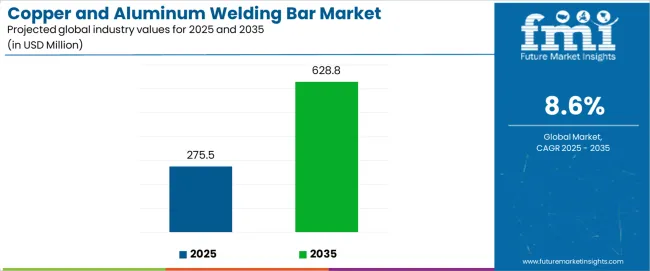

The global copper and aluminum welding bar market is projected to grow from USD 275.5 million in 2025 to USD 628.8 million in 2035, reflecting a CAGR of 8.6%. Demand and supply dynamics define the growth path, shaped by industrial consumption trends, raw material availability, and manufacturing capacity adjustments over the forecast horizon.

On the demand side, welding bars made from copper and aluminum are increasingly required in automotive, electrical, aerospace, and construction applications. The electrification of vehicles is one of the strongest demand drivers, as copper and aluminum are essential for busbars, battery connectors, and lightweight structural components. Automotive manufacturers favor these bars for joining dissimilar metals, ensuring both conductivity and mechanical stability. Electrical infrastructure expansion is another critical demand factor, with high-voltage transmission systems, renewable integration, and grid modernization relying on welding bars for safe and efficient joints. Aerospace and defense sectors add specialized demand for high-strength, corrosion-resistant welding bars. Construction applications, including HVAC, plumbing, and modular building systems, sustain baseline demand, making the sector diverse in its consumption profile.

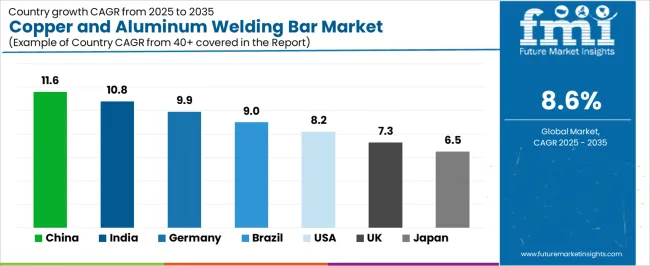

Demand patterns are also influenced by regional growth. Asia Pacific accounts for the largest share due to high vehicle production and large-scale construction projects. Europe shows stable demand anchored in renewable energy and advanced manufacturing, while North America reflects steady uptake in aerospace, automotive electrification, and power grid upgrades. Latin America and Africa remain emerging demand regions, where infrastructure development and mining equipment fabrication drive incremental growth.

On the supply side, raw material availability plays a decisive role. Copper prices are highly sensitive to global mining output, particularly in Chile, Peru, and Africa, while aluminum supply is linked to energy-intensive smelting operations concentrated in China and the Middle East. Volatility in metal prices directly affects manufacturing costs, influencing profitability for welding bar producers. Supply chains are also shaped by processing technologies, where extrusion and casting capabilities determine production quality and output levels. Producers investing in advanced metallurgy and alloying techniques gain competitive advantage by offering bars with superior performance in conductivity and durability.

Trade flows impact supply availability. Import and export restrictions on copper and aluminum, combined with tariff structures, create regional imbalances. Manufacturers located near mining and smelting hubs enjoy lower input costs, while others rely on global sourcing. Recycling of copper and aluminum provides an additional supply channel, supporting cost stability and reducing dependency on primary mining output. However, fluctuations in scrap availability limit its ability to fully offset supply risks.

Copper and Aluminum Welding Bar Market Year-over-Year Forecast (2025-2035)

Between 2025 and 2030, the copper and aluminum welding bar market is projected to expand from USD 275.5 million to USD 416.2 million, resulting in a value increase of USD 140.7 million, which represents 39.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for battery assembly solutions in electric vehicle production, product innovation in friction stir welding technologies and ultrasonic bonding systems, as well as expanding integration with automated manufacturing processes and quality control systems. Companies are establishing competitive positions through investment in advanced metallurgical research, precision manufacturing capabilities, and strategic partnerships with battery manufacturers and automotive OEMs.

From 2030 to 2035, the copper and aluminum welding bar market is forecast to grow from USD 416.2 million to USD 628.8 million, adding another USD 212.6 million, which constitutes 60.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized joining technologies, including advanced composite welding bars with enhanced conductivity and durability properties tailored for next-generation battery architectures, strategic collaborations between material suppliers and energy storage system manufacturers, and an enhanced focus on reducing interface resistance and improving thermal management performance. The growing emphasis on battery energy density optimization and manufacturing cost reduction will drive demand for advanced, high-performance copper and aluminum welding bar solutions across diverse battery production applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 275.5 million |

| Market Forecast Value (2035) | USD 628.8 million |

| Forecast CAGR (2025-2035) | 8.6% |

The copper and aluminum welding bar market grows by enabling battery manufacturers to achieve superior electrical conductivity and mechanical strength in dissimilar metal joints while meeting stringent quality requirements for electric vehicle and energy storage applications. Battery producers face mounting pressure to improve production efficiency and connection reliability, with copper-aluminum welding solutions typically providing 30-40% reduction in joint resistance compared to conventional bonding methods, making these specialized welding bars essential for next-generation battery pack assembly. The electric vehicle industry's need for lightweight, high-conductivity connections creates demand for advanced welding technologies that can join copper terminals to aluminum bus bars without compromising electrical performance or structural integrity across diverse operating conditions.

Government initiatives promoting electric vehicle adoption and renewable energy storage accelerate welding bar demand in battery manufacturing, automotive assembly, and energy storage system production, where connection quality has a direct impact on battery performance and safety ratings. The global shift toward electrification and clean energy infrastructure drives copper and aluminum welding bar adoption as manufacturers seek reliable joining solutions that enable mass production of battery systems with consistent quality standards. However, technical challenges in preventing intermetallic compound formation and higher capital investment requirements for specialized welding equipment may limit adoption rates among smaller battery manufacturers and regions with underdeveloped battery production infrastructure.

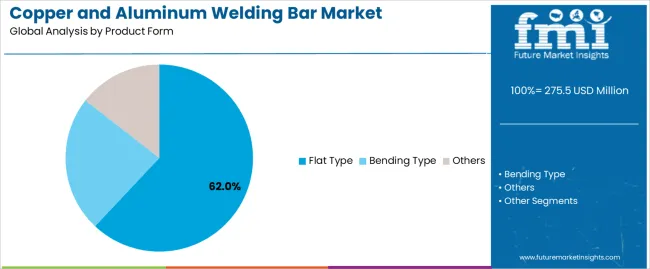

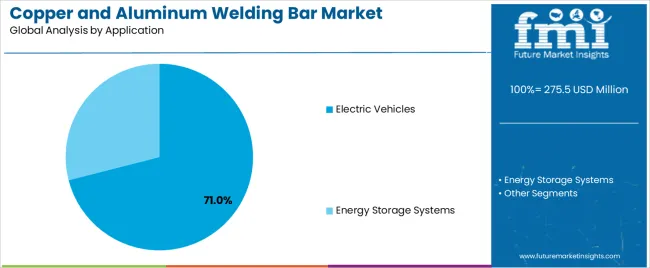

The copper and aluminum welding bar market is segmented by product form, application, and region. By product form, the copper and aluminum welding bar market is divided into flat type, bending type, and others. Based on application, the copper and aluminum welding bar market is categorized into electric vehicles and energy storage systems. Regionally, the copper and aluminum welding bar market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

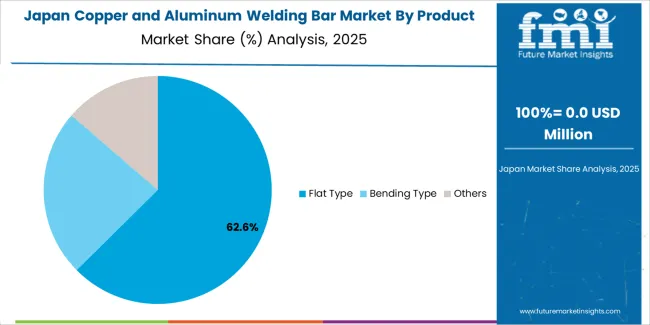

The flat type segment represents the dominant force in the copper and aluminum welding bar market, capturing approximately 62.0% of total market share in 2025. This advanced category delivers comprehensive joining solutions with enhanced surface contact area, uniform current distribution properties, and compatibility with automated welding systems deployed across high-volume battery manufacturing facilities. The flat type segment's market leadership stems from its exceptional performance in battery pack assembly applications, where consistent joint quality and minimal resistance are critical for electric vehicle range optimization and energy storage efficiency.

The bending type segment maintains a substantial 31.0% market share, serving manufacturers who require flexible joining solutions for complex battery geometries and three-dimensional bus bar configurations in compact battery pack designs. The others segment accounts for 7.0% market share, featuring specialized configurations including customized profiles and composite welding bars engineered for specific application requirements.

Key advantages driving the flat type segment include:

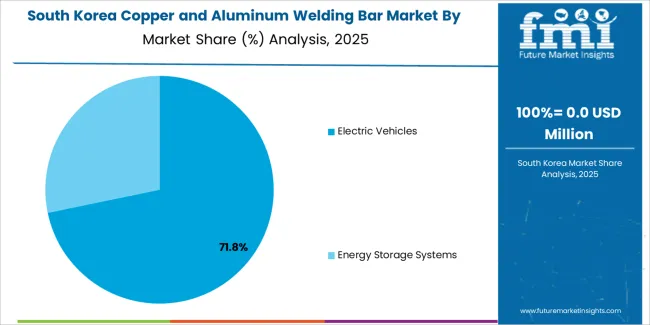

Electric vehicles dominate the copper and aluminum welding bar market with approximately 71.0% market share in 2025, reflecting the critical role of reliable copper-aluminum connections in battery pack assembly and power distribution systems across passenger vehicles, commercial vehicles, and two-wheelers. The electric vehicles segment's market leadership is reinforced by exponential growth in global EV production, stringent safety requirements for battery connections, and automotive manufacturers' emphasis on lightweight, high-conductivity joining solutions that maximize vehicle range and performance.

The energy storage systems segment represents 29.0% market share through specialized applications including grid-scale battery installations, residential energy storage units, and industrial backup power systems. This segment benefits from increasing renewable energy integration, growing demand for energy independence, and supportive government policies promoting distributed energy storage deployment in residential and commercial applications.

Key market dynamics supporting application preferences include:

The copper and aluminum welding bar market is driven by three concrete demand factors tied to electrification and performance outcomes. First, explosive electric vehicle growth creates unprecedented requirements for battery pack assembly solutions, with global EV production expected to exceed 30 million units annually by 2030, requiring reliable copper-aluminum joining technologies for battery terminal connections and bus bar integration. Second, energy density optimization drives manufacturers toward lightweight aluminum bus bar architectures connected to copper terminals, with copper-aluminum welding bars enabling 20-30% weight reduction compared to all-copper solutions while maintaining electrical performance standards. Third, manufacturing automation advancement through Industry 4.0 integration accelerates adoption of standardized welding bar products compatible with robotic welding systems and real-time quality monitoring platforms deployed across battery gigafactories.

Market restraints include technical challenges in managing intermetallic compound formation at copper-aluminum interfaces, where improper welding parameters can create brittle phases that compromise joint reliability and long-term electrical performance in demanding automotive environments. Higher initial capital investment requirements for ultrasonic welding equipment and friction stir welding systems pose adoption barriers for smaller battery manufacturers operating with limited budgets, particularly in emerging markets where battery production is expanding but financial resources remain constrained. Quality control complexity requiring sophisticated testing protocols, including destructive testing for interface characterization and non-destructive evaluation for production validation, creates additional operational challenges as manufacturers transition from traditional bonding methods.

Key trends indicate accelerated adoption in Asia Pacific battery manufacturing hubs, particularly China and South Korea, where government-backed electric vehicle programs and battery gigafactory investments create massive demand for reliable welding technologies. Technology advancement trends toward ultrasonic welding systems with real-time process monitoring, advanced surface preparation techniques that improve bond strength, and composite welding bars featuring intermediate layers that mitigate intermetallic formation are enabling next-generation product development. However, the copper and aluminum welding bar market thesis could face disruption if solid-state battery technologies eliminate the need for traditional copper-aluminum connections or if alternative joining methods, such as laser welding or adhesive bonding, achieve cost and performance parity with mechanical welding approaches.

The copper and aluminum welding bar market in Europe is projected to grow from USD 52.4 million in 2025 to USD 119.5 million by 2035, registering a CAGR of 8.6% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced battery manufacturing infrastructure and major automotive production centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia regions.

France follows with a 19.3% share in 2025, projected to reach 19.8% by 2035, driven by comprehensive electric vehicle production expansion programs and battery gigafactory development initiatives. The United Kingdom holds a 16.2% share in 2025, expected to reach 16.5% by 2035 through automotive electrification transition and battery manufacturing investments. Italy commands a 12.8% share in both 2025 and 2035, backed by energy storage system production and electric vehicle component manufacturing. Spain accounts for 9.4% in 2025, rising to 9.6% by 2035 on renewable energy storage expansion. The Netherlands maintains 5.1% in 2025, reaching 5.3% by 2035 on advanced manufacturing technology adoption. The Rest of Europe region is anticipated to hold 8.7% in 2025, expanding to 9.2% by 2035, attributed to increasing battery manufacturing capacity in Nordic countries and emerging Eastern European automotive production facilities.

The Japanese copper and aluminum welding bar market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of precision welding systems with existing battery manufacturing infrastructure across automotive production facilities, energy storage installations, and advanced research institutions. Japan's emphasis on quality excellence and technical validation drives demand for high-performance welding bars that support stringent automotive standards and consumer expectations for reliability in premium electric vehicle applications.

The copper and aluminum welding bar market benefits from strong partnerships between international welding technology providers and domestic manufacturing equipment specialists including major automotive suppliers, creating comprehensive service ecosystems that prioritize process consistency and technical support programs. Manufacturing centers in Aichi, Kanagawa, Osaka, and other major production areas showcase advanced welding implementations where joining processes achieve 99.9% quality rates through automated monitoring systems and comprehensive validation protocols.

The South Korean copper and aluminum welding bar market is characterized by strong international technology provider presence, with companies maintaining significant positions through comprehensive technical services and quality assurance capabilities for battery manufacturing and electric vehicle production applications. The copper and aluminum welding bar market demonstrates increasing emphasis on high-performance battery systems and export-quality electric vehicles, as Korean manufacturers increasingly demand advanced welding technologies that integrate with domestic battery production infrastructure and sophisticated automation systems deployed across major manufacturing complexes.

Regional welding equipment manufacturers are gaining market share through strategic partnerships with international technology suppliers, offering specialized services including Korean automotive certification support and application-specific process development programs for high-volume battery production operations. The competitive landscape shows increasing collaboration between multinational welding technology companies and Korean manufacturing specialists, creating hybrid service models that combine international materials science expertise with local automotive industry knowledge and automation capabilities.

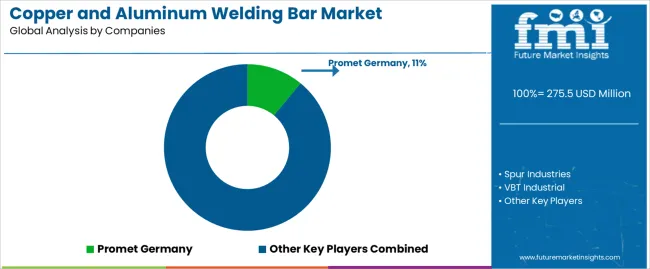

The copper and aluminum welding bar market features approximately 20-25 meaningful players with moderate to high fragmentation, where the top three companies control roughly 28-32% of global market share through established technology leadership and strong relationships with major battery manufacturers and automotive OEMs. Competition centers on product quality consistency, metallurgical performance validation, and technical support capabilities rather than price competition alone. Promet Germany leads with approximately 11.0% market share through its comprehensive welding technology portfolio and strong European automotive presence.

Market leaders include Promet Germany, Spur Industries, and VBT Industrial, which maintain competitive advantages through advanced metallurgical research capabilities, validated process documentation for automotive applications, and deep expertise in dissimilar metal joining technologies, creating performance and reliability advantages with battery manufacturers and electric vehicle producers. These companies leverage research and development capabilities in interface engineering optimization and ongoing technical support relationships with gigafactory operators to defend market positions while expanding into emerging battery technologies and next-generation electric vehicle platforms.

Challengers encompass QS Advanced Materials and Zibo Infini Composite Materials, which compete through specialized welding bar formulations and strong regional presence in key battery manufacturing markets. Product specialists, including Dongguan Well-linking Industrial, Suzhou Nano-Mei Precision Machinery, and Zhejiang RHI Electric, focus on specific product configurations or application segments, offering differentiated capabilities in custom profile development, surface treatment technologies, and application-specific performance optimization.

Copper and aluminum welding bars represent advanced joining solutions that enable battery manufacturers to achieve 30-40% reduction in interface resistance compared to conventional bonding methods, delivering superior electrical conductivity and mechanical reliability with enhanced current distribution and minimal weight penalty in demanding electric vehicle and energy storage applications. With the copper and aluminum welding bar market projected to grow from USD 275.5 million in 2025 to USD 628.8 million by 2035 at an 8.6% CAGR, these specialized welding technologies offer compelling advantages - production efficiency, performance optimization, and quality consistency - making them essential for electric vehicles production (71.0% market share), energy storage systems (29.0% share), and battery manufacturing operations seeking reliable copper-aluminum connections that enable mass production of high-performance battery systems.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 275.5 million |

| Product Form | Flat Type, Bending Type, Others |

| Application | Electric Vehicles, Energy Storage Systems |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Promet Germany, Spur Industries, VBT Industrial, QS Advanced Materials, Zibo Infini Composite Materials, Dongguan Well-linking Industrial, Suzhou Nano-Mei Precision Machinery, Zhejiang RHI Electric, Shenglan Technology, Bekoll Technology |

| Additional Attributes | Dollar sales by product form and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with welding technology providers and manufacturing equipment suppliers, quality validation requirements and performance specifications, integration with battery manufacturing processes and automotive production systems, innovations in metallurgical technology and process control systems, and development of specialized welding solutions with enhanced conductivity and durability capabilities. |

The global copper and aluminum welding bar market is estimated to be valued at USD 275.5 million in 2025.

The market size for the copper and aluminum welding bar market is projected to reach USD 628.8 million by 2035.

The copper and aluminum welding bar market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in copper and aluminum welding bar market are flat type, bending type and others.

In terms of application, electric vehicles segment to command 71.0% share in the copper and aluminum welding bar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Coated Film Market Insights & Industry Trends 2024-2034

Copper Azoles Market

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA