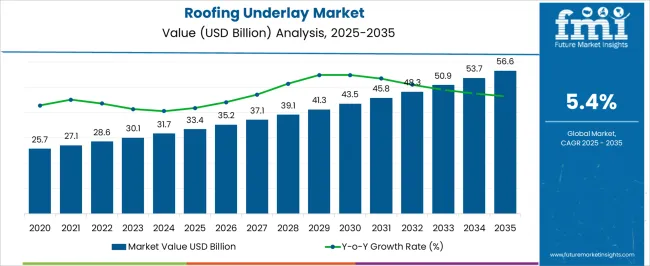

The roofing underlay market is projected to grow from USD 33.4 billion in 2025 to USD 56.6 billion by 2035, with a CAGR of 5.4%. A rolling CAGR analysis reveals steady growth with consistent contributions over the forecast period. Between 2025 and 2030, the market grows from USD 33.4 billion to USD 43.5 billion, contributing USD 10.1 billion in growth, with a CAGR of 6.0%. This early-phase acceleration is driven by increasing demand for roofing underlay in residential, commercial, and industrial construction, particularly as the need for better energy efficiency, waterproofing, and durability in roofing materials rises. Innovations in roofing technology, combined with rising construction activities globally, contribute to this growth. From 2030 to 2035, the market continues to expand, moving from USD 43.5 billion to USD 56.6 billion, adding USD 13.1 billion in growth, with a slightly lower CAGR of 4.5%. This phase reflects a deceleration in growth as the market matures and the widespread adoption of advanced underlay materials becomes the norm. The later-stage growth is driven by technological innovations in roofing underlays, such as eco-friendly materials and improved moisture barriers, alongside sustained demand from the construction industry. The overall rolling CAGR analysis shows a strong early-stage acceleration followed by stable, consistent growth as the market reaches maturity.

| Metric | Value |

|---|---|

| Roofing Underlay Market Estimated Value in (2025 E) | USD 33.4 billion |

| Roofing Underlay Market Forecast Value in (2035 F) | USD 56.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The roofing underlay market is growing steadily, driven by the rising demand for durable and weather-resistant roofing solutions in construction. The increasing emphasis on energy efficiency and building safety has encouraged the adoption of advanced underlay materials that protect structures from moisture, wind, and temperature fluctuations.

Non-bitumen synthetic underlays have gained popularity for their superior durability, lightweight nature, and breathability compared to traditional bitumen-based products. The surge in residential construction, particularly in urban and suburban areas, has significantly contributed to market growth.

Builders and contractors are favoring roofing underlays that enhance roof longevity while complying with evolving building codes and environmental standards. Innovations in material technology and increased consumer awareness about sustainable construction are expected to further support market expansion. Residential construction remains the primary application, reflecting the consistent demand for reliable roofing components in new housing projects and renovations.

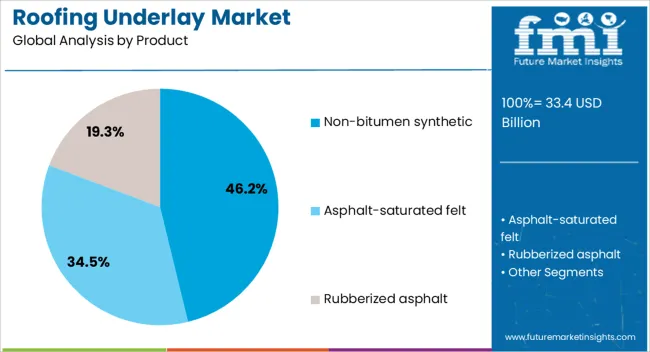

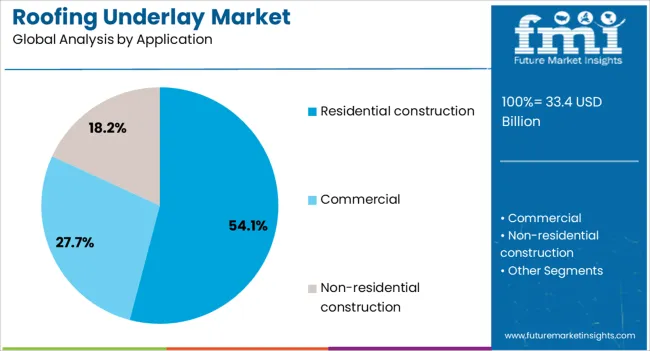

The roofing underlay market is segmented by product, application, and region. By product, it is divided into non-bitumen synthetic, asphalt-saturated felt, and rubberized asphalt. In terms of application, the market is classified into residential construction, commercial, and non-residential construction. Regionally, the roofing underlay industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Non-bitumen Synthetic segment is expected to hold 46.2% of the roofing underlay market revenue in 2025, establishing its position as the leading product type. This segment’s growth is attributed to the enhanced performance characteristics offered by synthetic materials, including high tensile strength, resistance to UV degradation, and superior water repellency.

These underlays provide better protection against water ingress while allowing vapor to escape, preventing mold and structural damage. Their lightweight nature facilitates easier installation, reducing labor costs and installation time.

Additionally, synthetic underlays are less prone to tearing during handling compared to traditional felt underlays. Growing builder preference for materials that combine durability with ease of use is driving this segment’s expansion. As roofing standards tighten and demand for resilient roofing systems grows, non-bitumen synthetic underlays are expected to dominate the market.

The Residential Construction segment is projected to contribute 54.1% of the roofing underlay market revenue in 2025, maintaining its leadership as the key application. This segment’s growth is supported by the steady increase in new housing developments and renovations, especially in emerging urban areas.

Homeowners and builders prioritize roofing materials that offer long-term protection, energy efficiency, and compliance with safety standards. The expanding middle-class population and government incentives for housing projects have accelerated residential construction activities.

Moreover, the focus on sustainable building practices has increased the use of advanced roofing underlays that improve insulation and moisture control. As residential construction continues to grow in scale and sophistication, demand for effective roofing underlay solutions is expected to remain robust.

The roofing underlay market is experiencing growth driven by increasing construction activities, particularly in residential, commercial, and industrial sectors. Roofing underlay serves as a protective layer beneath roofing materials, ensuring durability, water resistance, and thermal insulation. The demand for energy-efficient and weather-resistant roofing solutions is promoting the adoption of advanced underlay materials, including breathable and non-breathable types. As the construction industry focuses on improving building quality, and energy efficiency, the roofing underlay market continues to expand. Despite challenges such as fluctuating raw material costs, innovation in material technology presents new opportunities for market growth.

The growth of the roofing underlay market is primarily driven by rising construction demand across residential, commercial, and industrial sectors. With an increasing emphasis on energy-efficient and durable building materials, the demand for advanced roofing solutions, including underlays, is also rising. Roofing underlays provide essential protection by preventing water infiltration, improving thermal insulation, and contributing to the overall lifespan of roofing systems. As governments and regulatory bodies impose stricter building codes for energy efficiency and insulation, the need for high-quality, reliable roofing materials, including underlays, is intensifying. The growing trend of green building practices and eco-friendly construction methods further fuels the demand for sustainable roofing solutions, increasing the adoption of underlay materials that enhance both performance and energy efficiency.

A key challenge in the roofing underlay market is the volatility of raw material prices, particularly for synthetic and natural fibers used in underlay production. These price fluctuations, driven by global supply chain disruptions and fluctuations in commodity costs, can make it difficult for manufacturers to maintain stable pricing for consumers. The complexity of installation and compatibility with various roofing materials can pose challenges. Some underlay materials require professional installation, which can increase the overall cost and labor requirements for construction projects. As a result, market growth may be constrained in cost-sensitive regions or for projects where budget constraints limit the adoption of higher-performance underlay solutions.

The roofing underlay market presents significant opportunities through innovations in material technology and the expanding construction sector in emerging markets. New developments in materials, such as breathable and non-breathable underlays, offer improved performance, including better moisture resistance, energy efficiency, and ease of installation. These innovations are making roofing underlays more attractive to consumers and contractors alike. Rapid urbanization and industrialization in emerging economies such as Asia-Pacific, Africa, and Latin America are driving demand for modern construction techniques, which include advanced roofing solutions. As these regions develop their infrastructure, there is substantial opportunity for manufacturers to introduce high-quality, durable underlays that meet the growing need for reliable roofing systems in new housing, commercial, and industrial developments.

A significant trend in the roofing underlay market is the increasing adoption of energy-efficient and eco-friendly solutions. With rising awareness about climate change and the environmental impact of construction practices, there is growing demand for underlays made from sustainable, recyclable, and non-toxic materials. Roofing underlays with enhanced thermal insulation properties are gaining popularity, as they help improve energy efficiency and reduce heating and cooling costs in buildings. The integration of smart materials, such as reflective underlays that help regulate indoor temperatures, is another trend contributing to the growing interest in energy-efficient solutions. As regulations become more stringent around energy conservation, the demand for roofing underlays that improve insulation and reduce energy consumption will continue to rise, especially in the residential and commercial sectors.

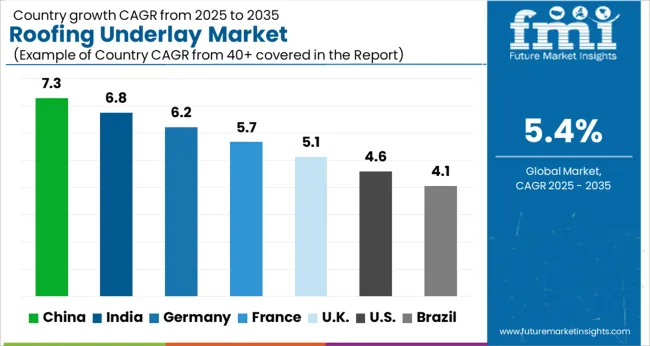

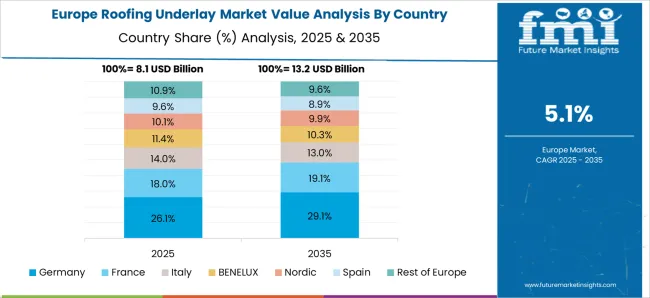

The roofing underlay market is projected to grow at a global CAGR of 5.4% from 2025 to 2035. China leads with a growth rate of 7.3%, followed by India at 6.8%. France records a growth rate of 5.7%, while the UK is expected to grow at 5.1%. The United States shows a growth rate of 4.6%. The market is driven by rising demand in both residential and commercial construction sectors, with a particular focus on durable and efficient roofing materials. Emerging economies like China and India are expanding rapidly in the construction sector, while developed markets like the UK, France, and the USA continue to prioritize advanced roofing solutions for energy efficiency and durability. The analysis spans 40+ countries, with the leading markets highlighted below.

China is projected to grow at a CAGR of 7.3% through 2035, leading the roofing underlay market. The country’s rapid urbanization, ongoing construction boom, and focus on sustainability are key drivers of market growth. The demand for roofing underlays is increasing as China invests heavily in both residential and commercial real estate projects. The increasing awareness about energy-efficient and durable building materials, along with growing infrastructure projects, is also supporting the market’s expansion. As construction standards in China improve, the demand for high-performance roofing underlays continues to rise.

India is projected to grow at a CAGR of 6.8% through 2035, driven by the country’s rapid construction growth, particularly in residential and commercial sectors. The rising population and increasing urbanization in India are boosting demand for durable roofing materials, including roofing underlays. India’s growing focus on energy efficiency, driven by government initiatives and rising awareness of sustainable construction practices, is further accelerating the adoption of roofing underlay products. The expansion of infrastructure, coupled with increased private sector investments in real estate, provides a significant growth opportunity for roofing underlay manufacturers.

France is projected to grow at a CAGR of 5.7% through 2035, driven by the increasing adoption of advanced construction materials. The demand for roofing underlays in France is influenced by the country’s focus on improving building energy efficiency and the ongoing construction of new residential and commercial buildings. The renovation and retrofitting of old buildings are driving demand for roofing underlay solutions. The French market is also seeing increased adoption of eco-friendly and energy-efficient building materials, aligning with rising environmental concerns.

The United Kingdom is projected to grow at a CAGR of 5.1% through 2035, with demand for roofing underlays driven by the increasing adoption of modern construction techniques and materials. The UK construction sector is expanding, with particular emphasis on energy-efficient building solutions. The country’s growing focus on green building certifications and energy-efficient homes has increased the demand for roofing underlays that enhance insulation and overall building performance. Government regulations and private investments in infrastructure and residential projects further support the market’s growth.

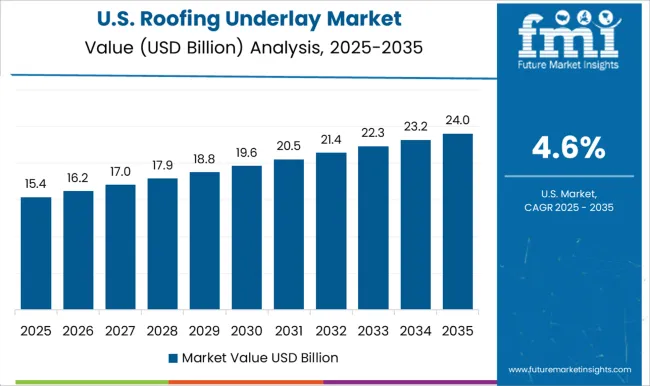

The United States is projected to grow at a CAGR of 4.6% through 2035, with demand driven by the growing focus on sustainable and energy-efficient construction. The USA construction industry continues to adopt advanced roofing solutions, with roofing underlays becoming a critical component in improving building energy performance. The demand for roofing underlays in the USA is also driven by the growing renovation market, which seeks to upgrade old structures with energy-efficient solutions. Rising building codes and environmental standards contribute significantly to the market’s expansion.

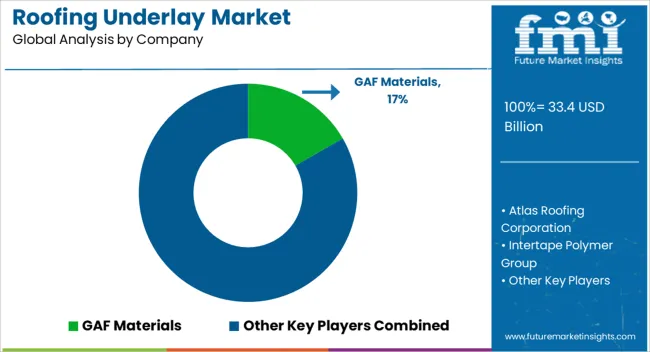

The roofing underlay market is driven by key manufacturers that offer innovative solutions to improve the durability, energy efficiency, and protection of roofs. GAF Materials is a market leader, known for its wide range of roofing underlay products that provide excellent water resistance and UV protection, contributing to improved roof performance and longevity. Atlas Roofing Corporation offers high-performance underlays designed to meet the demanding needs of both residential and commercial roofing systems, with a focus on superior protection and ease of installation. Intertape Polymer Group provides high-quality roofing underlays that ensure weather resistance, waterproofing, and energy efficiency, addressing the growing demand for reliable roofing solutions. Braas Monier Building Corporation and Duro-Last Inc. specialize in manufacturing roofing underlays for commercial applications, offering solutions that focus on protection against extreme weather conditions, such as heavy rain, snow, and strong winds. Carlisle Companies Inc. offers roofing underlays known for their moisture protection, UV resistance, and durability, catering to the commercial roofing sector.

Johns Manville and CertainTeed Corporation provide advanced roofing underlay products that contribute to energy efficiency and enhance building comfort by minimizing heat loss and moisture infiltration. VaproShield focuses on offering breathable underlays that allow for moisture management and vapor control while maintaining roof insulation performance. DuPont de Numerous, Inc., Tamko Building Products, Inc., and Gardner Gibson offer roofing underlays designed for residential and commercial markets, emphasizing moisture resistance, ease of installation, and long-lasting durability. Polyglass and Tarco provide highly effective underlays that ensure weather protection and roofing stability. Owens Corning and MFM Building Products Mfg. offer durable roofing underlay products designed for both residential and commercial sectors, with a focus on enhancing thermal insulation and moisture protection. Boral Roofing LLC, Keene Building Products, IKO Industries, Inc., and GCP Applied Technologies Inc. provide a diverse portfolio of roofing underlays that meet specific environmental standards, offering solutions that are lightweight, strong, and resistant to extreme conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Non-bitumen synthetic, Asphalt-saturated felt, and Rubberized asphalt |

| Application | Residential construction, Commercial, and Non-residential construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GAF Materials, Atlas Roofing Corporation, Intertape Polymer Group, Braas Monier Building Corporation, Duro-Last Inc, Carlisle Companies Inc, Johns Manville, Certain Teed Corporation, VaproShield, DuPont de Numerous, Inc, Tamko Building Products, Inc, Gardner Gibson, Polyglass, Tarco, Owens Corning, MFM Building Products Mfg., Boral Roofing LLC, Keene Building Products, IKO Industries, Inc, and GCP Applied Technologies Inc |

| Additional Attributes | Dollar sales by product type (synthetic underlays, felt underlays, reflective underlays, breathable membranes) and end-use segments (residential, commercial, industrial). Demand dynamics are influenced by increasing construction activities, the rise in sustainable and energy-efficient roofing solutions, and the growing need for weather-resistant roofing materials. Regional trends indicate strong growth in North America and Europe, driven by high demand for durable, weather-resistant roofing systems, while Asia-Pacific is expanding due to rapid urbanization and infrastructure development. |

The global roofing underlay market is estimated to be valued at USD 33.4 billion in 2025.

The market size for the roofing underlay market is projected to reach USD 56.6 billion by 2035.

The roofing underlay market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in roofing underlay market are non-bitumen synthetic, asphalt-saturated felt and rubberized asphalt.

In terms of application, residential construction segment to command 54.1% share in the roofing underlay market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roofing & Tile Underlayment Market Size and Share Forecast Outlook 2025 to 2035

Roofing Material Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Roofing Anchors Market Size and Share Forecast Outlook 2025 to 2035

Roofing Chemicals Market Size & Trends 2025 to 2035

Roofing Shingles Market

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Holding and Proofing Cabinets Market - Temperature Control & Bakery Solutions 2025 to 2035

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Automotive Sound Proofing Material Market

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA