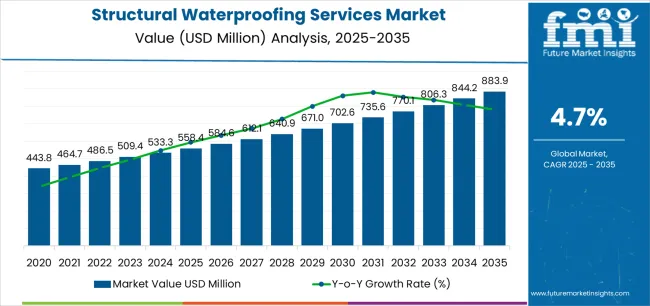

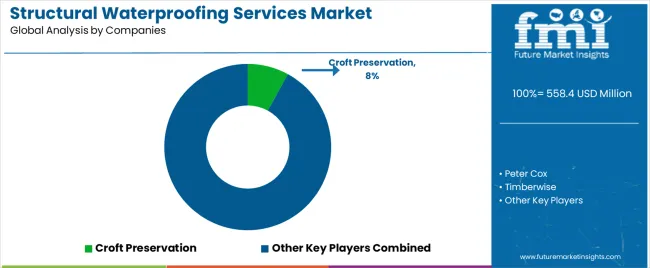

The global structural waterproofing services market is valued at USD 558.4 million in 2025. It is slated to reach USD 883.9 million by 2035, recording an absolute increase of USD 325.5 million over the forecast period. Demand translates into a total growth of 58.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.58X during the same period, supported by increasing building deterioration in aging infrastructure, growing awareness of moisture-related structural damage prevention, and rising emphasis on property preservation and value protection across diverse residential, commercial, and industrial construction applications.

Between 2025 and 2030, the structural waterproofing services market is projected to expand from USD 558.4 million to USD 670.1 million, resulting in a value increase of USD 111.7 million, which represents 34.3% of the total forecast growth for the decade. This phase of development will be shaped by increasing building maintenance expenditure and property renovation activity, rising awareness of damp-related health hazards and structural integrity concerns, and growing demand for comprehensive waterproofing solutions addressing basement seepage, rising damp, and roof penetration issues. Property maintenance contractors and waterproofing specialists are expanding their service capabilities to address the growing demand for effective moisture control solutions that ensure building longevity and occupant safety.

From 2030 to 2035, the market is forecast to grow from USD 670.1 million to USD 883.9 million, adding another USD 213.8 million, which constitutes 65.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of climate change adaptation measures addressing increased precipitation and flooding risks, the development of smart building technologies integrating moisture monitoring and early detection systems, and the growth of sustainable waterproofing materials and methods supporting environmental performance objectives. The growing adoption of preventive maintenance strategies and building lifecycle management approaches will drive demand for structural waterproofing services with enhanced durability and long-term performance features.

Between 2020 and 2025, the structural waterproofing services market experienced steady growth, driven by increasing recognition of moisture ingress as a primary cause of building deterioration and growing acceptance of professional waterproofing intervention as essential property maintenance in responsible building ownership. The market developed as property owners and facility managers recognized the potential for structural waterproofing services to prevent foundation damage, eliminate damp-related health risks, and preserve property value while addressing insurance requirements. Technological advancement in membrane systems and chemical injection techniques began emphasizing the critical importance of maintaining building envelope integrity and preventing costly structural repairs in residential, commercial, and heritage building applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 558.4 million |

| Forecast Value in (2035F) | USD 883.9 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

Market expansion is being supported by the increasing prevalence of aging building stock in developed markets requiring remedial waterproofing interventions driven by deteriorating building envelopes and failing historical waterproofing systems, alongside the corresponding need for professional services that can diagnose moisture problems, implement effective remediation strategies, and provide long-term warranties across various residential property, commercial facility, and industrial structure applications. Modern property owners and facility managers are increasingly focused on implementing structural waterproofing solutions that can eliminate water ingress, prevent structural deterioration, and maintain healthy indoor environments through comprehensive moisture control.

The growing emphasis on property value preservation and investment protection is driving demand for professional waterproofing services that can address basement flooding, rising damp penetration, and roof leakage issues while ensuring comprehensive building protection. Building owners' preference for guaranteed solutions that combine technical expertise with warranty-backed performance and insurance-compliant workmanship is creating opportunities for innovative structural waterproofing implementations. The rising influence of climate change impacts and increasing precipitation intensity is also contributing to increased adoption of waterproofing services that can provide enhanced protection without compromising building integrity or occupant comfort.

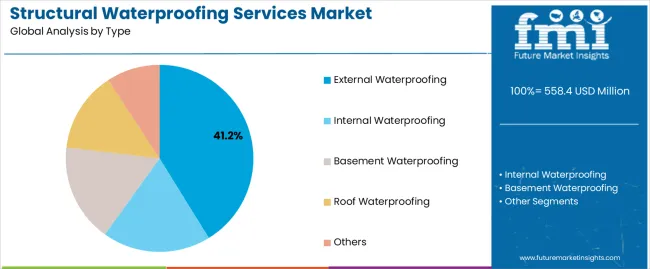

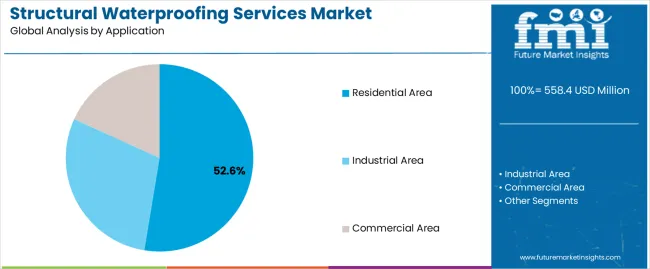

The market is segmented by type, application, and region. By type, the market is divided into external waterproofing, internal waterproofing, basement waterproofing, roof waterproofing, and others. Based on application, the market is categorized into residential area, industrial area, and commercial area. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The external waterproofing segment is projected to maintain its leading position in the structural waterproofing services market in 2025 with a 41.2% market share, reaffirming its role as the preferred service category for comprehensive building envelope protection and foundation moisture barrier applications. Property owners and maintenance contractors increasingly utilize external waterproofing methods for their superior effectiveness in preventing water ingress at source, comprehensive foundation protection capabilities, and proven long-term performance in eliminating basement dampness and structural moisture problems. External waterproofing technology's proven effectiveness and application versatility directly address the property requirements for permanent moisture control solutions and foundation preservation across diverse building types and soil conditions.

This service segment forms the foundation of comprehensive building protection, as it represents the approach with the greatest contribution to permanent moisture problem resolution and established reliability record across multiple building applications and foundation configurations. Construction industry investments in excavation equipment and membrane installation technologies continue to strengthen adoption among property restoration specialists and foundation repair contractors. With building surveys identifying external water pressure as the primary moisture ingress mechanism, external waterproofing aligns with both technical best practices and long-term property protection objectives, making it the central component of comprehensive structural moisture management strategies.

The residential area application segment is projected to represent the largest share of structural waterproofing services demand in 2025 with a 52.6% market share, underscoring its critical role as the primary driver for waterproofing service adoption across single-family homes, multi-family dwellings, and residential basement conversions requiring habitable space protection. Homeowners prefer professional waterproofing services for residential properties due to their ability to eliminate damp-related health hazards, protect property investment value, and create usable living space from previously damp basements while addressing insurance requirements and property survey recommendations. Positioned as essential property maintenance services for building owners, structural waterproofing offers both property protection and value enhancement benefits.

The segment is supported by continuous growth in property renovation activity and the expanding awareness of damp-related health impacts including mold growth and respiratory problems affecting occupant wellbeing. Additionally, property owners are investing in comprehensive waterproofing programs to address increasingly stringent building regulations and mortgage lender requirements for damp-free properties. As climate change increases precipitation levels and property maintenance standards advance, the residential area application will continue to dominate the market while supporting property value preservation and occupant health optimization strategies.

The structural waterproofing services market is advancing steadily due to increasing building stock age in established markets requiring remedial intervention driven by deteriorating waterproofing systems and historical construction methods lacking adequate moisture protection, and growing adoption of basement conversion projects requiring comprehensive waterproofing enabling residential expansion and property value enhancement across diverse urban, suburban, and rural property applications. However, the market faces challenges, including high service costs creating affordability barriers for property owners, competition from DIY waterproofing products marketed to cost-conscious homeowners, and market fragmentation related to varying building construction methods and regional moisture problem characteristics. Innovation in application technologies and warranty-backed service offerings continues to influence market development and competitive positioning patterns.

The growing demand for additional living space in existing properties is driving increased basement conversion activity requiring comprehensive structural waterproofing enabling transformation of damp storage areas into habitable rooms including home offices, entertainment spaces, and rental units. Property owners are increasingly recognizing the value creation potential of basement conversion projects that deliver significant additional square footage without property footprint expansion or planning permission complications. Waterproofing contractors are experiencing growing project volumes from basement conversion specialists and property developers seeking reliable moisture control solutions supporting building regulation compliance and long-term space usability, creating opportunities for comprehensive waterproofing system installations combining tanking systems, cavity drainage, and ventilation solutions. Urban property market pressures and remote work trends continue to accelerate basement conversion adoption and corresponding waterproofing service demand.

Modern structural waterproofing is incorporating smart building technologies and digital moisture monitoring capabilities to enhance diagnostic accuracy, enable predictive maintenance, and provide ongoing performance verification through integrated sensor networks and remote monitoring platforms. Leading contractors are developing digital inspection methodologies utilizing thermal imaging, moisture meters, and building information modeling that improve problem identification, optimize solution design, and support evidence-based client communication. These technological approaches improve service quality while enabling new business models including subscription-based monitoring services, proactive maintenance contracts, and data-driven warranty programs that differentiate professional contractors from basic waterproofing providers. Advanced technology integration also allows contractors to demonstrate treatment effectiveness and build long-term client relationships beyond single project transactions.

The advancement of environmentally friendly waterproofing materials, low-VOC chemical formulations, and sustainable application methods is driving demand for eco-conscious structural waterproofing services addressing growing environmental awareness and green building certification requirements. Contractors are investing in training programs and material partnerships that enable delivery of waterproofing solutions meeting environmental standards including reduced carbon footprint, recycled content utilization, and minimal environmental impact throughout product lifecycle. These sustainable approaches create opportunities for differentiated service offerings appealing to environmentally conscious property owners while supporting compliance with evolving building regulations and green construction standards that increasingly mandate sustainable material selection and environmental performance documentation.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

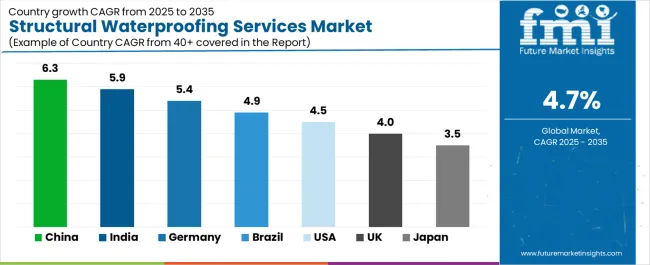

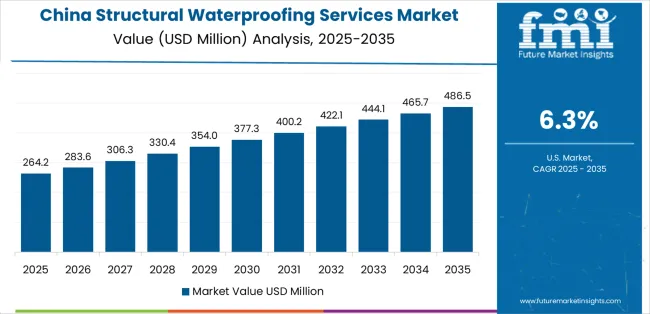

The structural waterproofing services market is experiencing solid growth globally, with China leading at a 6.3% CAGR through 2035, driven by massive urban construction volume, aging building stock in major cities, and increasing property maintenance awareness among growing middle-class homeowners. India follows at 5.9%, supported by expanding urban infrastructure, monsoon-related moisture problems requiring professional intervention, and growing property investment protection awareness. Germany shows growth at 5.4%, emphasizing comprehensive building maintenance culture, stringent building regulations, and established property preservation industry.

Brazil demonstrates 4.9% growth, supported by tropical climate moisture challenges, expanding urban property development, and growing awareness of professional waterproofing importance. The United States records 4.5%, focusing on aging residential building stock, basement finishing activity, and comprehensive property maintenance services. The United Kingdom exhibits 4.0% growth, emphasizing established damp proofing industry and heritage building preservation requirements. Japan shows 3.5% growth, supported by earthquake resilience standards and comprehensive building maintenance protocols.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from structural waterproofing services in China is projected to exhibit exceptional growth with a CAGR of 6.3% through 2035, driven by massive urban building volume and aging property stock requiring remedial waterproofing interventions supported by growing middle-class property ownership and increasing awareness of building maintenance importance. The country's extensive construction activity and rising property maintenance standards are creating substantial demand for professional waterproofing solutions. Major property maintenance contractors and waterproofing specialists are establishing comprehensive service capabilities to serve both residential property owners and commercial property managers.

Revenue from structural waterproofing services in India is expanding at a CAGR of 5.9%, supported by the country's challenging monsoon climate conditions creating severe moisture ingress problems, expanding urban construction activity, and growing awareness of professional waterproofing importance among property developers and homeowners. The country's diverse climate conditions and rapid urban development are driving sophisticated waterproofing service demand throughout metropolitan regions. Leading property maintenance companies and waterproofing contractors are establishing market presence through professional service networks and technical training programs.

Revenue from structural waterproofing services in Germany is expanding at a CAGR of 5.4%, supported by the country's comprehensive building maintenance culture, stringent building regulations requiring proper moisture control, and established property preservation industry providing professional waterproofing services. The nation's advanced construction standards and emphasis on building longevity are driving sophisticated waterproofing service utilization throughout residential and commercial property sectors. Leading property maintenance companies are maintaining strong market presence through established service networks and technical expertise.

Revenue from structural waterproofing services in Brazil is expanding at a CAGR of 4.9%, supported by the country's tropical climate conditions creating persistent moisture challenges, expanding urban property development, and growing awareness of professional waterproofing importance for property protection and value preservation. The nation's diverse climate zones and growing construction activity are driving demand for reliable waterproofing solutions. Property maintenance contractors and waterproofing specialists are investing in market development strategies addressing residential, commercial, and industrial property sectors.

Revenue from structural waterproofing services in the United States is expanding at a CAGR of 4.5%, supported by the country's aging residential building stock, extensive basement finishing activity creating habitable space requirements, and comprehensive property maintenance service industry. The nation's established waterproofing contractor network and sophisticated property owner awareness are driving sustained demand for professional waterproofing solutions. Specialized contractors and national franchise operations maintain extensive market presence through regional service networks and marketing programs.

Revenue from structural waterproofing services in the United Kingdom is expanding at a CAGR of 4.0%, supported by the country's established damp proofing industry, comprehensive building survey requirements for property transactions, and extensive heritage building stock requiring specialized moisture control interventions. The UK's mature property maintenance sector and sophisticated property owner awareness are driving stable waterproofing service demand. Established contractors and specialist property preservation companies maintain market presence through professional accreditation and insurance-approved workmanship.

Revenue from structural waterproofing services in Japan is growing at a CAGR of 3.5%, driven by the country's earthquake resilience standards requiring comprehensive building envelope integrity, aging building stock requiring maintenance interventions, and sophisticated property care culture emphasizing preventive maintenance and building longevity. Japan's construction quality standards and disaster preparedness emphasis are supporting demand for reliable waterproofing services. Established construction companies and specialized contractors maintain market presence through technical expertise and quality-focused service delivery.

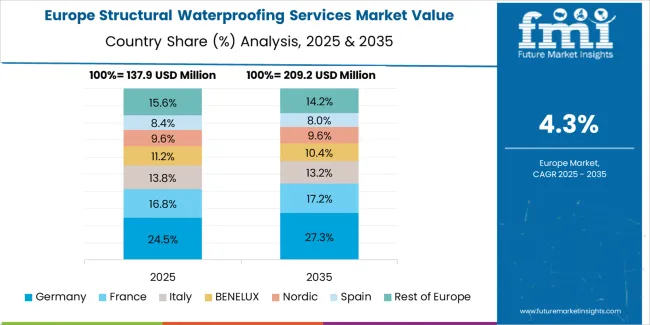

The structural waterproofing services market in Europe is projected to grow from USD 186.2 million in 2025 to USD 284.6 million by 2035, registering a CAGR of 4.3% over the forecast period. The United Kingdom is expected to maintain leadership with a 28.4% market share in 2025, moderating to 27.8% by 2035, supported by established damp proofing industry, comprehensive building survey requirements, and extensive heritage building stock.

Germany follows with 22.6% in 2025, projected at 23.1% by 2035, driven by stringent building regulations, comprehensive maintenance culture, and strong property preservation standards. France holds 16.8% in 2025, expected to reach 17.2% by 2035 supported by heritage building preservation and growing property renovation activity. Italy commands 12.4% in 2025, rising slightly to 12.7% by 2035, while Spain accounts for 9.3% in 2025, reaching 9.5% by 2035 aided by coastal property moisture challenges and expanding property maintenance awareness.

The Netherlands maintains 4.1% in 2025, up to 4.3% by 2035 due to below-sea-level construction challenges and comprehensive water management requirements. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 6.4% in 2025 and 5.4% by 2035, reflecting varied building stock age and waterproofing industry maturity across diverse national markets.

The structural waterproofing services market is characterized by competition among established property preservation specialists, regional waterproofing contractors, and national franchise operations. Companies are investing in technical training programs, warranty-backed service offerings, technology integration, and customer service excellence to deliver reliable, effective, and professionally executed structural waterproofing solutions. Innovation in application methodologies, moisture monitoring technologies, and comprehensive service packages is central to strengthening market position and competitive advantage.

Croft Preservation leads as an established property preservation specialist offering comprehensive structural waterproofing services with emphasis on technical expertise, insurance-approved workmanship, and long-term warranty protection. Peter Cox provides extensive damp proofing and waterproofing services with national coverage and established brand recognition. Timberwise specializes in property preservation including comprehensive waterproofing solutions for residential and commercial properties.

Richardson & Starling offers specialist damp proofing and waterproofing services with focus on heritage buildings and traditional construction. Rentokil Property Care delivers comprehensive property maintenance including structural waterproofing through national service network. Property Conservation Services focuses on specialist property preservation and waterproofing interventions.

MacLennan provides property restoration and waterproofing services for diverse building applications. APP offers comprehensive damp proofing and waterproofing solutions. ProTen specializes in basement waterproofing and foundation protection services. Protectahome delivers property preservation services including structural waterproofing. Advanced Damp focuses on damp proofing and moisture control interventions. SWS provides specialist waterproofing and property preservation services. Basement Systems offers comprehensive basement waterproofing solutions through franchise network. B-Dry specializes in basement waterproofing and foundation repair services. The Basement Doctor provides basement waterproofing and crawl space solutions.

Everdry offers comprehensive basement waterproofing services. AquaGuard specializes in foundation waterproofing and drainage solutions. DryZone provides basement and crawl space waterproofing services. BWS offers comprehensive structural waterproofing solutions. Complete Basements specializes in basement waterproofing and finishing services. DryCORE provides basement waterproofing and moisture control services. Damp Solutions focuses on damp proofing and structural waterproofing. London Waterproofing Solutions offers specialist waterproofing services for urban properties. Pure Basement Systems provides comprehensive basement waterproofing solutions. Trace Basement Systems specializes in basement protection services. AJ Waterproofing Services offers structural waterproofing for diverse property types. Vision Specialist Contracting provides specialist waterproofing and property preservation. Matheson Damp Services focuses on damp treatment and waterproofing solutions. CDI Waterproofing Services offers comprehensive moisture control interventions. Alliance provides property preservation and waterproofing services. Abtech (UK) specializes in structural waterproofing solutions. Arti Structural Waterproofing focuses on comprehensive building protection services.

Structural waterproofing services represent a critical property maintenance segment within building preservation and construction sectors, projected to grow from USD 558.4 million in 2025 to USD 883.9 million by 2035 at a 4.7% CAGR. These specialized services, primarily external and basement waterproofing applications addressing moisture ingress and structural protection, serve as essential interventions in property maintenance where prevention of water damage, elimination of dampness, and preservation of building integrity are critical for property value protection and occupant health. Market expansion is driven by aging building infrastructure requiring remedial intervention, increasing basement conversion activity creating habitable space requirements, growing climate change impacts intensifying precipitation challenges, and rising emphasis on preventive maintenance approaches in property lifecycle management.

How Building Regulators Could Strengthen Standards and Construction Quality?

How Professional Trade Associations Could Advance Industry Standards and Best Practices?

How Service Providers Could Drive Quality and Customer Satisfaction?

How Property Owners Could Optimize Building Protection and Investment Preservation?

How Research Institutions Could Enable Technical Advancement?

How Financial and Insurance Sectors Could Support Property Protection?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 558.4 million |

| Type | External Waterproofing, Internal Waterproofing, Basement Waterproofing, Roof Waterproofing, Others |

| Application | Residential Area, Industrial Area, Commercial Area |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Croft Preservation, Peter Cox, Timberwise, Richardson & Starling, Rentokil Property Care, Property Conservation Services |

| Additional Attributes | Dollar sales by type and application category, regional demand trends, competitive landscape, technological advancements in waterproofing methods, sustainable material development, warranty programs, and property preservation strategies |

The global structural waterproofing services market is estimated to be valued at USD 558.4 million in 2025.

The market size for the structural waterproofing services market is projected to reach USD 883.9 million by 2035.

The structural waterproofing services market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in structural waterproofing services market are external waterproofing, internal waterproofing, basement waterproofing, roof waterproofing and others.

In terms of application, residential area segment to command 52.6% share in the structural waterproofing services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Structural Adhesive Market Outlook & Growth 2025 to 2035

Metal Structural Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Bridge Structural Health Monitoring (SHM) Solution Market Size and Share Forecast Outlook 2025 to 2035

Silicone Structural Glazing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Structural Steel Market Growth - Trends & Forecast 2025 to 2035

Waterproofing Admixtures Market Size and Share Forecast Outlook 2025 to 2035

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA