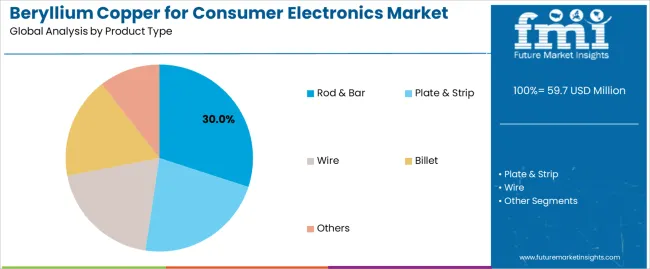

The beryllium copper for consumer electronics market grows from USD 59.7 million in 2025 to USD 60.9 million by 2035 at a CAGR of 0.2%, with segment structure defining most of the demand stability. The rod & bar segment leads with 30% share, anchored by its suitability for high-precision connectors, pins, spring contacts and micro-mechanical components across personal computers, handheld devices and compact electronic assemblies. Rod & bar formats offer consistent mechanical strength, conductivity and machinability, allowing manufacturers to shape micro-components required for high-density circuitry and repeated mechanical cycling. Plate & strip segments support lead frames, shielding elements and contact pads, while ultra-fine wire forms cater to miniature assemblies in wearables, audio devices and compact battery modules.

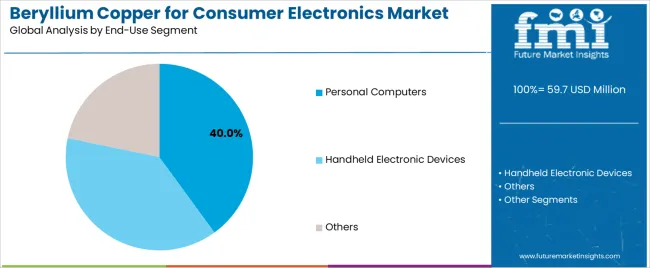

Personal computers dominate end-use segmentation at 40%, where thermal stability, fatigue strength and electrical reliability are critical in connectors, switches, and interface components. Increased heat loads, higher circuit density and shrinking form factors reinforce the use of beryllium copper in premium laptops, high-performance workstations and modular computing boards. Handheld electronics maintain stable demand as smartphones, tablets and wearables require spring contacts, charging-port components and microswitch elements capable of enduring thousands of insertion cycles without loss of conductivity. Segment-level behaviour is shaped by continued miniaturisation, tighter tolerances in signal-carrying components and the need for alloys that maintain strength under micro-scale deformation.

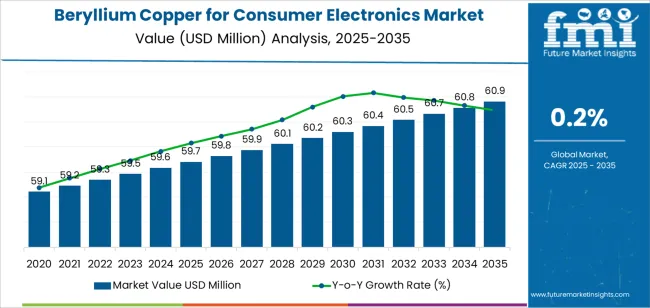

The CAGR of 0.20% for the beryllium copper for consumer electronics market indicates that while the market will continue to grow, it will do so at an extremely slow pace. The market will increase from USD 59.7 million in 2025 to USD 60.9 million by 2035, which represents a modest growth of USD 1.2 million over the 10-year forecast period. The slow growth rate reflects the mature nature of the market, as beryllium copper has been widely adopted in consumer electronics for years, particularly for high-performance electronic components such as connectors and batteries.

This growth rate of 0.20% suggests that the market is nearing maturity. As new material innovations and electronic advancements continue to develop, beryllium copper’s role in consumer electronics is unlikely to grow significantly, as it has already been integrated into a variety of applications. The market will likely see small incremental growth driven by the continual demand for reliable and durable components in consumer electronics and energy-efficient devices. However, the modest CAGR indicates that major market shifts or technological breakthroughs are not expected within the forecast period, and the overall market growth will remain slow and steady.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 59.7 million |

| Market Forecast Value (2035) | USD 60.9 million |

| Forecast CAGR (2025-2035) | 0.2% |

The beryllium copper for consumer electronics market is growing rapidly as device manufacturers seek materials that combine high electrical conductivity, mechanical resilience, and excellent fatigue resistance for compact, high performance components. In smartphones, tablets, wearables and other IoT devices, connectors, spring contacts and lead frame elements require materials that can maintain signal integrity while coping with repeated insertion cycles and miniaturised form factors. According to one analysis, the consumer electronics segment represented about 22 % of the market for beryllium copper plate consumables, reflecting its importance in miniaturised applications. The rise in mobile device adoption, 5G rollout and increasing demand for ultra thin electronics all contribute to the material’s relevance in the consumer sector.

Another key driver is the evolution of manufacturing technologies and design architectures that demand precision alloys capable of fine tuning performance attributes such as thermal stability, corrosion resistance and dimensional reliability. Beryllium copper excels in these respects, making it a preferred choice for high density module assemblies and compact connectors found in consumer electronics. Despite this growth opportunity, the market faces challenges including raw material cost volatility, strict health and safety regulation associated with beryllium handling and the emergence of alternative alloys that could substitute in certain lower spec applications. Nevertheless, as consumer electronic devices continue to become more sophisticated and performance driven, the demand for beryllium copper in this market segment is expected to remain strong.

The beryllium copper for consumer electronics market is segmented by product type and end-use. The leading product type is rod & bar, which holds 30% of the market share, while the dominant end-use segment is personal computers, accounting for 40% of the market. These segments play a crucial role in the market’s growth, driven by the increasing demand for high-performance, durable, and reliable materials in consumer electronics, particularly in components like connectors, switches, and heat sinks.

The rod & bar product type leads the beryllium copper for consumer electronics market, capturing 30% of the market share. Beryllium copper in rod and bar forms is commonly used in the consumer electronics industry due to its excellent combination of electrical conductivity, high strength, and resistance to corrosion. These characteristics make it ideal for producing components that require both conductivity and mechanical performance, such as connectors, pins, and other parts in consumer electronics.

Rod & bar products are particularly preferred for their versatility, as they can be easily processed and machined into various shapes and sizes to meet specific requirements in electronic devices. As the demand for high-quality, long-lasting components in personal computers, handheld devices, and other consumer electronics continues to rise, the rod & bar segment is expected to remain the leading product type in the beryllium copper market, supporting the growth of electronics manufacturing.

The personal computers end-use segment leads the beryllium copper for consumer electronics market, accounting for 40% of the market share. Beryllium copper is widely used in the production of high-performance components in personal computers, such as connectors, switches, heatsinks, and other electronic parts that require high thermal and electrical conductivity. The material's ability to provide both mechanical strength and superior electrical performance is crucial for ensuring the reliability and longevity of computer systems.

The demand for beryllium copper in personal computers is driven by the increasing need for advanced, efficient, and durable components as computer technology becomes more sophisticated. As consumer preferences shift toward faster, more powerful, and energy-efficient devices, the requirement for high-quality materials like beryllium copper in personal computing hardware continues to grow. This trend, along with the ongoing development of new computing technologies, ensures that the personal computers segment remains the largest end-use segment in the market for beryllium copper in consumer electronics.

The beryllium copper for consumer electronics market is influenced by the expanding demand for high-performance materials in electronic devices, where small form factors and high electrical conductivity are required. Consumer electronics account for a significant share of overall beryllium copper alloy usage, especially in connectors, switches, relays and micro-components. At the same time, challenges such as cost pressures, health-safety concerns with beryllium handling and competition from alternative alloys shape supplier strategies and regional uptake patterns.

What Are The Primary Growth Drivers For the Beryllium Copper for Consumer Electronics Market?

Several key drivers support growth in this market. First, miniaturisation in consumer devices such as smartphones, tablets, laptops and wearables demands materials that combine excellent conductivity and mechanical durability, and beryllium copper alloys meet both needs. Second, the surge in connectivity and electronic features, such as more ports, faster charging, and higher data rates, increases the number of connectors and contact components in each device, thereby raising volumetric usage of premium alloys. Third, the shift of manufacturing to regions such as Asia-Pacific and the rise of local consumer-electronics OEMs expand volumes and material demand in those geographies. Finally, regulatory and performance requirements, such as regarding signal integrity, wear resistance and current-carrying capacity, favour alloy upgrades from standard copper towards higher-performance beryllium copper.

What Are The Key Restraints In the Beryllium Copper for Consumer Electronics Market?

Despite favourable underlying trends, the market faces several restraints. The cost of beryllium copper alloys is higher than standard copper alloys due to raw-material and processing complexity, which may limit adoption in cost-sensitive consumer-electronics segments. Supplier handling and health-safety regulation of beryllium impose additional compliance and manufacturing costs, which can slow scale-up. Alternative materials and alloys that provide acceptable performance at lower cost can act as substitution threats, particularly in mature device lines where incremental improvements are less visible. Also, severe price competition in consumer-electronics supply chains may limit material premium that OEMs are willing to pay and thus reduce the incremental demand for premium alloy grades.

What Are The Emerging Trends In the Beryllium Copper for Consumer Electronics Market?

Emerging trends include the development of ultra-fine beryllium copper wire, micro-connector and spring-contact components adapted to next-generation devices with higher port densities and smaller footprints. Another trend is the increased focus on sustainability and recyclability of electronics materials; manufacturers are looking for alloy solutions with higher lifecycle value and lower environmental footprint even in premium components. There is also a regional shift toward production and consumption in Asia-Pacific, where both consumer-electronics manufacturing and material supply chains are expanding rapidly. Finally, collaboration between material suppliers, connector makers and device OEMs to co-optimize material properties, finishings and contact reliability is becoming more common, helping drive adoption of beryllium copper in next-generation consumer electronics.

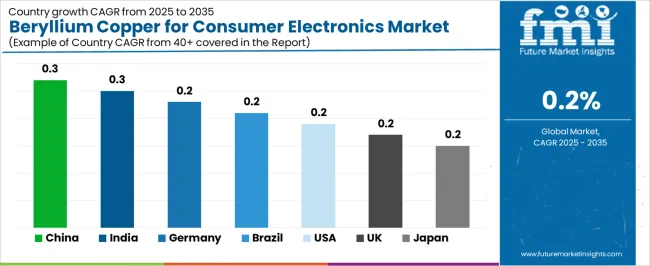

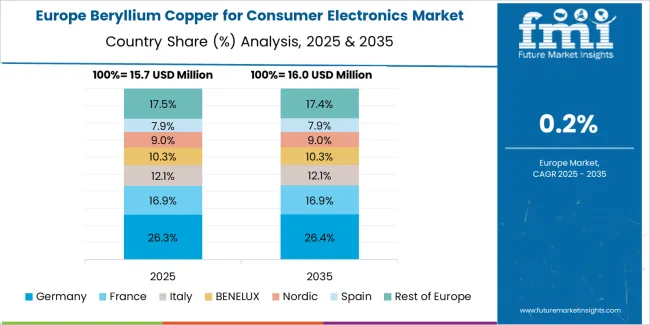

The beryllium copper for consumer electronics market is seeing moderate growth due to the increasing demand for high-performance materials used in the manufacturing of electronic components. Beryllium copper alloys are known for their excellent electrical conductivity, strength, and corrosion resistance, making them ideal for use in connectors, switches, relays, and other electronic parts. As consumer electronics continue to evolve with the rise of mobile devices, wearables, and advanced technologies, the demand for durable and reliable materials like beryllium copper is increasing. While emerging markets like China and India are seeing steady growth due to expanding electronics manufacturing industries, developed economies such as the USA and Germany are also experiencing growth driven by technological advancements and demand for high-performance electronics. This analysis explores the factors driving the growth of the beryllium copper for consumer electronics market across different countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 0.27% |

| India | 0.25% |

| Germany | 0.23% |

| Brazil | 0.21% |

| USA | 0.19% |

| United Kingdom | 0.17% |

| Japan | 0.15% |

China leads the beryllium copper for consumer electronics market with a growth rate of 0.27%. The country’s dominance in electronics manufacturing, particularly in consumer devices such as smartphones, laptops, and home appliances, is a major driver for the demand for beryllium copper. Beryllium copper’s excellent conductivity, durability, and resistance to corrosion make it an essential material in connectors, switches, and other electronic components.

China’s robust manufacturing infrastructure, combined with its focus on becoming a global leader in technology and innovation, is driving growth in the consumer electronics sector. With China producing a significant portion of the world’s consumer electronics, the demand for high-performance materials like beryllium copper is expected to remain strong. Additionally, the ongoing advancements in mobile technology and the increasing adoption of IoT devices further support the growth of the market in China.

India’s beryllium copper for consumer electronics market is growing at a rate of 0.25%. India is rapidly emerging as a major hub for electronics manufacturing, driven by the government's push to promote the “Make in India” initiative, which aims to boost domestic manufacturing and attract foreign investment. The demand for high-quality materials like beryllium copper is increasing as India expands its production of smartphones, wearables, and other consumer electronics.

India’s increasing focus on digitalization, urbanization, and the growing middle class, which is driving consumer demand for electronics, is contributing to the market growth. As the electronics manufacturing sector in India continues to evolve, the demand for reliable and efficient materials such as beryllium copper will continue to rise. The country’s growth in the electronics sector, along with government initiatives, is expected to further fuel market demand.

Germany’s beryllium copper for consumer electronics market is projected to grow at a CAGR of 0.23%. Germany is one of Europe’s largest markets for consumer electronics, with high demand for advanced technological products, including automotive electronics, industrial devices, and consumer electronics like smartphones and wearable devices. The country’s strong engineering and industrial base, combined with its focus on high-quality, durable materials, supports the need for beryllium copper in electronic components.

Germany’s commitment to innovation and technological advancement in sectors like automotive and manufacturing, where high-performance electronic components are essential, continues to drive the demand for beryllium copper. As consumer electronics become increasingly integrated into daily life, the need for materials with high conductivity, durability, and corrosion resistance will continue to grow in Germany’s electronics manufacturing industry.

Brazil’s beryllium copper for consumer electronics market is expected to grow at a rate of 0.21%. While Brazil’s consumer electronics market is smaller compared to other regions, it is showing steady growth due to the increasing demand for smartphones, home appliances, and other electronic devices. As Brazil’s middle class continues to expand, there is rising demand for electronic products that require reliable and high-performance components.

Brazil’s growing manufacturing sector, combined with investments in local production and technological innovation, is contributing to the market’s expansion. As the country continues to focus on improving its infrastructure and adopting advanced technologies, the demand for high-performance materials like beryllium copper will increase, supporting steady growth in the consumer electronics sector.

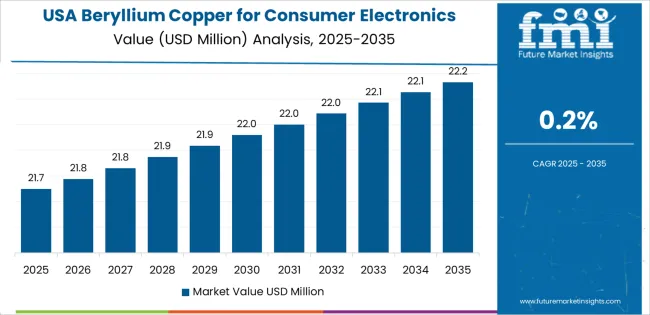

The United States has a projected CAGR of 0.19% for the beryllium copper for consumer electronics market. The USA remains one of the largest markets for consumer electronics, driven by demand for products like smartphones, laptops, wearables, and home entertainment systems. Beryllium copper plays a key role in providing durable and reliable materials for connectors and other electronic components, which are essential for the performance and longevity of these devices.

As the USA continues to lead in technological innovation, particularly in sectors like mobile technology, automotive electronics, and the IoT market, the demand for high-performance materials will continue to grow. The ongoing advancements in wireless communication, along with the increasing use of smart devices, will ensure that the market for beryllium copper in consumer electronics remains steady in the USA.

The United Kingdom’s beryllium copper for consumer electronics market is projected to grow at a CAGR of 0.17%. The UK is seeing steady demand for consumer electronics, driven by the increasing use of smartphones, home appliances, and wearable devices. As the UK continues to embrace digitalization and technological advancements, the need for high-performance materials such as beryllium copper for electronic components will remain strong.

The UK’s focus on innovation and digital technologies, along with its robust consumer electronics sector, will continue to drive market demand for reliable and efficient materials like beryllium copper. Additionally, the rising adoption of IoT devices and connected technologies will further fuel the demand for durable and high-conductivity components, supporting growth in the market.

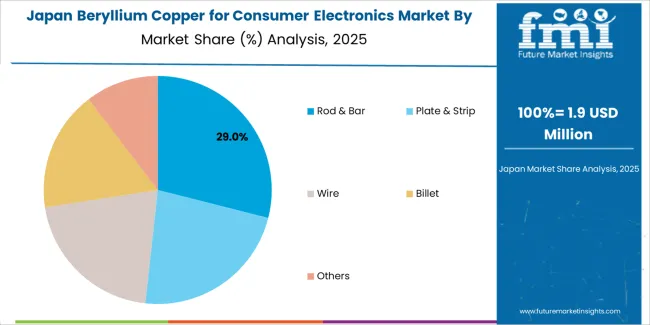

Japan’s beryllium copper for consumer electronics market is expected to grow at a rate of 0.15%. Japan has long been a leader in consumer electronics, with strong demand for products such as smartphones, gaming consoles, and home electronics. The country’s focus on high-quality manufacturing and technological advancements supports the ongoing demand for durable, high-performance materials in electronic components.

As Japan continues to lead in sectors like robotics, automation, and consumer electronics, the need for reliable materials such as beryllium copper remains essential. Although the market is growing at a slower pace compared to emerging markets, Japan’s strong technological foundation and continued investments in the electronics sector will ensure the steady use of beryllium copper in consumer electronics.

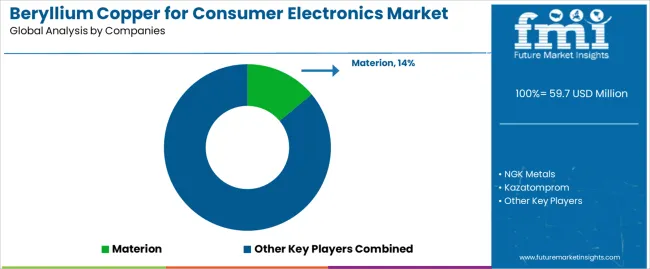

In the beryllium copper market for consumer electronics, companies such as Materion (holding around 14% share), NGK Metals, Kazatomprom, Aviva Metals, IBC Advanced Alloys, Belmont Metals, Ampco Metal, Minmetals Beryllium, CNMNC, XJNM, Emeishan Zhongshan, Zhuhai Dahua, Wonder Copper, and Advanced Refractory Metals (ARM) are actively engaged. The consumer electronics segment is a significant application area for beryllium copper alloys thanks to their high electrical conductivity, mechanical strength, and reliability. The consumer electronics and telecommunications sectors account for nearly half of all beryllium copper alloy consumption.

These companies pursue competing strategies focused on alloy performance, cost management, and customer application alignment. Some prioritize the development of enhanced alloy grades tailored for miniaturized connectors, switches, and contacts in mobile devices, wearables, and compact electronic modules. The alloy formulations emphasize high fatigue strength, strong spring behavior, and consistent conductivity under small, intricate geometries. Others emphasize supply chain reliability, regional production scale, especially in Asia Pacific where consumer electronics manufacturing is concentrated, and efficient alloy processing to meet high volumes. Brochure content for these materials typically highlights properties such as tensile strength, conductivity percentage, fatigue cycle life, rod/wire/stRIP availability, and compatibility with high density printed circuit board assemblies. By aligning their product portfolio and messaging with the trend toward smaller, faster, and more reliable electronics, these firms aim to capture leadership in the beryllium copper for consumer electronics market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Product Type | Rod & Bar, Plate & Strip, Wire, Billet, Others |

| End-Use Segment | Personal Computers, Handheld Electronic Devices, Others |

| Key Companies Profiled | Materion, NGK Metals, Kazatomprom, Aviva Metals, IBC Advanced Alloys, Belmont Metals, Ampco Metal, Minmetals Beryllium, CNMNC, XJNM, Emeishan Zhongshan, ZHUHAI DAHUA, Wonder Copper, Advanced Refractory Metals (ARM) |

| Additional Attributes | The market analysis includes dollar sales by product type and end-use segment categories. It also covers regional adoption trends across major markets. The competitive landscape highlights key manufacturers in the beryllium copper for consumer electronics market, with innovations in rod, bar, plate, wire, and billet forms. Trends in the growing demand for beryllium copper in personal computers, handheld devices, and other electronics applications are explored, along with advancements in material properties and manufacturing techniques for the consumer electronics industry. |

The global beryllium copper for consumer electronics market is estimated to be valued at USD 59.7 million in 2025.

The market size for the beryllium copper for consumer electronics market is projected to reach USD 60.9 million by 2035.

The beryllium copper for consumer electronics market is expected to grow at a 0.2% CAGR between 2025 and 2035.

The key product types in beryllium copper for consumer electronics market are rod & bar, plate & strip, wire, billet and others.

In terms of end‑use segment, personal computers segment to command 40.0% share in the beryllium copper for consumer electronics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beryllium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Aluminum Alloy Market Growth - Trends & Forecast 2025 to 2035

Beryllium Copper Plate Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper Billet Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Automobile Market Size and Share Forecast Outlook 2025 to 2035

Beryllium Copper for Industrial Equipment Market Size and Share Forecast Outlook 2025 to 2035

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA