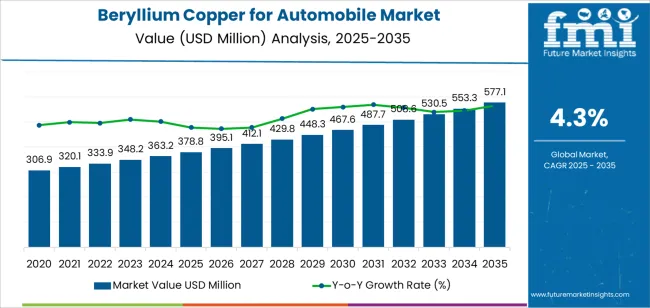

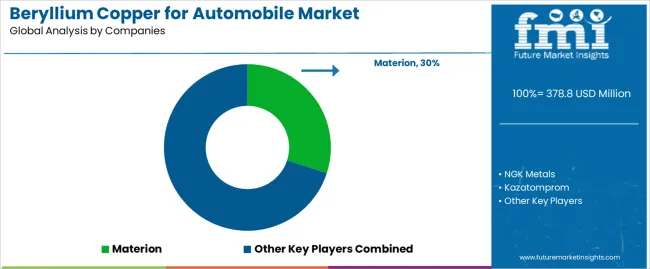

The global beryllium copper for automobile market is valued at USD 378.8 million in 2025. It is slated to reach USD 577.1 million by 2035, recording an absolute increase of USD 198.3 million over the forecast period. This translates into a total growth of 52.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.52X during the same period, supported by increasing demand for high-performance electrical connectors in electric vehicle applications, growing adoption of beryllium copper components in advanced safety systems and electronic control units, and rising emphasis on lightweight materials with superior conductivity and durability characteristics across diverse automotive electrical systems, sensor housings, and precision mechanical components.

Between 2025 and 2030, the beryllium copper for automobile market is projected to expand from USD 378.8 million to USD 467.5 million, resulting in a value increase of USD 88.7 million, which represents 44.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing electric vehicle production requiring robust electrical interconnection systems, rising complexity of automotive electronics demanding reliable contact materials, and growing utilization of beryllium copper in battery management systems and charging infrastructure components. Automotive manufacturers and component suppliers are expanding their material specifications to address the growing demand for high-reliability solutions that ensure electrical performance and mechanical integrity while meeting stringent automotive qualification requirements.

From 2030 to 2035, the market is forecast to grow from USD 467.5 million to USD 577.1 million, adding another USD 109.6 million, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of autonomous vehicle sensor systems requiring precision electrical contacts, the development of advanced driver assistance technologies utilizing beryllium copper components, and the growth of vehicle electrification platforms incorporating high-current electrical distribution systems. The growing adoption of 48-volt electrical architectures and high-voltage battery systems will drive demand for beryllium copper materials with enhanced current-carrying capacity and thermal management properties.

Between 2020 and 2025, the beryllium copper for automobile market experienced steady growth, driven by increasing automotive electronics content per vehicle and growing recognition of beryllium copper alloys as essential materials for ensuring reliable electrical connections in demanding automotive environments. The market developed as automotive engineers and component designers recognized the potential for beryllium copper to provide superior spring properties, excellent electrical conductivity, and resistance to stress relaxation while supporting miniaturization objectives and extended service life requirements. Technological advancement in alloy processing and component manufacturing began emphasizing the critical importance of maintaining consistent material properties and surface quality in high-volume automotive production environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 378.8 million |

| Forecast Value in (2035F) | USD 577.1 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

Market expansion is being supported by the increasing global transition toward electric vehicles and hybrid powertrains driven by environmental regulations and consumer preferences, alongside the corresponding need for advanced electrical contact materials that can deliver superior conductivity, maintain spring force under thermal cycling, and ensure reliable performance across various connector assemblies, switch mechanisms, and sensor applications. Modern automotive suppliers and vehicle manufacturers are increasingly focused on implementing beryllium copper solutions that can support higher current densities, withstand vibration and thermal stress, and provide consistent electrical performance throughout vehicle service life.

The growing emphasis on vehicle electrification and autonomous driving technologies is driving demand for beryllium copper materials that can support complex electronic architectures, enable miniaturized connector designs, and ensure comprehensive electrical reliability. Automotive engineers' preference for materials that combine exceptional mechanical properties with excellent electrical conductivity and corrosion resistance is creating opportunities for innovative beryllium copper implementations. The rising influence of electric vehicle charging infrastructure development and high-voltage battery system deployment is also contributing to increased utilization of beryllium copper components that can provide reliable electrical connections without compromising safety or operational performance.

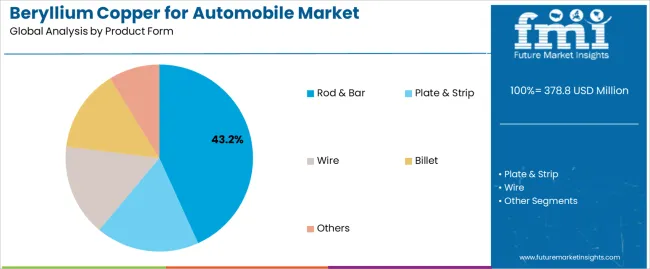

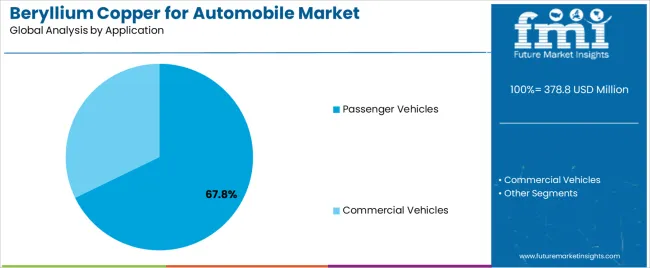

The market is segmented by product form, application, and region. By product form, the market is divided into rod & bar, plate & strip, wire, billet, and others. Based on application, the market is categorized into commercial vehicles and passenger vehicles. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

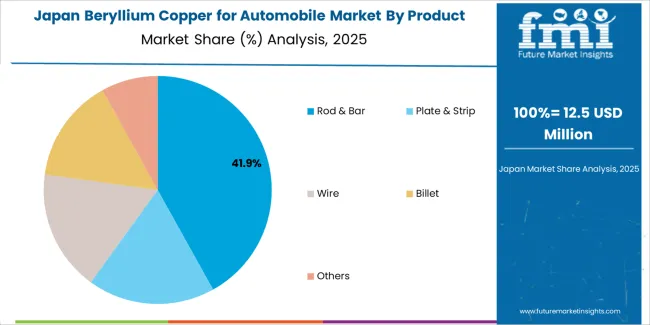

The rod & bar segment is projected to maintain its leading position in the beryllium copper for automobile market in 2025 with a 43.2% market share, reaffirming its role as the preferred product form for connector pin manufacturing and electrical contact component production. Automotive component manufacturers increasingly utilize beryllium copper rods and bars for their suitability for machining operations, consistent material properties throughout cross-sections, and proven effectiveness in high-volume stamping and forming processes while supporting tight dimensional tolerances. Rod and bar product technology's established manufacturing compatibility and material availability directly address the industry requirements for reliable feedstock that enables efficient component production across diverse connector types and electrical contact applications.

This product form segment forms the foundation of automotive electrical component manufacturing, as it represents the material configuration with the greatest contribution to connector pin production and established processing infrastructure across multiple automotive supply chain tiers. Automotive industry investments in electric vehicle platforms continue to strengthen adoption among connector manufacturers and stamping operations. With increasing demand for high-performance electrical contacts capable of handling elevated current levels and thermal loads, rod and bar forms align with both manufacturing efficiency objectives and material performance requirements, making them the central component of comprehensive electrical system strategies.

The passenger vehicles application segment is projected to represent the largest share of beryllium copper demand in 2025 with a 67.8% market share, underscoring its critical role as the primary driver for material adoption across battery electric vehicles, plug-in hybrid vehicles, and conventional passenger cars requiring advanced electrical systems. Passenger vehicle manufacturers prefer beryllium copper for electrical applications due to its exceptional spring properties that ensure contact reliability, superior electrical conductivity supporting efficient power distribution, and ability to maintain performance under vibration and temperature cycling while meeting automotive qualification standards. Positioned as essential materials for modern vehicle electrical architectures, beryllium copper alloys offer both functional performance and durability advantages.

The segment is supported by continuous expansion of passenger vehicle production and the growing electrification of vehicle platforms that require increased electrical content with enhanced connector reliability and current-carrying capabilities. Additionally, automotive manufacturers are investing in advanced electrical system designs to support autonomous driving features, connectivity systems, and electrified powertrain components that demand high-performance contact materials. As passenger vehicle electrification accelerates and electronic content increases, the passenger vehicles application will continue to dominate the market while supporting advanced material utilization and electrical system optimization strategies.

The beryllium copper for automobile market is advancing steadily due to increasing demand for electric vehicles driven by regulatory emissions standards and growing adoption of advanced driver assistance systems that require specialized materials providing superior electrical conductivity and mechanical reliability across diverse connector assemblies, battery management components, sensor housings, and control unit applications. The market faces challenges, including high material costs compared to alternative copper alloys, health and safety considerations related to beryllium handling during manufacturing, and competition from alternative contact materials and plating technologies in certain applications. Innovation in alloy compositions and processing technologies continues to influence product development and market expansion patterns.

The growing production of battery electric vehicles and plug-in hybrid vehicles is driving demand for beryllium copper materials that address unique electrical system requirements including high-current battery connections, charging system components, and power distribution networks operating at elevated voltages. Electric vehicle applications require beryllium copper components that deliver exceptional current-carrying capacity while maintaining contact reliability under thermal cycling and mechanical stress conditions associated with battery charging and high-power operation. Automotive suppliers are increasingly recognizing the performance advantages of beryllium copper for critical electrical connections in battery packs, onboard chargers, and motor control systems, creating opportunities for specialized alloy grades optimized for high-voltage automotive applications and thermal management requirements.

Modern beryllium copper producers are incorporating advanced melting techniques, precision rolling processes, and specialized heat treatment protocols to enhance material properties, improve consistency, and support comprehensive performance specifications through optimized microstructure control and surface quality management. Leading companies are developing tailored alloy compositions for specific automotive applications, implementing statistical process control for material property verification, and advancing processing capabilities that enable thin-gauge strip production and wire drawing for miniaturized connector designs. These developments improve material performance while enabling new market opportunities, including high-density connector systems, micro-switch assemblies, and precision sensor components for autonomous vehicle applications. Advanced processing integration also allows manufacturers to support comprehensive quality requirements and application diversity beyond traditional automotive electrical contact specifications.

The expansion of vehicle weight reduction initiatives and component integration strategies is driving demand for beryllium copper solutions that combine structural functions with electrical performance, enable thin-wall designs, and support space-efficient packaging in compact electrical assemblies. These applications require material solutions with optimized strength-to-weight ratios, enhanced formability characteristics, and specialized surface treatments that address corrosion protection and contact resistance requirements, creating market segments with differentiated technical specifications and value propositions. Manufacturers are investing in application engineering resources and collaborative development programs to serve evolving automotive design requirements while supporting innovation in next-generation vehicle electrical architectures and component miniaturization strategies.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| United States | 4.1% |

| United Kingdom | 3.7% |

| Japan | 3.2% |

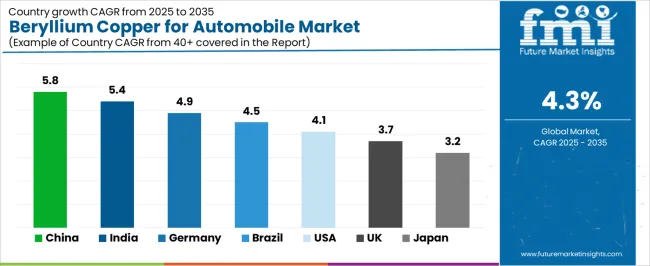

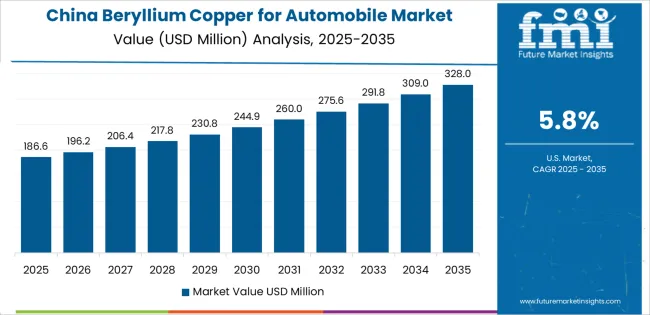

The beryllium copper for automobile market is experiencing solid growth globally, with China leading at a 5.8% CAGR through 2035, driven by massive electric vehicle production expansion, growing automotive electronics content, and increasing domestic supplier capabilities for electrical components. India follows at 5.4%, supported by expanding automotive manufacturing capacity, rising electric vehicle adoption, and growing component localization initiatives. Germany shows growth at 4.9%, emphasizing premium vehicle electrical systems, electric vehicle technology leadership, and precision automotive component manufacturing. Brazil demonstrates 4.5% growth, supported by automotive industry modernization, expanding domestic production, and increasing vehicle electronics content. The United States records 4.1%, focusing on electric vehicle market expansion, automotive electronics innovation, and domestic manufacturing revitalization. The United Kingdom exhibits 3.7% growth, emphasizing electric vehicle adoption, automotive technology development, and specialized component manufacturing. Japan shows 3.2% growth, supported by automotive electronics excellence, hybrid vehicle technology leadership, and quality-focused material processing.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from beryllium copper for automobile in China is projected to exhibit exceptional growth with a CAGR of 5.8% through 2035, driven by massive battery electric vehicle production scale and rapidly expanding automotive electronics component manufacturing supported by government New Energy Vehicle policies and industrial development programs. The country's dominant position in global automotive production and increasing emphasis on electric vehicle technology are creating substantial demand for beryllium copper materials. Major automotive suppliers and electrical component manufacturers are establishing comprehensive material processing and component fabrication capabilities to serve both domestic vehicle manufacturers and international markets.

Revenue from beryllium copper for automobile in India is expanding at a CAGR of 5.4%, supported by the country's growing automotive production capacity, expanding electric vehicle market, and increasing emphasis on component localization under government manufacturing initiatives. The country's comprehensive automotive sector development programs and rising electronics content per vehicle are driving demand for advanced electrical contact materials throughout diverse vehicle segments. Leading automotive suppliers and international component manufacturers are establishing production facilities and material processing operations to address growing domestic and export requirements.

Revenue from beryllium copper for automobile in Germany is expanding at a CAGR of 4.9%, supported by the country's premium automotive sector, electric vehicle technology leadership, and advanced electrical component manufacturing serving global automotive markets. The nation's engineering capabilities and quality standards are driving sophisticated material implementations throughout automotive electrical systems. Leading automotive manufacturers and tier-one suppliers are investing extensively in electric vehicle component development and high-performance material specifications.

Revenue from beryllium copper for automobile in Brazil is expanding at a CAGR of 4.5%, supported by the country's automotive manufacturing presence, developing electric vehicle market, and increasing electronics content in vehicles produced for domestic and regional markets. Brazil's automotive sector modernization and growing supplier capabilities are driving demand for advanced electrical materials. Automotive manufacturers and component suppliers are investing in material specifications and component technologies to serve both local production and export opportunities.

Revenue from beryllium copper for automobile in the United States is expanding at a CAGR of 4.1%, supported by the country's expanding electric vehicle production, advanced automotive electronics development, and emphasis on domestic manufacturing and supply chain resilience. The nation's automotive innovation ecosystem and electrification initiatives are driving demand for high-performance electrical contact materials. Automotive manufacturers and component suppliers are investing in production capacity and material specifications to serve both domestic vehicle production and international markets.

Revenue from beryllium copper for automobile in the United Kingdom is expanding at a CAGR of 3.7%, driven by the country's electric vehicle market growth, automotive technology development capabilities, and specialized component manufacturing serving European and global automotive markets. The United Kingdom's automotive sector transformation and electrification focus are driving demand for advanced electrical materials. Automotive component manufacturers and technology developers are investing in material specifications and manufacturing capabilities for electric vehicle components.

Revenue from beryllium copper for automobile in Japan is expanding at a CAGR of 3.2%, supported by the country's automotive electronics manufacturing leadership, hybrid vehicle technology excellence, and precision material processing capabilities serving domestic and international automotive markets. Japan's technological sophistication and quality manufacturing standards are driving demand for high-precision beryllium copper products. Leading automotive suppliers and material processors are investing in specialized capabilities for advanced automotive applications.

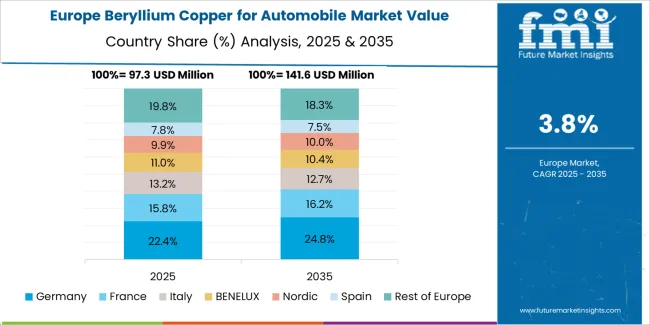

The beryllium copper for automobile market in Europe is projected to grow from USD 132.7 million in 2025 to USD 212.6 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain leadership with a 34.6% market share in 2025, moderating to 34.1% by 2035, supported by premium automotive manufacturing, electric vehicle technology development, and advanced component supplier capabilities.

The United Kingdom follows with 16.8% in 2025, projected at 16.5% by 2035, driven by electric vehicle market growth, automotive component manufacturing, and technology development capabilities. France holds 14.7% in 2025, rising to 14.9% by 2035 on the back of automotive industry presence, electric vehicle production, and component supplier development. Italy commands 11.3% in 2025, increasing slightly to 11.5% by 2035, while Spain accounts for 8.9% in 2025, reaching 9.1% by 2035 aided by automotive manufacturing operations and component production capabilities. The Netherlands maintains 4.2% in 2025, up to 4.3% by 2035 due to automotive logistics expertise and component distribution networks. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 9.5% in 2025 and 9.6% by 2035, reflecting steady progress in automotive manufacturing development, electric vehicle adoption, and component supplier expansion.

The beryllium copper for automobile market is characterized by competition among established specialty alloy manufacturers, diversified materials companies, and regional metal processors. Companies are investing in alloy development programs, processing capability enhancement, product portfolio expansion, and technical service capabilities to deliver consistent, high-performance, and application-specific beryllium copper solutions. Innovation in alloy compositions, thermomechanical processing, and surface treatment technologies is central to strengthening market position and competitive advantage.

Materion leads the market with comprehensive beryllium copper solutions with a focus on automotive-grade alloys, technical support capabilities, and global supply capabilities across diverse connector, switch, and sensor applications. NGK Metals provides specialized beryllium copper strip and wire products with emphasis on precision processing, consistent material properties, and automotive qualification support. Kazatomprom delivers beryllium-containing materials with focus on raw material supply and alloy production. Aviva Metals offers beryllium copper products with emphasis on material distribution and processing services. IBC Advanced Alloys provides specialized beryllium materials with focus on engineered solutions and custom specifications.

Belmont Metals specializes in non-ferrous alloy supply including beryllium copper materials for industrial markets. Ampco Metal produces copper-based alloys including beryllium copper for automotive and industrial applications. Minmetals Beryllium focuses on beryllium production and beryllium copper alloy manufacturing for Asian markets. CNMNC emphasizes non-ferrous metal processing and supply. CXJNM provides specialty metal materials including beryllium copper products. Emeishan Zhongshan specializes in beryllium copper production for Chinese markets. ZHUHAI DAHUA offers beryllium copper materials and processing services. Wonder copper provides copper alloy products including beryllium copper grades. Advanced Refractory Metals (ARM) delivers specialty metal materials including beryllium copper for technical applications.

Beryllium copper for automobile represents a specialized materials segment within automotive electrical systems and component manufacturing, projected to grow from USD 378.8 million in 2025 to USD 577.1 million by 2035 at a 4.3% CAGR. These high-performance copper alloys serve as critical materials in electrical connectors, switch contacts, and sensor housings where exceptional electrical conductivity, superior spring properties, and reliable mechanical performance are essential. Market expansion is driven by increasing electric vehicle production, growing automotive electronics content, expanding advanced driver assistance system deployment, and rising implementation of high-voltage electrical architectures across diverse passenger vehicle, commercial vehicle, and automotive component applications.

How Industry Regulators Could Strengthen Material Standards and Safety Requirements?

How Industry Associations Could Advance Technical Standards and Application Knowledge?

How Beryllium Copper Manufacturers Could Drive Material Innovation and Market Leadership?

How Automotive Manufacturers Could Optimize Material Utilization and Component Performance?

How Research Institutions Could Enable Technology Advancement?

How Component Manufacturers Could Support Market Development and Customer Success?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 378.8 million |

| Product Form | Rod & Bar, Plate & Strip, Wire, Billet, Others |

| Application | Commercial Vehicles, Passenger Vehicles |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Materion, NGK Metals, Kazatomprom, Aviva Metals, IBC Advanced Alloys |

| Additional Attributes | Dollar sales by product form and application category, regional demand trends, competitive landscape, technological advancements in alloy processing, automotive qualification standards, material property optimization, and application integration strategies |

The global beryllium copper for automobile market is estimated to be valued at USD 378.8 million in 2025.

The market size for the beryllium copper for automobile market is projected to reach USD 577.1 million by 2035.

The beryllium copper for automobile market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in beryllium copper for automobile market are rod & bar, plate & strip, wire, billet and others.

In terms of application, passenger vehicles segment to command 67.8% share in the beryllium copper for automobile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beryllium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Aluminum Alloy Market Growth - Trends & Forecast 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA