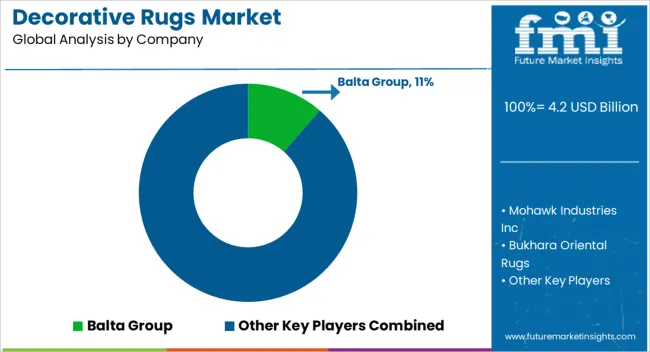

The decorative rugs market is shaped by suppliers such as Balta Group, Mohawk Industries Inc., Bukhara Oriental Rugs, Capel Rugs, Agnella, Harounian Rugs International, Kalaty Rug Corp, Milliken and Co., Loloi Inc., and Momeni Inc.. Competition is defined by material innovation, design diversity, and distribution reach. Balta Group and Mohawk Industries offer broad product lines with machine-woven and tufted rugs in polypropylene, nylon, and polyester blends, highlighting stain resistance and durability in their brochures.

Bukhara Oriental Rugs and Kalaty Rug Corp specialize in hand-knotted wool and silk rugs, with datasheets specifying knot density, pile height, and weaving techniques. Capel Rugs, Loloi Inc., and Momeni Inc. focus on trend-driven collections, often integrating natural fibers such as jute, sisal, and cotton. Observed market direction shows increased consumer interest in sustainable, artisanal, and customizable rug options. Market strategies revolve around product positioning, sustainability initiatives, and retail partnerships. Mohawk Industries emphasizes eco-friendly materials and recycling programs, aligning with consumer demand for green home furnishings.

Balta Group leverages high-capacity manufacturing to serve mass-market retailers, while Harounian Rugs International and Agnella position themselves in the premium segment with exclusive collections. Milliken and Co. integrates performance features such as stain protection, antimicrobial finishes, and enhanced durability for commercial applications. Loloi Inc. and Momeni Inc. collaborate with designers and influencers to create branded collections that appeal to younger demographics.

Capel Rugs focuses on USA manufacturing heritage, highlighting craftsmanship and quality assurance. Across suppliers, observed strategies include broadening online distribution and enhancing direct-to-consumer sales channels. Brochures and technical datasheets highlight rug dimensions, fiber content, backing material, recommended care, and performance ratings. Balta Group and Mohawk Industries provide detailed specifications on fiber resilience, colorfastness, and traffic ratings, enabling comparison across product tiers. Kalaty Rug Corp and Bukhara Oriental Rugs emphasize authenticity markers, weaving origin, and handcraft certifications.

Milliken and Co. supplies datasheets with flammability compliance and warranty details for contract-grade rugs. Loloi and Momeni include consumer-facing information such as styling guides, room visualization tools, and care instructions. Capel Rugs and Harounian Rugs International highlight construction types braided, tufted, or flatwoven and the unique design elements of each collection. This documentation supports architects, interior designers, retailers, and end-users in selecting decorative rugs based on durability, aesthetic appeal, and sustainability attributes.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Product | Hand-Knotted Rugs, Hand-Tufted rugs, Machine-Made Rugs, Flatweave Rugs, and Others (Braided Rugs, etc.) |

| Material | Wool, Nylon, Cotton, Polyester, Jute, and Others |

| Distribution Channel | Specialty Stores, Wholesalers/ Distributors, Hypermarkets/ Supermarkets, Online Retailers, and Others |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Balta Group, Mohawk Industries Inc, Bukhara Oriental Rugs, Capel Rugs, Agnella, Harounian Rugs International, Kalaty Rug Corp, Milliken and Co, Loloi Inc., and Momeni Inc. |

| Additional Attributes | Dollar sales vary by rug type, including hand-knotted, tufted, flat-weave, and braided rugs; by material, spanning wool, cotton, silk, jute, and synthetic fibers; by application, such as living rooms, bedrooms, offices, and hospitality; by end-use industry, covering residential, commercial, and hospitality sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising interior décor trends, disposable income, and demand for sustainable and aesthetic home furnishings. |

The global decorative rugs market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the decorative rugs market is projected to reach USD 7.9 billion by 2035.

The decorative rugs market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in decorative rugs market are hand-knotted rugs, hand-tufted rugs, machine-made rugs, flatweave rugs and others (braided rugs, etc.).

In terms of material, wool segment to command 41.2% share in the decorative rugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decorative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Decorative Inks Market Analysis by Application and Region Through 2035

Decorative Paints Market Growth – Trends & Forecast 2025 to 2035

Decorative Surface Films Market

Decorative Laminates Market Growth 2022 to 2032

MDF Decorative Overlays Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Automotive Decorative Exterior Trim Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pet Rugs Market

Bath Rugs & Mats Market Growth - Trends & Industry Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA