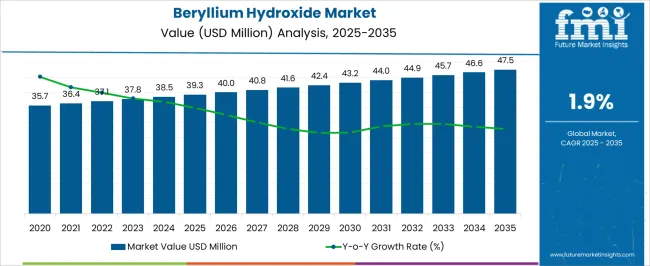

The Beryllium Hydroxide Market is estimated to be valued at USD 39.3 million in 2025 and is projected to reach USD 47.5 million by 2035, registering a compound annual growth rate (CAGR) of 1.9% over the forecast period.

| Metric | Value |

|---|---|

| Beryllium Hydroxide Market Estimated Value in (2025 E) | USD 39.3 million |

| Beryllium Hydroxide Market Forecast Value in (2035 F) | USD 47.5 million |

| Forecast CAGR (2025 to 2035) | 1.9% |

The beryllium hydroxide market is experiencing steady growth, supported by the material’s critical role as an intermediate in the production of beryllium-based alloys and ceramics. Rising demand across industries such as aerospace, defense, electronics, and energy is reinforcing the importance of beryllium hydroxide as a strategic material. Its unique properties, including high stiffness-to-weight ratio, thermal stability, and superior conductivity, are driving applications in advanced technologies that require lightweight yet durable components.

Increasing investments in aerospace and defense modernization programs, coupled with the expansion of high-performance electronics manufacturing, are contributing to long-term demand growth. Additionally, regulatory frameworks emphasizing the use of high-performance materials in energy-efficient and safety-critical applications are strengthening adoption.

Research advancements are enabling higher-purity production processes, ensuring reliable supply for industries with stringent performance requirements As global industries continue to prioritize lightweight materials with superior mechanical and thermal properties, the market for beryllium hydroxide is expected to witness sustained expansion, with manufacturers focusing on capacity scaling and supply chain resilience to address growing end-use demand.

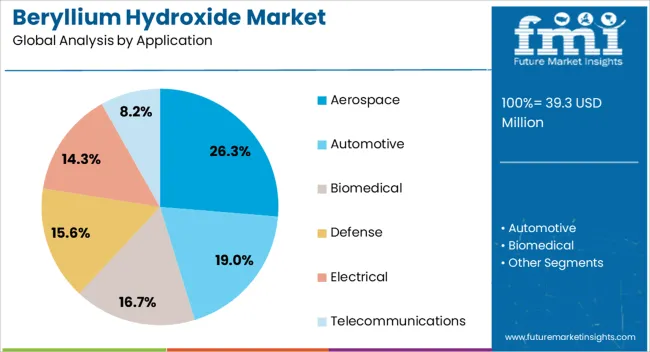

The beryllium hydroxide market is segmented by application, and geographic regions. By application, beryllium hydroxide market is divided into Aerospace, Automotive, Biomedical, Defense, Electrical, and Telecommunications. Regionally, the beryllium hydroxide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aerospace application segment is anticipated to account for 26.3% of the beryllium hydroxide market revenue share in 2025, making it the leading application segment. Its leadership is being driven by the rising use of beryllium-based materials in components that demand high strength, lightweight characteristics, and resistance to extreme temperatures. Beryllium hydroxide, as a precursor material, is essential in the production of beryllium alloys used for structural, electronic, and thermal management components in aerospace systems.

Growing investments in next-generation aircraft, satellites, and defense systems are reinforcing demand for high-performance materials that enhance fuel efficiency, durability, and operational reliability. The aerospace sector is prioritizing materials that meet strict safety and performance regulations, and beryllium derivatives are uniquely positioned to satisfy these requirements.

The increasing integration of advanced avionics and electronic systems, which require superior thermal conductivity and dimensional stability, is further accelerating adoption With continued expansion of global aerospace production and rising defense budgets, the aerospace segment is expected to maintain its position as the dominant end-use application for beryllium hydroxide.

As the global chemicals market transitions into a period of recovery, companies are focusing on identifying and seizing new opportunities. The global beryllium hydroxide market is growing as a result of factors such as the rising demand for beryllium oxide in various sectors, particularly in the nuclear, aerospace, telecommunications, and information technology industries. The rise in beryllium oxide and beryllium metal demand from various end-use industries is responsible for the expansion of the beryllium hydroxide market. While beryllium metal has many uses, including in the aerospace, defence, and automotive sectors, beryllium oxide is utilized as a precursor in the production of optical fibres.

Since it is lighter and may replace heavier parts, beryllium hydroxide is frequently used by manufacturers in the production of aeronautical parts. Additionally, it plays a big role in the production of several parts for fuel-efficient and passenger automobiles. Due to its great electrical insulation and strong thermal conductivity, beryllium is quickly gaining ground in the production of connections used in computers and cell phones. Along with this, the burgeoning downsizing trend in electronics and the explosive growth in consumer electronics sales as a result of rising consumer disposable incomes, better lifestyles, and quick urbanization is accelerating the product demand.

Beryllium is a delicate, light, silver-grey metal that is both robust and frail chemically. Of all the light metals, beryllium has the highest melting point. It has good thermal and electrical conductivities, is nonmagnetic, and can withstand attacks from strong nitric acid. Due to its low atomic number, it is highly permeable to X-rays. Four grades of high-purity beryllium foil, with purity levels ranging from 98.5% to 99.8%, are offered by certain significant companies for use in x-ray applications.

By focusing on digitalizing operations and adjusting to new technologies in robotic automation and artificial intelligence, market participants in the beryllium hydroxide market are aligning their operating model to the new standard. For instance, in March 2025, California-based Radian Audio and Materion Corp., a top manufacturer of beryllium and its hydroxide, announced their collaboration to create superior acoustic beryllium diaphragms for use in high-end loudspeakers for the audiophile market. For more than 20 years, Materion has made beryllium speaker domes, cones, and diaphragms, providing high-end speaker manufacturers all around the world.

In comparison to factory original or other aftermarket diaphragms, international manufacturers are developing diaphragms that offer great efficiency and quality of sound with extended bandwidth. All diaphragms provide exceptional value, repeatability, and dependability. Genuine Acoustic Beryllium is used to create the diaphragm domes, which are then fused to pure aluminium edge wound voice coils using a former that employs special bonding techniques. This Acoustic Beryllium has the lowest total moving mass of any commercially available dome material, which considerably improves responsiveness while maintaining rigidity across a broad frequency range. It is also the lightest and stiffest of any existing dome materials.

Beryllium hydroxide is an amphoteric compound with chemical formula Be(OH)2. An amphoteric chemical compound is so called, due to its nature of acting either as base or an acid during the chemical reaction. Amphoteric behavior is dependent upon the oxidation state of the oxide.

Beryllium hydroxide is vivid white, opaque crystals and slightly soluble in water; synonymously known as Beryllium dihydroxide.

Industrially, Beryllium hydroxide is obtained as a byproduct in the extraction of beryllium metal from the ores beryl and bertrandite. Beryl ores are usually imported whereas Bertrandite ore is obtained from mining activities. Beryllium Hydroxide thus produced is used in the processing of Beryllium-Metal alloys, Copper Beryllium master alloy and in ceramic processing to get Beryllium Oxide Ceramic shapes.

Beryllium hydroxide is used as an intermediate in the manufacture of beryllium and beryllium oxide. Its the universal raw material for the production of Beryllium and all other forms.

Beryllium is the fourth element on the periodic table and the 44th most abundant element in the earth’s crust. It occurs in rocks and minerals, although the most highly enriched beryllium deposits are found in granitic pegmatites. Around 50 beryllium-containing minerals have been identified.

Only ores containing Beryl (3BeO.Al2O3.6SiO2) and Bertrandite (4BeO.2SiO2.H2O) have achieved economic significance. Beryllium is the lightest of all solid chemically stable substances, and has an unusually high melting-point. It has a very low density and a very high strength-to-weight ratio. Beryllium is lighter than aluminium but is greater than 40% more rigid than steel.

It has excellent electrical and thermal conductivities. Its only markedly adverse feature is relatively pronounced brittleness, which restricts the use of metallic beryllium to specialized applications. Because of its low atomic number, beryllium is very permeable to X-rays.

Neutron emission after bombardment with α or γ rays is the most important of its nuclear physical properties, and beryllium can be used as a neutron source. Moreover, its low neutron absorptiveness and high-scattering cross-section make it a suitable moderator and reflector in structural materials in nuclear facilities; where most other metals absorb neutrons emitted during the fission of nuclear fuel.

Beryllium atoms reduce the energy of such neutrons and reflect them back into the fission zone.

Beryllium is primarily used in its metallic form, in alloys and in beryllium oxide ceramics. Its physical and mechanical properties make it useful for many applications across a range of industries. These properties include outstanding strength (when alloyed), electrical conductivity, high melting-point, low neutron absorption, high specific heat, excellent thermal properties, reflectivity and transparency to X-rays.

It finds its applications in industries ranging from aerospace (altimeters, braking systems, engines, and precision tools), automotive (air-bag sensors, anti-lock brake systems, steering wheel connecting springs), biomedical (dental crowns, medical laser components, X-ray tube windows), defense (heat shields, missile guidance systems, nuclear reactor components), energy and electrical (heat exchanger tubes, microwave devices, relays and switches) and telecommunications (mobile telephone components, electronic and electrical connectors, undersea repeater housings)

Beryllium annual consumption is expected to surpass 400 million tons per year driven by such applications such as the construction of the ITER fusion reactor. Rising automotive sales, growing telecommunications network, need for highly secure defense systems are few factors driving the growth of the beryllium hydroxide market.

Extraction techniques, mining regulations, production and associated costs are probable factors restraining the growth of the beryllium hydroxide market.

With growing population and rising urbanization the need for biomedical devices, electrical equipments are increasing. Consequently the beryllium hydroxide production will grow to meet the aforementioned requirements. US, Germany, Japan and China are the top countries meeting the global demand of beryllium hydroxide.

The global beryllium hydroxide market is expected to expand at a promising CAGR during the forecast period (2025-2025).

The global beryllium hydroxide market is expected to register a double-digit CAGR for the forecast period. Depending on geographic regions, global beryllium hydroxide market is segmented into seven key regions: North America, South America, Eastern Europe, Western Europe, Asia Pacific, Japan, and Middle East & Africa. As of 2025, North America dominated the global beryllium hydroxide market in terms of market revenue followed by Europe.

Asia Pacific & Japan are projected to expand at a substantial growth and will contribute to the global beryllium hydroxide market value exhibiting a robust CAGR during the forecast period, 2025?2025.

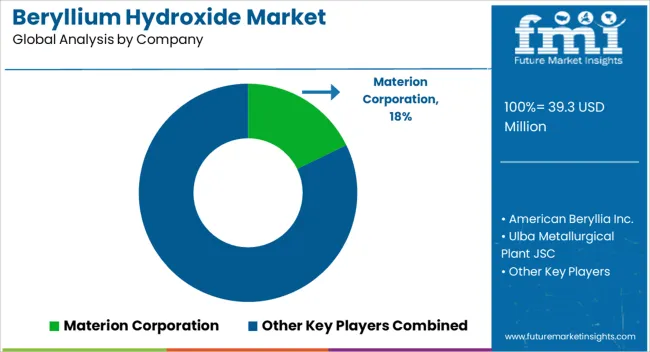

Some of the key market participants in global beryllium hydroxide market are Materion Corporation, Ulba Metallurgical Plant JSC, Hunan Non-Ferrous Metals Corp. Ltd, FHBI, NGK Metals Corporation, Starmet and Advanced Industries International.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

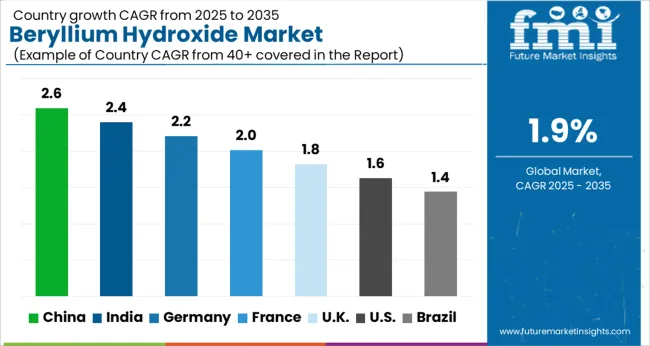

| Country | CAGR |

|---|---|

| China | 2.6% |

| India | 2.4% |

| Germany | 2.2% |

| France | 2.0% |

| UK | 1.8% |

| USA | 1.6% |

| Brazil | 1.4% |

The Beryllium Hydroxide Market is expected to register a CAGR of 1.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 2.6%, followed by India at 2.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 1.4%, yet still underscores a broadly positive trajectory for the global Beryllium Hydroxide Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 2.2%. The USA Beryllium Hydroxide Market is estimated to be valued at USD 13.4 million in 2025 and is anticipated to reach a valuation of USD 15.8 million by 2035. Sales are projected to rise at a CAGR of 1.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.8 million and USD 1.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.3 Million |

| Application | Aerospace, Automotive, Biomedical, Defense, Electrical, and Telecommunications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Materion Corporation, American Beryllia Inc., Ulba Metallurgical Plant JSC, NGK Metals Corporation, IBC Advanced Alloys Corp., Belmont Metals Inc., EaglePicher Technologies LLC, Stanford Advanced Materials, Shanghai Feixing Special Ceramics Factory, and Xinjiang Nonferrous Metal Industry Group |

The global beryllium hydroxide market is estimated to be valued at USD 39.3 million in 2025.

The market size for the beryllium hydroxide market is projected to reach USD 47.5 million by 2035.

The beryllium hydroxide market is expected to grow at a 1.9% CAGR between 2025 and 2035.

The key product types in beryllium hydroxide market are aerospace, automotive, biomedical, defense, electrical and telecommunications.

In terms of , segment to command 0.0% share in the beryllium hydroxide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beryllium Copper for Consumer Electronics Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Aluminum Alloy Market Growth - Trends & Forecast 2025 to 2035

Sodium Hydroxide Market Growth - Trends & Forecast 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Food Grade Sodium Hydroxide Market

Food-Grade Calcium Hydroxide Market Trends – Industry Insights 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA