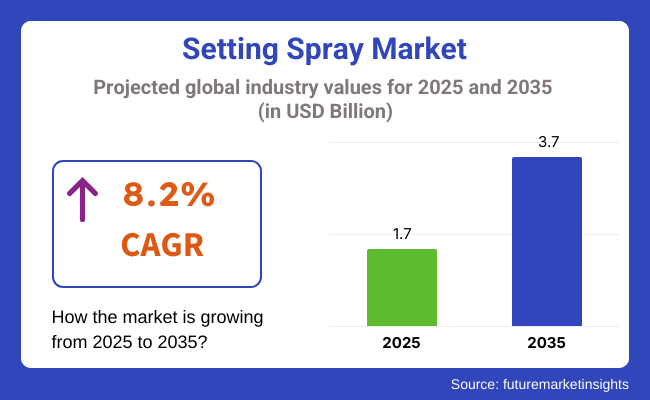

The setting spray market is estimated to be USD 1.7 billion in 2025 and is anticipated to grow at an 8.2% CAGR from 2025 to 2035. The industry size is expected to reach USD 3.7 billion by 2035. Increasing customer demand for performance-oriented and long-lasting cosmetics because of exposure through social media and influence from beauty influencers is one of the major growth drivers. The need for high-technology formulation sprays that will extend makeup wear time and offer further skincare advantages remains strong.

The growth of multifunctional products is altering the setting spray category, and moisturizing, mattifying, or protective products containing ingredients like SPF and blue-light protection ingredients are available. These developments not only address convenience consumerism but also address the increased trend toward skincare-makeup fusion products. Brands are utilizing these benefits to propel industry penetration in mass and premium markets.

Industry expansion also benefits from changing consumer trends requiring greater wear and smudge-resistant cosmetics, especially in urban cities and professional industries. Moreover, product innovations for specific skin types and climate-specific needs are enhancing local product heterogeneity and enabling brands to penetrate niche industries while creating brand loyalty.

Channel innovation in the form of e-commerce channels, influencer marketing, and retail partnerships is spearheading reach extension for brands. Virtual try-ons and customized product suggestions have added to consumers' confidence even further, speeding up purchase intent even more within the category.

As sustainability is integrated into brand stories, the industry is witnessing a shift towards clean-label products and green packaging. Brands that are taking up biodegradable packaging, refill packaging, and open sourcing of ingredients are becoming increasingly competitive. This will be following consumer values and is expected to shape purchasing behavior, especially among gen Z and millennial consumers, in the coming decade.

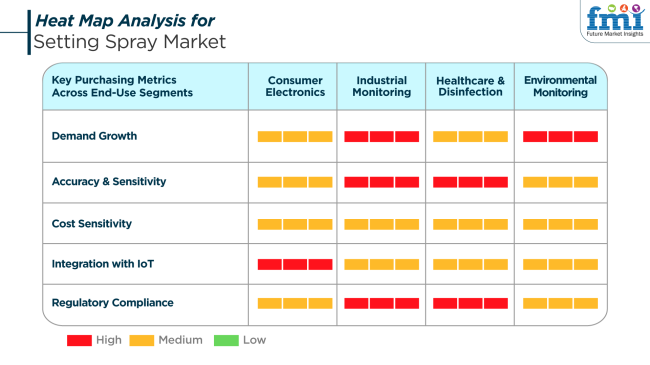

Key Purchasing Metrics Across End-Use Segments

While the industry does not directly align with conventional industrial monitoring or consumer electronics metrics, parallels can be drawn in terms of demand indicators and purchasing criteria. For example, the consumer preference for advanced, technology-integrated cosmetic products mirrors the demand for high sensitivity and IoT-based integration seen in tech sectors. Brands are investing in innovative spray mechanisms, such as micro-diffusion and sensor-controlled nozzles, to enhance application precision and reduce wastage.

In healthcare and disinfection-inspired settings, setting sprays with antimicrobial properties and skin barrier fortification reflect high accuracy and regulatory demands. The post-pandemic consumer awareness regarding hygiene has increased preference for sprays that double as protective skincare enhancers. This mirrors the high compliance and sensitivity metrics applicable in regulated sectors.

Environmental considerations are influencing product development, where sustainable ingredients and eco-packaging reflect cost and compliance sensitivities. The alignment with clean beauty trends and transparent labeling indicates that consumers are willing to pay more for sprays that demonstrate environmental accountability, much like decision-making in environmental monitoring industries.

The industry faces several nuanced risks over the forecast period. One primary concern lies in regulatory compliance, especially as governments tighten cosmetic ingredient regulations across major industries like the EU and North America. This may restrict the use of certain formulation agents, requiring costly reformulation efforts by manufacturers to remain compliant without compromising product efficacy.

Supply chain volatility presents another risk. Fluctuations in raw material availability and rising costs for natural or certified ingredients may impact pricing strategies and profit margins. Brands heavily reliant on global sourcing, particularly for botanicals and eco-friendly packaging, are more exposed to geopolitical and logistical disruptions. Industry saturation and brand fragmentation pose challenges.

With low barriers to entry and high consumer demand, numerous indie and established players are competing for visibility. This crowding makes brand differentiation more difficult, leading to increased marketing expenditures and price competition. To remain resilient, companies must continuously innovate and build strong emotional brand connections with consumers.

Between 2020 and 2024, the industry witnessed a phenomenal shift towards long-lasting, smudge-free, and hydrating sprays, as customers increasingly demanded products that would last all day, particularly in the context of altered daily life habits introduced by the COVID-19 pandemic.

The pandemic pushed online shopping for beauty products to be on the increase, with consumers going for in-home beauty treatments as they spent more time indoors. Increasing demands for multi-purpose products that would create makeup setting and skin care benefits brought about the introduction with incorporated ingredients like hyaluronic acid, vitamin C, and SPF.

The industry will evolve with the rise of personalized beauty and innovative formulation. The consumer will demand more personalized sprays according to their specific skin types, i.e., oily, dry, or sensitive skin. The trend for sustainability will continue to reign with the transformation of brands into sustainable packaging, clean beauty products, and natural products.

Technology-enabled innovations like AI-based skincare providing product recommendations based on specific skin types are on the cards. Moreover, green and clean beauty will drive the introduction of sprays with zero harsh chemicals and provide an organic, skin-natural alternative.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increase in web shopping of beauty products, quest for long-wear and moisturizing textures, and multi-function formulations. | Tailor-made beauty, cutting-edge technologies for specific skin types, bio-sustainable packages, and artificially intelligent recommendation platforms. |

| Youth and professional beauticians craving everlasting, fault-free finishings. | Conscientious environmental consumers of beauty, those knowledgeable of modern technologies, and users expecting cleanliness, customizability, and green attributes to products. |

| Water-friendly, all-day lasting, smudge-immune, multifunction sprays with skin- optimized enhancements (e.g., UV SPF protection, vitamin treatments). | Reformulated sprays for varied skin types, clean beauty products, natural actives, and environmentally friendly packaging. |

| E-commerce expansion, influencer-led trends, and digital promotion. | AI-driven product personalization, try-ons, and incorporation with customized beauty technologies. |

| Clean beauty, green packaging, and natural actives trends. | Green beauty, zero-waste packaging, and utilization of plant-derived and biodegradable actives. |

| Beauty websites, beauty stores, and expert makeup artists. | Omni channel shopping with tailored online experiences, beauty technology integrations, and sustainable stores. |

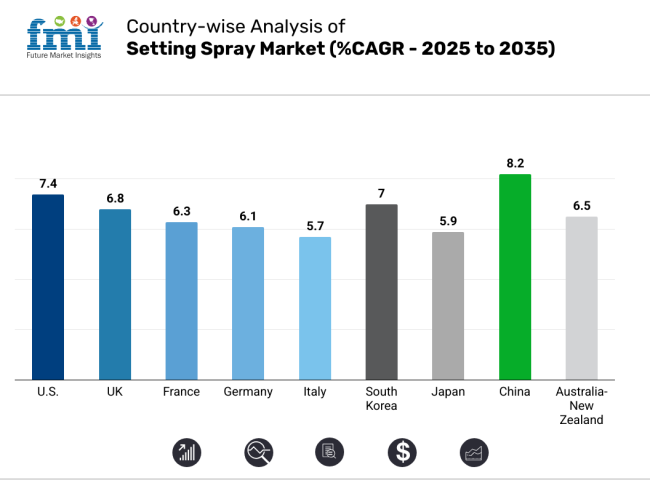

The USA industry will register a growth of 7.4% CAGR throughout the study period. Growing awareness among consumers for long-lasting makeup applications and enhanced involvement in social and professional occasions are driving demand. The consumer base in the USA has a strong preference for premium cosmetic brands with high-performance and skin-friendly ingredients.

A significant increase in product innovation, such as variations in skincare functions like hydration and sun protection, continues to drive purchasing habits favorably. Social media and celebrity-backed product lines have a profound impact on adoption, especially among millennials and Gen Z.

The spread of e-commerce sites and Omni channel retailing has increased availability and accessibility, enabling product discovery for various consumer groups to be easy. In addition, the demand for cruelty-free and vegan cosmetics is impacting brand portfolios, resulting in more mindful product offerings. Makeup artists and beauty influencers also push repeat use, leading to repeat revenue streams. With strong consumer purchasing power and a culture supportive of cosmetic innovation, the USA is one of the most profitable industries.

The UK industry is anticipated to expand at 6.8% CAGR over the period under study. Changing beauty trends and rising demand for makeup that delivers long-lasting wear in disparate climatic conditions are key drivers for the adoption. UK consumers value quality and skin-friendliness above all else, with demand for alcohol-free and dermatologically tested products.

These urban hubs like London and Manchester feature a high-profile retail presence of indigenous and international beauty brands that raise visibility for this product category. The growth of indie beauty companies and the partnership with influencers on TikTok and Instagram have added momentum to setting up spray products.

In addition, shopper awareness regarding sustainability and ethical sourcing has fueled the demand for environmentally friendly packaging and open ingredient labeling. An increasing trend towards multifunctional products, particularly those that integrate skincare with makeup, underpins new product development.

The use of AI in online beauty shopping also enables consumers to obtain customized product suggestions, building confidence in buying. Coupled with high digitalization and increasing expenditure on beauty, the UK industry shows consistent potential for expansion and industry growth.

The French industry is anticipated to expand at 6.3% CAGR over the forecast period. As a global hub for fashion and cosmetics, France has a mature but dynamic beauty industry where product innovation, quality, and elegance influence consumer choice. The segment is growing because of heightened demand for professional-level makeup that can withstand extended periods under diverse lighting and environmental conditions. French consumers value dermatological safety and ingredient provenance highly and prefer products with organic and hypoallergenic designations.

French consumers of cosmetics tend to seek subtlety and sophistication from makeup, which manifests as demand that provide a natural, dewy finish without sacrificing staying power. Beauty retailers and pharmacies with carefully selected ranges are instrumental in the direction of industry preference.

Moreover, local brands emphasizing product authenticity and sustainability have picked up popularity, adding further impetus to the diversification of the industry. Ongoing R&D activities by French beauty majors help in the development of an innovative and trust-oriented ecosystem. The surge in tourism, fashion festivals, and digital marketing initiatives guarantees a steady flow of consumers, aiding stable growth in the segment.

The German industry is anticipated to expand at 6.1% CAGR throughout the study. Being the largest economy in Europe, Germany has a well-established beauty and personal care industry with high consumer purchasing power and an extensive retail network. The rising demand is driven by the higher usage of long-wear cosmetics by working professionals and younger generations who focus on all-day makeup stability.

German customers have a deep preference for function-skin health combination products that support the introduction with water, anti-pollution, and skin-beneficial properties. Germany also focuses on green beauty with increasing demand for vegan, cruelty-free, and eco-packaging products.

Excellent consumer knowledge concerning product ingredients and certifications has brought about more sophisticated purchasing behavior, increasing the industry share of responsible, science-informed brands. Brick-and-mortar beauty shops, pharmacies, and expanding online platforms ensure the broad availability of both local and foreign brands. Urbanization and digital interaction continuously create a supportive setting for spray brands to flourish in the German industry.

The Italian industry is anticipated to expand at 5.7% CAGR over the study period. Italy's long-standing beauty culture, coupled with increasing consumer interest in new cosmetic trends, drives the changing setting spray environment. The industry is influenced by a combination of traditional and contemporary beauty standards, where consumers value light, high-performance products that are compatible with Mediterranean climates.

More Italian consumers, particularly urban millennials, are now testing out full makeup regimens, driving the application to make makeup last longer. Makeup tutorials and growing exposure to global beauty ideals are driving product penetration.

While mass-market brands have a wide reach, niche and artisanal cosmetics with custom solutions are also in high demand. Retail formats like concept stores, beauty chains, and online shopping portals are expanding product reach and awareness. As sustainability and clean beauty increasingly drive industry preferences, brands that provide transparent labeling and natural ingredient formulations are likely to gain a larger share.

The South Korean industry is anticipated to grow at a 7% CAGR over the study period. Renowned for its innovation-oriented cosmetics industry, South Korea sets global beauty trends and provides a dynamic platform for the industry. The trend of "glass skin" and long-wear makeup look has driven demand for high-performance setting products that provide radiant finishes and are resistant to environmental stressors.

South Korean consumers prefer multifunctional beauty solutions, leading to the innovation that act as skincare toners or as misting solutions. Ongoing product innovation, underpinned by fast R&D and flexible supply chains, allows for rapid innovation cycles.

Daily makeup habits and widespread use of social media by consumers and influencers foster business growth through a culture of constant makeup usage. In addition, South Korea's effective retail infrastructure, including beauty road shops, department stores and online platforms, provides quick industry coverage and product exposure. With a very beauty-oriented population and facilitative infrastructure, South Korea is a major growth driver in the industry.

The Japanese industry is anticipated to expand at 5.9% CAGR over the study period. Minimalism, functionality, and the emphasis on quality dominate the beauty industry in Japan. The adoption is slowly increasing with the demand for successful solutions for the long-lasting properties of makeup in a nation renowned for humid summers and heat variations. Products that maximize the longevity of foundation and color cosmetics without skin irritation are preferred.

Japanese consumers are extremely discerning and tend to prefer science-backed cosmetic products that have documented effectiveness. This has led to brands creating setting sprays with ingredients that offer protection from UV radiation, pollution and sebum accumulation. Aesthetics and ease of use of the packaging also significantly affect buying behavior.

Distribution via up-market department stores, beauty shops and online channels guarantees widespread consumer availability, an inclination for subtle, natural-looking makeup is consistent with setting sprays that provide a light, undetectable hold. With demanding expectations for cosmetic performance and a maturing beauty industry, Japan remains to provide stable growth opportunities.

The China industry is anticipated to grow at 8.2% CAGR throughout the study. With a fast-growing beauty and personal care business, China is one of the most promising industries for setting spray demand. Growing disposable incomes and a young population with a penchant for cosmetics and beauty experts have heavily driven the uptake of products.

Chinese consumers are extremely sensitive to online campaigns and product review marketing on e-commerce and social media sites. Local and international brands alike are using this platform to push setting sprays with extra skincare value and longer-lasting wear.

Consumers' desire for premiumization and innovation in packaging and performance is evident, particularly in Tier 1 and Tier 2 urban areas. Moreover, increasing awareness of environmental issues is encouraging demand for eco-friendly and clean-label cosmetic products. With a blend of industry size, changing beauty consciousness, and technology-enabled retail, China offers the most rapid growth path for setting spray producers.

The Australia-New Zealand industry is anticipated to expand at 6.5% CAGR over the study period. Positive demographic profiles, high beauty consciousness, and increasing interest in multifunctional cosmetic products are fueling demand in this region. Consumers are seeking formulations that offer protection from heat and humidity while enabling long-lasting makeup, particularly in Australia's varied climate conditions.

The impact of wellness and natural beauty trends is widespread, driving demand for products with botanical ingredients, clean labeling, and a low environmental footprint. Both nations have a robust retail environment, with beauty chains, pharmacies, and digital platforms playing a key role in product distribution.

The growing interest in vegan and cruelty-free endorsements reflects a more aware consumer base. Social media trends and beauty influencer recommendations play a significant role in influencing purchase decisions, particularly among young consumers. The openness of the region to global beauty trends and growing disposable incomes are continually creating an environment favorable for innovation and industry growth for the setting spray segment.

In 2025, the worldwide industry will be dominated by matte variants at 22.5%, followed by dewy finish sprays at 18.4%.

There has always been a demand for more matte finishes, as there has been an increased number of consumers who use oily combinations, especially in tropical or humid areas. It would control the shine, cut down on sebum production, and provide a longer-lasting finish to makeup.

With the All Nighter Ultra Matte Setting Spray, Urban Decay leads the pack, with brands like NYX Professional Makeup and Maybelline promoting their matte sprays as essentials for that polished, oil-free look. Following the matte finish has been growth across sectors promoted by social media influencers and professional makeup artists, especially in camera and photo work, such as bridal makeup.

Of course, for those who prefer an all-natural glow, dewy setting sprays have taken a stronghold among consumers. Mostly, these products are being used by dewy fans of Gen Z and millennials who are adopting the so-called "clean girl" and "glass skin" aesthetics on TikTok and Instagram.

Dewy sprays also provide the basic benefit of hydration and light reflection, as popularized by brands such as "Luminous Dewy Skin Mist" by Tatcha, Morphe, and e.l.f. Cosmetics, which attract those with dry or mature skin. In other words, there is the conclusion of the hybridization of skincare and makeup that is leading to dewy sprays with hyaluronic acid, niacinamide, and botanical extracts inside them, creating a blurred line between cosmetic and skin care utility.

Brands offering various degrees of finishes in their products should have a lead over competition because of changing consumer preferences for personalization in beauty.

Normal skin types are likely to be the biggest segment in the global industry in 2025, with 41.9%, followed by oily skin types at 22.6%.

Normal skin consumers have a wider choice for setting sprays since they are not usually limited by oiliness or dryness. Brands take advantage of this freedom by offering multi-benefit formulations that gently hydrate, moderately set makeup, and enhance the skin's appearance. Products such as MAC Fix+ and the celebrated Too Faced Hangover 3-in-1 Setting Spray are viewed as universal in their applications for normal skin while imparting freshness, radiance, and light longevity, appealing to the large retail and professional consumer base.

The category of oily skin represents one of the largest growing sectors, especially in urban surroundings and tropical climates, where concerns about sebum production and breakdown of makeup have begun to surface. Setting sprays for oily skin are pitted with oil-control polymers, mattifying ingredients, and fixing attributes of alcohol for shine control and makeup locking. Urban Decay's All Nighter Ultra Matte and Milani's Make It Last Matte are two examples of targeting this group. In Southeast Asia, India, and the southern USA, moistening semis is very high due to environmental factors.

Setting sprays aimed at specific skin types have proliferated and are marketed as "non-comedogenic," "oil-free," or "hydrating." This unabashedly targeted marketing is clearly a means by which cosmetic differentiation will continue to spur segmentation in drive skins by attributed claims within the setting spray segment.

The fast-growing demand for long-lasting makeup amongst consumers has led to stiff competition in the industry. Urban Decay, of which "All Nighter" is a best-selling brand with strong brand recognition and customer loyalty, retains leadership. Rare Beauty, marketed by celebrity Selena Gomez, is growing rapidly with a clean beauty pitch for hydration setting sprays, catering to Gen Z and Millennial consumers.

Industry positions for e.l.f Cosmetics, Inc. and Sugar Cosmetics are backed by luxurious yet affordable setting sprays, looking to woo the price-sensitive yet quality-conscious segment. However, Charlotte Tilbury Cosmetics and Anastasia Beverly Hills are catering to the luxury segments with their extremely high-quality formulations for the setting sprays that provide longevity to the makeup meant for special occasions.

Mass brands like L'Oréal and Lakme Cosmetics (Unilever) give accessibility for their brand trust, while the emerging brands Swiss Beauty and Faces Canada are flourishing in urban and tier-2 markets. An innovation of features concerning hydration, oil control, and multifunctional sprays threatens the competitive landscape even further.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Urban Decay | 18-21% |

| Rare Beauty | 14-17% |

| e.l.f Cosmetics, Inc. | 12-15% |

| L'Oréal | 10-13% |

| Sugar Cosmetics | 7-10% |

| Other Players | 27-32% |

Key Company Insights

Urban Decay holds about 18-21% of the industry, with its "All Nighter" series popularizing recognition by not only professional makeup artists but also the public. Urban Decay has also turned up the heat on industry competition by coming out with freshly developed products, launching specialized product lines for periods, and holding star collaborations with influencers.

With about 14-17% of the industry share, Rare Beauty quickly becomes an industry player through brand authenticity, raw media attraction, and nurturing skin-focused products for skin health and hydration. e.l.f. Cosmetics, Inc., whose share borders on a powerful 12-15% in the industry, is crowded by affordable items that do not cut corners on performance. At the same time, it glides unbothered past the usability of L'Oréal and Sugar Cosmetics as these carry the weight of mass appeal pulped through their functional innovations.

The industry is segmented into before makeup and after makeup.

The industry is categorized into commercial and residential.

The industry is divided into online, offline, supermarkets and hypermarkets, retail stores, and others.

The industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, driven by region-specific beauty trends, urbanization, and consumer awareness.

The industry is expected to reach USD 1.7 billion in 2025.

The industry is projected to grow to USD 3.7 billion by 2035.

The industry is expected to grow at a CAGR of approximately 8.2% during the forecast period.

Matte variants are a key segment in the industry.

Key players include Rare Beauty, e.l.f Cosmetics, Inc., Urban Decay, Swiss Beauty, L'Oréal, Sugar Cosmetics, Lakme Cosmetics (Unilever), Faces Canada, Charlotte Tilbury Cosmetics, and Anastasia Beverly Hills.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by End-use, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by End-use, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by End-use, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End-use, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End-use, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End-use, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End-use, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End-use, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End-use, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End-use, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End-use, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End-use, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End-use, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Makeup Setting Spray Market Forecast and Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Mini Spray Bottles Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA