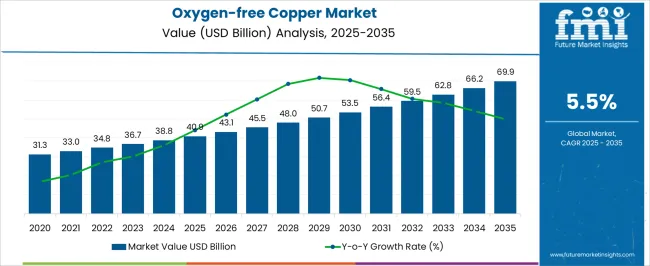

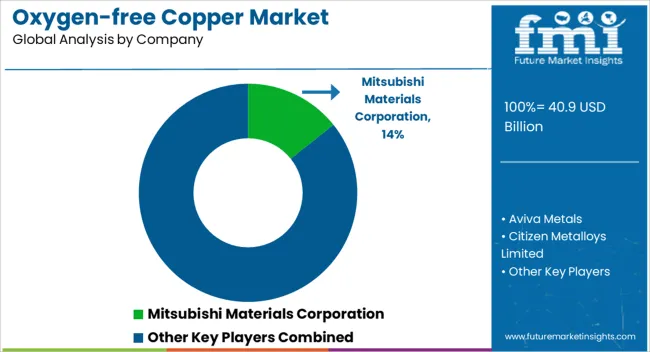

The oxygen-free copper market is estimated to be valued at USD 40.9 billion in 2025 and is projected to reach USD 69.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Stringent environmental regulations on mining operations and smelting activities directly affect the supply chain, as manufacturers are required to implement emission control technologies and maintain strict adherence to wastewater and air quality standards. Compliance with such regulations increases operational costs but ensures sustainable production practices, indirectly shaping market value and growth trajectories over the forecast period. The quality and safety standards for high-purity copper products play a central role in regulating production technologies and certifications, particularly for electronics, electrical, and industrial applications where oxygen-free copper is essential.

Regulatory enforcement by agencies in key markets such as North America, Europe, and Asia-Pacific mandates adherence to standardized purity levels, testing protocols, and documentation, which influences both manufacturing investments and product pricing strategies. Trade policies and import-export restrictions further impact regional market dynamics, as compliance with international standards determines cross-border market participation. Manufacturers optimizing production and supply chains to meet regulatory requirements can capture a larger market share, while non-compliance risks market exclusion. The regulatory factors act as both a growth enabler and cost determinant, shaping the market from 2025 to 2035, and affecting investment, production scale, and regional competitiveness.

| Metric | Value |

|---|---|

| Oxygen-free Copper Market Estimated Value in (2025 E) | USD 40.9 billion |

| Oxygen-free Copper Market Forecast Value in (2035 F) | USD 69.9 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The oxygen-free copper market is regarded as a high purity copper segment used in critical electrical and industrial applications. It is estimated to hold 8.5% of the electrical and electronics market, due to its superior conductivity in wiring, connectors, and circuit components. Within power transmission and distribution, a 6.3% share is observed, reflecting use in cables, busbars, and transformers. Automotive components contribute 4.7%, driven by high conductivity requirements in electric vehicles, wiring harnesses, and motors. Industrial machinery and equipment account for 3.9%, highlighting use in coils, windings, and specialized equipment. Aerospace and defense applications hold 2.8%, where oxygen-free copper ensures reliability and performance under demanding conditions. Recent industry trends include development of oxygen-free copper alloys, improved conductivity grades, and large scale production for high efficiency energy systems.

Groundbreaking developments include ultra-high purity copper for electronics, additive manufacturing applications, and specialized surface coatings to enhance corrosion resistance. Key players are focusing on strategic partnerships with automotive OEMs, electrical equipment manufacturers, and electronics producers. Strategies include expanding production capacity, optimizing supply chains for consistent purity, and R&D in lightweight and high conductivity solutions. Regional growth is led by Asia Pacific due to electronics and EV demand, while North America and Europe emphasize aerospace, defense, and renewable energy applications.

The market is experiencing steady growth, driven by increasing demand for high-purity copper in critical applications across electronics, electrical, and industrial sectors. The market is currently characterized by a preference for copper that exhibits superior conductivity, thermal stability, and minimal oxygen content, which ensures reliability in sensitive electronic and electrical components.

Growth is being influenced by the rapid expansion of consumer electronics, renewable energy infrastructure, and high-performance electrical equipment that require consistent material quality to enhance performance and reduce failure rates. Technological advancements in copper refining and manufacturing processes have improved production efficiency and product quality, further enabling broader adoption across multiple industries.

Additionally, the rising focus on sustainable materials and reduced energy losses in power transmission is supporting the shift towards high-purity oxygen-free copper As global electronics and energy infrastructure continue to expand, demand for oxygen-free copper is expected to grow steadily, creating opportunities for manufacturers to innovate in both material grades and application-specific solutions while maintaining high reliability standards.

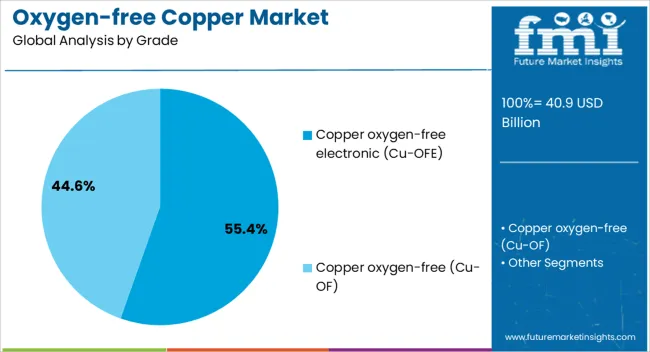

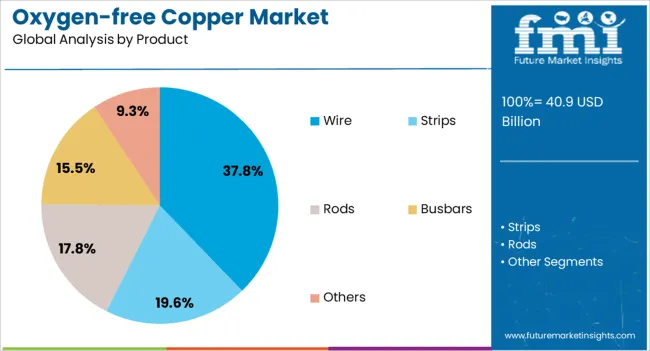

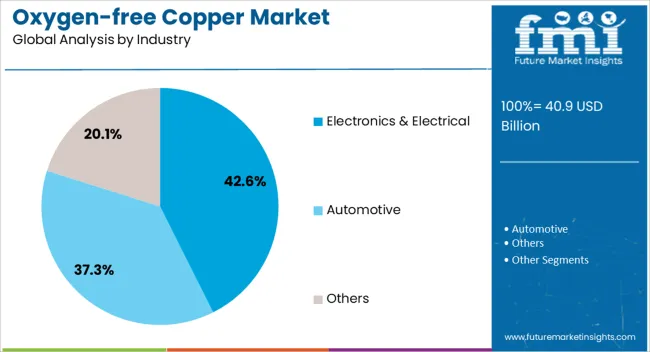

The oxygen-free copper market is segmented by grade, product, industry, and geographic regions. By grade, oxygen-free copper market is divided into copper oxygen-free electronic (Cu-OFE) and copper oxygen-free (Cu-OF). In terms of product, oxygen-free copper market is classified into wire, strips, rods, busbars, and others. Based on industry, oxygen-free copper market is segmented into electronics & electrical, automotive, and others. Regionally, the oxygen-free copper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The copper oxygen-free electronic (Cu-OFE) grade is projected to hold 55.40% of the overall oxygen-free copper market revenue in 2025, making it the leading grade segment. This dominance is being driven by its superior electrical and thermal conductivity, minimal impurity levels, and high reliability in critical electronic and electrical applications.

The segment has benefited from the growing demand for high-performance wiring, connectors, and precision components where material purity directly impacts efficiency and lifespan. Adoption has been facilitated by the compatibility of Cu-OFE with advanced manufacturing processes and its ability to maintain conductivity under high-temperature and high-stress conditions.

The long-term durability of this grade, along with its proven performance in electronics and electrical systems, has reinforced its position as the preferred choice for high-end applications Future growth is expected to be supported by expanding production of consumer electronics, industrial automation, and renewable energy infrastructure where consistent material performance is critical.

The wire product segment is expected to account for 37.80% of the overall market revenue in 2025, establishing it as the leading product type. This growth is being driven by the increasing use of high-purity copper wires in electronics, power transmission, and industrial equipment, where conductivity, thermal stability, and durability are critical factors.

Wire applications benefit from the ability to deliver precise electrical performance and minimal signal loss, which is essential for high-speed data transmission, power grids, and sensitive instrumentation. The flexibility of copper wire production and the ease of integrating it into complex electronic systems have further supported adoption.

As industries continue to demand high-efficiency power solutions and reliable connectivity, the wire segment has maintained a dominant position Continued innovation in manufacturing, including improved drawing and annealing processes, is expected to strengthen the segment’s role in enabling high-performance electrical and electronic systems while ensuring consistent quality standards.

The electronics & electrical end-use industry is projected to hold 42.60% of the market revenue in 2025, representing the leading industry segment. This position is being supported by the growing need for high-purity copper in electronic components, printed circuit boards, connectors, transformers, and electrical wiring.

The segment has been driven by the expansion of consumer electronics, smart devices, industrial automation, and energy-efficient electrical systems, where material performance is critical for reliability and longevity. Oxygen-free copper ensures minimal signal degradation, improved thermal management, and extended component life, which aligns with industry demands for high-quality and durable materials.

The adoption of renewable energy infrastructure and high-performance electrical grids has further accelerated market growth within this sector As electronics and electrical systems continue to become more complex and energy-efficient, the demand for oxygen-free copper in these applications is expected to rise, solidifying its leading role and encouraging continued investment in advanced manufacturing and material innovation.

The market has expanded due to its high electrical and thermal conductivity, corrosion resistance, and purity, making it essential in electrical, electronics, and industrial applications. OFC is widely used in power generation, telecommunications, wiring, precision instruments, and industrial machinery where minimal impurities are critical for performance. Growth is driven by rising demand for high-efficiency electrical systems, renewable energy infrastructure, and advanced electronic devices. Technological advancements in copper refining, casting, and processing have improved quality, consistency, and application versatility.

Oxygen-free copper is extensively used in electrical wiring, connectors, and electronics components due to its superior conductivity and minimal oxygen content, which reduces the risk of hydrogen embrittlement and improves signal transmission. High-performance power cables, switchgear, transformers, and circuit boards rely on OFC to ensure efficiency and reliability. Consumer electronics, including audio, video, and computing devices, increasingly incorporate OFC in cables and connectors to enhance signal clarity and device lifespan. The growth of electric vehicles, renewable energy installations, and smart grid systems has further intensified demand for OFC in critical electrical applications. Manufacturers focus on high-purity copper products to meet performance and safety standards across industrial and consumer markets.

Advances in refining, casting, and continuous casting technologies have enhanced OFC quality, purity, and mechanical properties. Techniques such as vacuum melting, electron beam refining, and controlled atmosphere casting reduce oxygen and impurity levels while maintaining structural integrity. Automated production lines, continuous quality monitoring, and precision machining ensure uniformity and reliability for electrical, industrial, and electronic applications. Surface treatment, annealing, and coating innovations improve corrosion resistance, thermal performance, and durability. These technological improvements have expanded the range of applications for oxygen-free copper, enabling its use in complex electronics, advanced industrial equipment, and renewable energy systems, while maintaining high-performance standards.

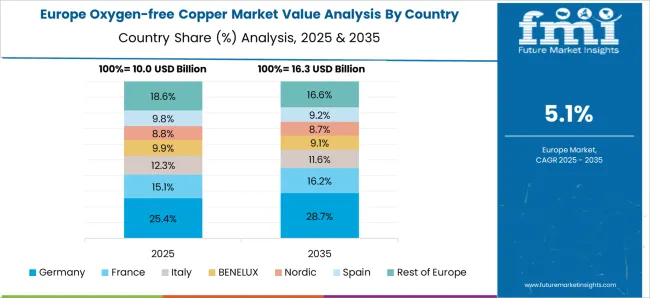

Regional adoption of oxygen-free copper is closely tied to industrial activity, energy infrastructure development, and electronics manufacturing. North America and Europe emphasize high-quality copper for power generation, aerospace, and advanced electronics, while Asia Pacific, led by China, Japan, and South Korea, drives demand through rapid electronics manufacturing, renewable energy projects, and electric vehicle expansion. Latin America and the Middle East are gradually increasing OFC adoption for infrastructure and industrial modernization. Government regulations, environmental standards, and industrial quality requirements play a critical role in material selection, ensuring consistent adoption of high-purity copper. Regional differences in industrial capacity, energy projects, and technological integration shape market dynamics and growth opportunities.

Despite its advantages, oxygen-free copper faces challenges related to high production costs, raw material availability, and supply chain complexity. OFC production requires advanced refining processes, controlled atmospheres, and precise quality monitoring, which increase manufacturing expenses. Volatility in copper ore prices, energy costs, and logistics impacts market stability, particularly in emerging regions. Limited availability of high-purity copper feedstock may constrain large-scale production. Manufacturers are addressing these challenges through technological optimization, efficient supply chain management, and recycling initiatives. Overcoming cost and supply constraints is crucial to supporting widespread adoption in electronics, industrial, and energy applications, ensuring sustainable market growth globally.

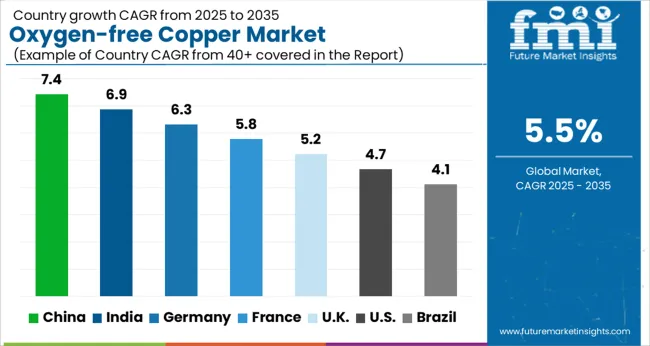

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

China is projected to lead the market with a CAGR of 7.4%, supported by its large-scale demand across electrical and electronic manufacturing. India is expected to expand at 6.9%, influenced by the growth of power generation and industrial applications. Germany, with 6.3%, benefits from its established automotive and aerospace sectors where oxygen-free copper is essential. The United Kingdom is forecast at 5.2%, reflecting its focus on precision engineering and electronic components. The United States is anticipated to grow at 4.7%, underpinned by continuous upgrades in electrical infrastructure and advanced technology use. These countries remain central to global development, innovation, and adoption of oxygen-free copper. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 7.4% in the market, driven by increasing demand from electronics, electrical equipment, and automotive industries. Expanding infrastructure projects and industrial automation contribute to higher consumption. The material’s superior electrical conductivity and corrosion resistance make it ideal for high-performance components. Investments in high-speed rail, renewable energy systems, and smart grids are further bolstering demand. R&D in copper processing and refined manufacturing techniques is enhancing supply efficiency. China’s focus on industrial modernization and electronics manufacturing strengthens its position as a key market for oxygen-free copper.

India is projected to expand at a CAGR of 6.9% due to rising industrialization and increased consumption in electronics, telecommunication, and automotive sectors. Investments in smart grids, renewable energy, and power distribution infrastructure drive material requirements. Superior electrical properties and resistance to oxidation encourage adoption in high-performance wiring and components. Initiatives for infrastructure modernization and electronics manufacturing further stimulate market growth. Ongoing R&D in copper refining and sustainable manufacturing practices supports cost-effectiveness and supply reliability. India’s industrial expansion and energy sector initiatives continue to reinforce its position in the global oxygen-free copper landscape.

Germany is anticipated to grow at a CAGR of 6.3%, backed by its advanced manufacturing and industrial sectors. Applications in high-end electronics, automotive components, and energy-efficient equipment drive consumption. Strong regulatory frameworks, focus on energy efficiency, and sustainable manufacturing encourage adoption. Demand for reliable electrical and electronic components in industrial automation and renewable energy infrastructure also supports growth. Continuous innovation in refining processes and precision applications strengthens market penetration. Germany’s commitment to sustainable industrial practices and advanced technology adoption reinforces its position in the oxygen-free copper market.

The United Kingdom is expected to grow at a CAGR of 5.2% as industrial and energy sectors adopt oxygen-free copper in critical applications. Its superior conductivity, resistance to corrosion, and suitability for electronics make it a preferred material. Government initiatives promoting infrastructure modernization, power grid upgrades, and renewable energy projects increase adoption. Industrial automation, high-performance electrical equipment, and energy efficiency programs further drive demand. R&D in sustainable production techniques and supply chain optimization strengthens the market’s growth potential. The United Kingdom continues to explore advanced applications, positioning itself as a competitive market for oxygen-free copper.

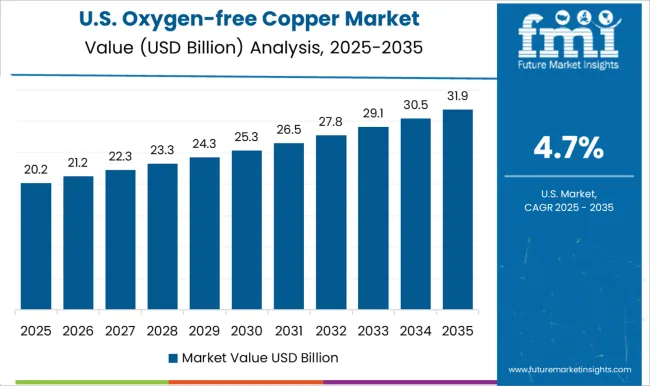

The United States is projected to grow at a CAGR of 4.7% due to consistent demand from electronics, aerospace, automotive, and industrial sectors. The material’s high conductivity and durability make it suitable for precision applications. Federal programs encouraging renewable energy integration, smart grids, and high-tech manufacturing contribute to expansion. Technological advancements in copper processing and large-scale infrastructure projects further strengthen market growth. Adoption across critical sectors such as energy distribution, high-performance electronics, and advanced manufacturing reinforces the United States’ position in the global oxygen-free copper market.

The market is characterized by the presence of established global providers delivering high-purity copper solutions for electrical, electronic, and industrial applications. Mitsubishi Materials Corporation and Aviva Metals are recognized leaders, producing oxygen-free copper with superior electrical conductivity and thermal performance suitable for high-demand environments. Citizen Metalloys Limited and Sam Dong America offer specialized copper products designed to meet stringent quality and performance standards, supporting sectors such as electronics manufacturing, precision engineering, and renewable energy. SH Copper Products Company (Hitachi Metals Neomaterial) and KGHM Polska MiedY S.A. focus on advanced manufacturing processes to ensure minimal oxygen content, enhancing corrosion resistance and mechanical strength.

KME Germany GmbH and Freeport-McMoRan Inc. contribute through large-scale production capabilities and global distribution networks, ensuring supply consistency for industrial clients. Aurubis AG and Metrod Holdings Berhad emphasize sustainable and technologically advanced production methods, aligning with industry demands for high-quality, eco-conscious materials. Other key players such as Cupori Oy, Wieland-Werke AG, thyssenkrupp Materials NA, Zhejiang Libo Holding Group Company, Pan Pacific Copper Company, Furukawa Electric Co., Ltd, Watteredge LLC (SOUTHWIRE COMPANY LLC.), and RK Copper & Alloy LLP provide diversified product portfolios, including rods, wires, and sheets, enabling application flexibility across electronics, power transmission, and specialty manufacturing sectors. These providers collectively drive innovation, reliability, and global accessibility within the oxygen-free copper industry, setting performance and quality benchmarks for downstream applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.9 Billion |

| Grade | Copper oxygen-free electronic (Cu-OFE) and Copper oxygen-free (Cu-OF) |

| Product | Wire, Strips, Rods, Busbars, and Others |

| Industry | Electronics & Electrical, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mitsubishi Materials Corporation, Aviva Metals, Citizen Metalloys Limited, Sam Dong America, SH Copper Products Company (Hitachi Metals Neomaterial), KGHM Polska MiedY S.A, KME Germany GmbH, Freeport-McMoRan Inc, Aurubis AG, Metrod Holdings Berhad, Cupori Oy, Wieland-Werke AG, thyssenkrupp Materials NA, Zhejiang Libo Holding Group Company, Pan Pacific Copper Company, Furukawa Electric Co., Ltd, Watteredge LLC. (SOUTHWIRE COMPANY LLC.), and RK Copper & Alloy LLP |

| Additional Attributes | Dollar sales by copper grade and application, demand dynamics across electrical, electronics, and industrial sectors, regional trends in high-purity copper adoption, innovation in conductivity, corrosion resistance, and processing techniques, environmental impact of mining and refining, and emerging use cases in high-performance wiring, aerospace components, and advanced electronics. |

The global oxygen-free copper market is estimated to be valued at USD 40.9 billion in 2025.

The market size for the oxygen-free copper market is projected to reach USD 69.9 billion by 2035.

The oxygen-free copper market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in oxygen-free copper market are copper oxygen-free electronic (cu-ofe) and copper oxygen-free (cu-of).

In terms of product, wire segment to command 37.8% share in the oxygen-free copper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Coated Film Market Insights & Industry Trends 2024-2034

Copper Azoles Market

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA