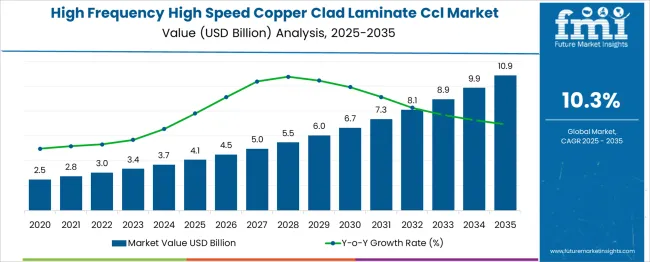

The High Frequency High Speed Copper Clad Laminate Ccl Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period. A Growth Contribution Index analysis reveals that the first half of the forecast period (2025-2030) adds approximately USD 2.6 billion, taking the market from USD 4.1 billion to USD 6.7 billion, which accounts for nearly 38% of the total incremental growth. This phase is driven by increasing demand for 5G infrastructure, high-speed data centers, and advanced automotive electronics, where low-loss, high-frequency laminates are critical for signal integrity.

The second half (2030–2035) contributes a larger share, adding USD 4.2 billion to reach USD 10.9 billion, reflecting 62% of total growth as adoption accelerates for next-generation communication systems, IoT-enabled devices, and high-performance computing platforms.

This late-stage surge underscores a strong technology-driven expansion where ultra-low dielectric materials and heat-resistant laminates gain traction. Vendors prioritizing high-frequency substrates optimized for mmWave applications, thermal stability enhancements, and compatibility with advanced PCB fabrication techniques will dominate as the market transitions toward cutting-edge digital infrastructure, supporting exponential data transmission and miniaturization requirements across global electronics ecosystems.

| Metric | Value |

|---|---|

| High Frequency High Speed Copper Clad Laminate Ccl Market Estimated Value in (2025E) | USD 4.1 billion |

| High Frequency High Speed Copper Clad Laminate CCL Market Forecast Value in (2035F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The high frequency high speed copper clad laminate (CCL) market is increasingly vital across multiple advanced electronics ecosystems due to its role in achieving low dielectric loss and high signal integrity. Within the printed circuit board (PCB) materials market, CCL holds 18–20%, driven by the shift toward multilayer boards for advanced electronics. In the high-speed digital and RF substrate materials segment, its share reaches 25–28%, reflecting its criticality in high-frequency transmission applications where minimal signal degradation is essential. For the 5G and telecommunications infrastructure components market, CCL accounts for 12–14%, supporting base station antennas and network hardware that require exceptional thermal and electrical stability.

In automotive electronics materials, the market contributes 10–12%, enabling ADAS systems, radar modules, and EV control units to handle high-speed communication within harsh environments. Within the advanced computing and data center hardware materials domain, CCL secures 15–17%, as servers and AI computing architectures demand low-loss substrates for reliable high-speed performance. Growth is fueled by exponential data transmission needs, miniaturization trends, and integration of high-layer PCB designs in mission-critical systems. Innovations in PTFE-based laminates, hydrocarbon resin systems, and ultra-thin composite structures are reshaping performance benchmarks, positioning high-speed CCL as an indispensable foundation for next-generation connectivity and computing solutions.

The growing need for high-speed signal transmission with minimal loss is compelling manufacturers to innovate in copper clad laminate technologies. Focus has been shifting toward materials that enable higher frequency stability, lower dielectric loss, and thermal resistance, all of which are essential for high-performance circuit boards.

Rapid investments in 5G infrastructure, aerospace electronics, automotive radar systems, and server interconnects are reinforcing the market’s trajectory. The expansion of cloud computing, IoT devices, and low-latency communication platforms has also increased reliance on high-frequency laminates that can support efficient signal propagation.

As the market matures, regulatory mandates for signal integrity and thermal reliability in high-performance applications are expected to stimulate adoption further. Key players are prioritizing resin innovation, signal loss reduction, and multilayer compatibility, ensuring long-term opportunities for growth and market diversification..

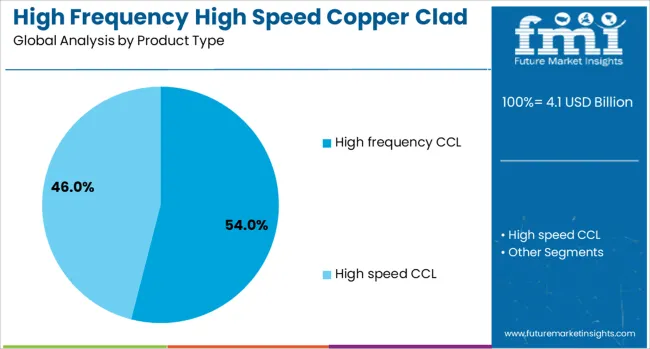

The high frequency high-speed copper-clad laminate CCLmarket is segmented by product type, resin type, and application and geographic regions. By product type, the high frequency high speed copper clad laminate CCL market is divided into High frequency CCL and High speed CCL.

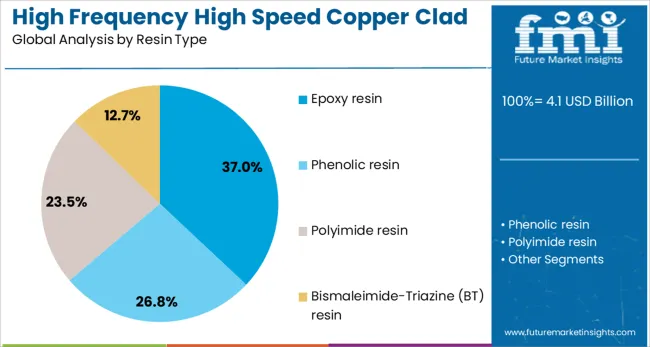

In terms of resin type, the high-frequency, high-speed copper-clad laminate CCL market is classified into Epoxy resin, Phenolic resin, Polyimide resin, and Bismaleimide-Triazine (BT) resin. Based on the application of the high-frequency, high-speed copper-clad laminate CCL market, it is segmented into 5G Base stations, Automotive electronics, Consumer electronics, Telecommunications, Aerospace and defense, and Others. Regionally, the high-frequency high-speed copper-clad laminate CCL industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high frequency product type segment is projected to hold 54% of the High Frequency High Speed Copper Clad Laminate CCL market revenue share in 2025, establishing it as the dominant category. This leading position has been supported by the rising demand for laminates capable of operating in the gigahertz frequency range without compromising signal fidelity.

As industries increasingly adopt technologies like millimeter-wave communication and advanced radar systems, high-frequency laminates have gained preference due to their ability to maintain a low dielectric constant and minimal signal distortion. Applications in telecommunications and defense sectors have particularly favored this product type for its superior electromagnetic performance.

Manufacturers have prioritized the development of materials that exhibit excellent thermal stability and moisture resistance, both of which are critical for outdoor and high-speed transmission environments. With a growing emphasis on compact device architecture and increased data throughput, the segment has become essential for enabling high-frequency signal integrity across multilayer circuit boards..

The epoxy resin segment is anticipated to account for 37% of the High Frequency High Speed Copper Clad Laminate CCL market revenue share in 2025, emerging as the leading resin type. This dominance has been achieved due to the resin’s balance of electrical performance, affordability, and processing compatibility. Epoxy resin has been widely used in printed circuit boards for its good adhesion, mechanical strength, and dimensional stability, which are crucial in high-speed and high-frequency electronic applications.

As demand grows for 5G infrastructure and smart electronic systems, the resin’s compatibility with both traditional and advanced manufacturing processes has enhanced its appeal. Additionally, epoxy-based laminates have shown dependable dielectric properties and consistent performance under thermal stress, enabling their usage in multi-layer circuit designs.

Ongoing enhancements in epoxy formulations have improved signal transmission characteristics, allowing this resin type to meet stringent reliability standards while keeping production costs under control. This has ensured its continued relevance in next-generation electronics..

The 5G base stations segment is expected to represent 29% of the High Frequency High Speed Copper Clad Laminate CCL market revenue share in 2025, making it the largest application segment. This leadership has been driven by the global rollout of 5G infrastructure, where high signal fidelity and low transmission loss are non-negotiable.

The integration of high frequency copper clad laminates into 5G base stations has addressed critical needs for thermal performance, frequency stability, and high-speed signal routing. These laminates have become essential for supporting the dense interconnects and rapid data exchange required by 5G transceivers and antennas.

With mobile network operators rapidly expanding their 5G coverage, especially in urban and industrial zones, demand for materials that ensure long-term reliability and operational consistency has significantly risen. Moreover, the push for smaller, energy-efficient base station hardware has accelerated adoption of advanced laminates, positioning this application at the forefront of the CCL market’s expansion..

Copper clad laminates designed for high frequency and high speed applications have become essential for RF and microwave multilayer printed circuit boards. These laminates are widely used in 5G infrastructure, satellite communication systems, and advanced computing modules, driven by the need for low dielectric loss, stable glass transition properties, and minimal signal attenuation. Competitive advantage has been maintained by manufacturers delivering sheets with precise thickness control, optimized surface smoothness, and strong copper adhesion. Products that enable fine line circuitry, maintain thermal reliability, and simplify multilayer lamination processes continue to influence material selection among PCB fabricators and telecom equipment developers.

Adoption of high frequency high speed CCL has been supported by rapid expansion of high-bandwidth telecom infrastructure including 5G base stations, WiFi 6 devices, and satellite communication modules. These applications demand PCBs that maintain signal integrity at multi‑gigahertz frequencies with negligible dielectric loss. Designers have relied on CCL materials with low dissipation factor and stable dielectric constant under varying temperature and humidity. Growth in high-speed interconnects in data center modules and radar arrays has reinforced supplier demand. Consistent production of fine feature PCB layouts and support for low-profile multilayer stackups have increased selection of specialist CCL grades by fabricators and OEMs.

Market growth has been restricted by the high expense associated with engineered dielectric resins, complex prepreg processing, and precise copper foil bonding. The qualification process for high-frequency materials, which includes impedance evaluation and thermal stress testing, remains resource-intensive and time-consuming. Inconsistent quality control among suppliers can cause variations in dielectric properties or issues with copper adhesion. Incorporating these laminates into quick-turn PCB manufacturing requires strict yield control and skilled operators. Smaller fabrication units often lack advanced drilling or contour routing capability for high-speed designs. Compliance testing for RF performance across varied temperature ranges adds cost and slows expansion in low-volume production environments.

Opportunities exist for development of CCL variants targeting specific telecom frequency bands or next-generation radar module designs. Suppliers offering custom dielectric formulations tuned to 28 GHz or mmWave regime use cases are being shortlisted by OEMs. Contracts delivering just-in-time or volume-variable supply for rapid design cycles create differentiation. Pre-bonded prepreg systems that reduce lamination steps improve production speed for fabricators. Co-development with PCB manufacturers for optimized foil textures supporting fine trace resolution yields better signal integrity. Expansion into emerging electronics regions with demand for compact telecom PCBs is creating service and logistics opportunities.

Emerging trends include production of ultra-thin CCL grades that support multilayer stacks with compact inter-trace spacing and controlled impedance. Advanced surface treatments such as micro-etch or proprietary foil texturing are being applied to reduce signal loss and improve copper bonding. Use of digital twin modeling for predicting dielectric behavior under signal load and thermal stress is gaining traction. Multi-source multilayer core architectures and selective foil plating techniques are improving yield in high-speed PCB fabrication. Collaboration between lamination material providers and CAD tool developers to embed material property libraries supports faster PCB stack-up design cycles. Automated quality analytics such as in-line dielectric constant scanning are being introduced for real-time process control.

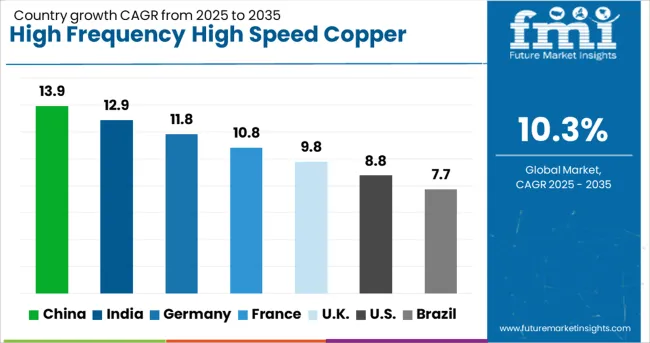

| Country | CAGR |

|---|---|

| China | 13.9% |

| India | 12.9% |

| Germany | 11.8% |

| France | 10.8% |

| UK | 9.8% |

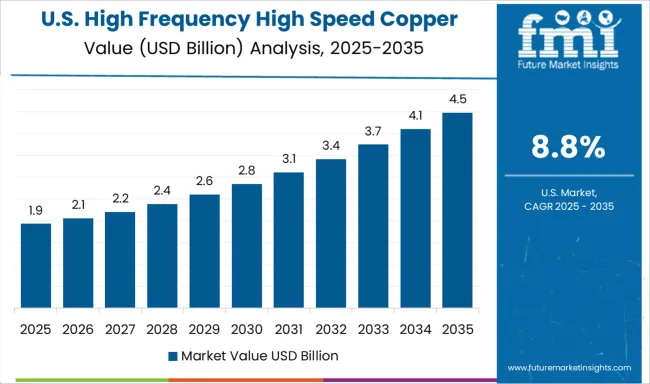

| USA | 8.8% |

| Brazil | 7.7% |

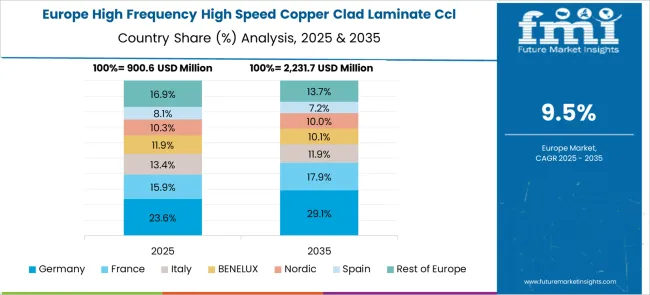

The high frequency high speed copper clad laminate (CCL) market is expected to expand at a CAGR of 10.3% from 2025 to 2035, driven by growth in 5G infrastructure, advanced automotive electronics, and high-speed data communication systems. China, a BRICS economy, leads with 13.9%, supported by large-scale 5G deployment and PCB manufacturing clusters. India, also part of BRICS, follows at 12.9%, driven by government-backed electronics manufacturing initiatives. Among OECD markets, France posts 10.8%, the United Kingdom records 9.8%, and the United States grows at 8.8%, reflecting strong demand from aerospace, defense, and data center applications. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 13.9% through 2035, driven by massive investments in 5G network rollouts, high-performance computing, and advanced PCB production. Domestic manufacturers are increasing capacity for high-frequency laminates to cater to telecom equipment and server applications. Partnerships between Chinese PCB firms and global material suppliers are accelerating technology transfer and innovation in low-loss dielectric materials. The surge in automotive electronics, especially for electric vehicles and ADAS systems, is creating new opportunities for high-speed CCL integration. Government support for semiconductor and electronics manufacturing strengthens China’s leadership in the global supply chain.

India is expected to achieve a CAGR of 12.9% through 2035, fueled by the expansion of telecom networks, electronics manufacturing hubs, and defense electronics programs. Government initiatives under the “Make in India” campaign and PLI schemes for electronics are supporting the estic production of CCL materials. Indian firms are focusing on cost-effective laminate solutions for consumer electronics, while global players target premium segments such as aerospace and automotive radar systems. Rapid growth in IoT-enabled devices and EV charging infrastructure is also creating consistent demand for high-speed laminates. Strategic collaborations with Japanese and Taiwanese suppliers enhance India’s capability in advanced CCL manufacturing.

France is projected to grow at a CAGR of 10.8% through 2035, supported by strong demand from aerospace, telecommunications, and defense sectors. Manufacturers are focusing on the development of lightweight, heat-resistant laminates to meet stringent performance requirements for avionics and radar applications. Growth in high-speed broadband connectivity projects and fiber-to-the-home initiatives further boosts market demand. Research collaborations between French electronics firms and material science companies aim to improve signal integrity and reduce dielectric losses in high-frequency environments. The adoption of high-speed laminates in medical imaging devices also adds to France’s market prospects.

The United Kingdom is expected to post a CAGR of 9.8% through 2035, driven by the adoption of high-speed laminates in aerospace electronics, defense radar systems, and advanced medical equipment. Investments in data centers and high-speed internet infrastructure are strengthening demand for PCBs with low-loss CCL materials. Manufacturers are introducing laminates with enhanced thermal reliability and chemical resistance to cater to demanding industrial environments. Growth in electric vehicle penetration and related charging infrastructure adds another layer of opportunity for CCL suppliers. Partnerships with European electronics manufacturers support the integration of high-performance materials across multiple verticals.

The United States is forecasted to achieve a CAGR of 8.8% through 2035, driven by high adoption in aerospace, military communication systems, and next-generation computing platforms. Manufacturers prioritize ultra-low-loss laminates and high thermal endurance materials to meet the requirements of high-frequency circuits used in satellite communication and radar systems. Investments in 5G infrastructure and semiconductor manufacturing further enhance market growth. The US also leads in R&D for advanced resin systems that deliver superior electrical performance for PCBs. Collaboration between electronics OEMs and material technology firms accelerates innovation for high-speed CCL integration across multiple application areas.

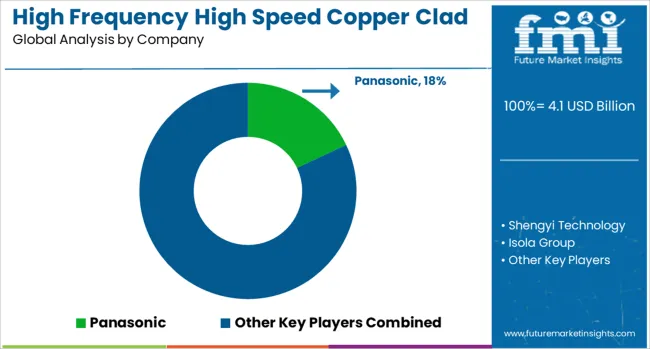

The high frequency high speed copper clad laminate (CCL) market is driven by leading players such as Panasonic, Shengyi Technology, Isola Group, ITEQ Corporation, and Rogers Corporation. Panasonic dominates with advanced CCL solutions optimized for high-frequency signal transmission, supporting next-generation applications like 5G infrastructure, high-speed data centers, and automotive radar systems.

Shengyi Technology leverages large-scale manufacturing capabilities to produce high-performance laminates that combine low dielectric constant (Dk) and low dissipation factor (Df), ensuring superior signal integrity for communication equipment. Isola Group specializes in premium laminates designed for high-speed digital and RF applications, focusing on consistent quality and thermal reliability for multilayer PCBs. ITEQ Corporation offers cost-effective solutions for high-speed designs in consumer electronics and networking equipment, emphasizing scalability and performance balance.

Rogers Corporation leads in the ultra-high-performance segment with specialized materials for advanced radar systems, millimeter-wave devices, and aerospace applications, providing exceptional electrical and mechanical stability. Competitive differentiation revolves around dielectric performance, thermal reliability, resin technology innovation, and compatibility with high-layer count PCB designs. Entry barriers include the need for advanced material science expertise, capital-intensive production, and strict quality standards for high-speed and RF circuit boards. Strategic initiatives among top players include R&D investment in low-loss materials, expansion of global manufacturing footprints, and partnerships with OEMs to meet evolving requirements for 5G, IoT, and autonomous vehicle technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Product Type | High frequency CCL and High speed CCL |

| Resin Type | Epoxy resin, Phenolic resin, Polyimide resin, and Bismaleimide-Triazine (BT) resin |

| Application | 5G Base stations, Automotive electronics, Consumer electronics, Telecommunications, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Panasonic, Shengyi Technology, Isola Group, ITEQ Corporation, and Rogers Corporation |

| Additional Attributes | Dollar sales by laminate type (PTFE-based, hydrocarbon resin-based, epoxy resin-based) and application (5G base stations, data centers, automotive radar, aerospace electronics), with demand driven by rapid expansion of high-frequency communication infrastructure and advanced electronics. Regional dynamics indicate Asia-Pacific as the largest production and consumption hub due to strong PCB manufacturing ecosystems, while North America and Europe lead in aerospace and high-reliability electronics adoption. Innovation trends include ultra-low Df materials, hybrid laminate structures for multi-functional PCBs, and advanced resin systems enabling higher thermal stability for next-generation high-speed applications. |

The global high frequency high speed copper clad laminate ccl market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the high frequency high speed copper clad laminate ccl market is projected to reach USD 10.9 billion by 2035.

The high frequency high speed copper clad laminate ccl market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in high frequency high speed copper clad laminate ccl market are high frequency ccl and high speed ccl.

In terms of resin type, epoxy resin segment to command 37.0% share in the high frequency high speed copper clad laminate ccl market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA