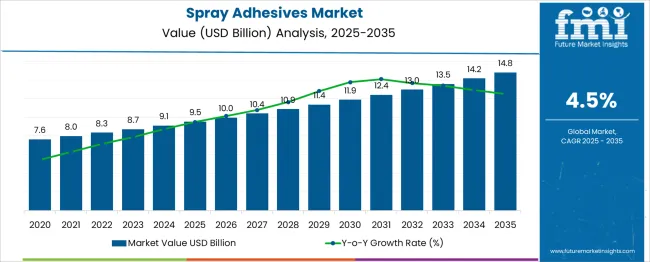

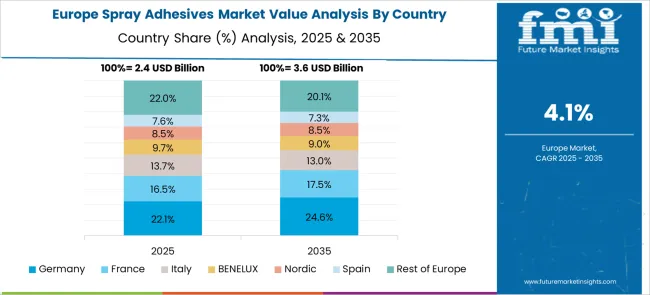

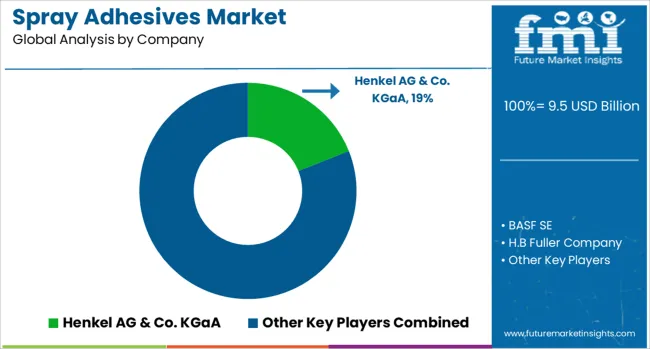

The Spray Adhesives Market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 14.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. However, underlying this expansion is a dynamic shift in market share among key players, technologies, and regions. In 2025, North America holds approximately 34% of the global market share, driven by construction and automotive applications.

By 2030, this share is expected to decline to 29%, as Asia-Pacific, currently at 31%, gains ground and is projected to reach 37% by 2035, led by increased industrialization and infrastructure investment in China, India, and Southeast Asia. Market share erosion is likely for manufacturers relying heavily on solvent-based formulations, as environmental regulations tighten and demand shifts toward eco-friendly, water-based spray adhesives. These sustainable products are expected to capture over 50% of the market by 2032, up from 36% in 2025. Meanwhile, companies investing in green chemistry and product customization for niche sectors like automotive interiors and furniture are positioned to gain market share. Private-label and regional players with agile supply chains and strong B2B partnerships may also outpace legacy brands struggling to adapt to cost pressures and evolving buyer preferences.

| Metric | Value |

|---|---|

| Spray Adhesives Market Estimated Value in (2025 E) | USD 9.5 billion |

| Spray Adhesives Market Forecast Value in (2035 F) | USD 14.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The spray adhesives market demonstrates a clear inflection point around 2029, where growth transitions from a moderate incline to a steeper upward curve. Between 2025 and 2029, the market grows steadily from USD 9.5 billion to USD 10.9 billion, averaging 3.5% YoY growth, reflecting gradual adoption of water-based adhesives and incremental demand in automotive and construction sectors. However, post-2029, the annual increments accelerate, climbing from USD 10.9 billion to USD 14.8 billion by 2035, with average YoY growth exceeding 5%. This breakpoint is primarily driven by a convergence of regulatory shifts, sustainability mandates, and end-user industry transformation.

The adoption of VOC-compliant adhesives, spurred by both environmental regulation and consumer preference, hits a critical mass around 2029. Additionally, advancements in spray technology and fast-curing formulations make these products more viable across industrial applications. This timing also coincides with expanding construction activity in emerging economies and increased investment in lightweight, composite materials in transportation both boosting demand for advanced adhesives. Post-breakpoint, market leaders with R&D investments aligned to green chemistry, automation-compatible adhesives, and energy-efficient application methods are expected to capture disproportionate gains, establishing a competitive moat for the next growth phase.

The spray adhesives market is witnessing steady growth, propelled by increasing demand for fast-setting, uniform coverage bonding solutions across diverse industrial and commercial applications. The growing need for high-performance adhesives in construction, automotive, furniture, and packaging industries is accelerating adoption.

Spray adhesives are valued for their ease of application, improved worker safety, and reduced material wastage. Market dynamics are further influenced by technological advancements in low-VOC and water-based formulations, aligning with regulatory standards and environmental policies.

Additionally, the increasing prevalence of composite materials and lightweight substrates in modern manufacturing has driven the requirement for reliable, flexible bonding agents. As industries prioritize efficiency, portability, and sustainability, spray adhesives continue to gain traction over traditional bonding methods.

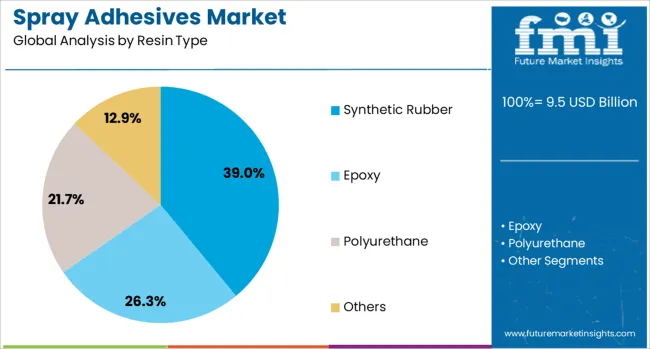

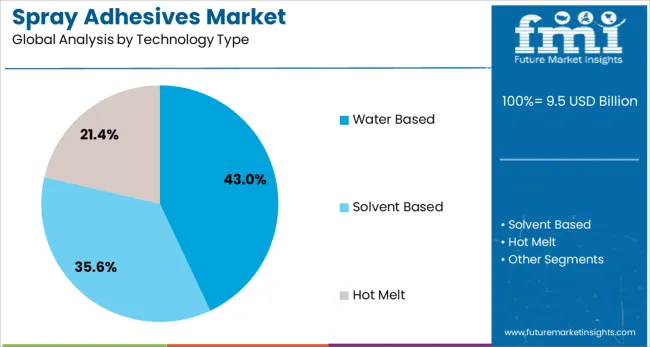

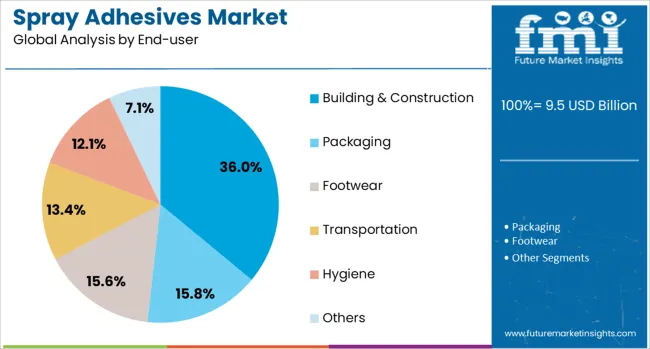

The spray adhesives market is segmented by resin type, technology type, end-user, and geographic regions. By resin type of the spray adhesives market is divided into Synthetic Rubber, Epoxy, Polyurethane, and Others. In terms of technology, the spray adhesives market is classified into Water-Based, Solvent-Based, and Hot Melt. The end-users of the spray adhesives market are segmented into Building & Construction, Packaging, Footwear, Transportation, Hygiene, and Others. Regionally, the spray adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Synthetic rubber is projected to dominate the resin type segment with a 39.00% share of the total spray adhesives market in 2025. This dominance stems from its strong tack, flexibility, and excellent adhesion to both porous and non-porous surfaces.

Synthetic rubber-based adhesives are widely used across applications requiring rapid initial grab, long-lasting bonds, and resistance to thermal expansion. These characteristics make them ideal for construction laminates, furniture assembly, and automotive interiors.

The cost-effectiveness and versatility of synthetic rubber compounds also enhance their adoption among small-to-medium-scale manufacturers seeking reliable bonding at scale.

Water-based spray adhesives are expected to lead the technology segment with a 43.00% revenue share in 2025, driven by increasing demand for low-emission, environmentally friendly formulations. These adhesives are non-flammable, have lower toxicity, and are compliant with stringent environmental regulations across North America and Europe.

Their superior safety profile makes them suitable for indoor use, particularly in furniture, upholstery, and packaging applications. As end-users transition toward greener alternatives, manufacturers are scaling up water-based production technologies to meet performance expectations in bond strength and drying time.

The segment’s growth is also supported by public procurement policies favoring sustainable materials in building renovations and public infrastructure projects.

The building and construction sector is projected to contribute 36.00% of the total market share by 2025, making it the largest end-user in the spray adhesives market. This is attributed to the widespread use of spray adhesives in flooring, insulation panels, roofing, wall laminates, and decorative applications.

The ability of spray adhesives to offer quick bond strength, uniform coverage, and easy application on-site enhances labor productivity and reduces installation time. With growing investments in residential and commercial infrastructure, especially in emerging economies, demand for efficient and reliable adhesive systems is surging.

Additionally, the compatibility of spray adhesives with a wide range of construction materials such as wood, foam, fabric, and metal boosts their utility in both new builds and retrofitting projects.

The spray adhesives market is expanding due to increased demand across construction, automotive, packaging, and furniture industries. These adhesives offer quick application, even coverage, and strong bonding across varied substrates like foam, plastic, wood, and metal. The convenience of aerosol and bulk spray formats boosts preference in fast-paced environments. Industrial and commercial users value reduced labor time and cleaner application. Growth in sectors requiring flexible bonding solutions supports market development, as manufacturers also refine formulations for better safety and material compatibility.

The widespread use of spray adhesives in multiple sectors is a key market driver. These adhesives deliver quick tack times, clean application, and compatibility with a wide range of surfaces. In industries such as automotive interiors, furniture manufacturing, insulation, and labeling, speed and efficiency are critical. Spray formats reduce the need for rollers or brushes, allowing fast coverage of irregular shapes and vertical surfaces. In construction and insulation projects, these adhesives offer consistent performance even in challenging conditions. Manufacturers continue to optimize formulations to improve spray control, minimize overspray, and extend open times. The ability to use spray adhesives in both permanent and repositionable formats appeals to users needing flexibility without sacrificing bond strength. As industries focus on minimizing downtime and increasing process efficiency, the demand for fast-acting, reliable bonding agents continues to grow, making spray adhesives an attractive choice in both light-duty and heavy-duty applications.

Despite their convenience, spray adhesives face challenges in performance variability across substrates and under different environmental conditions. Bond strength can fluctuate depending on surface texture, temperature, humidity, and material type. For example, non-porous or oily surfaces may resist adhesion or require additional surface preparation. Inconsistent spray patterns, poor nozzle quality, or incorrect application distances can also affect bonding efficiency. This variability can lead to increased waste, rework, or compromised structural integrity. Additionally, certain materials—such as some foams or plastics—may degrade when exposed to harsh solvents or propellants used in spray formulations. Industrial users must often perform testing to ensure compatibility before large-scale application. The lack of standardized guidelines for application in niche settings makes it harder for end-users to predict adhesive behavior. Addressing these technical uncertainties requires ongoing user education, improved product labeling, and development of more forgiving, all-purpose spray adhesive formulations.

The growing preference for lightweight materials in automotive interiors, insulation panels, upholstered furniture, and packaging has increased the demand for spray adhesives optimized for foam and fabric bonding. These materials often require non-invasive, low-soak adhesives that ensure both adhesion and aesthetic quality. Spray adhesives are ideal for quick bonding without compressing or deforming the substrate. As demand for modular and custom-fabricated products rises, spray adhesives provide a versatile option for manufacturers seeking flexible assembly processes. Additionally, the market is seeing a rise in demand for water-based or low-emission formulations, which can be tailored to sensitive applications such as healthcare furniture or cleanroom insulation. Custom formulation services for specific applications and private-label branding create new revenue streams. Players that offer targeted solutions—such as repositionable sprays for temporary installations or high-temperature adhesives for automotive use—can carve out niche markets and cater to specialized industrial demands.

One restraint limiting broader adoption of spray adhesives involves regulatory constraints on volatile organic compound (VOC) emissions and user safety. Many solvent-based adhesives release vapors that require adequate ventilation and protective gear during application. This becomes a significant concern in enclosed environments like automotive workshops or indoor construction sites. Regional regulations often mandate strict labeling, usage restrictions, or formulation changes to limit exposure risks. Compliance with such regulations adds complexity and can raise production costs for manufacturers. Additionally, in sensitive applications such as food packaging, schools, or hospitals, users may avoid solvent-based spray adhesives entirely due to health concerns. Water-based alternatives are gaining attention but may not always match the performance levels of solvent-based options, particularly in demanding industrial settings. As users become more aware of indoor air quality and worker safety, the demand for lower-emission solutions may outpace supply unless innovation catches up with regulatory trends.

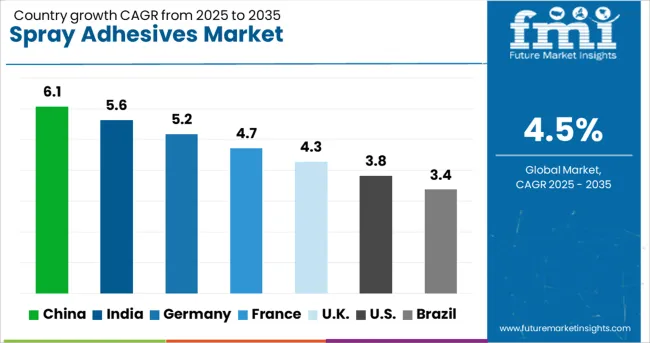

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global spray adhesives market is growing at a CAGR of 4.5%, supported by rising demand across automotive, construction, and furniture industries. China leads with 6.1% growth, driven by its vast industrial base and increased production of lightweight materials. India follows at 5.6%, fueled by infrastructure development and the expansion of local manufacturing. Germany records a 5.2% growth rate, reflecting innovation in eco-friendly formulations and stringent application standards. The United Kingdom sees 4.3% growth, focusing on specialized industrial uses and regulatory compliance. The United States, at 3.8%, remains a mature market with demand shaped by performance consistency and environmental regulations. Market trends are influenced by bonding strength, drying time, and VOC emission standards. This report includes insights on 40+ countries; the top countries are shown here for reference.

In China, the spray adhesives market has grown at a notable CAGR of 6.1%, fueled by increased application in furniture manufacturing, automotive interiors, and packaging. As industrial production scales up across provinces, manufacturers prefer spray adhesives for their uniform application and fast-setting properties. The furniture sector in particular has integrated spray systems to enhance efficiency in bonding foam, fabric, and composite surfaces. Rising demand for aesthetic and ergonomic interiors in automobiles has also supported adhesive usage in trim assembly. Local producers are ramping up the supply of solvent-based and water-based formulations tailored to meet national safety standards. The packaging sector, especially in e-commerce, continues to adopt spray adhesives for faster box and label bonding.

India’s spray adhesives market is expanding at a 5.6% CAGR, led by construction, packaging, and home décor segments. Lightweight material bonding and faster curing time are among the top reasons for increased adoption in woodworking and laminates. In metro areas, demand for readymade furniture and modular kitchen installations has accelerated the use of aerosol-based spray adhesives. The packaging industry, especially in consumer goods and logistics, has shifted toward high-tack spray products for corrugated box assembly and labeling. Domestic brands are offering low-cost, region-specific adhesive solutions, suitable for both industrial and small business use. Growth is also supported by the shift from traditional glue to cleaner and more efficient spray methods.

Germany’s spray adhesives market is progressing at a steady 5.2% CAGR, driven by industrial manufacturing, automotive upholstery, and interior décor. German manufacturers prioritize efficiency and environmental responsibility, leading to growing adoption of water-based spray adhesives with low emissions. Automotive component makers rely on sprays for bonding materials like foam, fabric, and rubber in seating and headliners. Additionally, office and commercial interior projects increasingly use spray adhesives for installing acoustic panels and decorative laminates. The demand for high-quality adhesives has led to partnerships between local firms and European chemical suppliers to develop long-lasting, heat-resistant formulations.

In the United Kingdom, the spray adhesives market is recording a CAGR of 4.3%, supported by growth in construction, crafts, and upholstery. Renovation and retrofitting projects have increased the use of adhesives for flooring, wall treatments, and insulation panels. Upholsterers and artisans favor aerosol sprays for quick-dry performance and minimal surface damage. The DIY sector, including small-scale furniture restoration and home improvement, is a significant contributor to sales. British importers are expanding their range of low-odour and multipurpose products to suit both commercial and personal users. Compliance with health regulations is encouraging a shift toward solvent-free options.

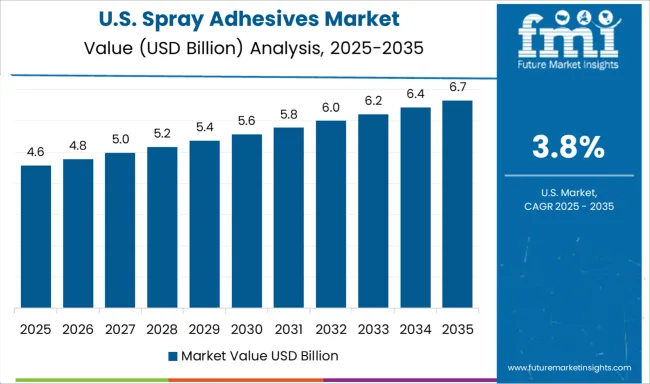

In the United States, the spray adhesives market has been growing at a CAGR of 3.8%, bolstered by usage in furniture assembly, HVAC insulation, and automotive aftermarket services. Foam and fiberglass insulation projects make extensive use of spray adhesives for efficient installation in residential and commercial properties. Auto body shops rely on quick-bond solutions for interior repair and trim applications. Moreover, large-scale furniture manufacturers in the Midwest have transitioned to water-based formulations to reduce VOC emissions and meet regulatory requirements. Craft and home repair segments are also seeing increased purchases of consumer-friendly spray adhesives from hardware stores and online retailers.

The spray adhesives market is experiencing steady demand across construction, automotive, furniture, packaging, and textile sectors due to the ease of application, fast bonding time, and suitability for large surface areas. These adhesives are often used where traditional glues are either impractical or too time-consuming, making them popular in both industrial and DIY settings. Among the key players, Henkel AG & Co. KGaA stands out with its Loctite and other industrial adhesive lines, offering solutions tailored for high-strength and versatile applications. 3M Company remains a dominant force with a wide-ranging portfolio, including products that cater to high-performance requirements in aerospace, woodworking, and automotive interiors. Its spray adhesives are particularly known for their consistent spray patterns and reliability under varied environmental conditions.

H.B. Fuller Company also plays a significant role, focusing on pressure-sensitive adhesives and spray products that meet stringent safety and performance standards, particularly in the packaging and textile industries. BASF SE and Sika AG contribute to the market with a strong emphasis on bonding technologies for construction and structural applications. BASF’s products are frequently used in insulation and panel bonding, while Sika’s range supports sectors like flooring and roofing where efficient adhesion and durability are crucial. Collectively, these companies are catering to growing needs for flexible, fast-setting bonding solutions in both industrial and consumer-facing markets.

On July 31, 2025, Henkel announced it will showcase a sustainable hot-melt adhesive at FACHPACK 2025. Designed with a significantly reduced carbon footprint, it supports the EU’s Packaging & Packaging Waste Regulation. This innovation is part of Henkel’s Packaging RecycLab, offering customers testing support for circular packaging systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Resin Type | Synthetic Rubber, Epoxy, Polyurethane, and Others |

| Technology Type | Water Based, Solvent Based, and Hot Melt |

| End-user | Building & Construction, Packaging, Footwear, Transportation, Hygiene, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel AG & Co. KGaA, BASF SE, H.B Fuller Company, Sika AG, and 3M Company |

| Additional Attributes | Dollar sales vary by adhesive type and resin chemistry, with water-based and hot-melt products dominating, while polyurethane-based formulations grow fastest. Asia‑Pacific leads in volume, while North America and Europe emphasize sustainable innovations. Pricing fluctuates with raw materials and VOC compliance. Growth accelerates via eco‑friendly formulations, precision spray technologies, IoT-enabled dispensers, and diverse industrial applications under evolving environmental regulations |

The global spray adhesives market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the spray adhesives market is projected to reach USD 14.8 billion by 2035.

The spray adhesives market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in spray adhesives market are synthetic rubber, epoxy, polyurethane and others.

In terms of technology type, water based segment to command 43.0% share in the spray adhesives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Mini Spray Bottles Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Nasal Sprays Market Analysis - Size, Share, and Forecast 2025 to 2035

Dermal Sprays Market Size and Share Forecast Outlook 2025 to 2035

Throat Sprays Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA