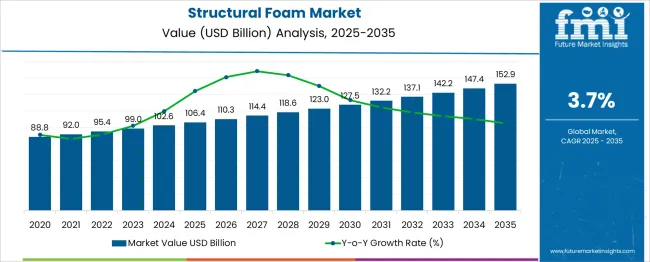

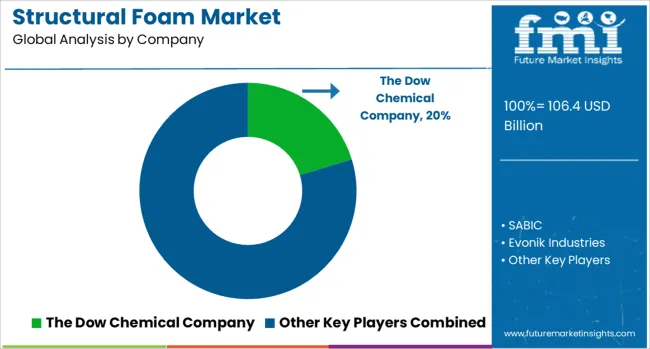

The Structural Foam Market is estimated to be valued at USD 106.4 billion in 2025 and is projected to reach USD 152.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

Between 2025 and 2030, the market increases from USD 88.8 billion to USD 110.3 billion, marking a 5-year gain of USD 21.5 billion, or a cumulative growth of 24.2%. The corresponding CAGR for this period is approximately 4.4%, reflecting a stable expansion phase driven by performance-driven material substitution in packaging, automotive, and construction sectors.

YoY growth over these five years ranges from USD 3.2 to 3.9 billion annually, with no signs of volatility, which suggests a demand-led expansion pattern. Structural foam’s unique properties—light weight, rigidity, and low material stress are increasingly meeting the demands of cost-efficient design in both high- and mid-volume manufacturing. This aligns with industry data from Elsevier's Journal of Materials Processing Technology and use-case documentation from SAE International, particularly in automotive interiors and lightweight panels.

Moreover, broader macroeconomic factors such as increased building activity, logistic optimization, and material engineering are reinforcing structural foam's uptake. As manufacturing standards evolve, particularly in Asia and North America, the market is expected to remain resilient and attractive through 2030.

| Metric | Value |

|---|---|

| Structural Foam Market Estimated Value in (2025 E) | USD 106.4 billion |

| Structural Foam Market Forecast Value in (2035 F) | USD 152.9 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The Structural Foam Market is primarily dominated by the building and construction sector, which accounts for approximately 42–43% of total demand. This dominance is driven by the use of structural foam in insulation panels, lightweight wall systems, and civil infrastructure components requiring high strength-to-weight performance. The automotive and transportation industry holds the second-largest share at around 35–40%, owing to the need for lightweight yet durable materials in seat bases, bumpers, interior panels, and HVAC systems to enhance fuel efficiency and safety.

The material handling and packaging segment contributes roughly 8–10%, using structural foam to manufacture durable pallets, crates, and industrial containers. The electrical and electronics sector comprises about 5–6% of the market, where structural foam is favored for its insulation, rigidity, and flame-retardant properties in housings and switchgear.

The consumer goods industry represents approximately 4–5%, employing the material in products such as sports equipment and appliance housings. The medical devices sector holds around 2–3%, with structural foam used in equipment casing and ergonomic supports. Lastly, aerospace and specialized industrial applications make up the remaining 2–3%, focusing on lightweight structural panels and specialty insulation. Together, these segments underline the diverse and application-specific utility of structural foam across industries.

The structural foam market is witnessing robust growth as manufacturers across industries seek alternatives that offer strength-to-weight advantages without compromising design flexibility or performance. The transition toward lightweighting, especially in the automotive and packaging sectors, is accelerating the adoption of structural foam due to its superior rigidity, insulation properties, and moldability. Growing focus on sustainability and material recyclability is encouraging the use of thermoplastic-based structural foam, particularly in energy-intensive applications.

Technological advancements in low-pressure molding and gas-assisted processes have enabled manufacturers to achieve complex geometries and cost-efficient production cycles. Furthermore, regulatory mandates on emission reduction and energy efficiency across North America, Europe, and parts of Asia are prompting the shift from traditional materials to high-performance foamed polymers.

Strategic investments in expanding foam molding capacities and collaborations between resin suppliers and end-use industries are paving the way for broader market penetration. Over the forecast period, demand is expected to rise steadily, supported by innovation in composite formulations and increased use in electric vehicles, appliances, and reusable packaging.

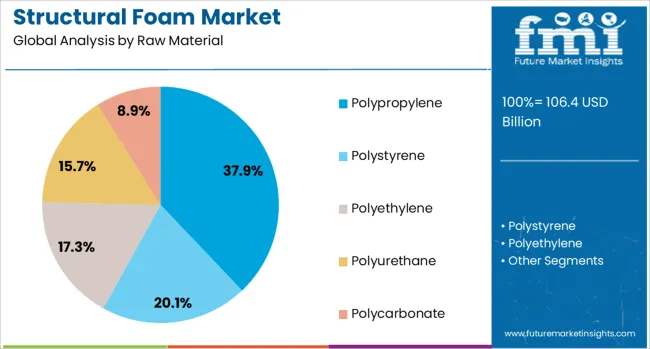

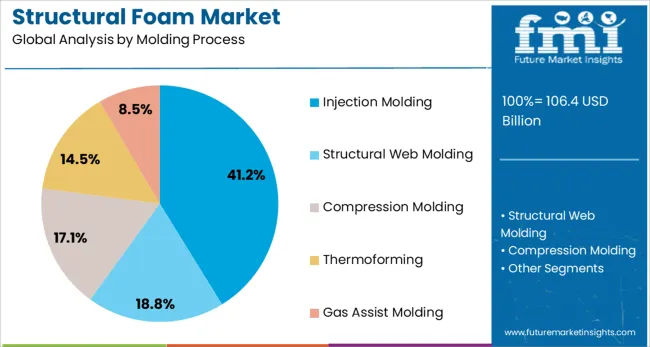

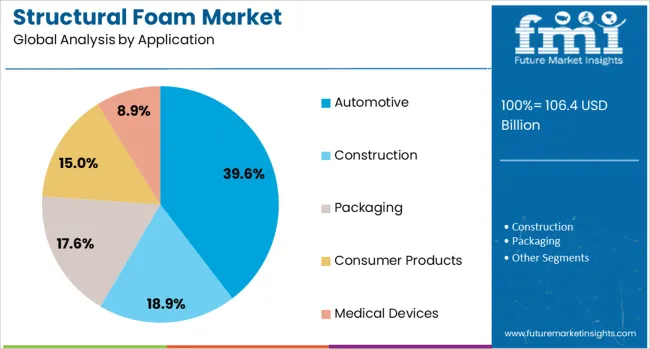

The structural foam market is segmented by raw material, molding process, application, density, additives, and geographic regions. The raw materials of the structural foam market are divided into Polypropylene, Polystyrene, Polyethylene, Polyurethane, and Polycarbonate. In terms of the molding process, the structural foam market is classified into Injection Molding, Structural Web Molding, Compression Molding, Thermoforming, and Gas Assist Molding.

The structural foam market is segmented into Automotive, Construction, Packaging, Consumer Products, and Medical Devices. The structural foam market is segmented by density into Medium Density, Low Density, and High Density. The additives of the structural foam market are segmented into Flame Retardants, Antioxidants, UV Stabilizers, Colorants, and Reinforcements. Regionally, the structural foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polypropylene is projected to account for 37.9% of the total revenue share in the structural foam market in 2025, driven by its low density, favorable mechanical properties, and cost-effectiveness. The material's ability to resist moisture, chemicals, and impact while offering ease of processing has made it highly suitable for a range of molding applications. Polypropylene's compatibility with structural foam technologies is being enhanced through the use of fillers and reinforcements that improve rigidity without compromising weight advantages.

Its widespread availability and recyclability align with sustainability goals across consumer and industrial sectors. In automotive and logistics, polypropylene-based foam components are increasingly being used for interior parts, battery enclosures, and durable storage systems.

As regulations continue to push for material efficiency and carbon footprint reduction, polypropylene has been favored due to its processing efficiency in low-pressure foam molding environments. The ability to support multi-cavity molds and integrate functional features during production has further reinforced its prominence in structural applications.

Injection molding is anticipated to hold 41.2% of the structural foam market revenue share in 2025, supported by its efficiency in producing high-strength components with minimal material waste. The process has become widely adopted due to its ability to support complex shapes, consistent wall thickness, and reduced cycle times, making it ideal for high-volume production. Structural foam injection molding enables the formation of thick-walled, lightweight parts with enhanced dimensional stability and reduced internal stresses.

Technological integration of gas-assist methods and advanced tooling designs has expanded its utility across automotive, packaging, and consumer goods industries. The process supports flexible material usage, including recycled polymers and filled compounds, further contributing to its cost-effectiveness.

Continuous improvements in automation and mold temperature control have improved the precision and surface finish of molded parts. These benefits, coupled with lower equipment and operational costs compared to alternative processes, have made injection molding the preferred method for producing complex structural foam components at industrial scale.

The automotive sector is expected to account for 39.6% of the structural foam market revenue in 2025, emerging as the dominant application segment. The growing need for lightweight materials to meet stringent fuel efficiency and emission regulations is propelling the use of structural foam in vehicle manufacturing. Foam-molded components are being utilized in seating structures, panels, bumpers, and under-the-hood applications due to their strength, thermal resistance, and impact absorption characteristics.

The rise of electric and hybrid vehicles has further increased demand for structural foam parts that support battery protection and noise insulation while minimizing weight. The automotive industry’s emphasis on modularity, crashworthiness, and recyclability aligns with the capabilities of structural foam, particularly in reducing material usage and overall vehicle mass.

OEMs are increasingly integrating foam molding into their manufacturing lines to produce large-format, structurally complex parts with reduced assembly time. These trends, combined with advancements in multi-material compatibility and functional integration, are reinforcing structural foam’s position in next-generation vehicle design.

Demand is rising as manufacturers seek lightweight, rigid core materials that improve structural integrity and weight efficiency in products like automotive panels, appliance components, and furniture. Growth is being fostered by blended chemistry development, application-specific tooling partnerships, and regional compounding networks.

Industries such as automotive, building products, appliances, and marine components increasingly specify structural foam materials to achieve high strength-to-weight ratios while enhancing rigidity and impact resistance. These foam composites are used in sandwich panels, stiffened cores, chassis reinforcements, and furniture elements where traditional thermoplastics or metals would add mass. Foam options that resist compression and absorb impact have proven effective in interiors, load-bearing parts, or vibration dampening applications. Manufacturers value the ability to mold complex shapes and integrate foam-filled sections with outer skins or shells. This performance-driven demand is growing as OEMs seek to reduce weight, improve energy efficiency, and maintain design durability without compromising cost targets.

Opportunities are being unlocked through development of resin blends tailored to specific application needs such as flame retardancy, thermal insulation, or UV stability combined with precise foam cell structure control. Collaborations between foam material suppliers and OEM tooling teams enable optimized mold designs and process tuning for consistent cell size and expansion control. Establishing compounding and pre-mix sites close to customer manufacturing zones reduces delivery time and simplifies inventory management. Packaging material kits including resin, catalysts, and dispensing systems facilitate easier plant adoption. Service offerings such as pilot foam trials, equipment lease terms, and onsite technical support help manufacturers evaluate and implement new foam chemistry. These strategies allow foam producers to support diverse applications in lightweight design across segments from transport equipment to construction insulation.

Structural foam gains traction in automotive body-in-white and appliance components as manufacturers pursue weight reduction and assembly simplification. By injecting foam into thick-section trims, brackets, or inner door panels, engineers achieve structural rigidity while reducing part weight by up to 30 percent relative to solid plastic or metal counterparts. This weight saving directly improves fuel efficiency or electric vehicle range. Foam also enables integration of multiple joining features into a single moulded part, cutting assembly steps and fastener counts. Compared to 2025, OEMs in Europe and Asia are projected to increase structural foam usage for inner body panels by more than 25 percent by 2030. Component cost is offset by reduction in downstream labor and improved fit consistency. As manufacturers seek leaner assembly lines, structural foam parts become key enablers of modular design and rapid production cycles.

Manufacturers of structural foam face ongoing challenges in maintaining consistency in cell morphology and mechanical properties. Variations in resin grade, foaming agent concentration, and process temperature lead to inconsistent density and flexural strength. These variations reduce confidence in downstream assembly, particularly where tight tolerances are required. In automobile side panels or appliance chassis, inconsistent foam structure can result in part warpage or reduced load-bearing capacity. Manual intervention during mixing or uneven temperature zones in moulding lines further contributes to variability. Without precise inline monitoring and closed-loop process controls, yield losses and scrap rates remain elevated. Companies that lack automation or feedback systems struggle to match the performance of leading OEM suppliers. This inconsistency limits customer acceptance for high-stress structural applications and raises quality assurance costs during assembly or validation stages.

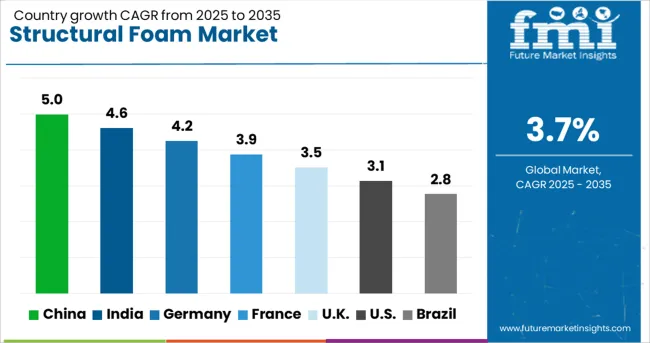

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.2% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

China, a leading BRICS economy, is expected to grow at a 5.0% CAGR from 2025 to 2035, as structural foam becomes integral to lightweight pallet manufacturing and modular furniture production across large-scale plastics hubs. India follows at 4.6%, where demand is gaining traction in domestic appliance housings and mid-range automotive interiors, especially in states with expanding injection molding capacity. In the OECD group, Germany shows 4.2% growth, supported by industrial-scale adoption in protective enclosures, HVAC casings, and custom tool carriers for robotic systems. France, projected at 3.9%, sees growing use in retail display systems and insulated logistics containers, particularly in export-oriented packaging units. The United Kingdom, at 3.5%, maintains demand through widespread use of foamed thermoplastics in warehouse automation bins and lightweight construction paneling. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

A CAGR of 5% is being recorded in China due to rising usage of molded structural components in automotive, appliance, and construction sectors. High-volume production is being supported by the expansion of low-pressure injection molding facilities. Structural foam is being chosen for producing large parts with reduced weight and improved stiffness. Manufacturers are focusing on meeting local and overseas requirements for panels, crates, and internal housings. Thick-walled parts with high impact resistance are being supplied to OEMs across packaging and equipment manufacturing. Government-backed infrastructure development is indirectly raising demand for cost-effective molded materials. Domestic producers are enhancing consistency in part geometry through process upgrades and advanced mold designs.

A CAGR of 4.6% is being observed in India, supported by higher usage of molded products in electricals, automotive, and building material segments. Medium and large manufacturers are adopting foam molding techniques to lower material consumption and improve dimensional strength. Load-bearing components such as crates, cabinets, and enclosures are being produced for commercial and industrial use. Local facilities are adding foam molding units to existing lines to meet regional demand. Components requiring thermal resistance and reduced deformation are increasingly being sourced from foam-based suppliers. Public housing projects and industrial transport needs are contributing to higher order volumes. Foam parts with simple geometries and long usage cycles are being preferred across small cities and rural installations.

A CAGR of 4.2% is being achieved in Germany through adoption of structural foam in machinery, tools, and automotive systems. Local companies are focusing on consistent output for medium- to high-load applications. Foam components are being developed for under-the-hood covers, insulation boards, and casings where rigidity and temperature resistance are required. Changes in material use regulations are encouraging replacement of metal and solid plastic parts with foam alternatives. Performance requirements for high-precision parts are being met through improved control over material density and wall thickness. Production lines are being modified to integrate multi-cavity tools and high-capacity presses suited for thick-section parts.

A CAGR of 3.9% is being recorded in France as long-lasting molded items gain popularity across construction, consumer goods, and transport sectors. Structural foam is being applied in parts where consistent strength and minimal material waste are required. Building panels, office furniture, and protective casings are among key applications. Producers are expanding material options that comply with regional building and fire resistance standards. Demand is increasing for parts that can be manufactured in large sizes without warping or shrinkage. Foam molding facilities are being upgraded to accommodate high-throughput production runs with minimal maintenance interruptions. Sheet and panel products are being delivered to support commercial and civil infrastructure.

A CAGR of 3.5% is being reported in the United Kingdom, supported by broader use of structural foam in transport packaging, housing systems, and industrial goods. The ability to produce complex shapes with stable mechanical performance is influencing material selection. Local manufacturers are focusing on items that require fewer reinforcements but offer high service life. Applications in modular structures, rail components, and marine fixtures are being supplied by domestic molding units. Production techniques are being refined to meet requirements for part uniformity, reduced cycle time, and lower scrap rates. Orders for repeat-use products such as containers, barriers, and wall inserts are increasing across industrial customers.

The structural foam market is composed of a dynamic mix of multinational chemical corporations and specialized manufacturers, segmented into Tier 1, Tier 2, and Tier 3 suppliers based on scale, technological capabilities, and market reach. Tier 1 suppliers are large global companies that provide high-performance structural foam materials used in demanding applications such as automotive components, industrial housings, and heavy-duty pallets.

These players are known for their innovation in polymer chemistry, delivering foam solutions with superior strength-to-weight ratios, thermal insulation, and impact resistance. Their global manufacturing footprints and R&D investments enable them to meet evolving industry requirements for lightweighting, durability, and regulatory compliance. Tier 2 suppliers focus on specific end-use industries, offering structural foam cores and molded parts tailored for marine, wind energy, infrastructure, and aerospace applications.

These companies often emphasize performance attributes like stiffness, moisture resistance, and long-term dimensional stability. They also provide value-added services such as precision molding, structural design support, and composite integration, making them reliable partners for manufacturers seeking application-specific solutions. Tier 3 suppliers cater to niche and regional markets, offering custom structural foam fabrication and low-volume production.

These companies excel in serving packaging, signage, construction, and OEM prototyping needs where flexibility, affordability, and rapid turnaround are key. Their agility allows them to develop cost-effective solutions that accommodate unique customer specifications. Overall, the structural foam market is driven by rising demand for lightweight, rigid, and energy-efficient materials across sectors, with suppliers continuously innovating to enhance processing efficiency, material sustainability, and end-use performance.

On September 3, 2024, Evonik Industries officially announced that its Darmstadt facility began producing ROHACELL® structural foam exclusively with 100% renewable electricity, reducing CO₂ emissions by 3,400 metric tons annually

| Item | Value |

|---|---|

| Quantitative Units | USD 106.4 Billion |

| Raw Material | Polypropylene, Polystyrene, Polyethylene, Polyurethane, and Polycarbonate |

| Molding Process | Injection Molding, Structural Web Molding, Compression Molding, Thermoforming, and Gas Assist Molding |

| Application | Automotive, Construction, Packaging, Consumer Products, and Medical Devices |

| Density | Medium Density, Low Density, and High Density |

| Additives | Flame Retardants, Antioxidants, UV Stabilizers, Colorants, and Reinforcements |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Dow Chemical Company, SABIC, Evonik Industries, Diab International AB, Armacell International S.A., PSI Molded Plastics, One Plastic Group, and Polycel Structural Foam Inc. |

| Additional Attributes | Dollar sales by foam material such as polyethylene, polypropylene, polystyrene or polyurethane, by application including material handling, automotive, construction and packaging, and by geographic region; demand driven by lightweighting, infrastructure growth, and industrial automation; innovation in injection molded structural foam, modular composites, and bio-based formulations; cost shaped by raw material volatility and energy-intensive processing; and emerging use in wind turbine blades and thermally insulated building panels. |

The global structural foam market is estimated to be valued at USD 106.4 billion in 2025.

The market size for the structural foam market is projected to reach USD 152.9 billion by 2035.

The structural foam market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in structural foam market are polypropylene, polystyrene, polyethylene, polyurethane and polycarbonate.

In terms of molding process, injection molding segment to command 41.2% share in the structural foam market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA