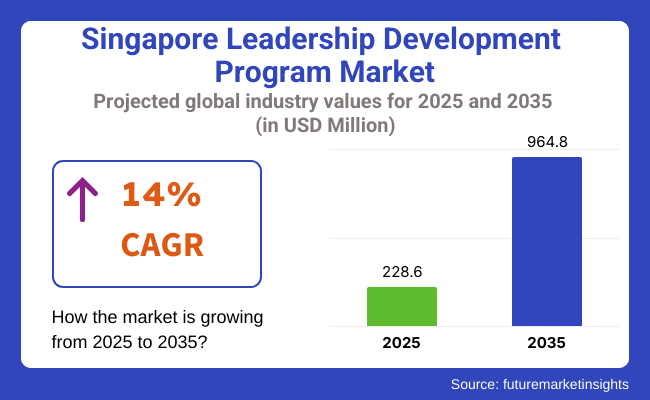

The Singapore leadership development program market is poised to witness spectacular growth over the next decade, fueled by the strategic imperative of cultivating world-class leadership skills within and between industries in the country. With a valuation of around USD 228.6 million in 2025, the industry will reach USD 964.8 million in 2035, growing at a strong compound CAGR of 14% over the forecast period.

As Singapore emerges as a global business hub, multinational firms as well as local companies are increasingly investing in leadership development programs to build agile, innovative, and future-ready teams. This is also fueled by increasing digitalization, reorganization of organizational forms, and flexible leadership requirements in the increasingly complex global context.

Government-initiated programs and partnerships with leading academic institutions have played a key role in shaping Singapore's landscape of leadership development. Courses are more personalized, tech-oriented, and content-heavy, focusing on the development of soft skills like emotional intelligence, strategic thinking, and cross-cultural communication.

Aside from global scalability, growing interest in hybrid work and virtual cross-border teams has elevated the demand for virtual and global workforce leaders. Leadership development schemes are being reengineered with studies on managing virtual teams, digital collaboration, and innovation leadership to render them compatible with the changing business requirements.

The rising involvement of SMEs, increasing access through web-based media, and rising perceptions of the need for leadership development among middle-management personnel are also driving the industry upwards. The problems of high training cost and measurable ROI requirements remain, though, where efforts can be improved.

In general, the industry will flourish in the backdrop of the country's aspiration for human capital supremacy and its visionary leadership strategy for preparedness in a developing world economy

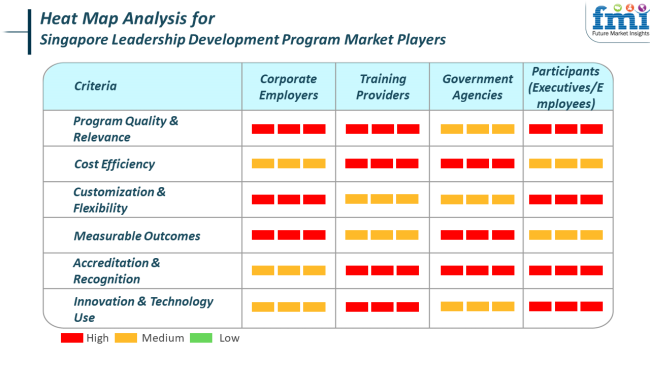

The industry is influenced by unique priorities for various stakeholders, including corporate employers, training organizations, government departments, and learners. Corporate employers' focus includes quality programs, individualization, and tangible outcomes for ensuring the linkage between leadership training and organizational objectives as well as talent initiatives.

Providers value cost-effectiveness and accreditation highly, striking a balance between quality provision and value for money. Outcomes and recognition are the concerns of government institutions in furthering national workforce development policy and competitiveness. For employees and executives-trainees-the most urgent needs are relevance, flexibility, and innovation, and these are seen as an expression of career-focused, participative, and forward-looking learning.

The sector is supported by Singapore's intense focus on ongoing professional development and digitalization. With the roles of leadership increasingly complex, demand for customized, technology-enabled programs remains on the rise. The dynamic environment calls for providers to innovate while remaining aligned with industry requirements and regulatory compliance, pushing sustained investment in leadership competencies across industries.

These leadership development programs have had a dramatic impact on the Singapore industry from 2020 to 2024, as organizations have increasingly focused on developing savvy leaders to traverse difficult business terrains. Between the years 2020 to 2024, companies really focused their energies on personalized leadership development that would close skill gaps and improve engagement with employees.

Now, it is very convenient for more professionals to study anywhere and at any time due to the availability of digital learning platforms and web-based training courses. The areas of the government's efforts, such as the SkillsFuture initiative, were indeed a vital stride into the urgent need for continuous learning and upgrading, thereby liberating the possibility of expanding this industry.

It will proceed into 2025 to 2035, whereby the industry continues to evolve under pressure demanding leadership development programs specializing in such areas as emotional intelligence, digital transformation, and sustainability. One will also get to see artificial intelligence (AI) and analytics in training to give them more adaptive and personalized learning.

Second, there will be a greater focus on global leadership through programs that will prepare leaders to thrive in an increasingly integrated and rapidly changing world. The increasing demand for diversity, equity, and inclusion in leadership development would further grow the industry as organizations want to develop leaders who are inclusive and globally aware.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government efforts ( SkillsFuture ), business necessity, digital training support | Combining AI, personalization of learning, focus on global leadership, sustainability |

| Leadership capabilities, employee engagement, online training technologies | Emotional intelligence, digitalization, diversity, equity, and inclusion |

| Blended mode learning, online locations, virtual mentoring | AI-based, interactive learning, tailored career-centric training |

| Digital technology, online platforms for learning | AI, machine learning, VR/AR for immersive learning experiences |

| Early emphasis on leadership skills for digital transformation and innovation | Greater emphasis on sustainability, eco-leadership, and corporate social responsibility |

| Hybrid model (offline & online), flexibility emphasis | Fully tailored, data-driven, real-time learning analytics for adaptive programs |

| High demand from the public and private sectors in Singapore | Regional growth with growing interest from multinational corporations and global leaders |

The industry is rising steadily, driven by the city-state's role as a regional business center and its strong emphasis on continuous professional development. However, several risk factors could affect the growth and sustainability of this industry.

Economic uncertainty is one of the largest threats. When economies are in recession, corporations will reduce training and development expenditure and view leadership programs as an expense of indulgence. This threatens training providers that rely on long-term corporate commitment to human resource expenditure.

A second risk factor is competition and industry saturation. Increasing numbers of local and overseas training facilities, online universities, and internal corporate schools tend to dilute industry share. Leadership programs are then unable to stand out if not sufficiently differentiated or niche-based to maintain levels of enrollment and profitability.

Sudden shifts in leadership skills also threaten to cause harm. With digital transformation moving at ever-increasing speeds, the skills demanded by leaders are changing. Initiatives that do not keep up with the new demands-e.g., managing remote teams, agility, and digital acumen-can quickly find themselves passé, made obsolete, and less attractive to corporate customers.

Furthermore, measurement complexity in ROI may pose a roadblock to growth. Leadership building is qualitative by nature and takes time, making it challenging for organizations to determine direct results. The absence of transparent metrics might discourage continued investment, particularly within tight-budget sectors.

Finally, cultural opposition to training within a company will dissuade people from participating. There is resistance to the worth or application of formal leadership training in some companies, particularly hierarchical or traditional ones.

In order to counteract such threats, providers must put program innovation first, push training closer to business results, tailor content to customers, and build stronger impact measurement systems. It will facilitate further growth of Singapore's competitive leadership development industry.

The industry in 2025 is projected to fundamentally see the Students segment, wherein 27.3% of the entire industry share will be allocated to this segment, followed closely by the Managers segment with a share of 22.5%.

This prominence of the Student segment is due to the increasing attention that educational institutions and government-funded programs give to early grooming of leadership skills, which aims to prepare future workers. An institution such as the National University of Singapore has partnered with many global leadership platforms to develop structured programs in communication, critical thinking, innovation, and entrepreneurship.

In contrast, the Singapore Management University has also promoted similar initiatives with leading graduates. Increasingly, such programs are transitioning to younger audiences through workshops, simulations, and interdisciplinary projects that develop the student's leadership skills from early on. Other Government-led initiatives, such as SkillsFuture, have heightened activities in this segment to attract and subsidize leadership training for tertiary students, which helped in "selling" the programs to many other prospective participants.

On the other hand, the Managers is a business-critical area in which investments are being pressed by companies that seek to develop mid-level leaders to take on strategic positions. Such development was unbounded by sectors such as finance, health, and technology that seemed to have cut across it, especially in leadership development programs for managers. Examples of this kind include DBS Bank and Singtel, which have designed in-house manager training modules in collaboration with INSEAD and IMD.

These programs typically consist of executive coaching, cross-functional project assignments, and digital learning platforms to develop competencies such as team management, decision-making, and strategic thinking. Upskilling for managers similarly aligns with Singapore's broader economic agenda to keep corporations competitive and structures agile.

That said, the two segments still play their roles in influencing leadership pipelines. Besides the Manager being responsible for the "emergent" demand that responds to transformation initiatives for businesses, the rapid growth of the Student segment reflects a clear national strategy for long-term human capital development.

By 2025, Singapore is expected to be driven highly by group/small team learners, who are projected to make up around 63.5% of the total industry share within the industry. On the contrary, individual/private learners will account for only 36.5%.

Group-based learning is a reflection of the culture of corporate training in Singapore, and therefore, it is expected that leadership programs will not be left behind. In this sense, both group and small team learners will use intragroup peer interaction, sharing challenges, and feedback as important elements in the acquisition of relevant practical skills.

Usually, organizations like CapitaLand, Keppel Corporation, or ST Engineering put their mid-level management and high-potential employees in team-based leadership tracks. Challenges in these shaping up are typical for the real world during group settings; thus, accompanying the enhancement of leadership competencies are communication, delegation, and conflict resolution skills.

Such a strategy has been adopted by training providers such as INSEAD and the Human Capital Leadership Institute (HCLI), who's learning now has a modular and cohort-based structure that, in turn, promotes knowledge sharing among participants. Such a learning environment closely mimics corporate environments, hence making the shift from training to reality seamless.

The other 36.5% belong to Individual or Private Learners, who are on the rise as a segment of professionals seeking career advancement independently. Many go on self-paced or hybrid learning offerings from institutions-like those provided by the Singapore Institute of Management (SIM)-or international providers such as Coursera or edX.

These include freelancers, entrepreneurs, and mid-career switchers aiming at leadership credentials without organization timelines or group dependencies. While this share is small, its occupation is growing through increasing online mediums in executive education and government funding schemes toward lifelong learning.

This represents both forms of tracks - structured corporate learning as well as self-led advancement pathways - within which these student types find commonality in their profiles.

The industry is anticipated to grow steadily due to the city-state's strategic emphasis on the creation of a globally competitive workforce. As a regional financial, logistics and high-technology center, Singapore has placed leadership development as one of its long-term national human capital strategies. Support from the government in the form of SkillsFuture programs and company subsidies for training creates high participation in leadership development programs.

Firms across industries like fintech, biotech and professional services increasingly spend money on leadership competency to stay worldwide competitive and innovative. Multinational corporations with regional hubs in Singapore also drive the demand for executive and future leader development programs in accordance with international business best practices. The multiracial talent pool as well as high English language proficiency within the nation also facilitate international program attendance and cross-border collaborations.

Singapore providers are offering tightly customized, modular leadership solutions in agility, digital, and ESG-influenced decision-making. Application of AI, behavioral analytics, and mixed-learning technologies enhances learner engagement and performance monitoring.

With strong industry-university collaborations and a talent-centric business environment, Singapore will remain a regional leadership development hub in Southeast Asia. The industry is predicted to continue being dynamic and open to future-oriented leadership demand from 2035.

The industry is under the control of elite consultancy firms such as McKinsey & Company, Bain & Company, Boston Consulting Group, Deloitte, and KPMG. These firms provide advanced leadership curricula in alignment with digital transformation, sustainability and cross-border business management, which are all critical pillars of Singapore's globalized economy.

McKinsey & Company stays ahead by offering AI-integrated executive training modules focused on the fast-changing industry challenges in the ASEAN region. Bain & Company endeavors to create unique leadership pipelines, embedding immersive learning with operational diagnostics for C-suite and next-gen leaders.

The Boston Consulting Group has launched leadership labs and workshops for cohort learning, focusing on themes such as innovation as well as stakeholder capitalism. Deloitte is strengthening its positioning through hybrid leadership academies and sector-focused coaching in finance and public service sectors. KPMG has expanded partnerships with local universities to embed digital leadership and risk governance training in resilient and compliant executive teams.

These key players leverage their consulting capabilities as well as digital platforms and global delivery models to maximize impact across industries, positioning Singapore as a regional hub for leadership transformation.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| McKinsey & Company | 18-22% |

| Bain & Company | 14-18% |

| Boston Consulting Group | 12-16% |

| Deloitte | 10-14% |

| KPMG | 8-12% |

| Other Players | 24-30% |

| Company Name | Offerings & Activities |

|---|---|

| McKinsey & Company | Introduced AI-driven leadership diagnostics and training programs for ASEAN executives. |

| Bain & Company | Offers bespoke leadership journeys using simulation-based learning and performance analytics. |

| Boston Consulting Group | Developed innovation-focused leadership labs for senior and mid-level managers. |

| Deloitte | Operates hybrid leadership academies with sector-specific content in finance and healthcare. |

| KPMG | Partnered with universities to co-create digital governance and compliance leadership programs. |

Key Company Insights

McKinsey & Company (18-22%)

Industry leaders with cutting-edge digital learning platforms and AI-based assessment tools specific to Southeast Asia.

Bain & Company (14-18%)

High emphasis on strategic leadership pipelines and experiential learning, popular with tech and consumer industries.

Boston Consulting Group (12-16%)

Famous for its innovation labs and stakeholder leadership programs focusing on social impact and adaptability.

Deloitte (10-14%)

Provides scalable leadership training for high-demanding industries such as finance and healthcare using blended learning models.

KPMG (8-12%)

Establish credibility in risk, compliance, as well as digital governance leadership through institutional partnerships.

By program participants, the industry is segmented into junior / entry-level employees, managers, mid-level employees, senior executives, and students.

By learner type, the industry includes group/small team learners and individual/private learners.

By mode of learning, the industry is divided into classroom, virtual (live online and pre-recorded), and blended learning modes.

By duration, the industry is segmented into 1 to 3 months, 3 to 6 months, 6 months to 1 year, and more than 1 year.

The industry is projected to reach USD 228.6 million in 2025.

By 2035, the industry is expected to grow substantially to USD 964.8 million.

The industry is expected to grow at a CAGR of 14% from 2025 to 2035.

The primary demographic contributing to the industry's growth are students, as more young professionals seek leadership development opportunities to enhance their careers.

Key players in the industry include McKinsey & Company, Bain & Company, Boston Consulting Group, Deloitte, KPMG, PricewaterhouseCoopers (PwC), Accenture, Ernst & Young LLP, Booz Allen Hamilton, and Mercer LLC.

Table 1: Market Value (US$ Million) Forecast, by Program Participants, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast, by Learner Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast, by Mode of Learning, 2018 to 2033

Table 4: Market Value (US$ Million) Forecast, by Duration, 2018 to 2033

Figure 01: Market Value (US$ Million), 2018 to 2022

Figure 02: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 03: Market Absolute $ Opportunity (US$ Million), 2023 to 2033

Figure 04: Market Share and BPS Analysis by Program Participants, 2023 & 2033

Figure 05: Market Attractiveness by Program Participants, 2023 to 2033

Figure 06: Market Share and BPS Analysis by Learner Type, 2023 & 2033

Figure 07: Market Attractiveness by Learner Type, 2023 to 2033

Figure 08: Market Share and BPS Analysis by Mode of Learning, 2023 & 2033

Figure 09: Market Attractiveness by Mode of Learning, 2023 to 2033

Figure 10: Market Share and BPS Analysis by Duration, 2023 & 2033

Figure 11: Market Attractiveness by Duration, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Australia Leadership Development Program Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States Leadership Development Program Market Size and Share Forecast Outlook 2025 to 2035

Singapore Tourism Market Forecast and Outlook 2025 to 2035

Developmental and Epileptic Encephalopathies (DEE) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Programmable Robots Market Size and Share Forecast Outlook 2025 to 2035

Programmable Logic Device (PLD) Market Growth & Demand 2025 to 2035

Programmatic Display Market Analysis by Ad Format, Sales Channel, and Region Through 2035

Programmable Logic Controller Market Growth – Trends & Forecast 2024-2034

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Field Programmable Gate Array (FPGA) Size Market Size and Share Forecast Outlook 2025 to 2035

Field-programmable Gate Array (FPGA) Market

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

CPLD Market – Trends & Growth through 2034

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA