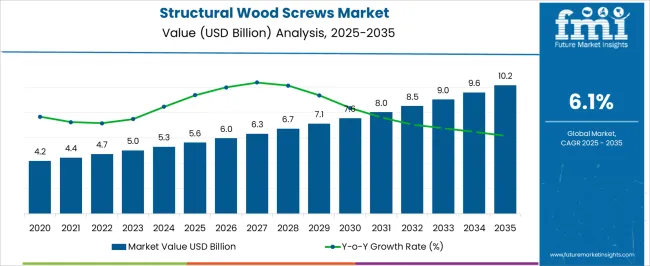

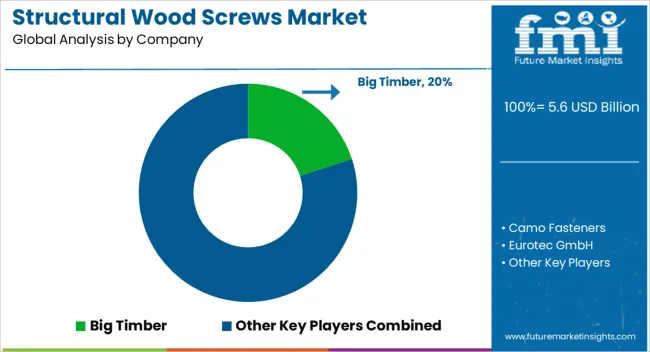

The structural wood screws market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Growth is driven by increasing construction and renovation activities, rising demand for high-strength fasteners, and adoption of engineered wood products in residential, commercial, and industrial applications. Product innovations such as corrosion-resistant coatings, self-drilling designs, and environmentally friendly materials are supporting market expansion. Year-on-year (YoY) growth analysis shows the incremental annual increase across the forecast period. Early years from 2025 to 2027 show steady YoY growth of 5–6%, supported by replacement demand and moderate expansion in North America and Europe, where construction and wood product usage is established.

Between 2028 and 2032, YoY growth accelerates to 6–7% as Asia Pacific and Latin America experience rising adoption driven by urban housing projects, industrial expansion, and infrastructure development. The late stage from 2033 to 2035 sees YoY growth stabilize at around 5–6% as mature markets approach higher penetration levels. North America and Europe contribute steady incremental growth, while Asia Pacific leads in annual gains due to expanding industrial and residential wood applications. Overall, YoY analysis reflects consistent annual growth, with the USD 4.6 billion opportunity reflecting both new installations and replacement cycles between 2025 and 2035.

| Metric | Value |

|---|---|

| Structural Wood Screws Market Estimated Value in (2025 E) | USD 5.6 billion |

| Structural Wood Screws Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The structural wood screws market is primarily driven by the construction and infrastructure sector, which accounts for around 70% of the market share due to ongoing residential, commercial, and industrial projects that require strong and durable fastening solutions. Furniture manufacturing contributes approximately 12%, with screws essential for assembling wooden furniture and cabinetry. The DIY and home improvement sector represents about 8%, reflecting the popularity of home renovation projects. Automotive and aerospace applications account for roughly 5%, while renewable energy projects contribute the remaining 5%, particularly for solar panel mounts and wind turbine structures.

The structural wood screws market is experiencing innovation in design and materials. Self-drilling screws are becoming popular as they remove the need for pre-drilling and reduce installation time. Screws with advanced coatings that resist corrosion and weathering are widely adopted, especially for outdoor applications. Leading manufacturers are focusing on improving thread design and load-bearing capacity while forming partnerships to expand their market presence. Adoption of environmentally friendly materials and manufacturing methods is increasing. These strategies allow companies to meet diverse demands across construction, furniture, and DIY sectors while driving market growth.

The market is witnessing robust demand due to the expanding application of high-performance fasteners in construction, infrastructure upgrades, and prefabricated building systems. Growth has been fueled by increasing adoption of wood as a sustainable structural material and a broader shift toward eco-efficient construction practices across both residential and commercial sectors.

Advancements in screw technology, including thread geometry and material strength, have enhanced the structural integrity and load-bearing capacity of modern wood joinery. Demand has also been supported by rising investments in modular and timber-based construction, along with evolving building codes emphasizing structural reliability.

As construction industries across emerging and developed regions prioritize durable fastening solutions, the need for reliable wood screws is expected to remain consistent The market is positioned for continued growth as manufacturers align product offerings with high-load applications, ease of installation, and compatibility with engineered wood products used in modern architecture and infrastructure development.

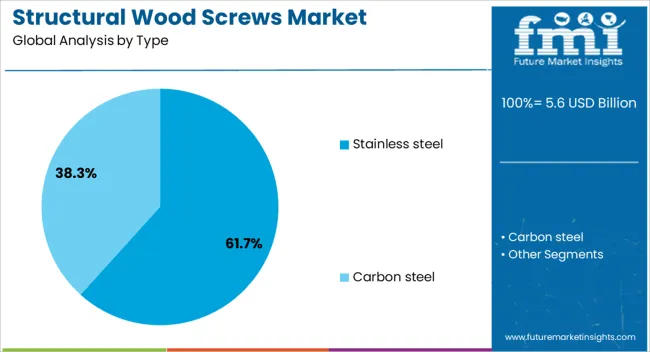

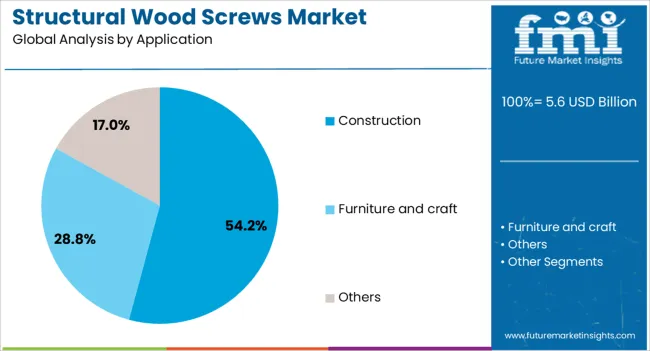

The structural wood screws market is segmented by type, application, and geographic regions. By type, structural wood screws market is divided into stainless steel and carbon steel. In terms of application, structural wood screws market is classified into construction, furniture and craft, and others. Regionally, the structural wood screws industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stainless steel segment is projected to contribute 61.7% of the overall structural wood screws market revenue in 2025, making it the dominant type. This leading share is being driven by the superior corrosion resistance, high tensile strength, and long-term durability offered by stainless steel in varied environmental conditions. The material’s performance in moisture-rich, outdoor, and coastal environments has made it a preferred choice for both structural framing and decking applications.

Its compatibility with treated lumber and engineered wood has further contributed to its adoption in load-bearing structures. The growth of this segment has also been reinforced by increasing construction standards that prioritize material longevity and safety.

As builders seek fastening solutions that reduce maintenance and improve long-term reliability, stainless steel has been favored for its ability to maintain structural integrity over time With sustainability and life-cycle performance becoming key factors in material selection, this segment is expected to retain its dominant position in the years ahead.

The construction application segment is expected to account for 54.2% of the market revenue in 2025, positioning it as the most significant end-use category. This segment’s dominance is being attributed to the widespread use of structural wood screws in framing, flooring, decking, and timber joint assemblies within residential and commercial building projects.

The need for high-strength fastening systems that offer consistent performance under heavy loads has supported the preference for wood screws in construction environments. The segment’s growth has also been influenced by the rise in timber-based construction, where engineered wood products demand specialized fastening solutions.

In addition, trends such as prefabrication and modular construction have favored screw-based systems that allow faster installation and stronger hold compared to traditional methods As building codes continue to evolve with an emphasis on safety and efficiency, the adoption of structural screws in new builds and renovations is anticipated to remain strong, reinforcing the construction segment’s leading role in the market.

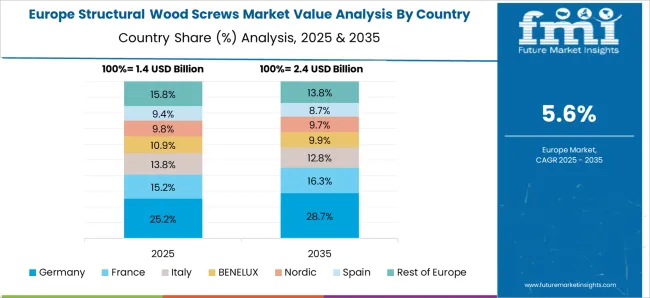

The structural wood screws market is expanding due to increasing construction projects, woodworking demand, and furniture production. Global revenue surpassed USD 3.5 billion in 2024, with North America accounting for 36% due to residential and commercial building activities. Europe contributes 32%, led by Germany, France, and the UK, driven by infrastructure and furniture manufacturing. Asia Pacific represents 25%, led by China, India, and Southeast Asia, with industrial furniture production and urban housing growth. Market growth is supported by high-strength screws, stainless steel variants, and coated self-tapping designs that improve durability, load-bearing capacity, and corrosion resistance. Rising DIY projects, commercial timber frameworks, and decking installations are further driving global adoption.

Coated and self-tapping screws dominate market adoption due to ease of installation, durability, and corrosion resistance. North America leads with 36% of global market share, driven by residential and commercial construction projects. Europe accounts for 32%, with Germany and UK investing in infrastructure and timber-based furniture. Asia Pacific adoption is growing at a CAGR of 5.6%, led by industrial furniture production and urban housing in China and India. Self-tapping screws reduce installation time by 20–25% and maintain structural stability. Zinc, epoxy, and stainless steel coatings increase lifespan by 15–20%. Demand for decking, framing, and heavy-duty carpentry is increasing adoption across residential, commercial, and industrial applications.

Innovations in materials, thread designs, and coatings improve screw performance in wood applications. Stainless steel and high-strength alloys provide 15–20% higher load-bearing capacity compared to standard steel. Advanced thread geometry enhances grip in softwood and hardwood, reducing splitting risk by 10–15%. Self-drilling tips and pre-threaded screws accelerate installation by 20%, improving efficiency in large-scale construction and furniture assembly. North America emphasizes premium screws for commercial construction, while Europe focuses on long-lasting screws for timber projects. Asia Pacific adopts high-performance screws at scale for industrial furniture and residential buildings. Continuous R&D ensures compatibility with modern woodworking machinery, structural standards, and high-load timber frameworks globally.

Structural wood screws are used in residential construction, commercial buildings, furniture manufacturing, decking, and timber frame projects. Construction accounts for 45% of global adoption due to framing, flooring, and decking requirements. Furniture production contributes 30%, driven by industrial and modular furniture manufacturing. Timber frameworks, including DIY and architectural structures, contribute 15–20%. North America leads construction adoption, while Europe emphasizes furniture and timber frameworks. Asia Pacific, led by China and India, is growing at a CAGR of 5.6% due to urban housing and industrial furniture expansion. Rising infrastructure spending, modular construction trends, and woodworking demand are sustaining growth in structural wood screw adoption globally.

High-quality screws, including stainless steel and coated variants, are 20–25% more expensive than standard fasteners. Variability in material strength, coating quality, and thread precision can affect performance. Skilled labor and proper tools are required for proper installation, increasing operational time by 10–15%. Supply chain dependencies for alloy steel and specialty coatings may impact availability in emerging markets. Manufacturers address these challenges with pre-threaded designs, corrosion-resistant coatings, and high-performance screws that reduce maintenance. Despite advantages in durability, load-bearing capacity, and efficiency, production costs, installation requirements, and material sourcing remain key factors limiting adoption in residential, commercial, and industrial construction globally.

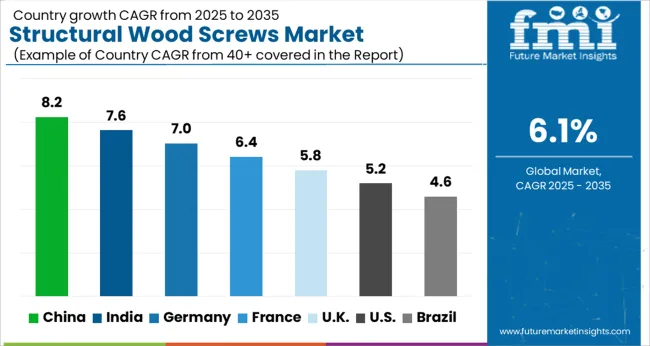

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

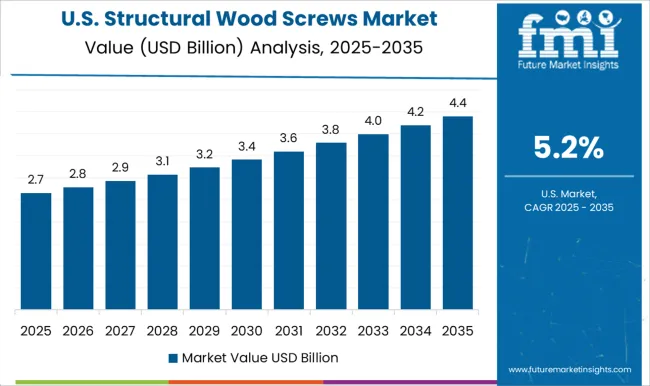

| USA | 5.2% |

| Brazil | 4.6% |

The structural wood screws market is projected to grow at a global CAGR of 6.1% through 2035, driven by rising demand in construction, furniture manufacturing, and industrial applications. China leads at 8.2%, 34% above the global benchmark, supported by BRICS-led expansion in residential and commercial construction, industrial wood processing, and hardware manufacturing. India follows at 7.6%, 25% above the global average, reflecting increasing construction activity, furniture production, and adoption of high-performance fastening solutions. Germany records 7.0%, 15% above the benchmark, shaped by OECD-driven innovations in precision screws, premium furniture, and industrial assembly applications. The United Kingdom posts 5.8%, 5% below the global rate, influenced by selective uptake in construction projects, furniture manufacturing, and specialty wood applications. The United States stands at 5.2%, 15% below the benchmark, with steady demand in commercial construction, industrial woodworking, and niche furniture applications. BRICS economies drive volume growth, OECD countries emphasize quality, performance, and advanced fastening solutions, while ASEAN nations contribute through expanding construction and furniture production networks.

The structural wood screws market in China is projected to grow at a CAGR of 8.2%, well above the global CAGR of 6.1%, driven by rising construction, industrial woodworking, and furniture manufacturing demand. In 2024, 46% of new screw production was directed toward heavy-duty, corrosion-resistant, and coated variants designed for structural stability. Production facilities in Guangdong, Jiangsu, and Zhejiang scaled operations by 16% to meet domestic and export requirements. Adoption of precision-engineered and high-strength screws grew by 19%, enhancing load-bearing capacity and installation speed. Leading suppliers including Wurth China, Hager Group China, and Fasten Group focused on advanced mechanical properties and optimized thread design.

The structural wood screws market in India is projected to grow at a CAGR of 7.6%, above the global CAGR of 6.1%, supported by residential construction growth, furniture demand, and industrial woodworking expansion. In 2024, 42% of new production focused on corrosion-resistant, fusible, and reinforced variants. Production facilities in Maharashtra, Gujarat, and Tamil Nadu increased output by 14% to meet domestic and export demand. Adoption of precision manufacturing and quality certification systems improved product reliability and structural performance. Key suppliers including Hager Group India, Fasten Group, and Wurth India emphasized process optimization and innovative screw design.

The structural wood screws market in Germany is projected to grow at a CAGR of 7.0%, above the global CAGR of 6.1%, driven by precision woodworking, furniture manufacturing, and construction segments. In 2024, 40% of new screw production targeted coated, high-strength, and non-corrosive variants. Production facilities in Bavaria and North Rhine-Westphalia scaled operations by 13% to meet domestic and European demand. Adoption of automated inspection systems and thread optimization improved product quality and installation efficiency. Leading suppliers including Wurth Germany, Hager Group, and EJOT delivered advanced screw designs for structural applications.

The structural wood screws market in the United Kingdom is projected to grow at a CAGR of 5.8%, slightly below the global CAGR of 6.1%, influenced by moderate construction and furniture manufacturing demand. In 2024, 36% of new production involved corrosion-resistant, fusible, and reinforced screws. Production facilities in the Midlands and South East increased capacity by 11% to meet domestic requirements. Adoption of batch quality monitoring and lightweight screw variants enhanced installation efficiency and performance. Suppliers such as Wurth UK, Hager Group UK, and EJOT UK introduced modular screw solutions for structural and industrial applications.

The structural wood screws market in the United States is projected to grow at a CAGR of 5.2%, below the global CAGR of 6.1%, influenced by mature construction and furniture manufacturing markets. In 2024, 38% of new screw production focused on coated, high-strength, and corrosion-resistant variants. Production facilities in California, Texas, and North Carolina increased output by 10% to meet domestic demand. Adoption of precision screw threading, standardized packaging, and modular batch production improved product performance and supply chain efficiency. Key suppliers including Wurth USA, EJOT USA, and Hager Group delivered innovative screw variants for residential, commercial, and industrial applications.

Competition in the structural wood screws market is being influenced by corrosion resistance, load-bearing performance, and adherence to building codes. Market positions are being maintained through certified fasteners, distribution networks, and technical support that ensure reliability for construction, woodworking, and industrial applications. Big Timber is being represented with high-strength screws engineered for heavy timber and structural connections, while Camo Fasteners is being promoted with concealed fastening systems optimized for secure installation and clean finishes. Eurotec GmbH is being highlighted with precision-engineered screws designed for strength and durability. Fast Cap is being applied with fastening solutions for decking, cabinetry, and furniture assembly, while Fasten Masters is being positioned with screws structured for efficient installation and high holding power.

Fischer is being recognized with coated and corrosion-resistant screws designed for long-term structural performance. Forch is being advanced with screws engineered for professional construction applications, while GRABBER Construction Products is being promoted with fasteners optimized for heavy-duty wood and composite materials. Grip-rite is being applied with coated and self-tapping screws designed for reliability and ease of use. GRK Fasteners is being showcased with precision-engineered screws for construction projects, while HECO-Schrauben is being highlighted with threaded fasteners optimized for strength and durability. Hillman is being represented with general-purpose and specialty screws designed for secure and long-lasting connections. Strategies among these companies are being centered on product improvement, regulatory compliance, and expansion of distribution and support networks.

Research and development efforts are being allocated to enhance corrosion resistance, thread geometry, and holding capacity. Product brochures are being structured with specifications covering screw diameter, length, material composition, coating type, and load capacity. Features such as ease of installation, tool compatibility, and long-term durability are being emphasized to guide procurement and construction decisions. Each brochure is being arranged to highlight certification compliance, application suitability, and technical support availability. Technical information is being presented in a clear, evaluation-ready format to assist contractors, architects, and purchasing teams in selecting screws that meet performance, reliability, and structural requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 billion |

| Type | Stainless steel and Carbon steel |

| Application | Construction, Furniture and craft, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Big Timber, Camo Fasteners, Eurotec GmbH, Fast Cap, Fasten Masters, Fischer, Forch, GRABBER Construction Products, Grip-rite, GRK Fasteners, HECO-Schrauben, Hillman, Kreg, KYOCERA SENCO, and MITEK Inc. |

| Additional Attributes | Dollar sales by screw type and end use, demand dynamics across construction, furniture, and DIY sectors, regional trends in wood-based construction, innovation in corrosion resistance and installation efficiency, environmental impact of production and disposal, and emerging use cases in modular construction and engineered wood products. |

The global structural wood screws market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the structural wood screws market is projected to reach USD 10.2 billion by 2035.

The structural wood screws market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in structural wood screws market are stainless steel and carbon steel.

In terms of application, construction segment to command 54.2% share in the structural wood screws market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Structural Adhesive Market Outlook & Growth 2025 to 2035

Structural Health Monitoring Market Insights – Growth & Forecast 2024-2034

Metal Structural Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Bridge Structural Health Monitoring (SHM) Solution Market Size and Share Forecast Outlook 2025 to 2035

Silicone Structural Glazing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Structural Steel Market Growth - Trends & Forecast 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA