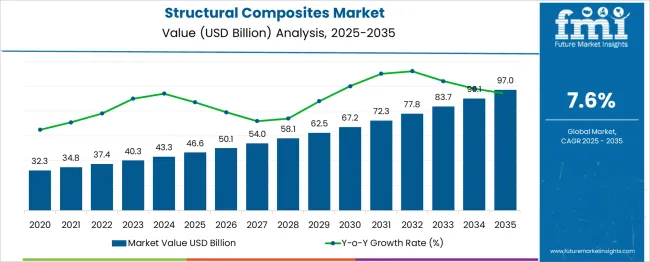

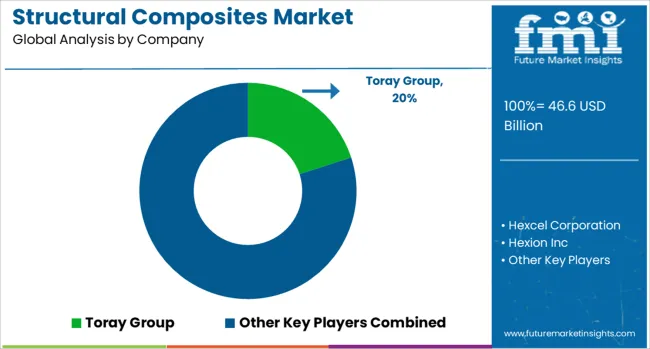

The Structural Composites Market is estimated to be valued at USD 46.6 billion in 2025 and is projected to reach USD 97.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period. The structural composites market is projected to generate an incremental gain of USD 20.6 billion over the first five years, which represents 46.5% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by increasing demand for lightweight, high-strength materials across sectors like aerospace, automotive, and construction. Structural composites are becoming integral to improving fuel efficiency, reducing emissions, and enhancing performance in commercial vehicles, wind turbines, and infrastructure projects, particularly in emerging economies.

The second half (2030-2035) will contribute USD 23.2 billion, representing 53.5% of the total growth, driven by further penetration of structural composites in industries like marine, defense, and renewable energy. Annual increments in the first phase average USD 4.1 billion per year, while later years are expected to see stronger growth driven by technological advancements, regulatory pressures, and the global shift towards sustainable and energy-efficient solutions. Manufacturers focusing on product innovation, recyclability, and cost-effective composites will capture the largest share of this USD 43.8 billion growth opportunity.

| Metric | Value |

|---|---|

| Structural Composites Market Estimated Value in (2025 E) | USD 46.6 billion |

| Structural Composites Market Forecast Value in (2035 F) | USD 97.0 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The structural composites market is witnessing robust momentum driven by rising demand for lightweight, high-strength materials across key industries. Growing emphasis on fuel efficiency, durability, and sustainability is accelerating the shift away from conventional metals toward advanced composites.

Innovations in manufacturing processes and material science are enabling improved performance, cost-effectiveness, and broader applicability of structural composites. Regulatory pressures around emissions reduction and energy efficiency are further propelling adoption, particularly in sectors that prioritize weight reduction without compromising structural integrity.

The future outlook remains positive as ongoing investments in research, expansion of production capacities, and increasing acceptance of composite materials in emerging economies are expected to unlock additional opportunities for growth. Collaborative initiatives between material suppliers and end users are paving the way for customized solutions that meet stringent industry standards and evolving customer requirements.

The structural composites market is segmented by matrix, reinforcement material, sector, and geographic regions. By matrix, the structural composites market is divided into polymer and wood-metal. In terms of reinforcement material, the structural composites market is classified into Glass fiber, Carbon fiber, Aramid fiber, and others. Based on sector, the structural composites market is segmented into Transportation, Construction & infrastructure, Energy, and others. Regionally, the structural composites industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

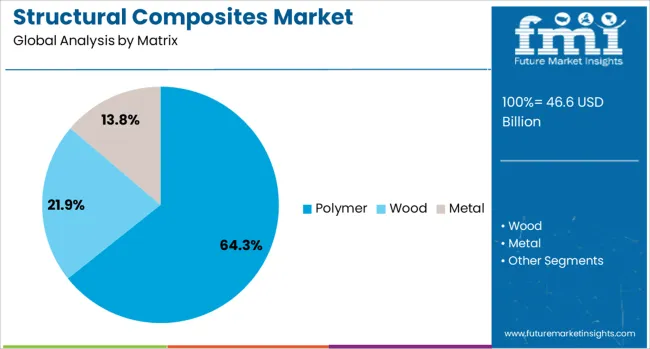

When segmented by matrix, the polymer subsegment is anticipated to hold 64.3% of the total market revenue in 2025, maintaining its leading position. This dominance is attributed to the versatility, cost-efficiency, and favorable mechanical properties offered by polymers compared to alternative matrices.

The widespread adoption of polymer matrices has been reinforced by their compatibility with various reinforcement materials and ease of processing through established techniques such as resin transfer molding and automated layup. Their ability to deliver superior fatigue resistance, corrosion protection, and weight savings has positioned them as the preferred choice for demanding structural applications.

Continuous advancements in polymer formulations enhancing thermal stability and strength have further strengthened their leadership. The adaptability of polymers to diverse design specifications and manufacturing scales has been instrumental in their sustained prominence within the structural composites landscape.

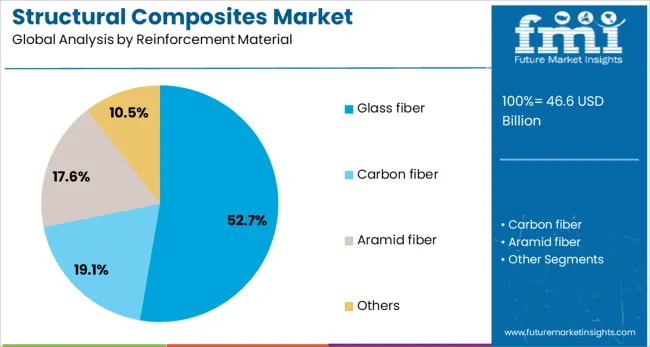

Segmented by reinforcement material, the glass fiber subsegment is projected to account for 52.7% of the structural composites market revenue in 2025, securing its role as the leading reinforcement material. The predominance of glass fiber is supported by its advantageous balance of performance, availability, and cost compared to alternatives.

The material’s high tensile strength, chemical resistance, and lightweight properties have enabled its extensive use in structural components across industries. Its ease of integration with various matrix materials and compatibility with mass-production processes have enhanced its attractiveness to manufacturers.

Technological improvements in fiber manufacturing and surface treatments have elevated the durability and mechanical performance of glass fiber composites. This combination of reliability, affordability, and processability has allowed glass fiber to maintain its leading share and meet the stringent structural demands of end-use sectors.

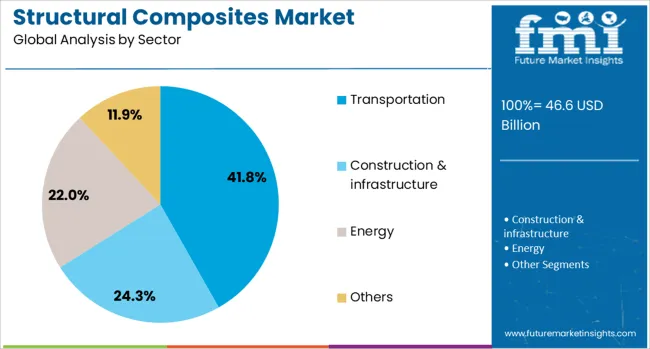

When segmented by sector, transportation is expected to hold 41.8% of the market revenue in 2025, establishing itself as the foremost sector. The leadership of transportation has been shaped by the sector’s critical need to reduce vehicle weight, enhance fuel efficiency, and meet stringent emission standards.

Structural composites have been increasingly incorporated into automotive, aerospace, rail, and marine applications to replace heavier metal components while maintaining or improving strength and durability. The ability of composites to enable innovative designs, reduce assembly complexity, and extend product lifecycles has encouraged their adoption within transportation manufacturing.

Ongoing investments in electrification, autonomous mobility, and next-generation vehicles are further driving demand for lightweight structural solutions. The alignment of composite capabilities with the operational and regulatory imperatives of the transportation sector has reinforced its position as the leading domain in the market.

The structural composites market is driven by growing demand for lightweight, durable materials in aerospace, automotive, and construction industries. Opportunities are rising in both aerospace and automotive applications, while emerging trends toward hybrid and multi-material composites are reshaping the market. However, high production costs and complex manufacturing processes pose challenges. By 2025, overcoming these obstacles through improved manufacturing techniques and cost-effective solutions will be crucial for continued market growth.

The structural composites market is growing due to the increasing demand for lightweight yet durable materials in industries like aerospace, automotive, and construction. Structural composites offer superior strength-to-weight ratios, making them ideal for high-performance applications, particularly in the aerospace and automotive sectors. As manufacturers seek materials that reduce weight while maintaining strength and flexibility, composites are increasingly favored. By 2025, this demand for high-performance, lightweight materials will continue to drive the market.

Opportunities in the structural composites market are rising in the aerospace and automotive sectors. In aerospace, lightweight composites help reduce fuel consumption and improve efficiency, driving demand for these materials. Similarly, in the automotive sector, structural composites are used to produce lightweight, energy-efficient vehicles. By 2025, both industries will continue to contribute to market growth, with increasing adoption of composites in manufacturing high-performance components, improving energy efficiency, and reducing emissions.

Emerging trends in the structural composites market include the growing demand for hybrid and multi-material composite systems. These systems combine the benefits of multiple materials, offering improved performance characteristics such as higher strength, impact resistance, and flexibility. Hybrid composites are becoming increasingly popular in applications where specific properties are required, such as in automotive and marine industries. By 2025, these composite systems are expected to see significant growth, driven by their ability to provide tailored solutions for diverse applications.

Despite growth, challenges related to high production costs and complex manufacturing processes persist in the structural composites market. The production of high-performance composite materials requires specialized equipment and expertise, making them expensive compared to traditional materials. Additionally, complex manufacturing processes can slow production times and increase costs. These factors may limit adoption, especially in industries with tight margins. By 2025, overcoming these challenges through more efficient manufacturing techniques will be essential to expand the market.

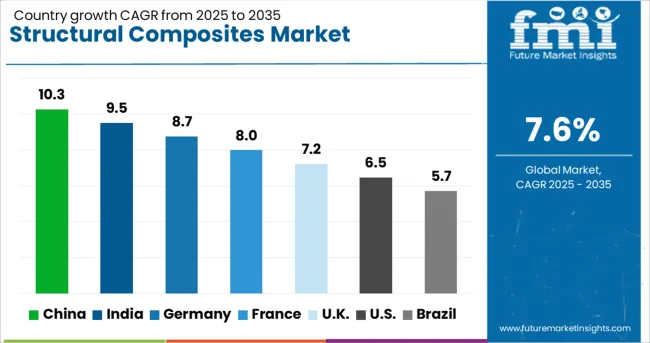

| Country | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global structural composites market is projected to grow at a 7.6% CAGR from 2025 to 2035. China leads with a growth rate of 10.3%, followed by India at 9.5%, and Germany at 8.7%. The United Kingdom records a growth rate of 7.2%, while the United States shows the slowest growth at 6.5%. These varying growth rates are driven by factors such as increasing demand for lightweight, high-performance materials in automotive, aerospace, construction, and industrial applications.

Emerging markets like China and India are seeing higher growth due to rapid industrialization, technological advancements, and rising demand for energy-efficient and sustainable materials, while more mature markets like the USA and the UK experience steady growth driven by established demand in key industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

The structural composites market in China is growing rapidly, with a projected CAGR of 10.3%. China’s expanding manufacturing sector, particularly in automotive, aerospace, and construction industries, is driving significant demand for lightweight, high-performance materials like structural composites.

The country’s growing focus on energy-efficient and sustainable solutions, as well as government support for green technologies, is further accelerating market growth. Additionally, China’s push toward improving the energy efficiency of industrial and transportation systems, along with increasing demand for durable and cost-effective materials, continues to drive the adoption of structural composites.

The structural composites market in India is projected to grow at a CAGR of 9.5%. India’s growing automotive and construction sectors, along with rising industrialization, are driving the demand for advanced materials like structural composites. The increasing focus on energy-efficient, lightweight materials for vehicles and infrastructure, as well as government initiatives to promote sustainable manufacturing, are key contributors to market growth. Additionally, the rise in demand for renewable energy solutions, including wind turbine blades, is boosting the adoption of structural composites in the country’s energy sector.

The structural composites market in Germany is projected to grow at a CAGR of 8.7%. Germany’s well-established automotive, aerospace, and manufacturing industries are major drivers of demand for structural composites, particularly for applications requiring lightweight and high-strength materials. The country’s focus on innovation in materials science, along with its commitment to reducing carbon emissions in the automotive and transportation sectors, supports the continued growth of the market. Additionally, Germany’s investments in renewable energy, particularly in wind energy, further accelerate the adoption of structural composites in energy-efficient applications.

The structural composites market in the United Kingdom is projected to grow at a CAGR of 7.2%. The UK continues to see steady demand for structural composites in the automotive, aerospace, and construction sectors, with increasing emphasis on lightweight, durable, and energy-efficient materials. The country’s focus on sustainability, energy efficiency, and reducing environmental impact is driving the adoption of composite materials in key industries. Additionally, the UK ’s investments in renewable energy projects, particularly in wind and solar energy, continue to contribute to market growth, especially in energy-efficient applications.

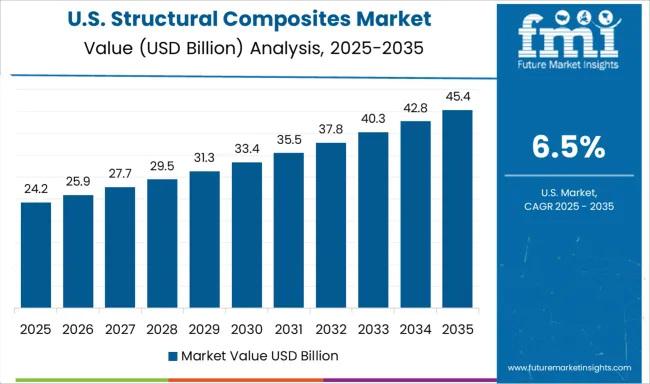

The structural composites market in the United States is expected to grow at a CAGR of 6.5%. The USA remains a key player in the global structural composites market, driven by the aerospace, automotive, and construction industries. The growing demand for lightweight, high-strength materials, particularly in vehicles and infrastructure, supports the market’s growth. Additionally, the increasing adoption of composite materials in renewable energy sectors, such as wind turbines, and a focus on reducing emissions and improving fuel efficiency in transportation systems contribute to the demand for structural composites.

Historically, market leaders such as Toray Group, Hexcel Corporation, and Teijin Limited focused on broad portfolio expansion, high-quality carbon fiber and resin systems, and global distribution networks. Investments were made in R&D to improve tensile strength, fatigue resistance, and temperature tolerance, supporting the adoption of aerospace and automotive applications. Partnerships with OEMs and contract manufacturers ensured integration of composites into large-scale structural applications. Emerging players like Solvay, Huntsman, and Mitsubishi Chemical Holdings initially targeted niche segments such as marine, renewable energy, and specialty industrial components, differentiating through customized materials and smaller-scale, application-specific solutions.

Forecast strategies indicate a shift toward high-value, application-ready solutions that combine material innovation with process efficiency. Leaders plan to scale automated manufacturing, digital quality monitoring, and modular composite systems while targeting electric and lightweight automotive segments. Differentiation levers include bio-based composites, enhanced recyclability, improved strength-to-weight ratios, and integration with additive manufacturing technologies. Growth opportunities are pronounced in electric vehicles, aerospace retrofitting, renewable energy structures, and industrial machinery requiring high durability at lower weight. Strategic alliances, co-development programs, and regional expansion in Asia-Pacific and Europe are expected to accelerate market penetration. Companies capable of delivering tailored, performance-validated composite solutions while optimizing production costs are likely to capture premium share in the evolving structural composites landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.6 Billion |

| Matrix | Polymer, Wood, and Metal |

| Reinforcement Material | Glass fiber, Carbon fiber, Aramid fiber, and Others |

| Sector | Transportation, Construction & infrastructure, Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Group, Hexcel Corporation, Hexion Inc, Teijin Limited, Solvay, Mitsubishi Chemical Holdings Corporation, Huntsman Corporation, Owens Corning, SGL Group, Argosy International Inc, Janicki Industries, and NORPLEX-MICARTA |

| Additional Attributes | Dollar sales by composite type and application, demand dynamics across aerospace, automotive, and construction sectors, regional trends in structural composites adoption, innovation in lightweight and high-strength materials, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy and advanced manufacturing technologies. |

The global structural composites market is estimated to be valued at USD 46.6 billion in 2025.

The market size for the structural composites market is projected to reach USD 97.0 billion by 2035.

The structural composites market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in structural composites market are polymer, wood and metal.

In terms of reinforcement material, glass fiber segment to command 52.7% share in the structural composites market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Structural Adhesive Market Outlook & Growth 2025 to 2035

Geocomposites Market

Metal Structural Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Bridge Structural Health Monitoring (SHM) Solution Market Size and Share Forecast Outlook 2025 to 2035

Dental Composites Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Composites Market

Dynamic Structural Packs Market Size and Share Forecast Outlook 2025 to 2035

CF PEEK Composites Market Size and Share Forecast Outlook 2025 to 2035

APAC Biocomposites Market Growth - Trends & Forecast 2025 to 2035

Plastic Composites Market

Silicone Structural Glazing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Advanced Composites Market Trends - Growth & Forecast 2025 to 2035

Industry Share Analysis for Advanced Composites Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA