The copper fungicides market is estimated to be valued at USD 350.3 million in 2025 and is projected to reach USD 657.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The copper fungicides market holds a crucial position within the crop protection industry, supported by its long-standing role in safeguarding fruits, vegetables, and cereal crops from fungal infections such as downy mildew, leaf spots, and blights. Within the overall fungicide category, copper-based solutions account for nearly 12–14% of usage, driven by their broad-spectrum efficacy and compatibility with both conventional and organic farming practices.

In the wider agrochemicals segment, copper fungicides contribute around 7–9%, reflecting their importance in integrated pest management systems where resistance management and residue compliance are critical factors. When assessed within the inorganic fungicides class, their share rises to nearly 18–20%, given their long history of adoption and reliability across diverse climatic conditions. In organic-certified agriculture, copper fungicides represent a vital 10–12% share, as their approval under specific organic standards positions them as one of the few viable protective solutions for farmers. Within specialty crops such as vineyards, horticulture, and fruit orchards, they represent almost 15–17% due to the high susceptibility of these crops to fungal diseases.

Growth is further enhanced by increasing awareness of food security, regulatory focus on minimizing crop losses, and the expansion of biocompatible formulations with reduced environmental impact. Manufacturers are focusing on micronized formulations, controlled-release variants, and lower-residue blends to meet stricter environmental and residue guidelines while enhancing crop protection efficacy. With rising global food demand and increasing agricultural exports, the copper fungicides market is expected to maintain steady growth, underpinned by its adaptability, proven performance, and continued innovation in application technologies across regional markets.

| Metric | Value |

|---|---|

| Copper Fungicides Market Estimated Value in (2025 E) | USD 350.3 million |

| Copper Fungicides Market Forecast Value in (2035 F) | USD 657.6 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Copper Fungicides market is experiencing consistent growth driven by rising demand for sustainable crop protection solutions and increasing pressure to reduce synthetic chemical usage in agriculture. The current market environment is shaped by the widespread adoption of copper-based fungicides due to their multi-site mode of action, which makes them effective against a broad spectrum of fungal and bacterial diseases.

This effectiveness, combined with relatively low resistance development, has contributed to their continued preference among growers. The increasing cultivation of fruits and vegetables, coupled with export-oriented production practices, is further elevating the need for reliable and residue-compliant fungicides.

Regulatory approvals in multiple regions and the rising shift toward integrated pest management practices are also encouraging the use of copper fungicides in diverse formulations and crop categories Looking ahead, advancements in formulation technologies and the growing demand for organic and eco-friendly fungicide alternatives are expected to support sustained market expansion across both mature and emerging agricultural economies.

The copper fungicides market is segmented by chemistry, formulation, application, and geographic regions. By chemistry, the copper fungicides market is divided into Copper Hydroxide, Copper Oxychloride, Cuprous Oxide, Copper Sulphate, and Others. In terms of formulation, the copper fungicides market is classified into Wettable Powder (WP), Water-dispersible Granules (WG), Soluble granules (SG), and Others.

Based on application, the copper fungicides market is segmented into Fruits & Vegetables, Cereals & Grains, and Oilseeds & Pulses. Regionally, the copper fungicides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The copper hydroxide segment is projected to hold 31.2% of the overall Copper Fungicides market revenue in 2025, making it the leading chemistry type. This dominant position is being supported by its high efficacy in controlling bacterial and fungal diseases across a variety of crops. The fine particle size and superior suspension properties of copper hydroxide enable better adhesion to plant surfaces, resulting in extended protection and reduced wash-off during rainfall.

The formulation compatibility and ease of handling in the field have contributed to its preference by growers. Moreover, the relatively lower metallic copper content compared to traditional compounds has made copper hydroxide a favorable option in regions with stricter environmental and residue regulations.

Its proven effectiveness in both conventional and organic farming systems has also contributed to its strong market position. With the continued expansion of horticultural production and rising demand for yield-enhancing crop protection products, copper hydroxide is expected to remain a primary choice within the chemistry segment.

The wettable powder formulation is expected to account for 37.6% of the Copper Fungicides market revenue in 2025, leading among all formulation types. This growth is being attributed to its long-standing use, ease of storage, and stable shelf life, which make it suitable for various climatic conditions and application systems. Farmers widely accept wettable powder formulations due to their ability to deliver consistent dispersion in spray solutions, resulting in uniform coverage on crop surfaces.

The lower cost of production and minimal requirement for advanced formulation technology have supported broader adoption, especially in cost-sensitive markets. In addition, the flexibility to use this formulation across multiple crops and disease spectrums has reinforced its relevance.

The compatibility with tank mixes and reduced clogging in spraying equipment has made wettable powder a practical choice for both smallholders and commercial farms. As farming operations continue to prioritize effective and economical disease management tools, wettable powder is expected to sustain its leadership position.

The fruits and vegetables application segment is anticipated to contribute 54.8% of the Copper Fungicides market revenue in 2025, marking it as the leading crop category. This high share is being driven by the intensive disease management needs of high-value horticultural crops that are highly susceptible to fungal and bacterial infections. The perishability and export-oriented nature of fruits and vegetables have prompted producers to adopt protective fungicide regimes that ensure quality and marketability.

Copper fungicides have remained a preferred solution due to their broad-spectrum efficacy and compliance with residue limits required in global trade. Additionally, the increasing area under cultivation and the emphasis on appearance and shelf-life of produce have reinforced the demand for effective crop protection products in this segment.

The versatility of copper fungicides in managing multiple pathogens and their acceptance in organic farming practices have further expanded their use in fruits and vegetables. With rising consumer demand for fresh and residue-free produce, this segment is expected to retain its dominant market share.

Copper fungicides remain critical in crop protection, with their effectiveness and cost-effectiveness driving demand. Growing interest in organic farming and emerging markets presents additional growth opportunities.

The demand for copper fungicides is largely driven by their effectiveness in controlling fungal diseases across a wide range of crops, including fruits, vegetables, and grains. The ability to manage diseases like downy mildew and blight makes copper fungicides a popular choice in both conventional and organic farming practices. Their broad-spectrum activity and relatively low cost make them indispensable for farmers seeking reliable crop protection solutions. Copper fungicides are particularly valued for their long history of safe usage, building trust among growers. This consistent demand ensures their position as a key player in the fungicide market, supporting both large-scale and smallholder agricultural operations.

Government regulations across key agricultural regions contribute significantly to the copper fungicide market’s growth. Regulations encouraging the use of eco-friendly and safe crop protection solutions have bolstered the adoption of copper-based products. In regions like the EU and the US, guidelines promoting reduced chemical residues in food have made copper fungicides an attractive option, especially in organic farming. By meeting environmental safety standards, copper fungicides ensure a place in various national farming programs, enhancing their market position. These regulations are instrumental in pushing manufacturers to refine and optimize copper fungicide formulations, making them more effective and accessible for widespread use.

While copper fungicides are effective, they face several challenges related to their environmental impact, particularly their accumulation in the soil. Prolonged use of copper fungicides can lead to toxicity issues in the soil, which could affect plant health and biodiversity. This has led to restrictions in some regions, requiring farmers to balance copper use with other fungicide alternatives. The development of fungal resistance to copper-based products poses an ongoing challenge, limiting their long-term efficacy. Such resistance issues necessitate the exploration of integrated pest management approaches, where copper fungicides are used in combination with other treatments to reduce the risk of resistance.

The rise in organic farming presents significant opportunities for copper fungicides, as these products are often one of the few approved fungicide options in organic agriculture. With increasing consumer demand for organically grown produce, farmers are turning to copper-based solutions to meet these requirements. Emerging markets in Asia and Africa are experiencing growth in agricultural activity, providing new opportunities for copper fungicide adoption. As farmers in these regions seek effective crop protection measures, copper fungicides stand out as a practical, cost-effective option. Market growth can also be supported by the continuous improvement of copper formulations that offer reduced environmental impact and enhanced efficacy.

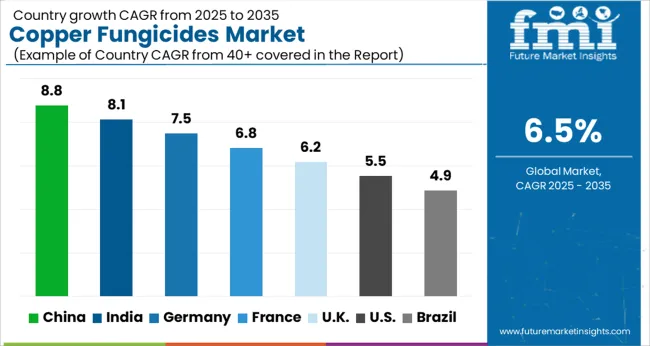

The copper fungicides market is projected to grow at a global CAGR of 6.5% between 2025 and 2035, driven by the need for effective crop protection and the rising adoption of eco-friendly farming practices. China leads with a CAGR of 8.8%, bolstered by the rapid growth of its agricultural sector, government support for eco-friendly farming practices, and increasing demand for effective disease control in high-value crops. India follows at 8.1%, supported by rising agricultural activity, increasing adoption of crop protection solutions, and the expansion of organic farming initiatives. France records a growth rate of 6.8%, driven by strong regulatory support for copper-based fungicides in organic farming and an emphasis on crop quality. The United Kingdom achieves 6.2%, benefiting from steady demand in both conventional and organic farming, while the United States posts 5.5%, influenced by the mature agricultural market and a shift towards integrated pest management solutions. This analysis incorporates insights from various regions, underscoring the pivotal role these countries play in shaping the dynamics of the copper fungicides market, influencing product development, regulatory frameworks, and growth strategies in the agricultural sector.

The UK copper fungicides market recorded a CAGR of about 5.0% between 2020 and 2024, driven by steady demand from traditional agricultural sectors and increased usage in organic farming. For 2025–2035, the growth rate advances to 6.2%, reflecting a shift towards integrated pest management, governmental incentives for eco-friendly farming, and rising awareness of environmental impacts. This increase is attributed to the adoption of copper-based solutions within organic farming programs, as well as competitive pricing strategies from both local and international manufacturers. Domestic suppliers have capitalized on partnerships with international distributors to improve market reach across smaller farming operations, while policies have expanded adoption among farmers seeking sustainable crop protection methods.

China’s copper fungicides market experienced a CAGR of 8.1% between 2020 and 2024, driven by strong demand in the agricultural sector and growing awareness about crop protection. For 2025–2035, the growth rate rises to 8.8%, driven by technological advancements in farming practices and the continued expansion of eco-friendly and organic farming initiatives. This surge in growth is attributed to the increasing preference for sustainable farming solutions and government-led policies supporting the agricultural industry. As demand for higher crop yields grows, copper fungicides continue to play a crucial role in ensuring crop protection and quality. China’s expanding domestic production of copper fungicides allows for cost-effective solutions for both large-scale and smaller operations.

India’s copper fungicides market posted a CAGR of around 7.2% during 2020–2024, driven by growing agricultural production and a shift towards safer and more effective crop protection methods. For 2025–2035, the growth rate rises to 8.1%, reflecting the expansion of organic farming, rising awareness about environmental concerns, and favorable government policies. The increase in growth can be attributed to the government’s support for organic certification for crops and the increased focus on sustainable farming practices. India’s market is benefitting from the rise in organic produce exports, especially in the fruit and vegetable sectors, where copper fungicides are heavily relied upon for fungal disease control.

France’s copper fungicides market experienced a CAGR of about 6.4% between 2020 and 2024, driven by the agricultural industry’s transition towards sustainable farming practices and stringent regulations for chemical use. For 2025–2035, the growth rate rises to 6.8%, supported by government regulations encouraging the adoption of copper-based products in organic farming and an increasing focus on reducing pesticide residues. The upward growth trend is driven by the emphasis on producing high-quality crops with minimal chemical input, which aligns with consumer demand for organic products. This trend is expected to strengthen as French farmers seek efficient solutions that meet both regulatory standards and consumer expectations for clean food.

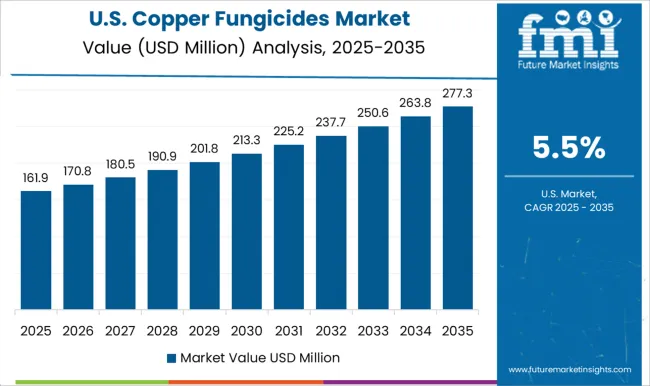

The USA copper fungicides market posted a CAGR of around 5.5% during 2020–2024, driven by the established agricultural market and steady demand from both conventional and organic farming sectors. For 2025–2035, the growth rate rises to 5.5%, reflecting the steady adoption of copper fungicides in integrated pest management practices and increasing awareness about the importance of disease control in specialty crops. The slower growth in the USA is attributed to the mature market conditions and the shift towards alternative fungicide products as farmers explore more targeted solutions. However, copper fungicides remain an essential tool for managing fungal diseases in various crops, particularly in organic farming.

The copper fungicides market is highly competitive, with several global players and specialized chemical manufacturers focusing on crop protection, eco-friendly solutions, and regulatory compliance. UPL Limited India stands out with its wide portfolio of agricultural chemicals, including copper-based fungicides, targeting diverse crops across regions. Spiess-Urania Chemicals GmbH is known for its strong emphasis on inorganic copper fungicide solutions and global distribution reach.

Nufarm offers copper fungicides as part of its plant protection portfolio, leveraging strong relationships with both conventional and organic farmers. Albaugh LLC focuses on cost-effective solutions for large-scale farming, catering to a broad spectrum of crop protection needs. Certis USA L.L.C focuses on providing integrated pest management solutions with an increasing emphasis on copper fungicides in organic farming. Isagro S.p.A integrates environmental compliance with copper-based products, establishing a strong foothold in European agricultural markets. Bayer AG, a key player in the global agrochemical industry, continues to innovate in copper fungicide formulations, emphasizing product efficiency. Nordox AS offers a wide range of copper-based fungicides known for their effectiveness in organic agriculture.

Quimetal provides specialty copper products with a focus on quality control and sustainable crop protection. ADAMA aims to expand its market share by integrating copper fungicides into its broad agricultural solutions. Cosaco is dedicated to delivering cost-effective copper fungicides with a focus on meeting global environmental standards. Corteva incorporates copper fungicides into its product portfolio with a strong focus on innovation and sustainable agriculture practices. Cinkarna Celje dd brings reliable copper solutions with an emphasis on agricultural use and product safety. Industrias Químicas del Vallés (IQV) is a regional player providing copper fungicides tailored for specific crop types, focusing on competitive pricing.

Competitive strategies in the copper fungicides market are focused on product innovation, compliance with environmental regulations, and expanding distribution networks across emerging and developed markets. Players aim to enhance their presence by offering environmentally friendly solutions, increasing market access through strategic partnerships, and improving product formulations to cater to both conventional and organic farming needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 350.3 Million |

| Chemistry | Copper Hydroxide, Copper Oxychloride, Cuprous Oxide, Copper Sulphate, and Others |

| Formulation | Wettable Powder (WP), Water-dispersible Granules (WG), Soluble granules (SG), and Others |

| Application | Fruits & Vegetables, Cereals & Grains, and Oilseeds & Pulses |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UPL Limited India, Spiess-Urania Chemicals GmbH, Nufarm, Albaugh LLC, Certis USA L.L.C, Isagro S.p.A, Bayer AG, Nordox AS, Quimetal, ADAMA, Cosaco, Corteva, Cinkarna Celje dd, and Industrias Químicas del Vallés (IQV) |

| Additional Attributes | Dollar sales trends across regions, with detailed forecasts for growth and the market share by segment, crop type, and geographical region. |

The global copper fungicides market is estimated to be valued at USD 350.3 million in 2025.

The market size for the copper fungicides market is projected to reach USD 657.6 million by 2035.

The copper fungicides market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in copper fungicides market are copper hydroxide, copper oxychloride, cuprous oxide, copper sulphate and others.

In terms of formulation, wettable powder (wp) segment to command 37.6% share in the copper fungicides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Coated Film Market Insights & Industry Trends 2024-2034

Copper Azoles Market

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

Amphimobile Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Bio-rational Fungicides Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA