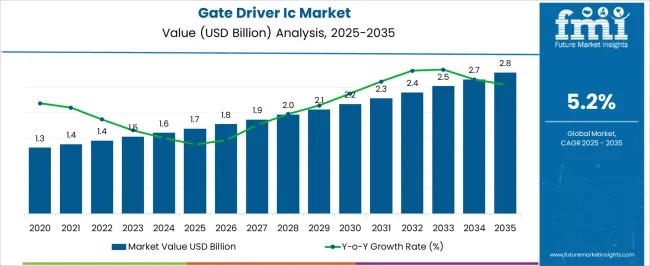

The global gate driver IC market is projected to grow from USD 1.7 billion in 2025 to USD 2.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.2%. This growth trajectory indicates a significant shift from early adoption to widespread industry integration. In the initial phase (2020–2024), the market was characterized by limited adoption, primarily driven by research institutions and specialized applications. During this period, stakeholders focused on validating the material's performance and establishing its viability as an alternative to traditional sensors.

As the market transitioned into the scaling phase (2025–2030), increased production capabilities and broader industry acceptance facilitated more extensive use in commercial applications. By the consolidation phase (2030–2035), capacitive tactile sensors are expected to become a mainstream technology, with established supply chains and standardized applications across various sectors. This adoption lifecycle illustrates the maturation of the capacitive tactile sensor market, highlighting the progression from experimental use to industry-wide integration. The early adoption phase was marked by research and development efforts, aiming to demonstrate the material's feasibility and advantages over conventional sensors.

The scaling phase saw the expansion of production facilities and the adoption of capacitive tactile sensors in larger-scale projects, driven by their cost-effectiveness and performance characteristics. In the final consolidation phase, the market is anticipated to achieve stability, with established standards and widespread utilization, positioning capacitive tactile sensors as a standard choice in various applications.

| Metric | Value |

|---|---|

| Gate Driver IC Market Estimated Value in (2025 E) | USD 1.7 billion |

| Gate Driver IC Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The gate driver IC market, expanding from USD 1.7 billion in 2025 to USD 2.8 billion by 2035 at a CAGR of 5.2%, exhibits notable breakpoints that signal shifts in adoption and market dynamics. The first key breakpoint occurs around 2025, when the market reaches USD 1.7 billion. At this stage, the technology transitions from early-stage experimentation to broader commercial adoption. Increased production capacity and successful pilot implementations build confidence among manufacturers and end-users. This phase represents the scaling period, characterized by gradual adoption, expansion of manufacturing capabilities, and more consistent integration into power management systems across automotive, industrial, and consumer electronics applications.

A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 2.4–2.5 billion. By this stage, gate driver ICs are widely adopted, and the market begins shifting from growth-driven expansion to consolidation. Major players strengthen their market positions, while smaller competitors face increased pressure to scale or exit.

Supply chains stabilize, pricing becomes more predictable, and standardization of product specifications enhances operational efficiency. By 2035, reaching USD 2.8 billion, the market reflects full consolidation, with gate driver ICs recognized as a mainstream component supported by mature production infrastructure, established distribution networks, and widespread acceptance across key end-use sectors.

Increasing demand for efficient power conversion and enhanced switching performance is driving the adoption of advanced gate driver solutions. The shift toward high-power density systems and wide bandgap semiconductor technologies, such as silicon carbide and gallium nitride, has further elevated the need for precise and reliable gate driver ICs.

Integration of protection features, improved thermal performance, and compatibility with high-frequency switching applications are enabling their widespread usage across demanding environments. Furthermore, advancements in electric mobility, energy storage systems, and smart grid infrastructure are creating significant opportunities for gate driver IC manufacturers.

Continuous innovations in packaging, isolation techniques, and control interfaces are shaping the market’s competitive landscape. As industries focus on improving operational efficiency and reducing energy losses, the market is anticipated to witness steady expansion with strong long-term prospects.

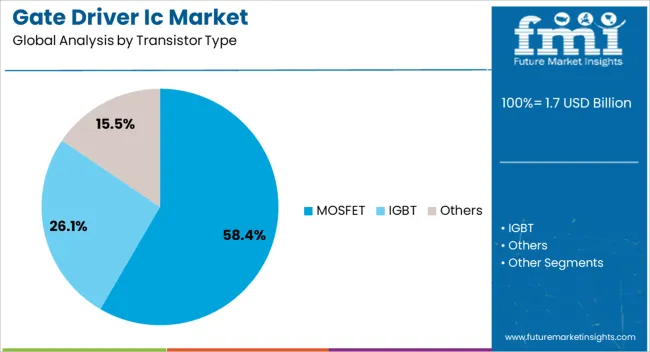

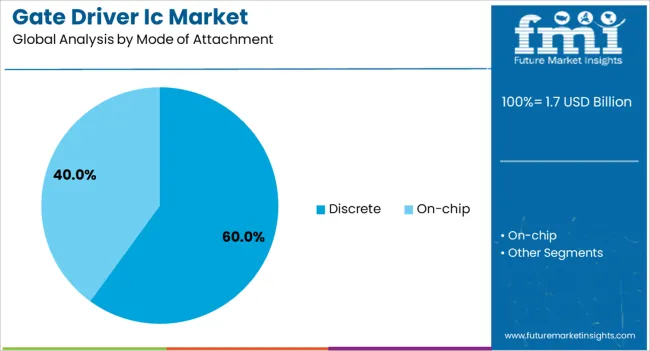

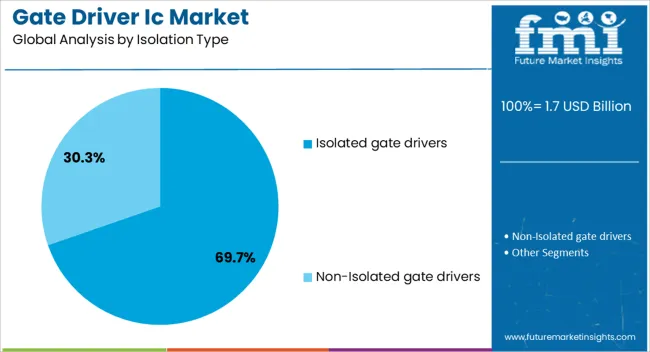

The gate driver IC market is segmented by transistor type, mode of attachment, isolation type, end use industry, and geographic regions. By transistor type, gate driver IC market is divided into MOSFET, IGBT, and Others. In terms of mode of attachment, gate driver IC market is classified into Discrete and On-chip. Based on isolation type, gate driver IC market is segmented into Isolated gate drivers and Non-Isolated gate drivers. By end use industry, gate driver IC market is segmented into Automotive, Consumer electronics, Energy & power, Telecommunications, and Others. Regionally, the gate driver IC industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The MOSFET transistor type segment is expected to account for 58.40% of the Gate Driver IC market revenue share in 2025, positioning it as the leading transistor type. This dominance has been driven by the widespread application of MOSFETs in medium to high-frequency switching operations that demand low conduction losses and fast switching speeds.

The superior efficiency, thermal stability, and design flexibility of MOSFET-based systems have strengthened their adoption in power supply units, motor control systems, and inverter applications. Their compatibility with advanced gate driver ICs has allowed for enhanced performance, particularly in compact and high-power-density designs.

The increasing use of MOSFETs in automotive powertrains, renewable energy converters, and consumer electronics has further reinforced their market position With continuous advancements in MOSFET technology, including reduced on-resistance and improved ruggedness, the segment is anticipated to maintain its leadership, supported by demand from industries prioritizing energy efficiency and operational reliability.

The discrete mode of attachment segment is projected to hold 60% of the Gate Driver IC market revenue share in 2025, making it the most prominent mode of attachment. This segment’s growth has been driven by its flexibility in design integration and the ability to tailor performance characteristics for specific applications.

Discrete gate driver solutions offer advantages in terms of heat dissipation, customization, and compatibility with a wide range of power devices. Industries with demanding operating environments, such as industrial automation and renewable energy, have preferred discrete configurations due to their durability and adaptability.

Furthermore, discrete attachment allows for easier maintenance and replacement without redesigning entire systems, which is beneficial in high-value industrial assets As application-specific customization continues to gain importance, discrete mode gate driver ICs are expected to remain the preferred choice, delivering optimal performance and cost-effectiveness in both legacy and next-generation systems.

The isolated gate drivers segment is anticipated to capture 69.70% of the Gate Driver IC market revenue share in 2025, establishing itself as the dominant isolation type. Growth in this segment has been propelled by the increasing need for electrical isolation to ensure safety, system reliability, and compliance with stringent industry standards. Isolated gate drivers play a critical role in high-voltage applications by protecting low-voltage control circuitry from electrical surges and noise.

Their adoption has been particularly strong in renewable energy inverters, electric vehicle systems, and industrial motor drives, where galvanic isolation is essential. Enhanced performance in terms of common-mode transient immunity, power efficiency, and fault protection has contributed to their rising demand.

Moreover, the growing prevalence of high-voltage architectures in automotive and energy sectors is reinforcing the need for robust isolation With continuous innovation in isolation technologies, including magnetic and capacitive isolation, isolated gate drivers are expected to maintain their leadership position in the coming years.

The gate driver IC market is growing as demand for high-efficiency power electronics rises across automotive, industrial, consumer electronics, and renewable energy sectors. Gate driver ICs are essential for controlling power transistors, enabling faster switching, improved energy efficiency, and thermal management in devices. Adoption is supported by trends in electric vehicles, industrial automation, and smart energy solutions. However, challenges related to design complexity, thermal reliability, and system integration remain. Companies focusing on compact, high-performance, and application-specific gate driver IC solutions are positioned to capture growth in next-generation power electronics applications.

Gate driver ICs face challenges related to thermal management, switching losses, and precise signal control. As switching frequencies increase, heat dissipation becomes critical to maintaining device reliability and performance. Design complexity grows with the need for protection features such as under-voltage lockout, short-circuit prevention, and electromagnetic interference mitigation. Integration with different power transistors (IGBTs, MOSFETs, SiC, GaN) requires optimized design to ensure compatibility and efficiency. Manufacturers must balance high-speed performance with durability while keeping costs manageable. Achieving consistent performance across diverse applications and operating conditions adds additional engineering and testing complexity, making innovation and quality assurance key differentiators in the market.

The gate driver IC market is trending toward high-speed switching and integration with wide-bandgap semiconductors like SiC and GaN. These technologies enable higher efficiency, lower energy losses, and compact system design, particularly in electric vehicles and renewable energy inverters. Multi-channel gate driver ICs and integrated protection features are becoming standard to simplify system design and reduce board space. There is also an increasing trend toward intelligent gate drivers with real-time monitoring, fault diagnostics, and adaptive control capabilities. These developments improve system reliability, efficiency, and lifespan while supporting next-generation power electronics applications. Continuous advancements in packaging and materials further enhance performance and thermal handling.

Gate driver ICs offer significant opportunities in electric vehicles, renewable energy systems, and industrial automation. EV adoption drives demand for efficient motor drives and battery management systems, where gate driver ICs are critical. Solar inverters, wind turbines, and smart grid infrastructure also benefit from efficient and reliable gate driver solutions. Industrial automation and robotics increasingly require precise control of power devices for motors, actuators, and high-voltage systems. Growing investments in smart energy and electrification provide additional opportunities for application-specific and high-performance gate driver ICs. Collaborations with semiconductor manufacturers, automotive OEMs, and industrial equipment suppliers can expand deployment in specialized, high-value applications.

Adoption of gate driver ICs is restrained by cost, reliability concerns, and limited standardization. High-performance ICs for wide-bandgap devices or high-voltage applications are expensive, affecting adoption in cost-sensitive markets. Thermal stress, voltage spikes, and harsh operating conditions can impact long-term reliability, requiring robust design and testing. Differences in industry standards for protection, interface compatibility, and packaging complicate integration across applications. Small or emerging manufacturers may face barriers in implementing advanced gate drivers due to design and testing requirements. Until costs decrease and standardization improves, adoption may remain concentrated in high-value, performance-critical applications like EVs, industrial automation, and renewable energy.

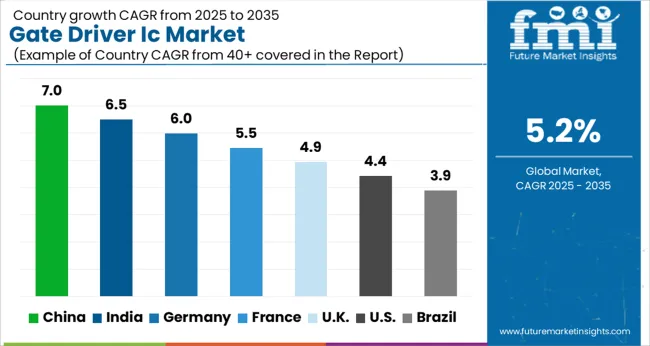

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global gate driver IC market is projected to grow at a CAGR of 5.2% through 2035, supported by increasing demand across power electronics, automotive, and industrial applications. Among BRICS nations, China has been recorded with 7.0% growth, driven by large-scale production and deployment in power management and automotive systems, while India has been observed at 6.5%, supported by rising utilization in industrial and automotive electronics. In the OECD region, Germany has been measured at 6.0%, where production and adoption for power electronic and industrial applications have been steadily maintained. The United Kingdom has been noted at 4.9%, reflecting consistent use in automotive and industrial electronics, while the USA has been recorded at 4.4%, with production and utilization across power electronics, industrial, and automotive sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The gate driver IC market in China is growing at a CAGR of 5.2%, driven by rising adoption in power electronics, electric vehicles, renewable energy systems, and industrial automation. Demand is increasing for energy efficient and high performance ICs in electric motor drives, inverters, and power management circuits. Domestic manufacturers are investing in R&D to enhance switching speed, voltage handling, and thermal management of gate driver ICs. Government initiatives supporting electric mobility, renewable energy adoption, and smart manufacturing are accelerating market expansion. Collaborations between universities, research institutes, and semiconductor companies are enhancing product development and scaling production. Pilot projects in industrial motor control, photovoltaic inverters, and electric vehicle applications are validating performance benefits and reliability. Increasing focus on energy efficiency and cost optimization is further driving adoption in China’s rapidly growing power electronics ecosystem.

Gate driver IC market in India is expanding at a CAGR of 5.2%, fueled by growth in electric vehicles, industrial automation, and renewable energy sectors. Manufacturers are focusing on producing reliable and cost effective ICs for inverters, motor drives, and power management systems. Government programs promoting EV adoption, solar power, and energy efficient industrial equipment are stimulating demand. Collaborative R&D between universities, startups, and semiconductor firms is enhancing device performance, thermal management, and switching speed. Pilot projects in solar inverters, electric vehicle drives, and industrial automation are demonstrating practical applications. Awareness campaigns and technical workshops are educating engineers and designers about benefits of high performance gate driver ICs. Rising adoption of EVs, photovoltaic systems, and energy efficient industrial equipment is expected to maintain steady market growth in India.

Gate driver IC market in India is recording a CAGR of 6.0%, supported by advanced industrial automation, electric mobility, and renewable energy adoption. Gate driver ICs are widely used in electric vehicle inverters, industrial motor drives, and photovoltaic systems to improve efficiency, switching speed, and reliability. R&D collaborations between semiconductor manufacturers and universities are focusing on performance optimization, thermal stability, and cost effective design. Pilot projects in EVs, solar inverters, and industrial machines are demonstrating practical performance advantages. Government initiatives promoting energy efficiency, low carbon mobility, and smart manufacturing are stimulating demand. Germany’s strong automotive and industrial electronics sectors remain key drivers of gate driver IC adoption. Technical workshops and seminars are further facilitating knowledge transfer and market awareness.

The United Kingdom is experiencing a CAGR of 4.9% in the gate driver IC market, driven by rising deployment in electric vehicles, renewable energy systems, and industrial electronics. Gate driver ICs are increasingly used in motor drives, inverters, and power management solutions to improve energy efficiency and switching reliability. Manufacturers and research institutes are investing in device optimization, thermal management, and integration capabilities. Government programs promoting EV adoption, smart grids, and industrial automation are enhancing market development. Pilot projects and demonstration studies in automotive drives and renewable energy systems validate IC performance benefits. Technical workshops, industry conferences, and collaborative R&D initiatives are helping accelerate adoption. As demand for energy efficient solutions grows, gate driver ICs continue to be an essential component in power electronics systems across the UK.

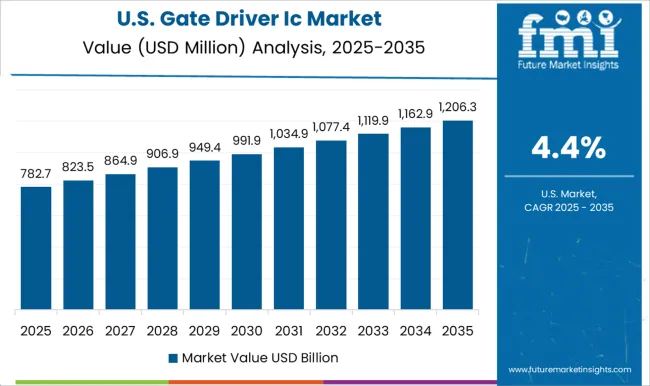

The United States gate driver IC market is growing at a CAGR of 4.4%, driven by adoption in electric vehicles, renewable energy, industrial automation, and consumer electronics. Gate driver ICs are used for efficient switching in motor drives, inverters, and power management applications. Semiconductor manufacturers are focusing on improving voltage handling, switching speed, and thermal reliability. Research collaborations with universities and industrial partners are optimizing IC design for cost efficiency and high performance. Pilot projects in EVs, solar inverters, and industrial machines demonstrate benefits of advanced gate driver ICs. Government incentives for EVs, renewable energy, and energy efficient industrial solutions are encouraging adoption. Increasing demand for reliable, high performance ICs in power electronics continues to support steady market growth across multiple sectors.

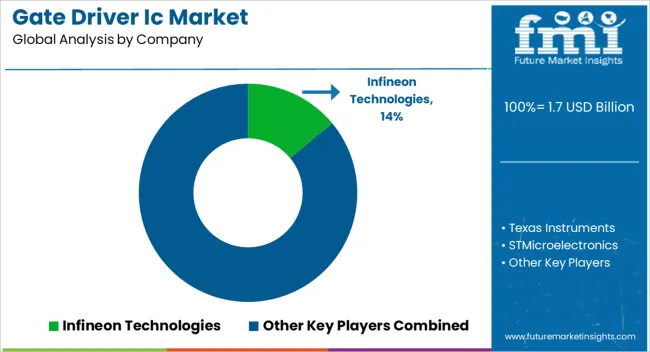

The gate driver IC market is highly competitive, driven by global semiconductor leaders and specialized OEMs. Infineon Technologies leverages its expertise in power electronics to deliver high-performance gate drivers for automotive, industrial, and renewable energy applications. Texas Instruments focuses on integrating precision, efficiency, and reliability into its IC portfolio, targeting industrial automation, consumer electronics, and motor control. STMicroelectronics combines gate driver technology with broader semiconductor solutions, emphasizing energy efficiency and robust performance. Renesas Electronics provides specialized ICs for automotive and industrial segments, prioritizing integration and compact designs. ON Semiconductor targets high-efficiency and cost-effective solutions for a wide range of applications, while NXP Semiconductors emphasizes automotive and industrial connectivity with reliable gate driver products.

Rohm Semiconductor focuses on power management and automotive-grade solutions, and Analog Devices along with other specialized OEMs offers tailored solutions for niche applications, including high-voltage and advanced industrial systems. Competition revolves around innovation, reliability, and scalability. Companies invest heavily in R&D to enhance switching performance, thermal management, and integration capabilities. Product brochures and technical documentation serve as key tools, presenting specifications, application use cases, and comparative advantages in concise, visually appealing formats. Global leaders emphasize scale, reliability, and seamless integration into power systems, whereas smaller or specialized players highlight flexibility, customization, and rapid responsiveness to emerging technological requirements. Marketing materials are designed to communicate technical benefits efficiently. Performance metrics, compatibility, and application scenarios are highlighted to influence decision-makers quickly.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Transistor Type | MOSFET, IGBT, and Others |

| Mode of Attachment | Discrete and On-chip |

| Isolation Type | Isolated gate drivers and Non-Isolated gate drivers |

| End Use Industry | Automotive, Consumer electronics, Energy & power, Telecommunications, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies, Texas Instruments, STMicroelectronics, Renesas Electronics, ON Semiconductor, NXP Semiconductors, Rohm Semiconductor, and Analog Devices / Other specialized OEMs |

| Additional Attributes |

The global gate driver IC market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the gate driver IC market is projected to reach USD 2.8 billion by 2035.

The gate driver IC market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in gate driver IC market are mosfet, igbt and others.

In terms of mode of attachment, discrete segment to command 60.0% share in the gate driver IC market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gate Impellers Market Size and Share Forecast Outlook 2025 to 2035

Gate-All-Around (GAA) Transistor Market Size and Share Forecast Outlook 2025 to 2035

Gate Valve Market Growth – Trends & Forecast 2023-2033

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Dog Gates, Doors and Pens Companies

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Automotive Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Board Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Fanfold Market Analysis - Size, Share, and Forecast 2025 to 2035

Aggregate Mining And Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Corrugated and Folding Carton Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Wrap Market Growth - Demand & Forecast 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Corrugated Bubble Wrap Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Printer Slotter Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Pallet Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA