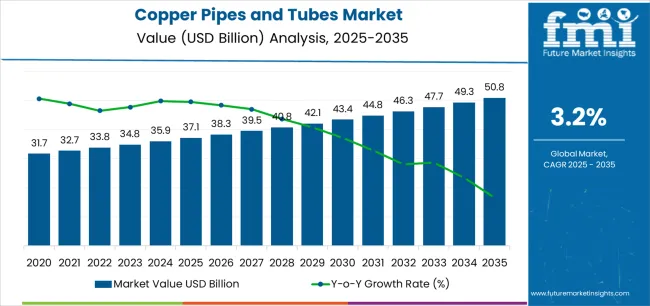

The copper pipes and tubes market, valued at USD 37.1 billion in 2025, is projected to reach USD 49.8 billion by 2035, reflecting a CAGR of 3.2% over the period. The market is likely to experience fluctuations driven by raw material price volatility, particularly copper, which directly impacts production costs and profit margins. Periods of high copper prices may temporarily constrain growth as manufacturers adjust pricing strategies and end users defer procurement, creating troughs in demand. The stable or declining copper prices, combined with increased construction and infrastructure activity, are expected to generate peak demand periods, supporting steady revenue expansion.

The market’s performance is also influenced by regulatory and environmental factors, as stringent building codes and standards for plumbing and HVAC applications drive adoption of high-quality copper tubing. Economic cycles in key regions, especially in residential and commercial construction, can lead to short-term slowdowns, while recovery phases often bring a surge in infrastructure and retrofit projects.

Technological advancements in manufacturing, such as improved corrosion resistance, flexible tubing solutions, and energy-efficient production processes, are anticipated to mitigate some of the volatility by enhancing product value and reducing operational costs. Manufacturers focusing on innovation, strategic partnerships, and regional diversification are better positioned to navigate market fluctuations.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | HVAC systems (residential & commercial) | 44% | Air-conditioning, refrigeration, heat pumps |

| Plumbing infrastructure | 34% | Potable water, drainage, building services | |

| Industrial heat exchangers | 17% | Power plants, process industries, cooling | |

| OEM direct supply (appliances, auto) | 5% | White goods, automotive HVAC systems | |

| Future (3-5 yrs) | Heat pump & efficient HVAC | 32-36% | Residential/commercial heat pump adoption |

| Traditional air-conditioning | 18-22% | Mature markets, replacement cycles | |

| Green building plumbing | 22-26% | Water efficiency, sustainable construction | |

| Industrial decarbonization heat exchange | 12-15% | Process efficiency, renewable integration | |

| Cold chain & refrigeration | 6-8% | Food safety, pharmaceutical logistics | |

| Specialty applications | 4-6% | Medical gas, solar thermal, electronics cooling |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 37.1 billion |

| Market Forecast (2035) | USD 49.8 billion |

| Growth Rate | 3.2% CAGR |

| Leading Product Technology | Welded |

| Primary Application | HVAC Segment |

The market demonstrates strong fundamentals with welded copper tube systems capturing dominant share through advanced manufacturing efficiency and HVAC application optimization. HVAC applications drive primary demand, supported by increasing air-conditioning penetration and heat pump deployment requirements. Geographic expansion remains concentrated in developed markets with established construction infrastructure, while emerging economies show accelerating adoption rates driven by urbanization initiatives and rising climate control standards.

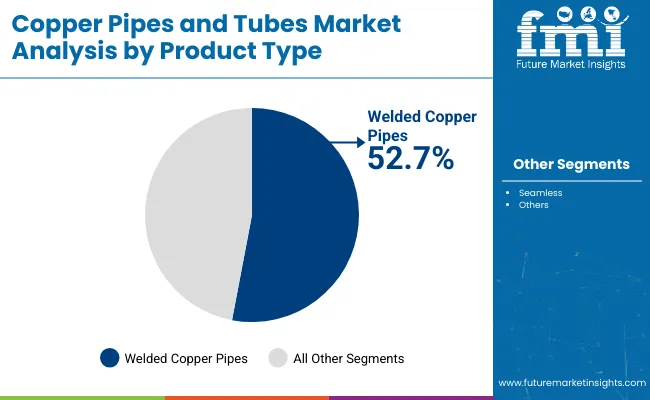

Primary Classification: The market segments by product type into welded (including ERW/HF-welded and laser/TIG-seam welded) and seamless (including drawn cold-worked and extruded) copper tubes, representing the evolution from traditional manufacturing to advanced production solutions for comprehensive thermal transfer optimization.

Secondary Classification: End-use segmentation divides the market into HVAC (including residential air-conditioning, commercial AC/chillers, and refrigeration), plumbing (including residential and commercial), industrial heat exchange (including power/energy, chemicals/process, and food & beverage), and other applications including medical gas, solar thermal, and OEM sectors.

Tertiary Classification: Outside diameter segmentation covers tubes up to 15 mm (including coils and straight lengths), 16-28 mm, 29-54 mm, and 55 mm and above, while sales channel spans direct to OEM (including HVAC OEM, appliance/white goods, and automotive HVAC) and distribution (including building merchants and industrial distributors).

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading consumption while emerging economies show accelerating growth patterns driven by construction expansion programs.

The segmentation structure reveals technology progression from standard tube manufacturing toward sophisticated high-efficiency production systems with enhanced quality and sustainability capabilities, while application diversity spans from residential air-conditioning to industrial process equipment requiring reliable heat transfer solutions.

Market Position: Welded copper tubes command the leading position in the copper pipes and tubes market with 72.0% market share through advanced manufacturing features, including cost-effective production, dimensional consistency, and HVAC application optimization that enable manufacturers to achieve efficient tube supply across diverse air-conditioning, plumbing, and heat transfer environments.

Value Drivers: The segment benefits from HVAC and plumbing preference for economical tube systems that provide reliable performance, consistent wall thickness, and production scalability without requiring intensive manufacturing processes. Advanced welding features enable high-speed production capabilities, automated quality control, and integration with coil winding systems, where cost efficiency and manufacturing throughput represent critical supply requirements.

Competitive Advantages: Welded copper tube systems differentiate through proven cost leadership, production flexibility, and compatibility with comprehensive HVAC manufacturing that enhance supply economics while maintaining adequate performance standards suitable for diverse residential and commercial applications.

Key market characteristics:

Within welded tubes, ERW/HF-welded technology maintains the dominant subsegment position with 61.0% of welded share due to its high-speed production capability and proven reliability for HVAC applications. These systems appeal to manufacturers requiring cost-effective tube production with established quality standards for air-conditioning coils. Market strength is driven by HVAC expansion and volume production, emphasizing efficient manufacturing solutions and consistent quality through proven welding technology.

Laser/TIG-seam welded tubes capture 39.0% of welded share through superior seam quality requirements in high-pressure applications and premium HVAC systems requiring enhanced leak prevention and aesthetic appearance capabilities.

Seamless copper tubes capture 47.3% market share through critical applications requiring superior pressure resistance, corrosion performance, and mechanical properties in industrial heat exchange and high-pressure plumbing installations.

Within seamless tubes, drawn cold-worked production maintains the dominant position with 68.0% of seamless share through superior dimensional control and mechanical properties. Extruded seamless tubes capture 32.0% of seamless share through heavy-wall requirements and larger diameter applications.

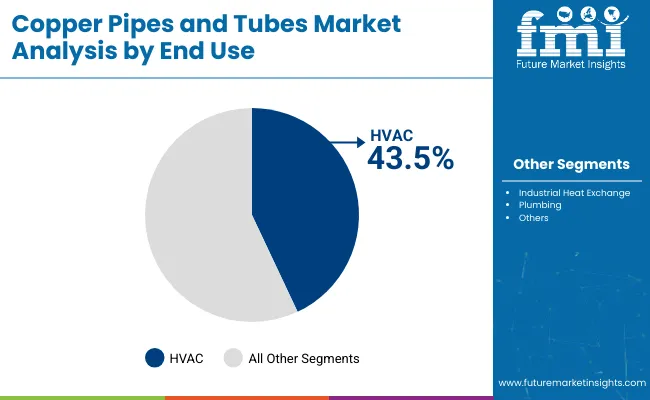

Market Context: HVAC applications demonstrate the dominant market position in the copper pipes and tubes market with 43.5% market share due to widespread adoption of air-conditioning systems and increasing focus on climate control, energy efficiency, and thermal comfort applications that maximize heat transfer performance while maintaining refrigerant containment standards.

Appeal Factors: HVAC users prioritize thermal conductivity excellence, refrigerant compatibility, and integration with air-conditioning systems that enable efficient heat transfer across cooling and heating cycles. The segment benefits from substantial residential construction investment and commercial building programs that emphasize the deployment of copper tube systems for air-conditioning and refrigeration applications.

Growth Drivers: Heat pump adoption programs incorporate copper tubes as essential components for refrigerant circuits, while climate change increases demand for cooling capacity that requires efficient heat transfer systems and reliable refrigerant distribution networks.

Market Challenges: Alternative materials including aluminum and stainless steel may compete in specific applications where cost or weight considerations outweigh thermal performance advantages.

Application dynamics include:

Within HVAC applications, residential air-conditioning maintains the leading position with 46.0% of HVAC share through mass market cooling demand and household climate control requirements. Commercial AC/chillers capture 36.0% of HVAC share, while refrigeration including food retail and cold chain holds 18.0% through specialized cooling and temperature maintenance applications.

Plumbing captures 34.0% market share through water distribution systems, sanitary applications, and building services requiring corrosion-resistant piping and potable water compatibility. Within plumbing, residential applications hold 60.0% of plumbing share while commercial plumbing accounts for 40.0%.

Industrial heat exchange accounts for 17.5% market share through power generation, chemical processing, and industrial cooling requiring high-performance heat transfer equipment. Within industrial heat exchange, power/energy applications hold 40.0%, chemicals/process accounts for 35.0%, while food & beverage represents 25.0%.

Other applications including medical gas, solar thermal, and OEM sectors capture 5.0% market share through specialized requirements and niche high-value applications.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Heat pump adoption & HVAC efficiency mandates (residential heating transition, commercial retrofits, regulatory standards) | ★★★★★ | Heat pump technology requires efficient refrigerant circuits; copper tube demand growing as governments mandate fossil fuel heating phase-out and building energy efficiency improvements. |

| Driver | Urban construction & housing development (residential towers, commercial buildings, infrastructure modernization) | ★★★★★ | New construction driving baseline copper tube demand; urbanization in emerging markets creating massive HVAC and plumbing installation requirements across residential and commercial projects. |

| Driver | Cold chain expansion (food safety, pharmaceutical logistics, retail refrigeration upgrades) | ★★★★☆ | Food safety regulations and vaccine distribution requiring temperature-controlled infrastructure; refrigeration system expansion driving copper tube demand in commercial and industrial segments. |

| Restraint | Copper price volatility & material cost (commodity price fluctuations, supply disruptions, mining constraints) | ★★★★☆ | Copper as globally-traded commodity subject to price swings; material cost representing 60-70% of tube price creating margin pressure and customer price sensitivity during upswings. |

| Restraint | Alternative material competition (aluminum, stainless steel, plastic composites in specific applications) | ★★★☆☆ | Lower-cost alternatives gaining share in price-sensitive segments; aluminum in automotive HVAC and PEX/plastic in some plumbing applications challenging copper despite inferior thermal properties. |

| Trend | Recycled content & circular economy (secondary copper usage, carbon footprint reduction, green building certification) | ★★★★★ | Sustainability regulations and building certifications requiring recycled content; tube manufacturers investing in secondary copper sourcing and carbon accounting to meet green building standards. |

| Trend | Thin-wall & miniaturized tubing (material efficiency, weight reduction, compact designs for space-constrained applications) | ★★★★☆ | Space constraints in modern buildings and appliances driving diameter reduction; thin-wall technology enabling material savings while maintaining pressure ratings through advanced manufacturing. |

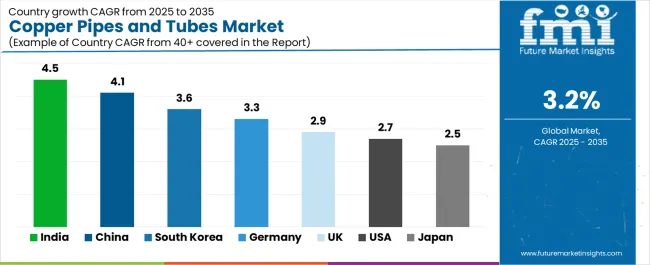

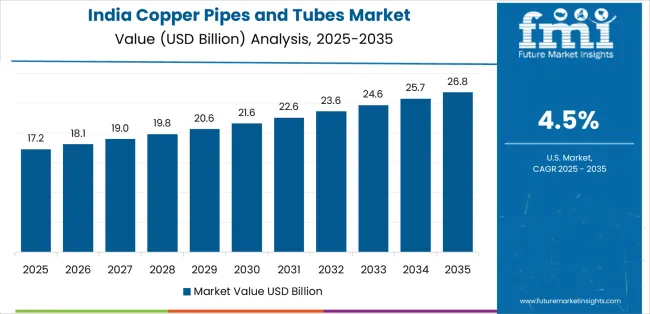

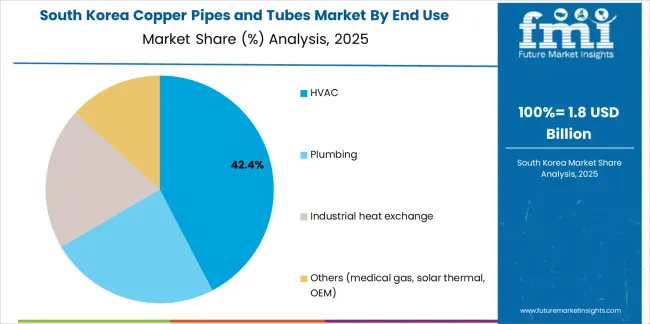

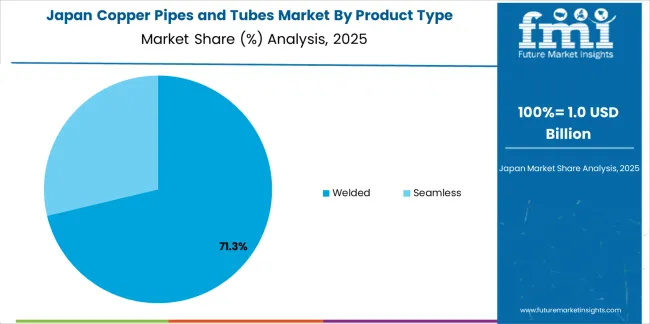

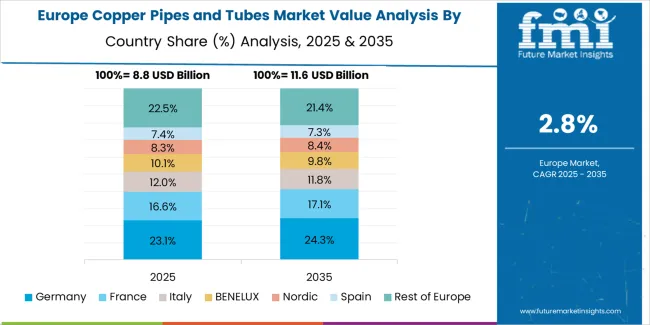

The copper pipes and tubes market demonstrates varied regional dynamics with Growth Leaders including India (4.5% growth rate) and China (4.1% growth rate) driving expansion through urbanization initiatives and HVAC penetration development. Steady Performers encompass South Korea (3.6% growth rate), Germany (3.3% growth rate), and United Kingdom (2.9% growth rate), benefiting from established construction industries and heat pump adoption. Developed Markets feature United States (2.7% growth rate) and Japan (2.5% growth rate), where infrastructure modernization and building retrofit support consistent growth patterns.

Regional synthesis reveals South Asian markets leading adoption through mass housing construction and commercial HVAC expansion, while East Asian countries maintain strong growth supported by appliance manufacturing and urban development. European markets show robust growth driven by heat pump deployment and energy efficiency mandates.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| India | 4.5% | Focus on tier-2/3 city expansion | Quality consistency; payment terms |

| China | 4.1% | Lead with HVAC OEM partnerships | Overcapacity; environmental regulations |

| South Korea | 3.6% | Push miniaturized precision tubes | Export dependency; construction cycles |

| Germany | 3.3% | Heat pump system expertise | Installation capacity constraints; permitting |

| United Kingdom | 2.9% | Modular construction solutions | Skills shortage; Brexit logistics |

| United States | 2.7% | Infrastructure program alignment | Copper price pass-through; contractor availability |

| Japan | 2.5% | Premium thin-wall technology | Shrinking construction market; deflation |

India establishes fastest market growth through aggressive urbanization programs and comprehensive housing development, integrating copper pipes and tubes as standard components in residential construction and commercial building installations. The country's 4.5% growth rate reflects government initiatives promoting urban infrastructure and affordable housing that mandate the use of quality piping systems in HVAC and plumbing facilities. Growth concentrates in emerging urban centers, including tier-2 and tier-3 cities across Maharashtra, Tamil Nadu, and Gujarat, where construction infrastructure development showcases expanding air-conditioning penetration that appeals to building developers seeking reliable HVAC solutions and water distribution capabilities.

Indian construction markets are adopting copper tube systems through growing awareness of corrosion resistance and thermal efficiency advantages, including residential air-conditioning and plumbing installations. Distribution channels through building material merchants and HVAC distributors expand market access, while rising middle-class incomes and climate control expectations support adoption across diverse residential and commercial segments.

Strategic Market Indicators:

In Guangdong manufacturing clusters, Jiangsu industrial zones, and major urban centers, HVAC manufacturers and construction projects are implementing copper pipes and tubes as standard components for air-conditioning systems and building services applications, driven by urban residential development and carbon-neutral heating/cooling transition programs that emphasize the importance of efficient thermal transfer. The market holds a 4.1% growth rate, supported by continued urbanization and appliance manufacturing dominance that promote copper tube systems for residential and commercial building facilities. Chinese operators are deploying tube systems that provide reliable thermal performance and cost-effective supply, particularly appealing in high-volume construction regions where building completion speed and HVAC efficiency represent critical project requirements.

Market expansion benefits from massive domestic HVAC manufacturing capacity and vertical integration that enables competitive tube supply for both domestic construction and appliance exports. Technology adoption follows patterns established in construction materials, where scale economics and supply chain integration drive procurement decisions and project-scale deployment.

Market Intelligence Brief:

In Seoul high-rise developments, Incheon industrial complexes, and semiconductor facility infrastructure, construction projects are implementing advanced copper tube systems as precision components for miniaturized HVAC and specialized cooling applications, driven by green building adoption and electronics sector requirements that emphasize the importance of compact, reliable piping. The market holds a 3.6% growth rate, supported by advanced construction technology and high-performance HVAC systems that promote miniaturized tube solutions for space-constrained building and industrial facilities. Korean operators are deploying tube systems that provide compact dimensions and precise tolerances, particularly appealing in high-rise construction regions where space optimization and system efficiency represent critical design requirements.

Market expansion benefits from advanced construction techniques and preference for high-quality building systems that require precision-manufactured copper tubes. Technology adoption follows patterns established in building technology, where performance and reliability drive specification decisions and premium system deployment.

Market Intelligence Brief:

Germany's energy transition demonstrates sophisticated copper tube deployment with documented operational effectiveness in residential heat pump systems and industrial heat exchanger retrofits through integration with building energy systems and efficiency mandates. The country leverages renewable energy leadership and building efficiency standards to maintain a 3.3% growth rate. Construction centers, including Bavaria residential development, North Rhine-Westphalia industrial zones, and nationwide retrofit programs, showcase heat pump installations where copper tubes provide essential refrigerant circuits and heating distribution to optimize energy efficiency and carbon reduction.

German building operators and contractors prioritize energy efficiency and system reliability in tube specification, creating demand for high-quality seamless and welded products with advanced features, including green building certification and recycled content verification. The market benefits from established efficiency standards and ambitious heat pump deployment targets supporting copper tube demand for heating system transition.

Market Intelligence Brief:

In London commercial districts, regional housing developments, and nationwide retrofit programs, construction projects are implementing copper tube systems as replacement components for heating upgrades and plumbing modernization applications, driven by heat pump incentives and building stock improvement that emphasize the importance of efficient heating distribution. The market holds a 2.9% growth rate, supported by government decarbonization targets and modular construction adoption that promote copper systems for residential and commercial building facilities. UK operators are deploying tube systems that support heat pump integration and accelerated installation methods, particularly appealing in retrofit scenarios where system compatibility and installation speed represent critical project requirements.

Market expansion benefits from substantial building retrofit funding and heat pump subsidy programs that require copper tube heat distribution systems. Technology adoption follows patterns established in construction renovation, where regulatory compliance and grant eligibility drive material selection and system upgrade decisions.

Market Intelligence Brief:

United States establishes stable market position through comprehensive infrastructure programs and building code updates, integrating copper pipes and tubes across water system upgrades and HVAC replacements. The country's 2.7% growth rate reflects established construction relationships and mature replacement cycles that support steady consumption of copper tube systems in residential and commercial facilities. Demand concentrates in growth regions including Sun Belt residential construction, infrastructure water projects, and commercial building retrofits, where construction activity showcases reliable copper tube deployment that appeals to contractors seeking code-compliant solutions and proven installation practices.

American construction markets leverage established distribution networks and comprehensive building code frameworks, including plumbing standards and HVAC efficiency requirements that maintain copper tube consumption. The market benefits from infrastructure investment programs and building energy code updates that support water system modernization and high-efficiency HVAC installation.

Market Intelligence Brief:

Japan's space-constrained construction market demonstrates sophisticated copper tube deployment with emphasis on miniaturization and quality through established manufacturing standards and precision requirements. The country maintains a 2.5% growth rate, driven by compact building design and premium installation quality expectations.

Market dynamics focus on thin-wall tube technology and small-diameter systems optimized for space-limited residential and commercial applications. Quality culture and performance requirements create sustained demand for precision-manufactured copper tubes supporting compact HVAC systems and medical facility installations.

Strategic Market Considerations:

The copper pipes and tubes market in Europe is projected to account for 29.8% of global revenue in 2025. Within Europe, Germany is expected to lead with a 22.4% share of European market, supported by heat pump deployment and industrial heat exchanger demand.

Italy follows with a 15.1% share driven by residential construction and HVAC manufacturing. United Kingdom holds a 12.9% share through heat pump incentives and building retrofit programs. France accounts for a 12.2% share with residential construction and commercial HVAC installations. Spain represents an 8.4% share through construction recovery and tourism sector HVAC demand. Nordics maintain a 7.3% share driven by district heating systems and energy-efficient construction. Benelux accounts for a 6.6% share through building services and industrial applications. Rest of Europe holds a 15.1% share through Central and Eastern European construction growth and HVAC market development, with demand anchored in heat pump rollouts, district heating and cooling retrofits, and stringent potable water compliance, while recycled-content tubes and seamless products for high-pressure heat exchanger duties gain mix share alongside welded plumbing coils for residential refurbishments.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Integrated copper producers | Mining/smelting, tube production, recycling infrastructure | Cost position, supply security, vertical integration | Customer intimacy; application engineering |

| Pure-play tube manufacturers | Production technology, customer relationships, quality systems | Application expertise, service flexibility, technical support | Copper price exposure; scale limitations |

| Regional specialists | Local distribution, contractor relationships, inventory management | Market knowledge, responsive service, credit flexibility | Technology innovation; international reach |

| OEM captive operations | Internal supply, specification control, process integration | Application optimization, cost transparency, logistics certainty | External market; technology licensing |

| Merchants & distributors | Market access, working capital, logistics networks | Volume aggregation, credit provision, inventory risk-taking | Manufacturing control; raw material exposure |

| Item | Value |

|---|---|

| Quantitative Units | USD 37.1 billion |

| Product Type | Welded (ERW/HF-welded, Laser/TIG-seam welded), Seamless (Drawn cold-worked, Extruded) |

| End Use | HVAC (Residential air-conditioning, Commercial AC/Chillers, Refrigeration), Plumbing (Residential, Commercial), Industrial heat exchange (Power/energy, Chemicals/process, Food & beverage), Others (medical gas, solar thermal, OEM) |

| Outside Diameter | Up to 15 mm (Coils, Straight lengths), 16-28 mm, 29-54 mm, 55 mm and above |

| Sales Channel | Direct to OEM (HVAC OEM, Appliance/white goods, Automotive HVAC), Distribution (Building merchants, Industrial distributors) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, South Korea, Canada, Brazil, France, Australia, and 25+ additional countries |

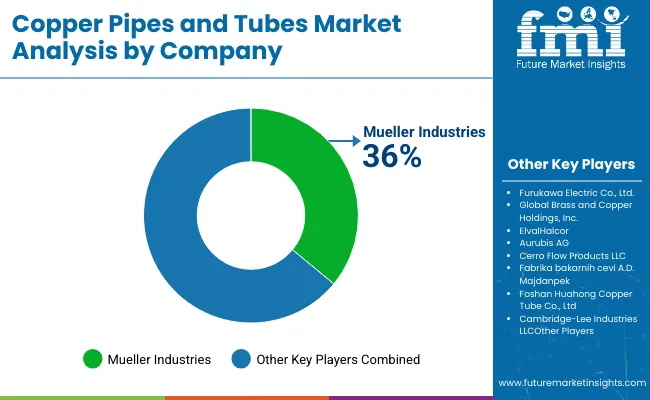

| Key Companies Profiled | Mueller Industries, Wieland Group, Aurubis AG, KME Group, Zhejiang Hailiang Co. Ltd., Kobelco & Materials Copper Tube Co. Ltd., MM Kembla, ElvalHalcor, Cambridge-Lee Industries LLC, Cerro Flow Products LLC |

| Additional Attributes | Dollar sales by product type and end-use categories, regional consumption trends across South Asia Pacific, East Asia, and Western Europe, competitive landscape with copper tube manufacturers and integrated producers, contractor preferences for quality certification and supply reliability, integration with HVAC systems and plumbing infrastructure, innovations in manufacturing technology and recycled content, and development of sustainable copper tube solutions with enhanced performance and environmental optimization capabilities. |

The global copper pipes and tubes market is estimated to be valued at USD 37.1 billion in 2025.

The market size for the copper pipes and tubes market is projected to reach USD 50.8 billion by 2035.

The copper pipes and tubes market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in copper pipes and tubes market are welded and seamless .

In terms of end use, hvac segment to command 43.5% share in the copper pipes and tubes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Azoles Market

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA