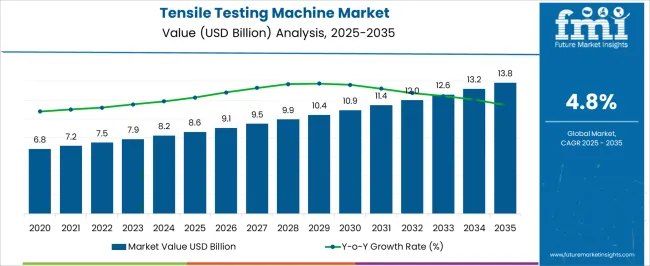

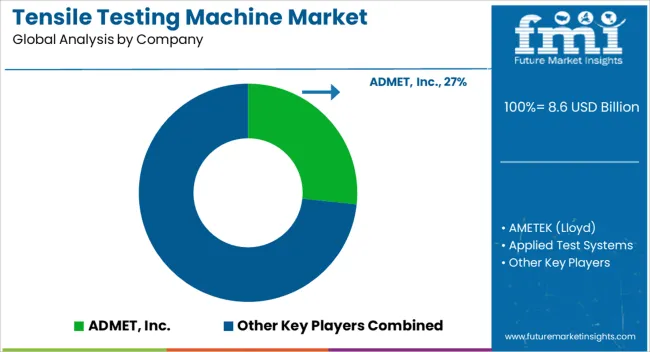

The Tensile Testing Machine Market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 13.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Tensile Testing Machine Market Estimated Value in (2025 E) | USD 8.6 billion |

| Tensile Testing Machine Market Forecast Value in (2035 F) | USD 13.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Tensile Testing Machine market is experiencing steady growth driven by the increasing demand for material characterization and quality assurance across multiple industries. The current market landscape is shaped by rising industrial automation, enhanced research and development activities, and stringent quality control regulations. Machines capable of performing precise tensile tests are being increasingly deployed to ensure the mechanical properties of materials meet industry standards.

Advancements in sensor technology, digital interfaces, and software-enabled data analytics are enhancing the accuracy and efficiency of tensile testing equipment. Growing investments in research laboratories, educational institutions, and manufacturing facilities are further fueling market expansion.

The adoption of versatile systems capable of testing diverse materials under varying load capacities is creating opportunities for scalable deployments As industries continue to prioritize product reliability, operational safety, and compliance with international standards, the Tensile Testing Machine market is poised for sustained growth, driven by both technological innovation and expanding end-use applications.

The tensile testing machine market is segmented by target material, load capacity, end use industry, loading type, and geographic regions. By target material, tensile testing machine market is divided into Rubber Tensile Testing Machine, Plastic Tensile Testing Machine, and Metal Tensile Testing Machine. In terms of load capacity, tensile testing machine market is classified into Tensile Testing Machine Up To 1 Kn, Tensile Testing Machine From 1 Kn To 10 Kn, Tensile Testing Machine From 10 Kn To 300 Kn, and Tensile Testing Machine More Than 300 Kn. Based on end use industry, tensile testing machine market is segmented into Tensile Testing Machine For The Rubber Industry, Tensile Testing Machine For The Automotive Industry, Tensile Testing Machine For Aerospace And Defense, Tensile Testing Machine For General Fabrication, Tensile Testing Machine For Textiles, Tensile Testing Machine For Plastic Manufacturing, Tensile Testing Machine For Packaging, Tensile Testing Machine For Paper And Pulp, and Tensile Testing Machine For Auxiliary Manufacturing. By loading type, tensile testing machine market is segmented into Screw Driven Tensile Testing Machine and Hydraulic Tensile Testing Machine. Regionally, the tensile testing machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

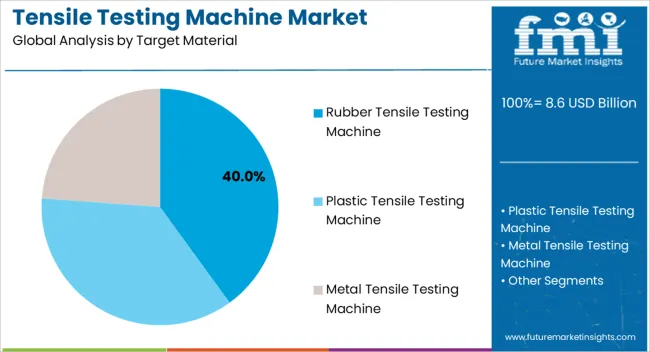

The Rubber Tensile Testing Machine is projected to account for 40.00% of the market revenue share in 2025, making it the leading target material segment. This position is being attributed to the growing utilization of rubber components in automotive, industrial, and consumer goods applications, where precise evaluation of tensile strength, elongation, and elasticity is critical.

Adoption has been accelerated by the need to maintain consistent material quality and comply with stringent safety and performance standards. The segment’s growth has also been reinforced by the machines’ ability to handle repeated testing cycles with minimal wear and high accuracy, reducing operational downtime.

The flexibility of these machines to test various types of rubber, including natural and synthetic variants, has further contributed to their widespread adoption With increasing focus on durability, performance validation, and regulatory compliance, the Rubber Tensile Testing Machine segment is expected to maintain its market leadership and attract further investments in the coming years.

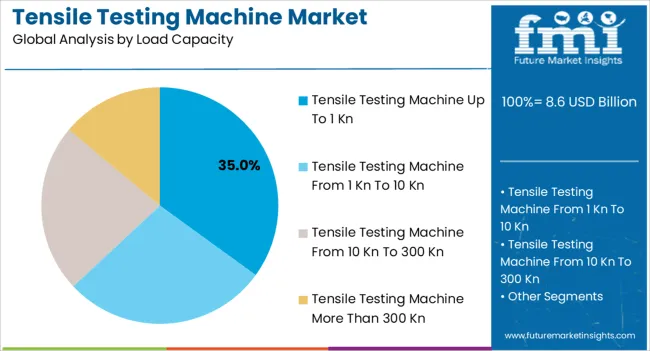

The Load Capacity segment for machines up to 1 Kn is estimated to hold 35.00% of the market revenue in 2025, establishing it as the leading capacity category. This prominence has been driven by the widespread demand for testing low-strength materials such as plastics, thin films, textiles, and polymers, which require precise, small-capacity load measurement.

The adoption of these machines is being enhanced by their high accuracy, ease of integration into laboratory workflows, and adaptability for a variety of testing protocols. The relatively lower cost and compact footprint of these machines have also facilitated broader use in research laboratories, quality control departments, and educational institutions.

Increasing automation and software-enabled data acquisition have further strengthened the segment’s value proposition by enabling detailed material analysis with minimal human intervention As industries continue to require rigorous testing of low-strength materials for quality assurance and product development, the machines with up to 1 Kn load capacity are expected to sustain their market dominance.

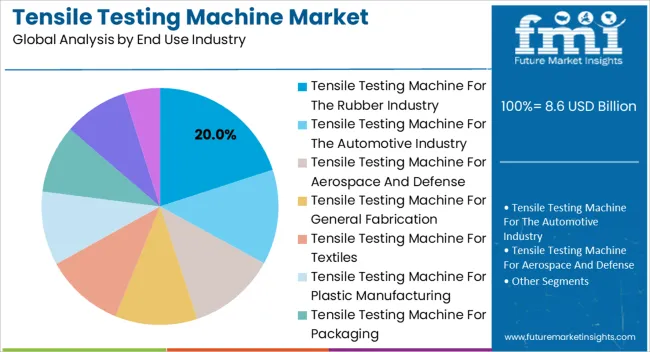

The Commercial end-use industry segment focused on rubber applications is projected to hold 20.00% of the market revenue in 2025, leading the end-use categories. This growth is being driven by the significant demand for high-performance rubber components across automotive, industrial, and consumer product manufacturing.

Machines designed specifically for the rubber industry allow precise measurement of tensile strength, elongation, and modulus, ensuring compliance with both international standards and internal quality benchmarks. The segment’s growth has also been fueled by increasing investments in research and development facilities, which prioritize material performance and durability testing.

The ability to test a variety of rubber types and formulations with specialized grips and software-enabled control has further encouraged adoption As regulatory scrutiny and performance expectations for rubber components increase globally, the demand for dedicated tensile testing machines in this end-use industry is expected to remain strong, consolidating its position as the leading segment.

Tensile testing machines are also known as tension test machines and universal testing machines. A tensile testing machine is a piece of testing equipment that is used to determine the mechanical properties or tensile strength of specimens. It assesses a material's mechanical properties, or characteristics such as ultimate tensile strength, yield strength, elongation, and modulus.

By simply adding fixtures, tensile testing machines can also perform compression, cyclic, shear, flexure, bend, peel, and tear tests. Due to increased demand for tensile testing machines from the automotive and textile sectors, the global tensile testing machine market is expected to expand at a rapid pace during the forecast period.

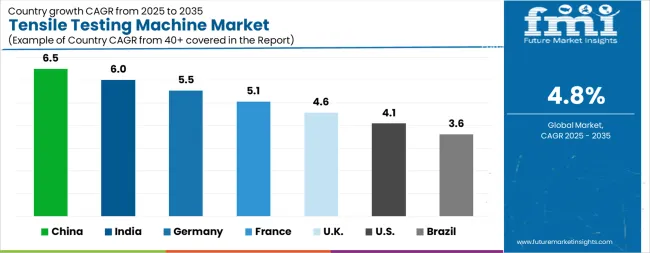

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.1% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The Tensile Testing Machine Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Tensile Testing Machine Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Tensile Testing Machine Market is estimated to be valued at USD 3.0 billion in 2025 and is anticipated to reach a valuation of USD 4.5 billion by 2035. Sales are projected to rise at a CAGR of 4.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 474.8 million and USD 273.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.6 Billion |

| Target Material | Rubber Tensile Testing Machine, Plastic Tensile Testing Machine, and Metal Tensile Testing Machine |

| Load Capacity | Tensile Testing Machine Up To 1 Kn, Tensile Testing Machine From 1 Kn To 10 Kn, Tensile Testing Machine From 10 Kn To 300 Kn, and Tensile Testing Machine More Than 300 Kn |

| End Use Industry | Tensile Testing Machine For The Rubber Industry, Tensile Testing Machine For The Automotive Industry, Tensile Testing Machine For Aerospace And Defense, Tensile Testing Machine For General Fabrication, Tensile Testing Machine For Textiles, Tensile Testing Machine For Plastic Manufacturing, Tensile Testing Machine For Packaging, Tensile Testing Machine For Paper And Pulp, and Tensile Testing Machine For Auxiliary Manufacturing |

| Loading Type | Screw Driven Tensile Testing Machine and Hydraulic Tensile Testing Machine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADMET, Inc., AMETEK (Lloyd), Applied Test Systems, Cometech Testing Machines Co., Ltd., ETS Intarlaken, FORM+TEST GmbH, Hegewald and Peschke, and Illinois Tool Works Inc. |

The global tensile testing machine market is estimated to be valued at USD 8.6 billion in 2025.

The market size for the tensile testing machine market is projected to reach USD 13.8 billion by 2035.

The tensile testing machine market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in tensile testing machine market are rubber tensile testing machine, plastic tensile testing machine and metal tensile testing machine.

In terms of load capacity, tensile testing machine up to 1 kn segment to command 35.0% share in the tensile testing machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tensile Testers Market Size and Share Forecast Outlook 2025 to 2035

Tensile Roof Fabrics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Examining Market Trends in the Self-Testing Industry Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA