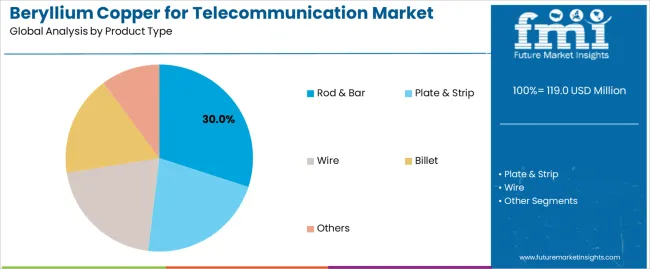

The beryllium copper for telecommunication market grows from USD 119 million in 2025 to USD 209 million by 2035 at a CAGR of 5.8%, with segment performance shaping most of the expansion. The rod & bar segment leads with a 30% share, supported by its role in producing high-precision connectors, contacts, terminal pins and spring elements used in 5G base stations, fiber-optic distribution frames, microwave modules and switching hardware. Rod & bar formats offer machinability, fatigue strength and conductivity suited for high-cycle, high-frequency telecom applications, especially where repeated mating cycles or vibration loads demand stable mechanical elasticity. Plate & strip formats supply shield plates, relay parts and microwave housings, while wire and billet forms address coil components, micro-springs and custom connector inserts.

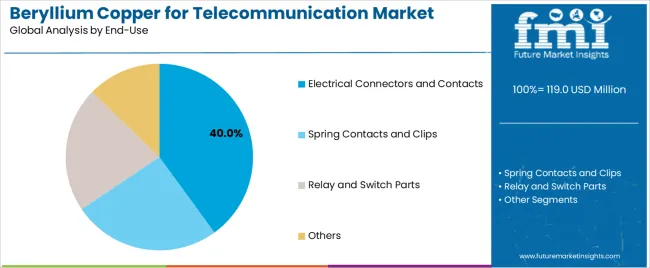

End-use segmentation is dominated by electrical connectors and contacts at 40%, reflecting the rapid deployment of 5G radios, dense small-cell networks, fiber backhaul equipment, and high-density data-center switchgear. These systems depend on beryllium copper’s ability to maintain conductivity, spring force and corrosion resistance in compact, thermally stressed assemblies. Spring contacts and relay components form the secondary demand tier, driven by telecom hardware miniaturisation and rising port density in advanced switching modules. Segment-level trends are defined by higher frequency bands in 5G, growth in edge-computing enclosures, and rising connector counts in distributed antenna systems. As networks shift toward compact, high-speed architectures, the requirement for alloys that balance conductivity with mechanical resilience ensures continued reliance on premium beryllium copper grades.

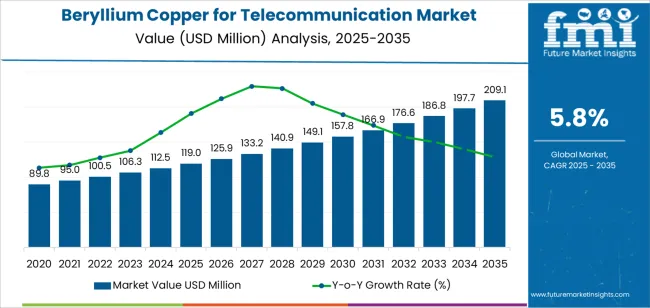

Between 2025 and 2026, the beryllium copper for telecommunication market is expected to grow from USD 119 million to USD 125.9 million, which represents a YoY increase of USD 6.9 million, or about 5.8%. This initial growth will likely be fueled by the increasing demand for high-quality, durable materials used in the expansion of 5G networks and other telecommunication infrastructure projects. As 5G adoption accelerates globally, the need for efficient and reliable telecom components such as connectors and switches made from beryllium copper will rise, particularly in network installations, base stations, and data centers. The enhanced electrical conductivity and mechanical strength of beryllium copper will be essential for these applications, driving the steady market growth. Additionally, this period will see increasing investments in telecommunication equipment, further fueling the demand for beryllium copper-based products.

Between 2026 and 2027, the market will expand from USD 125.9 million to USD 133.2 million, a YoY increase of USD 7.3 million, or 5.8%. This continued growth reflects the increasing deployment of 5G technology and the associated infrastructure. As telecom networks grow more complex with the advent of high-speed internet and IoT connectivity, the demand for reliable, high-performance components like beryllium copper increases. The market will benefit from expanding wireless communication systems and smart city projects, which require more advanced and durable materials for communication devices and network infrastructure. As telecom providers focus on next-generation connectivity, beryllium copper will remain a key material due to its superior electrical and thermal properties, making it ideal for components in 5G systems and beyond. This ongoing demand for advanced telecommunications solutions will sustain steady growth through this period, with more applications requiring high-quality materials such as beryllium copper.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 119 million |

| Market Forecast Value (2035) | USD 209 million |

| Forecast CAGR (2025-2035) | 5.8% |

The beryllium copper for telecommunications market is experiencing growth due to its unique combination of high electrical conductivity and excellent mechanical properties, making it an ideal material for critical telecom applications. Components such as connectors, terminals, and spring contacts in telecom infrastructure, including base stations, optical networking modules, and 5G microwave systems, require materials that can maintain stable performance over time. Beryllium copper alloys are known for their ability to deliver reliable electrical signal integrity while also withstanding the physical stresses of repeated use and mechanical deformation. As the demand for high-speed data transmission increases with the expansion of 5G networks and the growth of the Internet of Things (IoT), the need for durable, high-performance materials in telecommunications systems continues to rise.

The expansion of data centers, edge computing nodes, and distributed antenna systems is driving the demand for beryllium copper in telecommunications. These technologies require compact, high-density interconnects that can perform under demanding environmental conditions, which beryllium copper is well-suited for. Advances in alloy formulation and processing techniques are enhancing the material’s applicability for these high-precision applications, making it even more valuable for the telecommunication industry. However, challenges such as the volatility of raw material costs, strict health and safety regulations related to beryllium use, and the need for specialized manufacturing processes may pose barriers to growth in certain regions. Despite these challenges, the increasing need for efficient and long-lasting telecommunications components is expected to drive continued market growth.

The beryllium copper for telecommunication market is segmented by product type and end-use. The leading product type is rod & bar, which holds 30% of the market share, while the dominant end-use segment is electrical connectors and contacts, accounting for 40% of the market. These segments are key drivers of market growth, supported by the ongoing demand for high-performance materials in telecommunication infrastructure and devices that require excellent conductivity, strength, and reliability.

The rod & bar product type leads the beryllium copper for telecommunication market, capturing 30% of the market share. Beryllium copper in rod and bar forms is widely used in telecommunication applications due to its excellent combination of high electrical conductivity, strength, and durability. These properties make it ideal for manufacturing connectors, contacts, and other essential components in telecommunication equipment, where reliable and efficient electrical conduction is crucial.

Rod & bar forms are commonly used because they allow for precise machining and are easy to handle, making them suitable for various applications, including electrical contacts, connectors, and other telecommunication components that require robust mechanical properties and excellent conductivity. As the demand for reliable and efficient communication networks continues to grow, especially with the expansion of 5G infrastructure, the rod & bar segment is expected to maintain its leadership in the market.

The electrical connectors and contacts end-use segment leads the beryllium copper for telecommunication market, accounting for 40% of the market share. Beryllium copper is highly valued in the production of electrical connectors and contacts due to its superior conductivity, mechanical strength, and resistance to wear and corrosion. These properties are critical in ensuring long-lasting performance and reliability in telecommunication systems, where uninterrupted and high-quality signal transmission is essential.

The demand for beryllium copper in electrical connectors and contacts is primarily driven by the increasing need for high-performance materials in the telecommunication industry, particularly in the expansion of telecommunication networks, including fiber optics and 5G infrastructure. As the telecommunications industry continues to evolve and expand globally, the need for durable, efficient, and high-conductivity connectors will continue to drive the demand for beryllium copper in these applications, making the electrical connectors and contacts segment a key contributor to market growth.

The beryllium copper for telecommunication market is shaped by increasing deployment of high-performance connectors, contacts and spring components in telecom network equipment. As operators upgrade networks for 5G, fibre backhaul and edge-data infrastructure, the demand for materials that combine high electrical conductivity and robust mechanical strength escalates. The market is expected to grow with a compound annual growth rate (CAGR) of roughly 5.7%. At the same time, supply-chain constraints, the cost of beryllium materials, and regulatory or health-safety concerns in beryllium alloy manufacture are significant factors affecting the market’s pace and regional variations.

What Are The Primary Growth Drivers For The Beryllium Copper for Telecommunication Market?

Several drivers underpin growth in this market. First, telecom infrastructure upgrades such as deployment of 5G base stations, fibre-to-the-home (FTTH) networks and high-speed data centres require connectors, relay contacts, spring clips and other components that perform reliably under high frequency, high current and vibration conditions. Beryllium copper alloys, with their combination of high conductivity, fatigue resistance and corrosion resistance, fit these needs. Second, miniaturisation of telecommunication hardware and increasing port density force material selection toward alloys that handle both electrical performance and mechanical resilience in compact form-factors. Third, global expansion of telecommunication network roll-out, particularly in Asia-Pacific and Latin America, opens geographic markets where high-performance materials are increasingly required rather than standard grade alternatives. Fourth, the growth in Internet-of-Things (IoT) devices and edge-computing infrastructure increases the volume of smaller telecom modules and connectors, thereby boosting per-unit demand for premium materials such as beryllium copper alloy.

What Are The Key Restraints In The Beryllium Copper for Telecommunication Market?

Despite favourable drivers, the market faces several restraints. The high cost of beryllium copper alloys, due to beryllium’s scarcity and the processing complexity required for safe handling and precision alloying, increases component cost compared to standard copper alloys. This can limit adoption in cost-sensitive segments or regions where budget constraints dominate connector material decisions. Moreover, health and safety regulations around beryllium exposure in manufacturing add overheads for producers and restrict geographical supply options. Supply-chain risk is another concern: beryllium reserves and refinement capacity are concentrated, meaning disruptions or geopolitically driven export controls can impact material availability and pricing. Finally, alternative materials and alloys such as high-conductivity copper alloys, silver-plated copper, or advanced composites may offer acceptable performance at lower cost, which limits substitution risk for beryllium copper.

What Are The Emerging Trends In The Beryllium Copper for Telecommunication Market?

Emerging trends in this market include development of higher-performance beryllium copper alloy grades tailored for telecom applications, such as enhanced fatigue life for spring contacts in high-cycle data-centre switchgear, or advanced plating combinations for corrosion resistance in outdoor base-station equipment. Another trend is the move toward miniaturisation and multi-functional connector modules, which require materials that maintain high performance at reduced size. Beryllium copper alloys are increasingly used in micro-connector assemblies in 5G and fibre-optic systems. Sustainability and recycling considerations are also growing: manufacturers and OEMs are seeking alloys with longer life, improved recyclability and lower lifecycle cost, which benefits use of beryllium copper given its durability. Finally, regional growth in Asia-Pacific, especially China, India and Southeast Asia, is accelerating uptake of premium connector materials as telecom equipment OEMs localise production and demand higher-grade materials for next-generation networks.

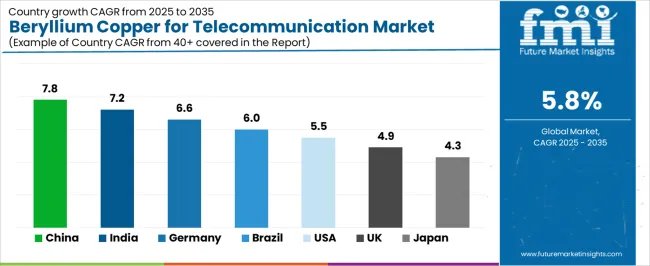

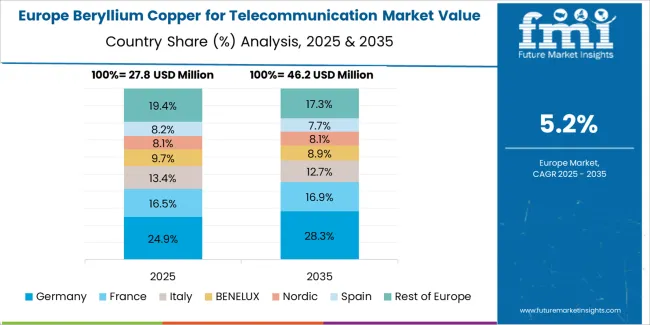

The beryllium copper for telecommunication market is experiencing steady growth, driven by the increasing demand for high-performance materials in the telecommunications industry. Beryllium copper alloys, known for their excellent conductivity, durability, and resistance to corrosion, are widely used in telecommunication equipment, particularly in connectors, contacts, and components that require reliable performance in harsh environments. As the global telecommunications sector continues to expand with the rise of 5G networks and the increasing need for data transmission infrastructure, the demand for materials like beryllium copper is increasing. Countries with strong industrial sectors, such as China and India, are seeing rapid growth in this market, while developed economies like the USA and Germany continue to drive steady demand due to technological advancements and ongoing investments in telecom infrastructure. This analysis explores the factors driving the growth of the beryllium copper for telecommunication market across various countries.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

| India | 7.2% |

| Germany | 6.6% |

| Brazil | 6% |

| USA | 5.5% |

| United Kingdom | 4.9% |

| Japan | 4.3% |

China leads the beryllium copper for telecommunication market with a CAGR of 7.8%. The country’s rapid expansion in the telecommunications sector, particularly with the ongoing deployment of 5G networks, is a key driver of demand for high-performance materials like beryllium copper. Beryllium copper alloys are essential in manufacturing connectors, switches, and other components used in telecommunications equipment, offering the necessary durability and electrical conductivity.

China's robust electronics manufacturing sector and its push to modernize telecom infrastructure, including the expansion of fiber optic networks and communication systems, are further fueling market growth. With the government’s strategic initiatives to boost digital connectivity, demand for high-quality materials such as beryllium copper is expected to remain strong. The country’s rapid industrialization and increasing investment in 5G infrastructure will continue to drive growth in the market for beryllium copper in telecommunications.

India’s beryllium copper for telecommunication market is growing at a CAGR of 7.2%. The telecommunications sector in India is undergoing rapid expansion, driven by increasing mobile and internet penetration, the rollout of 4G networks, and the imminent 5G deployment. As demand for high-quality and durable telecom components grows, beryllium copper alloys are being increasingly used due to their excellent conductivity, strength, and corrosion resistance, making them ideal for critical telecom equipment.

India’s growing infrastructure development, combined with government policies promoting digitalization, is boosting the demand for telecommunication components, including those made from beryllium copper. The government’s push for a Digital India, improving network connectivity across rural and urban areas, is further fueling market growth. As India continues to expand its telecom capabilities, the beryllium copper market for telecommunications will experience steady growth.

Germany’s beryllium copper for telecommunication market is projected to grow at a CAGR of 6.6%. As a leader in the European telecom sector, Germany is investing heavily in the development of advanced telecommunications infrastructure, particularly in the areas of 5G and fiber optic networks. Beryllium copper alloys are crucial in the production of durable and reliable telecom components, which are in high demand as Germany modernizes its network to meet the increasing data transmission needs.

Germany’s strong engineering and industrial base, along with a well-established telecom sector, is contributing to steady growth in the demand for beryllium copper products. The country’s focus on innovation and infrastructure expansion, particularly for 5G and high-speed broadband networks, is expected to continue to drive demand for high-performance materials used in telecom components.

Brazil’s beryllium copper for telecommunication market is expected to grow at a CAGR of 6.0%. Brazil’s growing telecom industry, particularly in mobile networks and internet services, is driving the demand for beryllium copper. The need for durable and efficient materials in telecom equipment, such as connectors, cables, and switches, is increasing as the country expands its communication infrastructure.

Brazil’s government initiatives aimed at expanding internet access to underserved areas, particularly in rural regions, are contributing to the demand for high-quality telecom components. With the increasing focus on broadband development and telecom modernization, the market for beryllium copper in telecommunications is expected to continue growing. Additionally, as Brazil prepares for the rollout of 5G networks, demand for reliable and high-performance materials like beryllium copper will increase.

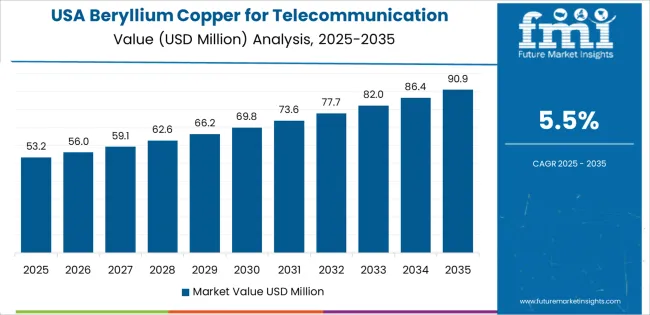

The United States has a projected CAGR of 5.5% for the beryllium copper for telecommunication market. The USA is a global leader in the telecom industry, and the ongoing demand for next-generation telecom infrastructure, particularly 5G, is driving the need for advanced materials like beryllium copper. The excellent conductivity and strength of beryllium copper make it an essential material for manufacturing telecom components such as connectors, cables, and switches, which are critical for modern communication systems.

As telecom companies in the USA continue to upgrade their networks to meet the demands of faster, more reliable communications, the demand for beryllium copper products will increase. With the expansion of 5G technology, the market for high-performance materials like beryllium copper will continue to grow, ensuring steady demand in the USA telecom sector.

The United Kingdom’s beryllium copper for telecommunication market is projected to grow at a CAGR of 4.9%. The UK has been investing significantly in its telecom infrastructure, particularly with the rollout of 5G networks. Beryllium copper is essential in the production of high-performance components for telecom applications, making it a critical material in the development of the UK’s modern communication networks.

The UK’s emphasis on innovation and high-tech industries, combined with its growing demand for reliable telecommunications, is fueling the market for beryllium copper in telecom applications. As the UK continues to expand its fiber optic and 5G networks, the demand for materials like beryllium copper, which ensures durability and reliability in telecom equipment, is expected to increase.

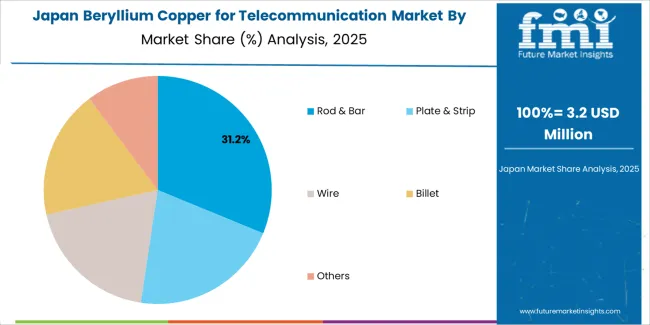

Japan’s beryllium copper for telecommunication market is expected to grow at a CAGR of 4.3%. Japan has one of the most advanced telecom industries in the world, and its focus on cutting-edge technologies, including 5G and broadband infrastructure, is driving the demand for high-performance materials like beryllium copper. The material’s excellent conductivity and durability make it ideal for use in connectors and other telecom components.

Japan’s strong focus on technological innovation and modernization of its telecom infrastructure, particularly in the context of 5G rollout, is contributing to the steady growth of the beryllium copper market in telecommunications. As the country continues to expand its digital networks, the demand for reliable materials like beryllium copper will remain strong.

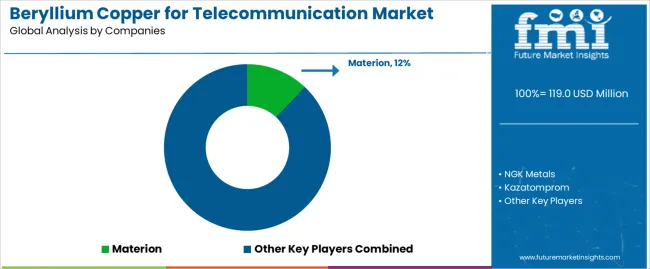

In the beryllium copper for telecommunication market, companies such as Materion (holding an estimated 12% share), NGK Metals, Kazatomprom, Aviva Metals, IBC Advanced Alloys, Belmont Metals, Ampco Metal, Minmetals Beryllium, CNMNC, XJNM, Emeishan Zhongshan, Zhuhai Dahua, Wonder Copper, and Advanced Refractory Metals (ARM) are actively competing. The market is driven by increasing demand in telecommunications equipment for materials that combine high strength with excellent electrical conductivity-capabilities found in beryllium copper alloys. The telecommunications segment is expected to represent a significant portion of beryllium copper billet applications.

These companies focus on several key strategic approaches. One approach emphasizes alloy innovation and performance optimization. New grades of beryllium copper are developed to meet demanding telecom requirements for connectors, high frequency components, and miniaturized systems. Materials are engineered for high fatigue strength, excellent conductivity, and durability in compact form factors. Another strategic focus is regional supply chain presence and the capability to support telecom equipment manufacturers with timely delivery of rod, bar, wire, or billet forms to match high volume deployment in data centers, 5G networks, and fiber optic equipment. A third approach addresses cost management and regulatory compliance. Given the health and environmental constraints around beryllium, firms emphasize safe production practices, alloy recycling, and differentiation through certification and environmental credentials. Brochures and technical product sheets typically highlight metrics such as tensile strength, electrical conductivity, fatigue cycle life, form factor availability (rod, wire, strip), application compatibility (e.g., telecom switchboards, connector pins, antenna components), and supply volume or custom alloy capabilities. By aligning product attributes with the evolving needs of telecom infrastructure—higher data throughput, miniaturization, and reliability—these firms aim to secure leadership in the beryllium copper for telecommunication market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Product Type | Rod & Bar, Plate & Strip, Wire, Billet, Others |

| End-Use | Electrical Connectors and Contacts, Spring Contacts and Clips, Relay and Switch Parts, Others |

| Key Companies Profiled | Materion, NGK Metals, Kazatomprom, Aviva Metals, IBC Advanced Alloys, Belmont Metals, Ampco Metal, Minmetals Beryllium, CNMNC, XJNM, Emeishan Zhongshan, ZHUHAI DAHUA, Wonder Copper, Advanced Refractory Metals (ARM) |

| Additional Attributes | The market analysis includes dollar sales by product type and end-use categories. It also covers regional adoption trends across major markets. The competitive landscape focuses on key manufacturers in the beryllium copper for telecommunication market, with innovations in rod, bar, plate, wire, and billet forms. Trends in the growing demand for beryllium copper in electrical connectors, spring contacts, and relay parts are explored, along with advancements in telecommunication and electronics industries. |

The global beryllium copper for telecommunication market is estimated to be valued at USD 119.0 million in 2025.

The market size for the beryllium copper for telecommunication market is projected to reach USD 209.1 million by 2035.

The beryllium copper for telecommunication market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in beryllium copper for telecommunication market are rod & bar, plate & strip, wire, billet and others.

In terms of end-use, electrical connectors and contacts segment to command 40.0% share in the beryllium copper for telecommunication market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beryllium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Aluminum Alloy Market Growth - Trends & Forecast 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Consumer Electronics Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA