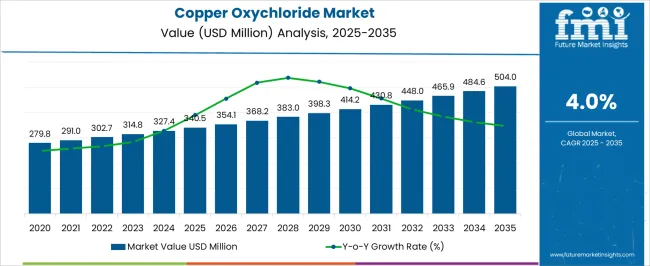

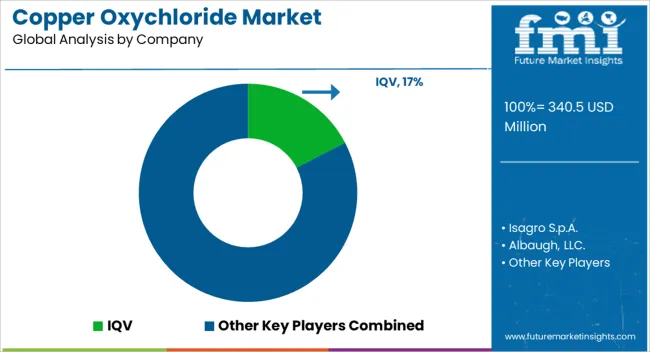

The copper oxychloride market is estimated to be valued at USD 340.5 million in 2025 and is projected to reach USD 504.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

The market expansion is being driven by rising demand in crop protection, fungicide applications, and agricultural productivity enhancement. Steady growth is observed as manufacturers focus on producing high-purity formulations and optimizing particle size to improve dispersion and efficacy. Over the decade, the market is being influenced by regional crop cultivation patterns, increasing adoption of protective chemicals, and regulatory compliance, which are shaping the trajectory of copper oxychloride consumption across major agricultural regions. Over the forecast period, the copper oxychloride market is being propelled by the consistent need for effective disease management solutions in cereals, vegetables, and fruit crops.

Application methods are being refined to maximize coverage, minimize residue, and enhance operational efficiency for farmers. Manufacturers are prioritizing supply chain enhancements, quality control measures, and distribution networks to meet growing regional demand. In opinion, the market is being positioned as an essential component for crop protection strategies, with growth supported by evolving agricultural practices, government recommendations, and targeted product formulations. Continuous adoption is being reinforced by the perceived value in improving crop yield and disease resistance, which sustains the market momentum.

| Metric | Value |

|---|---|

| Copper Oxychloride Market Estimated Value in (2025 E) | USD 340.5 million |

| Copper Oxychloride Market Forecast Value in (2035 F) | USD 504.0 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The copper oxychloride market has established a prominent position across its parent industries, driven by its effectiveness in controlling fungal diseases in crops and its role in improving agricultural yield. Within the agricultural chemicals market, copper oxychloride accounts for approximately 15–18% share, reflecting its widespread adoption in diverse crop protection applications. In the fungicides market, its contribution reaches about 25–28%, as it is a preferred agent for controlling blights, mildews, and leaf spots, particularly in fruit, vegetable, and cereal crops. Within the crop protection chemicals market, the segment holds around 12–15%, highlighting its use as a key component in integrated pest management strategies and conventional chemical treatments. In the broader pesticides market, copper oxychloride represents roughly 10–12% share, demonstrating its consistent demand for effective disease management in both large-scale and smallholder farming systems.

Within the specialty chemicals market, it accounts for approximately 8–10% share, as its chemical properties support formulation in combination products and enhance the stability and efficacy of crop protection solutions. While some observers may argue that regulatory restrictions and the emergence of alternative fungicides could limit growth, the market continues to be reinforced by its proven performance, ease of application, and acceptance across multiple agricultural regions. In my view, copper oxychloride remains a vital pillar in crop protection, shaping practices in both conventional and strategic disease management frameworks while sustaining its relevance in the agricultural chemical landscape.

The copper oxychloride market is progressing steadily, supported by its established role in agriculture as a highly effective protective fungicide. Industry bulletins and trade updates have noted growing adoption in crop protection programs, particularly for fruits, vegetables, and plantation crops susceptible to fungal infections.

Regulatory approvals in multiple agricultural regions and its acceptance in integrated pest management strategies have strengthened its demand profile. The product’s broad-spectrum activity, cost-effectiveness, and compatibility with other agrochemicals have further reinforced market expansion.

Additionally, shifts toward sustainable farming practices and the need to maintain high crop yields under changing climatic conditions are prompting greater reliance on preventive fungicide applications. Market growth is also being aided by innovations in formulation technology aimed at improving adherence, reducing application rates, and minimizing environmental impact. With agriculture sector modernization and heightened awareness of crop disease management, copper oxychloride’s position in the fungicide category is expected to remain strong.

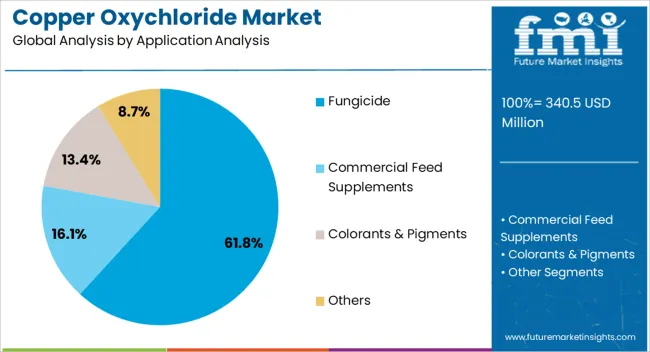

The copper oxychloride market is segmented by application analysis, and geographic regions. By application analysis, copper oxychloride market is divided into fungicide, commercial feed supplements, colorants & pigments, and others. Regionally, the copper oxychloride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fungicide segment is projected to account for 61.8% of the copper oxychloride market revenue in 2025, maintaining its position as the primary application area. This leadership is supported by copper oxychloride’s proven efficacy in controlling a wide range of fungal diseases across diverse crop categories. Its preventive mode of action and residual activity make it a preferred choice among farmers for long-term disease suppression. The product’s stability under varying environmental conditions ensures consistent performance, which is crucial for protecting high-value crops. Agricultural extension services and crop protection advisories have continued to recommend copper oxychloride as part of rotational and combination spray schedules to manage resistance development in fungal pathogens. Furthermore, its inclusion in organic farming systems in certain regions has broadened its market reach. As global agriculture faces mounting pressure to safeguard yields against disease outbreaks, the fungicide application segment for copper oxychloride is expected to sustain its dominant share through reliable field performance and widespread grower acceptance.

The copper oxychloride market is expanding due to increasing demand for effective crop protection and rising adoption in organic and export-oriented agriculture. Opportunities are strong in premium crop segments, while trends emphasize formulation innovations and improved application techniques. Regulatory restrictions, environmental concerns, and raw material fluctuations present ongoing challenges. Overall, the market outlook remains positive as farmers and agribusinesses seek reliable, efficient, and compliant solutions to enhance productivity and protect crops against diseases worldwide.

The copper oxychloride market is witnessing rising demand as global agriculture increasingly prioritizes crop protection and yield optimization. Copper oxychloride is widely used as a fungicide to control bacterial and fungal diseases in fruits, vegetables, and cereals. With growing concerns over plant health and food security, farmers are adopting proven chemical treatments to ensure consistent productivity. The product’s effectiveness, affordability, and compatibility with integrated pest management programs make it a preferred choice in both conventional and organic farming systems, driving steady growth in agricultural regions worldwide.

Significant opportunities exist as copper oxychloride is approved for use in several organic farming systems, allowing farmers to access premium markets. Regions focused on high-value export crops are increasingly adopting fungicides to meet stringent phytosanitary standards. Innovative formulations, such as wettable powders and water-dispersible granules, enhance ease of application and efficacy. Companies offering crop-specific solutions, advisory support, and localized distribution can tap into these growth areas. Expanding awareness of sustainable farming practices in emerging economies further supports the adoption of copper oxychloride as a reliable plant protection agent.

A key trend in the market is the development of improved copper oxychloride formulations with enhanced solubility, reduced phytotoxicity, and better rainfastness. Advanced application techniques, including foliar sprays, drip irrigation integration, and automated dosing, are being increasingly adopted to optimize effectiveness and reduce chemical use. Integration with digital agriculture platforms for precise application monitoring is also emerging. These trends demonstrate the market’s focus on improving user convenience, crop safety, and environmental compliance while maintaining the core efficacy of copper oxychloride in protecting diverse crops across multiple geographies.

The copper oxychloride market faces challenges from regulatory limitations in certain regions due to heavy metal accumulation concerns. Stringent environmental regulations and residue limits on crops may restrict usage or require careful adherence to dosage guidelines. Additionally, fluctuations in raw material availability and costs can impact production and supply stability. Manufacturers must invest in research to develop safer, low-residue formulations and support farmers with proper usage guidelines. Balancing regulatory compliance with market demand remains a key challenge for the long-term growth and acceptance of copper oxychloride-based products.

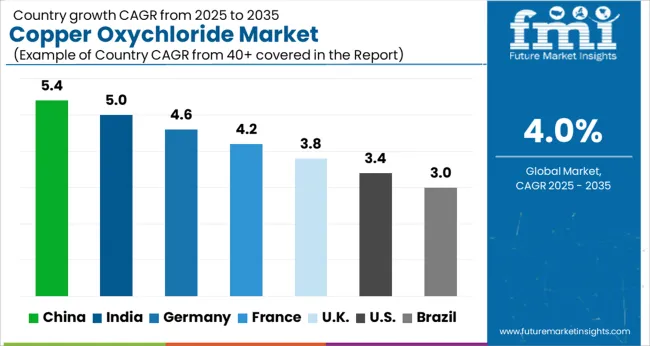

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

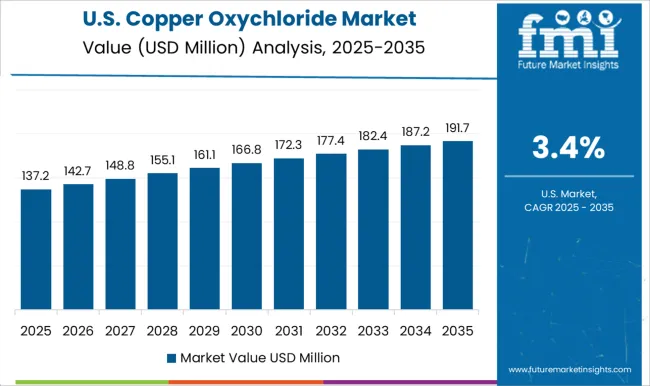

| USA | 3.4% |

| Brazil | 3.0% |

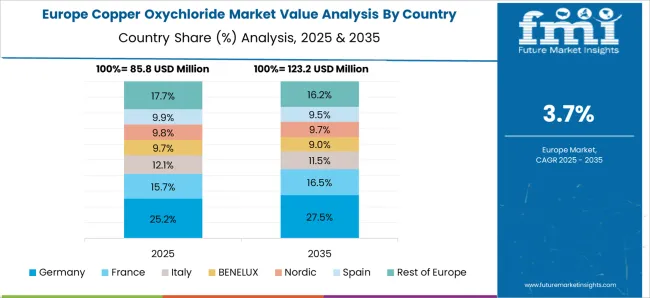

The global copper oxychloride market is projected to grow at a CAGR of 4% from 2025 to 2035. China leads with a growth rate of 5.4%, followed by India at 5% and Germany at 4.6%. The United Kingdom records a growth rate of 3.8%, while the United States shows the slowest growth at 3.4%. Expansion is supported by rising demand in agriculture, particularly for crop protection and fungicidal applications, along with growing adoption in horticulture and commercial farming. Emerging markets like China and India experience higher growth due to increasing crop cultivation, government support for agriculture, and rising investments in agrochemical manufacturing. Developed markets such as Germany, the UK, and the USA witness steady growth driven by regulatory compliance, technological enhancements, and adoption in sustainable agricultural practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The copper oxychloride market in China is projected to grow at a CAGR of 5.4%. Rising demand for crop protection chemicals, particularly fungicides, is fueling market expansion. Extensive cultivation of fruits, vegetables, and cereals increases the need for high-quality copper oxychloride products. Manufacturers are focusing on developing effective and stable formulations to meet agricultural performance standards. Government initiatives promoting agricultural productivity, pest control, and sustainable crop protection practices indirectly boost market adoption. Additionally, increasing agrochemical production capacity and modernization of farming practices support strong growth in the Chinese market.

The copper oxychloride market in India is expected to grow at a CAGR of 5%. The demand is driven by extensive agricultural activities, including cereal, vegetable, and fruit cultivation. Rising awareness among farmers regarding pest and disease management increases adoption of copper oxychloride. Manufacturers are developing high-performance formulations tailored to local crop protection needs. Government programs promoting modern farming, pesticide regulation, and improved yield practices indirectly accelerate market expansion. Growing agrochemical distribution networks also facilitate wider access to copper oxychloride products across rural and semi-urban areas, supporting steady market growth.

The copper oxychloride market in Germany is projected to grow at a CAGR of 4.6%. Demand is supported by the country’s highly regulated agricultural sector, with strong focus on plant health and crop protection. Use of copper oxychloride in vineyards, horticulture, and specialty crops ensures steady adoption. Manufacturers emphasize quality formulations that comply with EU regulations, maintain stability, and provide effective fungicidal action. Advanced farming practices, including integrated pest management, encourage the use of copper oxychloride. Research and development initiatives aimed at improving efficacy and environmental performance further support market growth in Germany.

The copper oxychloride market in the United Kingdom is expected to grow at a CAGR of 3.8%. Adoption is primarily driven by the horticulture and commercial agriculture sectors. Demand for effective fungicidal solutions to protect high-value crops supports market expansion. Manufacturers focus on formulations that provide stability, efficiency, and compliance with EU pesticide regulations. Growing awareness of integrated crop management practices and sustainable agricultural methods further encourages the use of copper oxychloride. Distribution channels, including agrochemical distributors and retailers, enable widespread market penetration across the country.

The copper oxychloride market in the United States is projected to grow at a CAGR of 3.4%. Adoption is supported by extensive use in crop protection, particularly for vegetables, fruits, and cereals. Manufacturers focus on developing formulations that comply with USA Environmental Protection Agency standards and provide effective fungicidal activity. Integration with modern farming practices and precision agriculture encourages steady usage. Distribution networks, including agrochemical retailers and online platforms, support accessibility for commercial and small-scale farmers. Continuous research into enhanced performance and environmental compliance ensures sustained market growth despite moderate CAGR compared to emerging markets.

The copper oxychloride market is led by agrochemical suppliers competing on product purity, crop efficacy, and regulatory compliance. IQV, Isagro S.p.A., and Syngenta dominate with brochures highlighting broad-spectrum fungicidal activity, optimized particle size, and compatibility with integrated pest management programs. Albaugh, LLC. and Biota Agro Solutions emphasize cost-efficient formulations and reliable performance in diverse climatic conditions, showcased through brochures targeting growers and distributors. Spiess-Urania and Killicks Pharma differentiate with specialty blends and micronized products, with marketing materials stressing enhanced adhesion, reduced phytotoxicity, and extended residual effect. Brochures are central in communicating product handling safety, application versatility, and adherence to international agrochemical standards, appealing to large-scale commercial agriculture buyers. Other players such as Manica S.p.A., Vimal Crop Care Pvt. Ltd., and Greenriver Industry Co., Ltd. focus on regional supply chains and locally optimized formulations.

Brochures emphasize solubility, shelf-life stability, and ease of application, which are crucial for small and mid-sized growers. Competition is shaped by efficacy claims, regulatory approvals, and supply reliability, making brochure-driven narratives a key tool for differentiation. Marketing efforts highlight environmental compliance, cost-effectiveness, and integrated crop protection benefits, positioning suppliers as trusted partners in sustainable and profitable agriculture. The market dynamic balances global brand strength with localized performance, using brochures to reinforce credibility, technical expertise, and operational value.

| Item | Value |

|---|---|

| Quantitative Units | USD 340.5 million |

| Application Analysis | Fungicide, Commercial Feed Supplements, Colorants & Pigments, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IQV, Isagro S.p.A., Albaugh, LLC., Biota Agro Solutions Private Limited, Spiess-Urania, Killicks Pharma, Syngenta, Manica S.p.A., Vimal Crop Care Pvt. Ltd., and Greenriver Industry Co., Ltd. |

| Additional Attributes | Dollar sales by product type (wettable powder, granules, liquid) and application (fungicides, crop protection, seed treatment) are key metrics. Trends include rising demand for sustainable agriculture solutions, growth in crop yield enhancement practices, and increasing adoption in horticulture and cereals. Regional adoption, regulatory approvals, and technological innovations are driving market growth. |

The global copper oxychloride market is estimated to be valued at USD 340.5 million in 2025.

The market size for the copper oxychloride market is projected to reach USD 504.0 million by 2035.

The copper oxychloride market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in copper oxychloride market are fungicide, commercial feed supplements, colorants & pigments and others.

In terms of application, the fungicide segment is set to command 61.8% share in the copper oxychloride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Foil Rolling Mill Market Forecast and Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Copper Pipes and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Copper Chromite Black Pigment Market Size and Share Forecast Outlook 2025 to 2035

Copper Cabling Systems Market Size and Share Forecast Outlook 2025 to 2035

Copper Bismuth Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Copper and Brass Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Copper and Copper Alloy Scrap and Recycling Market Size and Share Forecast Outlook 2025 to 2035

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Copper Tube Market Size and Share Forecast Outlook 2025 to 2035

Copper Foil Market Growth - Trends & Forecast 2025 to 2035

Copper Coated Film Market Insights & Industry Trends 2024-2034

Copper Azoles Market

Structural Copper Wire Market Size and Share Forecast Outlook 2025 to 2035

Oxygen-free Copper Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

High Frequency High Speed Copper Clad Laminate CCL Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA