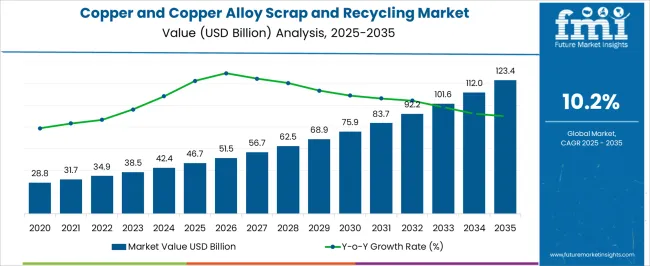

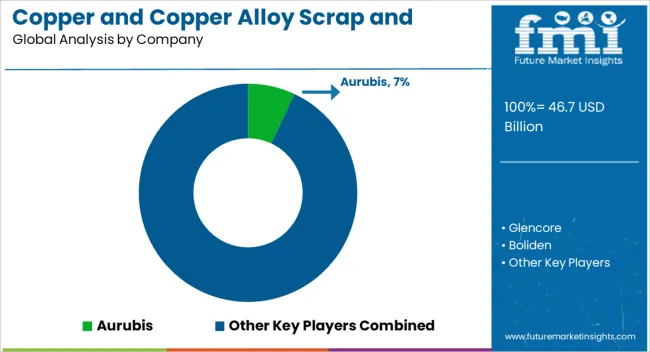

The copper and copper alloy scrap and recycling market is estimated to be valued at USD 46.7 billion in 2025 and is projected to reach USD 123.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

The acceleration and deceleration pattern of this market shows a steep and consistent upward movement, reflecting both supply-demand dynamics and structural changes in resource management. The early phase from 2025 to around 2029 shows strong acceleration, driven by the surging adoption of circular economy practices, rising regulatory pressures for metal recovery, and increasing use of recycled copper across automotive, electrical, and construction applications. As the decade progresses, growth momentum remains robust but begins to show slight deceleration after 2030 as the market becomes more mature, base volumes expand significantly, and global recycling systems reach higher levels of efficiency.

This shift represents a natural stabilization phase typical of high-growth industries once large-scale adoption sets in. The curve shape suggests a fast-rising incline up to the mid-forecast years, gradually moderating yet retaining strength, as demand for sustainable sourcing of raw materials remains high. Moreover, urbanization, electrification, and green energy projects will continue to propel recycling demand, ensuring that while acceleration eases, the market sustains a powerful growth rhythm throughout the decade. This dynamic indicates not just cyclical expansion but a long-term structural growth story in copper recycling.

| Metric | Value |

|---|---|

| Copper and Copper Alloy Scrap and Recycling Market Estimated Value in (2025 E) | USD 46.7 billion |

| Copper and Copper Alloy Scrap and Recycling Market Forecast Value in (2035 F) | USD 123.4 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The copper and copper alloy scrap and recycling market holds a notable share within the broader non-ferrous metals and metal recycling industry, accounting for approximately 18–22% share of the global copper supply chain. Within the secondary metals market, copper scrap represents about 25–28% share, driven by its high recyclability, cost efficiency, and growing adoption in electrical, electronics, and automotive applications. In construction and building materials, the market commands nearly 12–15% share, as recycled copper finds extensive use in wiring, piping, and roofing solutions. In industrial machinery and consumer electronics sectors, copper scrap recycling accounts for roughly 20–23% share, fueled by the need for sustainable sourcing and reduced dependency on primary mining operations.

Growth is influenced by rising copper prices, tightening supply from primary sources, and regulatory mandates promoting circular economy practices for metal recovery. The market is further strengthened by innovations in scrap sorting, processing, and refining technologies that improve recovery rates and purity levels, making recycled copper a cost-effective and reliable feedstock. Future expansion is expected as demand from electric vehicles, renewable energy infrastructure, and high-conductivity electronics rises, positioning copper scrap recycling as a critical component of global metal supply sustainability and operational efficiency.

The market is experiencing strong growth driven by the rising global demand for sustainable raw materials and the increasing emphasis on circular economy practices. The need to conserve natural resources and reduce the environmental impact of mining has led to greater adoption of recycled copper and copper alloys across multiple industries.

Regulatory support for recycling initiatives, coupled with technological advancements in scrap processing and sorting, is improving recovery rates and cost efficiency. Growth is also supported by expanding urbanization, which generates a steady supply of post-consumer scrap from infrastructure, construction, and electronic waste.

The consistent use of copper in critical sectors such as electrical systems, renewable energy, and industrial machinery ensures a robust demand for recycled material As industries strive to meet decarbonization goals and strengthen supply chain resilience, the role of copper recycling is expected to expand further, making it an essential component of sustainable manufacturing practices worldwide.

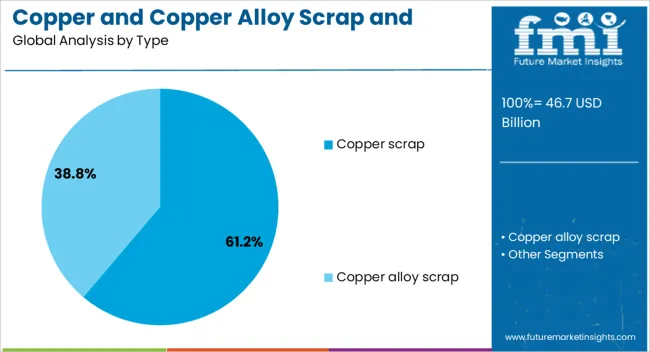

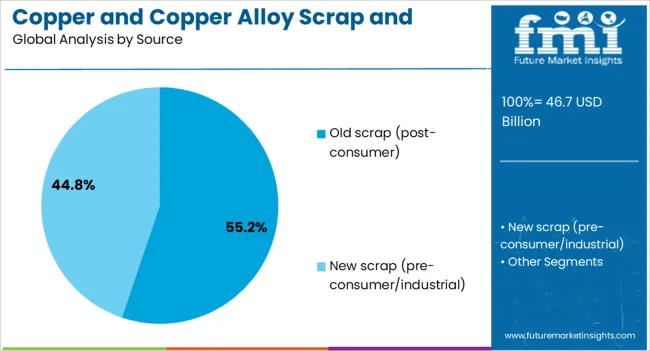

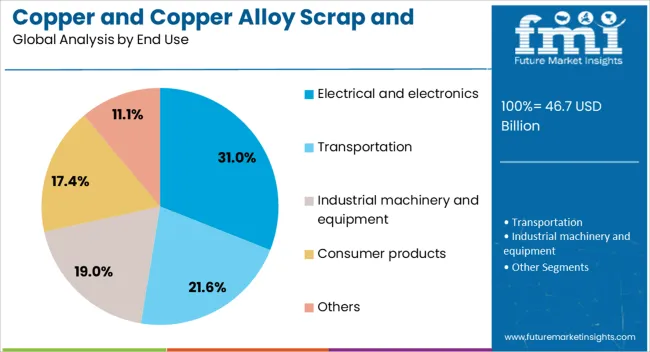

The copper and copper alloy scrap and recycling market is segmented by type, source, end use, processing method, and geographic regions. By type, copper and copper alloy scrap and recycling market is divided into copper scrap and copper alloy scrap. In terms of source, copper and copper alloy scrap and recycling market is classified into old scrap (post-consumer) and new scrap (pre-consumer/industrial). Based on end use, copper and copper alloy scrap and recycling market is segmented into electrical and electronics, transportation, industrial machinery and equipment, consumer products, and others. By processing method, copper and copper alloy scrap and recycling market is segmented into pyrometallurgical processing, mechanical processing, hydrometallurgical processing, electrometallurgical processing, and other processing methods. Regionally, the copper and copper alloy scrap and recycling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The copper scrap segment is projected to hold 61.20% of the copper and copper alloy scrap and recycling market revenue share in 2025, making it the leading type segment. This dominance has been driven by the high intrinsic value of copper and its ability to retain its physical and chemical properties through multiple recycling cycles. The strong demand for copper scrap has been supported by its significant use in manufacturing electrical conductors, plumbing materials, and industrial components. The segment has also benefited from the growing availability of collection networks and advanced separation technologies, which enable higher recovery efficiency. Increasing awareness about resource conservation and the lower energy requirements for recycling compared to primary production have further reinforced its preference among manufacturers The versatility of copper scrap in producing a range of alloys, combined with its contribution to reducing environmental impact, has ensured its sustained leadership in the overall market structure.

The old scrap or post-consumer source segment is anticipated to account for 55.20% of the market revenue share in 2025, emerging as the leading source category. This growth has been attributed to the increasing recovery of copper from end-of-life products such as electrical wiring, plumbing, vehicles, and consumer electronics. The segment’s prominence has been reinforced by regulatory mandates for e-waste management and landfill diversion, which prioritize recycling over disposal. Technological improvements in shredding, sorting, and refining processes have enhanced the ability to extract high-quality copper from post-consumer waste streams. Additionally, the availability of large volumes of scrap from urban demolition projects and obsolete electrical infrastructure has ensured a consistent feedstock supply The lower carbon footprint associated with processing post-consumer copper compared to mining new ore has further elevated its importance in achieving sustainability targets, supporting its dominant role in the market.

The electrical and electronics segment is expected to hold 31.00% of the market revenue share in 2025, making it the largest end-use industry. This leadership position has been reinforced by the extensive use of copper in wiring, circuit boards, connectors, and other electrical components due to its superior conductivity and durability. The segment has seen strong demand for recycled copper as manufacturers strive to reduce production costs and meet environmental compliance standards. Increasing global consumption of consumer electronics, coupled with frequent product replacement cycles, has generated a steady flow of recyclable material. The expansion of renewable energy projects and electric vehicle production has further boosted the requirement for copper in electrical applications With the dual benefit of performance consistency and sustainability, recycled copper continues to play a central role in supporting the growth and innovation within the electrical and electronics sector.

Copper and copper alloy scrap recycling is increasingly central to electrical, construction, automotive, and industrial sectors. Growth is driven by cost efficiency, quality requirements, and regulatory frameworks that enhance adoption across diverse applications.

Copper and copper alloy scrap is increasingly adopted in the electrical and electronics sector due to its high conductivity and cost efficiency compared to primary copper. Electrical wiring, circuit boards, connectors, and electric motors drive steady consumption of recycled copper, reducing dependence on mined copper. Manufacturers are prioritizing quality and purity of scrap to meet industry standards, while growing production of electric vehicles and smart appliances further supports demand. Supply chain optimization ensures timely delivery to electronics manufacturers, while innovations in scrap sorting and refining enhance material recovery rates. Regulatory compliance for product safety and import-export certification reinforces confidence in recycled copper use, strengthening its position in high-value industrial applications.

Recycled copper finds significant adoption in construction and building applications, including plumbing, roofing, cladding, and HVAC systems. Copper scrap is valued for corrosion resistance, durability, and ease of integration in prefabricated materials. Growth is driven by rising construction activity in both residential and commercial sectors, supported by infrastructure development and urban retrofitting projects. Efficient supply of high-quality scrap ensures material consistency, while recycling operations minimize production costs compared to primary copper. Demand for copper alloys in specialty architectural applications is increasing, particularly in premium buildings and institutional projects. The construction industry’s reliance on sustainable, reusable metals underlines recycled copper’s strategic importance for both cost management and material availability.

Copper scrap plays a crucial role in automotive and transport sectors due to widespread use in wiring harnesses, radiators, heat exchangers, and electric vehicle components. Growing production of hybrid and electric vehicles intensifies the need for high-purity recycled copper, making scrap an attractive alternative to primary metal. Supply chains emphasize consistency and traceability, while refiners focus on alloy composition and electrical performance standards. Recycled copper reduces raw material costs and shortens production timelines for automotive manufacturers. Regional automotive hubs increasingly integrate scrap processing facilities close to assembly plants, improving logistics efficiency. This trend supports circular supply chains and strengthens the adoption of recycled copper in high-value transport applications.

Government policies, import-export regulations, and metal procurement standards significantly influence copper scrap recycling. Incentives for secondary metal use and restrictions on landfilling industrial waste encourage higher collection and processing rates. Economic factors, including fluctuating copper prices and energy costs, make recycled copper a cost-effective feedstock for industrial users. Investments in sorting, shredding, and refining facilities improve output quality and operational efficiency. Regional variations in metal taxation, trade tariffs, and environmental standards impact market dynamics, with countries offering structured scrap collection and recycling programs gaining competitive advantage. Strategic alliances between scrap collectors, refiners, and end-use industries ensure steady availability of high-quality copper alloys, stabilizing pricing and supply.

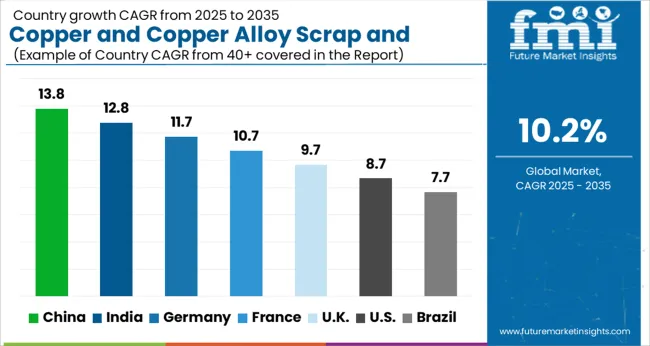

| Country | CAGR |

|---|---|

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| France | 10.7% |

| UK | 9.7% |

| USA | 8.7% |

| Brazil | 7.7% |

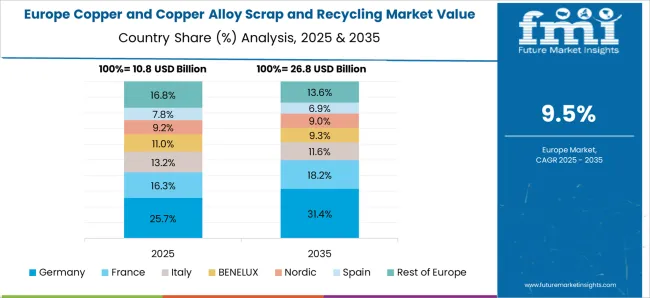

The copper and copper alloy scrap and recycling market is expected to grow globally at a CAGR of 10.2% from 2025 to 2035, supported by rising demand from electrical, construction, automotive, and industrial applications. China leads with a CAGR of 13.8%, driven by strong industrial demand, government-backed scrap collection initiatives, and growing use of recycled copper in electronics and renewable energy infrastructure. India follows at 12.8%, fueled by expansion of electrical and automotive sectors, rising construction activity, and investments in scrap processing facilities. France posts a CAGR of 10.7%, supported by regulatory incentives for secondary metal use and increasing adoption in industrial machinery. The United Kingdom grows at 9.7%, backed by efficient scrap collection programs, import substitution strategies, and uptake in high-value electronics. The United States posts 8.7%, with growth supported by stable recycling infrastructure, rising electrification in transportation, and demand for sustainable metal sourcing. The analysis spans over 40 global markets, with these five countries serving as benchmarks for evaluating supply chain efficiency, regulatory impact, and strategic investments in copper scrap recycling and processing.

China is projected to post a CAGR of 13.8% from 2025 to 2035, up from approximately 10.5% in 2020–2024, significantly above the global CAGR of 10.2%. Early-stage growth was driven by large-scale industrial demand, expansion in electrical and construction sectors, and government-backed scrap collection initiatives. As the period 2025–2035 unfolds, rising adoption of recycled copper in renewable energy, electronics, and automotive applications is expected to sustain growth. Increased investment in efficient recycling facilities and supply chain optimization is also lowering production costs, enabling broader market access. Growth is further fueled by import substitution strategies and regulatory support for secondary metal use.

India is expected to achieve a CAGR of 12.8% during 2025–2035, increasing from roughly 9.8% in 2020–2024, outperforming the global average of 10.2%. Initial growth was influenced by industrial electrification, automotive expansion, and gradual adoption of recycling practices. The acceleration in 2025–2035 is supported by increasing construction activity, higher industrial output, and growing reliance on secondary copper to meet rising demand. Enhanced scrap collection networks, improved logistics, and policy measures promoting circular metal use are strengthening market performance. In my assessment, India’s trajectory is aided by cost-competitive recycling units and growing domestic consumption across manufacturing and infrastructure projects.

France is projected to post a CAGR of 10.7% from 2025 to 2035, up from around 8.5% in 2020–2024, closely aligned with EU industrial metal trends but above the global 10.2% baseline. Initial growth was supported by regulatory initiatives, high adoption in industrial machinery, and strong environmental compliance policies. From 2025 onwards, growth is expected to strengthen due to higher integration of recycled copper in electronics, energy transmission, and automotive sectors. Investments in advanced scrap sorting, refining technology, and strategic partnerships with manufacturers further enhance efficiency. France benefits from a mature recycling ecosystem that supports both domestic and export-driven demand for secondary copper.

The United Kingdom is positioned to grow at a CAGR of 9.7% from 2025 to 2035, rising from approximately 7.9% during 2020–2024, slightly below the global 10.2% rate. Early growth was driven by expansion in electrical infrastructure, moderate automotive demand, and gradual scrap collection improvements. The acceleration in 2025–2035 is expected from enhanced industrial recycling standards, rising adoption of secondary copper in high-value electronics, and government programs promoting circular economy initiatives. Strong logistics frameworks and partnerships with manufacturers help improve the availability of processed scrap, enabling a consistent supply for downstream applications.

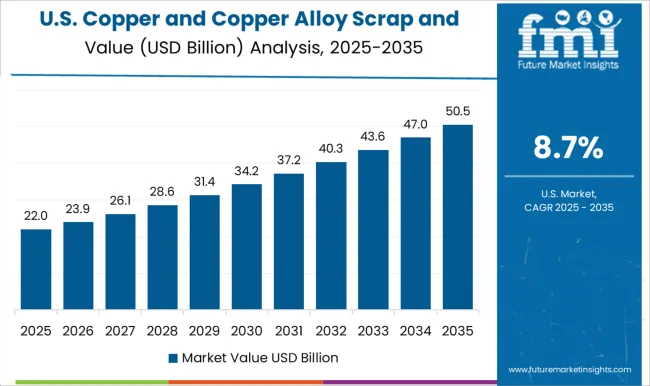

The United States is projected to post a CAGR of 8.7% from 2025 to 2035, increasing from about 7.0% in 2020–2024, below the global CAGR of 10.2% but steady due to mature market conditions. Initial growth was influenced by established recycling infrastructure, high industrial consumption, and moderate scrap imports. Future growth is expected from electrification of transport, energy grid modernization, and rising demand for high-quality recycled copper in electronics and industrial machinery. Expansion of scrap collection programs and investments in advanced separation and refining technologies are improving throughput and supporting cost efficiency. The US market benefits from predictable domestic demand and established supply chains.

The copper and copper alloy scrap and recycling market is shaped by leading global players such as Aurubis, Glencore, Boliden, Umicore, and a wide range of regional recyclers and local operators. These companies compete by leveraging efficient smelting and refining processes, securing long-term scrap supply contracts, and integrating advanced separation technologies to maintain high-quality recycled copper output. Aurubis holds a dominant position through large-scale, vertically integrated recycling operations and consistent feedstock access, ensuring stable production and dollar sales growth. Glencore focuses on global scrap sourcing and commodity trading, optimizing supply chains to support downstream industrial applications.

Boliden emphasizes process efficiency and metal recovery rates, providing high-purity recycled copper for electronics and industrial sectors. Umicore integrates recycling with chemical refining to produce specialty copper alloys, while other smelters leverage regional scrap networks and partnerships to expand reach. Regional recyclers focus on niche markets, cost-effective collection, and localized smelting to serve specific industrial needs. Competitive strategies involve mergers and acquisitions for resource consolidation, investment in advanced refining technologies, and strategic collaborations with industrial consumers. These players prioritize operational efficiency, regulatory compliance, and supply chain stability to navigate fluctuating metal prices and evolving market requirements. Future growth will be supported by maintaining cost leadership, improving scrap collection and processing efficiency, and expanding into emerging industrial applications where recycled copper demand is rising.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.7 billion |

| Type | Copper scrap and Copper alloy scrap |

| Source | Old scrap (post-consumer) and New scrap (pre-consumer/industrial) |

| End Use | Electrical and electronics, Transportation, Industrial machinery and equipment, Consumer products, and Others |

| Processing Method | Pyrometallurgical processing, Mechanical processing, Hydrometallurgical processing, Electrometallurgical processing, and Other processing methods |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aurubis, Glencore, Boliden, Umicore |

| Additional Attributes | Dollar sales, share, regional demand, scrap collection trends, end-use industry adoption, pricing fluctuations, regulatory impact, technology for separation and refining, supply chain efficiency, competitor strategies, and growth forecasts. |

The global copper and copper alloy scrap and recycling market is estimated to be valued at USD 46.7 billion in 2025.

The market size for the copper and copper alloy scrap and recycling market is projected to reach USD 123.4 billion by 2035.

The copper and copper alloy scrap and recycling market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in copper and copper alloy scrap and recycling market are copper scrap, bare bright copper scrap, and others.

In terms of source, old scrap (post-consumer) segment to command 55.2% share in the copper and copper alloy scrap and recycling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Coated Film Market Insights & Industry Trends 2024-2034

Copper Azoles Market

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA