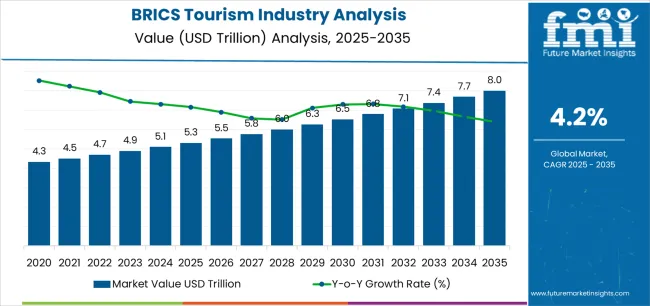

The BRICS Tourism Industry Analysis is estimated to be valued at USD 5.3 trillion in 2025 and is projected to reach USD 8.0 trillion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The BRICS tourism industry is experiencing substantial growth driven by increasing disposable incomes, expanding middle-class populations, and rising interest in travel and leisure experiences across Brazil, Russia, India, China, and South Africa. The future outlook is shaped by the adoption of digital platforms for tourism planning, improved transportation infrastructure, and government initiatives promoting tourism.

The sector is further supported by growing awareness of cultural and heritage destinations, which are increasingly recognized as key attractions in each country. Investment in hospitality services, including hotels, resorts, and experiential tourism offerings, is enhancing the overall travel experience, driving higher tourist inflows.

Additionally, improvements in online booking platforms and mobile applications have simplified travel planning and increased accessibility for both domestic and international tourists As the BRICS nations continue to focus on sustainable tourism and digital transformation in travel services, the market is expected to witness consistent expansion, with opportunities for growth in niche tourism segments and personalized travel experiences.

| Metric | Value |

|---|---|

| BRICS Tourism Industry Analysis Estimated Value in (2025 E) | USD 5.3 trillion |

| BRICS Tourism Industry Analysis Forecast Value in (2035 F) | USD 8.0 trillion |

| Forecast CAGR (2025 to 2035) | 4.2% |

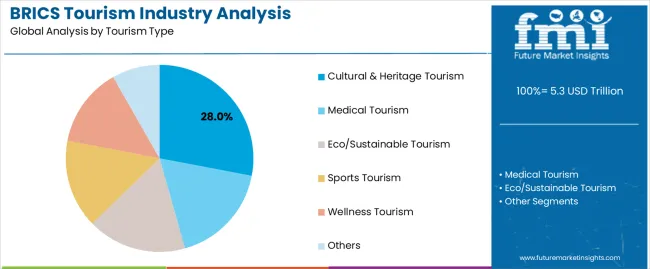

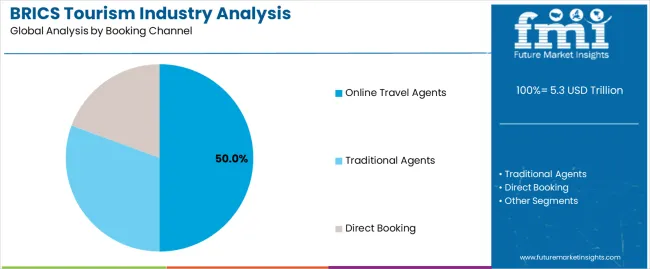

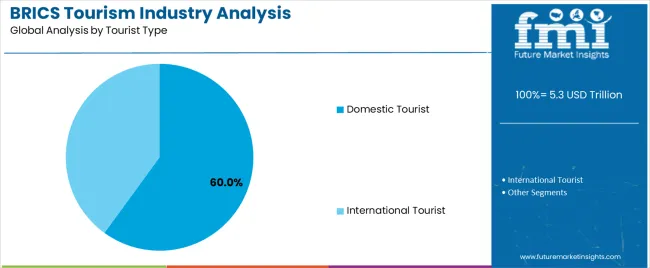

The market is segmented by Tourism Type, Booking Channel, Tourist Type, Tour Type, Consumer Orientation, and Age Group and region. By Tourism Type, the market is divided into Cultural & Heritage Tourism, Medical Tourism, Eco/Sustainable Tourism, Sports Tourism, Wellness Tourism, and Others. In terms of Booking Channel, the market is classified into Online Travel Agents, Traditional Agents, and Direct Booking. Based on Tourist Type, the market is segmented into Domestic Tourist and International Tourist.

By Tour Type, the market is divided into Independent Traveller, Tour Groups, and Package Traveller. By Consumer Orientation, the market is segmented into Men and Women. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, 66-75 Years, and Above 75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cultural and heritage tourism segment is projected to hold 28.0% of the BRICS tourism market revenue share in 2025, making it a leading tourism type. Growth in this segment has been driven by increasing demand for authentic and immersive travel experiences that highlight the rich historical and cultural heritage of BRICS nations.

Investments in preserving historical sites, museums, and cultural festivals have enhanced the appeal of this segment, while supportive policies by local governments have facilitated tourism promotion. The integration of technology in tourism services, such as virtual tours and interactive guides, has further improved accessibility and engagement for travelers.

Rising awareness among tourists about cultural significance and heritage conservation has contributed to higher visitation rates Moreover, the preference for structured travel itineraries that include cultural and heritage experiences has reinforced the prominence of this segment, making it a key contributor to the overall growth of the BRICS tourism industry.

The online travel agents segment is expected to capture 50.0% of the BRICS tourism market revenue share in 2025, positioning it as the leading booking channel. This growth has been influenced by the convenience and efficiency offered by digital platforms, allowing travelers to compare options, book accommodations, and plan itineraries seamlessly.

The increasing penetration of smartphones and internet services across BRICS countries has facilitated wider adoption of online travel services. Additionally, the integration of real-time reviews, personalized recommendations, and secure payment options has enhanced traveler confidence and engagement.

The platform-based model allows for a wide selection of services, including flights, hotels, and experiences, all in one place, which simplifies the travel process for tourists Rising preference for self-managed travel planning and cost-effective deals has further driven the adoption of online travel agents, solidifying this booking channel as a dominant segment in the market.

The domestic tourist segment is anticipated to account for 60.0% of the BRICS tourism market revenue in 2025, establishing it as the leading tourist type. This dominance is driven by the convenience, affordability, and familiarity associated with domestic travel, allowing tourists to explore destinations within their own countries. Government campaigns promoting local tourism, coupled with infrastructure improvements in regional transport and hospitality facilities, have encouraged domestic travel.

Cultural familiarity and language ease also contribute to higher participation in domestic tourism. Additionally, post-pandemic trends have heightened interest in domestic travel due to perceived safety and flexibility.

The increasing availability of customized tour packages, local experiences, and accessible travel services has further reinforced the appeal of this segment As disposable incomes rise and local tourism campaigns expand, domestic tourists are expected to remain the largest contributor to the BRICS tourism industry.

| Historical CAGR (2020 to 2025) | 3.70% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.40% |

From 2020 to 2025, the industry witnessed a sluggish CAGR of 3.70%, reflecting a period of gradual expansion and evolution. This era marked a boom in accessibility and a rise in interest in exploring the diverse landscapes and cultures within the BRICS nations.

The forecasted CAGR from 2025 to 2035 paints a picture of continued growth and adventure in the BRICS Tourism realm. With a projected CAGR of 4.40%, the future promises to be ripe with opportunities for exploration, discovery, and innovation.

From ancient treasures to modern marvels, each destination beckons with tales of past triumphs and beckons toward future adventures, inviting travelers to embark on a journey of a lifetime.

The below section shows the leading segment. Based on the consumer orientation, the men segment is accounted to hold an industrial share of 48.3% in 2025. Based on age group, the 26-35 years segment is accounted to hold an industrial share of 35.4% in 2025.

| Category | Industrial Share in 2025 |

|---|---|

| Men | 48.3% |

| 26-35 years | 35.4% |

Based on consumer orientation, the men's segment stands out, capturing a significant industrial share of 48.3%. The considerable share underscores the surge in the prominence of men as key consumers in the industry.

As societal norms evolve and traditional gender roles blur, men are widely embracing self-care and grooming, including investing in personal care products tailored to their needs.

The boom in specialized men's grooming brands and products tailored to men's preferences and lifestyles further fuels this trend, thus catering to their unique requirements and preferences.

Based on age group, the 26-35 years segment is accounted to hold an industry share of 35.4% in 2025. The age group represents a demographic characterized by young adults in the prime of their professional and personal lives, often prioritizing self-care and grooming routines.

With a focus on maintaining youthful appearances and adopting healthy lifestyles, individuals within this age bracket are keen consumers of personal care products.

The purchasing power, coupled with a desire to invest in quality grooming products, propels significant demand within the industry, making them a critical target audience for brands and retailers alike.

The table describes the top five countries ranked by revenue, with South Africa holding the top position. The dominance of South Africa in the BRICS tourism industry is propelled by its diverse landscapes, vibrant cities, and rich cultural heritage.

Iconic attractions such as safaris in Kruger National Park, Table Mountain in Cape Town, and artistic experiences contribute to its appeal, making it a top destination within the BRICS nations.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

| Brazil | 4.5% |

| Russia | 4.9% |

| China | 5.2% |

| India | 5.8% |

| South Africa | 6.2% |

In Brazil, the BRICS tourism industry thrives on the diverse natural landscapes, vibrant culture, and iconic attractions.

From the breathtaking Amazon rainforest to the bustling streets of Rio de Janeiro, Brazil offers a myriad of experiences for travelers seeking adventure, relaxation, and cultural immersion.

The warm climate, welcoming people, and rich heritage make it a top destination within the industry.

Tourists are drawn to iconic landmarks, including the Kremlin in Moscow, the Hermitage Museum in Saint Petersburg, and the historic cities along the Golden Ring in Russia.

Cultural attractions such as the Bolshoi Theatre and the Trans-Siberian Railway offer unique experiences for travelers seeking cultural immersion and adventure.

The vast wilderness areas, including Lake Baikal and the Kamchatka Peninsula, also attract ecotourists interested in exploring pristine natural environments.

The vibrant cities in China, including Beijing, Shanghai, and Xi'an, showcase modern developments, technological innovation, and dynamic urban landscapes.

The diverse cuisine, traditional festivals, and scenic landscapes, such as the Li River and Zhangjiajie National Forest Park, further contribute to its appeal as a top tourist destination within the BRICS nations.

Tourists are drawn to iconic landmarks, such as the Taj Mahal, Jaipur's palaces, and Kerala's backwaters, which offer glimpses into the rich history and architectural marvels.

Spiritual seekers flock to sacred sites such as Varanasi, Rishikesh, and Bodh Gaya, while adventure enthusiasts explore the Himalayas, national parks, and wildlife reserves.

The vibrant festivals, colorful industries, and culinary delights further enhance its appeal as a top tourist destination within the BRICS nations.

Tourists flock to South Africa to embark on safari adventures in Kruger National Park, explore the vibrant city of Cape Town, and visit iconic landmarks such as Table Mountain and Robben Island.

The rich cultural heritage, including its diverse population, languages, and traditions, offers immersive experiences for travelers seeking cultural exchange and exploration.

The scenic coastal drives, winelands, and outdoor activities appeal to adventure seekers and nature enthusiasts, making it a top destination within the BRICS nations for tourism.

Each member nation of the BRICS tourism industry competes with its unique blend of attractions, cultural heritage, and hospitality offerings. Competition drives innovation in infrastructure, services, and industrial strategies as each nation seeks to attract and retain tourists.

Collaboration within the BRICS framework fosters mutual growth and exchange of best practices, further enhancing the competitiveness of the collective tourism industry on the global stage. Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 5.09 trillion |

| Projected Industry Valuation in 2035 | USD 7.83 trillion |

| Value-based CAGR 2025 to 2035 | 4.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | Value in USD trillion |

| Key Industry Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type, By Consumer Orientation, By Age Group, Region |

| Key Countries Profiled | Brazil, Russia, China, India, South Africa, Egypt |

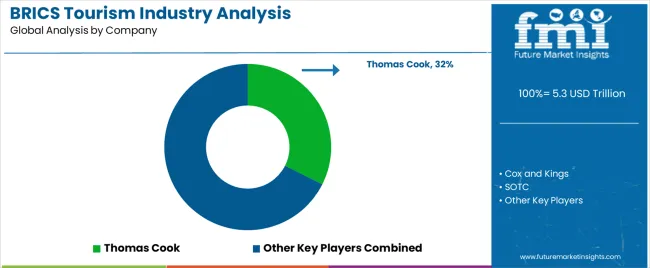

| Key Companies Profiled | Thomas Cook; Cox and Kings; SOTC; Kesari Tours; Expedia; Signature Tours; Natripp |

The global brics tourism industry analysis is estimated to be valued at USD 5.3 trillion in 2025.

The market size for the brics tourism industry analysis is projected to reach USD 8.0 trillion by 2035.

The brics tourism industry analysis is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in brics tourism industry analysis are cultural & heritage tourism, medical tourism, eco/sustainable tourism, sports tourism, wellness tourism and others.

In terms of booking channel, online travel agents segment to command 50.0% share in the brics tourism industry analysis in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Italy Tourism Market Analysis – Growth & Industry Trends 2024-2034

Greece Tourism Market Insights – Growth & Forecast 2024-2034

Leading Providers & Market Share in Virtual Tourism Industry

Asia-Pacific Religious Tourism Market Growth – Forecast 2024-2034

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Theme Park Tourism Providers

Philippines Tourism Industry Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Thailand Culinary Tourism Market Trends – Growth & Forecast 2024-2034

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA