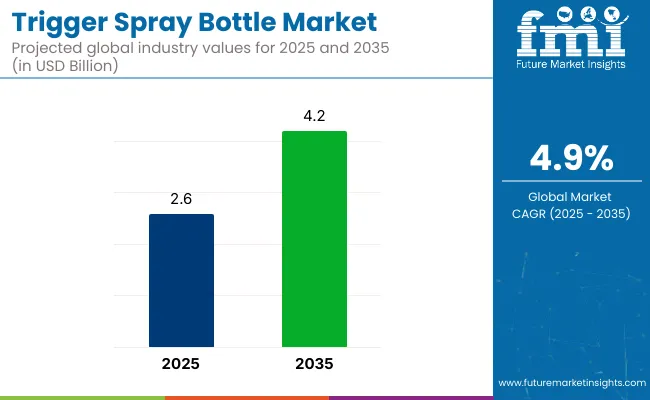

The global trigger spray bottle market is projected to grow from USD 2.6 billion in 2025 to USD 4.2 billion by 2035, registering a CAGR of 4.9% over the forecast period. Sales in 2024 were recorded at USD 2.5 billion.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 2.6 billion |

| Industry Value (2035F) | USD 4.2 billion |

| CAGR (2025 to 2035) | 4.9% |

This growth is primarily attributed to the increasing demand for convenient and efficient dispensing solutions in household cleaning, personal care, automotive, and gardening applications. Trigger spray bottles offer controlled dispensing, ergonomic design, and reusability, making them a preferred choice for both consumers and industries seeking sustainable packaging options.

In April 2025, Amcor plc announced the completion of its transformational merger with Berry Global Group, Inc. This strategic combination aims to enhance Amcor's positions in attractive categories, broaden its customer offerings, and expand material science and innovation capabilities. "Today is a defining day for Amcor as we closed our transformational merger with Berry Global.

Through this combination, Amcor has enhanced positions in attractive categories, a broader, more complete customer offering and expanded material science and innovation capabilities," stated Peter Konieczny, CEO of Amcor. This merger is expected to bolster Amcor's position in the trigger spray bottle market by integrating Berry Global's specialized technology and expanding their reach in the industry.

Recent innovations in trigger spray bottle design have led to significant improvements in product functionality and customization. Manufacturers have focused on developing high-quality, secure, and durable dispensing solutions that cater to the specific needs of various industries.

Advancements in nozzle technology have enabled adjustable spray patterns, leak-proof mechanisms, and enhanced user comfort. Additionally, the integration of eco-friendly materials and sustainable practices has improved the environmental footprint of trigger spray bottles.

The trigger spray bottle market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, due to rapid urbanization and increasing consumer awareness. Applications are expanding beyond traditional sectors, with growing adoption in personal care, automotive, and industrial cleaning industries. Manufacturers are anticipated to focus on developing cost-effective and versatile dispensing solutions to cater to diverse consumer needs and comply with evolving environmental regulations.

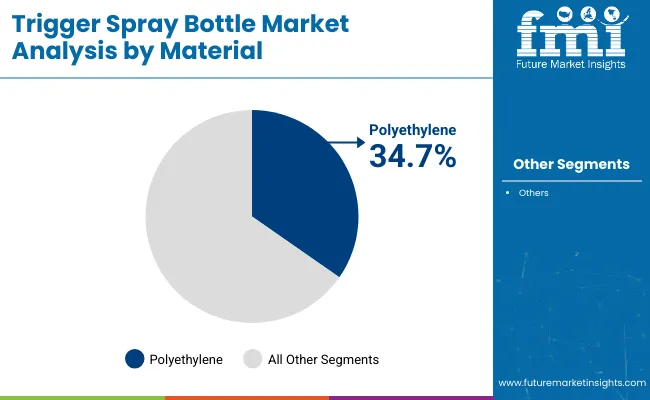

The market has been segmented based on material, capacity, end use, and region. Materials such as polyethylene terephthalate (PET), polyethylene (PE), high-density polyethylene (HDPE), low-density polyethylene (LDPE), polyvinyl chloride (PVC), and polypropylene (PP) have been used to achieve durability, chemical compatibility, and recyclability.

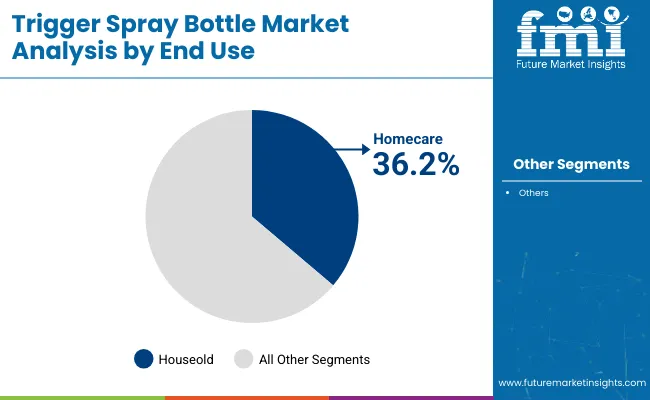

Capacity ranges including up to 100 ml, 100 ml to 250 ml, and above 250 ml have been defined to support household, commercial, and industrial spray applications. End-use sectors have been categorized into food & beverage, agriculture, pharmaceutical, cosmetic & personal care, homecare, and chemicals, where precise dispensing and hygienic packaging are essential.

Regional segmentation has been structured to include North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa to capture varying regulatory compliance and market penetration levels.

The polyethylene (PE) segment is expected to hold 34.7% of the trigger spray bottle market share in 2025, driven by its suitability for molding, durability, and compatibility with a wide range of liquids. PE bottles have been widely used for surface cleaners, disinfectants, and air fresheners due to their impact resistance and cost efficiency.

High-density and low-density variants have been utilized for different viscosity and dispensing needs. Packaging performance under repeated use and variable temperatures has been maintained through robust material properties. Nozzles and closures have been securely integrated with PE bottles to prevent leakage and maintain spray accuracy.

Color matching and surface texture customization have been enabled to support brand identity. Lightweight transport and damage resistance have further enhanced their utility in retail and e-commerce. PE’s widespread production and reliable function have sustained its dominance in the trigger bottle format.

The homecare segment is projected to account for 36.2% of the trigger spray bottle market in 2025, as strong demand has been noted across household cleaning and air care products. Trigger bottles have been implemented for glass cleaners, disinfecting sprays, and fabric refreshers in daily consumer routines. Ergonomic design and easy dispensing mechanisms have improved product handling and storage in domestic settings.

Refillability and extended usability have been emphasized in multipurpose spray formats. Varied nozzle types such as fine mist, foam, and stream have been utilized to support different cleaning tasks and preferences. Label-friendly surfaces and shelf-ready shapes have facilitated marketability through offline and online retail channels.

Batch packaging and tamper-evident features have been applied for high-volume SKUs. Continued dominance has been anticipated as home hygiene awareness and convenience purchasing patterns remain elevated.

Plastic Regulation, Cost Sensitivity, and Compatibility

Under new global sustainability frameworks, trigger spray bottles, which are plastic-intensive, will be scrutinized by regulators. Viscous / chemically aggressive liquids (bleach, oils) may be incompatible with trigger flagging performance degradation, leakage or failure. The high resin prices combined with import tariffs and global supply chain disruptions may further affect availability and cost-efficiency, especially for low-margin applications.

Sustainable Innovation, Customization, and Reusability

There is also opportunity for recyclable, biodegradable and compostable materials, and mono-polymer trigger assemblies that aid in recycling after use. Custom branding, color-coding and ergonomic enhancements that deliver value for private label and DTC (direct-to-consumer) players are also driving growth. The movement toward refillable household products, zero-waste packaging and subscription-based cleaning kits is carving out a new premium segment in the trigger spray category.

The USA trigger spray bottle market stands at 2.4 million units, growing at a decent pace, mired by strong consumer demand from household cleaning, personal care, and industrial sectors. They are most commonly used in trigger sprayers for surface disinfectants, pest control solutions, salon products, dancing, and gardening sprays.

Innovation driven by consumer preference towards ergonomic, refillable and adjustable-nozzle designs. Sustainable initiatives are pushing on brands to use recyclable plastics, and minimize material use via light-weight designs. Manufacturing automation and smart packaging integration are enhancing production efficiency and user friendliness.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

The UK trigger spray bottle market is growing steadily with the rising demand for eco-friendly packaging in cleaning chemical, pet care, and personal hygiene products. Product design is being influenced by a trend in concentrated refill formats and reusable trigger heads.

The material innovation is being driven by private-label brands and sustainability-oriented startups, especially with recyclable PET and post-consumer recycled content. Pressure from regulators to eliminate single-use plastics is further compounded by advancements being made in durable, multi-use trigger mechanisms in both retail and institutional environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

The EU trigger spray bottle market was led by Germany while France and Italy held the second and third place respectively due to high environmental standards and sufficient manufacturing potential. It is widely used in household care, automotive detailing, and horticulture applications, which benefits the overall market.

Policies in the EU to support circular packaging and bans on different single-use plastics are driving the uptake of mono-material spray systems and bio-based resins. For commercial use (professional grade cleaning, agricultural), industrial players are investing in durable trigger mechanisms and anti-clogging nozzles.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Japanese trigger spray bottle market in driven by precision dispensing, compact designs, and aesthetically refined packaging, especially in the personal care and home segment. Japanese consumers prefer quiet, low-force triggers and simple packaging that adheres to space-saving principles.

New airless spray innovations and refillable cartridge formats are seeing increased adoption. Sustainability measures are also shaping material selections, with brands using plant-based plastics and recyclable packaging to align with consumer demand and regulatory pressure.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The trigger spray bottle market in South Korea is seeing healthy growth due to demand in k-beauty, home care and disinfectant product segments. Sleeve bottles with compact and sleek designs, plus customizable spray patterns, are popular in cosmetic and lifestyle brands.

Automation and smart mold technologies are being adopted by domestic manufacturers to enhance production quality and cut cycle times. As buyers become more sustainability-conscious, triggering reuse packaging and reuse models are gaining traction in the eco-conscious urban shopper segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The trigger spray bottle market has been demonstrating steady growth primarily owing to increasing demand across various applications such as household cleaning, personal care, automotive and agriculture. Manual dispense bottles are commonly applied in a wide range of industrial and consumer applications as they provide accurate dispensing, easy grip and refill features.

The shift to sustainable packaging, increase in usage of disinfectants and surface cleaners, rise of private-label homecare brands, and development of spill free and 360° spray technologies are among the key market drivers.

The overall market size for the trigger spray bottle market was USD 2.6 billion in 2025.

The trigger spray bottle market is expected to reach USD 4.2 billion in 2035.

The demand for trigger spray bottles will be driven by rising usage in household and industrial cleaning products, growing demand for personal care and cosmetic packaging, increased focus on user-friendly and controlled dispensing solutions, and advancements in recyclable and ergonomic bottle designs.

The top 5 countries driving the development of the trigger spray bottle market are the USA, China, Germany, the UK, and India.

The polyethylene terephthalate (PET) segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trigger Sprayer Market Growth – Trends & Forecast 2025-2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Automotive Crank Trigger Market

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA