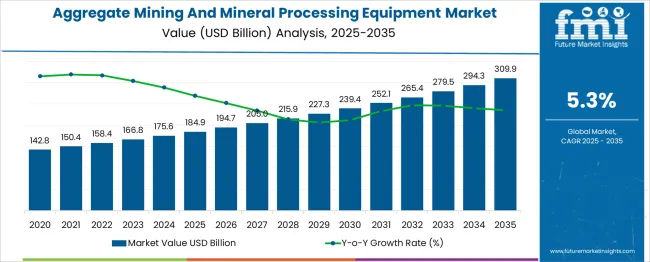

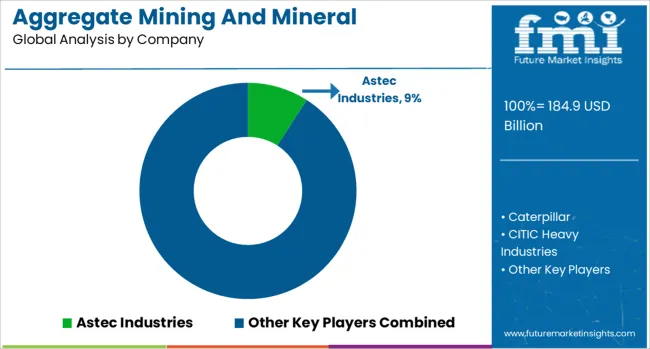

The Aggregate Mining And Mineral Processing Equipment Market is estimated to be valued at USD 184.9 billion in 2025 and is projected to reach USD 309.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Aggregate Mining And Mineral Processing Equipment Market Estimated Value in (2025 E) | USD 184.9 billion |

| Aggregate Mining And Mineral Processing Equipment Market Forecast Value in (2035 F) | USD 309.9 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The aggregate mining and mineral processing equipment market is advancing steadily, supported by the consistent demand for construction materials, infrastructure expansion, and the revival of mining activities across developing and developed economies. Equipment modernization and automation trends have reshaped operational priorities, emphasizing efficiency, safety, and cost reduction.

Governments and private operators continue to invest in mineral extraction and aggregate production, with surface mining operations playing a dominant role. The integration of digital monitoring systems, predictive maintenance tools, and energy-efficient technologies is transforming equipment utilization patterns.

Future market momentum is expected to build upon infrastructure megaprojects, resource security initiatives, and a renewed focus on local material sourcing to reduce logistics dependency. With demand being further bolstered by urban development, industrial expansion, and global mineral consumption, the market is well-positioned for sustainable long-term growth.

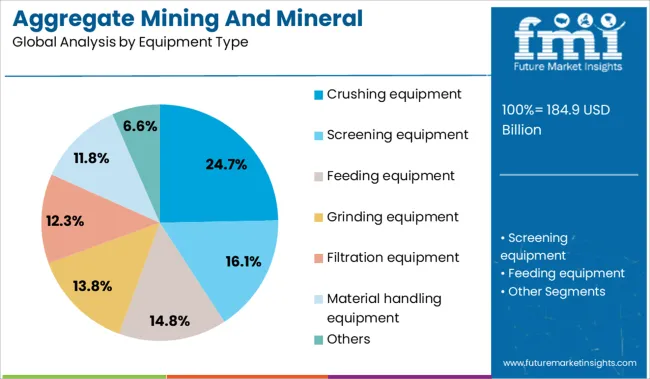

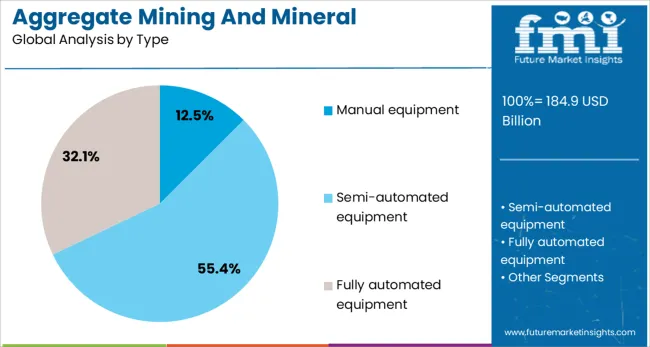

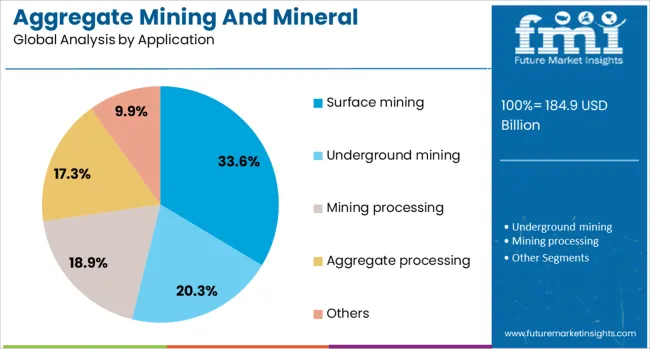

The aggregate mining and mineral processing equipment market is segmented by equipment type, application, end use, distribution channel, and geographic regions. The aggregate mining and mineral processing equipment market is divided by equipment type into Crushing equipment, Screening equipment, Feeding equipment, Grinding equipment, Filtration equipment, Material handling equipment, and Others. In terms of the type of aggregate mining and mineral processing equipment, the market is classified into Manual equipment, Semi-automated equipment, and fully automated equipment. Based on the application of the aggregate mining and mineral processing equipment market, it is segmented into Surface mining, Underground mining, Mining processing, Aggregate processing, and Others. The aggregate mining and mineral processing equipment market is segmented by end use into Construction, Mining, Aggregate, Recycling, and Others. The distribution channel of the aggregate mining and mineral processing equipment market is segmented into Direct and Indirect. Regionally, the aggregate mining and mineral processing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Crushing equipment leads the equipment type category with a 24.7% share, highlighting its essential role in breaking down large rock and ore materials into manageable sizes for further processing. The segment's growth is driven by its broad application across quarrying, mining, and recycling operations, where robust, high-capacity machines are required to support continuous workflows.

Advancements in crusher design, such as automation, wear-resistance, and energy-efficient models, have improved output quality and operational reliability, reducing downtime and maintenance costs. The rising demand for construction aggregates and the ongoing development of roads, bridges, and buildings globally are key factors supporting the sustained deployment of crushing systems.

As producers prioritize environmental compliance and cost-efficiency, modern crushing solutions equipped with emission control and dust suppression systems are expected to accelerate market penetration further.

The manual equipment segment holds a 12.5% share within the type category, representing a niche yet necessary component of smaller-scale operations and site-specific applications. While largely overshadowed by automated machinery, manual equipment continues to play a role in regions with limited access to capital-intensive systems or where labor is more cost-effective.

The segment finds usage in small-scale aggregate mining operations and remote locations where lightweight and portable equipment is essential. Applications in repair, maintenance, and preparatory tasks also support its relevance.

Despite the market’s general shift towards automation, the enduring need for flexible and low-cost tools ensures a stable, albeit modest, demand for manual solutions. The segment is expected to maintain a consistent market presence, particularly in emerging economies and artisanal mining areas where infrastructure and investment constraints limit the adoption of advanced equipment.

The surface mining application segment dominates with a 33.6% market share, reflecting the widespread use of extraction techniques such as open-pit, strip, and quarry mining for aggregates and minerals. Surface mining remains the most cost-effective and operationally feasible method for extracting large volumes of materials near the earth’s surface.

The segment’s leadership is driven by global construction demand and increased resource recovery from shallow deposits. Equipment used in surface mining—such as conveyors, crushers, and screening machines—is subject to continuous technological enhancement aimed at boosting productivity and reducing energy consumption.

Additionally, stricter regulatory and environmental frameworks have prompted innovation in dust control, noise reduction, and fuel efficiency. With the expansion of infrastructure projects and the demand for raw materials in cement, road construction, and building industries, surface mining is set to remain the primary growth engine for equipment demand in this market.

Demand for aggregate and mineral processing equipment is expanding due to infrastructure construction, material logistics, and operational modernization. Crusher and screening unit sales rose 14% in 2024, with modular systems being deployed in 27% of new quarry setups. Digital monitoring and wear analytics have reduced downtime by 12%. Asia Pacific and Latin America lead in mobile and semi-mobile plant adoption. With higher throughput, reduced setup time, and integrated maintenance support, OEMs are offering bundled packages to streamline site transitions and increase yield reliability in remote or time-sensitive applications.

Operators are shifting toward modular, high-throughput systems to reduce setup delays and align capital allocation with output schedules. Mobile crushers and screens now make up 32% of new projects in undeveloped zones due to faster deployment and disassembly cycles. Improved belt materials with abrasion-resistant steel coatings extend runtime by 22%. Sensors tracking real-time particle shape and distribution have helped plants cut fines generation by 9 % through automatic feed calibration. Wash systems with built-in water recyclers have trimmed fresh intake by 18%. Standard packages now feature touchscreen HMIs, energy counters, and transportable control modules to support configurations exceeding 300 tonnes per hour.

Upfront investment remains a friction point, mostly in mid-scale mining operations that lack full integration capacity. Smart-enabled crushers and automated screens cost 15–20% more than static installations due to layered controls, sensors, and packaging. Extended lead times for wear parts and inverter spares reduce asset availability in high-load regions. Without trained maintenance teams, field resets take 14% longer when dealing with advanced diagnostics or SCADA-linked systems. Older facilities using manual logic systems require 4–6 weeks to retrofit for real-time data capture. Limited training infrastructure and fragmented service networks slow the broader transition toward automation-ready processing chains.

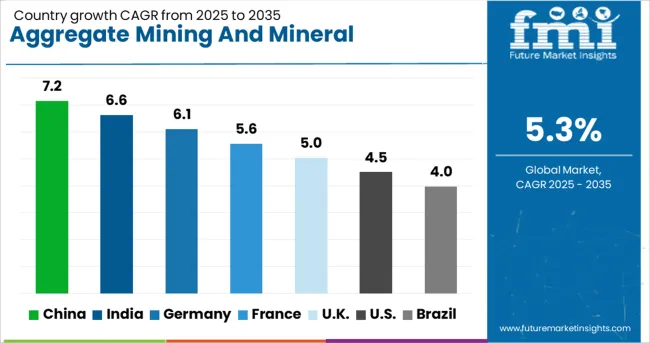

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global aggregate mining and mineral processing equipment market is projected to expand at a 5.3% CAGR from 2025 to 2035. China leads with 7.2%, outperforming the global benchmark by +36%, driven by infrastructure-focused mining and regional equipment deployment. India records 6.6% (+25%) with domestic mineral production encouraging equipment modernization. Germany posts 6.1% (+15%) with advanced equipment demand in limestone and aggregate operations. France aligns just above the average at 5.6% (+5%), while the United States trails at 4.5%, showing a –15% deviation, influenced by replacement-cycle delays and stricter regulatory controls. These contrasts reflect national investment flows, quarry automation rates, and export strength in specialized mining equipment. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China’s aggregate mining and mineral processing equipment market is projected to expand at a CAGR of 7.2%, exceeding the global average by 36%. Growth in inland and coastal quarry operations has increased demand for 450+ tph mobile crushers and integrated screening systems. Equipment suppliers report consistent orders from state-backed rail and port infrastructure sites for high-pressure hydrocyclones and centrifugal classifiers. Mineral extraction zoning plans in Anhui and Guangxi have triggered procurement of multi-stage crushers and slurry-handling systems tailored to regional geology.

India’s aggregate mining and mineral processing equipment market is expected to grow at a CAGR of 6.6%. Medium-scale operators in Rajasthan, Chhattisgarh, and Odisha are installing 200–400 tph cone crushers for limestone and basalt applications. Modular systems with secondary screening and automated conveyors are reducing maintenance downtime. Demand for M-sand units with fines recovery is increasing in Tier 2 infrastructure corridors. EPC contractors are moving from static setups to mobile-integrated process assemblies for flexibility in transport and deployment.

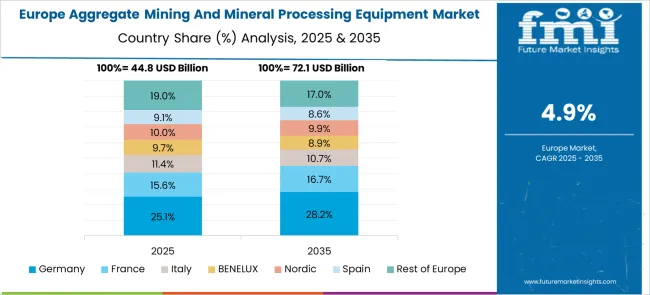

Germany’s aggregate processing equipment market is forecast to grow at a CAGR of 6.1%. Quarry operations in North Rhine-Westphalia and Bavaria are adopting hybrid crushers with real-time yield analytics. Recycled aggregate processors are implementing closed-loop process controls to optimize output. Tier 1 producers linked to cement firms are investing in crushers with wear monitoring sensors. Dust and noise suppression technologies are now part of procurement specifications, especially for quarrying operations near residential areas.

France’s aggregate mining equipment market is growing at a CAGR of 5.6%, driven by processing of demolition debris and tunnel excavation spoil. Urban contractors are deploying mobile jaw crushers and tracked stackers under short-term operating leases. Clay-heavy regions like Nouvelle-Aquitaine have spurred demand for sludge thickeners and water recovery tanks. In Rhône-Alpes and Provence, larger quarries are equipping production lines with automated sizing controls and vibrating feeders with load-responsive sensors.

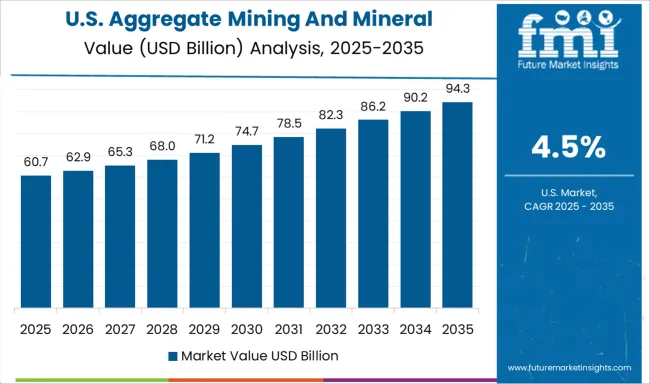

The United States market is projected to grow at a CAGR of 4.5%. Quarry operators in the Midwest and Southwest are upgrading to bulk feeders and jaw crushers rated above 600 tph. Limestone plants in Missouri and Kentucky are replacing legacy crushing lines from the 1970s with dual-shaft rotary systems. Wet processing units for frac sand and lightweight aggregate are boosting orders for custom log washers designed for site-specific discharge and screening needs.

The aggregate mining and mineral processing equipment market is highly competitive, with dominant players like Astec Industries, Caterpillar, and Metso Outotec leading with rugged crushing, screening, and material handling solutions for quarrying and mining operations. Key heavy machinery providers such as Komatsu, Sandvik, and Terex Corporation specialize in high-capacity crushers, mobile plants, and advanced automation systems. Emerging innovators, including FLSmidth, Weir Group, and ThyssenKrupp, are driving sustainability with energy-efficient grinding mills and water-recycling technologies. Regional players like CITIC Heavy Industries and Northern Heavy Industries expand market reach with cost-effective alternatives.

In July 2024, Komatsu acquires GHH Group to expand its underground mining product portfolio. Komatsu finalized the acquisition of Germany’s GHH Group GmbH, incorporating its advanced underground loaders and articulated dump trucks, strengthening its global underground mining equipment offerings and broadening aftermarket service reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 184.9 Billion |

| Equipment Type | Crushing equipment, Screening equipment, Feeding equipment, Grinding equipment, Filtration equipment, Material handling equipment, and Others |

| Type | Manual equipment, Semi-automated equipment, and Fully automated equipment |

| Application | Surface mining, Underground mining, Mining processing, Aggregate processing, and Others |

| End use | Construction, Mining, Aggregate, Recycling, and Others |

| Distribution channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astec Industries, Caterpillar, CITIC Heavy Industries, FLSmidth, KHD Humboldt Wedag, Kleemann, Komatsu, McLanahan, Metso Outotec, Northern Heavy Industries, Sandvik, Terex Corporation, ThyssenKrupp, Weir Group, and Wirtgen Group |

| Additional Attributes | Dollar sales by equipment type and mineral output, growing demand in infrastructure-grade aggregate and industrial mineral processing, stable utilization across cement plants and quarrying operations, advancements in modular crushing systems and automated screening technologies improve throughput and operational efficiency |

The global aggregate mining and mineral processing equipment market is estimated to be valued at USD 184.9 billion in 2025.

The market size for the aggregate mining and mineral processing equipment market is projected to reach USD 309.9 billion by 2035.

The aggregate mining and mineral processing equipment market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in aggregate mining and mineral processing equipment market are crushing equipment, screening equipment, feeding equipment, grinding equipment, filtration equipment, material handling equipment and others.

In terms of type, manual equipment segment to command 12.5% share in the aggregate mining and mineral processing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road Aggregates Market Growth - Trends & Forecast 2025 to 2035

Construction Aggregates Market Trends - Growth, Demand & Forecast 2025 to 2035

Composable Disaggregated Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Recycled Concrete Aggregates Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA