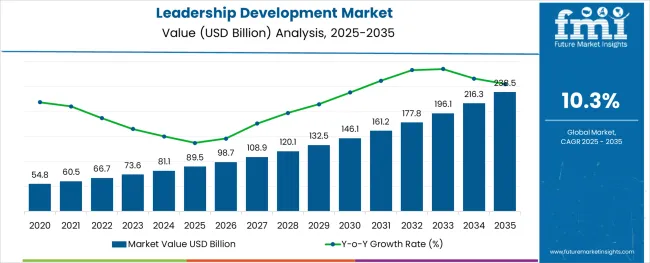

The leadership development program market is expected to grow to USD 238.5 billion by 2035 from USD 89.5 billion in 2025, progressing at a CAGR of 10.3%. Increased investment in leadership upskilling, cross-functional team capability, and executive alignment programs have shaped industry momentum.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 89.5 billion |

| Projected Market Value (2035F) | USD 238.5 billion |

| Value-based CAGR (2025 to 2035) | 10.3% |

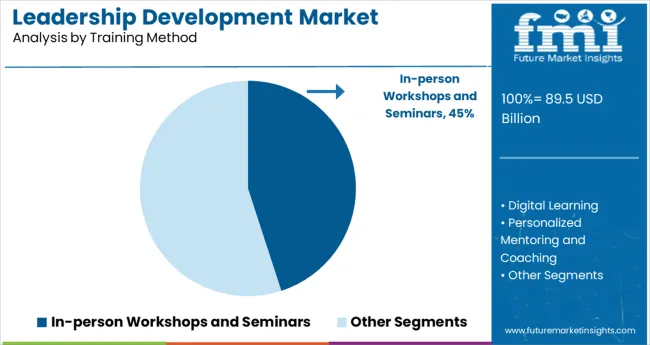

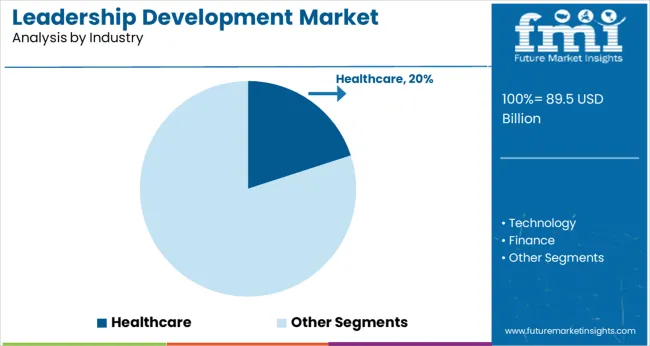

Organizations are re-structuring learning models to strengthen leadership pipelines and reduce succession gaps.Workshops and seminars are projected to account for 45% of training methods by 2025. Healthcare dominates by industry segment, holding 20% share, driven by demand for clinical decision-making, operational leadership, and administrative capability building.

The leadership development program market is a vital subset of the broader corporate training market. It accounts for approximately 6.2% of the USD 400+ billion CorporateTraining Market, 4.8% of the Professional Development Market, and 1.6%-2% of the Talent Management Solutions and HCM segments. In the Workforce Development Market, leadership programs represent 20–25% of training investments. Executive education providers dominate with a 55% shareheld by top institutions like Harvard and INSEAD. Leadership development program also commands significant presence in L&D delivery models, spanning face-to-face (55%), online (35%), andblended (30%) formats, reflecting its high impact on organizational growth.

In 2025, workshops and seminars dominate training methods with a 45% share due to their real-time feedback advantages. Healthcare leads industry-specific investment, capturing 20% of the market, driven by rising demand for leadership in clinical and administrative settings.

Workshops and seminars are projected to hold approximately of the training method market by 2025, posting a 3.8% YoY growth. Their sustained popularity is rooted in live interaction, peer feedback, and structured group learning environments. These formats remain the gold standard for mid- to senior-level leadership development program programs where emotional intelligence, collaboration, and scenario-based training are vital. However, digital platforms offering self-paced modules, webinars, and AI-based simulations are growing faster online courses saw a 7.5% YoY growth. As digital training expands access, workshops retain a lead in depth and effectiveness, particularly in sectors with high compliance and people-management needs.

Healthcare holds the largest share among industry segments in the leadership development program market, reaching 20% in 2025 and expanding at a 6.1% YoY rate. This dominance is tied to rising leadership gaps in clinical administration, patient engagement, and regulatory compliance. Hospitals and health networks increasingly invest in leadership pipelines to retain staff, improve outcomes, and navigate ongoing reforms. By contrast, sectors like technology and financial services-while growing-report slower YoY increases of 4.5% and 5.0%, respectively. The unique pressures of healthcare delivery make it a top priority for robust, structured leadership training programs over shorter, informal formats.

The global leadership development program market is expanding with a current value around USD 89.5 billion, driven by demand for virtual coaching, customized learning paths, and performance-driven leadership programs. Growth is expected at 10.3% annually.

Virtual Coaching and Personalized Learning Driving Program Adoption

Organizations increasingly invest in one-on-one virtual coaching and AI-enabled learning platforms to support mid- and senior-level managers. These solutions reduce travel costs and allow real-time feedback, boosting learner engagement by over 30%. Custom-built modules tailored to sector- or company-specific challenges are improving retention rates and strengthening skill application. As a result, blended solutions combining live virtual sessions, on-demand content, and peer interaction are gaining favor. Companies report a 20% increase in leadership bench strength following deployment of these integrated programs.

Outcome-Based Metrics and Executive Sponsorship Increasing ROI Focus

Buyers are demanding clear performance metrics tied to leadership interventions, such as promotion rates, team productivity, and retention, to justify spend. Leading providers now link pre- and post-assessments demonstrating 15–20% improvement in leadership effectiveness scores. Executive sponsorship models including C-suite-led endorsement and milestone reviews are becoming standard to ensure program relevance and accountability. Organizations enabling direct alignment between development activities and strategic goals report a 12% boost in employee performance and a 10% reduction in leadership turnover.

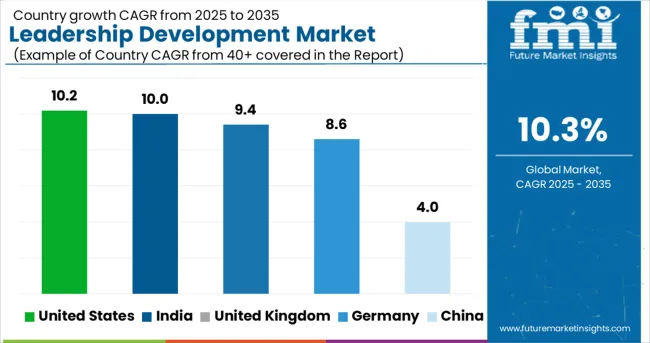

| Country | CAGR |

|---|---|

| United States | 10.2% |

| United Kingdom | 9.4% |

| Germany | 8.6% |

| India | 10% |

| China | 4% |

The global leadership development program market is set to grow at a CAGR of 10.3% from 2025 to 2035, driven by demand for future-ready workforce capabilities, digital transformation, and succession planning across industries. The United States, closely aligning with the global average at 10.2%, leads in programmatic investments, executive coaching, and digital learning ecosystems.

India follows with a 10% CAGR, reflecting rising corporate training budgets, startup-led HR tech platforms, and leadership pipeline gaps in fast-scaling enterprises. Among OECD nations, the United Kingdom (9.4%) and Germany (8.6%) show steady institutional adoption, supported by hybrid training models and EU-wide skill development initiatives.

In contrast, China’s 4% CAGR signals a more traditional leadership culture with slower digital L&D integration.This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a CAGR of 10.2%, the United States is leading global leadership development program expansion through tech-enabled programs, hybrid delivery, and skills-based transformation. Year-over-year adoption of AI-driven coaching platforms rose 38%, while enterprise microlearning modules surged 41% among Fortune 500 firms. Executive coaching is shifting from boardrooms to digital, with virtual assessments increasing by 34% YoY. Sector-wide investment in DEI-focused leadership initiatives jumped 29% in the past year, particularly in healthcare and tech. Organizations are also integrating leadership pipelines into succession planning, accelerating demand across mid-level and emerging manager segments.

United Kingdom leadership development program sector is expanding at a 9.4% CAGR, fueled by the pivot to hybrid learning models and board-level inclusion mandates. Virtual leadership workshops saw a 3.1× YoY rise in financial services and consulting. Soft-skills simulations increased 35% YoY, driven by demand for communication and empathy in post-pandemic management. Certifications in agile leadership and ESG stewardship jumped 44%, especially among mid-career professionals. More than 61% of HR departments now link leadership development program ROI directly to retention KPIs, reinforcing budgets for cohort-based learning.

Germany is tracking a CAGR of 8.6%, supported by demand for role-specific, high-compliance leadership programs aligned to industrial transformation. In 2024, cross-functional leadership bootcamps rose 28% YoY, with technical leadership certifications expanding 31% in engineering and pharma sectors. In-person learning still commands preference, but hybrid formats grew 22% YoY in mid-sized firms. German enterprises are also investing in cross-border leadership exchange initiatives, now present in 40% of DAX-listed organizations. Talent development is increasingly linked to digital transformation efforts, especially among export-intensive industries.

China’s leadership development program market is pacing at a more modest 4.0% CAGR, shaped by cautious corporate spending and state-driven competency frameworks. Domestic firms prioritized internal training modules, with external coaching down 18% YoY. Uptake of gamified learning tools increased 23% YoY, primarily in tech and e-commerce companies.

Local leadership pipelines are being built through partnerships with vocational institutes, though cross-border leadership development program saw a 36% YoY decline. Demand remains strongest in SOEs and family-run enterprises, where leadership grooming is often embedded into internal promotion tracks.

India is advancing at a CAGR of 10.0%, led by digital delivery models, emerging leadership cohorts, and demand from IT and BFSI sectors. Self-paced leadership modules surged 53% YoY, with strong uptake across Tier 1 and Tier 2 corporate clusters. In 2024, internal mentorship frameworks expanded 47% YoY, reinforcing organizational continuity among fast-growing unicorns.

Diversity-focused leadership pathways rose 2.4× YoY, especially among women in mid-level management. Companies are also tying leadership growth to innovation KPIs, aligning talent development with product and strategy cycles.

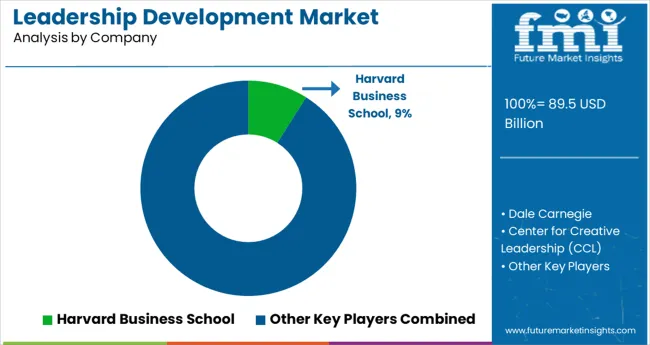

Leading Company - Harvard Business School fMarket Share - 9%

The leadership development program market is competitive and segmented into Tier 1, Tier 2, and Tier 3 providers, differentiated by academic prestige, delivery models, and global reach. Tier 1 institutions such as Harvard Business School, IMD, and Kellogg Executive Education dominate with evidence-based programs, global cohorts, and strong corporate partnerships.

Their influence stems from research-backed curricula and leadership pipelines for Fortune 500 firms. Tier 2 players like Center for Creative Leadership (CCL), Korn Ferry, and FranklinCovey focus on scalable executive coaching, competency mapping, and behavioral transformation.

Tier 3 firms including D2L Corporation and Interaction Associates serve niche needs in digital learning, blended training, and mid-level manager development, emphasizing flexibility, ROI, and learner engagement in fast-evolving corporate environments.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 89.5 billion |

| Projected Market Size (2035) | USD 238.5 billion |

| CAGR (2025 to 2035) | 10.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in adoption rate |

| Training Methods Analyzed | In-person Workshops & Seminars, Online/Digital Learning, Mentoring & Coaching, Experiential/Action-Based Learning |

| Industries Analyzed | Healthcare, Technology, Finance, Manufacturing, Retail |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa |

| Key Players Influencing the Market | Harvard Business School, Dale Carnegie, Center for Creative Leadership (CCL), Kellogg Executive Education, IMD, FranklinCovey , Korn Ferry, GP Strategies Corporation, D2L Corporation, Interaction Associates |

| Additional Attributes | Dollar by sales, share by training method and industry vertical, regional shifts in learning preferences, digital transformation trends in corporate learning, hybrid training adoption, seasonality of leadership budgeting, and expansion potential in emerging organizational development hubs. |

Leadership development program is categorized by approach, including in-person workshops and seminars, digital learning through online courses, personalized mentoring and coaching, and hands-on experiential or action-based learning.

The market spans multiple sectors such as healthcare, technology, finance, manufacturing, and retail.

Geographically, the market is distributed across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Market is expected to be valued at USD 89.5 billion in 2025.

Market is forecast to reach USD 238.5 billion by 2035.

Market is projected to grow at a CAGR of 10.3% over the forecast period.

Workshops and seminars lead the Market with a 45% share in 2025.

Harvard Business School is the leading company in the Leadership development program Market, holding a 9% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in Leadership Development Programs

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Singapore Leadership Development Program Market Trends- Growth to 2035

Australia Leadership Development Program Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States Leadership Development Program Market Size and Share Forecast Outlook 2025 to 2035

Leadership Training – AI-Powered Growth for Enterprises

Developmental and Epileptic Encephalopathies (DEE) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Cell Line Development Market Analysis – Growth & Industry Outlook 2025 to 2035

Cell Line Development Services Market Growth – Trends & Forecast 2025 to 2035

Application Development and Modernization (ADM) Market Size and Share Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Development Tools Market

Research And Development (R&D) Analytics Market Size and Share Forecast Outlook 2025 to 2035

Viral Vector Development Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA