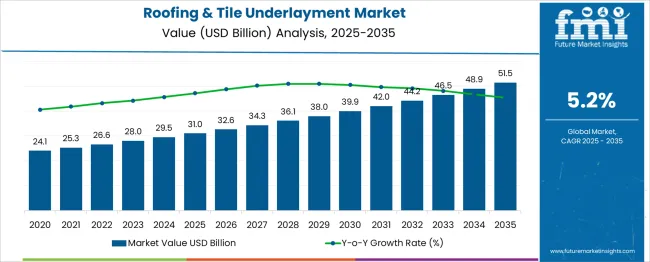

The roofing & tile underlayment market is estimated to be valued at USD 31.0 billion in 2025. Demand is projected to reach USD 51.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Analyzing the first five years (2025-2030), the market progresses from USD 31.0 billion to 39.9 billion, contributing an incremental gain of USD 8.9 billion, which accounts for approximately 43.4% of the total growth opportunity.

Annual values within this phase include USD 32.6 billion in 2026, USD 34.3 billion in 2027, USD 36.1 billion in 2028, and USD 38.0 billion in 2029, reflecting consistent upward movement supported by rising residential and commercial construction activity and stricter roofing durability standards.

The second half (2030-2035) is expected to add USD 11.6 billion, representing 56.6% of the overall expansion, signaling stronger momentum in later years due to the adoption of advanced synthetic underlayments, increased energy-efficient roofing systems, and higher demand in emerging markets. This growth pattern suggests a moderately back-loaded trend, highlighting opportunities for manufacturers to scale production capabilities, invest in UV- and moisture-resistant materials, and enhance distribution networks to meet the accelerating demand in the second half of the forecast period.

| Metric | Value |

|---|---|

| Roofing & Tile Underlayment Market Estimated Value in (2025 E) | USD 31.0 billion |

| Roofing & Tile Underlayment Market Forecast Value in (2035 F) | USD 51.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The roofing & tile underlayment market holds a modest yet strategic share across multiple construction and materials sectors. In the roofing materials market, underlayments capture 8-10% of overall materials spend, since shingles and tiles represent larger volumes. Within the roofing accessories and components market, they achieve 12-15%, reflecting their essential role alongside flashings, vents, and fasteners in moisture control.

In the residential and commercial construction materials market, underlayments account for 3-4%, as this category covers a broad range of elements from framing to finishes. Within the waterproofing and moisture protection market, they represent 10-12%, given their role as the first defense against water intrusion below roof surfaces.

In the building envelope systems market, underlayments contribute 5-6%, supporting energy efficiency and thermal integrity under exterior claddings. While share is concentrated, demand grows with stricter building codes on weather resistance and energy performance. Innovations like self-adhesive synthetic underlayments, enhanced UV stability, and vapor-retarding layers are boosting adoption rates, reinforcing the role of underlayment as a critical component in modern roofing systems.

Adoption is being driven by the need for durable, moisture-resistant, and energy-efficient solutions that enhance the lifespan of roofing systems. Advances in material technology and a shift toward synthetic options are improving performance and lowering long-term maintenance costs, strengthening market appeal. Future growth is expected to be propelled by urbanization, investments in infrastructure renewal, and consumer preference for higher-quality roofing systems.

Growing concerns about climate change and extreme weather events are also paving the way for premium products and installation methods that offer superior protection and compliance with evolving standards.

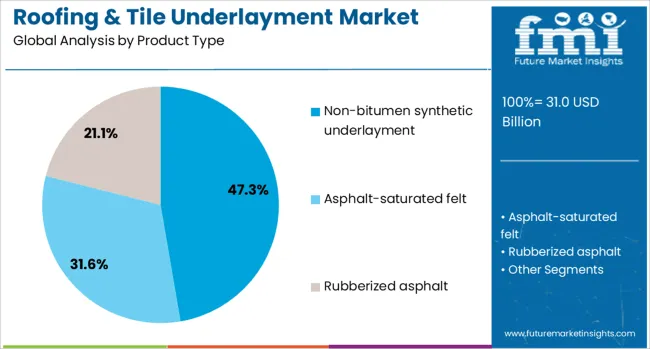

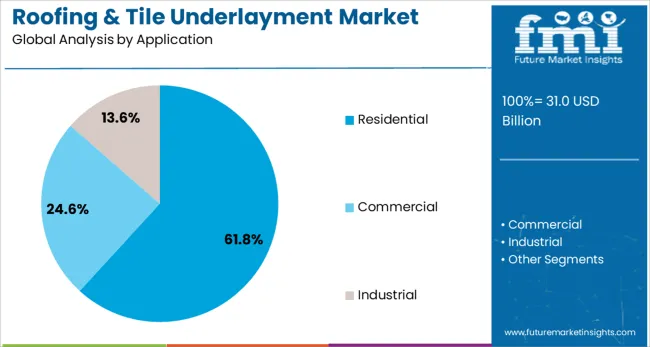

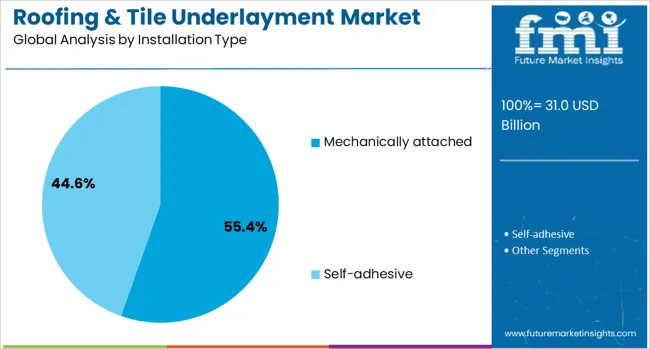

The roofing & tile underlayment market is segmented by product type, application, installation type, and geographic regions. The roofing & tile underlayment market is divided by product type into Non-bitumen synthetic underlayment, Asphalt-saturated felt, and Rubberized asphalt. In terms of application, the roofing & tile underlayment market is classified into Residential, Commercial, and Industrial. Based on the installation type of the roofing & tile underlayment market, it is segmented into mechanically attached and Self-adhesive. Regionally, the roofing & tile underlayment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, the non bitumen synthetic underlayment segment is projected to hold 47.30% of the total market revenue in 2025, making it the leading product type. This dominance is attributed to its superior resistance to moisture, mold, and tearing compared to traditional felt materials, which has encouraged adoption in both residential and commercial projects.

Enhanced durability and lighter weight have allowed faster and more efficient installation, reducing labor costs and project timelines. The ability to perform well under a wide range of temperatures and environmental conditions has positioned synthetic underlayment as the preferred choice among contractors and builders.

Increased availability of recyclable and environmentally friendly synthetic materials has also reinforced its market leadership, aligning with sustainable construction practices and regulatory requirements.

Segmented by application, the residential segment is expected to capture 61.8% of the market revenue in 2025, maintaining its leadership in the market. This position has been driven by a rise in residential construction activity, renovations, and replacement projects, particularly in regions prone to adverse weather conditions.

Homeowners’ growing awareness of the importance of underlayment in protecting roofs and improving energy efficiency has boosted demand within this segment. Regulatory emphasis on using compliant, weather-resistant materials in housing has further propelled adoption.

Additionally, the aesthetic and functional benefits of using advanced underlayment products in residential settings have contributed to increased uptake, as homeowners and developers prioritize durability, safety, and compliance in roofing solutions.

When segmented by installation type, the mechanically attached segment is forecast to hold 55.4% of the market revenue in 2025, establishing itself as the leading installation method. This leadership has been supported by its proven reliability, cost-effectiveness, and ease of application across varied roofing designs.

The ability to ensure secure attachment even in high-wind or sloped environments has made this method particularly attractive to contractors. Mechanically attached systems have also been favored due to their compatibility with a wide range of underlayment materials and roof types, allowing flexibility in project execution.

Efficiency in installation and reduced need for adhesives or heat-based methods have made it a practical choice, reinforcing its dominance in both new builds and retrofit projects.

Roofing and tile underlayments serve as protective layers beneath roofing materials, offering critical resistance against moisture, wind, and ice infiltration. These solutions include asphalt-saturated felt, synthetic membranes, and rubberized asphalt formats. They are utilized across residential, commercial, and industrial roofing applications worldwide. Market growth is being driven by expanding construction volumes and roof upgrade activity. Manufacturers offering durable, easy-to-install and water-resistant underlayments are well-positioned to meet demand for reliable, long‑lasting roof protection systems.

Market expansion is being driven by heightened construction activity in residential and commercial sectors, accompanied by increased roof replacement needs in aging buildings. Roofing underlayments serve as a protective barrier against leaks and moisture penetration, ensuring durability under severe weather conditions. Strong adoption has occurred where high wind and heavy rainfall events require reliable protection beneath shingles and tiles. The demand for lightweight synthetic alternatives has surged due to ease of installation and improved resistance compared to traditional felt. Regulations mandating enhanced roofing performance have supported the integration of advanced underlay systems in new projects. The consistent rise in reroofing and maintenance programs continues to boost recurring demand for high-quality underlayment solutions globally.

Growth has been constrained by raw material price fluctuations affecting asphalt and polymer-based components, leading to unpredictable production costs for manufacturers. High-performance underlayment products often carry elevated price points, limiting affordability in cost-sensitive markets. Variation in building codes across regions has created challenges in meeting compliance requirements, while inconsistencies in performance ratings complicate procurement decisions for contractors. Substandard and counterfeit materials in the market have contributed to reduced reliability, eroding buyer confidence in some aftermarket segments. Additional labor and installation costs for premium membranes deter widespread adoption. The absence of universal standards for moisture resistance and thermal performance continues to limit cross-market product interoperability, impacting large-scale construction projects.

The introduction of advanced synthetic membranes, self-adhesive systems, and breathable underlayment formats has expanded opportunities for differentiation among suppliers. Retrofit projects in aging residential and commercial buildings have emerged as a significant revenue stream, supported by increased roof rehabilitation activities. The growing preference for lightweight, durable underlayment solutions suitable for steep-slope and tile roofing is opening new product development avenues. Customized underlayments engineered for high-temperature environments and heavy rainfall regions are gaining traction. Strategic partnerships with roofing contractors and distributors have enabled integrated service models, improving market penetration. Subscription-based replacement programs for property management firms and large housing developers are also creating recurring revenue opportunities for leading underlayment brands.

The shift from traditional asphalt-saturated felt toward advanced synthetic membranes has become a dominant trend due to higher durability, tear strength, and water resistance. Products with enhanced UV stability and slip-resistant surfaces are gaining preference among contractors for faster and safer installation. Growth in high-pitch roofing systems has led to the adoption of reinforced underlayment sheets, which provide superior anchoring and load-bearing capacity. Design integration of multilayer membranes for combined vapor control and moisture protection is becoming more prevalent. Increased focus on fire-rated and heat-resistant underlayment products supports their application in regions prone to extreme climatic conditions. The market trajectory indicates a strong emphasis on innovation-driven performance upgrades in upcoming roofing solutions.

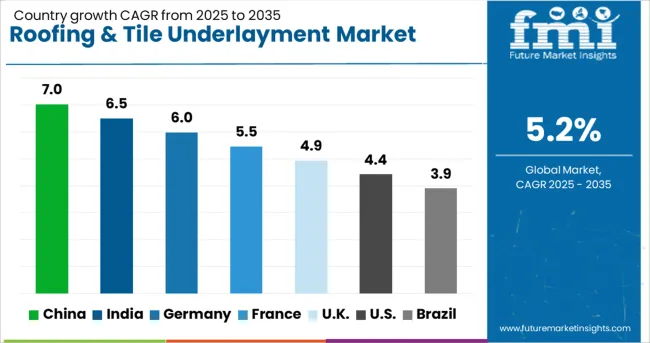

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

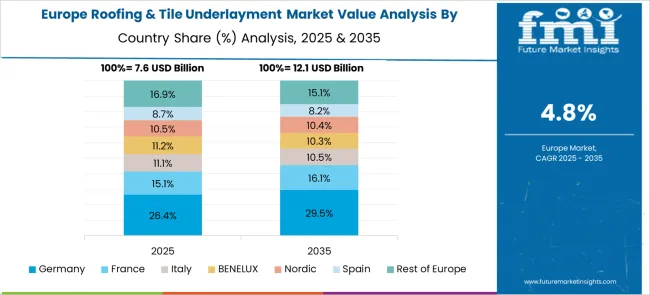

The roofing & tile underlayment market is projected to expand at a CAGR of 5.2% from 2025 to 2035, driven by the adoption of weather-resistant underlayment solutions, moisture protection technologies, and energy-efficient roofing systems. China, part of BRICS, leads with a 7.0% CAGR, supported by large-scale residential construction and infrastructure investments focused on high-performance synthetic membranes. India, also within BRICS, follows at 6.5% CAGR, driven by smart housing initiatives, affordable housing projects, and the rise of polymer-based underlayments in urban roofing. Germany, a core OECD economy, posts 6.0%, supported by energy-compliance programs, advanced roof renovation projects, and demand for eco-compliant synthetic products. France records 5.5%, driven by retrofitting programs emphasizing lightweight modular membranes for aging building stock. The United Kingdom, part of the OECD, grows at 4.9%, influenced by roof replacement cycles, premium synthetic sheet adoption, and advanced waterproofing technologies. The report includes an assessment of more than 40 countries, with five leading markets analyzed below.

China is forecast to achieve a 7.0% CAGR, significantly higher than the global average of 5.2%, driven by expanding urban construction and large-scale housing projects. Rapid development in commercial real estate and government-backed infrastructure initiatives is boosting demand for high-performance roofing systems. Increased awareness of water damage prevention and insulation efficiency is creating a strong preference for synthetic underlayments over traditional felt options. Manufacturers are focusing on advanced polymer-based materials to address climate durability and long-term performance. Export opportunities are also growing as Chinese suppliers target Southeast Asian markets, where cost-effective solutions dominate procurement strategies.

India is projected to grow at a 6.5% CAGR, supported by increasing adoption of energy-efficient and moisture-protection materials in new housing projects. Rapid growth in residential construction and smart city developments is driving consistent demand for advanced roofing solutions. Government initiatives focused on affordable housing under schemes like PMAY have boosted large-scale procurement of underlayment products. Rising adoption of lightweight synthetic variants and breathable membranes is observed among urban contractors for long-term protection in monsoon-prone areas. Domestic manufacturers are expanding product portfolios with UV-resistant and anti-slip properties to meet evolving customer preferences.

Germany is expected to register a 6.0% CAGR, driven by building energy codes and demand for high-performance roofing systems in residential and commercial sectors. Renovation projects under Europe’s green building programs are increasing the adoption of breathable membranes and synthetic roofing layers. Manufacturers are introducing recyclable and low-emission products to comply with environmental regulations. Heavy rainfall and snow-prone regions are favoring underlayments with superior water-shedding and thermal resistance features. Demand from industrial and warehouse construction segments also supports market growth, creating opportunities for premium-grade solutions designed for long service life.

France is projected to grow at 5.5%, slightly above the global average, driven by energy-efficiency requirements and the renovation of aging housing stock. Government subsidies for energy-saving retrofits have increased the use of roofing underlayments with thermal insulation benefits. Demand for lightweight synthetic membranes with improved ventilation capabilities is rising in both residential and commercial segments. French manufacturers are focusing on advanced product designs such as multi-layer underlayments and anti-slip coatings for enhanced safety during installation. Export opportunities within the EU further support long-term market growth for specialized roofing systems.

The United Kingdom is expected to record a 4.9% CAGR, slightly below the global average, influenced by steady demand from roof replacement and renovation projects. Adoption of underlayment products with enhanced waterproofing and condensation control features is growing in line with regulatory standards for energy efficiency. Construction activity in commercial real estate and public sector infrastructure projects is creating consistent procurement opportunities. Manufacturers are introducing lightweight membranes and vapor-permeable layers to meet modern building performance requirements. Digital platforms for material distribution are emerging as a significant channel for contractors and retailers.

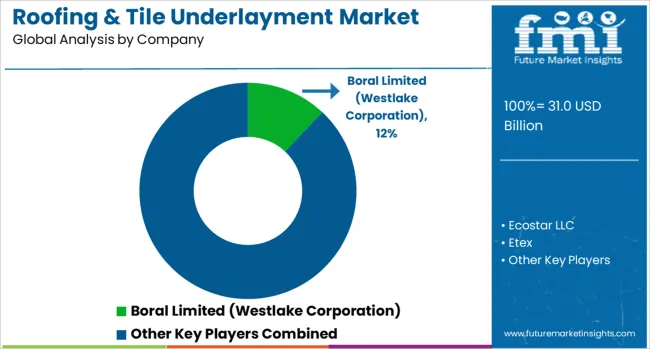

The roofing and tile underlayment market is highly competitive, featuring global and regional players such as Boral Limited (Westlake Corporation), Ecostar LLC, Etex, Atlas Roofing Corporation, Entegra Roof Tiles, Crown Roof Tiles, Hongbo Roof Tiles, Brava Roof Tile, IKO Industries Ltd., Ross Roof Group, Eagle Roofing, and Red Land Tiles. The market structure is moderately fragmented, with companies competing on product performance, material innovation, and cost efficiency. Leading firms like Boral (Westlake) and Etex dominate through advanced underlayment technologies tailored for both residential and commercial roofing, offering superior moisture resistance, thermal stability, and durability. Atlas Roofing and IKO Industries focus on asphalt-based and synthetic underlayment solutions optimized for steep-slope applications, while Brava Roof Tile and Eagle Roofing emphasize premium, lightweight products suitable for high-end and sustainable architectural projects.

Regional brands such as Hongbo Roof Tiles and Ross Roof Group cater to localized markets with competitively priced offerings and quick supply capabilities. Differentiation drivers include enhanced weatherproofing properties, UV resistance, ease of installation, and compatibility with diverse roofing systems. Strategic priorities among top players involve expanding production capacity, investing in polymer-modified underlayment, and adopting digital distribution to strengthen contractor and retailer engagement. Industry rivalry is intensified by regulatory compliance related to fire safety, energy efficiency, and environmental performance standards, particularly in North America and Europe.

Future growth will be driven by the rising trend toward synthetic and self-adhering underlayments, integration of reflective technologies for energy savings, and increased adoption in reroofing projects, positioning innovation-oriented companies as key beneficiaries in this evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.0 Billion |

| Product Type | Non-bitumen synthetic underlayment, Asphalt-saturated felt, and Rubberized asphalt |

| Application | Residential, Commercial, and Industrial |

| Installation Type | Mechanically attached and Self-adhesive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boral Limited (Westlake Corporation), Ecostar LLC, Etex, Atlas Roofing Corporation, Entegra Roof Tiles, Crown Roof Tiles, Hongbo Roof Tiles, Brava Roof Tile, IKO Industries Ltd., Ross Roof Group, Eagle Roofing, and Red Land Tiles |

| Additional Attributes | Dollar sales by product type (asphalt-saturated felt, synthetic underlayment, and self-adhering membranes) and application (residential roofing, commercial roofing, and specialty tile systems), with demand driven by improved moisture resistance, ease of installation, and extended roof lifespan. Regional trends highlight strong growth in North America and Europe due to reroofing projects and stringent building codes, while Asia-Pacific witnesses rapid adoption in urban construction and infrastructure developments. Innovation focuses on lightweight composite materials, UV-resistant coatings, and self-adhesive technologies to enhance performance, reduce installation time, and improve energy efficiency. |

The global roofing & tile underlayment market is estimated to be valued at USD 31.0 billion in 2025.

The market size for the roofing & tile underlayment market is projected to reach USD 51.5 billion by 2035.

The roofing & tile underlayment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in roofing & tile underlayment market are non-bitumen synthetic underlayment, asphalt-saturated felt and rubberized asphalt.

In terms of application, residential segment to command 61.8% share in the roofing & tile underlayment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roofing Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Roofing Anchors Market Size and Share Forecast Outlook 2025 to 2035

Roofing Underlay Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Roofing Shingles Market

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Holding and Proofing Cabinets Market - Temperature Control & Bakery Solutions 2025 to 2035

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Automotive Sound Proofing Material Market

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA