The Spray Polyurethane Foam Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Spray Polyurethane Foam Market Estimated Value in (2025 E) | USD 2.2 billion |

| Spray Polyurethane Foam Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Spray Polyurethane Foam market is experiencing robust growth driven by increasing demand for energy-efficient and sustainable insulation solutions across residential, commercial, and industrial sectors. Rising awareness of energy conservation, stricter building codes, and government initiatives promoting green construction have contributed to market expansion. Spray polyurethane foam offers superior thermal performance, moisture resistance, and air-sealing capabilities compared with conventional insulation materials, making it highly suitable for modern construction projects.

The ongoing trend toward retrofitting and upgrading older buildings for energy efficiency has further supported the adoption of spray polyurethane foam. Additionally, the versatility of the material, including its applicability in complex structures, flat or sloped roofs, and new constructions, provides significant opportunities for growth.

Manufacturers are focusing on innovations such as low global warming potential formulations and rapid-curing products to meet environmental standards and shorten project timelines With increasing residential construction activity and urbanization, the Spray Polyurethane Foam market is expected to sustain strong growth over the coming years, providing efficient, long-lasting insulation solutions that align with energy-saving objectives.

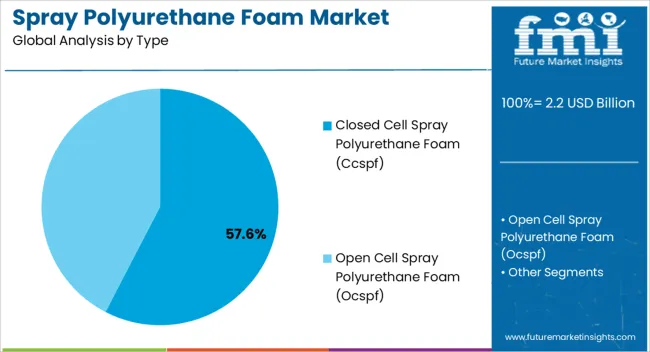

The spray polyurethane foam market is segmented by type, application, end user, and geographic regions. By type, spray polyurethane foam market is divided into Closed Cell Spray Polyurethane Foam (Ccspf) and Open Cell Spray Polyurethane Foam (Ocspf). In terms of application, spray polyurethane foam market is classified into Roofs, Floors, Walls, Ceilings, and Attics.

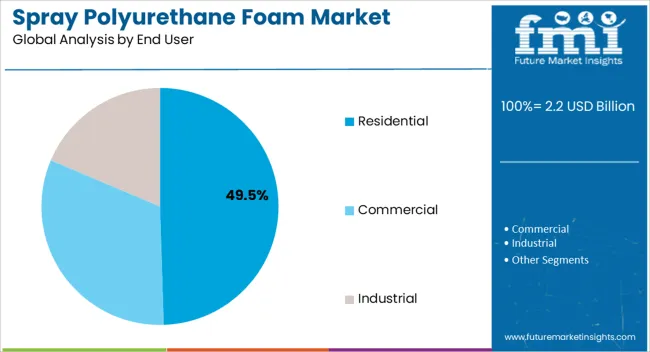

Based on end user, spray polyurethane foam market is segmented into Residential, Commercial, and Industrial. Regionally, the spray polyurethane foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Closed Cell Spray Polyurethane Foam segment is projected to hold 57.60% of the market revenue in 2025, making it the leading type in the Spray Polyurethane Foam market. This dominance is driven by its high insulation value, moisture resistance, and structural reinforcement properties, which are highly desirable in both new construction and retrofitting projects. The superior density of closed cell foam provides better thermal insulation per unit thickness, allowing for thinner application layers without compromising performance.

Its ability to act as both an air and vapor barrier has enhanced its adoption in regions with extreme weather conditions. The segment’s growth has also been fueled by increasing regulatory emphasis on energy efficiency and stringent building codes.

In addition, closed cell formulations provide enhanced durability, resistance to water absorption, and long-term dimensional stability, making them particularly suitable for residential and commercial roofing applications These performance advantages have positioned closed cell spray polyurethane foam as the preferred choice for developers, contractors, and architects seeking reliable, high-performance insulation solutions that meet both environmental and building standards.

The Roofs application segment is expected to account for 42.80% of the Spray Polyurethane Foam market revenue in 2025, representing the largest share among applications. This segment’s leadership is being driven by the material’s ability to improve thermal insulation, prevent water infiltration, and extend roof lifespan, which are critical factors in both new construction and renovation projects. Spray polyurethane foam allows for seamless coverage over complex roof geometries, ensuring superior performance compared with traditional insulation methods.

Its application reduces energy consumption by maintaining indoor temperatures and preventing heat loss, which is increasingly valued by homeowners and commercial property managers. In addition, the rapid curing time and lightweight properties of foam have facilitated faster construction schedules and reduced structural load requirements.

The segment has also benefited from growing investments in energy-efficient buildings and rising awareness of sustainable construction practices These factors combined have established roofs as the dominant application for spray polyurethane foam, and its usage is expected to expand further with increasing green building initiatives and regulatory mandates focused on energy efficiency.

The Residential end-user segment is projected to hold 49.50% of the Spray Polyurethane Foam market revenue in 2025, making it the leading end-use industry. This segment’s growth has been fueled by rising residential construction, urbanization, and a focus on energy-efficient homes. Spray polyurethane foam provides superior thermal insulation, airtightness, and moisture resistance, which are critical for reducing energy bills and maintaining indoor comfort in residential buildings.

Its adaptability for roofs, walls, and basement insulation has made it a preferred choice among homeowners, builders, and contractors seeking long-term performance and sustainability. Additionally, government incentives and subsidies for energy-efficient housing projects have encouraged wider adoption of spray polyurethane foam in residential construction. The ease of retrofitting older homes with foam insulation without major structural alterations has further supported market penetration.

The segment’s growth is also being driven by increased consumer awareness regarding environmental impact, indoor air quality, and energy conservation As residential construction continues to expand in emerging and developed markets, spray polyurethane foam is expected to maintain its leading position, offering high-performance, durable, and sustainable insulation solutions.

Spray polyurethane foam is an insulator that is sprayed on the interior parts of a building (e.g., walls, roofs, and floors); it acts as an air barrier that prevents thermal leaks. Spray polyurethane foam is produced by two liquid components, polyol blend and MDI, which are mixed under pressure and sprayed onto a wall cavity or roof. Usage of spray polyurethane foam reduces the overall maintenance cost, extends the life span of a building and allows flexibility of building design. The spray polyurethane foam comes in two forms: open cell foam and closed cell foam. Among these, open cell foam also known as half-pound or low density foam is expected to gain traction in the coming years, owing to its wide application in building interiors.

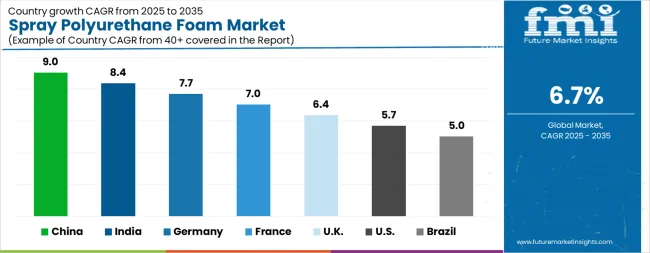

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The Spray Polyurethane Foam Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.0%, followed by India at 8.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Brazil posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Spray Polyurethane Foam Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.7%. The USA Spray Polyurethane Foam Market is estimated to be valued at USD 761.2 million in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035.

Sales are projected to rise at a CAGR of 5.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 99.1 million and USD 61.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | Closed Cell Spray Polyurethane Foam (Ccspf) and Open Cell Spray Polyurethane Foam (Ocspf) |

| Application | Roofs, Floors, Walls, Ceilings, and Attics |

| End User | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

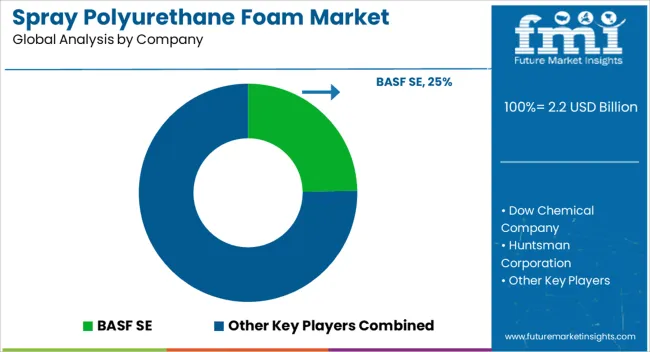

| Key Companies Profiled | BASF SE, Dow Chemical Company, Huntsman Corporation, Covestro AG, Carlisle Companies Inc., Johns Manville, and NCFI Polyurethanes |

The global spray polyurethane foam market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the spray polyurethane foam market is projected to reach USD 4.2 billion by 2035.

The spray polyurethane foam market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in spray polyurethane foam market are closed cell spray polyurethane foam (ccspf) and open cell spray polyurethane foam (ocspf).

In terms of application, roofs segment to command 42.8% share in the spray polyurethane foam market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Spray Foam Insulation Market 2025 to 2035

Mini Spray Bottles Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Throat Sprays Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA