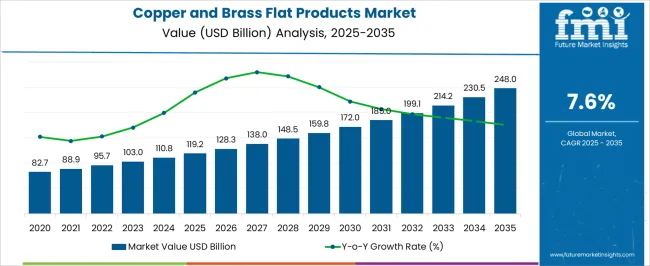

The copper and brass flat products market is projected to grow from USD 119.2 billion in 2025 to USD 248 billion by 2035, with a CAGR of 7.6%. The market exhibits significant growth with inflection points indicating accelerated expansion. Between 2021 and 2025, the market will grow steadily, from USD 82.7 billion in 2021 to USD 119.2 billion in 2025, reflecting an initial growth phase as demand rises for these materials in automotive, construction, and electrical applications. The first notable inflection point occurs in 2025, when the market value reaches USD 119.2 billion, transitioning from a moderate growth phase to a more rapid expansion.

This is driven by increasing demand for copper and brass in renewable energy projects, consumer electronics, and infrastructure, marking a shift to higher growth rates. From 2025 to 2030, the market accelerates from USD 119.2 billion to USD 172.0 billion, with a clear upward trajectory, driven by factors like the growing demand for energy-efficient solutions and technological advancements in manufacturing processes. Another inflection point occurs in 2030, when the market value reaches USD 172.0 billion. The pace of growth continues to strengthen, with the market reaching USD 248 billion by 2035.

| Metric | Value |

|---|---|

| Copper and Brass Flat Products Market Estimated Value in (2025 E) | USD 119.2 billion |

| Copper and Brass Flat Products Market Forecast Value in (2035 F) | USD 248.0 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The copper and brass flat products market is driven by several parent markets that significantly contribute to its growth across various industries. The metals and alloys market plays a crucial role, accounting for approximately 12-15% of the market share. Copper and brass flat products are widely used in manufacturing items like electrical conductors, heat exchangers, and decorative elements due to their excellent conductivity, strength, and corrosion resistance. In the construction and building materials market, copper and brass contribute about 10-12% of the share, where these materials are used in roofing, plumbing, and electrical wiring in both residential and commercial buildings, offering durability and aesthetic appeal while resisting corrosion. Within the automotive market, copper and brass flat products represent around 6-8% of the share. These materials are integral in automotive components such as radiators, heat exchangers, and electrical systems, where their efficient heat transfer and reliable conductivity are crucial. The electrical and electronics market holds a significant share, around 15-18%, for copper and brass flat products. These materials are essential for manufacturing connectors, circuit boards, and other electronic components, prized for their exceptional electrical conductivity and resistance to wear and corrosion. In the industrial equipment market, copper and brass flat products account for approximately 7-9% of the share. They are used in the production of machinery parts, valves, and fittings, where their durability and resistance to corrosion are critical for industrial applications.

The Copper and Brass Flat Products market is experiencing consistent expansion as industries seek high-performance materials with superior conductivity, corrosion resistance, and formability. Demand is being reinforced by sectors such as power distribution, construction, and manufacturing, where precision-engineered flat products are essential for operational reliability. The market is benefiting from advances in metallurgical processing, enabling improved dimensional accuracy and surface quality.

Sustainability considerations and recycling efficiencies of copper and brass are further enhancing their appeal, especially as regulatory frameworks increasingly favor environmentally responsible materials. Rapid industrialization in emerging economies and modernization of electrical infrastructure in mature markets are creating sustained demand.

Additionally, investments in downstream fabrication facilities are broadening the product application base, while global trade networks are ensuring efficient distribution to diverse geographies With technological advancements enabling tailored alloy compositions and product customization, the market is poised to maintain steady growth momentum in the coming years.

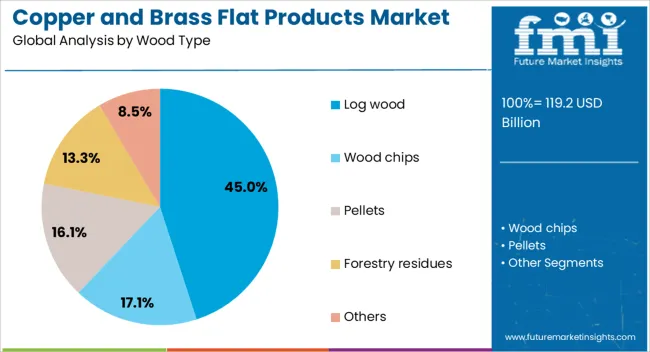

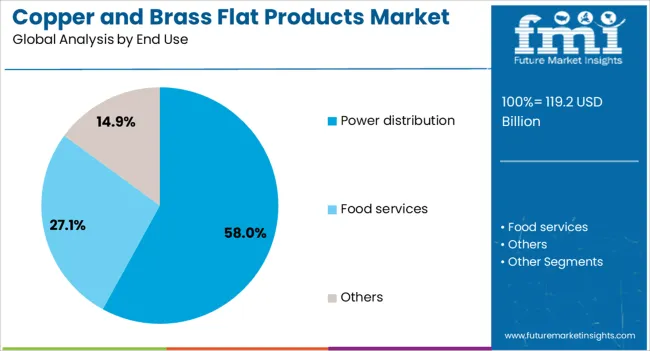

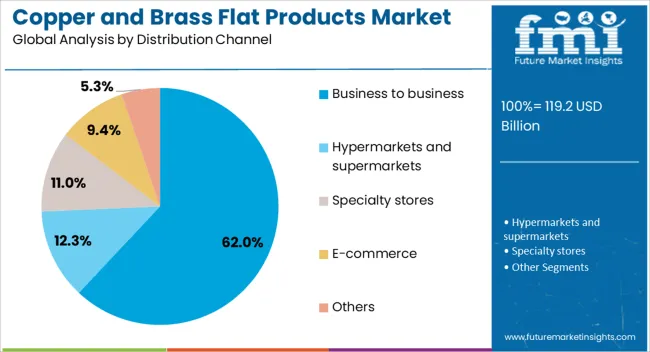

The copper and brass flat products market is segmented by wood type, end use, distribution channel, and geographic regions. By wood type, copper and brass flat products market is divided into Log wood, Wood chips, Pellets, Forestry residues, and Others. In terms of end use, copper and brass flat products market is classified into Power distribution, Food services, and Others. Based on distribution channel, copper and brass flat products market is segmented into Business to business, Hypermarkets and supermarkets, Specialty stores, E-commerce, and Others. Regionally, the copper and brass flat products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The log wood type segment is projected to hold 45% of the Copper and Brass Flat Products market revenue share in 2025, establishing its position as the leading product type. This dominance has been attributed to the segment’s adaptability in delivering consistent material quality and structural performance across a variety of industrial applications. The durability and processing flexibility of log wood type products have allowed them to be integrated efficiently into large-scale manufacturing and fabrication processes.

Their production is supported by advanced rolling and finishing techniques that enhance mechanical properties while ensuring dimensional precision. The segment’s competitive position has been further strengthened by its compatibility with both traditional and automated processing lines, enabling faster throughput.

In markets where high strength, uniformity, and reliability are required, the log wood type format has consistently met operational standards Continuous investment in production optimization and material enhancement has sustained its strong demand profile and market leadership.

The power distribution end use segment is expected to account for 58% of the Copper and Brass Flat Products market revenue share in 2025, making it the leading end-use category. This growth is being driven by the critical role of copper and brass in ensuring efficient electrical conductivity and system durability within power transmission and distribution networks.

The segment benefits from ongoing upgrades to electrical infrastructure, including grid modernization initiatives in both developed and developing economies. Copper and brass flat products are preferred for their high thermal stability, resistance to fatigue, and ability to withstand fluctuating loads without degradation.

The expansion of renewable energy installations and the integration of distributed power systems have also increased the demand for reliable conductive materials Compliance with stringent electrical safety standards and performance regulations has further reinforced the segment’s market dominance, ensuring continued adoption across utility and industrial power systems.

The business to business distribution channel segment is projected to secure 62% of the Copper and Brass Flat Products market revenue share in 2025, positioning it as the leading distribution pathway. This leadership has been influenced by the segment’s ability to deliver bulk quantities efficiently to industrial and commercial buyers who require consistent supply chains.

Direct transactions between producers and business clients enable tailored product specifications, competitive pricing, and improved logistical coordination. Long-term contractual arrangements within the business to business framework ensure predictable demand flows and production planning stability.

The segment has also benefited from the integration of digital procurement platforms, which have streamlined ordering processes and enhanced supply visibility By offering value-added services such as technical consultation, custom cutting, and just-in-time delivery, suppliers within this channel have strengthened customer loyalty and reinforced market presence, ensuring its continued growth in the overall market structure.

The copper and brass flat products market is experiencing steady growth, driven by their widespread use in industries such as electronics, automotive, construction, and renewable energy. Copper’s superior electrical conductivity and brass's corrosion resistance make them essential for electrical wiring, automotive components, and industrial applications. Technological advancements are enhancing product quality and manufacturing efficiency, further supporting market growth. The rise of electric vehicles and the continued expansion of infrastructure in developing regions are expected to further increase demand for copper and brass products, ensuring a positive market outlook.

The copper and brass flat products market faces several challenges that may impede its growth. One significant issue is the fluctuating prices of copper and brass, which are heavily influenced by raw material costs and global market trends. This volatility can affect the profitability of manufacturers and disrupt the market's price stability. Additionally, competition from alternative materials like aluminum and steel, which offer lower costs, presents another hurdle for the copper and brass sectors. High production costs, including energy-intensive processing and labor costs, further challenge manufacturers. The market also faces increasing regulatory pressure regarding environmental impact, pushing for more efficient processes. These factors require companies to continuously innovate and optimize operations to remain competitive while balancing environmental concerns and cost-effective production.

The copper and brass flat products market is driven by increasing demand across various industries, including electronics, automotive, construction, and renewable energy. Copper’s superior electrical conductivity and corrosion resistance make it essential in electrical wiring, while brass, with its strength and resistance to corrosion, is favored in plumbing, hardware, and industrial applications. The rapid growth of the electronics and electric vehicle sectors is significantly boosting demand for these materials. Moreover, the construction boom in developing regions, along with advancements in renewable energy infrastructure, is driving further need for copper and brass products. Technological advancements in manufacturing processes that improve the quality and efficiency of these products are also key factors in expanding the market.

The copper and brass flat products market presents numerous opportunities for growth, particularly with the rise of electric vehicles (EVs) and renewable energy applications. Copper is essential for EV motors, batteries, and charging infrastructure, creating significant demand in this sector. Brass, with its corrosion resistance, also sees growing use in marine applications and plumbing. Another opportunity lies in the increasing demand for high-quality copper products in electronics, including semiconductor manufacturing and power transmission. Additionally, advancements in product development, such as the creation of lightweight and durable copper alloys, open new application possibilities in aerospace and other high-performance sectors. Expanding into emerging markets where industrialization is increasing presents another promising avenue for market growth.

The push for more energy-efficient technologies is driving the demand for copper in renewable energy infrastructure, including solar power systems and wind turbines. The automotive industry's shift toward electric vehicles is also fueling the demand for copper in EV batteries, motors, and wiring. Additionally, the increasing adoption of smart manufacturing technologies, such as IoT and automation, is improving the efficiency and precision of copper and brass production, allowing manufacturers to meet stricter quality standards and reduce waste. The development of advanced alloys that combine the properties of copper and brass with other metals is creating new opportunities in various industries. These trends indicate a growing reliance on copper and brass products for modern infrastructure and technology.

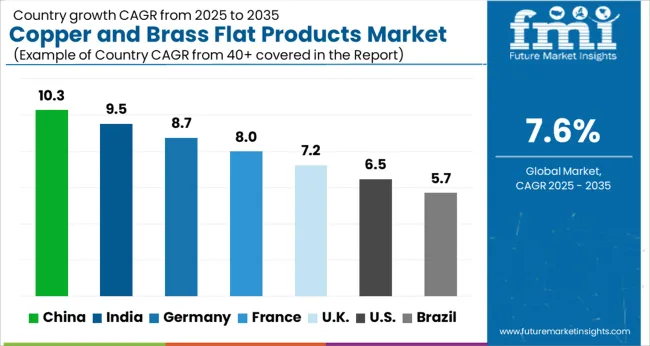

| Countries | CAGR |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global copper and brass flat products market is projected to grow at a CAGR of 7.6% from 2025 to 2035. China leads with a growth rate of 10.3%, followed by India at 9.5%, and Germany at 8.7%. The United Kingdom and the United States show more moderate growth rates of 7.2% and 6.5%, respectively. The market growth is primarily driven by rising demand in the automotive, construction, and electrical industries. Government investments, infrastructure development, and advancements in manufacturing technologies continue to fuel the demand for high-performance copper and brass products across these regions. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the copper and brass flat products market with a projected CAGR of 10.3% from 2025 to 2035. The rapid industrialization and demand for high-performance metals across various industries, such as electronics, construction, and automotive, are driving this market. The country’s robust manufacturing sector, coupled with strong demand for copper and brass in electrical components, power transmission, and other applications, supports continued growth. China’s ability to scale production efficiently and meet both domestic and international demand positions it as the dominant market for copper and brass flat products.

The copper and brass flat products market in India is set to grow at a CAGR of 9.5% from 2025 to 2035. The market expansion is supported by increasing demand in the construction, automotive, and electrical industries. As India’s industrial base continues to grow, the need for copper and brass products in various applications, from electrical components to industrial machinery, is rising. Government initiatives, including infrastructure development and modernization of electrical systems, are further boosting demand for these materials. The market also benefits from India’s growing focus on improving manufacturing capabilities in copper and brass products.

The copper and brass flat products market in Germany is expected to grow at a CAGR of 8.7% from 2025 to 2035. The demand for these materials is driven by the automotive, construction, and electrical industries, where high-quality metals are required for components, wiring, and machinery. Germany’s industrial strength, particularly in automotive and electrical systems, supports the continued need for copper and brass flat products. As the country continues to invest in technological advancements and manufacturing efficiency, the demand for specialized copper and brass products is expected to rise, particularly for applications in energy systems and precision machinery.

The copper and brass flat products market in the United Kingdom is projected to grow at a CAGR of 7.2% from 2025 to 2035. The growth is supported by the demand for copper and brass materials in construction, electrical, and transportation industries. The UK.’s shift toward energy-efficient systems and smart technologies in various sectors, including residential and commercial buildings, contributes to the increasing demand for these materials. The market is also bolstered by UK-based manufacturing facilities that focus on high-quality, specialized copper and brass products for critical applications.

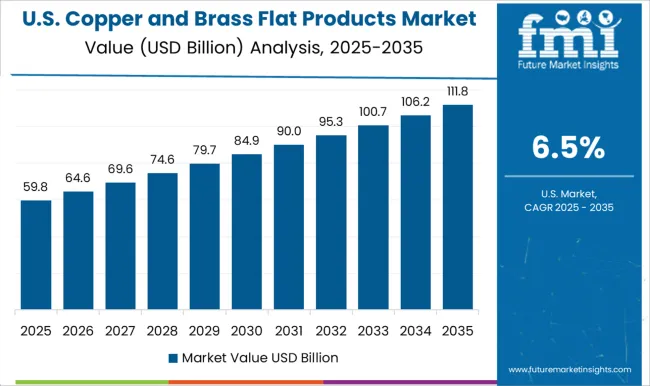

The USA copper and brass flat products market is expected to grow at a CAGR of 6.5% from 2025 to 2035. The key drivers include the ongoing demand in the automotive, aerospace, construction, and electrical industries. As the USA continues to advance its manufacturing base and invest in high-performance materials, the market for copper and brass products expands, particularly for applications in power transmission, electrical systems, and machinery components. Increasing demand for lightweight, corrosion-resistant materials in construction and transportation sectors strengthens the market growth trajectory.

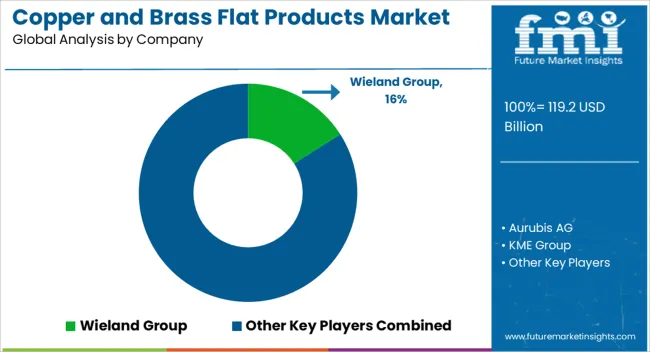

In the copper and brass flat products market, competition is driven by material quality, production efficiency, and innovation in manufacturing processes. Wieland Group and Aurubis AG dominate the market with their extensive product offerings in copper and brass sheets, strips, and coils. Wieland Group emphasizes advanced processing capabilities, offering high-performance products for automotive, electrical, and industrial applications. Aurubis, as a leading global copper producer, focuses on sustainable production and recycling, catering to sectors such as construction, electronics, and energy with copper flat products that meet strict quality and environmental standards. KME Group is a significant player, providing high-quality copper and brass products for demanding applications, particularly in the electrical and automotive industries, emphasizing their technological capabilities and long-standing market presence. The strategy of these companies revolves around product diversification, technological advancements, and geographic expansion. Mitsubishi Materials and Hindalco Industries focus on enhancing their production capabilities and expanding their market presence through advanced manufacturing processes and a broad range of applications, including construction, electrical, and electronics. Mitsubishi Materials stands out with its focus on high-performance alloys and sustainable product offerings, while Hindalco, through its strategic mergers and acquisitions, strengthens its foothold in emerging markets. Atlantic Copper, primarily known for its copper refining, competes through its high-purity copper products that are used in critical infrastructure and electrical applications. Product brochures from these companies detail their offerings, emphasizing copper and brass flat products used in a wide array of applications. Wieland Group presents sheets and strips for various industrial applications, while Aurubis AG highlights copper products suitable for energy-efficient solutions. KME Group focuses on the versatility of its copper and brass products in electrical systems, and Hindalco promotes its products’ suitability for demanding construction and industrial needs. These brochures highlight certifications, performance attributes, and specific application areas, underscoring the high quality and reliability of their products.

| Item | Value |

|---|---|

| Quantitative Units | USD 119.2 Billion |

| Wood Type | Log wood, Wood chips, Pellets, Forestry residues, and Others |

| End Use | Power distribution, Food services, and Others |

| Distribution Channel | Business to business, Hypermarkets and supermarkets, Specialty stores, E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wieland Group, Aurubis AG, KME Group, Mitsubishi Materials, Hindalco Industries Ltd., Atlantic Copper, and Boway Alloy |

| Additional Attributes | Dollar sales by product type (copper flat, brass flat, others), application (construction, electronics, automotive, industrial), and alloy composition (high-grade, standard). Demand dynamics are influenced by the growing need for lightweight, durable materials in construction and automotive sectors, alongside the increasing use of copper in electronic devices for improved conductivity. Regional trends show strong growth in Europe, Asia-Pacific, and North America, driven by infrastructure development, technological advancements, and rising investments in energy-efficient solutions. |

The global copper and brass flat products market is estimated to be valued at USD 119.2 billion in 2025.

The market size for the copper and brass flat products market is projected to reach USD 248.0 billion by 2035.

The copper and brass flat products market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in copper and brass flat products market are log wood, wood chips, pellets, forestry residues and others.

In terms of end use, power distribution segment to command 58.0% share in the copper and brass flat products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Azoles Market

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Consumer Electronics Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA