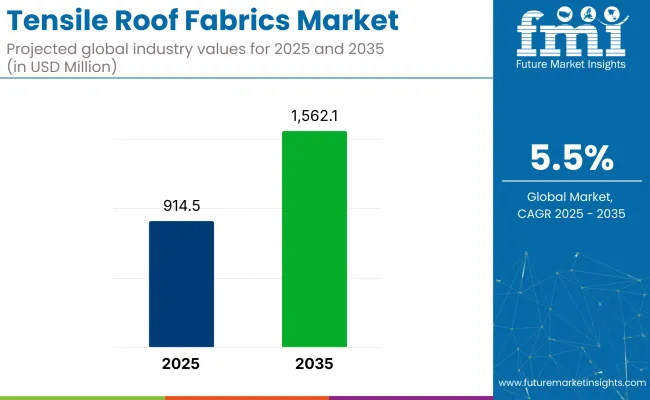

The tensile roof fabrics market is expected to expand from USD 914.5 million in 2025 to USD 1,562.1 million by 2035, at a CAGR of 5.5% during the forecast period. The tensile roof fabrics industry comprises a focused segment across several structural and construction-related industries.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 914.5 million |

| Market Value (2035F) | USD 1,562.1 million |

| CAGR (2025 to 2035) | 5.5% |

Within the tensile architecture membrane industry, it accounts for approximately 35-40%, as roofing applications dominate usage in stadiums, pavilions, and atriums. In the broader tensile fabric structure industry, its share is around 25-30%, with walls, facades, and canopies making up the rest.

Within the membrane structure industry, tensile roofing membrane contribute nearly 20-25%, competing with ETFE and PVC-based systems. In the construction fabrics category, their role is more limited about 10-12% due to competition from geotextiles and tarpaulins. Within the overall roofing materials industry, tensile roofing membranes represent less than 1%, reflecting their use in specialized architectural projects rather than conventional residential or industrial roofing.

Growth is being driven by the increasing demand for durable, cost-effective, and eco-friendly roofing solutions. Tensile roofing membranes, which are recognized for their flexibility and strength, are being increasingly adopted in various applications, including sports stadiums, exhibition halls, and shopping malls. These fabrics are considered ideal for providing a combination of lightness, strength, and design versatility, making them suitable for a wide range of architectural applications.

In December 2024, Birdair, Inc. announced the completion of a state-of-the-art PTFE tensile membrane amphitheater at Doral Central Park, Florida. The new structure enhances natural lighting, provides weather resistance, and supports community-focused outdoor entertainment. Dave Capezzuto, Senior Vice President at Birdair, stated:

“We’re proud to be a part of such an important project that will benefit the Doral community for years to come. Our PTFE tensile membrane amphitheater structure will offer durability and protection from the elements while requiring minimal maintenance. It will serve as a great space for Doral residents and visitors to spend time enjoying a variety of performances and events.”

The tensile roof fabrics market is segmented by material type into PVC coated polyester fabric, PTFE coated glass fabric, ETFE foils, and PVC glass fabrics. By end use, the industry covers parking sheds, stadium and sport structures, airports and transit stations, events and convention centres, public infrastructure, and others.

By tensile strength, the industry includes standard grade, reinforced grade, and high performance grade tensile roof fabrics. The industry spans North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa.

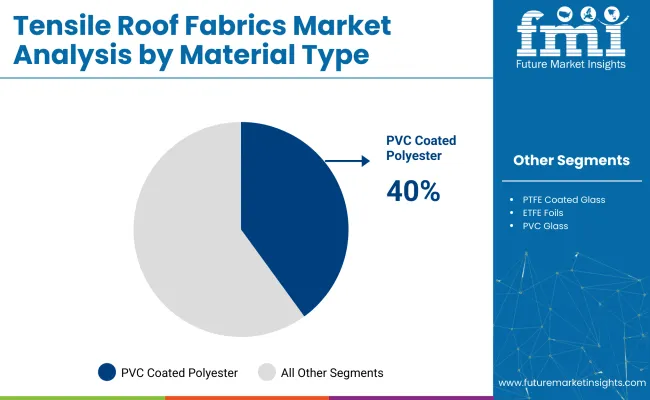

PVC coated polyester is projected to account for 40% share by 2025. Its widespread usage has been attributed to its resistance to UV exposure, high tensile strength, and ability to retain flexibility under varied temperatures.

This material has been preferred for stadium roofs and long-span architectural installations due to its reliability under stress and minimal maintenance requirements. Long-term contracts have been secured by manufacturers such as Serge Ferrari and MehlerTexnologies for supply in public infrastructure projects across Europe, the Middle East, and Asia.

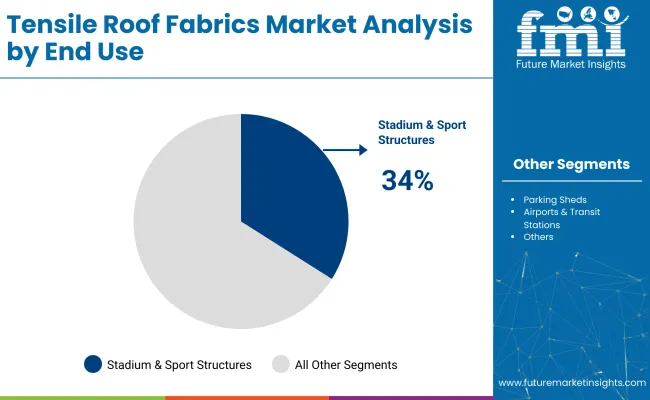

The stadium and sports structures segment is estimated to command 34% of the market share in 2025. Adoption of tensile roofing membrane in these venues has been encouraged by the need for translucent, wind-resistant coverings that enhance both aesthetics and functionality.

Implementation of these structures has been prioritized in large arenas for international sporting events. Companies such as FabriTec Structures and Vector Foiltec have delivered modular roofing systems that integrate seamlessly with steel and cable trusses, helping achieve faster installation and reduced site load.

The market is being driven by increasing demand for lightweight, durable, and aesthetically appealing roofing systems. Advancements in fabric technology are enhancing their performance, while high costs and limited awareness are hindering growth.

Lightweight architectural appeal boosts adoption rates

Widespread use of tensile roof fabrics is being driven by their structural lightness, minimal load demands, and modern design compatibility. These fabrics are being specified where uninterrupted spans and visual openness are prioritized. Their ability to endure environmental stress and support complex modular configurations is resulting in increased deployment in sports arenas, terminals, and public venues.

Cost-related constraints slow investment decisions

Market expansion is being curtailed by high installation expenses and fragmented expertise in emerging regions. In the absence of widespread technical demonstrations or lifecycle performance data, fabric-based roofing options are being overlooked. Procurement reluctance is being observed in both public and private infrastructure bids, where traditional materials dominate.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.4% |

| United States | 4.6% |

| Germany | 4.9% |

| India | 6.2% |

| UAE | 5.8% |

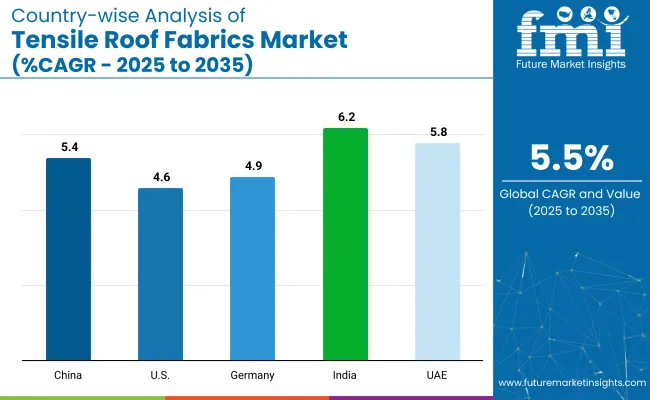

In the tensile roof fabrics market, OECD countries such as the United States and Germany are expected to grow at a moderate pace, with projected CAGRs of 4.6% and 4.9%, respectively. Growth in these markets is driven by renovation of stadiums, airports, and transit hubs, with added emphasis on design aesthetics and energy efficiency. In contrast, BRICS economies show stronger momentum, with India leading at 6.2% and China at 5.4%.

India’s growth is fueled by large-scale infrastructure projects including railway stations and exhibition venues, while China benefits from export-oriented fabric manufacturing and urban transport upgrades. The UAE, representing the GCC, is projected at 5.8%, supported by demand from hospitality, retail, and event-driven architecture. Emerging regions clearly outpace developed ones.

The China tensile roof fabrics market is expected to grow at a CAGR of 5.4% through 2035. The growth is being driven by rapid urbanization, rising infrastructure projects, and increased demand for durable, weather-resistant materials for architectural applications. Leading companies such as Sinosteel, Sika Group, and other Chinese-based manufacturers are driving production and distribution.

Government initiatives supporting the construction industry and technological advancements in material quality and design are accelerating the industry's expansion. The adoption of tensile fabric structures in the commercial and industrial sectors is increasing, further contributing to the growth of the industry in China.

The United States tensile roof fabrics market is projected to grow at a CAGR of 4.6% through 2035. The increasing demand for architectural and functional roof solutions in the commercial sector is driving this industry. Companies like Sika Group, Saint-Gobain, and Dow Inc. are advancing innovations in materials and design, ensuring durability and energy efficiency.

Government regulations promoting construction methods and eco-friendly materials are further contributing to industry growth. Additionally, the expansion of infrastructure projects, including sports complexes and public venues, is increasing the demand for tensile roofing membrane in the USA, ensuring industry growth.

The German tensile roof fabrics market is expected to grow at a CAGR of 4.9% through 2035. The well-established construction industry in Germany, along with a growing emphasis on green building practices, is supporting the growth. Leading companies such as Sika Group, Geiger Group, and Heytex are driving innovations in tensile fabrics used in roofing and shade structures.

Focus on renewable energy, durability, and cost-effectiveness is increasing the demand for tensile roof materials in both public and private infrastructure projects. Government incentives and regulations supporting green construction methods are further boosting the industry’s growth in Germany.

The India Tensile Roof Fabrics Market is expected to grow at a CAGR of 6.2% through 2035. The industry is driven by rapid urbanization, infrastructural development, and the increasing demand for eco-friendly and energy-efficient building materials.

Companies like Hira Ferro Alloys, Tension Fabric Structure India, and FabriTech are strengthening their position in the industry by providing high-quality, durable tensile fabrics. Government initiatives supporting infrastructure development, such as smart cities and public spaces, are further contributing to industry growth. The increasing adoption of tensile roofs for commercial, residential, and industrial applications is driving the demand in India.

The UAE Tensile Roof Fabrics Market is projected to grow at a CAGR of 5.8% through 2035. The industry is expanding due to the country’s ongoing investment in infrastructure development, particularly in sports, leisure, and public sector projects. Companies like Al-Futtaim Engineering, Doka Group, and Taiyo Kogyo Corporation are leading innovations in tensile roof fabric solutions.

The growing focus on architecture and energy-efficient building materials is also accelerating industry demand. Additionally, the UAE’s increasing focus on environmentally friendly and durable construction methods, combined with major events such as the Expo 2020, are contributing to industry growth.

Leading Company - Serge Ferrari Group Industry Share - 20%

The market is characterized by a moderately consolidated competitive landscape, segmented into dominant players, key players, and emerging firms. Serge Ferrari Group leads the industry with an estimated share of 20%, offering innovative, high-performance architectural fabrics suitable for various applications, including stadiums, airports, and exhibition halls. Other dominant players include Saint-Gobain, Sioen Industries, and Low & Bonar, each holding significant shares and providing advanced, durable fabrics tailored for diverse construction needs. Emerging companies such as Taiyo Kogyo Corporation, Jieol Tent, and MakMax Australia are expanding their presence through strategic partnerships and localized manufacturing, focusing on specialized solutions to meet regional demands.

Recent Tensile Roof Fabrics Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 914.5 million |

| Projected Industry Size (2035) | USD 1,562.1 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and square meters for volume |

| Material Types Analyzed (Segment 1) | PVC Coated Polyester Fabric, PTFE Coated Glass Fabric, ETFE Foils, PVC Glass Fabrics |

| End Uses Analyzed (Segment 2) | Parking Sheds, Stadium & Sport Structures, Airports & Transit Stations, Events & Convention Centres, Public Infrastructure, Others |

| Tensile Strength Analyzed (Segment 3) | Standard Grade, Reinforced Grade, High Performance Grade |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Serge Ferrari, mehler texnologies, Sioen Industries, Seaman Corporation, DUOL, Mermet |

| Additional Attributes | Dollar sales, share by material type and end-use, increasing demand in stadium and airport constructions, advancements in high-performance tensile fabrics, regional growth in infrastructure projects |

The industry is segmented into PVC coated polyester fabric, PTFE coated glass fabric, ETFE foils, and PVC glass fabrics.

The industry covers parking sheds, stadium & sport structures, airports & transit stations, events & convention centres, public infrastructure, and others.

The industry includes standard grade, reinforced grade, and high performance grade tensile roof fabrics.

The industry spans North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa

The industry is expected to reach USD 1,562.1 million by 2035.

The industry is projected to be USD 914.5 million in 2025.

The industry is expected to grow at a CAGR of 5.5%.

PVC Coated Polyester is projected to lead with a 40% market share.

Asia, particularly India, is expected to grow at a 6.2% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tensile Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Tensile Testers Market Size and Share Forecast Outlook 2025 to 2035

Roof Water Leak Detector Market Size and Share Forecast Outlook 2025 to 2035

Roofing Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Roofing Anchors Market Size and Share Forecast Outlook 2025 to 2035

Roofing Underlay Market Size and Share Forecast Outlook 2025 to 2035

Rooftop Solar Epc Market Size and Share Forecast Outlook 2025 to 2035

Roofing & Tile Underlayment Market Size and Share Forecast Outlook 2025 to 2035

Rooftop Solar PV Module Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Roof Vents Market

Roofing Shingles Market

Ex Proof Absolute Encoders Market Size and Share Forecast Outlook 2025 to 2035

Ex Proof Incremental Encoders Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Makeup Market Size and Share Forecast Outlook 2025 to 2035

Soundproof Drywall Materials Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA