The market for beryllium aluminum alloy is set to grow. The market will likely grow from USD 117.6 million in 2025 to USD 244.7 million by 2035, with a yearly growth rate of 7.6%. Improvements in how stuff is made, higher demand for light yet strong stuff, and more money from governments and companies for space and defense fuel this growth.

The beryllium aluminum alloy market is set to grow a lot between 2025 and 2035. This is thanks to its strong but light build, good heat transfer, and greater use in aerospace, defense, and electronics. The alloy mixes light aluminum with the stiffness and heat perks of beryllium. It's now often used in making satellite parts, optical tools, and top-notch defense gear.

Benefits of using beryllium aluminum alloy include light weight, high performance, and increasing demand in aerospace, defense, electronics, and automotive sectors are expected to propel the market growth. Ideally suited for applications where workpiece precision, thermal conductivity, and structural strength are critical, the alloys marry the lightweight nature of aluminum with the superb rigidity and thermal stability of beryllium.

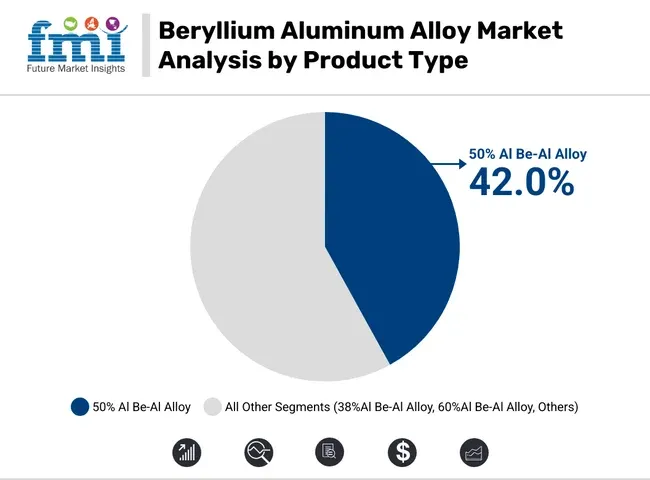

50% Al Be-Al Alloy Leads with Balanced Mechanical and Thermal Properties

50% Al Be-Al Alloy held the largest market share for alloys with an optimal combination of strength, thermal stability, and machinability. This formula composition is widely applied in optics, aerospace structures, and precision instruments in which distortion under stress is appreciable, and thermal conductivity is high.

The evolution of powder metallurgy and additive manufacturing methods is allowing for the production of 50% Al alloys with improved uniformity and performance, thus driving adoption in high-tech and defense sectors.

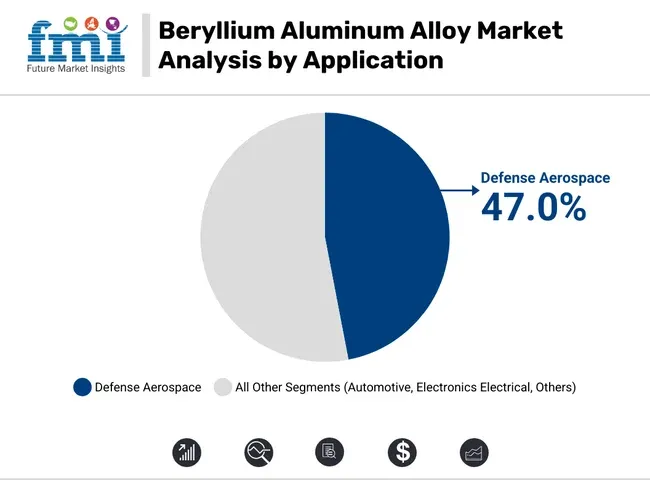

Defense Aerospace Applications Drive Market with Stringent Weight and Strength Requirements

Beryllium aluminum alloys are primarily used in defense and aerospace as their light but rigid structure enables robust use in missile guidance systems, satellites, space optics, and as structural components in multiplexed rear-engine aircraft. The alloy’s capability in high-stress, high-temperature, and low-gravity environments is vital to mission-critical aerospace and defense technologies.

This is complemented by global governments and space agencies investing significantly in next-gen aircraft and satellite networks, further driving the demand with high-performance alloys such as 50% Al Be-Al.

Supply Chain and Cost Constraints

Beryllium is a rare and heavily regulated element, and the process of extracting and processing it also has high costs and rigorous environmental controls. Such aspects have confined the scalability of alloy production and made it difficult to cater to an increasing demand across industries.

Expansion in Space and High-Tech Electronics

The growing number of satellite launches and money going into space ventures bring new chances for beryllium aluminum parts. Small high-tech devices, needing good heat management and strong structures, will likely increase the need for these metals too. New ways to mix and make the metal may cut down prices and lead to wider use in new fields.

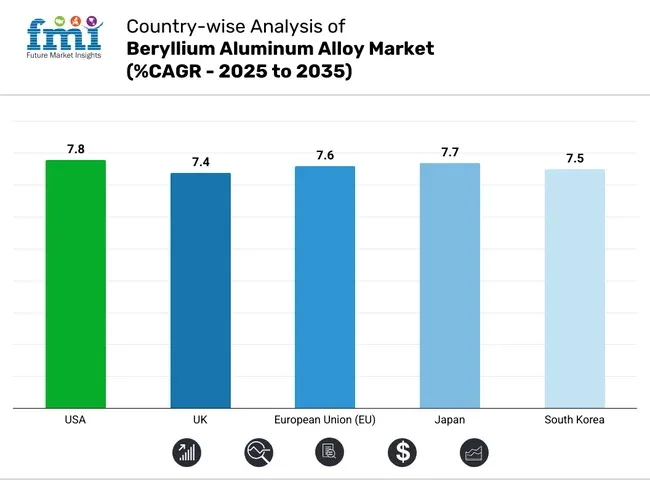

The USA market for beryllium aluminum alloy is growing. This is because it is used more in planes, defense gear, and electronics. The Defense Department and NASA are big users, liking this metal for its lightweight and high strength. It is also stable with temperature changes, making it perfect for precise parts. The OSHA and EPA make sure that handling this metal is safe and follows the rules.

Some main trends are more use in satellites, airplane parts, and gear to make semiconductors. There is also more money going into tech to handle rare and special metals.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

In the UK, the market for beryllium aluminum alloy is steadily growing. This growth is mainly due to its use in defense and industry. Groups like the Health and Safety Executive (HSE) and the Ministry of Defence (MOD) play a big part. They have rules and buying plans that shape the market.

Trends show more use of strong light alloys for military tech, satellite parts, and tools. Home research in new materials and eco-friendly alloy making is also picking up speed.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

The market for beryllium aluminum alloy in the EU is growing fast. This is because of its demand in planes, cars, and computer chips. The EU keeps it safe with help from the European Chemicals Agency and REACH rules. They make sure it is handled with care and is not harmful to the environment.

Germany and France are the top players in this market because of their strong manufacturing abilities. There are a few key trends in this market. One is that the alloy is being used more in cameras, defense electronics, and space projects. Another is that there are more joint projects between aerospace companies and alloy makers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.6% |

Japan’s market for beryllium aluminum alloy is getting bigger because of the precision machines, electronics, and airplane industries. Groups such as the Ministry of Economy, Trade, and Industry (METI), and Japan’s space group (JAXA) lead study and safe ways to use these materials.

Key trends show their use in light parts for planes, photonics, and making semiconductors. Japan's tech skills and precise engineering help push new ideas and market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

South Korea sees more need for beryllium aluminum alloys because of a jump in defense, car, and chip industries. The Ministry of Environment and the Korean Agency for Technology and Standards (KATS) keep an eye on how these rare metal alloys are used and handled.

Trends show these alloys being used more in fast electronics, strong military optics, and advanced tools. Local firms are putting money into plants to process alloys and working with global suppliers to stay ahead.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

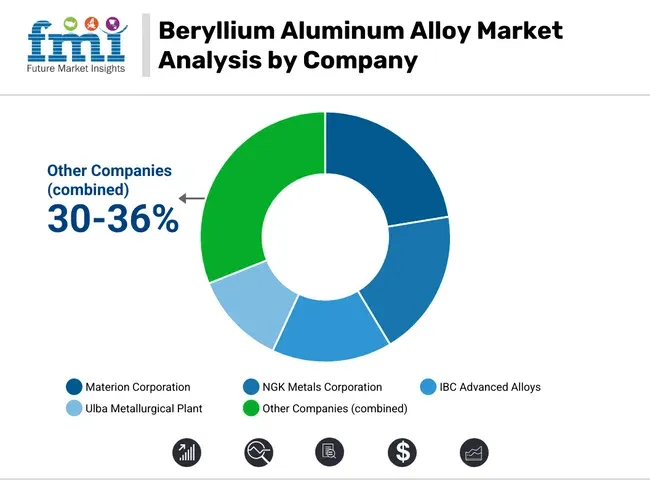

The beryllium aluminum alloy market sees steady growth because of high demand in aerospace, defense, electronics, and cars. This is due to the alloy’s good strength-to-weight ratio, heat conduction, corrosion resistance, and stable size. Key firms like Materion Corporation, NGK Metals Corporation, IBC Advanced Alloys, and Ulba Metallurgical Plant lead the market.

They use new alloy mixes, powder methods, and 3D printing methods. These firms make deals, grow their factories, and put money into research to supply for high-end uses, like satellites, missile systems, avionics, and electronics. Also, growing interest in green methods and recycling top-grade alloys makes firms use eco-friendly steps and low-carbon tech.

The market is quite limited, but new firms have chances to make precise parts and supply pure materials and custom alloys. This is especially true as demand rises in North America, Europe, and Asia-Pacific's defense and air industries.

Materion Corporation (22-26%)

Materion remains a dominant force with vertical integration from raw material sourcing to finished alloy production, focusing heavily on aerospace-grade products.

NGK Metals Corporation (18-22%)

NGK leverages its precision alloy development capabilities and strong ties in Asia to cater to the growing demand in the electronics and defense sectors.

IBC Advanced Alloys (14-18%)

IBC targets high-purity, high-precision alloy components for military applications and is a key innovator in beryllium-aluminum additive manufacturing.

Ulba Metallurgical Plant (10-14%)

Ulba's focus on cost-effective production and strategic export partnerships helps serve niche applications across Europe and Central Asia.

Other Key Players (30-36% Combined)

A number of smaller and regional players contribute to the global supply of beryllium aluminum alloys. These include:

The overall market size for the beryllium aluminum alloy market was approximately USD 117.6 Million in 2025.

The beryllium aluminum alloy market is projected to reach approximately USD 244.7 Million by 2035.

Increasing demand from the aerospace and defense sectors, growth in the automotive industry, and the alloy's superior mechanical properties, such as high strength-to-weight ratio and thermal stability, are expected to drive market growth.

The United States, China, Germany, Japan, and France are key contributors.

The aerospace and defense segment is expected to lead due to the alloy's critical role in manufacturing lightweight, high-strength components for aircraft and military applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Solar Aluminum Alloy Frame Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Consumer Electronics Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA