The Copper Tube Market is estimated to be valued at USD 37.7 billion in 2025 and is projected to reach USD 53.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. This growth reflects a multiplier of 1.41x, supported by a steady CAGR of 3.5%, driven by increasing demand from industries such as construction, HVAC systems, and electrical infrastructure. In the first five-year phase (2025–2030), the market is expected to expand from USD 37.7 billion to USD 46.4 billion, adding USD 8.7 billion, which accounts for 56.1% of the total incremental growth, as demand for copper tubes increases with urbanization and infrastructure development.

The second phase (2030–2035) contributes USD 6.8 billion, representing 43.9% of incremental growth, reflecting sustained momentum due to increased adoption in renewable energy systems, automotive applications, and specialized industrial processes. Annual increments will increase from USD 1.7 billion in the early years to USD 2.0 billion by 2035, reflecting a shift towards more energy-efficient applications and green construction standards.

Manufacturers focusing on high-strength, corrosion-resistant copper tubes and expanding supply chain capabilities will capture the largest share of this USD 15.5 billion opportunity, particularly in emerging markets such as Asia-Pacific and Latin America.

| Metric | Value |

|---|---|

| Copper Tube Market Estimated Value in (2025 E) | USD 37.7 billion |

| Copper Tube Market Forecast Value in (2035 F) | USD 53.2 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The copper tube market is experiencing sustained growth, supported by increasing demand from construction, HVAC, and industrial sectors for efficient thermal and fluid conductivity solutions. Shifts toward energy-efficient infrastructure, clean water systems, and green buildings have reinforced copper’s position as a preferred material for plumbing and refrigeration applications.

Regulatory standards related to recyclable materials and antimicrobial piping have also accelerated substitution from plastic and steel to copper in critical applications. Investments in advanced manufacturing technologies and alloy development have improved tube performance under high-pressure and corrosive environments.

Looking ahead, urbanization, retrofitting projects, and industrial automation are expected to drive the adoption of copper tubes, particularly in sectors requiring durability, longevity, and high heat-transfer efficiency.

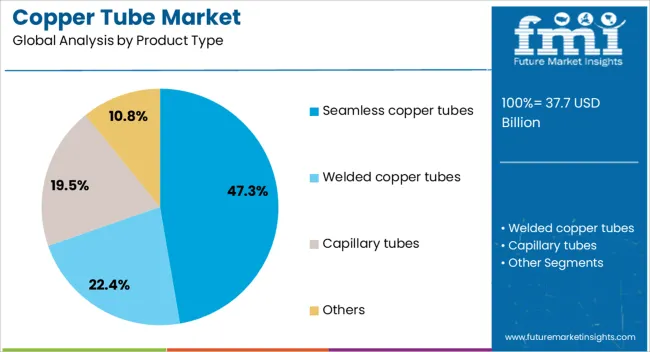

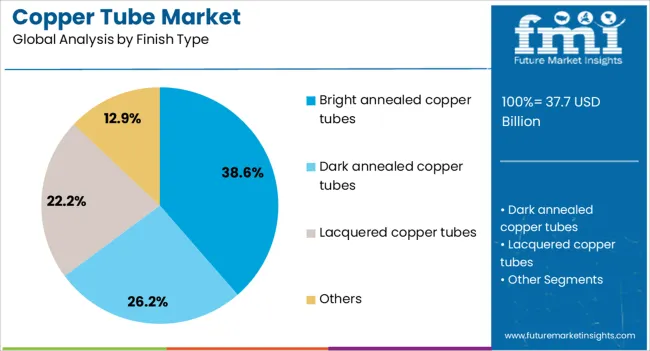

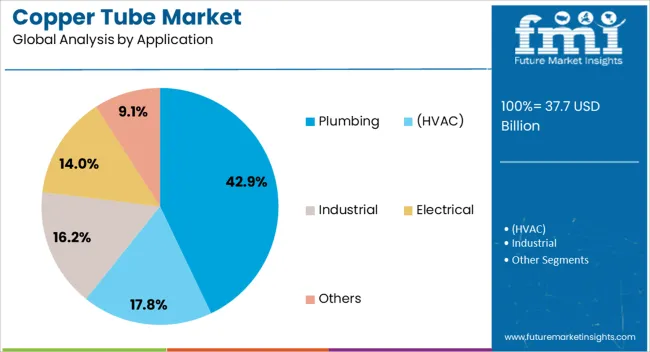

The copper tube market is segmented by product type, finish type, application, and geographic regions. By product type, the copper tube market is divided into Seamless copper tubes, Welded copper tubes, Capillary tubes, and Others. The copper tube market is classified by finish type into Bright annealed copper tubes, Dark annealed copper tubes, Lacquered copper tubes, and Others. Based on application of the copper tube market is segmented into Plumbing, (HVAC), Industrial, Electrical, and Others. Regionally, the copper tube industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Seamless copper tubes are projected to account for 47.30% of the total revenue in the copper tube market in 2025, making them the leading product type. This dominance is being driven by the superior mechanical strength, pressure resistance, and leak-proof performance associated with seamless construction.

These characteristics are particularly valued in HVAC, medical gas, and critical plumbing applications where reliability is non-negotiable. Seamless tubes also enable precise bending and shaping without compromising structural integrity, allowing for easier installation in compact or concealed spaces.

Their compatibility with brazing and high-temperature operations further enhances their suitability across diverse end-use environments. As demand increases for long-lasting and low-maintenance piping systems, seamless copper tubes remain the material of choice for both industrial and residential deployments.

Bright annealed copper tubes are anticipated to hold 38.60% of the market share by 2025, ranking as the top finish type in the copper tube market. Their rise in prominence is being attributed to the enhanced surface quality, corrosion resistance, and aesthetic appeal achieved through controlled atmospheric annealing.

These tubes are widely favored in applications where both appearance and performance are critical, such as exposed piping, HVAC coils, and medical systems. The bright annealing process ensures uniform metallurgical properties, which improve ductility and workability during fabrication and installation.

Their high cleanliness level and minimal oxidation also support sterilization standards, making them suitable for pharmaceutical and food-grade use. As product life-cycle performance and visual quality gain more importance in engineering and architectural applications, bright annealed copper tubes continue to attract increasing preference.

Plumbing is expected to represent 42.90% of the total market revenue in 2025, establishing it as the leading application segment for copper tubes. This dominance is being reinforced by copper’s proven record in delivering safe, durable, and corrosion-resistant piping solutions for residential and commercial water systems.

The inherent antimicrobial properties of copper support improved water quality and hygiene, a growing concern in densely populated and aging urban infrastructure. Its fire-resistant and pressure-tolerant nature also makes it suitable for high-rise and industrial plumbing systems.

Adoption is further supported by national plumbing codes and green building certifications that prioritize sustainable, recyclable materials. As smart city initiatives and real estate investments continue to expand across emerging and developed regions, plumbing remains a cornerstone use case driving copper tube demand.

The copper tube market is growing steadily, driven by the increasing demand in construction, automotive, and HVAC applications. In 2024 and 2025, growth drivers include the expanding construction sector, particularly in emerging economies, and the shift toward energy-efficient systems. Opportunities are arising in the refrigeration and air conditioning industries. Emerging trends involve the use of copper in renewable energy applications. However, market restraints such as fluctuating copper prices and competition from alternative materials may hinder growth.

The major growth drivers for the copper tube market include expanding demand in construction and HVAC systems. In 2024, rapid urbanization and industrialization in emerging economies led to increased demand for copper tubes in plumbing and air conditioning systems. Additionally, the adoption of energy-efficient HVAC systems boosted the demand for copper tubes due to their excellent heat transfer properties. As building and infrastructure projects expand, copper tube use for plumbing, heating, and cooling systems is expected to rise.

Opportunities in the copper tube market lie in the refrigeration and air conditioning industries. In 2025, the need for energy-efficient refrigeration solutions, driven by rising global temperatures and the growing food preservation industry, created a demand for copper tubes. Additionally, copper's excellent thermal conductivity made it an ideal choice for air conditioning systems, further driving demand. The shift toward eco-friendly refrigerants and energy-efficient designs presents an opportunity for copper tube manufacturers to develop specialized products for these growing sectors.

Emerging trends in the copper tube market include increasing use in renewable energy applications. In 2024, copper tubes found growing applications in solar and geothermal energy systems. These systems utilize copper's excellent heat-conducting properties to optimize energy efficiency. As renewable energy adoption accelerates globally, the demand for copper tubes in these applications is expected to grow. This trend, along with rising awareness of the benefits of copper in energy-efficient systems, is likely to drive the market in the coming years.

The key market restraints for copper tubes include fluctuating copper prices and competition from alternative materials. In 2024 and 2025, volatile copper prices posed challenges for manufacturers, making cost management difficult, particularly in regions dependent on imported copper. Additionally, the increasing use of alternative materials, such as plastic and aluminum, in HVAC and plumbing systems has created competition for copper tubes. These barriers must be overcome by manufacturers to maintain competitiveness and market growth.

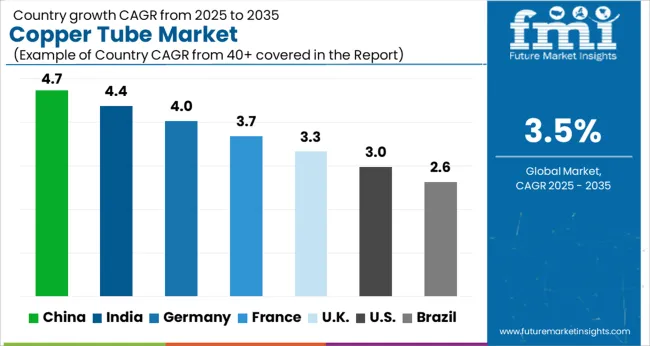

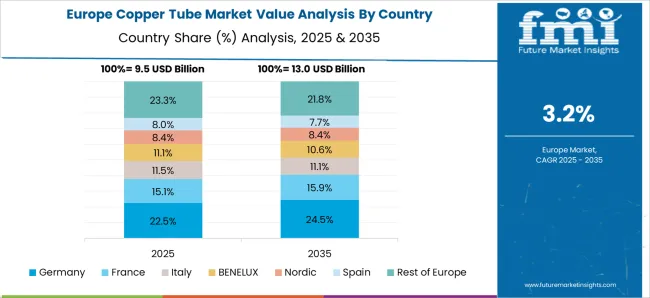

The global copper tube market is projected to grow at 3.5% CAGR from 2025 to 2035. China leads with 4.7% CAGR, driven by strong demand in the construction, automotive, and HVAC industries. India follows at 4.4%, supported by the country’s expanding industrial base and rising demand for copper tubes in plumbing, refrigeration, and air conditioning systems. Germany records 4.0% CAGR, reflecting strong demand in the construction, electrical, and renewable energy sectors. The United Kingdom grows at 3.3%, while the United States posts 3.0%, reflecting steady demand in mature markets with a focus on advanced applications in construction and industrial systems. Asia-Pacific leads the market growth, while Europe and North America focus on innovation and sustainability in copper tube applications.

The copper tube market in China is forecasted to grow at 4.7% CAGR, driven by the rapid expansion of construction, automotive, and HVAC industries. China’s booming construction sector, along with increasing demand for copper tubes in refrigeration and air conditioning systems, accelerates market growth. Additionally, the growing demand for copper tubes in electrical and renewable energy sectors strengthens the adoption of copper tubes for industrial applications.

The copper tube market in India is projected to grow at 4.4% CAGR, supported by rising demand for copper tubes in plumbing, refrigeration, and air conditioning systems. India’s expanding construction sector and the growing use of copper tubes in industrial applications drive market growth. The country’s focus on expanding HVAC and refrigeration technologies, along with increased urbanization, further accelerates the adoption of copper tubes.

The copper tube market in Germany is expected to grow at 4.0% CAGR, driven by the increasing demand for copper tubes in the construction, electrical, and renewable energy sectors. Germany’s strong focus on sustainability and energy-efficient systems in construction and industrial applications further accelerates market growth. The growing adoption of copper tubes for heat exchangers, solar energy applications, and electrical wiring also boosts demand in the market.

The copper tube market in the United Kingdom is projected to grow at 3.3% CAGR, supported by steady demand in the construction, plumbing, and HVAC industries. The increasing adoption of copper tubes in renewable energy systems and HVAC systems for energy-efficient buildings drives market growth. Additionally, government regulations and incentives for sustainable construction further accelerate the use of copper tubes in residential and commercial projects.

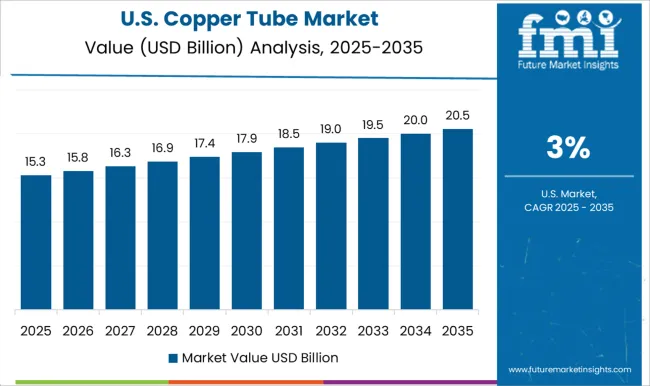

The copper tube market in the United States is projected to grow at 3.0% CAGR, driven by steady demand for copper tubes in construction, automotive, and HVAC applications. The rising focus on energy efficiency, coupled with advancements in industrial applications, strengthens the market for copper tubes. Additionally, the increasing adoption of copper tubes in plumbing, refrigeration, and electrical systems contributes to the market growth.

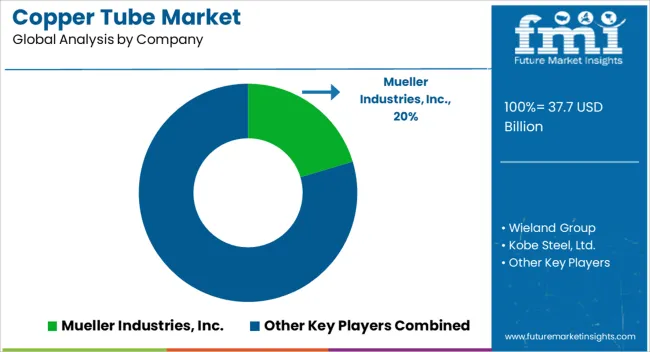

The copper tube market is dominated by Mueller Industries, Inc., which leads with a comprehensive portfolio of copper tube products used in various applications such as HVAC systems, plumbing, and industrial processes. Mueller Industries’ dominance is supported by its strong manufacturing capabilities, extensive distribution network, and consistent product quality.

Key players such as Wieland Group, Kobe Steel, Ltd., and KME (KME Group) maintain significant market shares by providing high-performance copper tubes designed for superior corrosion resistance, thermal conductivity, and durability. These companies focus on delivering versatile, high-quality copper tube solutions for commercial, industrial, and residential markets, driving demand in sectors such as construction, automotive, and renewable energy.

Emerging players like Cerro Flow Products, LLC are expanding their market presence by offering cost-effective copper tube solutions with specialized coatings and features aimed at enhancing efficiency in refrigeration and plumbing applications. Their strategies include improving production processes, increasing product range, and targeting regional markets with tailored offerings. Market growth is driven by rising demand for energy-efficient systems, increased construction activity, and the ongoing need for reliable infrastructure materials. Innovations in copper alloy formulations, enhanced recycling processes, and the development of eco-friendly applications are expected to further shape competitive dynamics and drive growth in the global copper tube market.

Companies are investing in the innovation of copper tube manufacturing processes, including the development of extrusion and drawing technologies to improve tube production efficiency. Advanced technologies allow for the production of tubes with more precise dimensions, better surface finish, and enhanced strength properties to meet the growing demand from industrial and commercial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.7 Billion |

| Product Type | Seamless copper tubes, Welded copper tubes, Capillary tubes, and Others |

| Finish Type | Bright annealed copper tubes, Dark annealed copper tubes, Lacquered copper tubes, and Others |

| Application | Plumbing, (HVAC), Industrial, Electrical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mueller Industries, Inc., Wieland Group, Kobe Steel, Ltd., KME (KME Group), and Cerro Flow Products, LLC |

| Additional Attributes | Dollar sales by tube type and application, demand dynamics across HVAC, construction, and automotive sectors, regional trends in copper tube consumption, innovation in corrosion-resistant and eco-friendly coatings, impact of regulatory standards on material safety, and emerging use cases in renewable energy and electric vehicle systems. |

The global copper tube market is estimated to be valued at USD 37.7 billion in 2025.

The market size for the copper tube market is projected to reach USD 53.2 billion by 2035.

The copper tube market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in copper tube market are seamless copper tubes, welded copper tubes, capillary tubes and others.

In terms of finish type, bright annealed copper tubes segment to command 38.6% share in the copper tube market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper(II) Carbonate Basic Market Size and Share Forecast Outlook 2025 to 2035

Copper Chrome Black Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Terminal Blocks Market Size and Share Forecast Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA