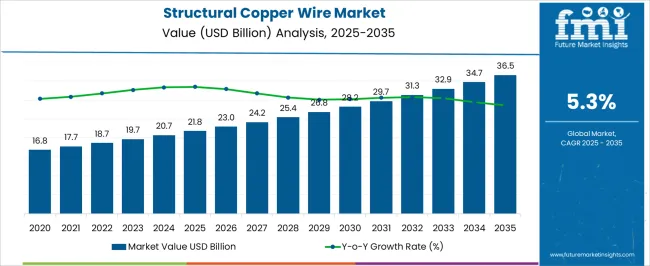

The structural copper wire market is projected to grow from USD 21.8 billion in 2025 to USD 36.5 billion by 2035, exhibiting a CAGR of 5.3%. Between 2021 and 2025, the market experiences steady growth, increasing from USD 16.8 billion in 2021 to USD 21.8 billion in 2025, representing a compound absolute growth of USD 5 billion. This growth is driven by the increasing demand for copper wire in electrical, construction, and industrial applications, particularly for wiring and electrical installations in infrastructure projects, renewable energy systems, and smart grids.

This steady upward trend is driven by the increasing use of copper wire in industries such as telecommunications, automotive, and renewable energy, which demand high conductivity materials for efficient power transmission. From 2025 to 2030, the market continues to expand, reaching USD 23.0 billion in 2026, USD 24.2 billion in 2027, and USD 25.4 billion in 2028. By 2030, the market will have grown to USD 26.8 billion, with a steady climb in demand for structural copper wire in both traditional and emerging sectors.

| Metric | Value |

|---|---|

| Structural Copper Wire Market Estimated Value in (2025 E) | USD 21.8 billion |

| Structural Copper Wire Market Forecast Value in (2035 F) | USD 36.5 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The structural copper wire market is shaped by several parent markets that contribute to its growth and demand across different industries. The electrical equipment market plays a significant role, accounting for approximately 15-18% of the market share. Copper is widely used in wiring for electrical distribution, circuit boards, and power systems due to its exceptional conductivity and durability. Within the telecommunications market, structural copper wire represents about 10-12% of the share, as copper wiring is essential in communication cables, including telephone lines and broadband infrastructure, ensuring reliable signal transmission over long distances.

The construction market also contributes around 8-10% of the structural copper wire market, with copper wiring being critical for electrical systems in residential, commercial, and industrial buildings, ensuring safe and efficient power distribution. In the automotive market, copper wire holds around 6-8% of the share, driven by its use in vehicle electrical systems, including powertrains, lighting, and onboard electronics. Copper’s reliability and conductivity make it a preferred material in modern vehicles.

The Structural Copper Wire market is experiencing steady growth due to rising demand for reliable and efficient electrical conductivity solutions in diverse applications. Increasing investment in infrastructure development, modernization of power distribution networks, and expansion of renewable energy installations have been pivotal in driving market adoption.

Copper wire continues to be preferred over alternative materials due to its superior conductivity, thermal performance, and durability, making it suitable for both new installations and replacement projects. The market is further supported by the increasing adoption of energy-efficient systems, stringent safety standards, and technological advancements in wire manufacturing processes that enhance product performance.

Expanding construction activities in urban and semi-urban regions, alongside the integration of copper wiring in smart building projects, are opening new avenues for growth As electrification initiatives intensify globally and industries continue to prioritize long-term reliability, the demand for structural copper wire is expected to remain strong, ensuring sustained market expansion over the coming years.

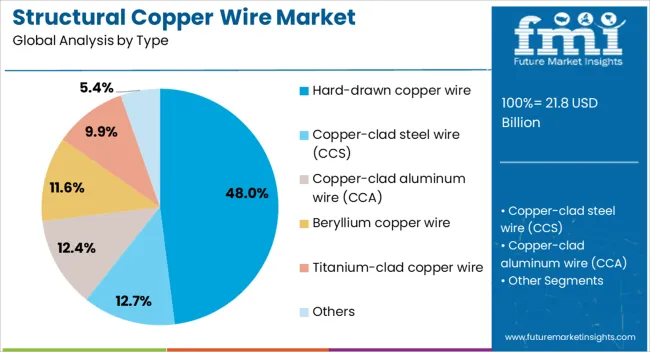

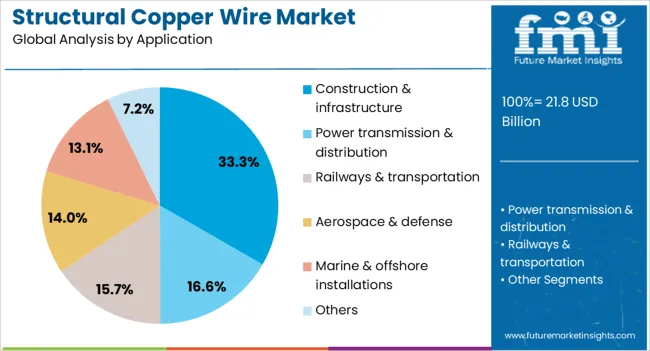

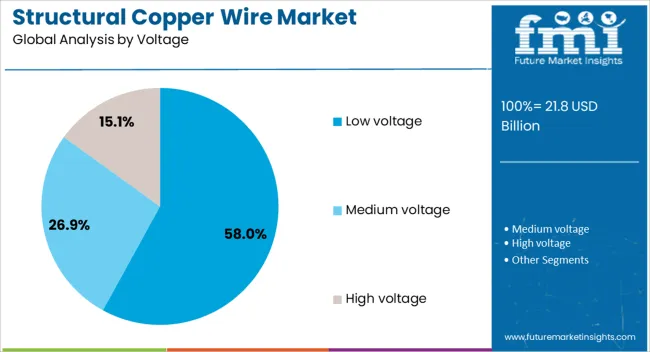

The structural copper wire market is segmented by type, application, voltage, and geographic regions. By type, structural copper wire market is divided into Hard-drawn copper wire, Copper-clad steel wire (CCS), Copper-clad aluminum wire (CCA), Beryllium copper wire, Titanium-clad copper wire, and Others. In terms of application, structural copper wire market is classified into Construction & infrastructure, Power transmission & distribution, Railways & transportation, Aerospace & defense, Marine & offshore installations, and Others. Based on voltage, structural copper wire market is segmented into Low voltage, Medium voltage, and High voltage. Regionally, the structural copper wire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hard-drawn copper wire segment is projected to hold 48% of the Structural Copper Wire market revenue share in 2025, making it the leading product type. The segment’s growth has been driven by the high tensile strength and durability of hard-drawn copper wires, which make them suitable for demanding applications where long-term performance is critical. Their resistance to stretching, abrasion, and mechanical stress ensures reliable service life in industrial, commercial, and utility installations.

The preference for this wire type has also been influenced by its consistent conductivity and stability under varying environmental conditions. The manufacturing process allows for precise diameter control, which enhances compatibility with connectors and fittings.

Additionally, hard-drawn copper wires have been widely adopted in sectors that require minimal maintenance and high efficiency, contributing to cost savings over the product lifecycle With infrastructure projects and electrification efforts expanding worldwide, this segment is expected to maintain its leading position through continued demand in both established and emerging markets.

The construction and infrastructure segment is anticipated to account for 33.30% of the Structural Copper Wire market revenue share in 2025, positioning it as the dominant application area. Growth in this segment has been supported by rapid urbanization, modernization of existing electrical systems, and increased investment in large-scale building projects. Copper wires are extensively used in residential, commercial, and industrial construction due to their unmatched conductivity and safety compliance.

Their role in ensuring efficient power distribution, supporting advanced building management systems, and meeting fire safety regulations has reinforced their importance in the sector. The segment has also benefited from government-led infrastructure development programs and the proliferation of smart city initiatives that demand high-quality wiring solutions.

The longevity and reliability of copper wiring make it a preferred choice for both contractors and developers, ensuring reduced downtime and maintenance costs As construction activities intensify globally, the adoption of structural copper wires in this segment is projected to remain strong.

The low voltage segment is expected to capture 58% of the Structural Copper Wire market revenue share in 2025, making it the leading voltage category. Its dominance has been attributed to the extensive use of low voltage systems in residential, commercial, and light industrial applications. These systems require wiring that ensures safety, flexibility, and efficient energy transmission, which copper provides effectively.

Low voltage copper wires are widely deployed for lighting, communication systems, control panels, and household electrical distribution, benefiting from their ease of installation and compliance with international safety standards. Their adaptability to modern building requirements, including integration with renewable energy and smart grid systems, has further enhanced their demand.

Additionally, the cost-effectiveness and reduced energy loss associated with low voltage copper wiring make it an attractive choice for end-users seeking long-term value With increasing electrification in developing regions and rising refurbishment activities in mature markets, the low voltage segment is set to retain its leadership position in the foreseeable future.

The structural copper wire market is witnessing steady growth driven by increasing demand for high-performance materials in industries like construction, power generation, and industrial equipment. Copper wires are preferred for their superior electrical conductivity, corrosion resistance, and mechanical durability. Their use in critical applications such as electrical wiring, power distribution, and industrial machinery ensures consistent demand. Technological advancements in wire manufacturing processes, alongside growing industrial infrastructure, are further propelling market expansion. As industries focus on enhancing electrical performance and safety, structural copper wire remains an essential material for various sectors.

One significant issue is the high cost of copper, which impacts production costs, making copper-based wires more expensive compared to alternatives like aluminum. The volatility in copper prices further complicates pricing stability, creating uncertainties for manufacturers and consumers. Additionally, the market faces competition from other materials such as aluminum wires, which are lighter and cheaper, especially for long-distance power transmission. Integration into existing infrastructure may also require costly modifications, which may deter investment from smaller businesses or companies with limited budgets. Furthermore, the demand for more sustainable materials and the regulatory focus on reducing environmental impact may limit copper’s attractiveness in certain applications, hindering market growth.

The growing demand for energy-efficient and durable wiring solutions is one of the main drivers of the structural copper wire market. As industries continue to focus on improving electrical performance and safety, copper’s superior conductivity, corrosion resistance, and mechanical strength make it the material of choice. In the construction industry, the increasing number of infrastructure projects and demand for renewable energy solutions are pushing the need for reliable copper-based wiring. Additionally, the rise of electric vehicles and the expansion of data centers is contributing to a surge in copper wire demand. Technological advancements, including improved manufacturing processes, further increase the affordability and quality of copper wires, reinforcing their importance across industrial sectors. As global infrastructure development accelerates, copper wire usage will continue to see significant demand.

The structural copper wire market offers significant opportunities for growth, particularly with ongoing infrastructure development and the increasing need for reliable and energy-efficient electrical systems. The rise in electric vehicle adoption, smart grids, and renewable energy projects is expected to increase the demand for copper wiring solutions. Expanding urbanization and industrialization, particularly in emerging markets like Asia-Pacific, offer growth potential for copper wire manufacturers. Innovations in manufacturing processes, including automated systems and improved wire coatings, present opportunities for increased performance and cost savings. The recycling of copper wires, driven by environmental regulations and cost-saving initiatives, offers opportunities to tap into secondary copper markets, reducing raw material dependence. These factors indicate strong future prospects for the market.

The focus on increasing energy efficiency and reducing power loss in electrical systems is driving innovations in copper wire production. Advancements in wire coatings and insulation materials are enhancing the durability and performance of copper wires, making them suitable for more demanding applications. Additionally, the demand for smaller, lighter, and more flexible copper wires is pushing for the development of advanced alloys and manufacturing techniques. The rise of smart grids and electric vehicle infrastructure is also contributing to an increased reliance on high-quality copper wires. Moreover, the growing focus on the circular economy is fostering the recycling of copper materials, reducing environmental impact while meeting demand. These trends indicate the continuous evolution of the market towards more efficient and innovative copper wire solutions.

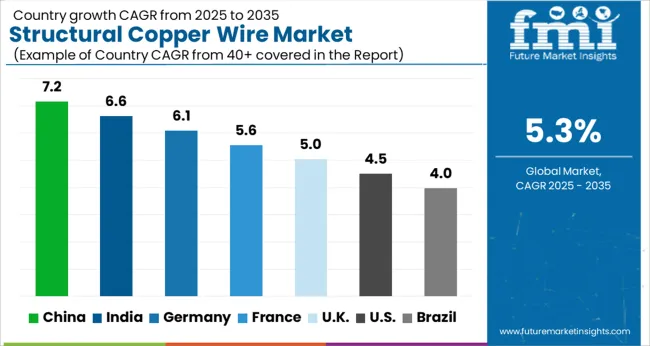

| Countries | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global structural copper wire market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads with a growth rate of 7.2%, followed by India at 6.6%, and France at 5.6%. The United Kingdom and the United States post moderate growth rates of 5.0% and 4.5%, respectively. The market’s growth is driven by the expanding demand for copper wire in power transmission, construction, telecommunications, and infrastructure development sectors. Key trends such as government investments in smart grid systems, power grid modernization, and increasing construction activities continue to fuel the market's expansion across these regions. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the structural copper wire market with a CAGR of 7.2% from 2025 to 2035. The rapid expansion of infrastructure, construction, and manufacturing sectors, alongside a growing demand for electrical wiring in residential and industrial applications, drives this growth. China’s strong industrial base and the increasing need for reliable and high-performance wiring solutions further support the demand for structural copper wire. Government investments in infrastructure and electrification programs are anticipated to contribute significantly to market expansion in the country. The push for improving the efficiency and reliability of power transmission networks also boosts the demand for copper wire.

The structural copper wire market in India is expected to grow at a CAGR of 6.6% from 2025 to 2035. The market is largely driven by the ongoing infrastructure development projects, increasing industrialization, and urbanization. As the demand for energy-efficient wiring in power transmission, telecommunications, and construction sectors rises, structural copper wire continues to play a pivotal role in these applications. The push for smart grid development and reliable electrical networks in India fuels the need for high-quality copper wires. Increased industrial output and the growing need for reliable electrical systems across commercial and residential projects also support market growth.

The structural copper wire market in France is expected to grow at a CAGR of 5.6% from 2025 to 2035. The market growth is driven by increasing demand for copper wire in the construction, telecommunications, and power transmission sectors. France’s robust industrial sector, coupled with rising government initiatives for infrastructure development and power grid improvements, boosts the market demand. The transition toward modernizing electrical grids and focusing on reliable, durable wiring solutions for energy-efficient transmission further supports the growth. The need for higher conductivity and the ability to withstand challenging environments continue to make structural copper wire an essential component in industrial and commercial applications.

The structural copper wire market in the United Kingdom is projected to grow at a CAGR of 5.0% from 2025 to 2035. Demand is driven by a strong focus on improving infrastructure, power systems, and telecommunications networks. With increased investment in the expansion and upgrading of power grids, the market for copper wire continues to thrive. The growth in residential and commercial construction also drives demand for copper wiring solutions, particularly for power distribution and electrical connectivity. The adoption of copper’s superior conductivity and reliability for energy-efficient systems in industrial settings further contributes to market growth in the UK

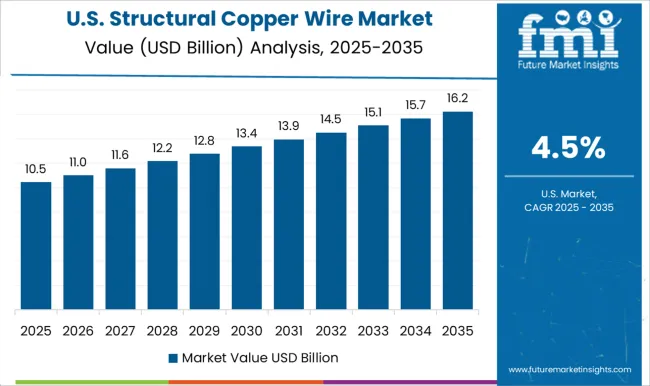

The USA structural copper wire market is projected to expand at a CAGR of 4.5% from 2025 to 2035. The market is driven by the growing demand for copper wire in key applications, including power transmission, telecommunications, and construction. The need for high-quality copper wire in smart grid systems, energy-efficient electrical systems, and advanced telecommunications infrastructure is propelling the market forward. The USA government’s focus on modernizing electrical networks and increasing investments in infrastructure supports market growth. The rise in residential and commercial construction further contributes to the demand for copper wiring solutions in the USA

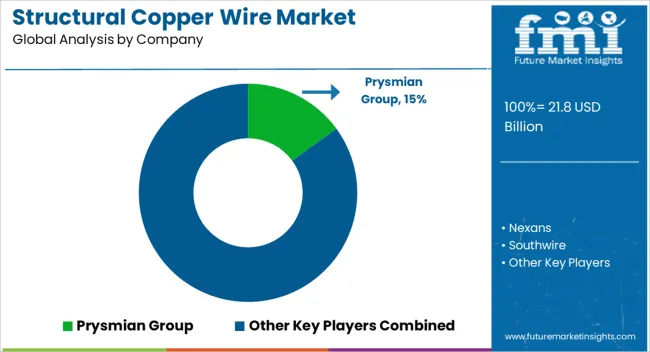

The structural copper wire market is highly competitive, with key players like Prysmian Group, Nexans, Southwire, LS Cable & System, and Sumitomo Electric constantly innovating to maintain their market positions. Prysmian Group leads with its diverse portfolio, focusing on high-performance copper wire for electrical transmission, telecommunications, and industrial applications. Their strategy revolves around expanding their global footprint and enhancing product sustainability, targeting energy-efficient and eco-friendly solutions. Nexans places strong emphasis on advanced technology, providing copper wire with exceptional electrical properties for sectors such as construction and power generation. Their focus on operational excellence and quality control ensures superior performance in demanding applications. Southwire competes by offering a broad range of copper wires, with a strong emphasis on customer-centric solutions. Their products are tailored to meet the specific needs of electrical power transmission and building infrastructure. Southwire’s competitive advantage lies in its innovation and commitment to manufacturing high-quality, durable wire products, often customized for large-scale industrial projects. LS Cable & System differentiates itself with a focus on innovation and reliability, offering copper wire solutions for energy, telecommunications, and infrastructure markets. Their global operations and cost-efficient manufacturing processes make them a significant player in the market. Sumitomo Electric competes by focusing on precision and advanced wire technology, providing copper wire solutions for diverse applications, including automotive, telecommunications, and energy. Their strategy involves creating value through high-quality products and technological advancements.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.8 Billion |

| Type | Hard-drawn copper wire, Copper-clad steel wire (CCS), Copper-clad aluminum wire (CCA), Beryllium copper wire, Titanium-clad copper wire, and Others |

| Application | Construction & infrastructure, Power transmission & distribution, Railways & transportation, Aerospace & defense, Marine & offshore installations, and Others |

| Voltage | Low voltage, Medium voltage, and High voltage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Nexans, Southwire, LS Cable & System, Sumitomo Electric, and Others |

| Additional Attributes | Dollar sales by wire type (solid, stranded, tinned), application (energy, telecommunications, industrial), and wire gauge (low, medium, high). Regional trends highlight growth in North America, Europe, and Asia-Pacific, driven by the demand for advanced electrical infrastructure and the expansion of renewable energy projects requiring high-quality copper wiring solutions. |

The global structural copper wire market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the structural copper wire market is projected to reach USD 36.5 billion by 2035.

The structural copper wire market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in structural copper wire market are hard-drawn copper wire, copper-clad steel wire (ccs), copper-clad aluminum wire (cca), beryllium copper wire, titanium-clad copper wire and others.

In terms of application, construction & infrastructure segment to command 33.3% share in the structural copper wire market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structural Waterproofing Services Market Size and Share Forecast Outlook 2025 to 2035

Structural Health Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Structural Wood Screws Market Size and Share Forecast Outlook 2025 to 2035

Structural Composites Market Size and Share Forecast Outlook 2025 to 2035

Structural Foam Market Size and Share Forecast Outlook 2025 to 2035

Structural Adhesive Market Outlook & Growth 2025 to 2035

Metal Structural Insulation Panels Market Size and Share Forecast Outlook 2025 to 2035

Bridge Structural Health Monitoring (SHM) Solution Market Size and Share Forecast Outlook 2025 to 2035

Silicone Structural Glazing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Frameless Structural Glass Balustrade Market Size and Share Forecast Outlook 2025 to 2035

Automotive Structural Steel Market Growth - Trends & Forecast 2025 to 2035

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA