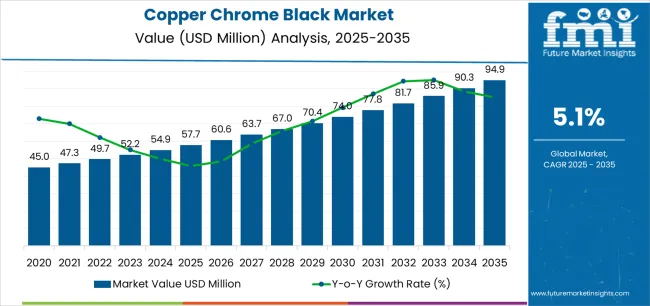

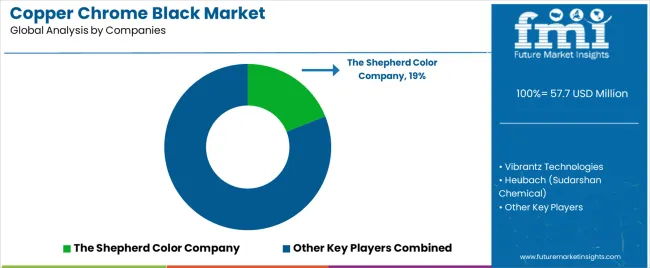

The global copper chrome black market is expected to grow from USD 57.7 million in 2025 to approximately USD 94.9 million by 2035, recording an absolute increase of USD 37.2 million over the forecast period. Demand for copper chrome black translates into a total growth of 64.4%, with the market forecast to expand at a CAGR of 5.1% between 2025 and 2035. Key trends in the copper chrome black market are centered around performance stability, manufacturing consistency, and application-specific pigment engineering. There is a noticeable shift toward high-purity pigment grades that provide improved dispersion, reduced variability in shade development, and stable color performance across different firing and processing temperatures. Heat-stable inorganic pigments are increasingly preferred in industrial coatings where organic alternatives cannot maintain long-term weathering resistance, supporting wider adoption in powder coatings, coil coatings, and protective metal finishing.

The ceramics sector continues to drive demand for pigment formulations with controlled melt behavior, enabling uniform coloration in tiles, sanitary ware, and tableware glazes. Growth in construction and architectural materials is encouraging the use of copper chrome black in cementitious coatings and structural composites where UV durability and abrasion resistance are required. In plastics processing, manufacturers are prioritizing pigment grades that remain stable during extrusion and injection molding, with attention to particle size uniformity for reduced processing defects. There is also increasing focus on production efficiency and batch repeatability, as automated manufacturing environments require pigments with predictable performance profiles. Suppliers offering technical application guidance and quality-certification support are gaining strategic advantage in procurement-driven purchasing environments.

Quick Stats for Copper Chrome Black Market

Regional growth patterns are particularly strong in Asian markets, where expanding ceramic tile production and industrial coating activity drive consistent pigment demand. European markets maintain steady growth through automotive coating requirements and architectural glass applications, while North American markets show increasing activity in high-performance plastic compounding leveraging stringent regulatory compliance frameworks. Manufacturing industry consolidation and quality certification requirements continue to support demand for established pigment suppliers with proven batch consistency and technical documentation.

Technology advancement in pigment synthesis methods, particle size control, and surface treatment technologies continues to improve color performance while reducing manufacturing costs. The integration of dispersion optimization and compatibility treatments enhances pigment functionality for diverse application systems. Manufacturers are developing grades with improved opacity and tinting strength to reduce dosage requirements and support customer cost reduction objectives.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 57.7 million |

| Market Forecast Value (2035) | USD 94.9 million |

| Forecast CAGR (2025-2035) | 5.1% |

| INDUSTRIAL MANUFACTURING EXPANSION | PERFORMANCE REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Ceramic Production Growth | Temperature Stability Demands | Heavy Metal Regulations |

| Continuous expansion of ceramic tile manufacturing across emerging markets driving demand for high-temperature stable inorganic pigment solutions. | Modern industrial applications requiring pigments delivering thermal stability and weathering resistance beyond organic colorant capabilities. | Regulatory requirements establishing performance standards favoring inorganic pigments with proven safety documentation. |

| Coating Industry Development | Durability Performance Standards | Color Consistency Requirements |

| Growing emphasis on industrial coating durability and exterior application performance creating demand for weather-resistant pigment systems. | Manufacturers investing in pigments offering consistent color performance while maintaining chemical resistance and outdoor durability. | Quality standards requiring batch-to-batch color consistency and manufacturing documentation for industrial coating formulations. |

| High-Performance Applications | Chemical Resistance Properties | Environmental Compliance |

| Superior opacity characteristics and tinting strength making copper chrome black essential for industrial coating and plastic applications. | Certified suppliers with proven formulation stability required for automotive coating and industrial plastic applications. | Environmental protection standards and manufacturing compliance requirements driving need for documented pigment manufacturing processes. |

| Category | Segments Covered |

|---|---|

| By Metal Composition | High Copper, High Manganese, Other |

| By Application | Coatings, Ceramics, Glass, Plastics, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

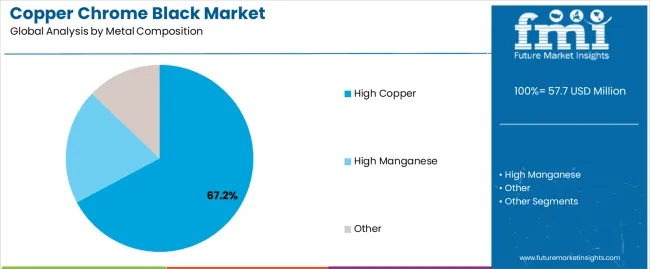

| High Copper | Leader in 2025 with 67.2% market share, likely to maintain leadership through 2035. Broadest application range across industrial coatings, proven color strength, established manufacturing processes. Momentum: steady growth driven by coating industry expansion and automotive finishing applications. Watchouts: copper price volatility affecting manufacturing costs and competitive pressure from alternative black pigments. |

| High Manganese | Specialized segment with 24.6% market share in 2025, concentrated in ceramic and glass applications. Enhanced firing stability and specific melting characteristics for high-temperature processes. Momentum: moderate growth in ceramic tile production and architectural glass manufacturing requiring firing stability. Watchouts: manganese regulatory scrutiny and limited application breadth outside ceramic markets. |

| Other | Minor segment with 8.2% market share in 2025, covering modified formulations and specialty grades. Momentum: limited growth due to niche application requirements and established dominance of primary formulation types. |

| Segment | 2025 to 2035 Outlook |

|---|---|

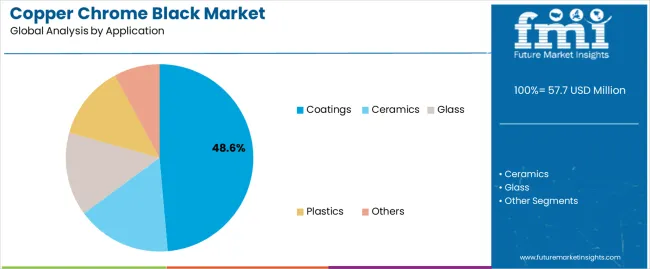

| Coatings | At 46.8%, largest application segment in 2025 with established formulation integration. Industrial coating systems, automotive finishes, architectural applications. Momentum: steady growth driven by industrial coating production and exterior durability requirements. Watchouts: organic pigment competition in interior applications and formulation cost pressure from coating manufacturers. |

| Ceramics | Significant segment with 28.4% market share in 2025, focused on tile and sanitaryware production. High-temperature stability requirements, color consistency standards, firing atmosphere compatibility. Momentum: strong growth through ceramic tile production expansion in emerging markets and architectural specification growth. Watchouts: natural gas price impacts on ceramic firing costs and alternative decoration technology development. |

| Glass | Growing segment with 13.7% market share in 2025, addressing architectural and automotive glass coloration. High-temperature melting requirements, chemical durability standards, optical property control. Momentum: moderate growth via architectural glass demand and automotive glass production expansion. Watchouts: alternative coloration technologies and energy cost impacts on glass production economics. |

| Plastics | Emerging segment with 8.2% market share in 2025, targeting high-performance polymer applications. Processing temperature resistance, color stability requirements, regulatory compliance emphasis. Momentum: steady growth in engineering plastics and automotive interior component applications requiring heat stability. Watchouts: carbon black competition in cost-sensitive applications and organic pigment advancement in specialty grades. |

| Others | Residual segment with 2.9% market share in 2025, covering specialty applications and emerging uses. Momentum: limited growth due to small volume requirements and diverse application characteristics. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Coating Expansion | Raw Material Cost Volatility | Particle Size Optimization |

| Global industrial coating production growth and automotive finishing requirements driving inorganic pigment consumption across established and emerging markets. | Copper and chromium price fluctuations affecting pigment manufacturing costs and pricing stability for coating formulators. | Development of ultrafine particle grades and controlled distribution profiles improving color strength and reducing dosage requirements. |

| Ceramic Industry Growth | Heavy Metal Regulatory Scrutiny | Surface Treatment Innovation |

| Emerging market ceramic tile production expansion and architectural specification growth requiring high-temperature stable colorants. | Chromium compound regulations and environmental protection requirements creating compliance costs and market access barriers. | Integration of surface modification technologies and dispersion aids enhancing pigment compatibility across diverse application systems. |

| Performance Requirements | Organic Pigment Competition | Manufacturing Process Efficiency |

| Industrial application demands for thermal stability and weathering resistance exceeding organic pigment capabilities. | Advanced organic colorants capturing share in interior applications and lower temperature processing systems. | Synthesis optimization and energy-efficient calcination processes reducing manufacturing costs and environmental impact. |

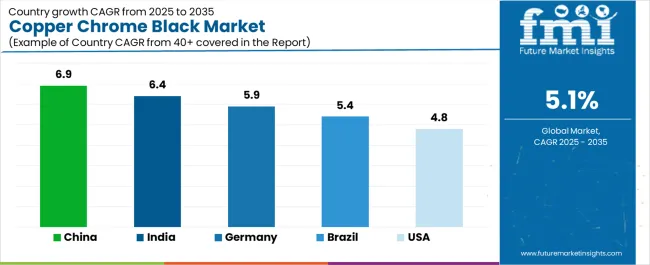

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

Revenue from copper chrome black in China is projected to exhibit strong growth with a CAGR of 6.9% through 2035, driven by expanding ceramic tile production and comprehensive coating industry infrastructure creating substantial opportunities for inorganic pigment suppliers across industrial coating operations, ceramic manufacturing facilities, and plastic compounding sectors. The country's established pigment manufacturing tradition and expanding industrial coating capabilities are creating significant demand for both high copper and high manganese formulation grades. Major coating manufacturers and ceramic tile producers are establishing comprehensive pigment procurement programs to support large-scale manufacturing operations and meet growing color consistency standards.

Ceramic tile production expansion programs are supporting widespread adoption of copper chrome black across manufacturing operations, driving demand for cost-effective high-temperature pigments. Industrial coating development initiatives and automotive finishing capacity growth are creating substantial opportunities for pigment suppliers requiring reliable color performance and competitive manufacturing costs. Regional manufacturing expansion and provincial industrial development are facilitating adoption of inorganic pigment systems throughout major production regions.

Revenue from copper chrome black in India is expanding with a CAGR of 6.4% through 2035, supported by extensive ceramic tile production growth and comprehensive industrial coating development creating sustained demand for inorganic pigments across diverse manufacturing categories and industrial application segments. The country's rapidly growing ceramic industry and expanding coating manufacturing capabilities are driving demand for pigment systems that provide consistent color performance while supporting cost-effective formulation requirements. Tile manufacturers and coating producers are investing in pigment supplier relationships to support growing production volumes and quality requirements.

Ceramic tile manufacturing expansion and industrial coating capability development are creating opportunities for copper chrome black across diverse application segments requiring reliable high-temperature performance and competitive pigment costs. Construction material production growth and coating industry advancement are driving investments in pigment supply chains supporting color consistency requirements throughout major manufacturing regions. Quality standardization programs and environmental compliance development are enhancing demand for certified inorganic pigments throughout Indian industrial markets.

Demand for copper chrome black in Germany is projected to grow with a CAGR of 5.9% through 2035, supported by the country's leadership in automotive coating technology and advanced ceramic manufacturing requiring high-performance inorganic pigments for industrial finishing and architectural applications. German coating manufacturers are implementing pigment systems that support comprehensive quality testing, operational consistency, and stringent environmental protocols. The market is characterized by focus on color accuracy, batch consistency, and adherence to automotive industry specifications and environmental standards.

Automotive coating industry investments are prioritizing pigment systems that demonstrate superior weathering performance and color retention while meeting German environmental protection and workplace safety standards. Industrial coating technology leadership programs and quality excellence initiatives are driving adoption of premium-grade inorganic pigments that support advanced finishing systems and durability requirements. Research and development programs for sustainable pigment synthesis are facilitating adoption of environmentally optimized manufacturing techniques throughout major coating production centers.

Revenue from copper chrome black in the United States is growing with a CAGR of 4.8% through 2035, driven by industrial coating production programs and high-performance plastic applications creating sustained opportunities for pigment suppliers serving both coating manufacturers and specialty polymer compounders. The country's extensive industrial coating infrastructure and expanding automotive refinishing sector are creating demand for inorganic pigments that support diverse performance requirements while maintaining regulatory compliance standards. Coating formulators and plastic manufacturers are developing procurement strategies to support formulation optimization and quality consistency.

Industrial coating development programs and automotive refinishing requirements are facilitating adoption of copper chrome black capable of supporting diverse durability requirements and competitive performance standards. High-performance plastic compounding and engineering polymer applications are enhancing demand for heat-stable inorganic pigments that support processing efficiency and color stability. Regulatory compliance requirements and environmental protection standards are creating opportunities for certified pigment capabilities across American coating and plastic manufacturing facilities.

Demand for copper chrome black in Brazil is projected to grow with a CAGR of 5.4% through 2035, driven by ceramic tile manufacturing expansion and industrial coating capabilities supporting construction material production and comprehensive architectural applications. The country's growing ceramic industry and expanding coating manufacturing market segments are creating demand for inorganic pigments that support operational performance and color consistency standards. Tile manufacturers and coating suppliers are maintaining comprehensive pigment sourcing capabilities to support diverse production requirements.

Ceramic tile production programs and construction material manufacturing are supporting demand for copper chrome black that meets contemporary firing stability and color performance standards. Industrial development and architectural coating programs are creating opportunities for inorganic pigments that provide comprehensive color consistency support. Manufacturing quality enhancement and environmental compliance programs are facilitating adoption of certified pigment capabilities throughout major production regions.

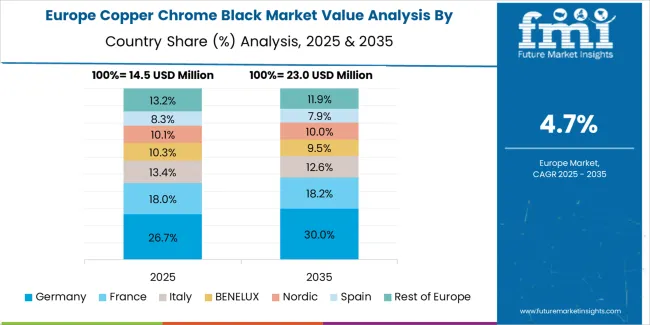

The copper chrome black market in Europe is projected to grow from USD 16.8 million in 2025 to USD 27.6 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 34.6% market share in 2025, projected to reach 35.2% by 2035, supported by its extensive automotive coating industry and ceramic tile manufacturing infrastructure.

Italy follows with a 26.8% share in 2025, expected to reach 27.3% by 2035, driven by comprehensive ceramic tile production capacity and architectural coating applications. Spain holds a 18.4% share in 2025, projected to reach 18.9% by 2035 due to ceramic industry concentration. France commands a 11.7% share, while the United Kingdom accounts for 5.9% in 2025. The Rest of Europe region is anticipated to maintain its collective share at approximately 2.6% through 2035, reflecting established market patterns in Eastern European manufacturing centers.

>

>

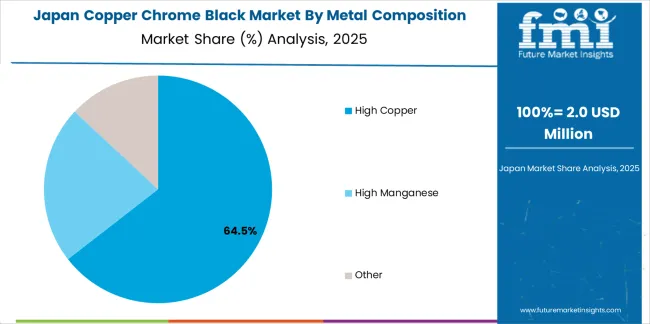

Japanese copper chrome black operations reflect the country's emphasis on automotive coating quality and precision ceramic manufacturing. Major coating manufacturers including Nippon Paint and Kansai Paint maintain rigorous pigment qualification processes requiring extensive color consistency testing, dispersion stability verification, and comprehensive weathering performance documentation. This creates barriers for pigment suppliers but ensures color quality for premium automotive finishing applications.

The Japanese market demonstrates preference for fine particle size grades with optimized dispersion characteristics suitable for high-gloss automotive coating systems. Companies require specific surface treatment approaches that address compatibility with urethane and acrylic coating resins. Performance specifications differ from Western markets, driving demand for customized pigment grades and technical support.

Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes chemical safety standards and manufacturing traceability requirements. The automotive coating supply chain supports premium pigment pricing through quality-driven procurement, creating advantages for suppliers with comprehensive technical data and consistent batch performance.

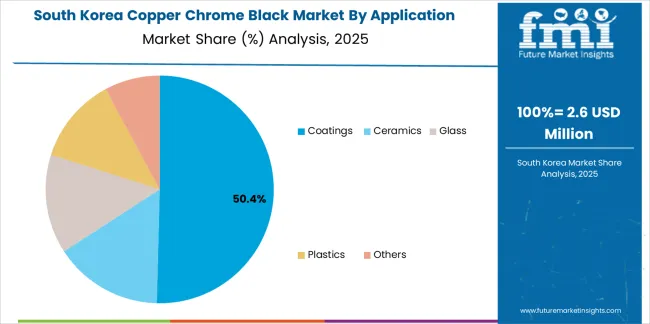

South Korean copper chrome black operations reflect the country's advanced ceramic tile manufacturing sector and automotive coating production capabilities. Major ceramic companies including Lotte Chemical and industrial coating manufacturers drive pigment procurement strategies, establishing relationships with certified suppliers to support large-scale tile production and automotive finishing operations.

The Korean market demonstrates strength in large-format ceramic tile production, with pigment requirements emphasizing firing stability across extended kiln cycles. Companies integrate copper chrome black with other inorganic pigments for decorative effects, requiring suppliers to provide technical support for color matching and firing optimization. This sophistication creates demand for consistent pigment quality and application expertise.

Regulatory frameworks emphasize environmental protection and workplace safety standards. Korea Occupational Safety and Health Agency oversight establishes manufacturing compliance requirements that favor suppliers with comprehensive safety documentation and environmental management systems. This benefits established pigment manufacturers with robust quality assurance programs.

Profit pools are consolidating around established inorganic pigment manufacturers with proven synthesis capabilities and comprehensive technical documentation. Value is migrating from commodity-grade pigments to application-optimized products offering particle size control, surface treatment customization, and technical support services that improve customer formulation performance. Several archetypes set the pace: global specialty pigment manufacturers defending share through quality consistency and automotive coating approvals; vertically integrated chemical producers offering copper chrome black within broader inorganic pigment portfolios; regional suppliers capturing ceramic industry segments through local manufacturing and technical service; and toll manufacturers providing synthesis capacity for branded pigment marketers.

Switching costs remain moderate due to formulation qualification requirements and color matching complexity, creating opportunities for suppliers who can demonstrate consistent batch performance. However, automotive coating approvals, ceramic firing stability verification, and customer technical relationships create barriers for new entrants lacking established performance records. Quality certification requirements and environmental compliance documentation favor suppliers with comprehensive manufacturing controls and testing capabilities.

Consolidation continues as larger specialty chemical companies acquire regional pigment manufacturers to expand product portfolios and geographic coverage. Vertical integration accelerates with coating manufacturers developing preferred supplier relationships and long-term supply agreements to ensure pigment availability and pricing stability. Technical service capabilities for dispersion optimization and application troubleshooting are becoming important differentiators, requiring expertise investment that pressures smaller manufacturers.

Market dynamics favor suppliers who can demonstrate color consistency through batch certification programs, offer application-specific grades for diverse end uses, and maintain manufacturing reliability that ensures delivery performance. Price competition intensifies in ceramic applications where pigment functionality is standardized, while automotive coating and specialty plastic segments offer opportunities for premium positioning through enhanced performance characteristics. Establish automotive coating approvals with quality consistency documentation and weathering test portfolios; develop application-specific grades with optimized particle size and surface treatments for market differentiation; invest in manufacturing process controls and environmental compliance systems for certification maintenance.

| Items | Values |

|---|---|

| Quantitative Units | USD 57.7 million |

| Metal Composition | High Copper, High Manganese, Other |

| Application | Coatings, Ceramics, Glass, Plastics, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Italy, Spain, United States, and other 40+ countries |

| Key Companies Profiled | The Shepherd Color Company, Vibrantz Technologies, Heubach (Sudarshan Chemical), Asahi Kasei Kogyo, Zhonglong Materials, Hunan Jufa Pigment, Fulln Glaze Co., Ltd., Jolychem (Shanghai) Company, Jiangxi Dingrui New Materials, Cadello, Shanghai Fulcolor Advanced Material |

| Additional Attributes | Dollar sales by metal composition/application, regional demand (NA, EU, APAC, LATAM, MEA), competitive landscape, coating vs ceramic adoption, formulation integration, and technology innovations driving color performance, thermal stability, and manufacturing efficiency |

The global copper chrome black market is estimated to be valued at USD 57.7 million in 2025.

The market size for the copper chrome black market is projected to reach USD 94.9 million by 2035.

The copper chrome black market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in copper chrome black market are high copper, high manganese and other.

In terms of application, coatings segment to command 48.6% share in the copper chrome black market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Azoles Market

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA