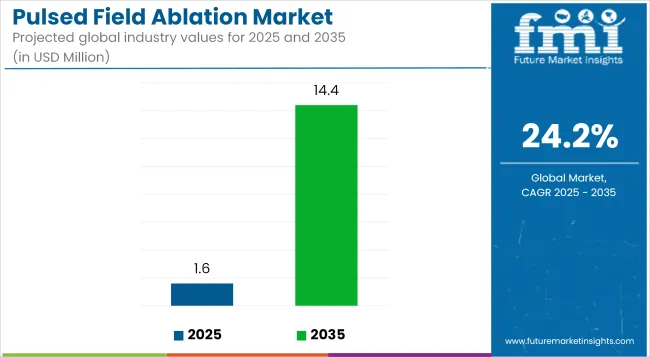

The Pulsed Field Ablation Industry is valued at USD 1.6 million in 2025. It is expected to grow at a CAGR of 24.2% and reach USD 14.4 million by 2035.In 2024, the PFA industry witnessed heightened clinical interest due to promising trial outcomes, favorable regulatory feedback in the U.S. and Europe, and increasing industry investments by major Medtech players. These developments laid a strong foundation for accelerated growth in the coming decade.

From 2025 to 2035, the pulsed field ablation industry is expected to experience sustained high growth, driven by rising adoption of non-thermal ablation techniques for atrial fibrillation treatment. Clinical preference for PFA over traditional RF and cryoablation methods is intensifying, given its tissue-selective advantages and reduced procedural complications.

Industry expansion is further supported by increasing procedural volumes globally, ongoing device innovation, and expansion into emerging healthcare systems with growing cardiovascular disease burdens.

Strategic partnerships and technological upgrades are expected to solidify the position of key players while creating room for new entrants. The Asia-Pacific region is projected to emerge as a high-potential growth area due to large patient pools and improving electrophysiology infrastructure. The overall outlook for the PFA industry remains strongly positive through 2035, driven by both clinical validation and commercial momentum.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 1.6 million |

| Industry Value (2035F) | USD 14.4 million |

| CAGR (2025 to 2035) | 24.2% |

The pulsed field ablation (PFA) industry is on a steep growth trajectory, propelled by increasing demand for safer and more effective atrial fibrillation treatments. The key driver is the technology's tissue-selective, non-thermal mechanism, which reduces collateral damage and shortens recovery times. Beneficiaries include electrophysiology device manufacturers and healthcare providers, while traditional ablation technology players risk industry share erosion if they fail to adapt.

The pulsed field energy is expected to dominate the pulsed field ablation industry with a CAGR of 23.9% from 2025 to 2035. During the forecast period from 2025 to 2035, the pulsed field energy segment is expected to lead the industry, driven by its growing clinical preference as a non-thermal, tissue-selective ablation method. Pulsed field energy enables safer and more efficient procedures by selectively targeting myocardial tissue while minimizing damage to surrounding structures such as the esophagus or phrenic nerve.

This safety profile is accelerating its adoption across advanced healthcare systems and shaping the development strategies of device manufacturers. Hospitals and electrophysiology labs increasingly favor standalone PFA systems, with early clinical trials validating their long-term efficacy. The segment benefits from continuous innovation, including the integration of advanced mapping technologies and catheter designs optimized for PFA delivery.

Pulsed field plus radiofrequency (RF) is gaining traction as a hybrid approach, offering procedural flexibility and bridging the transition from conventional methods. Though currently a supplementary solution, it allows practitioners to tailor ablation strategies based on patient anatomy and arrhythmia complexity.

This hybrid approach is expected to remain relevant, particularly in regions where full transition to standalone PFA is gradual. Overall, the product landscape is evolving toward PFA dominance, with the hybrid approach supporting adoption in mixed-technology environments.

The hospital segment is expected to dominate the pulsed field ablation industry with a CAGR of 23.7% from 2025 to 2035. Hospitals will continue to dominate as the primary end users of pulsed field ablation systems, leveraging their broad infrastructure and capacity to manage high patient volumes with complex cardiac conditions. The integration of PFA into hospital-based electrophysiology programs aligns with the broader trend of investing in advanced cardiovascular care and improving procedural safety and outcomes.

Hospitals also serve as central hubs for clinical trials and early-stage technology adoption, accelerating the mainstream integration of PFA. Cardiac catheterization laboratories are emerging as high-growth settings for PFA procedures, as these facilities increasingly adopt cutting-edge ablation technologies to enhance procedural efficiency and precision. Their focus on minimally invasive interventions makes PFA a strong fit, especially in academic and private cardiovascular centers.

Ambulatory surgical centers (ASCs) are expected to show gradual but consistent adoption, supported by the push toward outpatient-based care and cost-efficient delivery models. While ASCs face limitations in handling high-risk or complex arrhythmia cases, improvements in catheter design, device portability, and procedural protocols will support PFA integration in select cases. Collectively, all three end-user segments are moving toward PFA adoption, each at a different pace and with distinct integration strategies tailored to their operational models.

Prioritize Full-Stack PFA System Development Executives should invest in end-to-end PFA platforms that integrate mapping, ablation, and data analytics, rather than offering piecemeal solutions. Streamlining procedural workflows with single-vendor ecosystems will be crucial to gaining hospital trust and driving adoption.

Align Product Strategy with Clinical Shift Toward Tissue Selectivity Stakeholders must align development and industrying with the clinical shift away from thermal ablation. Messaging should focus on procedural safety, reduced esophageal damage, and short recovery times, directly addressing EP community pain points.

Expand Strategic Collaborations and Regional Penetration Companies should pursue co-development deals, university partnerships, and targeted M&A to accelerate IP access. Simultaneously, distribution models should be tailored for emerging industries where low-cost, compact systems can unlock new adoption curves.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays for PFA-specific approvals in the USA and EU | Medium - High |

| Limited physician training and procedural standardization | High - Medium |

| Overdependence on a few players with proprietary IP | Medium - High |

| Priority | Immediate Action |

|---|---|

| Reimbursement Mapping | Align product coding with updated CMS/Medicare guidelines for PFA |

| Clinical Education Scaling | Launch training programs for EPs in Asia and Latin America |

| Supply Chain Localization | Start feasibility studies for local catheter assembly in ASEAN |

Pulsed Field Ablation is nearing an inflection point. Executives must move beyond pilot-stage thinking and commit to scaled commercialization strategies by 2026. This requires early investment in clinical advocacy, full-stack PFA systems, and industry-specific distribution partnerships. The intelligence indicates a clear shift in stakeholder sentiment toward replacing traditional thermal methods.

(Surveyed Q4 2024, n=450 stakeholders including EPs, hospital buyers, MEDtech executives, and regulatory consultants across the USA, EU5, Japan, India, and Brazil)

Regional Variance:

Convergent Insight:

Consensus:

Divergence:

Physicians:

Hospitals:

Distributors:

Alignment:

Divergence:

Strategic Insight:

| Country | Policy/Regulatory Impact on PFA Market |

|---|---|

| United States | The FDA currently regulates PFA systems under the Class III medical device category, requiring rigorous premarket approval (PMA). Increasing focus on safety profiles post-AF ablation is expediting device-specific guidance. Medicare reimbursement codes are under review to include standalone PFA procedures, which could significantly accelerate adoption. |

| Germany | Governed by the EU MDR (Medical Device Regulation), which mandates strict clinical evidence and post-market surveillance. CE certification is compulsory and increasingly favoring devices with strong real-world evidence, pushing manufacturers to invest in large-scale European registries. |

| France | Similar to Germany under EU MDR, but with a more centralized hospital technology assessment through the Haute Autorité de Santé (HAS). HAS demands local cost-effectiveness data for reimbursement inclusion, prompting companies to run region-specific studies. |

| Japan | Regulated by the Pharmaceuticals and Medical Devices Agency (PMDA). Approval pathways are conservative; PFA devices require local clinical validation before Shonin ( industry approval). Hospitals often delay procurement until guidelines from Japanese Circulation Society explicitly support new methods. |

| India | Regulated by the Central Drugs Standard Control Organization (CDSCO). Currently, there is no device-specific framework for PFA, resulting in slow approvals under generic electrophysiology categories. No formal reimbursement pathways yet; pricing and registration approvals can take 12-18 months. |

| Brazil | Oversight by ANVISA with slow-moving regulatory processes. PFA falls under high-risk cardiac device category, requiring complete technical dossiers and local agent representation. Public healthcare coverage does not yet include PFA, limiting accessibility to private centers. |

| United Kingdom | Follows UKCA marking under the Medicines and Healthcare products Regulatory Agency (MHRA) post- Brexit. Currently recognizes CE-certified devices temporarily, but manufacturers will require UK-specific submissions soon. NICE (National Institute for Health and Care Excellence) guidance is increasingly influential in adoption decisions. |

| South Korea | Governed by the Ministry of Food and Drug Safety (MFDS). Requires local clinical data or bridging studies from comparable populations. National reimbursement decisions are centrally controlled, often delaying inclusion of newer technologies like PFA. |

| China | NMPA (National Medical Products Administration) mandates clinical trials within China unless exemption is granted. Registration process is lengthy (12-24 months) and PFA is still in early evaluation stages. Localization requirements are strong-foreign firms often need domestic partnerships. |

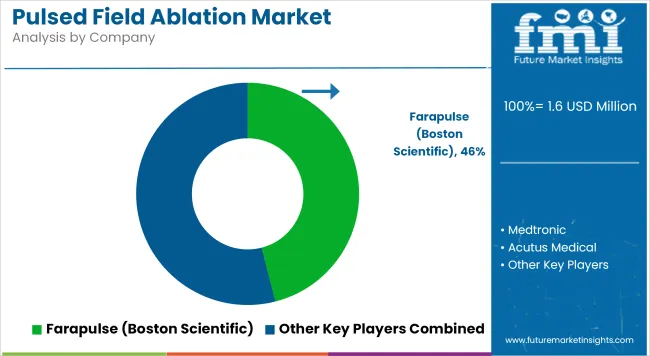

| Company | Estimated Global Market Share (2024) |

|---|---|

| Farapulse (Boston Scientific) | 46% |

| Medtronic | 29% |

| Acutus Medical | 12% |

| Afera Medical | 7% |

| Pulse Biosciences | 4% |

| Others | 2% |

Key Developments in 2024

The PFA industry in the United States is anticipated to grow at a CAGR of nearly 26.8% over the forecast period. That rapid growth is being aided by brisk FDA regulatory progress, positive revisions in CSM reimbursement, and some initial in-hospital adoption for Fara pulse and the Medtronic systems. USA has the most mature electrophysiology ecosystem in the world, from large academic centers driving clinical validation and procedural training.

Non-thermal ablation is strongly preferred by physicians due to safety improvements particularly in atrial fibrillation treatment. Procedural volumes are only set to increase further as Medicare structures its reimbursement strategies for standalone PFA, and commercial uptake is expected to exceed early expectations. In addition, the USA is a leading country for conducting clinical trials, which fuels first mover advantages for PFA vendors.

The industry in the United Kingdom is expanded to grow at a CAGR of 22.1% over during the forecast period. The UKCA regulatory transition introduces a degree of friction, but continued acceptance of CE-certified systems makes it possible to continue adoption. NHS hospitals are beginning to assess PFA systems as part of technology appraisals, and NICE guidance will likely shape wider adoption. PFA procedures have already been piloted at academic hospitals in London, Manchester and Oxford, building confidence in the clinical use of the technology.

Still, public-sector budgetary constraints and slower procurement cycles may temper early growth a bit. Private cardiac-centered care is expected to be the quicker adopter, especially when manufacturers offer leasing or hybrid pricing models. In 2026 and beyond, we will need a clearer understanding of how reimbursements will work to be able to scale this industry.

In France, PFA industry is projected to grow with a CAGR of 21.5% from 2025 to 2035. In France, centralized healthcare planning means that technologies such as PFA can be evaluated and deployed nationwide, as soon as clinical and cost-effectiveness criteria are met. This regulatory alignment with EU MDR and the option for early CE-cleared PFA systems will give France timely access to next-generation technologies.

The top EP centers in Paris and Marseille were involved in pivotal clinical studies confirming procedural confidence. But France’s focus on long-term outcome data ahead of mass procurement may put a brake on early volume growth. May take a conservative approach as it may not see strong economic and safety data within the context of French healthcare.

The PFA industry in Germany is anticipated to experience a CAGR of 25.0% during the assessment period from 2025 to 2035. As the largest EP device industry in Europe, Germany is central to both trial activity and early adoption. CE marking has allowed PFA devices from Boston Scientific, Medtronic and Acutus to achieve early access across university hospitals and cardiac specialty clinics.

The country’s structured hospital procurement process lends itself to quicker capital technology rollouts than other EU members. Germany's EP physicians also have embraced tissue-selective ablation with enthusiasm, regarding PFA as the answer to the complications associated with thermal approaches. Reimbursement under the DRG system is a critical enabler, and early inclusion of PFA under existing reimbursement codes is further accelerating procedural adoption.

Italy PFA industry is estimated to grow at a CAGR of 20.3% during the forecast period 2023 to 2035. Italy's cardiac centers in Milan, Bologna and Rome are among a growing number of facilities around the world to incorporate PFA into electrophysiology programs, albeit not amongst the first movers. The CE certification provides regulatory access and helps with faster availability, but actual adoption will be driven through region-based procurement policies.

Italy, with both public and private health care (and where early adoption of PFA technology is being led by the private sector owing to its more flexible evaluation of new technology), Italian clinical societies are monitoring available European trial data and greater advocacy for non-thermal applications is developing. But the need to be cost-conscious and slower reimbursement pathways will likely mean that they won’t go nationally.

New Zealand New Zealand’s PFA industry is forecast to grow at a CAGR of 18.7% over the next decade. The country's relatively small but advanced cardiac care infrastructure makes it a slow but steady adopter of electrophysiology innovations. PFA systems are expected to enter select private hospitals and government tertiary centers by 2026, contingent on procedural training and device approvals by Med safe.

typically follows Australia’s regulatory lead, so commercial activity will likely align with trans-Tasman clinical networks. Budget allocation challenges in the public sector and geographic dispersion of EP labs may restrict early adoption. Nevertheless, the growing burden of atrial fibrillation and national digitization of care pathways will create gradual demand for PFA solutions.

South Korea’s PFA industry is expected to expand at a CAGR of 23.4% from 2025 to 2035. Known for its rapid digital healthcare integration and aggressive medtech procurement in top-tier hospitals, South Korea represents one of Asia's fastest-growing PFA adoption zones. Leading cardiac centers in Seoul and Busan have already begun evaluating PFA platforms in real-world use.

Regulatory approvals from MFDS are progressing as companies complete bridging studies or local trials. However, centralized reimbursement structures create a hurdle; industry expansion is contingent on PFA’s inclusion in the National Health Insurance system. Stakeholders are optimistic, as early procedural outcomes and interest from South Korea’s academic EP societies are aligning in favor of the technology.

Japan’s PFA industry is forecast to grow at a CAGR of 19.6% between 2025 and 2035. The country is cautious with adopting novel cardiac technologies and typically waits for long-term procedural data. Regulatory approval from the PMDA requires localized clinical evidence, which lengthens go-to-industry timelines. While Japanese cardiac societies are closely tracking European and USA PFA data, broader adoption is likely to begin post-2026.

Initial interest is coming from large academic hospitals in Tokyo and Osaka, especially where catheter labs are well-funded. Physician training and endorsement by Japanese electrophysiology associations will be key to procedural standardization. Pricing and cost-effectiveness within the universal healthcare model also remain critical factors for scaling adoption.

China’s PFA industry is projected to grow at a CAGR of 24.6% over the next decade. With the world’s largest population of atrial fibrillation patients and growing demand for advanced cardiac treatments, China presents a high-volume, high-reward opportunity. However, regulatory approvals through the NMPA can be lengthy, and foreign device makers are often required to complete local trials.

Some Chinese firms are already entering the industry with homegrown PFA prototypes, signaling future domestic competition. Top hospitals in Tier 1 cities like Beijing and Shanghai are beginning pilot procedures. Long-term industry expansion depends on government inclusion of PFA within national reimbursement schemes and integration into public procurement frameworks under the Healthy China 2030 plan.

Australia’s PFA industry is anticipated to grow at a CAGR of 21.9% from 2025 to 2035. The Therapeutic Goods Administration (TGA) is expected to approve multiple PFA systems by 2026, giving early access to private cardiac centers in Sydney and Melbourne. Australian hospitals are known for rapid clinical tech evaluation and willingness to adopt minimally invasive techniques.

Early clinical collaborations with Boston Scientific and Medtronic have helped raise awareness about the safety and speed advantages of PFA. However, reimbursement policies via the Medicare Benefits Schedule (MBS) are often slow to catch up with innovation, delaying wider diffusion. Once government coding frameworks align with procedural use, nationwide adoption will significantly accelerate.

Pulsed Field Energy, Pulsed Field plus Radiofrequency

Hospitals, Cardiac Catheterization Laboratories, Ambulatory Surgical Centers

North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Africa.

The growth is primarily driven by increasing demand for safer and more precise ablation techniques in atrial fibrillation treatment, favorable regulatory progress, and expanding adoption in electrophysiology labs across the globe.

PFA uses non-thermal pulsed electric fields to selectively ablate cardiac tissue, minimizing damage to surrounding structures like the esophagus or phrenic nerve—unlike radiofrequency or cryoablation, which rely on heat or cold.

Major players include Boston Scientific (Farapulse), Medtronic, Acutus Medical, Afera Medical, and Pulse Biosciences, among others actively developing or commercializing PFA systems.

North America and Western Europe are leading in adoption, driven by regulatory clearances, trial activity, and infrastructure readiness, while Asia-Pacific is showing strong future potential.

Challenges include regulatory delays in certain regions, limited long-term clinical data, training gaps among electrophysiologists, and reimbursement uncertainties in emerging economies.

Table 01: Global Market Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 02: Global Market Analysis 2021 to 2022 and Forecast 2023 to 2033, by End User

Table 03: Global Market Analysis 2021 to 2022 and Forecast 2023 to 2033, by Region

Table 04: North America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 05: North America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 06: North America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by End User

Table 07: Latin America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 08: Latin America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 09: Latin America Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by End User

Table 10: Europe Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 11: Europe Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 12: Europe Market Analysis 2021 to 2022 and Forecast 2023 to 2033 by End User

Table 13: East Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 14: East Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 15: East Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by End User

Table 16: South Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 17: South Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 18: South Asia Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by End User

Table 19: Oceania Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 20: Oceania Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 21: Oceania Market Analysis 2021 to 2022 and Forecast 2023 to 2033 by End User

Table 22: Middle East & Africa Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Country

Table 23: Middle East & Africa Market Value (US$ Million) Analysis 2021 to 2022 and Forecast 2023 to 2033, by Product

Table 24: Middle East & Africa Market Analysis 2021 to 2022 and Forecast 2023 to 2033 by End User

Figure 01: Global Market Value (US$ Million) Analysis, 2021 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Product

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 13: North America Market Value (US$ Million) Analysis, 2021 to 2022

Figure 14: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 15: North America Market Value Share, by Product (2023 E)

Figure 16: North America Market Value Share, by End User (2023 E)

Figure 17: North America Market Value Share, by Country (2023 E)

Figure 18: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 19: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 20: USA Market Value Proportion Analysis, 2022

Figure 21: Global Vs. USA Growth Comparison

Figure 22: USA Market Share Analysis (%) by Product, 2022 & 2033

Figure 23: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 24: Canada Market Value Proportion Analysis, 2022

Figure 25: Global Vs. Canada. Growth Comparison

Figure 26: Canada Market Share Analysis (%) by Product, 2022 & 2033

Figure 27: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 28: Latin America Market Value (US$ Million) Analysis, 2021 to 2022

Figure 29: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 30: Latin America Market Value Share, by Product (2023 E)

Figure 31: Latin America Market Value Share, by End User (2023 E)

Figure 32: Latin America Market Value Share, by Country (2023 E)

Figure 33: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 34: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 35: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 36: Mexico Market Value Proportion Analysis, 2022

Figure 37: Global Vs Mexico Growth Comparison

Figure 38: Mexico Market Share Analysis (%) by Product, 2022 & 2033

Figure 39: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 40: Brazil Market Value Proportion Analysis, 2022

Figure 41: Global Vs. Brazil. Growth Comparison

Figure 42: Brazil Market Share Analysis (%) by Product, 2022 & 2033

Figure 43: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 44: Argentina Market Value Proportion Analysis, 2022

Figure 45: Global Vs Argentina Growth Comparison

Figure 46: Argentina Market Share Analysis (%) by Product, 2022 & 2033

Figure 47: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 48: Europe Market Value (US$ Million) Analysis, 2021 to 2022

Figure 49: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 50: Europe Market Value Share, by Product (2023 E)

Figure 51: Europe Market Value Share, by End User (2023 E)

Figure 52: Europe Market Value Share, by Country (2023 E)

Figure 53: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 54: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 55: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 56: UK Market Value Proportion Analysis, 2022

Figure 57: Global Vs. UK Growth Comparison

Figure 58: UK Market Share Analysis (%) by Product, 2022 & 2033

Figure 59: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 60: Germany Market Value Proportion Analysis, 2022

Figure 61: Global Vs. Germany Growth Comparison

Figure 62: Germany Market Share Analysis (%) by Product, 2022 & 2033

Figure 63: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 64: Italy Market Value Proportion Analysis, 2022

Figure 65: Global Vs. Italy Growth Comparison

Figure 66: Italy Market Share Analysis (%) by Product, 2022 & 2033

Figure 67: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 68: France Market Value Proportion Analysis, 2022

Figure 69: Global Vs France Growth Comparison

Figure 70: France Market Share Analysis (%) by Product, 2022 & 2033

Figure 71: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 72: Spain Market Value Proportion Analysis, 2022

Figure 73: Global Vs Spain Growth Comparison

Figure 74: Spain Market Share Analysis (%) by Product, 2022 & 2033

Figure 75: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 76: Russia Market Value Proportion Analysis, 2022

Figure 77: Global Vs Russia Growth Comparison

Figure 78: Russia Market Share Analysis (%) by Product, 2022 & 2033

Figure 79: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 80: BENELUX Market Value Proportion Analysis, 2022

Figure 81: Global Vs BENELUX Growth Comparison

Figure 82: BENELUX Market Share Analysis (%) by Product, 2022 & 2033

Figure 83: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 84: East Asia Market Value (US$ Million) Analysis, 2021 to 2022

Figure 85: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 86: East Asia Market Value Share, by Product (2023 E)

Figure 87: East Asia Market Value Share, by End User (2023 E)

Figure 88: East Asia Market Value Share, by Country (2023 E)

Figure 89: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 90: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 91: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 92: China Market Value Proportion Analysis, 2022

Figure 93: Global Vs. China Growth Comparison

Figure 94: China Market Share Analysis (%) by Product, 2022 & 2033

Figure 95: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 96: Japan Market Value Proportion Analysis, 2022

Figure 97: Global Vs. Japan Growth Comparison

Figure 98: Japan Market Share Analysis (%) by Product, 2022 & 2033

Figure 99: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 100: South Korea Market Value Proportion Analysis, 2022

Figure 101: Global Vs South Korea Growth Comparison

Figure 102: South Korea Market Share Analysis (%) by Product, 2022 & 2033

Figure 103: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 104: South Asia Market Value (US$ Million) Analysis, 2021 to 2022

Figure 105: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 106: South Asia Market Value Share, by Product (2023 E)

Figure 107: South Asia Market Value Share, by End User (2023 E)

Figure 108: South Asia Market Value Share, by Country (2023 E)

Figure 109: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 110: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 111: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 112: India Market Value Proportion Analysis, 2022

Figure 113: Global Vs. India Growth Comparison

Figure 114: India Market Share Analysis (%) by Product, 2022 & 2033

Figure 115: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 116: Indonesia Market Value Proportion Analysis, 2022

Figure 117: Global Vs. Indonesia Growth Comparison

Figure 118: Indonesia Market Share Analysis (%) by Product, 2022 & 2033

Figure 119: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 120: Malaysia Market Value Proportion Analysis, 2022

Figure 121: Global Vs. Malaysia Growth Comparison

Figure 122: Malaysia Market Share Analysis (%) by Product, 2022 & 2033

Figure 123: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 124: Thailand Market Value Proportion Analysis, 2022

Figure 125: Global Vs. Thailand Growth Comparison

Figure 126: Thailand Market Share Analysis (%) by Product, 2022 & 2033

Figure 127: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 128: Oceania Market Value (US$ Million) Analysis, 2021 to 2022

Figure 129: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 130: Oceania Market Value Share, by Product (2023 E)

Figure 131: Oceania Market Value Share, by End User (2023 E)

Figure 132: Oceania Market Value Share, by Country (2023 E)

Figure 133: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 134: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 135: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 136: Australia Market Value Proportion Analysis, 2022

Figure 137: Global Vs. Australia Growth Comparison

Figure 138: Australia Market Share Analysis (%) by Product, 2022 & 2033

Figure 139: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 140: New Zealand Market Value Proportion Analysis, 2022

Figure 141: Global Vs New Zealand Growth Comparison

Figure 142: New Zealand Market Share Analysis (%) by Product, 2022 & 2033

Figure 143: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 144: Middle East & Africa Market Value (US$ Million) Analysis, 2021 to 2022

Figure 145: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 146: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 147: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 148: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 149: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 150: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 151: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 152: GCC Countries Market Value Proportion Analysis, 2022

Figure 153: Global Vs GCC Countries Growth Comparison

Figure 154: GCC Countries Market Share Analysis (%) by Product, 2022 & 2033

Figure 155: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 156: Türkiye Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Türkiye Growth Comparison

Figure 158: Türkiye Market Share Analysis (%) by Product, 2022 & 2033

Figure 159: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 160: South Africa Market Value Proportion Analysis, 2022

Figure 161: Global Vs. South Africa Growth Comparison

Figure 162: South Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 163: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 164: North Africa Market Value Proportion Analysis, 2022

Figure 165: Global Vs North Africa Growth Comparison

Figure 166: North Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 167: North Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

1550nm LiDAR Pulsed Fiber Laser Market Forecast and Outlook 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Field Force Automation Market Size and Share Forecast Outlook 2025 to 2035

Field Service Management Market Size and Share Forecast Outlook 2025 to 2035

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field Erected Cooling Tower Market Growth – Trends & Forecast 2024-2034

Field-effect Rectifier Diodes Market

Field Erected Boiler Market

Field-programmable Gate Array (FPGA) Market

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Oilfield Chemicals Market Report - Growth, Demand & Forecast 2025 to 2035

Airfield Fencing Market Insights by Material, Height, Product Type, and Region through 2035

Oilfield Roller Chain Market

Far-field Tag Antennas Market Size and Share Forecast Outlook 2025 to 2035

Far Field Speech and Voice Recognition Market Size and Share Forecast Outlook 2025 to 2035

Fin Field Effect Transistor (FinFET) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA