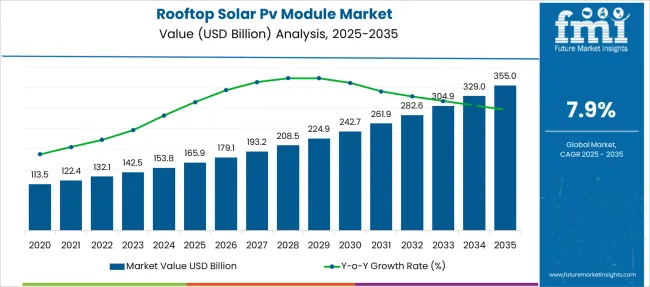

The Rooftop Solar PV Module Market is estimated to be valued at USD 165.9 billion in 2025 and is projected to reach USD 355.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

| Metric | Value |

|---|---|

| Rooftop Solar Pv Module Market Estimated Value in (2025 E) | USD 165.9 billion |

| Rooftop Solar Pv Module Market Forecast Value in (2035 F) | USD 355.0 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The rooftop solar PV module market is undergoing accelerated growth, driven by rising electricity demand, favorable policy incentives, and increased affordability of solar technology. Governments across regions are introducing net metering schemes, tax credits, and rooftop-specific subsidies to encourage decentralized solar adoption.

Urbanization and the rising cost of grid electricity have further catalyzed interest in rooftop installations, especially among commercial and residential users. Technological advancements in module efficiency, longevity, and ease of installation are improving return on investment, making solar a mainstream energy source.

The integration of smart inverters, IoT-enabled monitoring systems, and storage compatibility has expanded value-added benefits. Shift toward energy independence, carbon neutrality targets, and utility-scale rooftop deployments by institutional buyers is expected to sustain long-term market growth

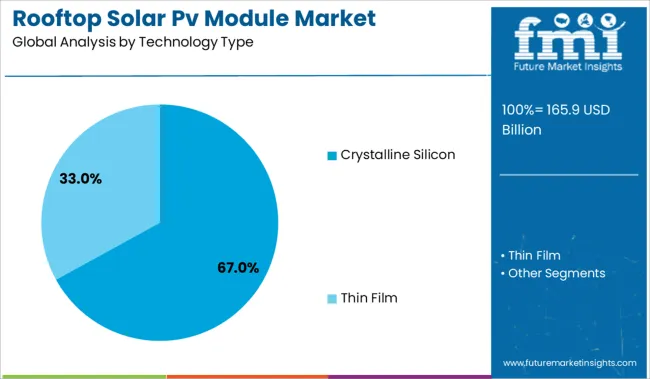

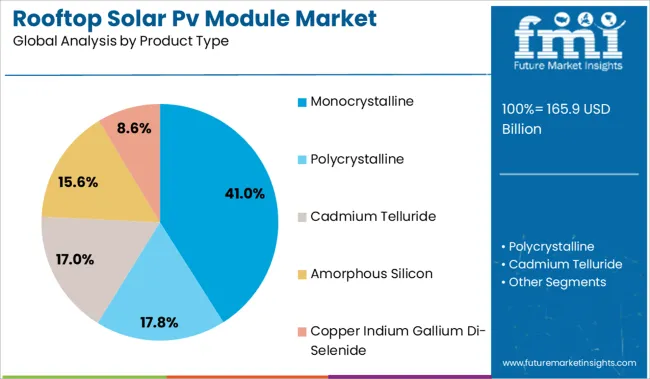

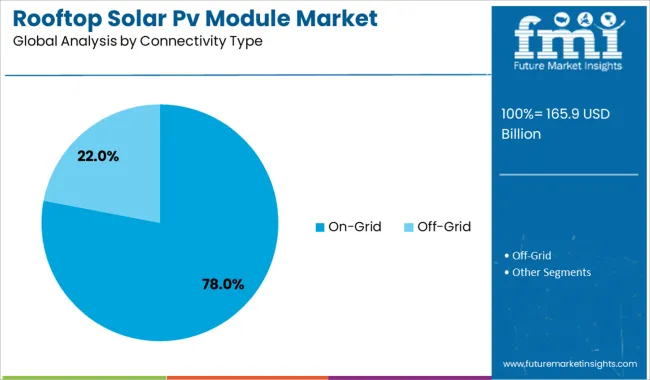

The market is segmented by Technology Type, Product Type, Connectivity Type, End Use Segment and region. By Technology Type, the market is divided into Crystalline Silicon and Thin Film. In terms of Product Type, the market is classified into Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Di-Selenide. Based on Connectivity Type, the market is segmented into On-Grid and Off-Grid.

By End Use Segment, the market is divided into Residential, Commercial & Industrial, and Utility. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Crystalline silicon technology is projected to contribute 67.0% of total revenue in the rooftop solar PV module market by 2025, positioning it as the leading segment. This dominance is being driven by its high energy conversion efficiency, long operational lifespan, and robust structural stability.

The mature manufacturing ecosystem around crystalline silicon has enabled economies of scale, reducing per-watt costs and improving deployment economics. Its widespread acceptance among installers and compatibility with a variety of rooftop surfaces have made it a default choice across regions.

In addition, consistent research investments and supply chain localization efforts have strengthened production capacity, reinforcing its leadership in the rooftop segment

Monocrystalline modules are expected to account for 41.0% of total market revenue in 2025, establishing them as the leading product type in rooftop solar applications. This growth is being supported by the superior efficiency and space-saving characteristics of monocrystalline cells, which are particularly advantageous in constrained rooftop environments.

Their high power output per square meter and better low-light performance make them suitable for both residential and commercial rooftops. Moreover, aesthetic appeal and uniformity in design have boosted their adoption in urban areas where architectural integration is a priority.

The declining cost gap between monocrystalline and other module types has also contributed to their wider preference across end-users seeking high-efficiency installations

On-grid systems are expected to dominate with 78.0% revenue share in 2025, making them the preferred connectivity type in rooftop solar installations. This segment’s leadership is being shaped by policy-driven incentives like feed-in tariffs, net metering, and grid-based performance bonuses, which have enhanced the financial attractiveness of grid-connected systems.

These setups allow users to offset energy consumption directly from solar production while leveraging grid backup, ensuring supply reliability. Simplified interconnection standards, low maintenance requirements, and favorable regulatory frameworks in urban and peri-urban zones have encouraged mass adoption.

Furthermore, the proliferation of digital monitoring and smart grid integration is enabling better energy management, reinforcing the on-grid segment’s continued dominance

Technological advancements, smart grid integration, and ESG-focused investments are accelerating rooftop solar PV adoption across sectors. However, high upfront costs, regulatory hurdles, and grid integration issues remain key challenges to broader deployment.

Driven by efficiency breakthroughs in monocrystalline and bifacial PV module technologies, the rooftop solar PV module market is witnessing strong momentum. Solar module conversion efficiency has been enhanced by innovations such as PERC and HJT cells, which are now being commercially adopted to meet high-performance rooftop requirements. Rooftop solar is increasingly being integrated with smart grids and digital energy management systems, enabling better load balancing and power optimization. ESG-driven corporate investments and sustainable building mandates are also being leveraged to scale rooftop solar installations, especially in sectors like manufacturing, real estate, education, and healthcare. As solar PV rooftop systems are increasingly linked with energy storage and building-integrated photovoltaics (BIPV), the rooftop solar market is being transformed into a future-proof solution aligned with decarbonization strategies.

The rooftop solar PV module market faces persistent challenges despite rapid growth. High initial installation costs and limited financing options continue to deter residential adoption, especially in emerging economies. Regulatory uncertainty, complex permitting processes, and inconsistent net metering policies across regions hamper large-scale deployment. Grid integration issues, such as voltage fluctuations and lack of smart infrastructure, pose technical barriers to scaling distributed solar. Additionally, supply chain disruptions-linked to raw material constraints and dependency on a few manufacturing hubs-impact module availability and pricing. Roof structural limitations and low awareness among end users also slow market penetration. Lastly, limited incentives for battery integration restrict the full potential of energy self-sufficiency and load balancing for rooftop PV systems.

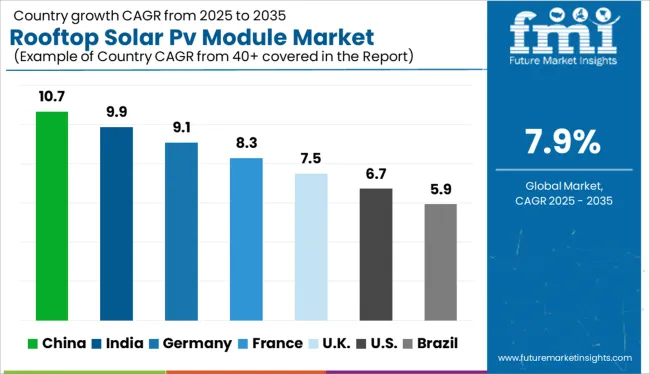

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

The global rooftop solar PV module market is forecast to expand at a CAGR of 7.9% from 2025 to 2035, driven by decarbonization mandates, falling installation costs, and prosumer energy models. Among BRICS nations, China and India lead the momentum with CAGRs of 10.7% and 9.9%, respectively. China’s dominance is rooted in policy-backed net metering, rooftop integration in urban housing schemes, and local manufacturing scale. India, is propelled by commercial rooftop uptake and subsidies across industrial clusters. OECD markets show slower but stable growth. Germany and France, with 9.1% and 8.3% CAGRs, are focusing on building-integrated photovoltaics (BIPV) and smart grid connectivity. The UK, at 7.5%, is prioritizing residential decarbonization and solar-ready infrastructure codes, while the US, at 6.7%, sees steady adoption across sunbelt states despite policy variances. ASEAN economies like Thailand, Indonesia, and the Philippines are emerging as downstream deployment hubs with favorable feed-in tariffs and localization policies.

The United States is advancing space robotics through mission-specific integration across government and private sector launches. Robotic mechanisms are prioritized in deep-space research, payload docking, and ISS maintenance. Advanced command-and-control layers are being paired with robotic arms and autonomous positioning systems.

Demand is further supported by national defense requirements and growing collaboration between aerospace primes and AI firms. Research clusters in California and Texas are influencing rapid prototyping cycles and launch-readiness precision, reinforcing the country’s leadership.

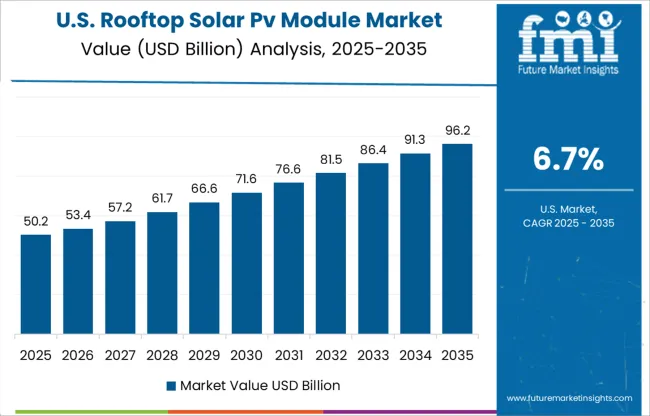

The rooftop solar PV module market in the USA saw a CAGR of nearly 4.6% from 2020 to 2024, which rose to 6.7% for the 2025-2035 period. Sluggish early growth was attributed to fragmented policy frameworks, net metering disputes, and variable interconnection standards across states. Residential adoption was primarily confined to solar-friendly states like California and Arizona. Post-2024, the implementation of the Inflation Reduction Act's extended tax credits (through 2032), solar investment incentives, and decarbonization targets changed the landscape.

By 2026, over 22 states had mandated rooftop solar in new construction for residential and commercial units. Distributed solar and energy resilience became a strategic priority for grid modernization and disaster preparedness, especially in hurricane- and wildfire-prone regions. Corporate ESG reporting standards also incentivized solar adoption across logistics, warehousing, and retail facilities. This collective momentum is now driving faster growth in the USA rooftop solar sector.

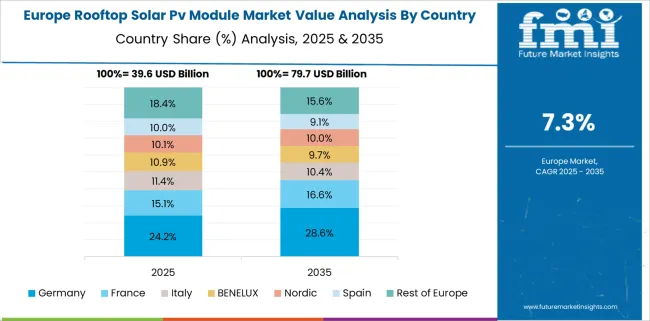

Germany's rooftop solar PV module market recorded a CAGR of about 6.8% from 2020 to 2024, increasing to a robust 9.1% during 2025-2035. The earlier period saw stable but policy-dependent growth, with the EEG (Renewable Energy Sources Act) driving feed-in tariffs and market access. However, capacity constraints, permit delays, and grid saturation capped faster rooftop growth. The shift came in 2025, when Germany launched the "Solar Package I" reforms, simplifying rooftop PV approvals, reducing bureaucracy, and unlocking municipal-level solar mandates.

The government’s push for climate neutrality by 2045 repositioned rooftop solar as a mainstream component in both residential and industrial energy systems. Integration with building automation systems, vehicle-to-grid charging, and community solar cooperatives enhanced consumer confidence and reduced payback periods. Solar carports and vertical solar façades became common in urban Germany by 2028, contributing to exponential rooftop area utilization.

India’s rooftop solar PV module market CAGR rose from around 6.5% during 2020-2024 to 9.9% for the 2025-2035 period, reflecting a policy-driven acceleration. Earlier, high dependency on subsidies, regulatory bottlenecks, and discom-level reluctance restrained rooftop solar growth. Fragmented implementation under the Phase-II Rooftop Programme delayed scale-up. However, from 2025, a paradigm shift occurred. The launch of the National Solar Rooftop Portal, simplified subsidy disbursements, and net billing mechanisms reinvigorated user confidence.

Government mandates for solar rooftops in government buildings and SEZs, along with states like Gujarat and Maharashtra introducing solar-ready housing codes, significantly boosted uptake. Industrial clusters began switching to solar rooftops for tariff savings, supported by green bonds and concessional finance. The residential market also revived through digital solar leasing and peer-to-peer trading pilots, creating a distributed solar boom.

The CAGR for China’s rooftop solar PV module market was nearly 7.6% during 2020-2024, which has sharply risen to 10.7% between 2025-2035. Early growth was driven by manufacturing efficiency, favorable FITs, and pilot projects in eco-cities. However, centralized grid infrastructure had limited room for distributed solar expansion. From 2025 onward, the Chinese government made rooftop solar a central element of its “Zero-Carbon Urban Infrastructure” strategy. Mandatory rooftop PV coverage in new residential and industrial buildings was implemented in over 100 counties through the “Whole County Rooftop PV” pilot scheme.

Provincial subsidies, easier grid access, and digital solar dashboards contributed to wider residential and rural adoption. Integration with electric vehicle charging and energy storage further enhanced the use-case. Local governments, in coordination with SOEs, promoted hybrid PV-storage systems under net metering and time-of-use pricing models.

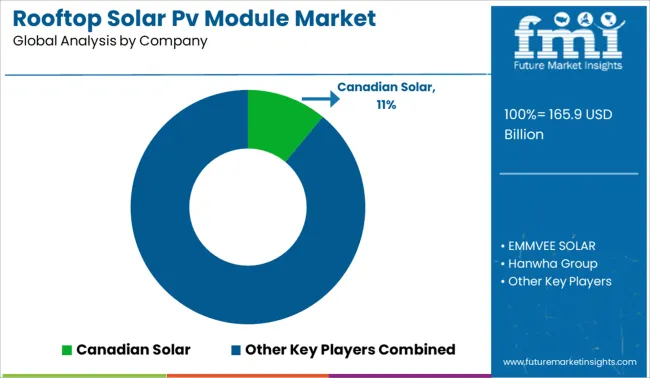

In the global rooftop solar PV module market, estimated at USD 68-72 billion in 2024, LONGi Solar leads with high-efficiency monocrystalline modules and robust global distribution, especially in Asia-Pacific and Europe. Backed by vertical integration and strong R&D capabilities, LONGi has set efficiency benchmarks using advanced PERC and TOPCon technologies. Other prominent players include Trina Solar, JinkoSolar, JA Solar Technology, and Canadian Solar, each leveraging large-scale capacity, export-driven sales models, and competitive pricing to retain dominance in both residential and C&I rooftop segments. Vikram Solar, EMMVEE, and Indosolar continue to strengthen India’s domestic supply, while Hanwha Group, SunPower Corporation, and REC Solar Holdings cater to premium markets in the USA and Europe. Risen Energy, RENESOLA, Yingli Solar, Motech Industries, and Shunfeng International Clean Energy maintain steady output in mid-tier segments through project-based partnerships and EPC support in emerging economies.

| Item | Value |

|---|---|

| Quantitative Units | USD 165.9 Billion |

| Technology Type | Crystalline Silicon and Thin Film |

| Product Type | Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon, and Copper Indium Gallium Di-Selenide |

| Connectivity Type | On-Grid and Off-Grid |

| End Use Segment | Residential, Commercial & Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Canadian Solar, EMMVEE SOLAR, Hanwha Group, Indosolar, JA Solar Technology, JinkoSolar, LONGi, Motech Industries, REC Solar Holdings, RENESOLA, Risen Energy, Shunfeng International Clean Energy, SunPower Corporation, Trina Solar, Vikram Solar, and Yingli Solar |

| Additional Attributes | Dollar sales, share by product category, regional demand shifts, rental vs. retail dynamics, smart gear adoption rates, and top-performing distribution channels. |

The global rooftop solar PV module market is estimated to be valued at USD 165.9 billion in 2025.

The market size for the rooftop solar PV module market is projected to reach USD 355.0 billion by 2035.

The rooftop solar PV module market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in rooftop solar PV module market are crystalline silicon and thin film.

In terms of product type, monocrystalline segment to command 41.0% share in the rooftop solar PV module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rooftop Solar Epc Market Size and Share Forecast Outlook 2025 to 2035

Solar Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Solar Grade Monocrystalline Silicon Rods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Solar Encapsulation Market Size and Share Forecast Outlook 2025 to 2035

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Tracker for Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered Active Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Solar-Powered UAV Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Solar Street Lighting Market Size and Share Forecast Outlook 2025 to 2035

Solar Reflective Glass Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Desalination Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA