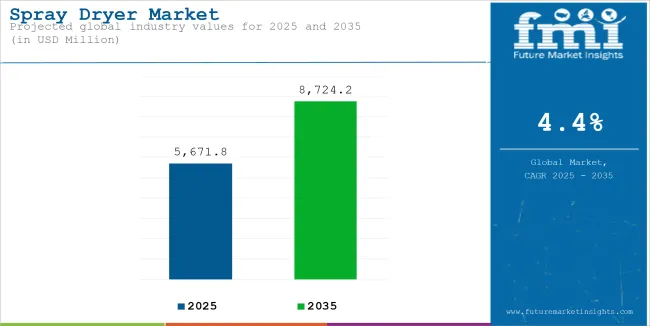

The global sales of Spray Dryer are anticipated to reach USD 5,432.9 million by 2024, with a growing demand increase from end users at 4.4% CAGR over the forecast period. The market value is forecast to grow from USD 5,671.8 million in 2025 to USD 8,724.2 million by 2035.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 5,432.9 Million |

| Estimated Market Value, 2025 | USD 5,671.8 Million |

| Projected Market Value, 2035 | USD 8,724.2 million |

| Market Value CAGR (2025 to 2035) | 4.4% |

Macroeconomic factors such as the growing rate of urbanization, growing population, changing lifestyles, as well as rising domestic income are likely to expand the spray dryer market size. However, the high cost and infrastructure of these equipment are serious challenges, restraining the advancement of the market.

On the other hand, manufacturers developing products that are energy-efficient and free from hazardous gas emissions owing to technological advances, is expected to present growth opportunities for the market.

High investment in technological development to refine the spray drying equipment is likely to boost the spray dryer market during the forecast period. In addition to this, the spray dryer has key applications in the food industry. For instance, it is used for encapsulation.

In emerging economies, such as India and China, government regulations to increase Foreign Direct Investments (FDI) limits for the food processing industry are effectuating the instalment of processing plants. This is anticipated to significantly contribute to the market growth.

The open cycle drying equipment comprises the largest share in the market, primarily due to its low energy consumption. Moreover, its ability to handle heat-resistive and heat-sensitive products is likely to positively impact the spray dryer market share.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Spray Dryer market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Spray Dryer sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.6% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.6% (2024 to 2034) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 4.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.1% in the first half and remain relatively moderate at 4.7% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

This section below examines the value shares of the leading segments in the industry. In terms of Application, the Food & Beverage segment is expected to have the Highest Market Share during the Forecast Period and generate a CAGR of around 5.4% in 2024.

Based on the product type, the centrifugal spray dryers segment is projected to account for a share of 45.2% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value CAGR (2024) |

|---|---|

| Food & Beverage (Application) | 5.4% |

Increasing disposable income, as well as rapid changes in lifestyle, significantly fuel the growth of the spray dryer market. Moreover, the application of spray drying in the pharmaceutical industry due to precision in particle size, morphology, and stability is required, therefore raising its demand.

Spray drying technologies are used by processed food manufacturers, which expands the market size. This is owing to the growing consumption of ready-to-eat (RTE) foods that do not require any elaborate processing.

Consumers seeking frozen foods in the conventional and non-conventional foods and beverages market are expected to surge the demand for spray dryers. Furthermore, sorbitol foods rising in demand and consumption are likely to contribute to the spray dryer market growth.

| Segment | Value Share (2024) |

|---|---|

| Centrifugal Spray Dryers (Product Type) | 45.2% |

The most expected to expand are the centrifugal spray dryers. With a predicted 45% share in the market, these are sure to become market leaders. It has high efficiency while handling large-scale drying operations; therefore, its use in the food, pharmaceutical, and chemical industries is extremely high. Their ability to produce fine, uniform powder with minimal thermal degradation makes them ideal for heat-sensitive materials such as milk powder, pharmaceuticals, and bio-based chemicals.

Growing demand for ready-to-eat food products and process food ingredients has led to a growing use of centrifugal spray dryers within the food and beverage sector. Additionally, with the improvement of pharmaceutical manufacturing such as accurate drying of APIs and nutraceuticals is on the increase.

Rising Adoption of IoT and Automation in Spray Drying Systems

The integration of IoT and automation is revolutionizing the spray dryer market, thereby enhancing operational efficiency, product quality, and sustainability. Advanced IoT-enabled spray drying systems feature real-time monitoring and predictive maintenance capabilities. With these technologies, manufacturers can optimize drying parameters, detect issues before they cause equipment downtime, and save energy.

For example, IoT sensors may monitor temperature, pressure, and airflow within spray dryers, allowing for precise control over the drying process. This saves waste, guarantees consistent product quality, and lowers operating expenses. Automation also allows producers to streamline batch production and scale up processes while maintaining efficiency.

The demand for these systems is greater in the pharmaceutical and food processing industries, requiring precision and dependability. As attention towards sustainable as well as intelligent manufacturing is the global focus today, the integration of IoT capabilities into spray drying systems is bound to increase at over 8% CAGR by the end of the next decade. They spend a lot in R&D as the leading companies integrate machine learning algorithms and AI-driven analytics that are pushing performance and innovation of spray drying technology to new frontiers.

Increasing Demand for Energy-Efficient and Eco-Friendly Spray Dryers

Sustainability is now the core focus of all industries, and it is driving the demand for energy-efficient and environmentally friendly spray drying solutions. Traditional spray dryers are very energy-intensive, which makes them less viable for manufacturers who want to reduce their carbon footprint. To this end, companies are developing systems with heat recovery technologies, advanced insulation, and renewable energy integration.

For instance, RTOs with spray dryers can recover waste heat. Energy consumption may be reduced up to 30%. Eco-friendly spray drying systems are designed to be compliant with stringent emission standards. Governments in Europe and North America have strictly enforced environmental regulations.

Adoption of such technologies is also incentivizing green technologies through tax benefits and subsidies offered to manufacturers that invest in them. Dairy, coffee, and infant nutrition industries are also a driving force because consumers are increasing their scrutiny over environmental impact. The global drive toward sustainable manufacturing practices will continue to drive up the adoption rate of energy-efficient spray dryers in both developed and emerging markets.

Growing Demand for Processed Food and Nutraceutical Products

The increasing demand from worldwide for processed food and nutraceuticals is a major growth factor of the market for spray dryers. With expanding populations and busier lifestyles, convenience and shelf stability at room temperature are in greater demand. Among the processed foods, powdered milk, instant coffee, powdered soup, and baby food are some of the most commonly used for spray drying to preserve, texture, and for easy transportation. In addition, health and wellness is a hot trend, so nutraceuticals such as vitamins and protein powder are in very high demand.

The World Health Organization (WHO) estimates that between 2023 and 2030, the global processed food market will witness a CAGR of 5.5%. Therefore, manufacturers, in order to overcome the nutritional depletion of products in the processing line, are compelled to look into efficient drying technologies like spray dryers, maintaining consistent particle size and high-quality powders. Another characteristic is that spray drying reduces moisture content and does not alter flavor or texture. That is why food manufacturers appreciate spray drying so much.

Advancements in Pharmaceutical and Biotech Applications

Spray dryers are becoming more significant in the pharmaceutical and biotechnology industries, particularly in the production of active pharmaceutical ingredients (APIs), vaccines, and biologics. The pharmaceutical sector requires advanced drying technologies to produce high-quality powders for inhalation and oral drug compositions. Spray drying enables precise control over particle size, shape, and density, crucial factors for drug efficacy and stability.

This increase in biologic drugs, which are complex and require careful manufacturing processes, also contributes to the demand for spray dryers. According to data by the International Trade Administration, sales of biologics worldwide will surpass USD 400 billion by 2035, and there is going to be an immense demand for drying technologies. Spray drying is a preferred method for biologics because it preserves the integrity of sensitive compounds and helps improve their shelf-life.

The development of more vaccines, along with the responses to global health challenges experienced worldwide in the recent past, increases the demand for advanced spray dryers. Due to their importance in the spray drying of various vaccines that require lyophilization or drying, such spray dryers facilitate the stability improvement and reduced costs of storage. As each country in this world seeks ways to upgrade the healthcare infrastructure coupled with the increase in pharmaceutical products, the trends are bound to continue.

From 2020 to 2024, the global spray dryer market experienced steady growth, driven primarily by advancements in the food and beverage industry and increasing demand for processed food products. The market expanded at a CAGR of approximately 5%, supported by rising consumption of powdered milk, coffee, and nutritional supplements. Pharmaceutical applications also saw significant adoption, particularly for active pharmaceutical ingredients (APIs) and vaccines requiring precision drying.

Between 2025 and 2035, the market is expected to accelerate, achieving a CAGR of 6.5%. This growth will be fueled by increasing demand for sustainable and energy-efficient spray drying technologies across industries. Rising awareness of sustainability is prompting manufacturers to invest in eco-friendly solutions, including heat recovery systems and IoT-enabled monitoring.

Additionally, the processed food market, projected to reach over USD 8 trillion by 2035, will be a key growth driver. Emerging markets in Asia-Pacific and Latin America are expected to lead demand, owing to rising middle-class populations and urbanization trends. Pharmaceutical advancements, including the proliferation of biologics and specialty drugs, will further boost market growth.

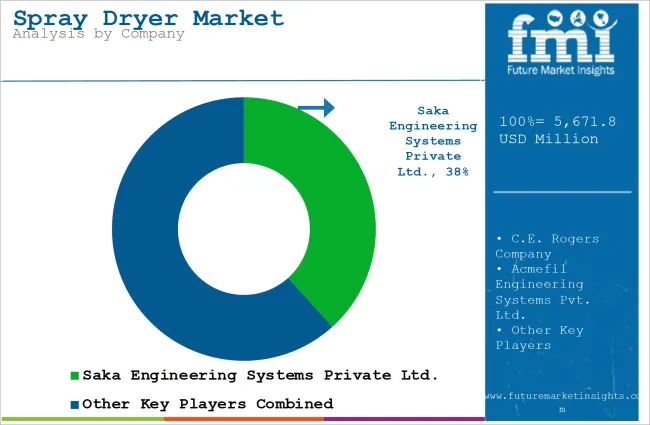

These companies are currently capturing a significant share of 45% to 50% globally. These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include Saka Engineering Systems Private Ltd., C.E. Rogers Company, Acmefil Engineering Systems Pvt. Ltd., Changzhou Lemar Drying Engineering Co. Ltd., BUCHI Labortechnik AG, Shandong Shungeng Drying Equipment Co. Ltd., Acmefil Engineering Systems Pvt. Ltd. and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Spray Dryer vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Spray Dryer industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 3.9% through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| The USA | 4.2% |

| India | 3.9% |

| China | 3.6% |

| Germany | 3.3% |

| Japan | 3.3% |

The United States holds the biggest portion in the international market for a spray dryer since the country's food processing and pharmaceutical industries are developed. Many global companies operating within its territories include Nestlé USA and Pfizer, where modern spray drying technology will be required in producing good powdered products like milk powders, nutraceuticals, and active pharmaceutical ingredients (APIs).

The USA food processing alone is expected to reach about USD 266 billion in 2023, and the increasing shelf-stable products tend to increase the demand for spray dryers. More than USD 100 billion is spent annually by the pharmaceutical segment on research and development, with massive investment in innovating drug formulating in which spray drying plays a vital role.

Advanced R&D facilities, high adoption rates of IoT-enabled and energy-efficient spray dryers, and further strengthening of the country's market position. The country also benefits from advanced R&D facilities and a high adoption rate of IoT-enabled and energy-efficient spray dryers, further cementing its market dominance.

Growth in the food and beverage market coupled with surging demand for dairy and processed food items is one reason responsible for accelerating the growth rate in the Indian market of spray driers. Also, the reason for ever-greater demand is because India leads as the highest milk-producing country worldwide and as per estimates has produced 225 million tons of milk by the end of 2023.

The rising middle-class population and urbanization are pushing the processed food market, which was valued at over USD 600 billion in 2023 and is expected to grow at a CAGR of 11% through 2030. Additionally, India’s pharmaceutical exports stood at USD 25.4 billion in 2023, highlighting its growing role in global drug production and the associated need for advanced drying technologies.

Supportive government policies like the Production Linked Incentive (PLI) scheme for food processing and pharmaceuticals further accelerate market growth.

China is a key player in the global spray dryer market, driven by its expanding industrial base and growing processed food consumption. The country’s food and beverage industry was valued at approximately USD 1.5 trillion in 2023, supported by a rising middle class demanding high-quality and convenient food products.

The important technology used in medicine production is called spray drying, which also thrives in the pharmaceutical industry in China. It was recorded to have generated USD 145 billion in 2023. The government promotes advanced manufacturing technologies to be adopted by the modernization of industrialization, such as "Made in China 2025". A spray dryer falls among these technologies.

One of the significant growth drivers for the spray dryer industry is China, which is due to the rising domestic market and exports.

The global spray dryer market is moderately fragmented, with key players focusing on innovation and technological advancements to strengthen their market position. Leading companies such as GEA Group, SPX Flow, and Büchi Labortechnik dominate the market, leveraging their expertise in engineering efficient and reliable spray drying systems. These players emphasize product customization and process optimization, catering to industries such as food, pharmaceuticals, and chemicals.

Mid-sized players like Dedert Corporation and European Spraydry Technologies compete by offering cost-effective solutions tailored to specific regional needs. These companies target niche applications, including nutraceuticals, dairy processing, and specialty chemicals, providing them with a competitive edge in localized markets.

Competition is intensifying as new entrants invest in sustainable and energy-efficient spray drying technologies. Innovations such as closed-loop systems and advanced control mechanisms are becoming industry benchmarks. Additionally, partnerships, mergers, and acquisitions are common strategies among market leaders to expand their global footprint and access untapped regions.

Industry Updates

Based on Product Type, the industry is segmented into atomizer, fluidized and centrifugal.

Based on Operation, the industry is segmented into batch and continuous

Based on Operating Principal, the industry is segmented into direct drying and indirect drying

Based on Application, the Spray Dryer Springs Market is segmented into food & beverage, pharmaceutical, chemical and others

Based on End Use Industries, the Spray Dryer Springs Market is segmented into co-current, counter current and mixed flow

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 5,432.9 Million in 2024.

The industry is set to reach USD 5,671.8 Million in 2025.

The industry value is anticipated to rise at 4.4% CAGR through 2035.

The industry is anticipated to reach USD 8,724.2 million by 2035.

China accounts for 17.2% of the global Spray Dryer market revenue share alone.

India is predicted to witness the highest CAGR of 3.9% in the Spray Dryer market.

Table 01: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 02: Global Market Volume (Units) Forecast by Region, 2017-2032

Table 03: Global Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 04: Global Market Volume (Units) Forecast by Type, 2017-2032

Table 05: Global Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 06: Global Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 07: Global Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 08: Global Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 09: Global Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 10: Global Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 11: Global Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 12: Global Market Volume (Units) Forecast by Application, 2017-2032

Table 13: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: North America Market Volume (Units) Forecast by Country, 2017-2032

Table 15: North America Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 16: North America Market Volume (Units) Forecast by Type, 2017-2032

Table 17: North America Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 18: North America Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 19: North America Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 20: North America Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 21: North America Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 22: North America Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 23: North America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 24: North America Market Volume (Units) Forecast by Application, 2017-2032

Table 25: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Latin America Market Volume (Units) Forecast by Country, 2017-2032

Table 27: Latin America Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 28: Latin America Market Volume (Units) Forecast by Type, 2017-2032

Table 29: Latin America Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 30: Latin America Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 31: Latin America Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 32: Latin America Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 33: Latin America Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 34: Latin America Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 35: Latin America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 36: Latin America Market Volume (Units) Forecast by Application, 2017-2032

Table 37: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 38: Europe Market Volume (Units) Forecast by Country, 2017-2032

Table 39: Europe Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 40: Europe Market Volume (Units) Forecast by Type, 2017-2032

Table 41: Europe Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 42: Europe Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 43: Europe Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 44: Europe Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 45: Europe Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 46: Europe Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 47: Europe Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 48: Europe Market Volume (Units) Forecast by Application, 2017-2032

Table 49: Asia Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2017-2032

Table 51: Asia Pacific Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 52: Asia Pacific Market Volume (Units) Forecast by Type, 2017-2032

Table 53: Asia Pacific Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 54: Asia Pacific Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 55: Asia Pacific Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 56: Asia Pacific Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 57: Asia Pacific Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 58: Asia Pacific Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 59: Asia Pacific Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 60: Asia Pacific Market Volume (Units) Forecast by Application, 2017-2032

Table 61: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 62: MEA Market Volume (Units) Forecast by Country, 2017-2032

Table 63: MEA Market Value (US$ Mn) Forecast by Type, 2017-2032

Table 64: MEA Market Volume (Units) Forecast by Type, 2017-2032

Table 65: MEA Market Value (US$ Mn) Forecast by Mode of Operation, 2017-2032

Table 66: MEA Market Volume (Units) Forecast by Mode of Operation, 2017-2032

Table 67: MEA Market Value (US$ Mn) Forecast by Operating Principal, 2017-2032

Table 68: MEA Market Volume (Units) Forecast by Operating Principal, 2017-2032

Table 69: MEA Market Value (US$ Mn) Forecast by Type of Flow, 2017-2032

Table 70: MEA Market Volume (Units) Forecast by Type of Flow, 2017-2032

Table 71: MEA Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 72: MEA Market Volume (Units) Forecast by Application, 2017-2032

Figure 01: Global Market Value (US$ Mn) by Type, 2022-2032

Figure 02: Global Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 03: Global Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 04: Global Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 05: Global Market Value (US$ Mn) by Application, 2022-2032

Figure 06: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 07: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 08: Global Market Volume (Units) Analysis by Region, 2017-2032

Figure 09: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 11: Global Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 12: Global Market Volume (Units) Analysis by Type, 2017-2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 15: Global Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 16: Global Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 19: Global Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 20: Global Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 23: Global Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 24: Global Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 27: Global Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 28: Global Market Volume (Units) Analysis by Application, 2017-2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 31: Global Market Attractiveness by Type, 2022-2032

Figure 32: Global Market Attractiveness by Mode of Operation, 2022-2032

Figure 33: Global Market Attractiveness by Operating Principal, 2022-2032

Figure 34: Global Market Attractiveness by Type of Flow, 2022-2032

Figure 35: Global Market Attractiveness by Application, 2022-2032

Figure 36: Global Market Attractiveness by Region, 2022-2032

Figure 37: North America Market Value (US$ Mn) by Type, 2022-2032

Figure 38: North America Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 39: North America Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 40: North America Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 41: North America Market Value (US$ Mn) by Application, 2022-2032

Figure 42: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 43: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 44: North America Market Volume (Units) Analysis by Country, 2017-2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 47: North America Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 48: North America Market Volume (Units) Analysis by Type, 2017-2032

Figure 49: North America Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 51: North America Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 52: North America Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 55: North America Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 56: North America Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 59: North America Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 60: North America Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 63: North America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 64: North America Market Volume (Units) Analysis by Application, 2017-2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 67: North America Market Attractiveness by Type, 2022-2032

Figure 68: North America Market Attractiveness by Mode of Operation, 2022-2032

Figure 69: North America Market Attractiveness by Operating Principal, 2022-2032

Figure 70: North America Market Attractiveness by Type of Flow, 2022-2032

Figure 71: North America Market Attractiveness by Application, 2022-2032

Figure 72: North America Market Attractiveness by Country, 2022-2032

Figure 73: Latin America Market Value (US$ Mn) by Type, 2022-2032

Figure 74: Latin America Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 75: Latin America Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 76: Latin America Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 77: Latin America Market Value (US$ Mn) by Application, 2022-2032

Figure 78: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 79: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2017-2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 83: Latin America Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 84: Latin America Market Volume (Units) Analysis by Type, 2017-2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 87: Latin America Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 88: Latin America Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 91: Latin America Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 92: Latin America Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 95: Latin America Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 96: Latin America Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 99: Latin America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 100: Latin America Market Volume (Units) Analysis by Application, 2017-2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 103: Latin America Market Attractiveness by Type, 2022-2032

Figure 104: Latin America Market Attractiveness by Mode of Operation, 2022-2032

Figure 105: Latin America Market Attractiveness by Operating Principal, 2022-2032

Figure 106: Latin America Market Attractiveness by Type of Flow, 2022-2032

Figure 107: Latin America Market Attractiveness by Application, 2022-2032

Figure 108: Latin America Market Attractiveness by Country, 2022-2032

Figure 109: Europe Market Value (US$ Mn) by Type, 2022-2032

Figure 110: Europe Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 111: Europe Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 112: Europe Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 113: Europe Market Value (US$ Mn) by Application, 2022-2032

Figure 114: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 115: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 116: Europe Market Volume (Units) Analysis by Country, 2017-2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 119: Europe Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 120: Europe Market Volume (Units) Analysis by Type, 2017-2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 123: Europe Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 124: Europe Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 127: Europe Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 128: Europe Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 131: Europe Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 132: Europe Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 135: Europe Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 136: Europe Market Volume (Units) Analysis by Application, 2017-2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 139: Europe Market Attractiveness by Type, 2022-2032

Figure 140: Europe Market Attractiveness by Mode of Operation, 2022-2032

Figure 141: Europe Market Attractiveness by Operating Principal, 2022-2032

Figure 142: Europe Market Attractiveness by Type of Flow, 2022-2032

Figure 143: Europe Market Attractiveness by Application, 2022-2032

Figure 144: Europe Market Attractiveness by Country, 2022-2032

Figure 145: Asia Pacific Market Value (US$ Mn) by Type, 2022-2032

Figure 146: Asia Pacific Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 147: Asia Pacific Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 148: Asia Pacific Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 149: Asia Pacific Market Value (US$ Mn) by Application, 2022-2032

Figure 150: Asia Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 151: Asia Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2017-2032

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 155: Asia Pacific Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 156: Asia Pacific Market Volume (Units) Analysis by Type, 2017-2032

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 159: Asia Pacific Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 160: Asia Pacific Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 163: Asia Pacific Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 164: Asia Pacific Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 167: Asia Pacific Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 168: Asia Pacific Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 171: Asia Pacific Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 172: Asia Pacific Market Volume (Units) Analysis by Application, 2017-2032

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 175: Asia Pacific Market Attractiveness by Type, 2022-2032

Figure 176: Asia Pacific Market Attractiveness by Mode of Operation, 2022-2032

Figure 177: Asia Pacific Market Attractiveness by Operating Principal, 2022-2032

Figure 178: Asia Pacific Market Attractiveness by Type of Flow, 2022-2032

Figure 179: Asia Pacific Market Attractiveness by Application, 2022-2032

Figure 180: Asia Pacific Market Attractiveness by Country, 2022-2032

Figure 181: MEA Market Value (US$ Mn) by Type, 2022-2032

Figure 182: MEA Market Value (US$ Mn) by Mode of Operation, 2022-2032

Figure 183: MEA Market Value (US$ Mn) by Operating Principal, 2022-2032

Figure 184: MEA Market Value (US$ Mn) by Type of Flow, 2022-2032

Figure 185: MEA Market Value (US$ Mn) by Application, 2022-2032

Figure 186: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 187: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 188: MEA Market Volume (Units) Analysis by Country, 2017-2032

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 191: MEA Market Value (US$ Mn) Analysis by Type, 2017-2032

Figure 192: MEA Market Volume (Units) Analysis by Type, 2017-2032

Figure 193: MEA Market Value Share (%) and BPS Analysis by Type, 2022-2032

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Type, 2022-2032

Figure 195: MEA Market Value (US$ Mn) Analysis by Mode of Operation, 2017-2032

Figure 196: MEA Market Volume (Units) Analysis by Mode of Operation, 2017-2032

Figure 197: MEA Market Value Share (%) and BPS Analysis by Mode of Operation, 2022-2032

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Mode of Operation, 2022-2032

Figure 199: MEA Market Value (US$ Mn) Analysis by Operating Principal, 2017-2032

Figure 200: MEA Market Volume (Units) Analysis by Operating Principal, 2017-2032

Figure 201: MEA Market Value Share (%) and BPS Analysis by Operating Principal, 2022-2032

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Operating Principal, 2022-2032

Figure 203: MEA Market Value (US$ Mn) Analysis by Type of Flow, 2017-2032

Figure 204: MEA Market Volume (Units) Analysis by Type of Flow, 2017-2032

Figure 205: MEA Market Value Share (%) and BPS Analysis by Type of Flow, 2022-2032

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Type of Flow, 2022-2032

Figure 207: MEA Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 208: MEA Market Volume (Units) Analysis by Application, 2017-2032

Figure 209: MEA Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 211: MEA Market Attractiveness by Type, 2022-2032

Figure 212: MEA Market Attractiveness by Mode of Operation, 2022-2032

Figure 213: MEA Market Attractiveness by Operating Principal, 2022-2032

Figure 214: MEA Market Attractiveness by Type of Flow, 2022-2032

Figure 215: MEA Market Attractiveness by Application, 2022-2032

Figure 216: MEA Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Spray Dryer in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Spray Dryer in Japan Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Gel Dryer Market Size and Share Forecast Outlook 2025 to 2035

Air Dryer Cartridge Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hand Dryer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA