Makeup Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

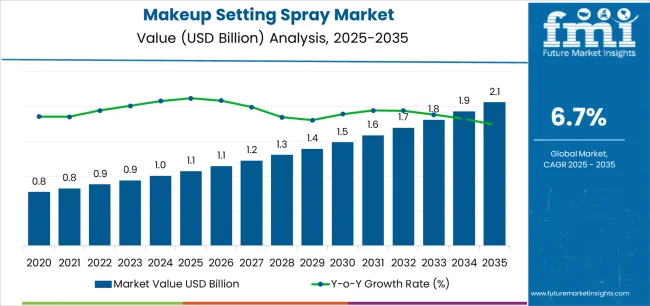

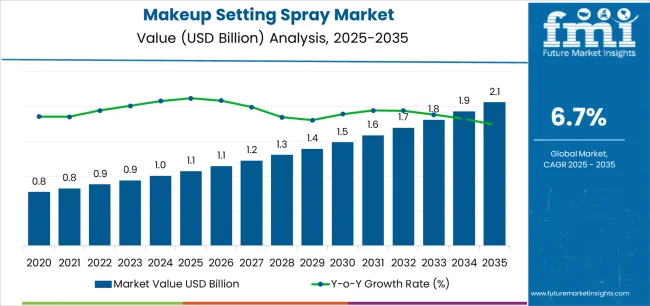

The Makeup Setting Spray Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The makeup setting spray market is experiencing robust growth driven by rising consumer focus on long-lasting cosmetic performance and increasing influence of beauty and fashion trends. Demand is being reinforced by the growing use of setting sprays in daily makeup routines and professional beauty services. Manufacturers are investing in innovative formulations that combine extended wear properties with skincare benefits such as hydration and oil control.

Expanding product availability through both online and offline retail channels has enhanced accessibility, particularly among younger consumers and urban populations. The market outlook remains positive as rising disposable income, social media influence, and advancements in product development continue to shape purchasing behavior.

Growth rationale is supported by the increasing integration of multifunctional products, expanding global beauty industry, and sustained consumer preference for high-performance, lightweight formulations These factors collectively are driving steady adoption across diverse demographics and geographies, ensuring consistent market expansion over the forecast period.

Quick Stats for Makeup Setting Spray Market

- Makeup Setting Spray Market Industry Value (2025): USD 1.1 billion

- Makeup Setting Spray Market Forecast Value (2035): USD 2.1 billion

- Makeup Setting Spray Market Forecast CAGR: 6.7%

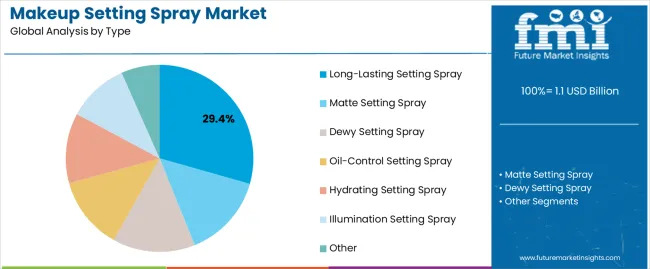

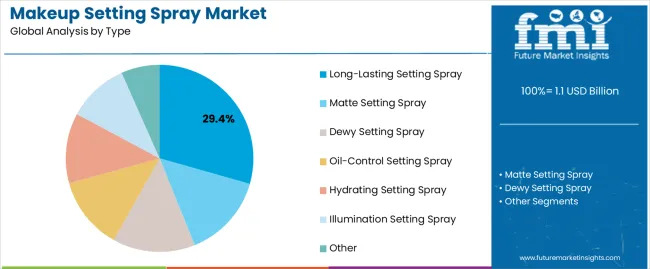

- Leading Segment in Makeup Setting Spray Market in 2025: Long-Lasting Setting Spray (29.4%)

- Key Growth Region in Makeup Setting Spray Market: North America, Asia-Pacific, Europe

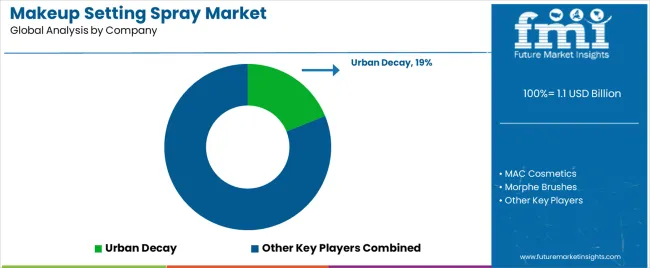

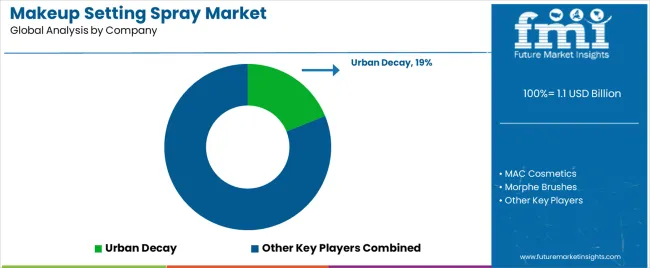

- Top Key Players in Makeup Setting Spray Market: Urban Decay, MAC Cosmetics, Morphe Brushes, Milani Cosmetics, Cover FX, Ben Nye Makeup, Kat Von D Beauty, Tarte Cosmeticsamong, NYX Professional Makeup, e.l.f. Cosmetics

| Metric |

Value |

| Makeup Setting Spray Market Estimated Value in (2025 E) |

USD 1.1 billion |

| Makeup Setting Spray Market Forecast Value in (2035 F) |

USD 2.1 billion |

| Forecast CAGR (2025 to 2035) |

6.7% |

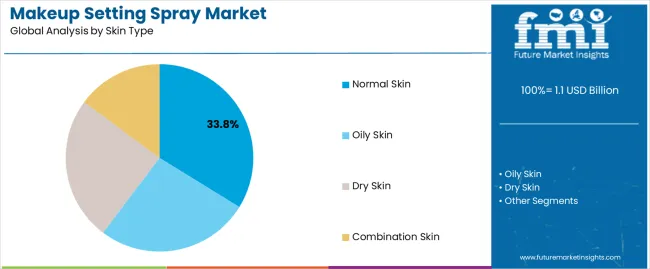

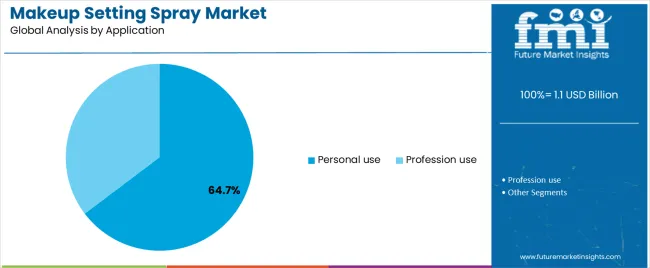

Segmental Analysis

The market is segmented by Type, Skin Type, Application, and Distribution Channel and region. By Type, the market is divided into Long-Lasting Setting Spray, Matte Setting Spray, Dewy Setting Spray, Oil-Control Setting Spray, Hydrating Setting Spray, Illumination Setting Spray, and Other. In terms of Skin Type, the market is classified into Normal Skin, Oily Skin, Dry Skin, and Combination Skin. Based on Application, the market is segmented into Personal use and Profession use. By Distribution Channel, the market is divided into Online Retailing, Specialty Beauty Stores, Drugstore and Pharmacies, Department Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Type Segment

The long-lasting setting spray segment, accounting for 29.40% of the type category, has maintained dominance due to strong consumer preference for products that enhance makeup durability and resistance to humidity, sweat, and environmental stress. The segment’s leadership is being reinforced by its widespread use in both personal and professional applications.

Continuous innovation in formulation, including the use of micro-fine mists and lightweight polymers, has improved product comfort and finish. Marketing efforts emphasizing all-day wear and flawless appearance have further strengthened demand.

Brands are focusing on clean-label and dermatologically tested variants to appeal to health-conscious consumers The combination of efficacy, safety, and broad usability across product ranges ensures this segment’s continued strength within the overall market structure.

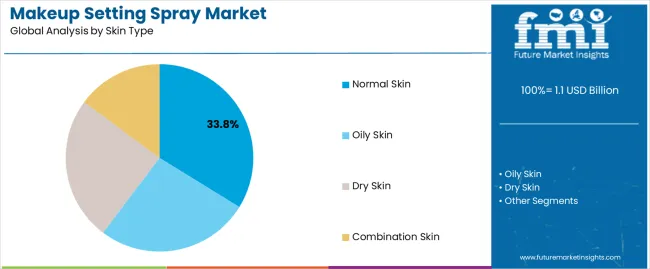

Insights into the Skin Type Segment

The normal skin segment, holding 33.80% of the skin type category, has emerged as the leading segment owing to its balanced compatibility with a wide variety of cosmetic formulations. Manufacturers have prioritized product stability and texture uniformity to meet the needs of this consumer group.

Demand has been supported by ease of formulation and broad consumer applicability without the requirement for specialized ingredients. The segment’s share is reinforced by strong adoption in mainstream retail, where general-use products dominate shelf space.

Increased awareness regarding everyday makeup care and balanced hydration levels has contributed to steady sales momentum The segment is expected to maintain its lead as product development continues to focus on versatile formulations suitable for general skin types.

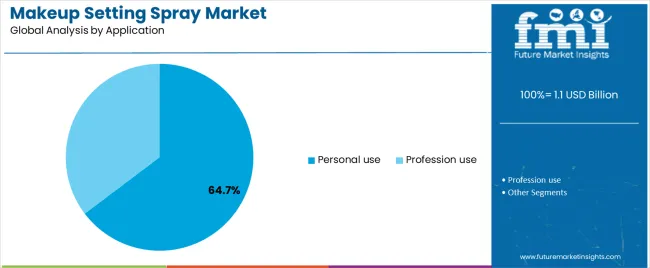

Insights into the Application Segment

The personal use segment, representing 64.70% of the application category, has remained dominant due to widespread adoption of makeup setting sprays for daily cosmetic routines. Rising awareness about long-lasting makeup performance and convenience of use has increased penetration across household consumers.

Social media tutorials, influencer marketing, and beauty product reviews have amplified brand visibility and consumer engagement. Growth has been further supported by the proliferation of affordable product lines and travel-friendly packaging formats.

Retail expansion through e-commerce platforms and drugstores has enhanced product accessibility With continued focus on individual grooming and appearance enhancement, the personal use segment is expected to retain its leading position and drive consistent demand throughout the forecast period.

Key Opportunities for Makeup Setting Spray Manufacturers

The makeup setting spray market is poised for significant growth due to the incorporation of skincare benefits into its formulations.

- The market is anticipated to experience a significant opportunity due to the global trend toward organic and vegan cosmetic products.

- Urban Decay is introducing a range of vegan setting sprays, including SPF protection and hydration options, to cater to its diverse customer base.

- Manufacturers are promoting the use of natural components in their cosmetics and facial care products to attract more customers.

- The strategy aligns with the increasing demand for skincare-infused cosmetics, offering brands a chance to differentiate themselves in a competitive market and cater to evolving consumer preferences for holistic beauty solutions.

- Developing specialized setting sprays for specific skincare needs, such as mattifying for oily skin or hydration for dry skin, can boost market penetration and consumer satisfaction.

- Makeup setting spray brands can capitalize on evolving consumer preferences by embracing opportunities for product diversification and customization, driving market growth.

Challenges in the Makeup Setting Spray Market

The makeup setting spray market is facing numerous challenges that could potentially hinder its growth and sustainability.

- Lack of awareness and understanding among consumers, particularly in emerging economies, hinders the market's ability to attract a broader audience.

- Premium pricing of hair-setting sprays remains a significant concern for budget-conscious consumers in regions with lower per capita incomes.

- Intense competition from alternative products like makeup setting powders and traditional methods diversifies consumer choices and impacts the market negatively.

- Misconceptions and negative perceptions surrounding the potential adverse effects of setting sprays need to be addressed through effective marketing strategies by industry leaders.

- Regulatory compliance regarding ingredient restrictions and labeling regulations adds complexity to product development and distribution processes across different regions and markets for manufacturers of makeup-setting sprays.

- Growing competition within the market poses challenges for new entrants to differentiate themselves and gain market share, potentially leading to price wars and margin pressure, which affects profitability.

- Educating consumers about the benefits and proper usage of makeup-setting sprays requires significant marketing efforts and resources to ensure alignment with consumer needs and preferences.

- Environmental concerns associated with the packaging and formulation of makeup-setting sprays, including plastic waste and harmful chemicals, drive pressure on brands to adopt sustainable practices such as recyclable packaging and eco-friendly formulations.

- Smaller brands encounter obstacles in establishing effective distribution channels and securing retail shelf space, particularly amidst the rise of e-commerce, requiring optimization of online presence and navigation of online retail complexities to effectively reach consumers.

Analysis of Top Countries Involved in Manufacturing, Distributing, and Using Makeup Setting Sprays

The Matte Setting Spray Segment Leads the Market by Product Type

| Attributes |

Details |

| Top Type |

Matte Setting Spray |

| CAGR (2025 to 2035) |

6.8% |

- The matte setting spray segment dominates the makeup setting spray market due to its popularity for matte finishes, effective oil control, long-lasting makeup hold, and versatility in usage.

- These sprays are popular among individuals with oily or combination skin types, as they ensure makeup stays in place for extended periods without frequent touch-ups.

- Versatile and suitable for various makeup styles and occasions, making them a reliable option for achieving a matte finish.

- The segment's dominance in the market is attributed to consumer preference for specific cosmetic benefits like oil control and long-lasting wear.

The Top Skin Type Comprises the Market in the Normal Skin Segment

| Attributes |

Details |

| Top skin type |

Normal skin |

| CAGR (2025 to 2035) |

6.5% |

- The normal skin type is the most common skin type, with a wide consumer base, a wide range of age groups, and diverse skincare needs.

- Products catering to normal skin types offer versatility in usage, as they cater to a wide range of individuals with different skincare needs. Unlike other skin types, normal skin requires fewer specialized products, making it easier for consumers to find suitable products.

- Individuals with normal skin often prioritize maintenance and prevention in their skincare routines, seeking products that help maintain skin balance and prevent issues like dryness or excess oiliness.

- The market offers a variety of skincare products tailored to normal skin, including cleansers, moisturizers, and treatments, catering to diverse consumer preferences.

- Balanced formulations with gentle ingredients promote hydration, nourishment, and overall skin health, appealing to consumers seeking effective yet gentle skincare solutions.

Makeup Setting Spray Industry Analysis by Top Investment Segments

| Countries |

CAGR through 2035 |

| United States |

7.2% |

| United Kingdom |

7.8% |

| China |

7.4% |

| Japan |

8.1% |

| South Korea |

8.2% |

The United States is Renowned for its Beauty and Innovation, Leading the Charge in Makeup-Setting Spray Trends

- The United States has a large consumer base that is highly receptive to beauty and cosmetic products, driving a consistent demand for makeup-setting sprays.

- The market is innovative, with continuous product launches and advancements catering to diverse consumer needs.

- Celebrity endorsements and social media influencers significantly influence consumer choices, driving the adoption of makeup-setting sprays as part of mainstream beauty routines.

- Health-conscious consumers seek natural and skin-friendly ingredients in makeup setting sprays, contributing to market growth.

- The widespread availability of makeup setting sprays through retail channels like specialty stores, department stores, and online platforms enhances accessibility.

- The fast-paced lifestyle in the USA fuels the demand for long-lasting makeup solutions.

- The market is highly responsive to emerging beauty trends, fostering continuous growth in the makeup setting spray segment.

The United Kingdom is Establishing Itself as a Leader in the Dynamic Makeup Setting Spray Market

- The United Kingdom's beauty-conscious population, driven by urbanization and fashion trends, is driving the growth of the makeup-setting spray market.

- Consumers seek products that help achieve flawless and long-lasting makeup looks. Influencer marketing influences purchase decisions, with social media influencers and beauty bloggers endorsing makeup-setting sprays.

- The market prefers premium, high-quality products, leading to the adoption of innovative and effective makeup setting sprays.

- Online retail platforms offer convenient access to a wide range of makeup-setting sprays from domestic and international brands.

- Seasonal changes and weather conditions also influence consumer preferences, with makeup setting sprays protecting against humidity and sweat.

- The shift towards natural ingredients aligns with the trend towards clean beauty.

China is Witnessing a Surge in the Demand For Makeup-Setting Sprays, Attracting Rising Beauty Giants

- China's beauty market is experiencing rapid growth due to rising disposable incomes, urbanization, and increasing beauty consciousness among consumers.

- Social media platforms and key opinion leaders (KOLs) play a crucial role in shaping beauty trends and consumer preferences.

- The Chinese market places a strong emphasis on skincare, with consumers seeking multifunctional makeup setting sprays that offer skincare benefits alongside makeup fixation.

- Chinese consumers prefer high-quality imported beauty products, leading to the adoption of premium makeup setting sprays with advanced formulations and effective performance.

- The expansion of beauty retail channels, including brick-and-mortar stores, online platforms, and social commerce, enhances accessibility to a wide range of makeup setting sprays.

- Urbanization and exposure to Western beauty standards influence consumer preferences, driving the adoption of makeup-setting sprays as an essential component of modern beauty routines.

- Increasing awareness of environmental sustainability prompts Chinese consumers to seek eco-friendly packaging and formulations.

Japan is Known for its Unwavering Obsession with Makeup Setting Sprays, Showcasing its Commitment to Beauty Excellence

- Japan's sophisticated beauty market is characterized by innovation, product quality, and consumer awareness, leading to significant demand for makeup setting sprays.

- The country's cultural emphasis on skincare and the adoption of premium products with advanced formulations are key factors in this market.

- J-Beauty trends, characterized by simplicity and natural beauty, shape consumer preferences for makeup setting sprays.

- Japanese consumers also prefer multifunctional products, such as hydration and UV protection, resulting in comprehensive beauty solutions.

- Japan's well-developed retail infrastructure, including department stores and specialty beauty stores, offers extensive access to a diverse range of makeup-setting sprays from domestic and international brands.

- Japan's embrace of technology also drives the development of cutting-edge makeup setting sprays, catering to tech-savvy consumers seeking innovative beauty solutions.

South Korea's Influence on Makeup-Setting Spray Trends, Specifically Focusing on K-Beauty's Reign

- South Korea's beauty industry is renowned for its innovative beauty trends and advanced skincare technologies, leading to a significant demand for makeup-setting sprays.

- The K-beauty trend, which emphasizes hydration, natural ingredients, and glowing skin, influences consumer preferences in the skincare-centric market.

- Social commerce platforms and influencer marketing drive awareness and demand for makeup-setting sprays.

- South Korean consumers prefer lightweight formulations, avoiding heavy textures that compromise skin comfort.

- Packaging and design aesthetics are also important, with consumers drawn to visually appealing and functional packaging.

- The expansion of beauty brands in the South Korean market offers a diverse range of makeup setting sprays, catering to diverse preferences and needs.

Competitive Landscape of the Makeup Setting Spray Market

The makeup setting spray market is fiercely competitive, with leading brands constantly innovating to maintain market share and capture emerging trends. New entrants and niche brands challenge incumbents, driving diversity and innovation. Marketing strategies like influencer collaborations and social media campaigns shape brand perception and consumer loyalty. Sustainability and clean beauty are growing, with brands striving for transparency and eco-friendly practices.

Recent Development in the Makeup Setting Spray Market

- In December 2025, RadiantCosmetics has unveiled its highly anticipated makeup setting spray range, featuring advanced formulations and sleek packaging, solidifying its reputation as a trendsetter in the cosmetics industry.

- In March 2025, BeautyGlow Inc. launched its latest makeup setting spray line, featuring advanced formulations and eco-friendly packaging, demonstrating its commitment to sustainability and consumer satisfaction.

- In September 2025, GlamourBeauty Corp. launched a groundbreaking makeup setting spray series, showcasing advanced formulations and chic packaging, solidifying its position as a leading cosmetics innovator.

- In June 2024, LuminousBeauty unveiled its groundbreaking makeup setting spray collection, showcasing innovative formulas and luxurious packaging, demonstrating the company's dedication to excellence and consumer satisfaction.

Leading Companies in the Makeup Setting Spray Market

- Urban Decay

- MAC Cosmetics

- Morphe Brushes

- Milani Cosmetics

- Cover FX

- Ben Nye Makeup

- Kat Von D Beauty

- Tarte Cosmeticsamong

- NYX Professional Makeup

- e.l.f. Cosmetics

Top Segments Studied in the Makeup Setting Spray Market

By Type:

- Matte Setting Spray

- Dewy Setting Spray

- Oil-Control Setting Spray

- Hydrating Setting Spray

- Long-Lasting Setting Spray

- Illumination Setting Spray

- Other

By Skin Type:

- Normal Skin

- Oily Skin

- Dry Skin

- Combination Skin

By Application:

- Personal use

- Profession use

By Distribution Channel:

- Online Retailing

- Specialty Beauty Stores

- Drugstore and Pharmacies

- Department Stores

- Others

By Region:

- North America

- Latin America

- Asia Pacific

- Middle East and Africa (MEA)

- Europe

Frequently Asked Questions

How big is the makeup setting spray market in 2025?

The global makeup setting spray market is estimated to be valued at USD 1.1 billion in 2025.

What will be the size of makeup setting spray market in 2035?

The market size for the makeup setting spray market is projected to reach USD 2.1 billion by 2035.

How much will be the makeup setting spray market growth between 2025 and 2035?

The makeup setting spray market is expected to grow at a 6.7% CAGR between 2025 and 2035.

What are the key product types in the makeup setting spray market?

The key product types in makeup setting spray market are long-lasting setting spray, matte setting spray, dewy setting spray, oil-control setting spray, hydrating setting spray, illumination setting spray and other.

Which skin type segment to contribute significant share in the makeup setting spray market in 2025?

In terms of skin type, normal skin segment to command 33.8% share in the makeup setting spray market in 2025.