The Rig and Oilfield Mat Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The Rig and Oilfield Mat market is experiencing substantial growth, driven by the increasing demand for safe and efficient operations in the oil and gas sector, as well as other heavy industrial applications. Adoption is being supported by the need to provide stable access in challenging terrains, including marshlands, deserts, and construction sites where equipment mobility and safety are critical. Steel and other high-strength mat materials are enabling durable and reusable solutions that improve operational efficiency, reduce downtime, and enhance worker safety.

The market is also benefiting from rising investments in upstream oil and gas exploration and production activities, particularly in regions with complex environmental and geological conditions. Increasing emphasis on regulatory compliance, environmental protection, and sustainable infrastructure development is further reinforcing demand.

Continuous improvements in mat design, load-bearing capacity, and corrosion resistance are shaping market dynamics As companies seek scalable, reliable, and cost-effective access solutions for heavy machinery and drilling rigs, the Rig and Oilfield Mat market is positioned for long-term growth with expanding applications across multiple sectors.

| Metric | Value |

|---|---|

| Rig and Oilfield Mat Market Estimated Value in (2025 E) | USD 1.9 billion |

| Rig and Oilfield Mat Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

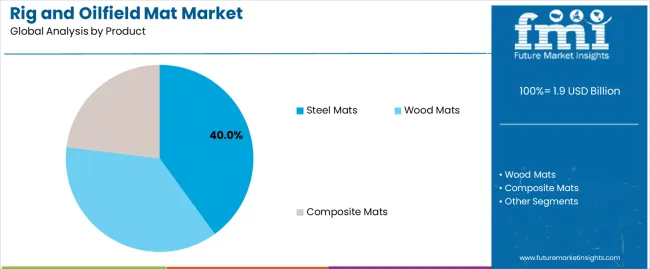

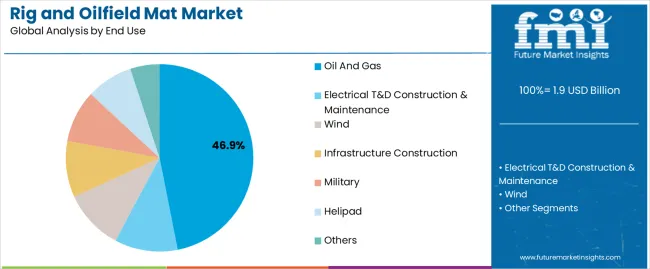

The market is segmented by Product and End Use and region. By Product, the market is divided into Steel Mats, Wood Mats, and Composite Mats. In terms of End Use, the market is classified into Oil And Gas, Electrical T&D Construction & Maintenance, Wind, Infrastructure Construction, Military, Helipad, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steel mats product segment is projected to hold 40.0% of the market revenue in 2025, making it the leading product type. This dominance is being driven by the superior strength, durability, and load-bearing capacity of steel mats, which provide reliable support for heavy machinery and drilling rigs in demanding operational environments. Steel mats are highly resistant to wear, deformation, and environmental stressors, enabling long-term reuse and reducing operational costs.

Their robustness allows deployment in diverse terrains, including mud, sand, and uneven ground, ensuring safety and stability for oilfield operations. The modular design and ease of installation further enhance adoption among operators seeking quick and flexible site access solutions.

Ongoing innovations in corrosion resistance, surface texture, and weight optimization have strengthened the performance and reliability of steel mats As the demand for safe, durable, and efficient access solutions grows, the steel mats segment is expected to maintain its leadership, supported by increasing investments in upstream and heavy industrial projects.

The oil and gas end-use segment is anticipated to account for 46.9% of the market revenue in 2025, establishing it as the leading sector. Growth is being driven by the extensive deployment of rigs and heavy equipment in upstream, midstream, and downstream operations, where site stability and operational safety are paramount. Rig and oilfield mats are used to create temporary roadways, work pads, and drilling platforms, allowing equipment and personnel to operate efficiently in challenging terrains.

Increasing exploration and production activities in remote and environmentally sensitive regions are further fueling adoption. The need to minimize environmental impact, prevent soil erosion, and comply with safety regulations is reinforcing demand for high-quality mats.

Modular design, reusability, and load-bearing performance make mats particularly suitable for oil and gas operations As operators continue to invest in expanding production capacity and ensuring operational continuity, the oil and gas segment is expected to remain the primary driver of market growth, supported by ongoing technological improvements in mat materials and deployment strategies.

The historical CAGR of 3.7% elevated the global rig and oilfield mat market from USD 1.5 billion in 2020 to USD 1.9 billion in 2025. The historical period's fundamental market driver shifted consumer needs from traditional mats to engineered mats. This created lucrative chances for the production of relevant mats.

However, the pandemic period affected the growth of the sector. This is because governments imposed strict regulations in terms of lockdowns, affecting many businesses.

| Historical CAGR from 2020 to 2025 | 3.7% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 5.1% |

The pot pandemic period will likely fuel the market, as relaxed restrictions will fuel the construction and oil extraction businesses. The frequent requirements for these industries create lucrative growth chances for the subject market, and this is a primary demand generator.

Apart from this, developing Asian countries form formidable opportunity-creating markets as they have undertaken development projects that require stabilizing mats for heavy-duty instruments.

Forecast CAGRs from 2025 to 2035

| Countries | Forecasted CAGR |

|---|---|

| Canada | 5.5% |

| The United Kingdom | 5.4% |

| China | 4.1% |

| South Korea | 15.3% |

| India | 4.6% |

Based on product type, steel mats deliver numerous benefits, which drive the market segment, justifying its market share.

| Category | Product Type - Steel Mats |

|---|---|

| Market Share in 2025 | 40% |

| Market Segment Drivers |

|

The oil and gas industry creates lucrative opportunities for the rig and oilfield mat market due to the wider usability of mats.

| Category | End-use - Oil & Gas |

|---|---|

| Market Share in 2025 | 46.9% |

| Market Segment Drivers |

|

Key strategic expansion initiatives of key players in the industry often govern the market competition. Moreover, the extent to which an organization innovates its products and services plays an active role in cluttering the market space. Strategies like product development, innovation, mergers and acquisitions, partnerships, and global expansions influence the rig and oilfield mat market’s competition.

The new entrants must differentiate their product portfolio by augmenting the market requirements. It can be achieved by creating a market niche through demand generation. Moreover, strategic expansion initiatives can play a great role in fueling their growth.

Key Market Developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.9 billion |

| Projected Market Valuation in 2035 | USD 3.0 billion |

| Value-based CAGR 2025 to 2035 | 4.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | By Product, By End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Horizon North Logistics Inc.; Newpark Resources Inc.; Signature Systems Group LLC; Strad Energy Services Ltd; Checkers Safety Group; Spartan Mat; Rig Mats of America Inc.; Quality Mat Company; Canada Rig Mats Ltd.; Alberta Rig Mats; Access Terrain Services |

The global rig and oilfield mat market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the rig and oilfield mat market is projected to reach USD 3.0 billion by 2035.

The rig and oilfield mat market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in rig and oilfield mat market are steel mats, wood mats and composite mats.

In terms of end use, oil and gas segment to command 46.9% share in the rig and oilfield mat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rigid Foam Market Forecast Outlook 2025 to 2035

Rigid Box Market Forecast and Outlook 2025 to 2035

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Rigid-Flex PCB Market Size and Share Forecast Outlook 2025 to 2035

Mattress Topper Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Mattress and Mattress Component Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA