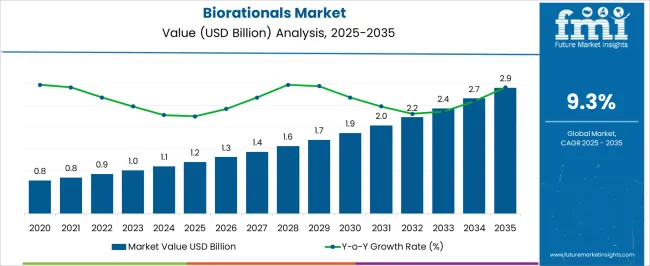

The global biorationals market is projected at 1.2 USD billion in 2025 and anticipated to reach 2.9 USD billion by 2035, registering a CAGR of 9.3%. Analysis of the Acceleration & Deceleration Pattern indicates a moderate acceleration during the early years of 2025–2028, with growth rates gradually rising from 5.0% to 8.3%, reflecting increasing adoption in agriculture for pest management and crop protection.

From 2029 to 2032, the market experiences sustained acceleration, driven by regulatory support for eco-friendly pest control, growing awareness of chemical reduction, and rising demand for organic and sustainable farming practices. Post-2032, the growth rate shows slight deceleration, stabilizing around 7–8% annually, as market penetration reaches maturity in developed regions, while emerging markets continue to expand adoption.

Early adoption is concentrated in horticulture, cereals, and high-value vegetable crops, where bio-insecticides, bio-fungicides, and bio-herbicides are integrated into pest management programs. Technological adoption in formulation improvements, microbial strain optimization, and enhanced shelf-life solutions supports broader application in both large-scale commercial and smallholder farms. Regional trends indicate North America and Europe dominate early revenue generation due to stringent pesticide regulations and advanced distribution networks, while Asia-Pacific and Latin America emerge as high-growth markets owing to increasing organic and integrated pest management initiatives. Dollar sales and share analyses reflect that bio-insecticides contribute the largest portion of market revenue, followed by bio-fungicides and bio-herbicides, highlighting targeted solutions as the main growth drivers. Overall, the market demonstrates a dynamic acceleration-deceleration pattern, combining early regulatory-driven adoption with steady global expansion through 2035.

| Metric | Value |

|---|---|

| Biorationals Market Estimated Value in (2025 E) | USD 1.2 billion |

| Biorationals Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 9.3% |

The biorationals market is influenced by several interconnected agricultural and crop protection segments, each contributing differently to overall demand and growth. The bio-insecticides segment holds the largest share at 40%, driven by increasing adoption in horticulture, cereals, and high-value vegetable crops to manage pests while reducing reliance on chemical insecticides.

Bio-fungicides account for 30% of the market, as growers increasingly seek natural solutions to prevent fungal infections in fruits, vegetables, and ornamental plants, ensuring yield protection and crop quality. The bio-herbicides segment contributes 15%, with targeted applications in weed management for cereals, pulses, and high-value crops, supporting integrated pest management strategies. Bio-nematicides hold 10% of the market, focusing on controlling nematode infestations in root crops, vegetables, and plantation crops to improve soil health and productivity. Finally, other biorational products, including bio-stimulants and plant growth regulators, represent 5%, providing supplementary benefits such as enhanced nutrient uptake, stress tolerance, and crop vigor.

Bio-insecticides, bio-fungicides, and bio-herbicides account for 85% of total demand, highlighting pest and disease management as the key growth drivers, while nematicides and growth regulators offer complementary opportunities for adoption across conventional, organic, and integrated farming systems globally. Dollar sales and share analyses indicate that high-value horticulture and specialty crops dominate revenue, whereas staple cereals and pulses show consistent incremental growth, emphasizing balanced adoption across crop types and regions.

The biorationals market is experiencing robust growth supported by the global shift toward sustainable and eco-friendly crop protection solutions. The current market landscape is shaped by increasing restrictions on synthetic chemical pesticides, rising awareness about environmental safety, and growing demand for residue-free agricultural products. Adoption is being reinforced by government initiatives promoting organic and integrated pest management practices.

Moreover, advancements in biochemistry and fermentation technologies have made biorational products more effective and scalable. As food safety regulations become more stringent and consumer preference continues to favor naturally derived inputs, biorationals are being positioned as a viable and long-term alternative in crop protection.

The future outlook remains positive as both developed and emerging economies integrate sustainable agriculture into their national food strategies. Expanding commercial farming, export-oriented horticulture, and precision agriculture are expected further to accelerate the adoption of biorationals in the coming years.

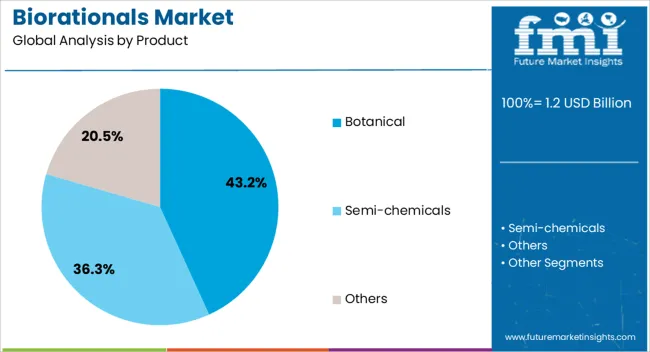

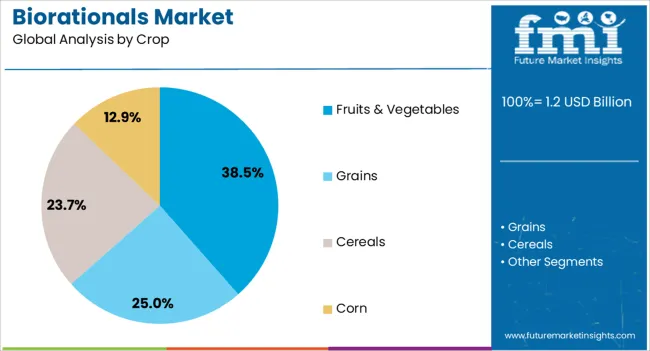

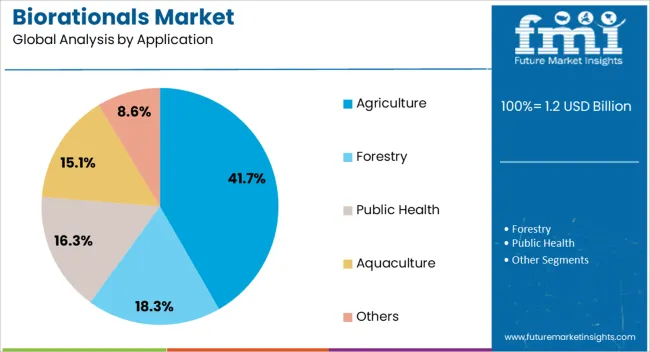

The biorationals market is segmented by product, crop, application, and geographic regions. By product, biorationals market is divided into Botanical, Semi-chemicals, and Others. In terms of crop, biorationals market is classified into Fruits & Vegetables, Grains, Cereals, and Corn. Based on application, biorationals market is segmented into Agriculture, Forestry, Public Health, Aquaculture, and Others. Regionally, the biorationals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The botanical product segment is projected to contribute 43.2% of the total revenue in the Biorationals market in 2025, emerging as the most dominant product category. This leadership position is being driven by increased reliance on plant-derived active compounds, which are biodegradable and considered safe for both the environment and human health.

The segment’s growth is being supported by favorable regulatory frameworks that allow for faster registration and commercialization of botanical products compared to synthetic chemicals. As consumer demand continues to shift toward organic produce and sustainable farming practices, botanicals are being adopted at a higher rate in pest and disease management programs.

The naturally occurring origin of these products has aligned well with the growing need for compliance with food safety certifications in both domestic and export markets Additionally, continuous innovations in extraction and formulation technologies are improving the efficacy and shelf life of botanical biorationals, encouraging broader commercial adoption.

The fruits and vegetables crop segment is anticipated to account for 38.5% of the Biorationals market revenue in 2025, leading among all crop-based applications. This growth is being attributed to the high commercial value and perishability of these crops, which demand minimal chemical residues and precise pest control. Regulatory pressure on maximum residue limits and export compliance has led producers to transition toward biorational inputs to maintain market access.

The increased focus on food safety and visual quality in retail and export channels has made biorationals a preferred solution. Furthermore, fruits and vegetables are often grown in intensive farming systems where pest pressure is high, thus necessitating targeted and eco-safe control measures.

As consumer preference for fresh and minimally processed produce rises globally, the use of botanical and microbial-based treatments in these crops is expected to remain strong. Investments in sustainable horticulture practices are also supporting the rapid scaling of biorational use in this segment.

The agriculture application segment is projected to hold 41.7% of the total Biorationals market share in 2025, maintaining its position as the largest application area. This dominance is being influenced by the widespread need to replace or reduce chemical pesticide use across large-scale farming systems. The segment has grown due to increasing pressure from regulatory agencies to adopt environmentally friendly pest control strategies, particularly in row crops and staple food production.

Adoption is being reinforced by sustainability programs introduced by global agribusinesses and cooperatives promoting integrated pest management. The compatibility of biorational products with other farming inputs and their ability to be applied using conventional equipment have also eased integration into existing agricultural practices.

As climate variability continues to impact pest and disease dynamics, the demand for flexible, low-toxicity solutions is growing. The agriculture sector’s push for productivity with environmental responsibility has made biorationals a strategic tool in long-term crop protection planning.

Biorationals are gaining traction across horticulture, cereals, and field crops due to chemical reduction and targeted pest control. Policy support, regional expansion, and product diversification are key factors sustaining market growth globally.

The biorationals market is being driven by growing adoption in horticulture and high-value vegetable cultivation. Farmers are increasingly integrating bio-insecticides, bio-fungicides, and bio-herbicides into pest management programs to reduce chemical usage and maintain crop quality. Specialty crops such as tomatoes, peppers, cucumbers, and strawberries are seeing higher adoption rates due to the need for residue-free produce. Bio-pesticides offer precise targeting of pests and pathogens, minimizing collateral damage to beneficial insects and soil microbes. Regional initiatives promoting organic and integrated pest management further support adoption. Dollar sales and share analyses indicate that horticulture contributes significantly to market revenue, while commercial vegetable farms in Europe, North America, and Asia-Pacific serve as key growth hubs, highlighting that high-value crops are primary drivers of biorational demand globally.

Cereal and field crop cultivation is emerging as a key segment for biorationals, accounting for a notable share of the market. Crops such as wheat, rice, maize, and pulses benefit from bio-insecticides and bio-fungicides that protect yields without leaving chemical residues. Farmers are adopting integrated approaches combining bio-products with traditional agrochemicals to optimize efficacy while complying with regulatory restrictions on chemical usage. Dollar sales and share data show cereals contribute steadily to revenue, particularly in high-intensity farming regions across Asia and Latin America. Market growth is also supported by awareness campaigns, soil and pest monitoring programs, and supply chain expansion by manufacturers to reach large-scale commercial farms, ensuring consistent availability of biorational solutions.

Government regulations and agricultural policies encouraging chemical reduction and eco-friendly pest management are key drivers for the biorationals market. Regions with strict pesticide residue limits and certifications for organic produce are accelerating adoption. Subsidies, extension services, and awareness campaigns support smallholder and commercial farmers in integrating bio-pesticides and bio-fungicides into crop protection programs. Dollar sales and share indicate that policy-driven markets in Europe, North America, and Asia-Pacific are capturing significant revenue. Manufacturers leverage these policies to expand market penetration, focusing on regulatory compliance, certifications, and standardized formulations. Incentives promoting integrated pest management practices enhance adoption, providing consistent opportunities for biorational products in both staple and high-value crops globally.

Product diversification and regional expansion are shaping competitive dynamics in the biorationals market. Companies are introducing bio-insecticides, bio-fungicides, bio-herbicides, and nematicides tailored for specific crops and regional pest profiles. Dollar sales and share data show that high-value, crop-specific formulations generate premium revenue, while general-purpose bio-products support broader adoption. Manufacturers are expanding distribution networks, partnering with cooperatives, and ensuring supply chain reliability across emerging and mature markets. Marketing campaigns, farmer training programs, and demonstration plots enhance awareness and correct application techniques, driving adoption in both smallholder and commercial farms. Regional expansion into Asia-Pacific and Latin America is expected to contribute significantly to long-term market growth by 2035.

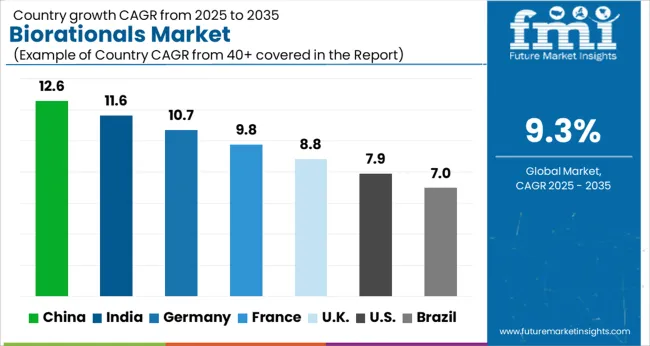

| Country | CAGR |

|---|---|

| China | 12.6% |

| India | 11.6% |

| Germany | 10.7% |

| France | 9.8% |

| UK | 8.8% |

| USA | 7.9% |

| Brazil | 7.0% |

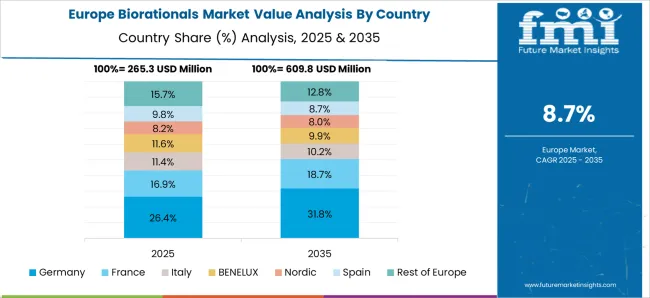

The global biorationals market is projected to grow at a CAGR of 9.3% from 2025 to 2035. China leads at 12.6%, followed by India at 11.6%, France at 9.8%, the UK at 8.8%, and the USA at 7.9%. Growth is driven by rising adoption of bio-insecticides, bio-fungicides, and bio-herbicides across horticulture, cereals, and high-value vegetable crops. Asia, particularly China and India, exhibits rapid expansion due to intensive farming, organic cultivation initiatives, and integrated pest management adoption, whereas Europe emphasizes regulatory compliance, organic certifications, and targeted crop protection. North America focuses on precision agriculture, large-scale commercial adoption, and premium organic produce. Dollar sales and share analyses highlight bio-insecticides and bio-fungicides as dominant revenue generators, while emerging regional markets continue to contribute incremental growth opportunities. The analysis spans over 40 countries, with the leading markets detailed above.

The biorationals market in China is projected to grow at a CAGR of 12.6% from 2025 to 2035, driven by rapid adoption of bio-insecticides, bio-fungicides, and bio-herbicides across horticulture, cereals, and high-value vegetable crops. Farmers are increasingly integrating biorational solutions into integrated pest management programs to reduce chemical pesticide reliance while maintaining crop quality. High-value crops such as tomatoes, cucumbers, strawberries, and peppers see the highest adoption rates, supported by regional government initiatives promoting organic and eco-friendly farming practices. Manufacturers are expanding distribution networks, offering crop-specific formulations, and providing farmer training programs to ensure proper application. Dollar sales and share indicate strong revenue generation in both commercial farms and emerging organic farming regions, while research collaborations with agricultural institutes help enhance formulation efficacy.

The biorationals market in India is expected to expand at a CAGR of 11.6% from 2025 to 2035, fueled by increasing awareness of eco-friendly pest management in cereals, pulses, and horticulture crops. Bio-insecticides and bio-fungicides are widely applied in rice, wheat, maize, and vegetable farms to ensure high yield and reduce chemical residues. Government subsidies, crop-specific recommendations, and regional extension programs promote adoption among smallholder and commercial farmers. Dollar sales and share analyses show that large-scale agricultural regions in northern and southern India are leading revenue contributors. Manufacturers are focusing on formulation diversity, including water-soluble, slow-release, and foliar-applied products, along with supply chain strengthening to reach rural and peri-urban areas efficiently.

The biorationals market in France is projected to grow at a CAGR of 9.8% from 2025 to 2035, driven by stringent regulations on chemical pesticides and growing demand for organic farming. Adoption is concentrated in vineyards, fruit orchards, and high-value vegetable crops, where bio-insecticides and bio-fungicides are integrated into sustainable pest management programs. Dollar sales and share analyses highlight that organic and specialty crop producers contribute substantially to revenue. Manufacturers focus on certified, standardized products and provide technical guidance for optimized application. Regional cooperatives, farmer associations, and government programs support education and awareness, ensuring that integrated pest management practices are widely adopted. France also serves as a hub for innovation in biorational formulations targeting European export markets.

The biorationals market in the UK is expected to grow at a CAGR of 8.8% from 2025 to 2035, with adoption primarily in horticulture, vegetables, and protected cultivation systems. Organic farms and high-value crop growers increasingly integrate bio-insecticides and bio-fungicides into integrated pest management strategies to meet regulatory limits and consumer demand for residue-free produce. Dollar sales and share data indicate that premium, organic, and greenhouse-grown crops dominate revenue generation. Manufacturers emphasize certification, traceability, and standardized formulations to ensure efficacy and safety. Distribution through specialized agro-retailers, cooperatives, and e-commerce platforms supports adoption. Awareness campaigns and training programs guide farmers on optimal dosing, timing, and crop-specific application, reinforcing consistent market growth.

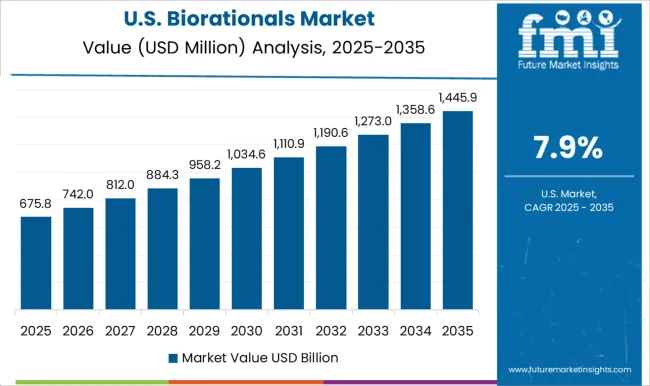

The biorationals market in the USA is projected to grow at a CAGR of 7.9% from 2025 to 2035, supported by adoption in large-scale commercial agriculture, specialty vegetables, and orchard crops. Bio-insecticides, bio-fungicides, and bio-herbicides are increasingly integrated into pest management programs to comply with regulatory restrictions and reduce chemical pesticide residues. Dollar sales and share analyses show that organic and high-value crops contribute most revenue, while staple grains adopt biorationals incrementally. Manufacturers focus on supply chain reliability, product standardization, and farmer training programs. Regional distribution through cooperatives, agri-retail networks, and e-commerce ensures availability across diverse farming systems. Research partnerships with agricultural universities enhance product efficacy and support adoption in precision agriculture systems.

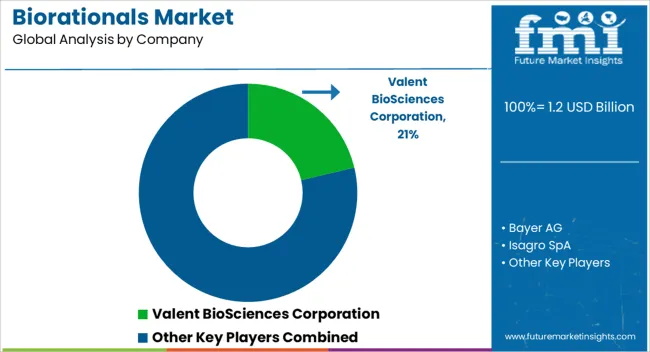

Competition in the biorationals market is driven by product efficacy, formulation diversity, regulatory compliance, and regional distribution capabilities. Valent BioSciences Corporation leads with a broad portfolio of bio-insecticides, bio-fungicides, and nematicides, emphasizing crop-specific formulations, pest-target precision, and large-scale commercial adoption. Bayer AG competes through integrated crop protection solutions combining chemical and biological approaches, targeting high-value vegetables, cereals, and specialty crops globally. Isagro SpA and BASF SE focus on research-driven formulations, optimizing microbial strains, shelf life, and application methods for enhanced pest and disease control. Marrone Bio Innovations Inc and Syngenta AG differentiate through proprietary bioactive compounds and certified organic product lines, catering to eco-conscious farmers and organic agriculture markets. Koppert B.V and Certis USA LLC emphasize biological control solutions and beneficial organisms for integrated pest management, targeting vineyards, orchards, and greenhouse crops.

Russell IPM Ltd and Andermatt Biocontrol AG provide regionally tailored solutions with strong technical support and education programs for optimal adoption. Suterra LLC and Gowan Company LLC focus on specialty bio-pesticides, pheromone-based interventions, and high-value crop protection, while Bioworks Inc and Real IPM Kenya Ltd target emerging markets with scalable, cost-effective solutions. Camson Bio Technologies Ltd differentiates through localized production, strain-specific bio-insecticides, and collaborations with agricultural research institutes. Strategies across market players emphasize product diversification, regional expansion, and compliance with regulatory standards. Partnerships with distributors, cooperatives, and agricultural institutions ensure widespread market penetration. Companies invest in R&D to improve strain efficacy, shelf life, and compatibility with integrated pest management practices.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Product | Botanical, Semi-chemicals, and Others |

| Crop | Fruits & Vegetables, Grains, Cereals, and Corn |

| Application | Agriculture, Forestry, Public Health, Aquaculture, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Valent BioSciences Corporation, Bayer AG, Isagro SpA, BASF SE, Marrone Bio Innovations Inc, Syngenta AG, Koppert B.V, Certis USA LLC, Russell IPM Ltd, Andermatt Biocontrol AG, Suterra LLC, Gowan Company LLC, Bioworks Inc, Real IPM Kenya Ltd, and Camson Bio Technologies Ltd |

| Additional Attributes | Dollar sales, market size, CAGR, top product types (bio-insecticides, bio-fungicides, bio-herbicides), regional adoption trends, high-growth crops, regulatory landscape, leading players, share, distribution channels, and emerging market opportunities. |

The global biorationals market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the biorationals market is projected to reach USD 2.9 billion by 2035.

The biorationals market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in biorationals market are botanical, semi-chemicals and others.

In terms of crop, fruits & vegetables segment to command 38.5% share in the biorationals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA