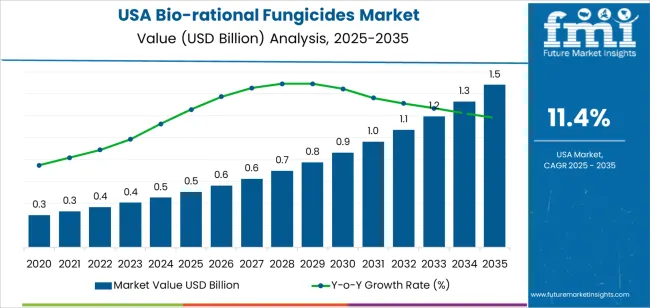

Bio-rational fungicide demand in the USA is valued at USD 0.5 billion in 2025 and is projected to reach USD 1.5 billion by 2035 at a CAGR of 11.4%. Early market expansion reflects rising deployment in high-value specialty crops where resistance management and residue control shape input selection. Fruits, vegetables, vineyards, and controlled-environment agriculture account for most early adoption as growers rotate bio-rational products alongside conventional fungicides to protect yield without disrupting export residue limits. Formulations based on microbial strains, plant extracts, and biochemical actives see higher placement in integrated disease management programs. Distribution growth is led by specialist agri-input dealers and contract application services serving California, Florida, Washington, and the Midwest specialty crop belts.

After 2030, demand growth becomes more program-driven and contract-oriented. Market value rises from about USD 0.9 billion in 2030 toward USD 1.5 billion by 2035 as bio-rational fungicides gain deeper inclusion in multi-season disease management schedules rather than single-application use. Greenhouse production, organic-certified acreage, and residue-sensitive export crops contribute increasing value per acre. Field crop adoption also broadens where resistance pressure intensifies in soybeans, corn, and wheat rotations. Supplier strategies focus on strain consistency, shelf stability, and compatibility with conventional spray programs. Pricing dynamics increasingly reflect formulation complexity, application frequency, and regulatory registration costs rather than direct competition with commodity fungicide actives.

Bio-rational fungicides derive their demand strength from regulatory pressure on conventional chemistries and rising residue sensitivity across food supply chains, giving this category a structurally reformulation-led growth profile. Demand in USA increases from USD 0.5 billion in 2025 to USD 0.6 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady integration into high-value crops such as fruits, vegetables, vineyards, and specialty turf where growers target disease control with lower resistance risk and shorter re-entry intervals. Adoption is reinforced by retailer pesticide residue thresholds and export-driven compliance standards rather than yield maximization alone. Growth remains controlled because growers transition gradually, balancing biological efficacy with conventional programs.

From 2030 to 2035, the market expands from USD 0.6 billion to USD 1.5 billion, adding a substantial USD 0.9 billion in the second half of the decade. This back weighted acceleration reflects broader penetration into row crops, protected agriculture, and large-acreage disease management programs. Higher formulation stability, multi-mode biological blends, and improved shelf life allow bio-rational fungicides to compete directly with synthetic actives at scale. As resistance management becomes a cost-critical priority and regulatory pipelines tighten further, bio-rational products shift from supplemental tools to core fungicide programs, driving rapid value expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.5 billion |

| Forecast Value (2035) | USD 1.5 billion |

| Forecast CAGR (2025–2035) | 11.4% |

The market for bio-rational fungicides in the USA expanded initially as growers and agribusinesses sought alternatives to conventional synthetic fungicides. Concerns over chemical residues, environmental impact, and regulatory restrictions gradually encouraged farmers to adopt biological and botanical treatments derived from microbes or plant extracts. For high-value crops such as fruits, vegetables, and horticultural produce, bio-rational fungicides offered targeted disease control with lower ecological burden. Early demand came from organic farms, greenhouse growers, and producers supplying residue-sensitive export or retail markets. As integrated pest management practices gained ground, bio-rational fungicides became part of broader strategies combining crop rotation, biological controls, and reduced-chemical inputs.

Rising regulatory scrutiny on synthetic pesticide use, growing consumer demand for residue-free produce, and greater interest in sustainable agriculture are driving future growth of this segment. Bio-rational fungicides are expected to see wider adoption beyond niche or organic farms as efficacy improves and cost per hectare becomes competitive. Advances in microbial strain development, formulation technology (e.g. encapsulation, improved shelf life), and application methods tailored for large-scale row crops could broaden use across cereals, grains, and oilseeds in addition to horticulture. barriers remain: comparatively higher cost per treatment, variable performance under different climate conditions, limited shelf life, and lower awareness among conventional growers. The pace of expansion will depend on how well providers address these challenges while aligning with evolving regulatory, environmental, and consumer-driven demands.

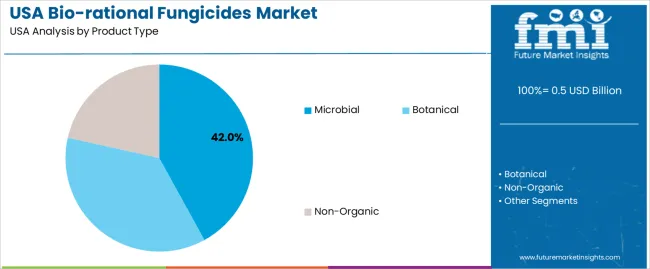

The demand for bio rational fungicides in the USA is structured by product type and end user application. Microbial fungicides account for 42% of total demand, followed by botanical and non organic bio rational formulations used across integrated disease management programs. By application, fruits and vegetables represent 46.0% of total consumption, followed by cereals and grains, and oil seeds and pulses. Demand behavior is shaped by resistance management needs, residue control requirements, crop value protection, and compatibility with integrated pest management systems. These segments reflect how biological mode of action and crop specific disease pressure influence fungicide selection across commercial farming operations in the USA.

Microbial bio rational fungicides account for 42% of total demand in the USA due to their targeted mode of action, low residue profile, and strong compatibility with integrated pest management programs. These products use beneficial bacteria, fungi, and microorganisms to suppress plant pathogens through competitive exclusion, antibiosis, and induced plant resistance. Growers favor microbial fungicides for use in high value crops where residue sensitivity and export compliance remain critical. Their suitability for repeated application without major resistance buildup also supports adoption across extended growing seasons.

Microbial products also benefit from regulatory acceptance across organic and reduced residue farming systems. Continued field validation by agricultural research institutions reinforces confidence in disease control performance under commercial conditions. Improved formulation stability and shelf life have expanded their use beyond specialty crops into broader acreage. These resistance management, regulatory suitability, and field performance factors sustain microbial products as the leading bio rational fungicide type in the USA.

Fruits and vegetables account for 46.0% of total bio rational fungicide demand in the USA due to high disease pressure, export quality standards, and strict residue limits. These crops are highly susceptible to fungal infections such as powdery mildew, downy mildew, and botrytis, which directly affect marketable yield and post-harvest quality. Growers rely on bio rational fungicides to maintain disease control while protecting visual quality, shelf life, and food safety compliance across domestic and export markets.

Fruit and vegetable production also operates under intensive spray schedules that favor low toxicity fungicide options. Bio rational products allow close to harvest application without extended pre harvest intervals. Adoption is strongest in leafy greens, berries, tomatoes, cucurbits, and orchard crops where consumer demand for low residue produce remains high. These crop sensitivity, market value, and regulatory compliance factors position fruits and vegetables as the dominant application segment for bio rational fungicides in the USA.

Demand for bio-rational fungicides in the USA is increasingly tied to risk management in high-value crop production rather than simple disease suppression. Specialty crops such as grapes, berries, leafy greens, and tree fruits carry high per-acre revenue exposure, where single disease outbreaks can erase seasonal profitability. Growers use bio-rational fungicides as preventive inputs to stabilize production under unpredictable weather patterns that favor fungal pressure. These products are applied earlier in crop cycles to maintain plant resilience rather than as last-stage rescue tools. This shifts demand toward system-level crop insurance logic rather than reactive chemical control.

USA retailers and food processors now enforce strict residue thresholds that directly influence fungicide selection at the farm level. Bio-rational fungicides fit into procurement programs where maximum residue limits are often set below federal tolerance. Growers supplying national grocery chains and export markets rely on these products to maintain market access without triggering rejections. Organic and transitional growers also depend on bio-rational tools to manage disease without disqualifying certification status. This buyer-driven compliance environment creates demand that flows backward from retail contracts into farm chemical programs.

Bio-rational fungicides in the USA face commercial hesitation due to variability in field performance under high disease pressure. Many products depend on environmental conditions, microbial survival, or precise timing to achieve consistent results. Shelf life sensitivity to temperature and UV exposure complicates storage and transport across wide geographies. Tank-mix compatibility with conventional spray programs also limits flexibility for large-acreage operators. Growers managing thousands of acres remain cautious about switching away from predictable synthetic fungicides. These reliability and logistics challenges moderate aggressive acres-wide conversion despite regulatory and retail pressure.

Demand for bio-rational fungicides in the USA increasingly follows advisory influence rather than direct distributor promotion. Crop consultants integrate weather modeling, spore tracking, and disease forecasting tools to time bio-rational applications with narrow biological windows. Mobile scouting platforms generate real-time disease alerts that trigger targeted treatments instead of blanket spraying. This data-driven deployment increases success rates and gradually builds grower confidence. Seed treatment and soil-applied bio-rationals are also expanding as part of integrated disease programs. These shifts show demand being shaped by precision agronomy infrastructure rather than commodity chemical sales cycles.

| Region | CAGR (%) |

|---|---|

| West | 13.1% |

| South | 11.7% |

| Northeast | 10.5% |

| Midwest | 9.1% |

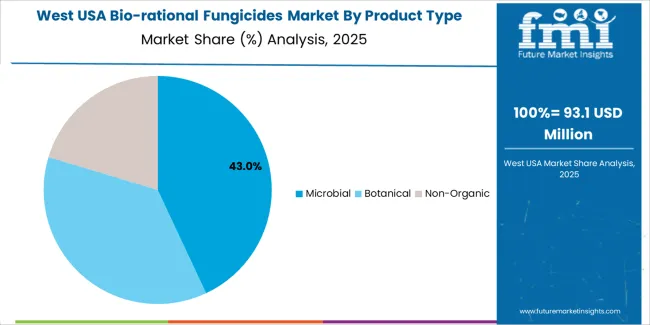

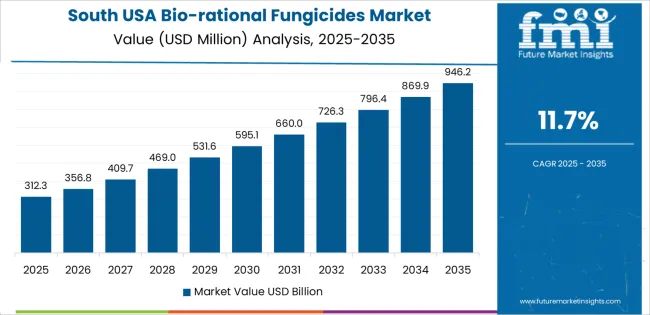

The demand for bio rational fungicides in the USA is showing strong regional growth, led by the West at a 13.1% CAGR. Growth in this region is supported by extensive fruit, vegetable, and specialty crop cultivation, along with increased adoption of residue compliant crop protection solutions. The South follows at 11.7%, driven by large scale row crop farming, warm climate disease pressure, and rising adoption of biological crop protection products. The Northeast records 10.5% growth, supported by horticulture, vineyard cultivation, and organic farming practices. The Midwest shows comparatively moderate growth at 9.1%, reflecting gradual integration of bio rational fungicides into large acreage commodity crop systems where conventional fungicides remain widely used.

Transition toward biological crop protection in the West is advancing at a CAGR of 13.1% through 2035 for bio rational fungicide demand, driven by specialty crop cultivation, vineyard disease management, and high organic acreage concentration. Fruit, nut, and vegetable producers rely on bio based fungicides for residue control and compliance with export standards. Water scarcity also increases emphasis on crop stress management through compatible biological inputs. University extension trials support adoption across orchards and greenhouse operations. Demand remains agronomy driven, with growers focused on yield stability and resistance management under strict regulatory oversight.

Expansion in the South is progressing at a CAGR of 11.7% through 2035 for bio rational fungicide demand, supported by row crop farming, horticulture production, and rising disease pressure from humidity and rainfall. Peanuts, cotton, vegetables, and turfgrass rely on biological fungicides for resistance rotation and residue sensitive markets. Poultry litter based agriculture also aligns with integrated crop management models. Demand remains volume oriented and seasonal, guided by planting cycles and disease outbreaks rather than constant year round application. Grower cooperatives play a key role in distribution across broad acreage zones.

Adoption patterns in the Northeast reflect a CAGR of 10.5% through 2035 for bio rational fungicide demand, shaped by high value produce farming, greenhouse cultivation, and strong organic certification activity. Apples, berries, leafy greens, and nursery crops require disease control programs compatible with residue limits. Short growing seasons intensify disease management focus within limited production windows. Institutional buyers prefer bio based solutions for compliance assurance. Demand remains application specific and quality driven, with growers prioritizing formulation reliability and pre harvest interval compatibility across fresh produce supply chains.

Expansion across the Midwest is registering a CAGR of 9.1% through 2035 for bio rational fungicide demand, supported by gradual integration into corn, soybean, and specialty crop disease programs. Biological fungicides are applied mainly for seed treatment, soil borne disease control, and rotation with conventional chemistries. Resistance management drives experimental and localized adoption. Large acreage farming and cost sensitivity continue to temper mass scale usage. Demand remains trial driven and agronomy led, guided by university research, cooperative field programs, and grower evaluation of cost to performance balance.

Demand for bio rational fungicides in the USA is growing as growers, food producers, and regulators shift toward environmentally conscious crop protection methods. Agricultural and horticultural producers face increasing pressure to reduce chemical residues and adopt pest management solutions that are compatible with integrated pest management and organic farming practices. Bio rational fungicides—derived from natural or biological sources—are favored where soil health, sustainability, and consumer safety are priorities. Expansion in specialty crops, organic fruits and vegetables, and greenhouse farming increases demand. Rising resistance to conventional chemical fungicides also encourages adoption of alternative agents that work via different mechanisms.

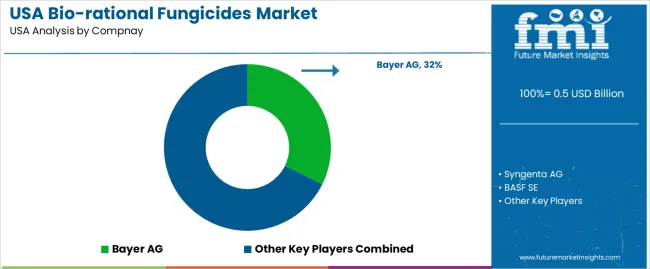

Key suppliers active in the bio rational fungicide market in the USA include Bayer AG, Syngenta AG, BASF SE, Marrone Bio Innovations, and FMC Corporation. Global agrochemical leaders such as Bayer, Syngenta, BASF, and FMC leverage scale and regulatory expertise to offer formulations that combine efficacy with lower environmental impact. Marrone Bio Innovations specializes in biologically derived fungicides and offers products designed for organic or low residue applications. Together these companies supply a mix of conventional and bio based fungicide options, support grower transition toward bio rational solutions, and influence adoption through product availability, technical support, and regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Microbial, Botanical, Non-Organic |

| End Users/Application | Fruits and Vegetables, Cereals and Grains, Oil Seeds and Pulses |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Bayer AG, Syngenta AG, BASF SE, Marrone Bio Innovations, FMC Corporation |

| Additional Attributes | Dollar by sales by product type, Dollar by sales by end-use application, Dollar by sales by region, Regional CAGR, Specialty crop penetration, Organic and residue sensitive crop adoption, Multi-season program integration, Contract and cooperative distribution, Resistance management strategies, Shelf stability and formulation performance |

The demand for bio-rational fungicides in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the bio-rational fungicides in USA is projected to reach USD 1.5 billion by 2035.

The demand for bio-rational fungicides in USA is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in bio-rational fungicides in USA are microbial, botanical and non-organic.

In terms of end users/application, fruits and vegetables segment is expected to command 46.0% share in the bio-rational fungicides in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biorational Pesticide Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Biorationals Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA