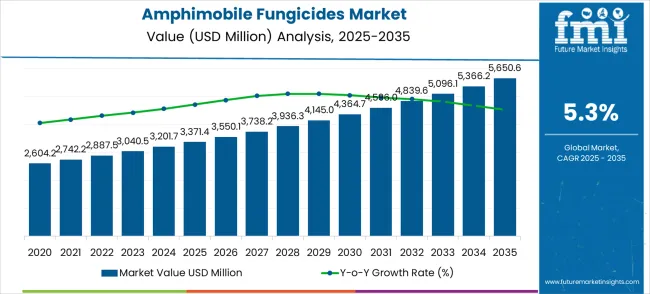

The amphimobile fungicides market is projected to grow from USD 3,371.4 million in 2025 to USD 5,650.6 million by 2035, at a CAGR of 5.3%. In the initial phase from 2021 to 2025, the market expands from USD 2,604.2 million to USD 3,371.4 million, with annual increments of USD 2,742.2 million, USD 2,887.5 million, USD 3,040.5 million, and USD 3,201.7 million. This growth is primarily driven by the increasing adoption of amphimobile fungicides in agriculture to combat plant diseases, improve crop yield, and address growing food security challenges.

Between 2026 and 2030, the market continues its upward trajectory, moving from USD 3,371.4 million to USD 4,145.0 million. Intermediate values show increases through USD 3,550.1 million, 3,738.2 million, 3,936.3 million, and 4,145.0 million, supported by advancements in fungicide formulations that offer better protection against a wider range of pathogens, alongside stricter agricultural regulations and the demand for higher crop productivity. From 2031 to 2035, the market is expected to reach USD 5,650.6 million, with intermediate increments of USD 4,364.7 million, USD 4,596.0 million, USD 4,839.6 million, USD 5,096.1 million, and USD 5,366.2 million. This period is marked by continued demand for high-performance fungicides, adoption in developing regions, and innovations that drive higher efficacy. The absolute dollar opportunity represents significant growth driven by increasing agricultural output and the evolving needs of modern farming.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,371.4 million |

| Forecast Value in (2035F) | USD 5,650.6 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The agriculture sector dominates the market, contributing 45-50%, as amphimobile fungicides are crucial in controlling fungal diseases across various crops such as cereals, vegetables, and fruits. These fungicides are favored for their effectiveness in disease control and minimal environmental impact. The horticulture sector follows closely, accounting for 20-25%, with these fungicides being essential in protecting ornamental plants, flowers, and landscaping plants in nurseries and greenhouses. In forestry, which makes up about 15-18% of the market, amphimobile fungicides are used to safeguard trees from fungal infections that can damage timber quality and ecosystem health, especially in forest management programs. The home and garden sector contributes 10-12%, driven by growing interest in home gardening, where homeowners use amphimobile fungicides to protect plants from common fungal diseases. The industrial applications segment, though smaller at 5-8%, relies on amphimobile fungicides to prevent fungal growth in environments that can impact materials, machinery, and infrastructure.

Market expansion is being supported by the increasing global demand for food security and agricultural productivity, and the corresponding need for effective crop protection solutions that can prevent yield losses, ensure quality harvests, and support eco-friendly farming practices across various crops and growing conditions. Modern agricultural producers and crop protection specialists are increasingly focused on implementing fungicide solutions that can provide broad-spectrum disease control, support integrated pest management, and deliver consistent crop protection performance across diverse agricultural applications. Amphimobile fungicides' proven ability to produce systemic and contact activity, provide long-lasting protection, and support resistance management make them essential components for contemporary farm production and crop protection strategies.

The growing emphasis on green agriculture and environmental stewardship is driving demand for amphimobile fungicides that can support integrated crop management, reduce application frequency, and enable precision disease control strategies. Agricultural producers' preference for fungicide solutions that combine effectiveness with environmental compatibility and resistance management capabilities is creating opportunities for innovative amphimobile fungicide implementations. The rising influence of climate change and evolving pathogen pressures is also contributing to increased adoption of amphimobile fungicides that can provide reliable disease control without compromising long-term agricultural sustainability.

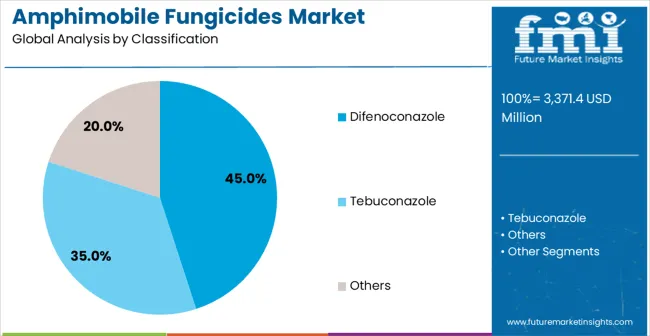

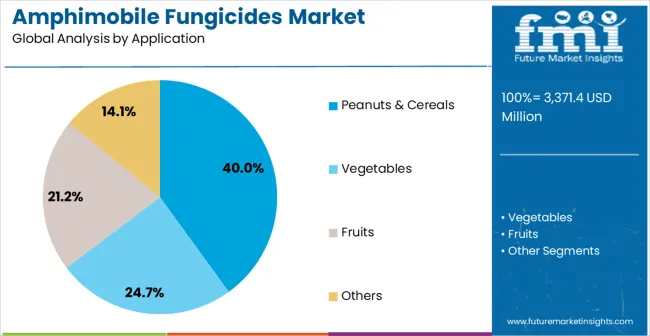

The market is segmented by active ingredients, application, and region. By active ingredients, the market is divided into difenoconazole, tebuconazole, and others. Based on application, the market is categorized into peanuts & cereals, vegetables, fruits, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

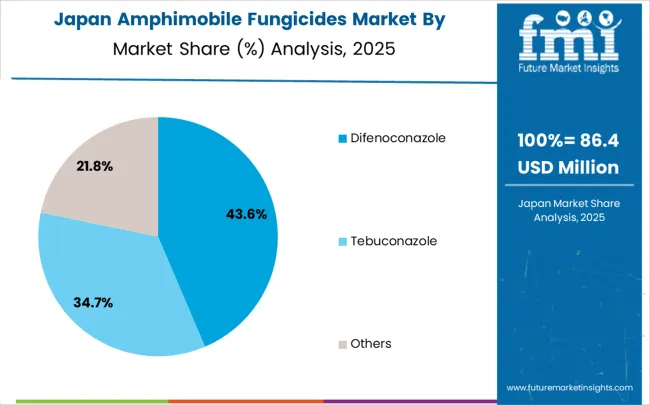

The difenoconazole segment is projected to maintain its leading position in the amphimobile fungicides market in 2025, capturing 45% of the market share. Agricultural producers and crop protection specialists increasingly favor difenoconazole due to its broad-spectrum disease control, systemic and protectant activity, and versatile application across various crop types and growing conditions. Its advanced mode of action and proven efficacy meet agricultural requirements for reliable disease management and yield protection in diverse cropping systems. As a result, difenoconazole remains a cornerstone of modern crop protection programs, supporting both crop protection effectiveness. With continuous investments in difenoconazole-based fungicides, adoption continues to grow among growers and crop advisors who seek consistent disease control and improved yields.

The peanuts & cereals application segment is projected to represent the largest share of amphimobile fungicides demand in 2025, accounting for 40% of the market. This segment plays a critical role in fungicide adoption across staple crop production, especially in food security applications. Agricultural producers rely on amphimobile fungicides for their effectiveness against key diseases in cereal crops. These fungicides help enhance yield stability, improve grain quality, and support storage characteristics. The growing availability of precision application technologies and crop-specific formulations enables more effective disease control while supporting environmental stewardship and resistance management. As global food demand rises and cereal production requirements become more stringent, the peanuts & cereals segment will continue to dominate the market, driving advanced fungicide utilization and crop production strategies.

The amphimobile fungicides market is advancing steadily due to increasing demand for green crop protection and growing adoption of integrated disease management practices that provide enhanced agricultural productivity and environmental stewardship across diverse cropping systems. The market faces challenges, including regulatory pressures and registration requirements, development of pathogen resistance to existing active ingredients, and environmental concerns regarding fungicide residues and ecological impact. Innovation in green formulation technologies and precision application systems continues to influence product development and market expansion patterns.

The growing adoption of environmentally compatible formulations and reduced-risk fungicide technologies is enabling agricultural producers to achieve effective disease control while meeting environmental stewardship objectives and regulatory compliance requirements. Green formulation systems provide improved environmental profiles while allowing more precise application and consistent disease control across various crop types and growing conditions. Manufacturers are increasingly recognizing the competitive advantages of green formulation capabilities for market differentiation and regulatory approval.

Modern amphimobile fungicide providers are incorporating precision application technologies and digital agriculture platforms to enhance application efficiency, optimize disease control timing, and enable data-driven crop protection decisions for improved agricultural outcomes. These technologies improve application effectiveness while enabling new capabilities, including variable rate application and predictive disease modeling. Advanced digital integration also allows producers to support comprehensive crop management and disease prevention beyond traditional calendar-based application programs.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| USA | 5.0% |

| UK | 4.5% |

| Japan | 4.0% |

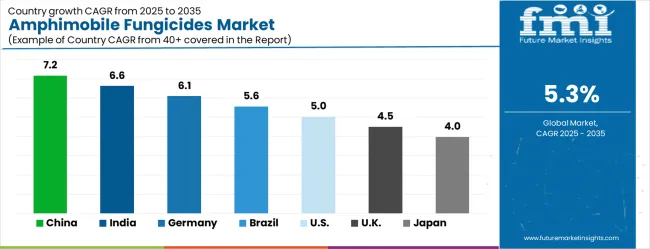

The amphimobile fungicides market is experiencing solid growth globally, with China leading at a 7.2% CAGR through 2035, driven by the expanding agricultural sector, growing food security demands, and significant investment in modern crop protection technologies and green farming practices. India follows at 6.6%, supported by large agricultural production, increasing crop intensification, and growing adoption of advanced plant protection products. Germany shows growth at 6.1%, emphasizing agriculture practices and precision crop protection technologies. Brazil records 5.6%, focusing on agricultural modernization and large-scale crop production expansion. The USA demonstrates 5.0% growth, supported by advanced farming technologies and an emphasis on integrated crop management systems. The UK exhibits 4.5% growth, emphasizing green farming practices and environmental stewardship initiatives. Japan shows 4.0% growth, supported by precision agriculture and advanced crop protection technologies.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The amphimobile fungicides market in China is projected to grow at a CAGR of 7.2% from 2025 to 2035. The growing agricultural sector, driven by increasing food demand due to a large population and shifting dietary preferences, is a significant factor behind this growth. China’s rapid industrialization and modernization of its agriculture practices have led to higher crop yields, necessitating the use of effective plant protection products like fungicides. As the demand for food security rises and pest resistance to conventional treatments grows, farmers are turning to more efficient and specialized solutions, including amphimobile fungicides. Government initiatives to ensure food safety and protect crops from diseases are also playing a key role in market growth.

India’s amphimobile fungicides market is expected to grow at a CAGR of 6.6% from 2025 to 2035. The country’s agriculture-based economy is a major driver of this market. With the demand for crop protection solutions rising in response to India’s need to increase crop yield and combat the impact of pests and diseases, the adoption of specialized fungicides like amphimobile is on the rise. The market is also supported by the increasing awareness among Indian farmers about the benefits of modern fungicide products that offer long-lasting protection. Government programs and subsidies to promote green agriculture are fostering the use of advanced plant protection technologies.

Germany’s amphimobile fungicides market is projected to grow at a CAGR of 6.1% during the forecast period. Germany’s strong agricultural base and its focus on high-quality, farming methods have spurred the demand for advanced fungicide solutions. The country is home to many large agricultural enterprises, particularly in sectors like grains, vegetables, and fruits, all of which require regular fungicide application. Stricter regulations and rising concerns about plant diseases are pushing the agricultural sector to adopt more effective, long-term protection methods such as amphimobile fungicides.

Brazil’s amphimobile fungicides market is expected to grow at a CAGR of 5.6% from 2025 to 2035. As one of the world’s largest agricultural producers, Brazil’s market for fungicides is expanding rapidly. The country’s agricultural output, particularly in crops like soybeans, sugarcane, and coffee, requires robust plant protection products to maintain high yields. With growing concerns about crop diseases and pests, Brazilian farmers are increasingly adopting advanced fungicide solutions, including amphimobile, to safeguard their crops. The Brazilian government’s support for agricultural innovations and green farming practices is driving the shift toward advanced fungicide products.

The USA amphimobile fungicides market is projected to grow at a CAGR of 5.0% from 2025 to 2035. The United States, with its vast agricultural sector, is experiencing a surge in demand for high-performance fungicides to combat the rise in crop diseases and pest resistance. As USA agriculture focuses on improving crop productivity and maintaining food security, the need for advanced, long-term crop protection solutions such as amphimobile fungicides is growing. The growing focus on precision agriculture and the increasing use of data-driven solutions in farming are contributing to the wider adoption of fungicides across the country.

Surge in demand for crop protection solutions due to increasing pest resistance

Growing adoption of precision agriculture and data-driven farming methods

Focus on improving agricultural productivity and maintaining food security

The United Kingdom’s amphimobile fungicides market is expected to grow at a CAGR of 4.5% from 2025 to 2035. The UK has seen an increasing demand for advanced crop protection solutions as it strives to meet the agricultural sector’s needs while adhering to stringent environmental regulations. The rise in plant diseases, along with increasing public awareness about food safety and green farming, is leading to the growing adoption of products like amphimobile fungicides. The UK agricultural sector is focusing on maintaining crop yields and protecting against fungal diseases that threaten production.

Japan’s amphimobile fungicides market is expected to grow at a CAGR of 4.0% from 2025 to 2035. Japan’s agricultural sector is shifting towards more advanced technologies and solutions for crop protection, as farmers aim to optimize production and protect their crops from diseases. The increasing use of fungicides, including amphimobile, is a response to the growing risk of fungal diseases, especially in the rice and vegetable sectors. With Japan’s focus on high-quality agricultural products and the need to protect against pests and diseases, the demand for these advanced fungicides is anticipated to rise.

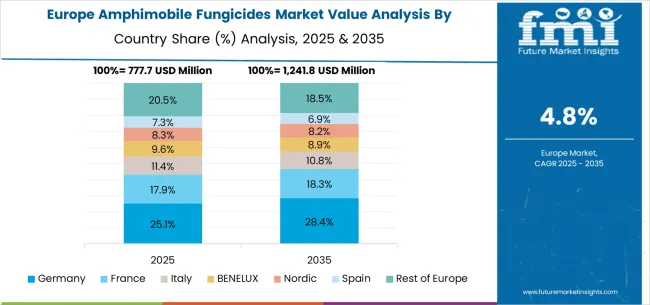

The amphimobile fungicides market in Europe is projected to grow from USD 1,253.8 million in 2025 to USD 2,038.5 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 26.0% market share in 2025, moderating slightly to 25.8% by 2035, supported by its strong agricultural sector, advanced crop protection infrastructure, and comprehensive green farming programs serving major European markets.

The United Kingdom follows with 20.0% in 2025, projected to reach 19.8% by 2035, driven by established green farming practices, comprehensive agricultural extension services, and advanced integrated pest management programs. France holds 18.5% in 2025, rising to 18.7% by 2035, supported by large-scale agricultural production and growing adoption of precision crop protection technologies. Italy commands 14.0% in 2025, projected to reach 14.1% by 2035, while Spain accounts for 10.0% in 2025, expected to reach 10.2% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 7.5% by 2035, attributed to increasing agricultural modernization and growing crop protection adoption across emerging agricultural markets implementing advanced farming standards.

The amphimobile fungicides market is characterized by competition among established crop protection companies, specialized fungicide manufacturers, and integrated agricultural solution providers. Companies are investing in advanced active ingredient research, greem formulation development, regulatory compliance, and comprehensive product portfolios to deliver effective, environmentally responsible, and economically viable amphimobile fungicide solutions. Innovation in green chemistry, precision application technologies, and resistance management strategies is central to strengthening market position and competitive advantage.

Bayer leads the market with comprehensive crop protection solutions, offering advanced amphimobile fungicide products with a focus on integrated pest management. Syngenta provides specialized fungicide technologies with an emphasis on innovation and agricultural productivity enhancement. SDS Biotech delivers targeted crop protection solutions with a focus on specialty crops and precision agriculture applications. Suli specializes in fungicide development and manufacturing with emphasis on quality and effectiveness. Jiangsu Xinhe focuses on crop protection product development and agricultural solutions. Jiangsu Weunite offers comprehensive agricultural chemicals with a focus on green farming support.

Amphimobile fungicides represent a critical crop protection segment within global agriculture, projected to grow from USD 3,371.4 million in 2025 to USD 5,650.6 million by 2035 at a 5.3% CAGR. These dual-action fungicides—primarily difenoconazole and tebuconazole formulations—provide both systemic and contact protection against fungal diseases in cereals, peanuts, vegetables, and fruits. Market expansion is driven by increasing food security demands, adoption of integrated pest management practices, climate-induced disease pressures, and the need for resistance management strategies that ensure long-term crop protection effectiveness.

How Agricultural Governments Could Strengthen Crop Protection and Food Security?

How Agricultural Organizations Could Advance Sustainable Disease Management?

How Crop Protection Companies Could Drive Innovation and Stewardship?

How Farmers and Agricultural Advisors Could Optimize Disease Management?

How Research Institutions Could Support Innovation and Sustainability?

How Investors and Financial Enablers Could Accelerate Market Development?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,371.4 million |

| Active Ingredients | Difenoconazole, Tebuconazole, Others |

| Application | Peanuts & Cereals, Vegetables, Fruits, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Bayer, Syngenta, SDS Biotech, Suli, Jiangsu Xinhe, and Jiangsu Weunite |

| Additional Attributes | Dollar sales by active ingredients and application category, regional demand trends, competitive landscape, technological advancements in fungicide formulations, green agriculture development, precision application innovation, and resistance management optimization |

The global amphimobile fungicides market is estimated to be valued at USD 3,371.4 million in 2025.

The market size for the amphimobile fungicides market is projected to reach USD 5,650.6 million by 2035.

The amphimobile fungicides market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in amphimobile fungicides market are difenoconazole, tebuconazole and others.

In terms of application, peanuts & cereals segment to command 40.0% share in the amphimobile fungicides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Bio-rational Fungicides Market Growth – Trends & Forecast 2025 to 2035

Bacillus-based Biofungicides Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bio-rational Fungicides in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA